The Men's Underwear Market is estimated to be valued at USD 43.2 billion in 2025 and is projected to reach USD 72.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Men's Underwear Market Estimated Value in (2025 E) | USD 43.2 billion |

| Men's Underwear Market Forecast Value in (2035 F) | USD 72.4 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The men’s underwear market is expanding steadily as a result of rising consumer focus on comfort, style, and durability, combined with a growing preference for premium and functional fabrics. Increasing health awareness and lifestyle changes have driven demand for breathable and skin friendly materials that support all day wear.

Global fashion trends and brand strategies are further elevating product innovation, with manufacturers integrating advanced moisture wicking fabrics, seamless stitching, and ergonomic fits to enhance comfort and appeal. Expanding e commerce channels and targeted marketing campaigns have widened product accessibility across both developed and emerging economies.

Sustainability trends are also shaping purchasing preferences, with eco friendly materials and ethical manufacturing gaining traction. The market outlook remains positive as consumer expectations for quality, design variety, and performance oriented innerwear continue to rise, positioning underwear as both a functional necessity and a lifestyle product.

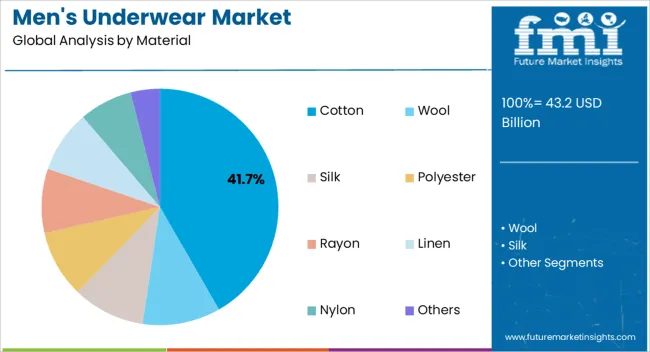

The cotton segment is expected to contribute 41.70% of total market revenue by 2025 within the material category, positioning it as the leading segment. This dominance is attributed to the fabric’s natural breathability, softness, and skin compatibility, which continue to make it the most trusted choice among consumers.

Cotton’s ability to provide comfort across varying climates and its affordability have reinforced widespread adoption.

Additionally, cotton based underwear is often preferred due to its moisture absorption qualities and durability, further solidifying its role as the most widely used fabric in men’s underwear production.

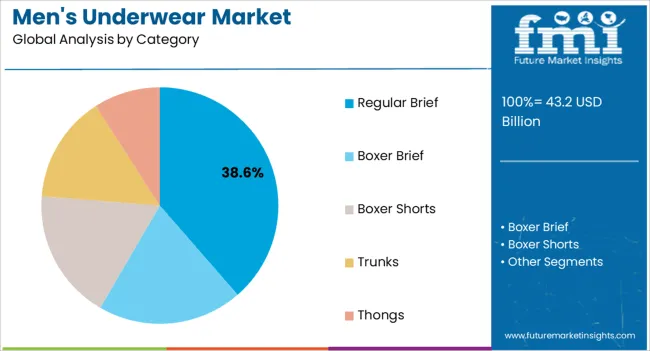

The regular brief category is projected to hold 38.60% of total market revenue by 2025, making it the most prominent style segment. This is largely driven by consumer preference for supportive and practical underwear that delivers consistent comfort and fit.

Regular briefs are considered versatile and suitable for daily wear, catering to a wide demographic. Their simple design, affordability, and ease of availability have sustained their popularity despite the emergence of newer styles.

The enduring demand highlights consumer loyalty to traditional formats that balance functionality with affordability.

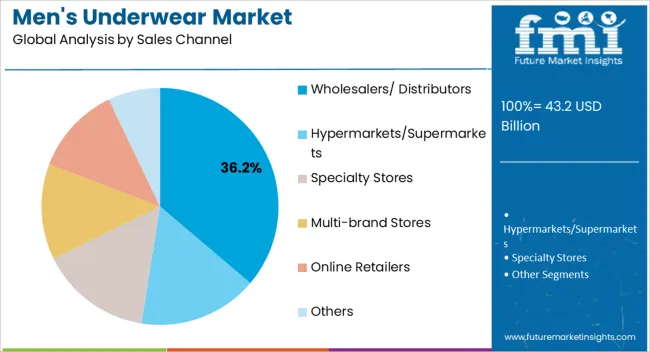

The wholesalers and distributors sales channel is anticipated to account for 36.20% of the overall market revenue by 2025, establishing it as the dominant distribution method. This segment’s growth is supported by its ability to ensure large scale availability and cost efficiency for retailers and end consumers.

Strong networks of wholesalers and distributors have enabled consistent supply, especially in emerging markets where traditional retail channels remain influential. Their capacity to handle bulk orders and facilitate wide geographical coverage has reinforced this channel’s importance in the overall market structure.

As consumer demand continues to diversify across urban and rural markets, wholesalers and distributors remain central to sustaining accessibility and affordability.

The men’s underwear market exhibited a CAGR of over 4% from 2020 to 2025. This growth was mainly due to the rise in the availability of a wide range of products based on designs and functionality such as regular wear and sportswear men’s underwear. Increasing concerns among individuals regarding personal hygiene and cleanliness are driving the sales of men’s underwear.

Increasing awareness regarding health and fitness and personal hygiene among men is influencing them to spend on good quality undergarments. Thanks to glittering promotional campaigns and endorsements by popular celebrities, sales within the men’s underwear industry are consistently rising.

Looking at the future growth prospects, the market is anticipated to progress at a CAGR of 5.3% during the forecast period.

Increasing disposable income, on-the-go lifestyle, improved living standards, and changing preferences of consumers are likely to remain the chief growth drivers in the men’s underwear industry.

According to FMI, the improving penetration of modern retail formats such as supermarkets, discount stores, and pharmacy stores is resulting in increasing product visibility. In addition to this, the availability of a large variety of products related to intimate apparel for men at discounted rates is fueling online shopping trends. Consequently, enables the men’s underwear industry growth.

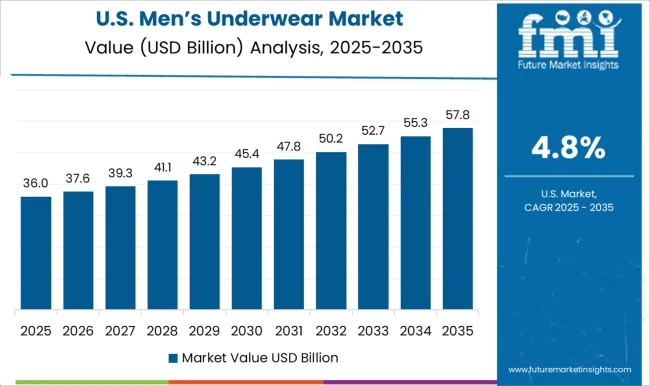

Within North America, the United States is likely to dominate the men’s underwear industry. According to FMI, the demand for men’s underwear within the United States is expected to increase at a CAGR of over 6.5% between 2025 and 2035.

The United States men’s underwear industry is highly competitive owing to the presence of a relatively high number of global and local intimate apparel manufacturers. The market is characterized by a high intensity of brand loyalty as customers look forward to fashionable men’s underwear. In addition, customers are generally reluctant to switch to new brands emerging in the market.

The men’s underwear industry in the United Kingdom is projected to expand at a CAGR of over 5%. Awareness regarding health and fitness among individuals to counter the prevalence of lifestyle concerns such as obesity, fluctuation of blood pressure, and others is rising. As men in the United Kingdom increasingly focus on leading an active lifestyle, the demand for comfortable innerwear is likely to rise for them to perform their best while participating in any physical activities.

The country has initiated its focus on HEPA (Health-enhancing physical activity) across sectors. This factor is enhancing the growth of fitness among individuals and is driving the sales of men’s underwear.

The men’s underwear market in Thailand is projected to register a CAGR of over 3% during the forecast period. The development in the product line of men’s underwear, and the rise in the use of innovative and better fabrics that help reduce moisture and regulate temperature are helping the demand to grow in the country.

The United Arab Emirates is a highly lucrative market for men’s underwear, majorly because of the presence of various global leading brands, which have adopted various growth strategies to expand their business in the country. Moreover, the rising trend of online shopping and the availability of high-quality retail spaces are creating opportunities for players to grow their businesses drastically.

In terms of material type, cotton is likely to witness the high demand among all. The segment is expected to register a CAGR of over 2%. The reason behind the high interest in cotton underwear is attributable to the basic properties of cotton being comfortable, lightweight, soft, and absorbency against moisture that improves the overall feel.

As per the analysis, the boxer briefs segment is expected to register a CAGR of over 8.2% during the assessment period. The rising spending capacity, coupled with the changing lifestyle of consumers is anticipated to fuel demand for boxer briefs during the forecast period.

Based on the size of men’s underwear, the XXL segment is projected to be the significantly growing size during the forecast period, exhibiting a CAGR of over 5%. This is because of the rise in the prevalence of obesity among individuals.

A high inclination for indoor activities and easy availability of a huge variety of food through doorstep delivery are affecting the health and fitness of an individual.

Men’s underwear ranging between USD 20 to USD 30 is projected to contribute the maximum to the industry. The rise in the number of players in the industry and the growing interest of individuals in new designs, comfortability, and colors of men’s underwear is growing the competition. Thus, in turn, players are launching products at an affordable rate with new designs to grow their customer base and expand their business globally.

Based on sales channels, sales via multi-brand stores are likely to increase at a CAGR of 3%, over the forecast period. Such stores provide a large variety of product lines to the customer and aid customers pick the desired product.

Customers prefer to feel and understand the material of apparel before making a purchase, and such multi-brand stores provide them with the opportunity to select from various available brands.

The men’s underwear industry is highly competitive with numerous established players in the market. These companies hold a significant market share and have a strong brand presence in the industry. However, new entrants are also emerging in the market, offering innovative designs, sustainable materials, and unique marketing strategies to differentiate themselves.

Key Players Strategize to Stay at the Top

But wait, what is holding them back?

To stay competitive in the men’s underwear industry, key players are focusing on product innovation, expanding their distribution channels, and improving their marketing strategies. They are also investing in sustainable materials to meet the increasing demand for eco-friendly products. For instance,

Hanesbrands Inc. launched a line of underwear made with recycled polyester, while Calvin Klein introduced a line of organic cotton underwear.

One of the biggest challenges faced by the key players in the Men’s Underwear industry is the increasing competition from new entrants. The emergence of direct-to-consumer brands and online retailers is also disrupting traditional retail channels. Additionally, increasing raw material costs and fluctuations in currency exchange rates are affecting the profitability of the industry.

Innovative Marketing Strategies to Play a Crucial Role for Businesses Looking to Expand

In recent years, innovative marketing strategies have become a key differentiator in the Men’s Underwear industry. Brands are leveraging social media platforms and influencer marketing to connect with their target audience and build a strong brand image. They are also collaborating with celebrities and athletes to promote their products and drive sales. For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East & Africa (MEA). |

| Key Countries Covered | The United States, Canada, Germany, the United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Türkiye, Northern Africa, and South Africa. |

| Key Segments Covered | Material Type, Category, Size, Age Group, Price Range, Sales Channel, and Region. |

| Key Companies Profiled | Hanesbrands Inc.; Philips-Van Heusen Corporation; Ralph Lauren Corporation; Jockey International Inc.; American Eagle Outfitters Inc; Iconix Brand Group Inc.; J.C. Penney Corporation Inc.; Under Armour, Inc.; RibbedTee Company; Ramblers Far, Inc.; Levi Strauss & Co.; Perry Ellis International Inc.; Naked Brand Group Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global men's underwear market is estimated to be valued at USD 43.2 billion in 2025.

The market size for the men's underwear market is projected to reach USD 72.4 billion by 2035.

The men's underwear market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in men's underwear market are cotton, wool, silk, polyester, rayon, linen, nylon and others.

In terms of category, regular brief segment to command 38.6% share in the men's underwear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

In Motion Dimensioning Systems Market Analysis Size and Share Forecast Outlook 2025 to 2035

Menstrual Care Market - Size, Share, and Forecast Outlook 2025-2035

Menstrual Cups Market Growth - Trends & Forecast 2025 to 2035

Menstrual Cup Foam Wash Market Trends - Growth & Demand From 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA