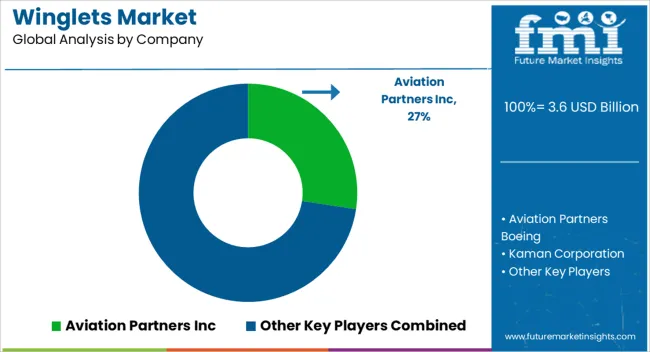

The winglets market, valued at USD 3.6 billion in 2025 and projected to reach USD 8.4 billion by 2035 at a CAGR of 8.9%, demonstrates a pronounced growth trajectory characteristic of a technology experiencing early mainstream adoption with progressive maturity. The adoption lifecycle indicates an initial phase dominated by early adopters among commercial and cargo aircraft operators seeking improvements in fuel efficiency, aerodynamic performance, and overall operational cost reduction.

During this stage, adoption is influenced by aircraft retrofitting cycles, fleet modernization programs, and airline investment priorities, which determine the rate at which winglet integration spreads across different aircraft classes.

As the market progresses toward mid-stage maturity, growth is fueled by demonstrable performance benefits, wider acceptance by aircraft manufacturers, and increasing regulatory encouragement for fuel efficiency and emission reduction. The compounding effect of these factors drives a steady increase in adoption rates, with more operators integrating winglets into new builds and retrofitting existing fleets.

In the latter part of the forecast period, the market approaches late maturity as the majority of compatible aircraft incorporate winglet technology, leading to incremental rather than exponential growth. The market maturity curve is therefore characterized by an early adoption surge, a pronounced growth phase as the technology proves its operational value, and a gradual stabilization as penetration saturates. Adoption is expected to continue at a measured pace, with advanced winglet designs, material innovations, and optimization for specific aircraft types shaping the lifecycle dynamics through 2035.

| Metric | Value |

|---|---|

| Winglets Market Estimated Value in (2025 E) | USD 3.6 billion |

| Winglets Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The winglets market represents a specialized segment within the global aerospace and aviation industry, emphasizing aerodynamic efficiency, fuel savings, and performance optimization. Within the broader commercial aircraft components sector, it accounts for about 4.8%, driven by adoption in narrow-body, wide-body, and regional jets. In the aerostructures and aircraft design segment, its share is approximately 5.2%, reflecting use in reducing drag, improving lift-to-drag ratio, and lowering operational costs. Across the aircraft modification and retrofit market, it holds around 4.1%, supporting fuel efficiency upgrades for existing fleets.

Within the aviation fuel efficiency and environmental solutions category, it represents 3.7%, highlighting its role in reducing carbon emissions and operational fuel consumption. In the overall aerospace technology and performance solutions sector, the market contributes about 3.3%, emphasizing integration with advanced wing designs, materials, and flight optimization systems. Recent developments in the winglets market have focused on aerodynamics, lightweight materials, and retrofit adaptability. Innovations include blended, split, and sharklet winglet designs that enhance lift and reduce drag for both new aircraft and retrofits. Key players are collaborating with airframe manufacturers, airlines, and research institutions to improve fuel efficiency, reduce carbon footprint, and comply with global emission standards.

Adoption of composite materials, high-strength alloys, and simulation-driven aerodynamic testing is gaining traction to optimize performance while minimizing structural weight. The digital monitoring and maintenance systems are being implemented to track winglet integrity, enabling predictive maintenance and improved lifecycle management.

The winglets market is witnessing notable growth as aircraft manufacturers and airlines increasingly prioritize fuel efficiency, emission reduction, and extended flight range. Winglets play a critical role in reducing aerodynamic drag, thereby improving fuel economy and lowering operational costs across various aircraft categories. The market is being driven by strong demand for narrow-body and wide-body aircraft with enhanced aerodynamic performance, as well as growing retrofitting activities in the commercial aviation sector.

Regulatory focus on environmental sustainability and carbon emission reduction is pushing the adoption of winglet technologies, especially among major global air carriers. Technological advancements in composite materials and aerodynamic design have allowed winglets to deliver higher fuel savings without significant weight penalties.

Furthermore, rising global air traffic, ongoing fleet modernization, and the need for extended range performance in both domestic and long-haul operations are contributing to the winglets market’s expansion As aircraft manufacturers aim to meet next-generation fuel efficiency targets, winglet adoption is expected to remain a key area of focus, ensuring steady growth over the forecast period.

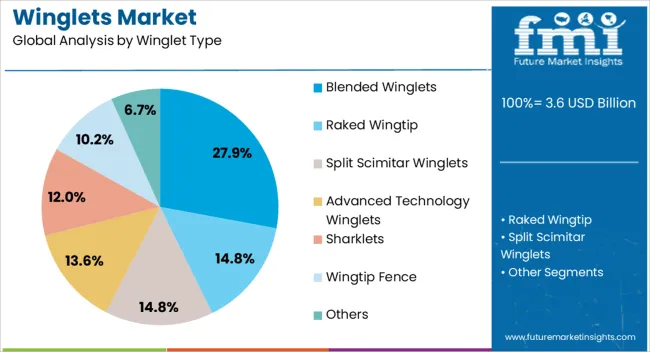

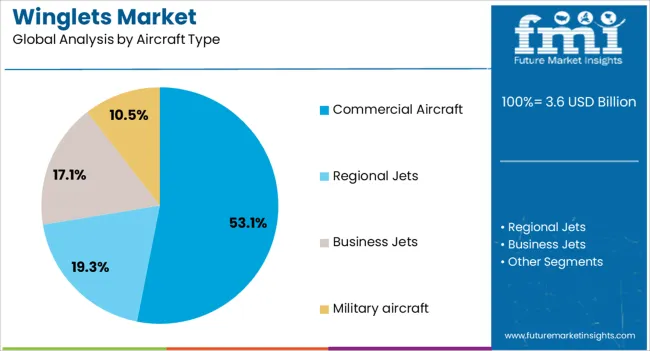

The winglets market is segmented by winglet type, aircraft type, platform type, fit type, and geographic regions. By winglet type, winglets market is divided into Blended Winglets, Raked Wingtip, Split Scimitar Winglets, Advanced Technology Winglets, Sharklets, Wingtip Fence, and Others. In terms of aircraft type, winglets market is classified into Commercial Aircraft, Regional Jets, Business Jets, and Military aircraft.

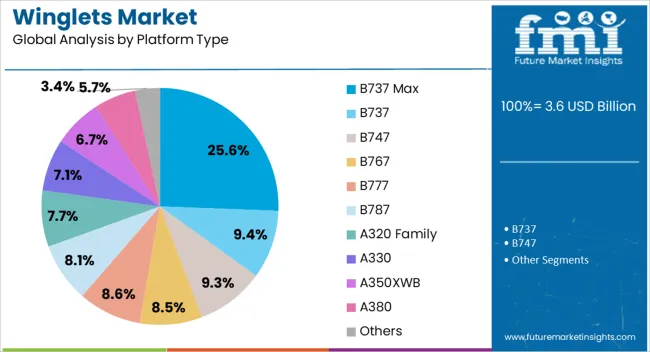

Based on platform type, winglets market is segmented into B737 Max, B737, B747, B767, B777, B787, A320 Family, A330, A350XWB, A380, and Others. By fit type, winglets market is segmented into Line fit and Retrofit. Regionally, the winglets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The blended winglets segment is projected to account for 27.9% of the winglets market revenue share in 2025, establishing it as the leading winglet type. This dominance is being driven by the aerodynamic advantages offered by the smooth, upward-swept design that reduces drag at the wingtips, leading to significant fuel savings. Blended winglets are widely adopted due to their proven performance in increasing range, improving climb performance, and lowering engine maintenance requirements.

Their structural integration with the wing design allows for more efficient lift distribution, thereby enhancing overall flight efficiency. The segment's leadership is further supported by successful certification across multiple commercial aircraft platforms and compatibility with both new-build and retrofit applications.

Airlines and aircraft manufacturers have increasingly favored blended winglets due to their strong return on investment and environmental benefits, especially in fuel-sensitive operations. As the industry continues to focus on operational cost reduction and environmental compliance, the blended winglets segment is expected to maintain its market share leadership.

The commercial aircraft segment is expected to hold 53.1% of the winglets market revenue share in 2025, positioning it as the dominant aircraft type. The segment’s leadership is being driven by the high fuel consumption and extensive global operations of commercial fleets, making aerodynamic enhancements through winglets highly impactful. Airlines operating narrow-body and wide-body aircraft have consistently adopted winglets to achieve reductions in fuel burn, emissions, and maintenance costs.

The rising global demand for passenger travel and increased aircraft utilization have placed greater emphasis on fuel-saving technologies, further encouraging the integration of winglets into commercial platforms. Retrofitting older aircraft with winglets has become a common cost-saving measure, especially among low-cost carriers and international operators focused on long-haul efficiency.

The segment is also benefiting from fleet renewal programs that prioritize sustainability and improved performance. As the commercial aviation sector continues to recover and grow post-pandemic, the use of winglets on commercial aircraft is expected to remain a strategic priority for airlines aiming to reduce environmental impact and operating expenses.

The B737 Max platform is anticipated to capture 25.6% of the winglets market revenue share in 2025, making it the leading platform within this segment. Its leadership is being supported by Boeing’s design integration of advanced winglet technologies as a core efficiency enhancement feature. The aircraft’s dual-feather split-tip winglets provide optimized lift and drag balance, enabling better fuel economy and extended range over previous generation models.

The widespread global deployment of the B737 Max, particularly by major commercial carriers, has significantly contributed to the growth of this platform type within the winglets market. Airlines have shown strong interest in the B737 Max due to its favorable operating economics, and the inclusion of high-performance winglets has been a major factor in fleet acquisition decisions.

As deliveries resume and global airline fleets expand with more fuel-efficient models, the B737 Max platform is expected to continue generating significant demand for advanced winglet solutions. Its market leadership reflects the broader trend of incorporating aerodynamic refinements to meet industry goals for efficiency and sustainability.

The market has expanded significantly as aircraft manufacturers increasingly focus on improving fuel efficiency, reducing emissions, and enhancing overall aerodynamic performance. Winglets, which are vertical or angled extensions at the wingtips, reduce drag and improve lift-to-drag ratio, resulting in lower fuel consumption and operational costs for airlines. Rising air travel demand, coupled with stringent environmental regulations and carbon emission targets, has intensified the adoption of winglet technology in both commercial and business aircraft. Additionally, retrofit programs for existing fleets and the integration of advanced composite materials have further accelerated growth.

Winglets are widely adopted to enhance fuel efficiency by reducing wingtip vortices and drag, leading to measurable decreases in fuel burn per flight. Airlines benefit from operational cost reductions and compliance with emission regulations. Modern winglets, including blended, split-tip, and sharklet designs, are optimized using computational fluid dynamics and wind tunnel testing. The integration of lightweight composites and high-strength materials reduces weight without compromising structural integrity. Fuel efficiency benefits are especially significant for long-haul flights, where drag reduction directly translates to reduced fuel usage. Environmental concerns and rising jet fuel costs have driven airlines to prioritize winglet-equipped aircraft for both new production and retrofit applications, making it a critical component of sustainable aviation strategies.

Winglets improve aircraft performance by enhancing lift-to-drag ratio, which results in better climb performance, higher cruising efficiency, and extended range capabilities. Improved aerodynamics reduce turbulence effects on wingtips, leading to smoother flights and reduced structural stress. Advanced designs also contribute to lower noise generation, supporting compliance with airport noise regulations. Winglets are increasingly integrated into narrow-body, wide-body, and business aircraft to balance aerodynamic efficiency with structural demands. Aircraft manufacturers and operators focus on optimized winglet geometry tailored to specific aircraft models, ensuring improved fuel efficiency and operational flexibility. These performance enhancements make winglets an attractive investment for fleet modernization and long-term operational cost management.

Existing aircraft fleets are being retrofitted with winglets to capitalize on fuel savings, extended range, and reduced emissions. Retrofit solutions allow airlines to upgrade operational efficiency without investing in entirely new aircraft. Installation is supported by modular designs, manufacturer-led certification programs, and lightweight composite materials that minimize downtime. Airlines in regions with high fuel costs or long-haul operations particularly benefit from such upgrades. Fleet modernization strategies often prioritize aircraft with advanced winglet configurations to maintain competitiveness, improve environmental performance, and meet international sustainability targets. The retrofit market continues to expand alongside new production, ensuring steady demand for winglet solutions across global aviation sectors.

North America and Europe are leading markets due to high aircraft manufacturing activities, stringent environmental regulations, and emphasis on fuel efficiency. Asia Pacific shows rapid growth driven by rising air travel, new airline fleets, and aircraft manufacturing investments. Key market players focus on R&D in aerodynamics, composite materials, and winglet optimization to maintain competitive advantage. Strategic partnerships with aircraft manufacturers, airlines, and MRO providers enhance market penetration. Regional adoption is influenced by fuel prices, government incentives, and airline modernization programs. Continuous innovation in winglet design and integration ensures global market expansion while addressing environmental sustainability, operational efficiency, and performance expectations.

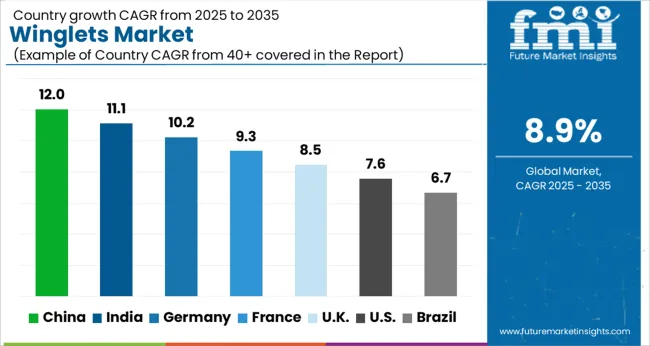

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| U.K. | 8.5% |

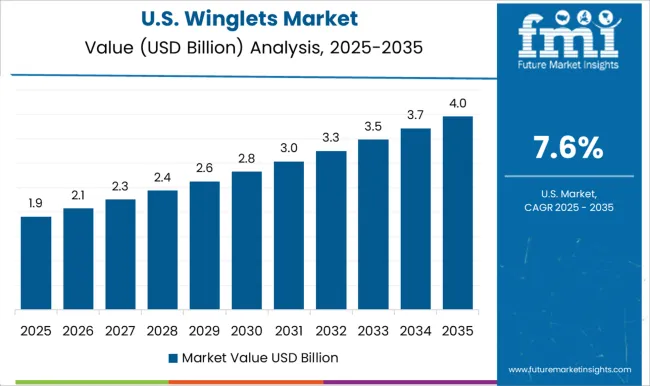

| U.S. | 7.6% |

| Brazil | 6.7% |

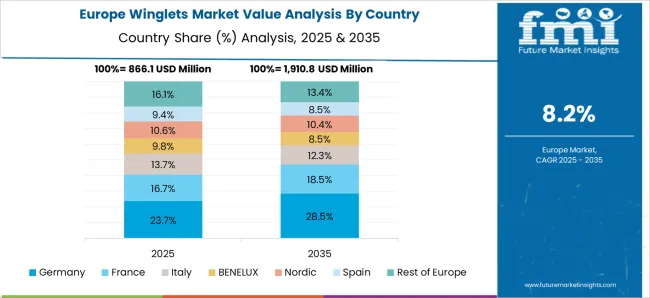

The market is projected to grow at a CAGR of 8.9% from 2025 to 2035. China leads with 12.0%, supported by extensive aircraft manufacturing and retrofitting programs. India follows at 11.1%, driven by growth in civil aviation and fleet modernization. Germany accounts for 10.2%, reflecting strong aerospace engineering capabilities and adoption of fuel-efficient winglet designs. The U.K. stands at 8.5%, focusing on innovation in aerodynamics and environmental efficiency. The United States registers 7.6%, emphasizing integration of advanced winglet technologies in commercial and private aircraft. These countries are advancing, scaling, and innovating to enhance aircraft performance, fuel efficiency, and emissions reduction in line with global aviation trends. This report includes insights on 40+ countries; the top markets are shown here for reference.

China, projected to grow at a CAGR of 12.0%, experiences robust demand for winglets driven by a rapidly expanding commercial aviation sector, growing domestic passenger traffic, and fleet modernization initiatives. Both new aircraft production and retrofit programs are prioritized to enhance fuel efficiency and reduce operational costs. Domestic manufacturers collaborate with international OEMs to develop advanced blended and raked winglets suitable for narrow-body and wide-body aircraft. The government’s focus on environmental efficiency and emissions reduction further encourages adoption.

India, growing at a CAGR of 11.1%, is influenced by expanding domestic and regional air travel, rapid fleet expansion, and rising adoption of fuel-efficient technologies. Retrofit services for existing aircraft, alongside new aircraft deliveries with integrated winglets, form the primary market. Airlines focus on operational cost reduction, extended aircraft range, and environmental compliance. MRO providers actively support installation and maintenance, while OEM collaborations enhance technological adoption.

Germany, with a CAGR of 10.2%, maintains steady adoption due to its established aviation industry, presence of commercial airlines, and aircraft leasing companies. Retrofit of older fleets and inclusion in new aircraft procurement are key drivers. Focus is placed on advanced blended winglets and raked tips to improve aerodynamics, fuel efficiency, and environmental performance. Integration with digital flight operations enhances monitoring and performance optimization.

The United Kingdom, forecast to grow at a CAGR of 8.5%, is shaped by airline focus on reducing fuel consumption, operational costs, and carbon footprint. Retrofit programs for older aircraft coexist with new deliveries incorporating integrated winglets. Airlines and MRO providers prioritize designs that enhance range, minimize drag, and optimize environmental performance. Demand is significant in narrow- and medium-range aircraft used for domestic and short-haul international routes.

The United States, growing at a CAGR of 7.6%, remains a mature market with a large commercial fleet. Adoption is driven by the need to reduce fuel consumption, improve aerodynamics, extend aircraft range, and meet environmental regulations. Both retrofit and new aircraft programs are significant, with widespread use of blended, raked-tip, and split-tip winglets. Airlines also integrate winglet performance data into flight management systems for optimized efficiency.

The market is shaped by specialized aerospace component manufacturers focusing on improving aircraft fuel efficiency, aerodynamics, and operational performance. Aviation Partners Inc and Aviation Partners Boeing are key innovators, offering advanced blended winglet and split-scimitar technologies widely adopted across commercial and business aircraft fleets. These companies leverage extensive engineering expertise, certifications, and close collaborations with airframe manufacturers to optimize wingtip designs for fuel savings and emission reductions. Kaman Corporation and GKN Aerospace contribute through precision aerostructures and composite winglet solutions, emphasizing lightweight, high-strength materials that enhance aircraft performance.

FACC AG focuses on integrated aerodynamic and structural solutions, combining design innovation with material optimization to meet evolving airline requirements. Competition in this market is driven by technological differentiation, regulatory compliance, and partnerships with OEMs. Companies invest in research and development to improve aerodynamic efficiency, reduce drag, and integrate environmentally sustainable materials. The market is further influenced by increasing air travel demand, rising fuel costs, and airlines’ focus on operational efficiency, compelling manufacturers to continuously enhance winglet designs and maintain a technological edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Winglet Type | Blended Winglets, Raked Wingtip, Split Scimitar Winglets, Advanced Technology Winglets, Sharklets, Wingtip Fence, and Others |

| Aircraft Type | Commercial Aircraft, Regional Jets, Business Jets, and Military aircraft |

| Platform Type | B737 Max, B737, B747, B767, B777, B787, A320 Family, A330, A350XWB, A380, and Others |

| Fit Type | Line fit and Retrofit |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aviation Partners Inc, Aviation Partners Boeing, Kaman Corporation, GKN Aerospace, and FACC AG. |

| Additional Attributes | Dollar sales by winglet type and aircraft application, demand dynamics across commercial, regional, and business aviation sectors, regional trends in fuel efficiency and aerodynamic optimization adoption, innovation in materials, design, and drag reduction, environmental impact of reduced fuel consumption and emissions, and emerging use cases in next-generation aircraft, retrofitting programs, and performance-enhanced flight operations. |

The global winglets market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the winglets market is projected to reach USD 8.4 billion by 2035.

The winglets market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in winglets market are blended winglets, raked wingtip, split scimitar winglets, advanced technology winglets, sharklets, wingtip fence and others.

In terms of aircraft type, commercial aircraft segment to command 53.1% share in the winglets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA