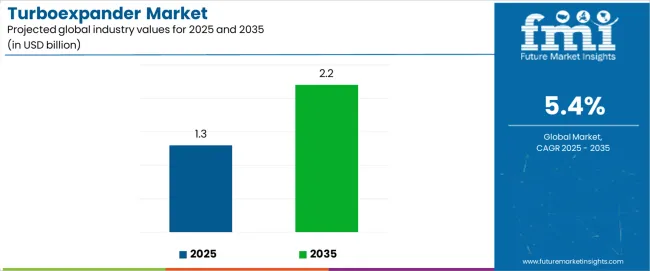

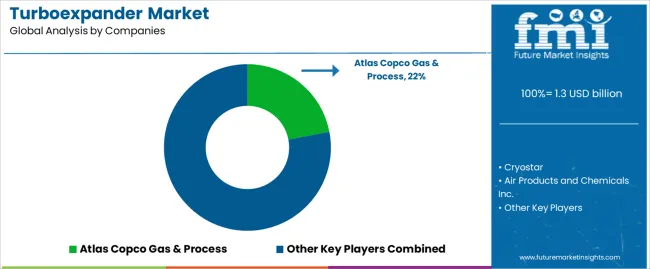

The global turboexpander market is projected to reach USD 2.2 billion by 2035, recording an absolute increase of USD 0.9 billion over the forecast period. The market is valued at USD 1.3 billion in 2025 and is set to rise at a CAGR of 5.4% during the assessment period. The overall market size is expected to grow by 1.7 times during the same period, supported by increasing natural gas processing capacity and LNG export infrastructure development worldwide, driving demand for efficient energy recovery systems and increasing investments in industrial gas production and cryogenic process optimization globally. However, high capital expenditure requirements and technical complexity may pose challenges to market expansion.

Between 2025 and 2030, the turboexpander market is projected to expand from USD 1.3 billion to USD 1.7 billion, resulting in a value increase of USD 0.4 billion, which represents 44.4% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for natural gas liquefaction and LNG export facilities, product innovation in magnetic bearing technologies and high-efficiency turbine designs, as well as expanding integration with process electrification initiatives and waste-heat recovery applications. Companies are establishing competitive positions through investment in advanced compressor-loaded configurations, digital monitoring solutions, and strategic market expansion across oil and gas processing, air separation, and cryogenic applications.

From 2030 to 2035, the market is forecast to grow from USD 1.7 billion to USD 2.2 billion, adding another USD 0.5 billion, which constitutes 55.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized hydrogen production systems, including advanced cryogenic cycles and integrated carbon capture solutions tailored for specific industrial requirements, strategic collaborations between turbomachinery manufacturers and process technology providers, and an enhanced focus on operational efficiency and energy optimization. The growing emphasis on industrial decarbonization and process intensification will drive demand for advanced, high-performance turboexpander solutions across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.3 billion |

| Market Forecast Value (2035) | USD 2.2 billion |

| Forecast CAGR (2025-2035) | 5.4% |

The turboexpander market grows by enabling process operators to achieve superior energy recovery and operational efficiency while meeting evolving industrial processing demands. Plant operators face mounting pressure to improve energy efficiency and reduce operational costs, with turboexpander solutions typically providing 25-35% energy recovery from high-pressure gas streams, making expansion turbines essential for LNG liquefaction and natural gas processing facilities. The industrial decarbonization movement's need for efficient energy utilization creates demand for advanced turboexpander solutions that can enhance process economics, reduce carbon footprint, and ensure consistent performance across diverse operating conditions.

Government initiatives promoting energy efficiency and industrial emissions reduction drive adoption in oil and gas processing, air separation, and cryogenic applications, where energy recovery has a direct impact on project economics and environmental performance. The global shift toward natural gas infrastructure and LNG export capacity accelerates turboexpander demand as operators seek solutions for efficient gas processing that maximize energy recovery from pressure letdown operations. However, higher initial capital costs and engineering complexity compared to conventional throttling valves may limit adoption rates among smaller processing facilities and operations with limited technical expertise.

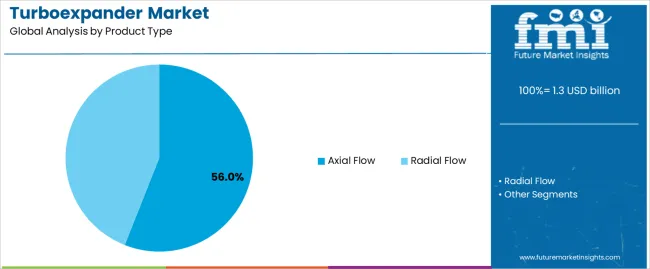

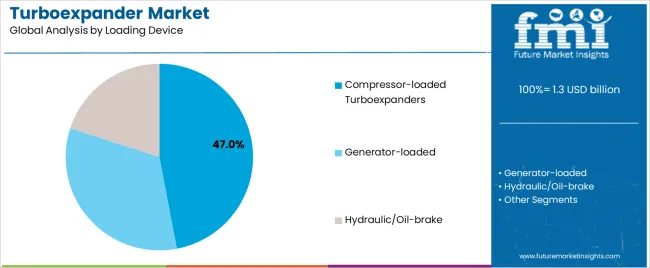

The market is segmented by product type, loading device, application, power capacity, and region. By product type, the market is divided into axial flow and radial flow turboexpanders. Based on loading device, the market is categorized into compressor-loaded turboexpanders, generator-loaded, and hydraulic/oil-brake systems. By application, the market includes oil and gas processing, air separation, cryogenic applications, and others. Based on power capacity, the market is segmented into less than 1 MW, 1-4 MW, 5-9 MW, 10-19 MW, 20-24 MW, and 25 MW or greater. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

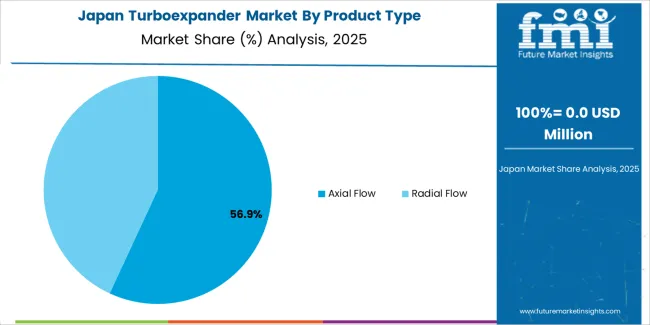

The axial flow segment represents the dominant force in the turboexpander market, capturing approximately 56% of total market share in 2025. This advanced category encompasses turbine designs featuring axial gas flow paths, multi-stage expansion capabilities, and superior efficiency characteristics at higher flow rates, delivering comprehensive performance capabilities with optimal isentropic efficiency across large-scale processing applications. The axial flow segment's market leadership stems from its exceptional efficiency in high-volume gas processing operations, superior performance in LNG liquefaction trains, and compatibility with large natural gas processing facilities that require maximum energy recovery.

The radial flow segment maintains a substantial 44% market share, serving operators who require compact installations and cost-effective solutions for moderate flow rate applications. Radial flow turboexpanders offer advantages in smaller processing facilities, offshore platform installations, and applications where space constraints and installation flexibility outweigh the efficiency benefits of axial designs.

Key advantages driving the axial flow segment include:

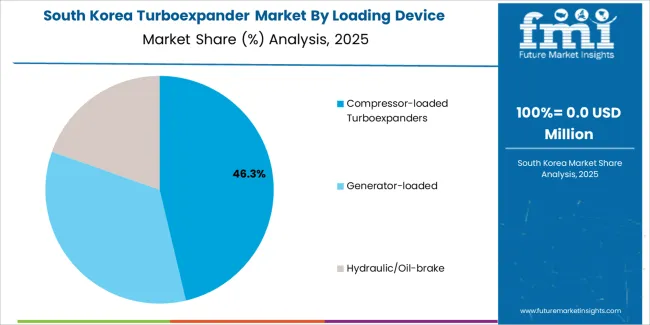

The compressor-loaded turboexpanders segment represents the leading loading device category in the turboexpander market, capturing approximately 47% of total market share in 2025. This critical configuration encompasses integrated expander-compressor packages where expansion energy directly drives refrigeration or recompression duties, delivering superior process integration with enhanced thermodynamic efficiency and reduced auxiliary power requirements. The compressor-loaded segment's dominance reflects the fundamental requirement for refrigeration in LNG liquefaction and natural gas processing, where direct mechanical coupling provides optimal energy utilization and process economics.

The generator-loaded segment maintains a substantial 38% market share, serving facilities prioritizing electrical power generation from pressure letdown operations where grid power is valuable or process refrigeration requirements are minimal. Hydraulic/oil-brake loading accounts for 15% market share, featuring simple control systems for applications where energy recovery is secondary to pressure reduction and flow control objectives.

Key factors driving compressor-loaded segment leadership include:

The oil and gas processing segment represents the leading application category in the turboexpander market, capturing approximately 41% of total market share in 2025. This critical application encompasses natural gas liquids recovery, LNG liquefaction facilities, gas conditioning operations, and offshore platform processing where turboexpanders deliver efficient pressure reduction with energy recovery capabilities. The oil and gas processing segment's dominance reflects the massive scale of global LNG infrastructure development, increasing NGL extraction requirements, and the fundamental role of energy-efficient processing in project economics and operational profitability.

The air separation segment maintains a substantial 28% market share, serving industrial gas production facilities requiring cryogenic temperature generation for oxygen, nitrogen, and argon separation processes. Cryogenic applications account for 19% market share, featuring turboexpander utilization in industrial gas liquefaction, medical gas production, and electronics manufacturing. Other applications represent 12% of the market, including waste-heat recovery, geothermal energy systems, and petrochemical processing operations.

Key factors driving oil and gas processing segment leadership include:

The market is driven by three concrete demand factors tied to energy infrastructure and industrial efficiency outcomes. First, accelerating LNG export capacity development creates increasing requirements for efficient liquefaction technology, with global LNG infrastructure investment growing 15-20% annually across major producing regions worldwide, requiring multiple turboexpander trains per facility for natural gas cooling and liquefaction operations. Second, industrial decarbonization pressures and energy cost reduction initiatives drive process operators toward energy recovery solutions, with turboexpanders enabling 25-35% reduction in auxiliary power consumption while recovering valuable energy from high-pressure gas streams that would otherwise be wasted through throttling valves. Third, natural gas infrastructure expansion and pipeline network development accelerate adoption of pressure letdown stations with energy recovery, where turboexpanders reduce emissions by 40-60% compared to conventional pressure regulation while generating valuable power or refrigeration duty.

Market restraints include high initial capital costs affecting project economics for smaller facilities, with turboexpander systems priced 3-5 times higher than conventional throttling valves, creating financial barriers for marginal gas fields and small-scale processing operations operating with limited capital budgets. Technical complexity and specialized maintenance requirements pose operational barriers, as facilities evaluate engineering expertise needs including vibration analysis, performance monitoring, and bearing system maintenance for rotating equipment operating at 15,000-30,000 rpm with tight clearance tolerances. Supply chain constraints affecting turbomachinery component availability create additional challenges, particularly for specialized bearings, high-performance seals, and precision-machined impellers where manufacturing lead times extend to 12-18 months for custom engineered solutions.

Key trends indicate accelerated adoption of magnetic bearing systems in high-reliability applications, particularly in offshore platforms and remote facilities where oil-free operation enables 99.5% uptime while eliminating contamination risks and reducing maintenance requirements by 60-70% compared to conventional oil-lubricated bearings. Digital twin technology and predictive maintenance advancement trends toward real-time performance monitoring, vibration analysis platforms, and AI-assisted condition assessment systems are enabling next-generation reliability improvements and maintenance optimization capabilities. However, the market thesis could face disruption if alternative pressure letdown technologies or distributed power generation systems emerge as cost-competitive solutions to turboexpander installations, potentially reshaping energy recovery approaches and equipment selection criteria across the gas processing sector.

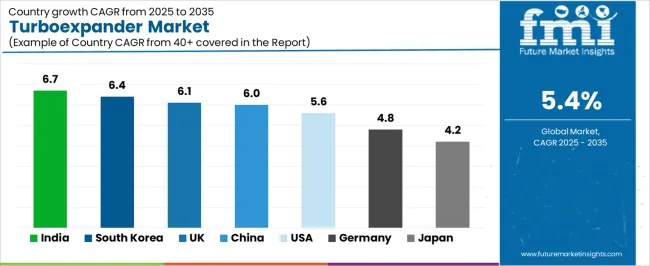

| Country | CAGR (2025-2035) |

|---|---|

| India | 6.7% |

| South Korea | 6.4% |

| United Kingdom | 6.1% |

| China | 6% |

| United States | 5.6% |

| Germany | 4.8% |

| Japan | 4.2% |

The turboexpander market is gaining momentum worldwide, with India taking the lead thanks to gas pipeline infrastructure development and new refinery construction programs. Close behind, South Korea benefits from petrochemical capacity expansion and hydrogen production initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. The United Kingdom shows strong advancement, where North Sea gas processing upgrades and waste-heat recovery projects strengthen its role in European energy infrastructure. China demonstrates robust growth through LNG terminal construction and air separation capacity additions, signaling continued investment in industrial gas infrastructure. Meanwhile, the United States stands out for its shale gas processing expansion combined with LNG export facility development, while Germany and Japan continue to record consistent progress driven by chemical industry modernization and LNG import infrastructure upgrades. Together, India and South Korea anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries; 7 top-performing countries are highlighted below.

India demonstrates the strongest growth potential in the Turboexpander Market with a CAGR of 6.7% through 2035. The country's leadership position stems from comprehensive natural gas pipeline network expansion, intensive refinery and petrochemical construction programs, and aggressive LNG regasification capacity targets driving adoption of modern turboexpander systems. Growth is concentrated in major industrial regions, including Gujarat, Maharashtra, Andhra Pradesh, and Odisha, where gas processing facilities, petrochemical complexes, and LNG terminals are implementing advanced expansion turbines for energy recovery and process optimization. Distribution channels through EPC contractors, turbomachinery suppliers, and direct industrial relationships expand deployment across processing clusters and infrastructure development sites. The country's National Gas Grid development and refinery expansion programs provide policy support for energy efficiency technology, including incentives for energy recovery equipment and process optimization initiatives.

Key market factors:

In major petrochemical complexes, industrial gas facilities, and energy infrastructure projects, the adoption of turboexpander systems is accelerating across debottlenecking initiatives, hydrogen production facilities, and utility optimization applications, driven by capacity expansion programs and government sustainability initiatives. The market demonstrates strong growth momentum with a CAGR of 6.4% through 2035, linked to comprehensive petrochemical industry expansion and increasing focus on energy efficiency enhancement solutions. Korean industrial operators are implementing advanced turboexpander technology and process optimization platforms to improve production economics while meeting emission reduction targets in key industrial regions including Ulsan, Yeosu, Daesan, and Onsan. The country's hydrogen economy roadmap and carbon capture utilization initiatives create sustained demand for efficient processing solutions, while increasing emphasis on industrial competitiveness drives adoption of energy recovery systems that enhance operational efficiency.

The United Kingdom's expanding energy sector demonstrates sophisticated implementation of turboexpander systems, with documented case studies showing 30-40% energy cost reduction in gas processing and waste-heat recovery projects through advanced expansion technology adoption. The country's energy infrastructure in major producing regions, including North Sea platforms, Teesside industrial cluster, and Humber industrial zone, showcases integration of turboexpander technologies with existing processing assets, leveraging expertise in offshore gas production and industrial energy management. British operators emphasize system reliability and performance guarantees, creating demand for proven turboexpander solutions that support operational commitments and production uptime requirements. The market maintains strong growth through focus on North Sea field development and industrial decarbonization investment, with a CAGR of 6.1% through 2035.

Key development areas:

The Chinese market leads in large-scale industrial gas infrastructure based on integration with air separation unit capacity and sophisticated LNG import terminal networks for enhanced energy supply security. The country shows solid potential with a CAGR of 6% through 2035, driven by LNG terminal construction and increasing industrial gas demand across major industrial regions, including Yangtze River Delta, Pearl River Delta, Bohai Rim, and Western China. Chinese operators are adopting technology-enhanced turboexpander equipment for compliance with energy efficiency standards and emission regulations, particularly in large-scale industrial complexes requiring efficient gas processing and in coastal regions with expanding LNG import infrastructure supporting natural gas consumption growth. Technology deployment channels through state-owned enterprises, international joint ventures, and domestic equipment manufacturers expand coverage across diverse industrial applications.

Leading market segments:

The United States' turboexpander market demonstrates sophisticated implementation focused on shale gas processing systems and advanced LNG export technologies, with documented integration of high-efficiency expansion achieving 92-94% isentropic efficiency in major liquefaction operations. The country maintains steady growth momentum with a CAGR of 5.6% through 2035, driven by natural gas production expansion and operators' emphasis on energy recovery principles aligned with project economics optimization. Major processing regions, including Permian Basin, Marcellus/Utica Shale, Gulf Coast, and Appalachia, showcase advanced deployment of compressor-loaded turboexpander systems that integrate seamlessly with existing gas processing infrastructure and LNG export facility requirements.

Key market characteristics:

In major chemical parks, industrial gas facilities, and manufacturing complexes, process operators are implementing turboexpander programs to enhance energy efficiency and meet strict environmental standards, with documented case studies showing improved economics in low-carbon steel and glass production through efficient air separation. The market shows solid growth potential with a CAGR of 4.8% through 2035, linked to ongoing chemical industry modernization, low-carbon manufacturing initiatives, and increasing focus on industrial energy efficiency enhancement solutions. German operators are adopting precision turboexpander systems and advanced control platforms to maintain process quality while complying with energy efficiency regulations in sensitive industrial environments including Rhine-Ruhr chemical zone, Central Germany industrial region, and Southern Bavaria manufacturing districts.

Market development factors:

The Japanese turboexpander market demonstrates mature implementation focused on LNG import terminal operations and specialty gas cryogenic systems, with documented integration achieving superior reliability in high-uptime applications and commercial gas processing exposed to continuous operation requirements. The country maintains steady growth through energy infrastructure investment programs and industrial gas market development, with a CAGR of 4.2% through 2035, driven by comprehensive LNG terminal modernization requirements and policy support for energy efficiency technology. Major energy regions, including Tokyo Bay, Osaka Bay, Nagoya area, and Kyushu, showcase advanced turboexpander deployment where operators integrate modern expansion systems with existing LNG infrastructure for enhanced energy recovery.

Key market characteristics:

The turboexpander market in Europe is projected to grow from USD 0.4 billion in 2025 to USD 0.7 billion by 2035, registering a CAGR of 5.3% over the forecast period. Germany is expected to maintain its leadership position with a 24% market share in 2025, declining slightly to 23.6% by 2035, supported by its advanced chemical industry infrastructure and major process modernization programs, including Rhine-Ruhr chemical parks, Central Germany industrial regions, and Bavaria manufacturing zones.

The United Kingdom follows with an 18.2% share in 2025, projected to reach 18.5% by 2035, driven by comprehensive North Sea gas processing upgrades and waste-heat recovery initiatives implementing efficient turboexpander systems. France holds a 15.9% share in 2025, expected to rise to 16.3% by 2035 through air separation unit expansion and hydrogen production projects. Italy commands a 12.4% share in 2025, reaching 12.6% by 2035, backed by refinery and petrochemical revamps and LNG import infrastructure development. Spain accounts for 9.8% in 2025, rising to 10.1% by 2035 on LNG regasification facility expansions and green hydrogen hub development. The Rest of Europe region is anticipated to hold 19.7% in 2025, adjusting to 18.9% by 2035, attributed to Nordic countries' energy recovery projects and Eastern European gas processing and air separation unit additions driving steady turboexpander adoption.

The Japanese turboexpander market demonstrates a mature and technology-focused landscape, characterized by sophisticated integration of high-efficiency expansion systems and advanced magnetic bearing technologies with existing LNG terminal infrastructure across import facilities, industrial gas production operations, and specialty cryogenic processing communities. Japan's emphasis on energy security and operational reliability drives demand for certified turboexpander equipment that supports continuous operation commitments and quality expectations in premium domestic energy standards. The market benefits from strong partnerships between international turbomachinery manufacturers and domestic engineering specialists including industrial gas companies, creating comprehensive service ecosystems that prioritize equipment uptime and technical support programs. LNG terminals in Tokyo Bay, Osaka region, Nagoya area, and other major energy centers showcase advanced turboexpander implementations where expansion systems achieve 99% operational availability through precision monitoring systems and integrated maintenance platforms.

The South Korean turboexpander market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive engineering support and technical services capabilities for petrochemical complexes and high-capacity industrial gas applications. The market demonstrates increasing emphasis on process integration and energy efficiency optimization, as Korean industrial operators increasingly demand advanced turboexpander solutions that integrate with domestic process control systems and sophisticated production management platforms deployed across major petrochemical facilities. Regional engineering contractors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including performance optimization support and application-specific expansion programs for intensive processing operations. The competitive landscape shows increasing collaboration between multinational turbomachinery companies and Korean process technology specialists, creating hybrid service models that combine international manufacturing expertise with local engineering knowledge and precision industrial integration systems.

The turboexpander market features approximately 10-15 meaningful players with moderate concentration, where the top three companies control roughly 35-40% of global market share through established engineering capabilities and comprehensive product portfolios. Competition centers on equipment reliability, efficiency performance, and technical support capabilities rather than price competition alone. Atlas Copco Gas & Process leads with approximately 22% market share through its comprehensive turbomachinery and gas processing technology portfolio.

Market leaders include Atlas Copco Gas & Process, Cryostar, and Air Products and Chemicals Inc., which maintain competitive advantages through global engineering infrastructure, extensive service networks, and deep expertise in cryogenic and expansion technology across multiple industrial segments, creating trust and reliability advantages with LNG operators and industrial gas producers. These companies leverage research and development capabilities in magnetic bearing systems and ongoing technical support relationships to defend market positions while expanding into digital monitoring solutions and integrated process optimization platforms.

Challengers encompass Baker Hughes and GE Vernova, which compete through comprehensive turbomachinery portfolios and strong presence in oil and gas processing markets. Product specialists, including Siemens Energy, Elliott Group, and L.A. Turbine (Chart Industries), focus on specific capacity ranges or application segments, offering differentiated capabilities in aerodynamic design, control systems, and customized equipment configurations. Regional players and emerging turbomachinery manufacturers create competitive pressure through specialized engineering capabilities and responsive technical support, particularly in high-growth markets including India and China, where local manufacturing advantages provide benefits in delivery timelines and project execution relationships.

Turboexpanders represent efficient energy recovery solutions that enable process operators to achieve 25-35% reduction in auxiliary power consumption compared to conventional throttling systems, delivering superior process economics and operational efficiency with enhanced energy utilization in demanding industrial applications. With the market projected to grow from USD 1.3 billion in 2025 to USD 2.2 billion by 2035 at a 5.4% CAGR, these advanced turbomachinery systems offer compelling advantages - energy recovery capabilities, reduced carbon footprint, and operational cost savings opportunities - making them essential for oil and gas processing operations (41% market share), air separation applications (28% share), and processing facilities seeking alternatives to conventional pressure reduction methods that waste valuable energy through throttling operations.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product Type | Axial Flow, Radial Flow |

| Loading Device | Compressor-loaded Turboexpanders, Generator-loaded, Hydraulic/Oil-brake |

| Application | Oil & Gas Processing (incl. NGL/LNG), Air Separation, Cryogenic Applications (industrial/medical gases, electronics), Others (waste-heat/energy recovery, geothermal, petrochemicals) |

| Power Capacity | <1 MW, 1-4 MW, 5-9 MW, 10-19 MW, 20-24 MW, ≥25 MW |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | India, South Korea, United Kingdom, China, United States, Germany, Japan, and 40+ countries |

| Key Companies Profiled | Atlas Copco Gas & Process, Cryostar, Air Products and Chemicals Inc., Baker Hughes, GE Vernova, Siemens Energy, Elliott Group, L.A. Turbine (Chart Industries), Nikkiso (ACD), R&D Dynamics Corporation |

| Additional Attributes | Dollar sales by product type, loading device, application, and power capacity categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with turbomachinery manufacturers and engineering service networks, technology requirements and specifications, integration with process control platforms and energy management systems, innovations in magnetic bearing technology and efficiency optimization, and development of specialized turboexpander solutions with enhanced energy recovery and operational reliability capabilities. |

The global turboexpander market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the turboexpander market is projected to reach USD 2.2 billion by 2035.

The turboexpander market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in turboexpander market are axial flow and radial flow.

In terms of loading device, compressor-loaded turboexpanders segment to command 47.0% share in the turboexpander market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA