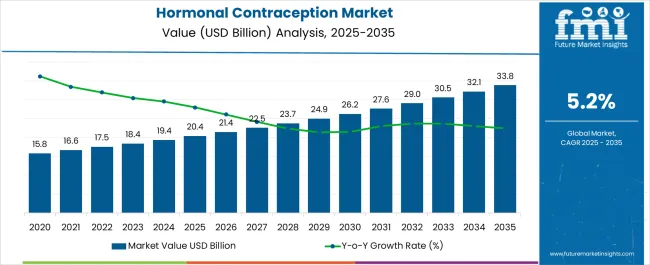

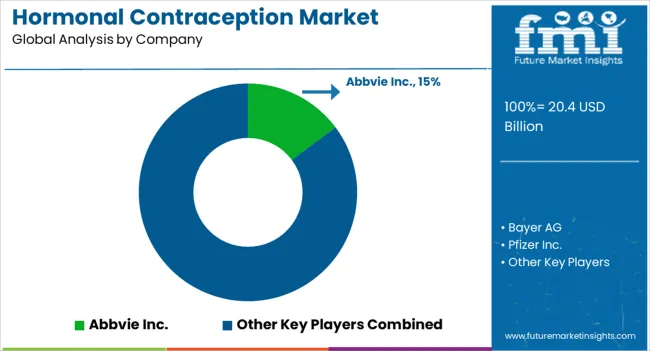

The Hormonal Contraception Market is estimated to be valued at USD 20.4 billion in 2025 and is projected to reach USD 33.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Hormonal Contraception Market Estimated Value in (2025 E) | USD 20.4 billion |

| Hormonal Contraception Market Forecast Value in (2035 F) | USD 33.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The hormonal contraception market is experiencing consistent expansion, supported by growing awareness of family planning, reproductive health, and women’s healthcare empowerment. Rising government initiatives to increase access to contraceptives, coupled with improvements in healthcare infrastructure, are driving greater adoption in both developed and developing regions. Expanding educational programs and awareness campaigns are encouraging women to consider safer and more effective methods of birth control, contributing to demand growth.

Increasing innovation in drug formulations, such as low-dose and extended-cycle options, is improving convenience, compliance, and safety, making hormonal contraceptives more widely accepted. The market is also benefiting from demographic trends, including a large population of women of reproductive age and delayed family planning decisions, which are increasing reliance on hormonal solutions.

Strong support from healthcare providers and integration of contraceptives into broader reproductive health services are further boosting uptake As social attitudes evolve and access expands through pharmacies, hospitals, and digital healthcare platforms, the market is positioned for sustained growth with opportunities for manufacturers to enhance product diversity and reach.

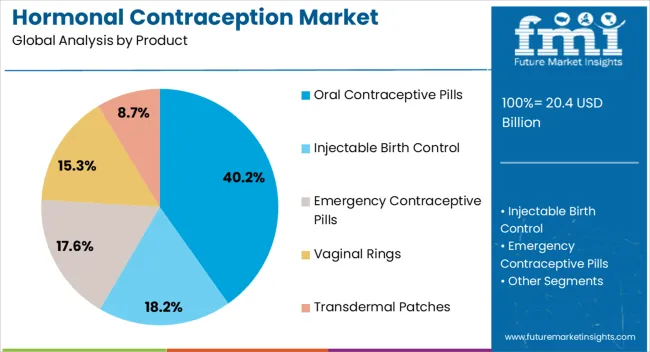

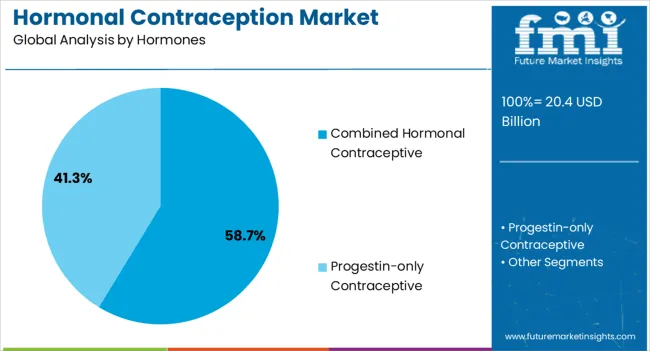

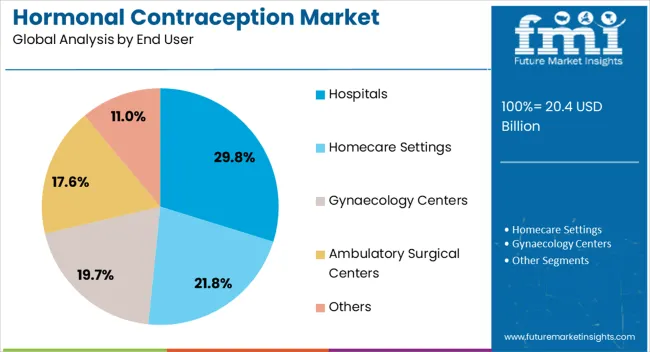

The hormonal contraception market is segmented by product, hormones, end user, and geographic regions. By product, hormonal contraception market is divided into Oral Contraceptive Pills, Injectable Birth Control, Emergency Contraceptive Pills, Vaginal Rings, and Transdermal Patches. In terms of hormones, hormonal contraception market is classified into Combined Hormonal Contraceptive and Progestin-only Contraceptive. Based on end user, hormonal contraception market is segmented into Hospitals, Homecare Settings, Gynaecology Centers, Ambulatory Surgical Centers, and Others. Regionally, the hormonal contraception industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oral contraceptive pills segment is projected to account for 40.2% of the hormonal contraception market revenue share in 2025, making it the leading product type. This dominance is being driven by the convenience, affordability, and ease of administration offered by oral pills, which remain the most widely used form of hormonal contraception globally.

Daily dosing schedules, combined with broad availability across retail pharmacies and healthcare institutions, have contributed to high patient compliance rates. Continued improvements in pill formulations, including lower hormone doses and extended-cycle regimens, have enhanced safety profiles and reduced side effects, strengthening acceptance among women.

The segment is further benefiting from strong physician recommendations due to its proven efficacy in preventing pregnancy and its additional health benefits, such as regulation of menstrual cycles and reduction of certain gynecological risks As awareness of reproductive health expands and healthcare providers encourage safer family planning options, oral contraceptive pills are expected to maintain their leadership in the market, supported by broad accessibility and continued innovation in drug development.

The combined hormonal contraceptive segment is anticipated to hold 58.7% of the hormonal contraception market revenue share in 2025, positioning it as the leading hormone type. Its dominance is being supported by the high effectiveness of combined estrogen and progestin formulations in regulating ovulation and providing consistent contraceptive protection. These formulations are preferred due to their ability to deliver dual hormonal action, which ensures higher efficacy compared to single hormone options.

The segment is also benefiting from widespread availability in multiple dosage forms, including oral pills, patches, and vaginal rings, offering flexibility and convenience for different user needs. Clinical evidence supporting additional non-contraceptive health benefits, such as reduced risk of ovarian cysts, anemia, and endometrial cancer, has further encouraged adoption.

Growing physician preference for prescribing combined hormonal contraceptives, along with increased patient confidence in their safety and effectiveness, is strengthening market share As healthcare providers continue to focus on comprehensive reproductive health solutions, combined hormonal contraceptives are expected to remain the most widely utilized option within the hormonal contraception landscape.

The hospitals segment is expected to represent 29.8% of the hormonal contraception market revenue share in 2025, making it a leading end-user category. Its strong position is being reinforced by the critical role hospitals play in prescribing, dispensing, and monitoring hormonal contraceptives, particularly in urban and semi-urban regions. Hospitals serve as the primary point of care for women seeking reproductive health consultations, family planning services, and treatment for gynecological conditions, thereby creating significant demand for contraceptive products.

Comprehensive counseling provided by healthcare professionals in hospital settings enhances patient awareness and adherence, supporting growth in this segment. Hospitals are also key channels for ensuring safe and regulated access to hormonal contraception, particularly in markets where regulatory oversight is strict.

In addition, hospitals frequently participate in public health programs and government initiatives aimed at increasing contraceptive coverage, further driving utilization With expanding healthcare infrastructure and growing integration of reproductive health services into hospital systems, the segment is anticipated to maintain a strong market presence, ensuring continued growth opportunities for manufacturers and healthcare providers.

The major use of hormonal contraception is by women for the prevention of pregnancy. In the process, the intake imbalances the hormones and can cause different complications. The latest development through research and development programs are helping with the side effects of contraception pills.

With the FDA approvals, combined estrogen/progestin contraception help the women with different complications. Most women (83%) have regular menses when using the contraceptive. This advancement helps in reducing bleeding and faster return to fertility than DMPA and this too with lower side effects.

This hormonal contraception includes dosing one patch weekly for three consecutive weeks. The advanced mean serum helps in the reduction of excessive bleeding and infection caused by hormonal contraception. It is generally helpful and effective to the women that have a weight of over 90 Kgs.

Females utilize hormonal contraception extensively across the world. Due to increased public awareness of the importance of making informed decisions regarding one's sexual and reproductive health, hormonal contraception is increasingly used as a method of birth control.

Furthermore, the market is expanding as a result of increasing expenditures by key manufacturers in the R&D of novel contraceptive devices and supportive programs launched by various governments to provide access to contraceptives. The increase in the female population worldwide, urbanization, more awareness of hormonal contraception, and supportive NGOs all contribute to the expansion of the hormonal contraceptive industry.

Furthermore, a rise in emphasis on family planning, health problems related to teenage pregnancies, and an increased understanding of contemporary contraceptive methods are major drivers anticipated to fuel market expansion for hormonal contraceptives globally.

Geographically, the hormonal contraception market is distributed into major seven regions –North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa. Among these regions, the North American region dominates the market due to the presence of the major key players, a high percentage of unintended pregnancies and increasing knowledge of sexual health issues.

Key factors supporting the regional growth of the European market are the advent of innovative contraceptive methods for women and the rapid expansion of the economy.

Additionally, the Asia-Pacific market for hormonal contraception is anticipated to show rapid growth in the forecast period due to the development in the pharmaceutical industry and government involvement to impose some measure of control on the birth rate of the population.

Some of the key manufacturers operating in the hormonal contraception market are Abbvie Inc., Bayer AG, Pfizer Inc, Agile Therapeutics, Pregna International Ltd., Lupin Pharmaceuticals Inc, Janssen Pharmaceuticals Inc., Teva Pharmaceuticals Industries Ltd., Afaxys, Inc., Johnson & Johnson, Merck & Co, Inc, Church & Dwight, Co, Inc and others.

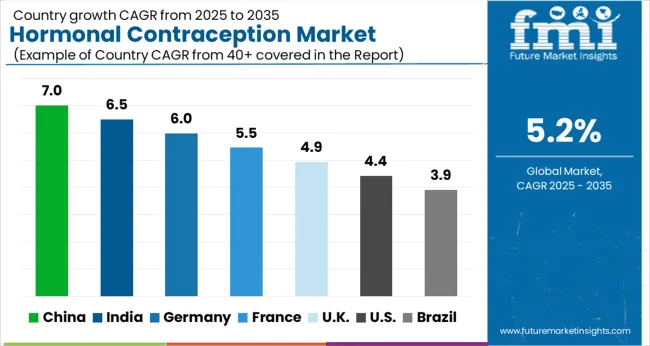

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The Hormonal Contraception Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UKcontinue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Hormonal Contraception Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Hormonal Contraception Market is estimated to be valued at USD 7.3 billion in 2025 and is anticipated to reach a valuation of USD 11.2 billion by 2035. Sales are projected to rise at a CAGR of 4.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.1 billion and USD 550.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.4 Billion |

| Product | Oral Contraceptive Pills, Injectable Birth Control, Emergency Contraceptive Pills, Vaginal Rings, and Transdermal Patches |

| Hormones | Combined Hormonal Contraceptive and Progestin-only Contraceptive |

| End User | Hospitals, Homecare Settings, Gynaecology Centers, Ambulatory Surgical Centers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abbvie Inc., Bayer AG, Pfizer Inc., Agile Therapeutics, Pregna International Ltd., Lupin Pharmaceuticals Inc., Janssen Pharmaceuticals Inc., Teva Pharmaceuticals Industries Ltd., Afaxys, Inc., Johnson & Johnson, Merck & Co, Inc., and Church & Dwight, Co, Inc. |

The global hormonal contraception market is estimated to be valued at USD 20.4 billion in 2025.

The market size for the hormonal contraception market is projected to reach USD 33.8 billion by 2035.

The hormonal contraception market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in hormonal contraception market are oral contraceptive pills, injectable birth control, emergency contraceptive pills, vaginal rings and transdermal patches.

In terms of hormones, combined hormonal contraceptive segment to command 58.7% share in the hormonal contraception market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA