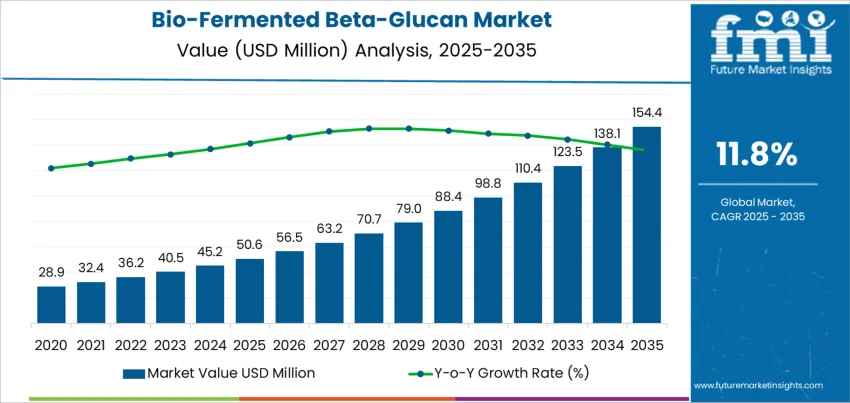

The global demand for bio-fermented beta-glucan is expected to grow from USD 50.6 million in 2025 to USD 154.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 11.8%. Bio-fermented beta-glucan, known for its immune-boosting and anti-inflammatory properties, is becoming an increasingly important ingredient in dietary supplements, functional foods, and skincare products. As consumers continue to prioritize health and wellness, the demand for bio-fermented beta-glucan is expected to rise, driven by its natural ability to support immune function and improve overall well-being. The increasing preference for plant-based, sustainable ingredients in functional foods and personal care products also fuels the market growth.

The market will experience steady growth, starting at USD 50.6 million in 2025 and rising to USD 56.5 million in 2026, USD 63.2 million in 2027, and USD 70.7 million in 2028. By 2029, demand for bio-fermented beta-glucan will rise to USD 79.0 million, continuing its upward trajectory through the 2030s. By 2035, the demand for bio-fermented beta-glucan is projected to reach USD 154.4 million, driven by the increasing awareness of its health benefits, expanding applications in functional foods and dietary supplements, and growing consumer interest in natural, immune-boosting ingredients.

The Growth Rate Volatility Index for the bio-fermented beta-glucan market indicates low volatility in the growth rate over the forecast period, with a steady increase expected each year. From 2025 to 2029, the market will grow from USD 50.6 million to USD 79.0 million, indicating a relatively consistent and stable growth rate, with year-on-year increases maintaining a strong and steady pace. This period reflects a stable market as consumer awareness of bio-fermented beta-glucan's benefits increases, and its adoption in various sectors (including supplements, functional foods, and cosmetics) gains momentum.

From 2029 to 2035, the market will continue to experience steady growth, reaching USD 154.4 million by 2035. The growth rate may slightly stabilize towards the later years, but the overall trend will remain upward, driven by increased market maturity, broader product applications, and heightened consumer demand for health-conscious, immune-supporting ingredients. The low volatility index suggests that the bio-fermented beta-glucan market will see predictable and stable growth, benefiting from ongoing innovation and expanding consumer interest in natural health and wellness products.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 50.6 million |

| Industry Forecast Value (2035) | USD 154.4 million |

| Industry Forecast CAGR (2025-2035) | 11.8% |

Demand for bio-fermented beta-glucan is increasing worldwide as health and wellness trends drive consumers toward natural, science-backed functional ingredients. Beta-glucan is valued for its ability to support immune function, improve cardiovascular health by helping manage cholesterol levels, support gut health, and regulate blood glucose, all of which resonate with growing public focus on preventive health and chronic-disease risk management. As more people adopt dietary supplements, functional foods, and nutraceuticals to supplement conventional nutrition, bio-fermented beta-glucan is seeing growing inclusion in products like cereals, health drinks, snack bars, and supplements. Its reputation as a natural immunomodulator and dietary fiber has helped expand its use not only in food and beverages but also in pharmaceuticals and animal nutrition.

At the same time, industry dynamics and production technology improvements enhance market growth. Advances in fermentation, extraction, and purification processes have increased the availability, consistency, and purity of beta-glucan, making it easier for manufacturers to incorporate it into a wide variety of applications such as functional foods, dietary supplements, cosmetics, and health-oriented products. Regional growth patterns also support expansion of the market, especially in North America and Asia-Pacific, where demand for wellness and preventive health products continues to grow. Forecasts suggest the global beta-glucan market may more than double over the coming decade, implying robust future demand for bio-fermented beta-glucan across sectors.

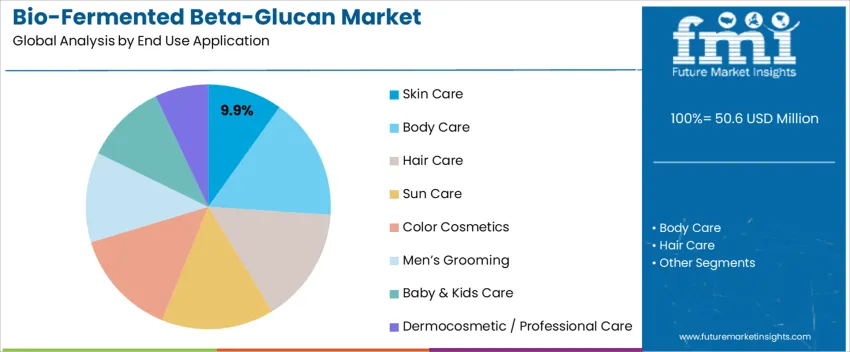

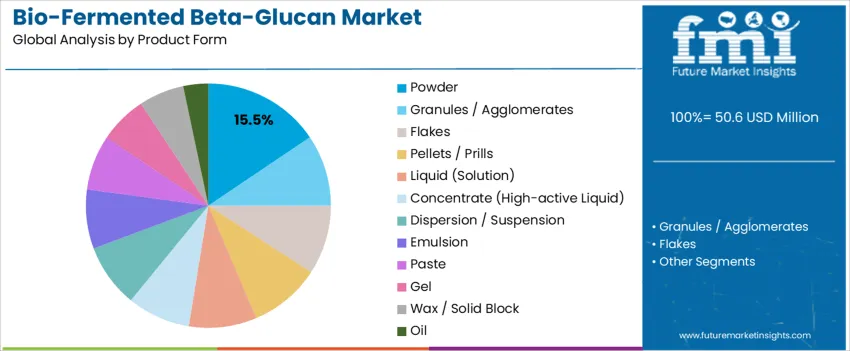

The global demand for bio-fermented beta-glucan is primarily driven by application and product form. The leading end-use application is skin care, accounting for 9.9% of the market share, while powder holds the largest share in the product form segment, capturing 15.5%. Bio-fermented beta-glucan, known for its skin-protecting, anti-inflammatory, and immune-boosting properties, is increasingly used in various personal care products. As consumer interest in natural and effective skincare solutions grows, bio-fermented beta-glucan continues to gain traction across the global beauty and personal care market.

Skin care is the leading application for bio-fermented beta-glucan, capturing 9.9% of the market share. This ingredient is valued for its ability to enhance the skin's defense mechanisms, providing hydration, reducing irritation, and supporting skin regeneration. It is commonly used in moisturizers, serums, and other skincare formulations aimed at soothing and protecting the skin, especially for sensitive or compromised skin types.

The demand for bio-fermented beta-glucan in skin care is driven by the growing consumer preference for natural, scientifically-supported ingredients that offer multiple skin benefits. As awareness increases about the importance of strengthening the skin barrier and improving skin resilience, bio-fermented beta-glucan is becoming a key ingredient in skincare formulations targeting sensitive skin, redness, and inflammation. With the rising trend for clean and sustainable beauty products, bio-fermented beta-glucan is expected to see continued growth in the skin care market globally.

Powder is the leading product form for bio-fermented beta-glucan globally, holding 15.5% of the market share. Powdered bio-fermented beta-glucan is preferred for its stability, ease of incorporation into a wide range of formulations, and longer shelf life compared to liquid or gel forms. It allows for precise dosage control and is versatile in various personal care products such as creams, serums, masks, and professional skincare treatments.

The demand for powdered bio-fermented beta-glucan is driven by its flexibility in formulation and its efficiency in offering high concentrations of active ingredients. As the beauty industry continues to focus on creating personalized and high-performance skincare products, powdered beta-glucan is becoming a preferred choice for manufacturers. This form allows for more precise application in formulations and greater control over ingredient potency, ensuring it remains a strong contender in the global personal care market.

Global demand for bio-fermented beta-glucan is increasing as industries and consumers alike recognise its wide range of health, wellness, and skincare benefits. Bio-fermented beta-glucan - derived from yeast, fungi or microbial fermentation rather than relying solely on cereal/grain extraction - is used across sectors such as nutraceuticals, functional foods and beverages, dietary supplements, and personal care/cosmetics. Its properties, including immune support, skin barrier enhancement, hydration, antioxidant protection and skin-soothing effects, make it attractive for both internal wellness products and topical skincare formulations. Demand is rising in regions worldwide, spurred by growing health awareness, aging populations, and increasing interest in natural / bio-derived ingredients.

Several factors drive the growing demand globally. First, growing consumer interest in immune health, overall wellness and preventive care boosts demand for beta-glucan in supplements and functional foods. Beta-glucan’s immune-modulating and cholesterol-management properties are well accepted in nutrition and health industries. Second, rising demand for natural, clean-label and bio-derived ingredients - especially in markets for dietary supplements and cosmetics - encourages use of fermented beta-glucan over synthetic alternatives or less refined extracts. Third, in skincare and personal care, increasing prevalence of skin sensitivity, environmental stress, pollution and aging has pushed demand for gentle, barrier-supportive, antioxidant and moisturizing actives - beta-glucan fits well in this niche. Fourth, improvements in fermentation and extraction technologies allow more efficient, scalable, and high-quality production of beta-glucan, making it more accessible for large-scale use in food, supplement and cosmetic products.

Despite its benefits, some factors limit widespread adoption globally. One challenge is variability in beta-glucan quality - differences in source (yeast, fungi, grain), molecular structure, purity and extraction method can lead to inconsistent performance in terms of bioactivity or skin/health benefits. This variability can make regulatory approval, labeling and consumer trust more difficult, especially in highly regulated markets. Cost of high-purity, bio-fermented beta-glucan remains higher than more basic alternatives or conventional ingredients, which can restrict use in lower-cost or mass-market products. For ingestible products, taste, formulation stability and consumer acceptance (e.g. texture, solubility) can pose challenges. Additionally, for topical or cosmetic use, certain consumers may prefer newer or more aggressive actives (like retinoids or synthetic antioxidants), making beta-glucan a less compelling choice despite its gentleness.

A prominent trend is the convergence of wellness, nutrition and beauty: beta-glucan is being used both internally (supplements, functional foods) and externally (skin creams, lotions, serums), reflecting holistic “beauty from within and without” consumer demand. There is increasing use of beta-glucan in “clean-label,” vegan, and microbiome-friendly skincare formulations - appealing to consumers seeking gentle, natural, non-animal derived ingredients. Development of multifunctional products combining beta-glucan with other bio-actives (such as antioxidants, hyaluronic acid, botanical extracts) is growing, offering combined benefits like hydration, anti-aging, barrier support and immune wellness. Expansion into emerging markets - especially in Asia-Pacific, Latin America and parts of Africa - is accelerating as awareness of health, wellness, and premium skincare rises. Finally, advances in biotechnology and fermentation techniques are making bio-fermented beta-glucan production more efficient and scalable, which may lower costs and enable broader integration into foods, supplements and personal-care products worldwide.

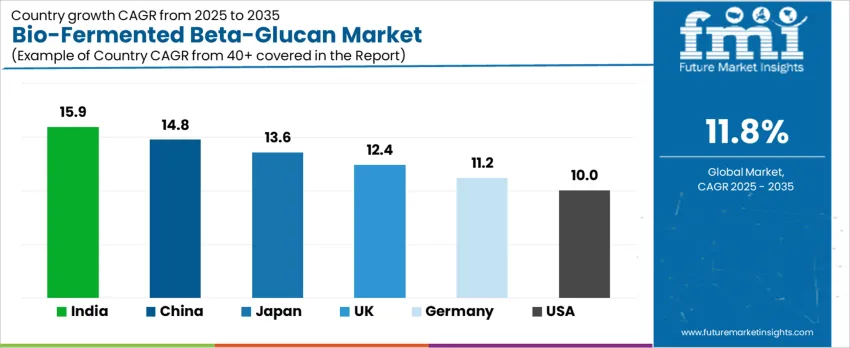

The demand for bio-fermented beta-glucan is seeing significant growth across the globe, with India leading the charge at a projected CAGR of 15.9%. China follows closely with a growth rate of 14.8%, while Japan is expected to grow at 13.6%. The UK, Germany, and the USA are also experiencing steady growth, with CAGRs of 12.4%, 11.2%, and 10%, respectively. This surge in demand is primarily driven by the growing consumer preference for natural, effective ingredients that support immune health, skin rejuvenation, and overall wellness. As awareness of the benefits of bio-fermented ingredients continues to rise, bio-fermented beta-glucan is becoming a key component in the dietary supplements, skincare, and functional food markets.

| Country | CAGR (%) |

|---|---|

| India | 15.9 |

| China | 14.8 |

| Japan | 13.6 |

| UK | 12.4 |

| Germany | 11.2 |

| USA | 10.0 |

In India, the demand for bio-fermented beta-glucan is projected to grow at a robust CAGR of 15.9%. The country’s growing health-conscious population, coupled with an increasing focus on immunity-boosting and natural wellness products, is fueling the demand for bio-fermented beta-glucan. Consumers are increasingly seeking natural alternatives to synthetic ingredients, and bio-fermented beta-glucan is highly regarded for its immune-modulating and anti-inflammatory properties. Additionally, India’s expanding middle class, rising disposable incomes, and increasing awareness about the benefits of functional foods and supplements are driving market growth. The rapid expansion of e-commerce platforms has made these health products more accessible to consumers across the country, further boosting demand. As India continues to embrace modern wellness trends and prioritize preventative health, the market for bio-fermented beta-glucan is expected to see continued expansion.

In China, the demand for bio-fermented beta-glucan is projected to grow at a CAGR of 14.8%. The increasing awareness of the importance of immune health, combined with a growing preference for natural and functional food ingredients, is driving the market for bio-fermented beta-glucan. With the rise in chronic health conditions and an aging population, Chinese consumers are increasingly seeking out supplements and food products that enhance immunity and overall wellness. Bio-fermented beta-glucan, known for its ability to support immune function and provide antioxidant benefits, is a key ingredient in both dietary supplements and functional foods. Additionally, the influence of health-conscious trends and increasing disposable incomes is boosting consumer demand for premium, bio-based wellness products. As the Chinese market continues to focus on natural ingredients and holistic health solutions, the demand for bio-fermented beta-glucan is expected to grow steadily.

In Japan, the projected CAGR for bio-fermented beta-glucan is 13.6%. Japan’s well-established skincare and wellness market is increasingly embracing functional ingredients like bio-fermented beta-glucan, which is known for its skin-rejuvenating, anti-aging, and immune-supporting benefits. Japanese consumers are particularly focused on products that provide visible health benefits and enhance skin health, making bio-fermented beta-glucan a popular ingredient in both dietary supplements and skincare formulations. The growing interest in preventive health and longevity, coupled with an increasing demand for natural, plant-based ingredients, further supports the growth of this market. Japan’s reputation for high-quality, scientifically-backed products also contributes to the rising consumer confidence in bio-fermented beta-glucan, driving adoption across both food and skincare sectors. As the focus on immunity, skin health, and natural beauty continues to rise, the demand for bio-fermented beta-glucan is expected to remain strong.

In the UK, the demand for bio-fermented beta-glucan is expected to grow at a CAGR of 12.4%. The UK’s health-conscious consumer base, which increasingly prioritizes natural ingredients and functional foods, is contributing significantly to the growth of bio-fermented beta-glucan in the market. Consumers are seeking products that not only support immunity but also provide additional benefits like skin rejuvenation and anti-aging, both of which are associated with bio-fermented beta-glucan. The rise of the clean beauty movement and growing consumer awareness of the importance of gut and immune health further fuel demand for this bio-fermented ingredient. Additionally, the growing trend of personalized nutrition and wellness, along with the popularity of natural supplements and plant-based products, ensures that bio-fermented beta-glucan remains a preferred choice in the UK market. As consumers become more informed and demand effective, clean ingredients, the adoption of bio-fermented beta-glucan is expected to increase steadily.

In Germany, the demand for bio-fermented beta-glucan is projected to grow at a CAGR of 11.2%. Germany’s reputation for high-quality, scientifically proven wellness and skincare products aligns well with the adoption of bio-fermented beta-glucan. The country’s strong focus on natural ingredients, particularly in the health and wellness sectors, supports the growth of functional foods and supplements containing bio-fermented beta-glucan. As German consumers increasingly turn to immune-boosting and skin-rejuvenating products, bio-fermented beta-glucan’s ability to support immune function, reduce inflammation, and enhance skin health makes it an attractive option. Additionally, Germany’s emphasis on sustainability and transparency in ingredient sourcing supports the demand for bio-fermented, plant-based alternatives. With a growing interest in preventative health and natural beauty solutions, the market for bio-fermented beta-glucan is expected to see steady expansion in Germany.

In the USA, the projected CAGR for bio-fermented beta-glucan is 10%. The demand for functional foods, supplements, and skincare products that offer both health and beauty benefits is rapidly increasing in the USA Bio-fermented beta-glucan, known for its immune-supporting, anti-inflammatory, and skin-rejuvenating properties, is increasingly being included in dietary supplements and skincare formulations targeting aging, hydration, and overall skin health. The growing trend of clean beauty and natural ingredients, combined with a strong focus on immunity and overall wellness, drives the adoption of bio-fermented beta-glucan in the USA market. As consumers seek products that are both effective and sustainably sourced, bio-fermented beta-glucan’s natural, plant-based benefits are becoming more popular. Additionally, the rise of wellness-focused products in the USA means that demand for this ingredient is likely to grow steadily in the coming years.

Global demand for bio-fermented beta-glucan has increased as consumers and formulators of skin care, wellness and nutrition products increasingly favour natural, bioactive and multifunctional ingredients. Beta-glucan is a polysaccharide derived from yeasts, fungi, oats and other natural sources. In topical applications it is valued for moisturising, skin-soothing, barrier-strengthening, antioxidant and anti-inflammatory effects. These attributes make it useful in creams, serums and lotions aimed at sensitive, dry or aging skin. As awareness about skin health, clean-label formulations and gentle actives rises worldwide, demand for bio-fermented beta-glucan continues to grow. Parallel interest in nutritional and functional products using beta-glucan supports overall market expansion.

Several major ingredient-specialist firms dominate supply of bio-fermented beta-glucan. Among them, BASF SE is a leading supplier. Other significant companies include Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow Inc., Ashland, Clariant and Seppic. These firms supply beta-glucan in cosmetic-grade or nutraceutical-grade forms to manufacturers worldwide. Competition among them revolves around purity and reproducibility of the beta-glucan, efficiency and scalability of fermentation and extraction processes, regulatory compliance and consistency across batches. Some firms distinguish themselves by offering high-molecular-weight, bio-active-rich beta-glucan suitable for premium skin-care and wellness products. Others compete on breadth of portfolio, integrating beta-glucan with other botanicals or bioactives to offer multifunctional ingredient blends. Suppliers that combine robust quality control, sustainable sourcing and scalable production capacity are best positioned to capture growth in markets demanding clean-label, effective and safe beta-glucan-based products.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | North America, Europe, Asia Pacific, The Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (incl. IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic |

| Additional Attributes | Dollar sales by end-use application and product form show strong demand for bifida ferment lysate, particularly in skin care and body care products. Liquid solutions and emulsions are the most popular product forms, with concentrate forms also growing in demand. Major companies like BASF, Evonik, and Ashland dominate the market, offering a range of active ingredients for the cosmetic and dermocosmetic industries. The market is expected to grow with rising demand for innovative skincare solutions and natural ingredients. |

The global bio-fermented beta-glucan market is estimated to be valued at USD 50.6 million in 2025.

The market size for the bio-fermented beta-glucan market is projected to reach USD 154.4 million by 2035.

The bio-fermented beta-glucan market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in bio-fermented beta-glucan market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 15.5% share in the bio-fermented beta-glucan market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA