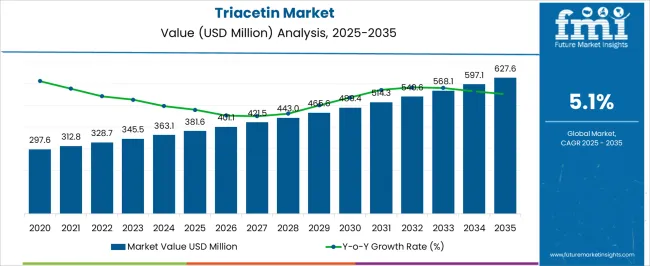

The triacetin market is estimated to be valued at USD 381.6 million in 2025 and is projected to reach USD 627.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The triacetin market is valued at USD 381.6 million in 2025 and is projected to reach USD 627.6 million by 2035, with a CAGR of 5.1%. Between 2021 and 2025, the market grows from USD 297.6 million to USD 381.6 million, passing through intermediate values of USD 312.8 million, 328.7 million, 345.5 million, and 363.1 million. This early growth phase is driven by the increasing use of triacetin in food and beverages, pharmaceuticals, and personal care products due to its properties as a plasticizer, solvent, and preservative. As global demand for these products rises, the market sees consistent expansion.

Between 2026 and 2030, the market continues to grow at a faster rate, progressing from USD 381.6 million to USD 489.4 million, with intermediate values of USD 401.1 million, 421.5 million, 443.0 million, and 465.6 million. This phase is characterized by a higher growth rate driven by triacetin’s increasing application in the expanding bioplastics market, as well as growing demand in cosmetics, medicine, and agricultural sectors.

From 2031 to 2035, the market reaches USD 627.6 million, with values passing through USD 514.3 million, 540.6 million, 568.1 million, and 597.1 million. As product innovations continue and global markets expand, the growth rate stabilizes, with volume and price growth driven by the demand for sustainable and versatile ingredients in diverse industries.

| Metric | Value |

|---|---|

| Triacetin Market Estimated Value in (2025 E) | USD 381.6 million |

| Triacetin Market Forecast Value in (2035 F) | USD 627.6 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The plasticizers market is the largest contributor, accounting for approximately 40-45%, as triacetin is widely used as a plasticizer in the production of flexible PVC products. The increasing demand for plasticized materials in industries like construction, automotive, and consumer goods significantly drives the demand for triacetin. The food and beverage market follows with around 20-25%, as triacetin is used as an emulsifier, stabilizer, and flavoring agent in various food products, including confectionery, beverages, and baked goods.

As processed and packaged food consumption continues to rise globally, so does the demand for triacetin in this sector. The pharmaceutical market contributes about 15-18%, driven by the use of triacetin as a solvent and excipient in drug formulations, particularly for tablet coatings. The growing pharmaceutical industry and the demand for oral dosage forms increase the need for triacetin in this market. The cosmetics and personal care market accounts for approximately 10-12%, as triacetin is used in personal care products like lotions, creams, and perfumes due to its properties as a solvent and emulsifier. Lastly, the chemical industry contributes around 8-10%, with triacetin used as a chemical intermediate in the production of acetates, resins, and solvents.

The triacetin market is gaining momentum across diverse industrial sectors due to its multifunctional properties as a solvent, plasticizer, and humectant. Rising demand for performance-enhancing additives in pharmaceuticals, food processing, and polymer applications is fueling the growth of triacetin consumption globally.

The market is further supported by its favorable safety profile and compatibility with regulatory standards across end-use industries. Technological advancements in downstream applications and the shift toward eco-friendly additives have expanded triacetin's utility in biodegradable and bio-based product formulations.

As industries seek to improve product stability, flexibility, and shelf life, triacetin's role as a high-functionality additive remains pivotal. Looking ahead, the market is expected to witness stable expansion driven by increased demand from the pharmaceutical and polymer sectors and the growing emphasis on material performance, process efficiency, and product consistency

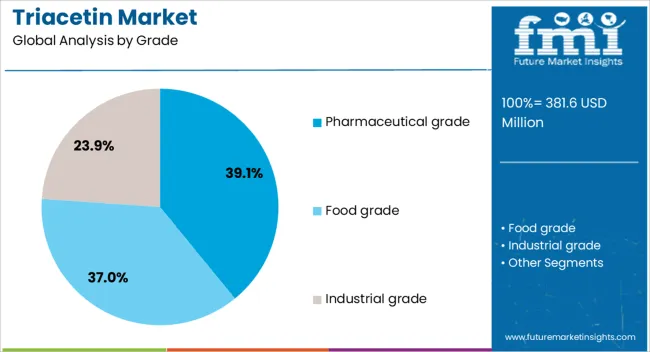

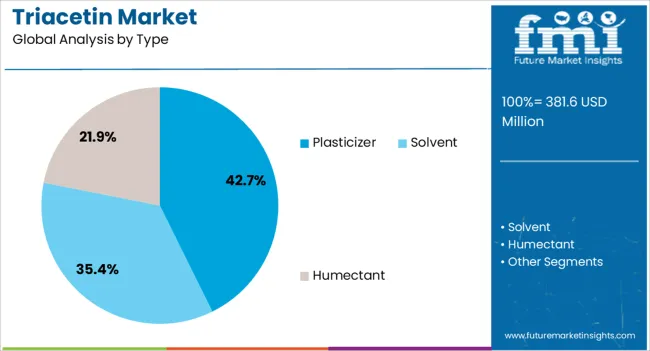

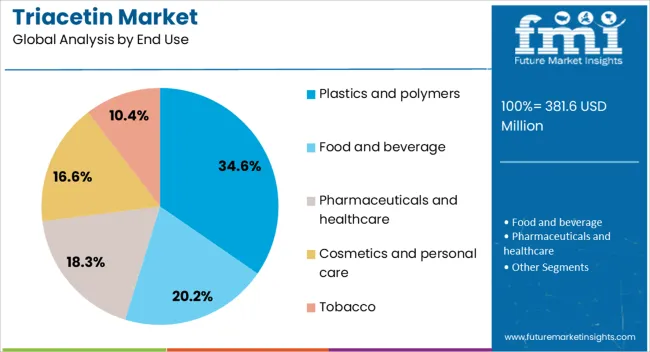

The triacetin market is segmented by grade, type, end use, and geographic regions. By grade, triacetin market is divided into pharmaceutical grade, food grade, and industrial grade. In terms of type, triacetin market is classified into plasticizer, solvent, and humectant. Based on end use, triacetin market is segmented into plastics and polymers, food and beverage, pharmaceuticals and healthcare, cosmetics and personal care, and tobacco. Regionally, the triacetin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceutical grade segment holds a commanding 39.1% share within the triacetin market, underlining its crucial role in drug formulation and excipient development. Its widespread use as a plasticizer in capsule coatings and its ability to enhance the solubility and stability of active pharmaceutical ingredients have made it a preferred choice for drug manufacturers.

Pharmaceutical-grade triacetin is produced under stringent quality and purity standards to meet regulatory requirements, ensuring its suitability for human consumption and medical use. The segment continues to benefit from rising global pharmaceutical production, particularly in generics and over-the-counter drugs.

Furthermore, its compatibility with gelatin and other biopolymers has increased its adoption in soft-gel formulations. As the healthcare industry prioritizes advanced drug delivery systems and patient-centric formulations, demand for high-purity excipients such as pharmaceutical-grade triacetin is expected to grow consistently

The plasticizer type segment leads the triacetin market with a 42.7% share, reflecting its extensive application in enhancing the flexibility, durability, and processability of various polymer products. Triacetin’s effectiveness as a plasticizer in cellulose acetate, nitrocellulose, and other thermoplastic formulations has positioned it as a preferred additive in industries such as packaging, coatings, and adhesives.

Its biodegradability and non-toxic profile further support its use in environmentally sensitive applications, aligning with sustainability goals in material development. The segment’s growth is reinforced by ongoing innovations in plastic manufacturing and increasing demand for flexible films and molded goods.

Additionally, regulatory pressures to replace harmful phthalate-based plasticizers have accelerated the transition toward safer alternatives like triacetin. This segment is poised for steady growth as industries continue to prioritize performance-driven and eco-compliant materials in their production processes

The plastics and polymers segment accounts for 34.6% of the triacetin market, underscoring its vital function as a value-adding additive in the manufacturing of synthetic materials. Triacetin serves as a key component in improving the flexibility, transparency, and stability of plastic products, particularly in cellulose-based and biodegradable polymers.

This end-use segment is benefiting from the growing demand for durable and lightweight materials across automotive, electronics, and packaging industries. Rising environmental concerns and increased focus on sustainable alternatives have amplified the need for non-phthalate plasticizers, positioning triacetin as an ideal solution.

Furthermore, its compatibility with various polymer systems ensures versatile application in both rigid and flexible formulations. As manufacturers strive to meet both performance standards and environmental regulations, the role of triacetin in enhancing polymer properties is expected to sustain segment growth in the foreseeable future

Triacetin, a colorless, odorless liquid, is widely used as a plasticizer, solvent, and humectant, and serves as an additive in food and beverage products. The market is driven by its increasing use in the production of tobacco products, as well as its applications in personal care products, food, and pharmaceuticals. However, challenges related to fluctuating raw material prices, regulatory compliance, and competition from alternative plasticizers and solvents may hinder market growth. Opportunities exist in the development of eco-friendly triacetin production processes and expanding applications in emerging markets, particularly in the Asia-Pacific region.

The triacetin market is benefiting from rising demand for plasticizers, solvents, and additives across various industries. In the food and beverage sector, triacetin is used as a flavor carrier and humectant to improve the texture and shelf-life of processed foods. In the pharmaceutical industry, it serves as a solvent and stabilizer in formulations of certain drugs and medications. The tobacco industry is one of the largest consumers of triacetin, using it as a plasticizer in cigarette filters and to improve the burn characteristics of tobacco. Triacetin finds applications in personal care products such as cosmetics, where it acts as a stabilizer and humectant. As these industries continue to grow, the demand for triacetin is expected to increase.

The triacetin market faces several challenges related to raw material costs, environmental concerns, and regulatory compliance. The primary raw materials for triacetin production glycerin and acetic acid are subject to price fluctuations, which can impact the overall cost structure of the product. As the focus on sustainability increases, manufacturers are under pressure to find more eco-friendly production methods, particularly in industries such as food and personal care. Triacetin’s use in these sectors is subject to stringent regulatory controls regarding safety, labeling, and permissible concentrations, which can create barriers to market entry. These factors necessitate investment in alternative production techniques, as well as compliance with regulations in various regions to ensure the continued growth of the triacetin market.

Opportunities in the triacetin market are strongest in the development of eco-friendly production processes and expansion into emerging markets. As consumer demand for natural and environmentally-friendly ingredients rises, there is a growing focus on developing triacetin using renewable sources, such as plant-based glycerin, which can offer a more sustainable production pathway. Additionally, the increasing industrialization and urbanization in emerging markets, especially in the Asia-Pacific region, present significant growth opportunities for triacetin producers. The expanding pharmaceutical, cosmetic, and food sectors in these regions are driving demand for triacetin-based products, offering a valuable opportunity for manufacturers to diversify their customer base and increase sales.

In the food and beverage sector, there is a growing interest in using triacetin as a safe and effective additive for health-oriented products, including low-calorie and organic foods. In personal care and cosmetics, triacetin is being used in innovative formulations aimed at providing enhanced moisture retention, making it a key ingredient in skincare products. As manufacturers focus on improving product functionality and performance, triacetin-based products are being adapted for use in various health-focused and eco-conscious applications. Moreover, companies are expanding their market presence in regions where demand for such ingredients is increasing, particularly in emerging economies.

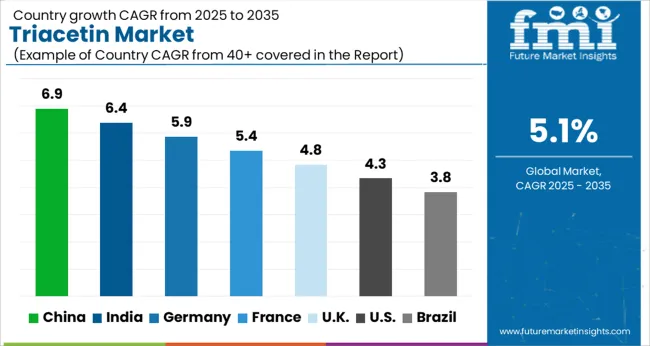

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global triacetin market is expected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with the highest growth rate of 6.9%, followed by India at 6.4% and France at 5.4%. The UK and USA show moderate growth rates of 4.8% and 4.3%, respectively. The market is driven by the rising demand for plasticizers in various industries, increasing adoption of triacetin as a food additive, and the growing pharmaceutical and cosmetic sectors. As industrial and consumer applications expand globally, the market for triacetin is set for continued growth. The analysis includes over 40+ countries, with the leading markets detailed below.

The triacetin market in China is expected to grow at a CAGR of 6.9% from 2025 to 2035. The robust demand for triacetin is driven by its expanding chemical, pharmaceutical, and food industries. As one of the leading manufacturing hubs in the world, China is witnessing an increased demand for triacetin as a plasticizer, solvent, and stabilizer, particularly in the production of plastics, personal care products, and food additives. The growing demand for convenience and processed foods in the country is boosting the use of triacetin as a food additive, enhancing texture and stability. China’s expanding pharmaceutical sector, driven by increasing healthcare needs, is propelling the demand for triacetin as a stabilizer in drug formulations. The government's ongoing focus on modernizing its industrial sector is expected to further fuel the demand for triacetin in various applications.

The triacetin market in India is expected to grow at a CAGR of 6.4% from 2025 to 2035. The market is being driven by the growing demand for plasticizers in various industrial applications, including the automotive and construction sectors. India’s expanding food and beverage industry is also contributing to the growth, as triacetin is increasingly used as a food additive and flavor stabilizer. The pharmaceutical sector in India is another key driver, with triacetin serving as a stabilizer in drug formulations and as an excipient in tablet coatings. The rising awareness of personal care and cosmetic products is further contributing to the demand for triacetin as a solvent and stabilizer. The government's efforts to bolster manufacturing through initiatives such as "Make in India" are expected to drive the consumption of triacetin in various sectors, boosting market growth in the country.

The triacetin market in France is anticipated to grow at a CAGR of 5.4% from 2025 to 2035. The growth is driven by the country’s emphasis on improving manufacturing processes and the increasing demand for safer, more effective food additives. Triacetin is used as a stabilizer and emulsifier in processed foods and beverages, where the demand for long-lasting products is rising. The pharmaceutical and cosmetic industries in France continue to grow, driving the use of triacetin in drug formulations and personal care products. France’s regulatory focus on consumer safety is also contributing to the demand for high-quality, non-toxic stabilizers, ensuring continued market growth.

The UK triacetin market is projected to grow at a CAGR of 4.8% from 2025 to 2035. The country’s demand for triacetin is primarily driven by the expanding pharmaceutical, cosmetic, and food sectors. As the UK places greater emphasis on food quality and safety, the use of triacetin as a stabilizer and emulsifier in packaged and processed food is increasing. In the pharmaceutical sector, triacetin is used as an excipient in tablet coatings, and as the UK’s pharmaceutical market continues to expand, so does the demand for triacetin. The cosmetics sector is also a key consumer of triacetin, as it is used to enhance the texture and consistency of lotions, creams, and other personal care products.

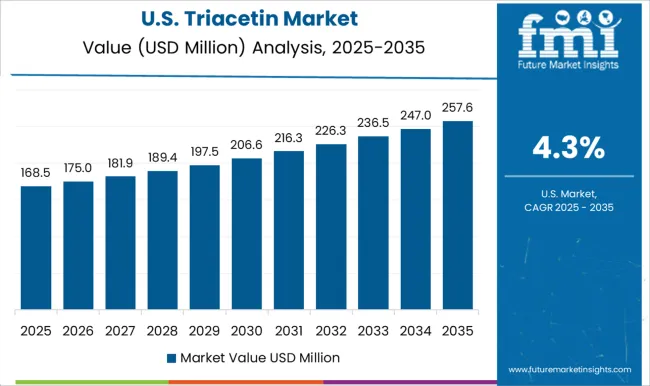

The USA triacetin market is expected to grow at a CAGR of 4.3% from 2025 to 2035. The USA remains a leading market for triacetin, driven by its significant application in the food and beverage, pharmaceutical, and cosmetic industries. Triacetin is widely used as a stabilizer and emulsifier in processed foods, contributing to longer shelf life and enhanced texture. The pharmaceutical sector in the USA is one of the largest consumers of triacetin, using it as a plasticizer and excipient in drug formulations. The growing demand for personal care products, including skin and hair care formulations, is further boosting the demand for triacetin.

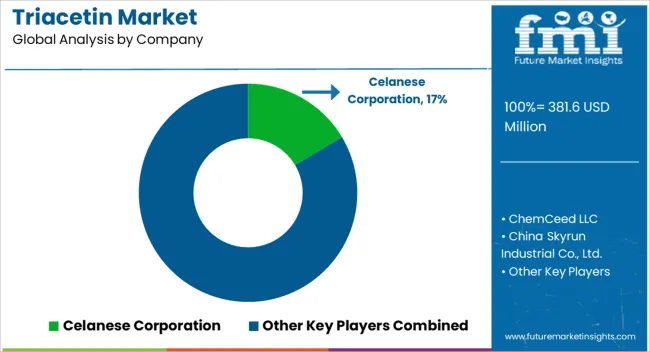

The triacetin market is competitive, with key players focusing on product diversification, innovation, and expanding their reach across various industries such as food, pharmaceuticals, and cosmetics. Celanese Corporation leads with a strong portfolio of high-quality triacetin products, primarily used as plasticizers, solvents, and stabilizers. Their strategy revolves around offering versatile and reliable solutions that meet stringent industry standards, particularly in food and personal care applications. ChemCeed LLC competes by providing triacetin solutions tailored for specific industrial applications, focusing on performance and high-quality standards for customers requiring specialized formulations.

Daicel Corporation and Eastman Chemical Company both focus on broadening their market presence by offering high-purity triacetin solutions, widely used in food flavoring, pharmaceuticals, and tobacco applications. Daicel’s competitive edge lies in its innovative approach to manufacturing, emphasizing consistency, performance, and compliance with industry regulations. Eastman Chemical Company follows a similar strategy, positioning its triacetin as a high-performance plasticizer for the production of flexible films and coatings, targeting industries that demand strong durability and flexibility. China Skyrun Industrial Co., Ltd. and Haihang Industry Co., Ltd. focus on providing cost-effective triacetin products that cater to the global demand for plasticizers and stabilizers in multiple sectors. Their strategy is centered around offering affordable solutions without compromising on quality, ensuring broad market appeal.

Henan GP Chemicals Co., Ltd., Henan Huayin Chemical Co., Ltd., and Jiangsu Lemon Chemical & Technology Co., Ltd. supply triacetin primarily for the domestic Chinese market, with some reaching international markets. These companies emphasize manufacturing efficiency and pricing strategies, targeting industries that require large volumes of triacetin at competitive prices. Product brochures from these companies highlight key features such as high purity, versatility, and efficiency. Many brochures emphasize triacetin's applications as a plasticizer, solvent, and stabilizer, with a strong focus on quality and regulatory compliance to cater to the needs of diverse industries.

| Items | Values |

|---|---|

| Quantitative Units | USD 381.6 million |

| Grade | Pharmaceutical grade, Food grade, and Industrial grade |

| Type | Plasticizer, Solvent, and Humectant |

| End Use | Plastics and polymers, Food and beverage, Pharmaceuticals and healthcare, Cosmetics and personal care, and Tobacco |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Celanese Corporation, ChemCeed LLC, China Skyrun Industrial Co., Ltd., Daicel Corporation, Eastman Chemical Company, Haihang Industry Co., Ltd., Henan GP Chemicals Co., Ltd., Henan Huayin Chemical Co., Ltd., Jiangsu Lemon Chemical & Technology Co., Ltd., and Jiangxi Acetron Chemical Co., Ltd. |

| Additional Attributes | Dollar sales of triacetin span pharmaceuticals, food, plastics, and cosmetics, fueled by bio-based plasticizers and F&B growth. North America, Europe stress compliance; Asia-Pacific adoption rises with industrial and textile expansion. |

The global triacetin market is estimated to be valued at USD 381.6 million in 2025.

The market size for the triacetin market is projected to reach USD 627.6 million by 2035.

The triacetin market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in triacetin market are pharmaceutical grade, food grade and industrial grade.

In terms of type, plasticizer segment to command 42.7% share in the triacetin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glyceryl Triacetate (Triacetin) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA