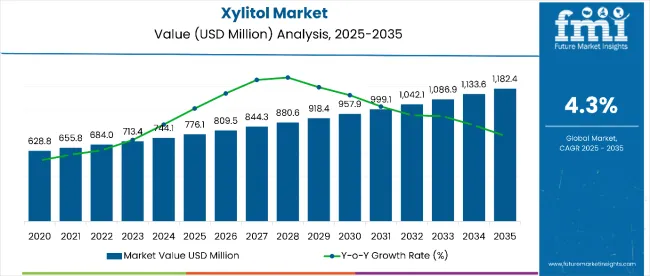

The xylitol market is estimated to be valued at USD 776.1 million in 2025. It is projected to reach USD 1,182.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 406 million over the decade.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 776.1 million |

| Projected Value (2035F) | USD 1,182.4 million |

| CAGR (2025-2035) | 4.3% |

This reflects a 1.52 times growth at a CAGR of 4.3%. The market’s evolution is expected to be driven by rising demand for sugar-free products, oral care items, and pharmaceuticals, alongside increasing consumer awareness regarding diabetic-friendly and low-calorie sweeteners.

By 2030, the market is expected to reach approximately USD 957.9 million, reflecting an incremental value of USD 181.8 million over the first half of the decade. The remaining USD 224.5 million is projected during the second half, indicating a moderately back-loaded growth pattern driven by increasing incorporation of xylitol in functional foods, beverages, and oral care products.

Companies such as Cargill, Inc., Archer Daniels Midland Company, Ingredion Incorporated, and Merck KGaA are enhancing their market positions through investments in production technologies, R&D for sustainable raw materials, and strategic partnerships. Product innovations focusing on sugar substitutes in confectionery and pharmaceuticals are supporting expansion. Market growth is anchored in compliance with regulatory standards, superior sweetness profiles, and multifunctional applications in health-oriented products.

The market holds a significant share across its parent markets, reflecting its versatile applications and growing consumer preference for low-calorie and functional ingredients. In the sugar alcohols market, xylitol accounts for approximately 28% of total demand due to its sweetness and health benefits. Within sugar substitutes, it captures nearly 22% of the market, driven by its natural origin and low glycemic index. In functional food ingredients, xylitol represents around 18%, particularly in sugar-free confectionery and beverages. Its presence in oral care and diabetic-friendly products contributes roughly 15% and 12%, respectively, underscoring its critical role in specialized nutritional and wellness-oriented formulations.

The market is being driven by the rising demand for low-calorie and diabetic-friendly sweeteners, as well as the growing adoption of sugar-free confectionery and oral care products. Innovations in extraction technologies from corn husks and wood xylan are improving purity and reducing production costs. Trends indicate expansion in functional foods, beverages, and pharmaceuticals, while developments in sustainable sourcing and formulation enhancements are further accelerating market growth. Consumer preference for healthier alternatives continues to underpin the industry’s expansion

Xylitol’s low-calorie profile, tooth-friendly properties, and natural origin make it a preferred sugar substitute for health-conscious consumers and food manufacturers aiming to reduce sugar content without compromising taste. Its versatility across confectionery, oral care, pharmaceuticals, and functional food applications enhances its adoption globally.

Rising awareness of diabetes, obesity, and dental health concerns is driving demand, particularly in sugar-free chewing gums, candies, baked goods, and oral care products. Innovations in sustainable extraction methods from corn husks and wood xylan are improving production efficiency and purity, enabling broader application in food and pharmaceutical industries.

Government regulations promoting reduced sugar intake and clean-label ingredients further support market growth. As consumer preference shifts toward healthier, low-glycemic, and functional ingredients, Xylitol is increasingly recognized as a safe, multifunctional sweetener. With manufacturers investing in R&D, quality enhancement, and supply chain scalability, the market outlook remains robust across all major regions.

The market is segmented byraw material, application, and regions. By raw material, the market is classified into corn husk, berries, sugarcane bagasse, mushrooms, and oats. Based on application, the market is segmented into food & beverage, cosmetics, and healthcare. Regionally, the market is categorized intoNorth America, Latin America, Europe, Asia Pacific, Oceania, and MEA.

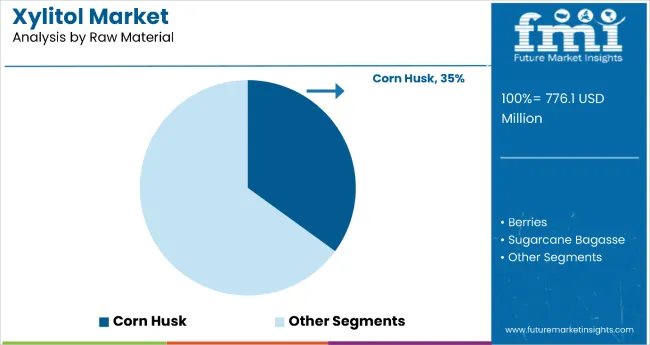

The corn husk segment holds a leading position in the raw material category with 35% of the market share in 2025. Its prominence is driven by high xylan content, cost-efficient extraction, and widespread availability, which support scalable industrial production. Xylitol derived from corn husks is increasingly preferred by manufacturers due to its consistent purity, lower production costs, and environmental sustainability.

Its applications in sugar-free chewing gums, candies, and functional foods leverage the material’s natural origin and consumer-friendly profile. Technological advances in enzymatic hydrolysis and purification processes further improve yield and consistency in sweetness, enhancing product reliability for both food and pharmaceutical applications. The segment’s growth is also anchored by rising demand for diabetic-friendly sweeteners and sugar substitutes in developed and emerging markets.

Manufacturers are investing in supply chain optimization, sustainable sourcing, and R&D for process efficiency to strengthen competitive positioning. With consumer preference shifting toward natural, low-calorie sweeteners, the corn husk segment is projected to maintain robust growth and capture incremental market share over the decade.

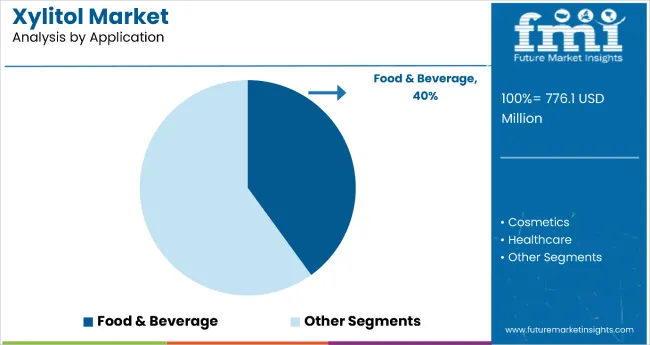

The food & beverage segment is the most lucrative application, accounting for 40% of the Xylitol market in 2025. Its growth is driven by rising consumption of sugar-free products, including chewing gum, confectionery, baked goods, beverages, and dairy-based functional foods. Xylitol provides sweetness without the calories of sugar and supports oral health, making it a preferred ingredient for manufacturers targeting health-conscious consumers.

Functional versatility, low glycemic index, and clean-label positioning enable Xylitol to be integrated across multiple food formulations. Product innovation, such as sugar-free chocolates, flavored gums, and beverages, is accelerating adoption in both developed and emerging markets. The segment’s expansion is further supported by regulatory encouragement for reduced-sugar formulations and rising consumer awareness about diabetes and obesity management.

Companies are enhancing R&D efforts, improving product solubility and taste profiles, and leveraging sustainable raw material sourcing to meet growing industry requirements. With increasing focus on healthier alternatives, the Food & Beverage segment is expected to retain its leading share and drive overall market growth through 2035.

In 2025, the global xylitol market is projected to reach USD 776.1 million, with Asia-Pacific and North America together accounting for more than 50% of total consumption. Applications span sugar-free confectionery, chewing gums, beverages, oral care products, and pharmaceuticals. Manufacturers are focusing on advanced enzymatic extraction processes from corn husks and birch wood to improve yield, purity, and cost-efficiency.

Rising consumer preference for natural, low-calorie, and diabetic-friendly sweeteners is bolstering demand. Clean-label positioning, multifunctional health benefits, and oral health advantages support adoption across retail and industrial applications. Technology providers increasingly offer ready-to-use Xylitol formulations that simplify product integration and ensure consistent sweetness profiles.

Health and Wellness Trends Drive Xylitol Adoption

Food and beverage manufacturers, oral care companies, and pharmaceutical producers are incorporating xylitol to achieve sugar reduction, caloric control, and dental protection benefits. In functional foods and sugar-free products, xylitol delivers sweetness without the glycemic impact of conventional sugar.

Its application in chewing gums and candies helps prevent tooth decay, while incorporation in beverages and baked goods aligns with the growing demand for low-sugar alternatives. Regulatory encouragement for sugar reduction and rising diabetic populations further accelerates adoption. These factors contribute to robust growth, with the Food & Beverage segment projected to capture 40% of market share in 2025 and expand steadily through 2035.

Supply Chain, Cost, and Production Constraints Limit Expansion

Growth is moderated by challenges, including raw material sourcing, price volatility, and processing complexity. Seasonal availability of corn husks and birch wood affects production volumes, while enzymatic conversion requires specialized infrastructure, extending development cycles.

Fluctuations in Xylitol extraction efficiency can increase production costs by 10-15%, impacting profitability. Cold storage requirements and quality assurance standards for pharmaceutical-grade Xylitol further raise logistics and operational expenditures. These constraints restrict large-scale adoption in cost-sensitive markets despite rising consumer awareness and the product’s functional benefits.

| Countries | CAGR (2025 to 2035) |

| UK | 7.5% |

| France | 7.4% |

| Germany | 7.1% |

| Japan | 6.5% |

| US | 5.6% |

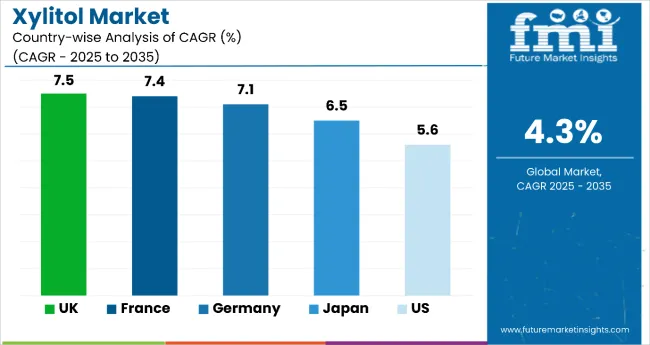

In the global xylitol market, the UK, France, Germany, Japan, and the US demonstrate strong growth potential, with projected CAGRs of 7.5%, 7.4%, 7.1%, 6.5%, and 5.6% respectively, from 2025 to 2035. The UK and France lead Europe due to rising demand for sugar-free confectionery and oral care products. Germany shows steady growth driven by functional food innovation. Aging populations and low-sugar dietary trends influence Japan’s expansion, while the US maintains strong consumption due to established production and high consumer awareness.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Revenue from xylitol in the UK is projected to grow at a CAGR of 7.5% from 2025 to 2035. Demand is driven by sugar-free chewing gums, candies, and functional beverages, with London, Manchester, and Birmingham emerging as key consumption hubs. Manufacturers focus on clean-label formulations and sustainable sourcing to align with health-conscious consumer trends. Product innovation in oral care and confectionery, combined with regulatory support for sugar reduction, reinforces adoption across retail and industrial channels.

Key Statistics:

Sales of the xylitol market areanticipated to expand at a CAGR of 7.4% from 2025 to 2035, driven by sugar-free confectionery, oral care products, and functional beverages. Paris, Lyon, and Marseille are primary consumption regions. Rising awareness of diabetes management and calorie-conscious diets supports market adoption, while regulatory encouragement for reduced sugar intake enhances product innovation. Manufacturers are increasingly investing in high-purity Xylitol extraction and formulation technologies to meet consumer demands for natural and functional ingredients.

Key Statistics:

Demand for Xylitol is estimated to rise at a CAGR of 7.1% from 2025 to 2035, with Berlin, Munich, and Frankfurt serving as major adoption hubs. The market benefits from functional food innovation, premium sugar-free confectionery, and oral care product integration. Manufacturers are enhancing extraction efficiency and investing in sustainable raw material sourcing. Regulatory frameworks and EU standards support clean-label applications. Rising health awareness and preference for low-calorie sweeteners sustain growth and reinforce Germany’s position as a significant European Xylitol market.

Key Statistics:

The xylitol market in Japan is projected to strengthen at a CAGR of 6.5% from 2025 to 2035, driven by low-sugar dietary preferences, aging demographics, and strong dental health awareness. Tokyo, Osaka, and Nagoya are leading consumption centers. Xylitol is widely incorporated into chewing gums, candies, beverages, and functional foods. Domestic and imported products leverage high-quality production standards to ensure purity and safety. Manufacturers continue to invest in innovative formulations and efficient production technologies to meet growing consumer demand for sugar substitutes.

Key Statistics:

Revenue of xylitol in the USA is slated to increase at a CAGR of 5.6% from 2025 to 2035. Key regions include California, New York, and Texas, where retail and industrial adoption is strong. Growth is fueled by increasing demand for sugar-free confectionery, beverages, and oral care products. Manufacturers focus on large-scale production, supply chain optimization, and product innovation to meet health-conscious consumer preferences. Rising diabetic population, clean-label trends, and regulatory support for sugar reduction contribute to steady market expansion across North America.

Key Statistics:

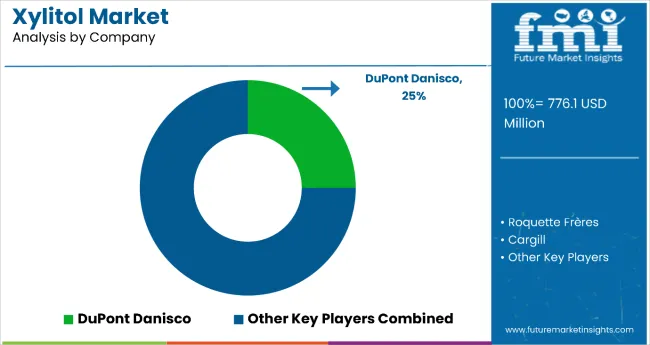

The global xylitol market is moderately consolidated, featuring a mix of multinational corporations and specialized regional players. Leading companies such as Cargill, Inc., Ingredion Incorporated, Roquette Frères, Archer Daniels Midland Company, and Zhejiang Huakang Pharmaceutical Co., Ltd. dominate the market, leveraging their extensive production capabilities and established distribution networks. These industry leaders focus on expanding their production facilities to meet the growing demand for xylitol, particularly in the food and beverage, pharmaceuticals, and personal care sectors.

In addition to the major players, several regional manufacturers contribute to the market's competitiveness. Companies like Shandong Futaste Co., Ltd., Shandong Longlive Bio-Technology Co., Ltd., and JiningHengda Green Engineering Co., Ltd. are notable for their specialized production processes and regional market presence. These firms often emphasize cost-effective production methods and cater to local market needs, providing competition to the global leaders.

The competitive dynamics in the xylitol market are influenced by factors such as production efficiency, product quality, and the ability to meet the increasing consumer demand for natural and low-calorie sweeteners. Companies are also focusing on research and development to innovate and expand their product offerings, ensuring they remain competitive in this evolving market landscape.

| Item | Value |

| Quantitative Units (2025) | USD 776.1 Million |

| Raw Material | Corn Husk, Berries, Sugarcane Bagasse, Mushrooms, Oats |

| Application | Food & Beverage, Cosmetics, Healthcare |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Oceania, MEA |

| Countr ies Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | DuPont Danisco, Cargill, Ingredion, Roquette Freres, Shandong Futaste , CSPC Shengxue Glucose, Archer Daniels Midland Company, Merck KGaA , ZuChem Inc , NovaGreen Inc |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, integration with sustainable sourcing practices, innovations in extraction technology and quality standardization for diverse industrial applications |

The global xylitol market is estimated to be valued at USD 776.1 million in 2025.

The market size for the xylitol market is projected to reach USD 1,182.4 million by 2035.

The xylitol market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in xylitol market are corn husk, berries, sugarcane bagasse, mushrooms and oats.

In terms of application, food & beverage segment to command 54.2% share in the xylitol market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA