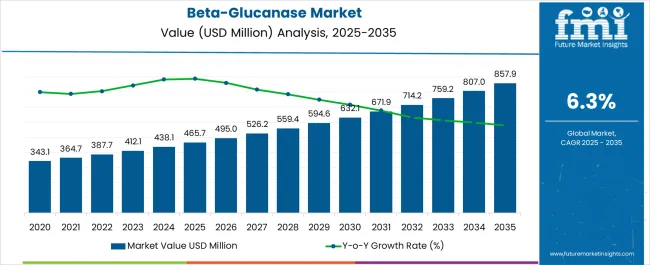

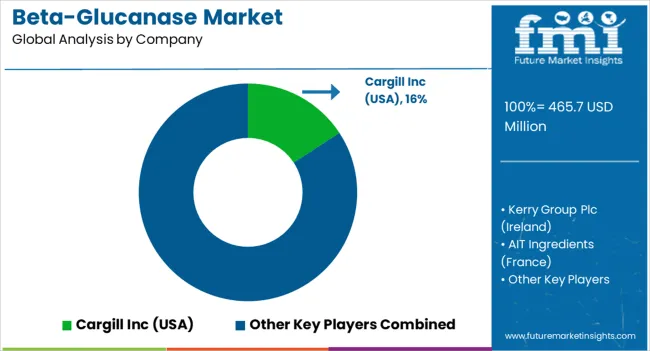

The Beta-Glucanase Market is estimated to be valued at USD 465.7 million in 2025 and is projected to reach USD 857.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Beta-Glucanase Market Estimated Value in (2025 E) | USD 465.7 million |

| Beta-Glucanase Market Forecast Value in (2035 F) | USD 857.9 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The beta-glucanase market is demonstrating steady growth, supported by the rising demand for functional ingredients in food, beverage, feed, and nutraceutical industries. Increasing awareness of digestive health and immunity-boosting products is driving the integration of beta-glucanase into dietary supplements and wellness products. The enzyme’s ability to break down complex beta-glucans into simpler, bioavailable components is being leveraged to improve nutrient absorption and functional efficacy across a wide range of applications.

Growing investments in enzyme biotechnology, along with advancements in fermentation processes, are enhancing product efficiency, stability, and cost-effectiveness. The market is also benefiting from the expansion of clean-label and natural product categories, where beta-glucanase is being increasingly adopted as a natural processing aid.

Regulatory support for safe and effective enzyme-based ingredients in human and animal nutrition is further accelerating adoption As consumer preferences shift toward health-oriented food products and sustainable feed solutions, the market is anticipated to expand significantly, supported by innovation in enzyme formulations and broader acceptance of enzyme-based functional solutions across global markets.

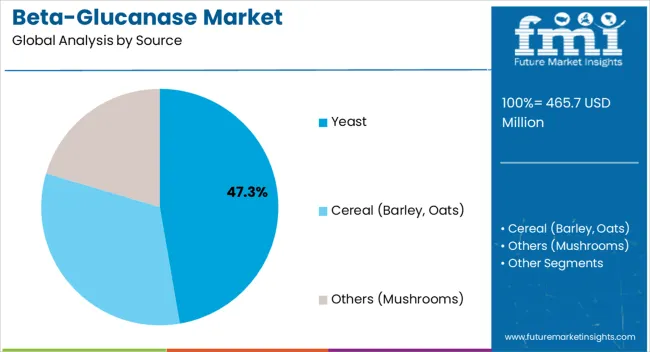

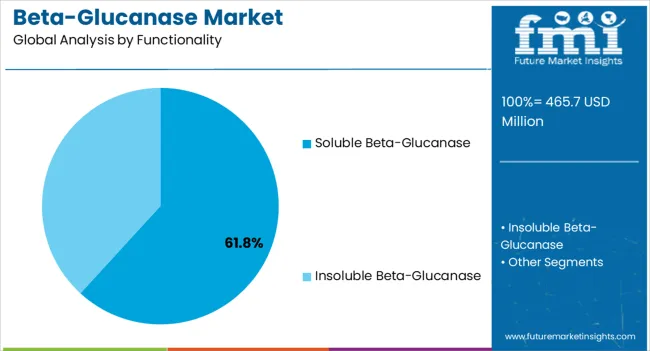

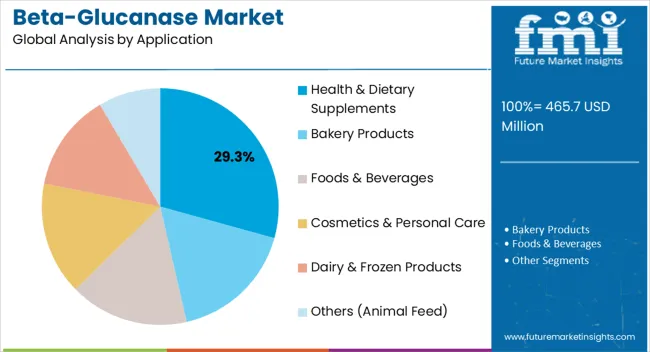

The beta-glucanase market is segmented by source, functionality, application, and geographic regions. By source, beta-glucanase market is divided into Yeast, Cereal (Barley, Oats), and Others (Mushrooms). In terms of functionality, beta-glucanase market is classified into Soluble Beta-Glucanase and Insoluble Beta-Glucanase. Based on application, beta-glucanase market is segmented into Health & Dietary Supplements, Bakery Products, Foods & Beverages, Cosmetics & Personal Care, Dairy & Frozen Products, and Others (Animal Feed). Regionally, the beta-glucanase industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The yeast source segment is projected to account for 47.3% of the beta-glucanase market revenue share in 2025, making it the leading source category. This dominance is being attributed to the abundance of yeast-derived beta-glucans in various applications and the cost-effective production methods associated with yeast fermentation. The enzymatic extraction from yeast provides high yield and consistency, which supports large-scale commercial use in both food and feed industries.

The stability and effectiveness of yeast-derived beta-glucanase have been demonstrated across a wide range of processing environments, making it suitable for industrial applications that require reliable enzyme activity under varying conditions. The demand for yeast-based solutions is also being reinforced by their acceptance in natural and clean-label formulations, aligning with growing consumer interest in sustainable and traceable sources.

Advances in fermentation technologies and strain development are enabling higher enzyme purity and activity, ensuring consistent performance across applications As industries prioritize efficiency and sustainability, yeast remains the most practical and scalable source of beta-glucanase, solidifying its leadership position in the global market.

The soluble beta-glucanase functionality segment is expected to hold 61.8% of the beta-glucanase market revenue share in 2025, establishing it as the leading functionality type. Its growth is being driven by the superior solubility and ease of incorporation into liquid and powdered formulations, making it highly suitable for nutraceuticals, beverages, and functional foods. Soluble beta-glucanase enhances bioavailability and efficacy, supporting its adoption in products targeted toward improving digestion and immune function.

The ability of soluble forms to retain stability across a range of processing conditions is further increasing their application potential in health and dietary supplements. Manufacturers are prioritizing soluble formulations due to their ability to blend seamlessly with other ingredients without compromising texture or taste, which is critical in consumer-facing products.

The segment’s expansion is also linked to ongoing research in biotechnology aimed at optimizing solubility and enzymatic activity With the growing trend toward functional and fortified food solutions, soluble beta-glucanase is expected to remain the preferred choice for manufacturers, ensuring its strong contribution to overall market growth.

The health and dietary supplements application segment is anticipated to capture 29.3% of the beta-glucanase market revenue share in 2025, making it the dominant application. The leadership of this segment is being fueled by the increasing consumer focus on digestive wellness, immunity enhancement, and preventive healthcare. Beta-glucanase is being incorporated into dietary supplements to improve the breakdown of beta-glucans, thereby enhancing nutrient absorption and overall effectiveness of formulations.

Its role in supporting gut health and immunity is particularly relevant as consumers prioritize natural solutions to strengthen resilience against lifestyle-related disorders and infections. The expanding nutraceutical sector, combined with rising disposable incomes and health-conscious lifestyles, is reinforcing demand for enzyme-based supplements. Regulatory acceptance of beta-glucanase as a safe and beneficial dietary ingredient is further driving adoption in supplement formulations.

The ability to combine beta-glucanase with other functional ingredients in capsules, powders, and liquid supplements is increasing product diversity and accessibility As the global demand for wellness products accelerates, the health and dietary supplements segment is expected to remain the largest contributor to market revenues.

A novel substance called beta-glucanase is currently being introduced to the market. It is a nutritional supplement produced from yeast cell walls. According to some research, beta-glucanase is good for the heart and can lower the chance of developing heart disease. Clinical testing of the product has shown that it effectively lowers levels of harmful cholesterol.

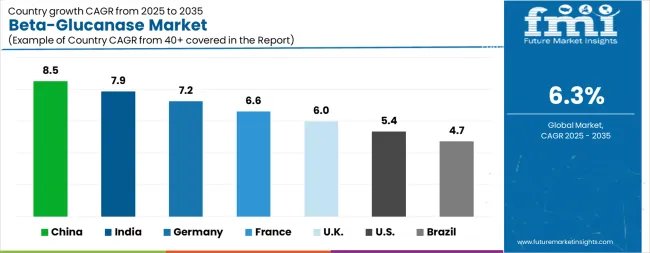

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The Beta-Glucanase Market is expected to register a CAGR of 6.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.5%, followed by India at 7.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.7%, yet still underscores a broadly positive trajectory for the global Beta-Glucanase Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.2%. The USA Beta-Glucanase Market is estimated to be valued at USD 174.1 million in 2025 and is anticipated to reach a valuation of USD 293.3 million by 2035. Sales are projected to rise at a CAGR of 5.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 22.5 million and USD 16.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 465.7 Million |

| Source | Yeast, Cereal (Barley, Oats), and Others (Mushrooms) |

| Functionality | Soluble Beta-Glucanase and Insoluble Beta-Glucanase |

| Application | Health & Dietary Supplements, Bakery Products, Foods & Beverages, Cosmetics & Personal Care, Dairy & Frozen Products, and Others (Animal Feed) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill Inc (USA), Kerry Group Plc (Ireland), AIT Ingredients (France), Ohly GmbH (Germany), Biorigin Zilor (Brazil), Alltech Life Sciences (USA), Tate & Lyle Plc (UK), Koninklijke DSM N.V. (Netherlands), Garuda International Inc (USA), Angel Yeast Co Ltd (China), Biotec BetaGlucans AS (Norway), and Ceapro Inc (Canada) |

The global beta-glucanase market is estimated to be valued at USD 465.7 million in 2025.

The market size for the beta-glucanase market is projected to reach USD 857.9 million by 2035.

The beta-glucanase market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in beta-glucanase market are yeast, cereal (barley, oats) and others (mushrooms).

In terms of functionality, soluble beta-glucanase segment to command 61.8% share in the beta-glucanase market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA