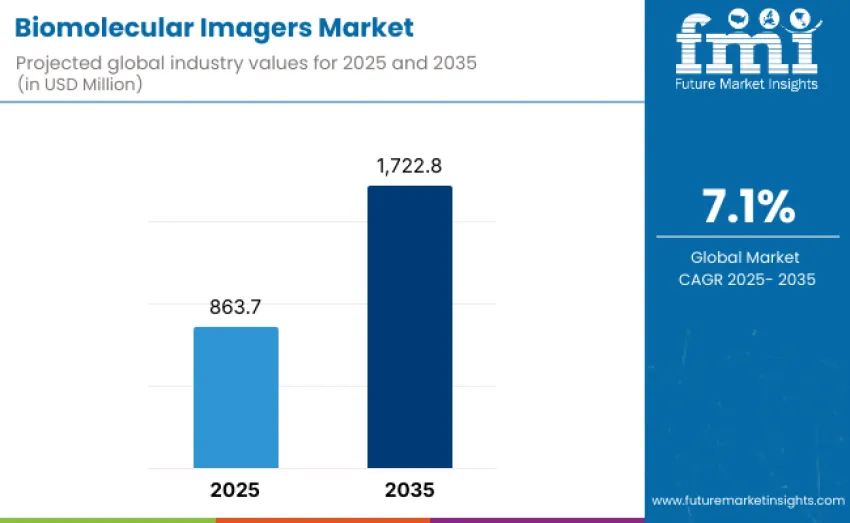

The biomolecular imagers market is projected to reach USD 1,722.8 million by 2035, recording an absolute increase of USD 859.1 million over the forecast period. This market is valued at USD 863.7 million in 2025 and is set to rise at a CAGR of 7.1% during the forecast period 2025-2035.

Overall size is expected to nearly double during this time, driven by rising demand for high-throughput imaging systems in drug discovery, genomics, and proteomics research, as well as increasing adoption of automated laboratory workflows and investments in life sciences infrastructure globally. High equipment costs and competition from alternative imaging platforms may constrain growth.

Biomolecular Imagers Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 863.7 million |

| Market Forecast Value (2035) | USD 1,722.8 million |

| Forecast CAGR (2025 to 2035) | 7.1% |

Market expansion reflects fundamental shifts in biomedical research and diagnostic workflows, where advanced biomolecular imagers enable researchers to perform high-resolution imaging with enhanced sensitivity and multiplexing capabilities. Academic institutions, pharmaceutical companies, and biotechnology laboratories are under pressure to accelerate experimental throughput and improve data quality. Modern biomolecular imagers typically provide 30-50% higher detection sensitivity and faster image acquisition compared with conventional imaging systems, making them essential for applications including fluorescence assays, cell-based imaging, and protein quantification.

Technological advancements in detector systems, optical modules, and software analytics are transforming biomolecular imaging landscape. Modern platforms incorporate cooled CCD and CMOS detectors, high-intensity LED or laser illumination, confocal and widefield imaging options, and multiplexed detection capabilities that allow simultaneous imaging of multiple biomolecules in a single experiment. Integration with automated quantification and 3D visualization software enables researchers to extract meaningful insights from complex datasets efficiently.

Between 2025 and 2030, biomolecular imagers market is projected to expand from USD 863.7 million to USD 1,219.8 million, resulting in a value increase of USD 356.1 million, representing 41.5% of total forecast growth for the decade. This phase of development will be shaped by rising demand for high-throughput, automated imaging systems in drug discovery, genomics, proteomics, and cell biology research, advancements in detector sensitivity and multiplexing capabilities, as well as expanding integration with laboratory information management systems and automated image analysis platforms.

From 2030 to 2035, market is forecast to grow from USD 1,219.8 million to USD 1,722.8 million, adding another USD 503.0 million, constituting 57.8% of overall ten-year expansion. This period is expected to be characterized by development of specialized imaging platforms, including high-content screening systems, live-cell and 3D imaging capabilities, and integrated workstation configurations tailored for complex cellular and molecular analysis.

Biomolecular imagers market is growing by enabling researchers and laboratory professionals to achieve high-resolution, quantitative, and reproducible imaging while streamlining complex experimental workflows. Life sciences laboratories face mounting pressure to accelerate drug discovery, biomarker validation, and cellular analysis, with modern biomolecular imagers often providing 30-50 percent faster image acquisition and higher detection sensitivity compared with conventional imaging systems, making these platforms essential for genomics, proteomics, cell biology, and translational research applications.

Expansion of precision medicine, high-content screening initiatives, and biomarker-driven research creates strong demand for imaging systems capable of delivering reliable, reproducible, and biologically relevant data across diverse experimental setups. Government research funding programs, public-private initiatives, and investments in laboratory infrastructure are driving adoption across academic institutions, pharmaceutical companies, and biotechnology laboratories. High acquisition costs along with the need for specialized technical expertise to operate advanced imaging platforms may limit adoption among smaller laboratories and budget-constrained academic programs.

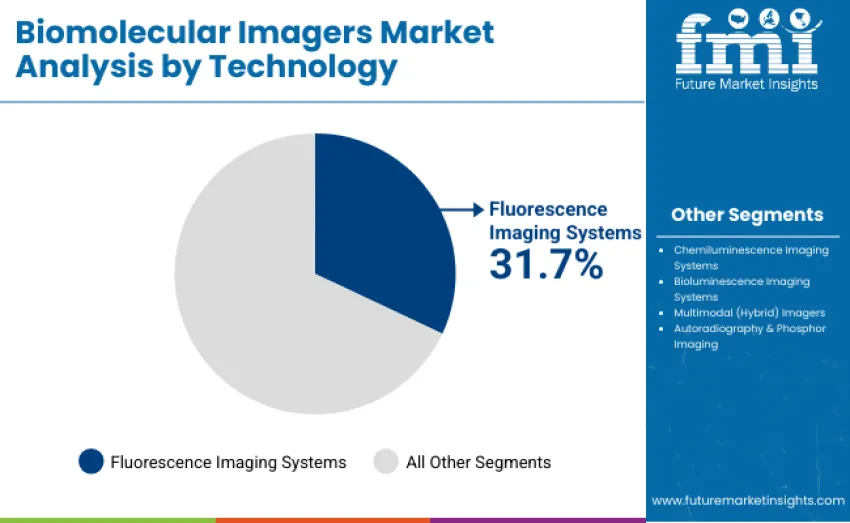

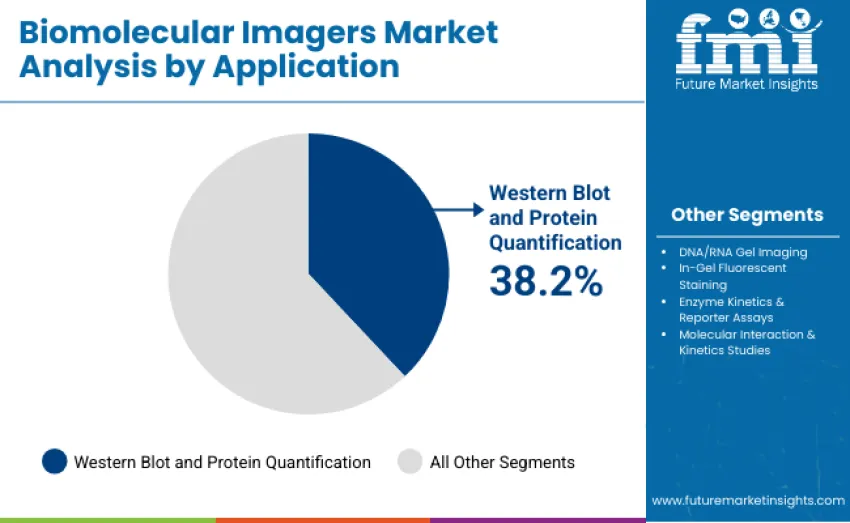

Biomolecular imagers market is segmented by technology, application, and region. By technology, it includes fluorescence imaging systems, chemiluminescence imaging systems, bioluminescence imaging systems, multimodal (hybrid) imagers, and autoradiography & phosphor imaging platforms. Based on application, it is categorized into western blot and protein quantification, DNA/RNA gel imaging, in-gel fluorescent staining, enzyme kinetics and reporter assays, and molecular interaction and kinetics studies. Regionally, it is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

Fluorescence imaging systems dominate the biomolecular imagers landscape with a 31.7% share in 2025, driven by high sensitivity, multiplexing capability, and compatibility with diverse dyes used in cell based assays, protein localization, and biomarker validation. Chemiluminescence systems hold 26.3% share, supported by strong demand for high dynamic range detection and rapid signal acquisition in western blotting and protein analysis. Multimodal imagers capture 19.2% of revenue by integrating multiple detection modes in one platform, enabling flexible workflows for research and clinical laboratories.

Western blot and protein quantification lead biomolecular imager applications with 38.2% revenue in 2025, driven by their central role in biomarker discovery, drug development, and functional genomics. DNA and RNA gel imaging holds 22.9%, reflecting consistent demand for nucleic acid analysis in gene expression and diagnostic workflows. Enzyme kinetics and reporter assays contribute 15.1%, while in gel fluorescent staining accounts for 13.7% through direct visualization of proteins and nucleic acids. Molecular interaction and kinetics studies represent 10.1%, supporting advanced biophysical and drug target research.

Growth is supported by expanding life science research, increasing proteomics and genomics activity, and wider adoption of high sensitivity imaging platforms across academic, pharmaceutical, and biotechnology laboratories. Rising demand for precise detection of proteins, nucleic acids, and fluorescently labeled targets reinforces use in Western blotting, gel documentation, in gel fluorescence, and multiplexed assay visualization. Higher resolution, wider dynamic range, and improved quantitative accuracy are increasingly required as experimental complexity intensifies across biomarker studies and translational research.

What Are the Key Restraints Affecting Adoption of Biomolecular Imagers?

High costs associated with advanced and multimodal imaging platforms remain a major barrier, limiting adoption in budget constrained laboratories. Integration of fluorescence, chemiluminescence, and infrared modalities increases system prices and service requirements. Limited access to high end systems in emerging markets, alongside operational complexity for labs without trained personnel, further slows penetration. Manual image interpretation challenges also reduce workflow efficiency for institutions lacking automated analysis tools.

What Key Trends Are Shaping the Future of Biomolecular Imaging?

Strong movement toward automated quantification, AI assisted analysis, and integrated data management platforms is reshaping imaging workflows. Adoption of near infrared imaging, multiplex fluorescence detection, and high throughput imaging continues to increase as research programs expand. Greater focus on standardized imaging protocols, software driven reproducibility, and cloud linked data handling is emerging, while rising demand in Asia Pacific and Latin America accelerates global diffusion of advanced imaging technologies.

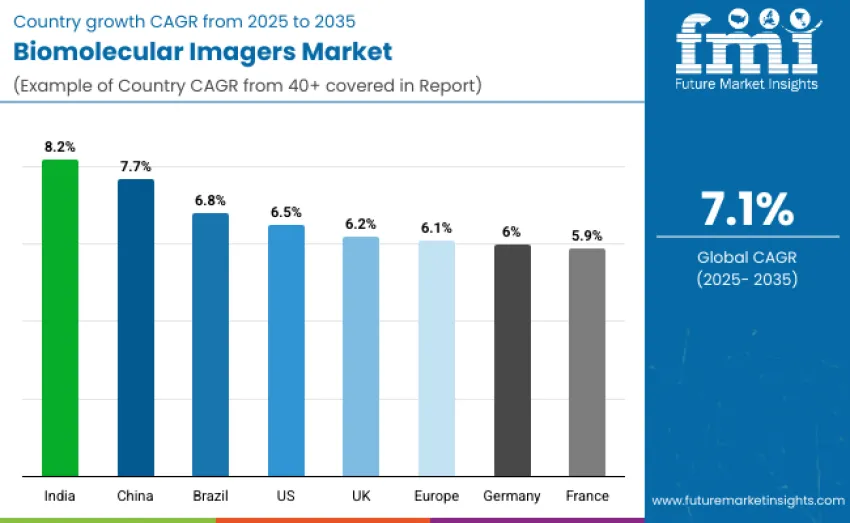

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| India | 8.2% |

| China | 7.7% |

| Brazil | 6.8% |

| United States | 6.5% |

| Europe | 6.1% |

| United Kingdom | 6.2% |

| Germany | 6.0% |

| France | 5.9% |

India leads the biomolecular imagers landscape with an 8.2% CAGR, driven by expanding life sciences activity, strong research infrastructure, and government support for digital molecular analysis. China follows at 7.7% CAGR due to biotechnology investment and laboratory modernization. Brazil grows at 6.8% as academic programs and biotech funding rise. The United States advances at 6.5% with high adoption of premium imaging systems. Europe records 6.1% CAGR, with the United Kingdom at 6.2%, Germany at 6.0%, and France at 5.9%, supported by research clusters and imaging technology upgrades.

China shows the strongest growth potential with a 7.7% CAGR through 2035, driven by rapid modernization of molecular biology and clinical laboratories in Shanghai, Beijing, and Shenzhen, where automated imaging systems support high throughput protein, nucleic acid, and cell analysis. Government support under the Made in China 2025 program accelerates adoption through grants and biotechnology park upgrades. Academic and pharmaceutical institutions increasingly integrate imagers into genomics, proteomics, and drug discovery workflows. Domestic manufacturers expand production capacity, while standardized workflows, personnel training, and collaborative R&D improve reproducibility and strengthen high resolution imaging adoption nationwide.

India’s biomolecular imagers market is projected to grow at a 8.2% CAGR through 2035, driven by rapid expansion of molecular biology, clinical, and pharmaceutical laboratories in Bengaluru, Hyderabad, Mumbai, and Pune, where high throughput imaging systems support protein analysis, cell imaging, and nucleic acid quantification. Government programs under the National Biotechnology Development Strategy and Make in India promote local manufacturing and reduce import reliance. Public laboratories and research institutes increasingly use automated imaging for diagnostics and drug development, while academic collaborations and CRO partnerships enhance protocol standardization and training.

Germany’s biomolecular imagers market is projected to grow at a 6.0% CAGR through 2035, supported by highly regulated biotechnology, diagnostics, and pharmaceutical laboratories in Berlin, Munich, and Frankfurt where imaging systems are widely used for cell analysis, protein quantification, and nucleic acid visualization. Compliance with EU regulatory frameworks and ISO laboratory standards strengthens platform reliability. University-industry R&D programs continue to advance high resolution imaging technologies, while growing laboratory automation improves throughput and reproducibility. Sustainability goals encourage adoption of energy efficient systems.

Brazil’s biomolecular imagers market is projected to grow at a 6.8% CAGR through 2035, supported by expansion of clinical, diagnostic, and research laboratories in São Paulo, Rio de Janeiro, Brasília, and Porto Alegre. Government funding through the Ministry of Health’s modernization program enables wider procurement of automated imaging platforms. Cost efficiency over manual workflows drives adoption in budget conscious facilities, while partnerships with global distributors improve access to instruments and reagents.

The United States biomolecular imagers market is projected to grow at a 6.5% CAGR through 2035, driven by strong R&D investments across pharmaceutical, academic, and clinical laboratories in California, Massachusetts, and New York. NIH funded programs support widespread acquisition of automated, high resolution imaging platforms for drug discovery, diagnostics, and molecular analysis. Biopharmaceutical companies collaborate with manufacturers to develop high throughput solutions, while FDA compliant workflows ensure reliable performance.

The United Kingdom’s biomolecular imagers market is projected to grow at a 6.2% CAGR through 2035, supported by modernization of molecular biology, clinical, and pharmaceutical laboratories in London, Manchester, Bristol, and Edinburgh. Government backed biopharmaceutical programs and university-industry collaborations enable wider adoption of automated imaging systems and standardized workflows. Academic institutions and CROs strengthen training to improve data accuracy and reproducibility. Public and private laboratories increasingly integrate imaging platforms with advanced analytics software, boosting high throughput capabilities.

France’s biomolecular imagers market is projected to grow at a 5.9% CAGR through 2035, driven by strong academic research institutions and expanding molecular biology programs concentrated in Paris, Lyon, Marseille, and Toulouse. Government-backed investments in genomics, proteomics, and structural biology have enabled adoption of high-resolution imaging systems for protein analysis, nucleic acid visualization, and cell based assays. National research agencies and university-industry partnerships promote standardized workflows and personnel training to ensure reproducibility and analytical accuracy. Laboratories increasingly integrate imaging systems with advanced software for automated quantification and data management.

Europe’s biomolecular imagers market is projected to grow at a 6.1% CAGR through 2035, supported by advanced research ecosystems, well-established pharmaceutical hubs, and strong clinical diagnostics infrastructure across Germany, the UK, France, the Netherlands, and the Nordics. Widespread modernization of molecular biology and proteomics laboratories has increased deployment of fluorescence, chemiluminescence, and multimodal imaging platforms for cell assays, protein quantification, and nucleic acid visualization.

EU-funded research programs and collaborative innovation networks accelerate acquisition of automated imaging systems and standardized protocols. Integration of imaging platforms with advanced analytics, high throughput workflows, and digital data management tools strengthens reproducibility and supports translational research adoption.

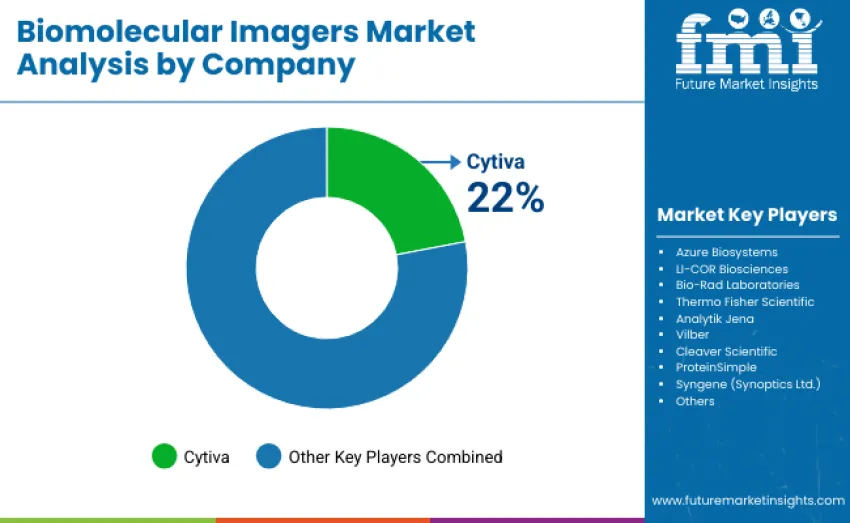

The global biomolecular imagers market shows moderate concentration, with around 12 to 15 manufacturers competing across fluorescence, chemiluminescence, infrared, and multiplex imaging platforms. The top three companies collectively hold about 55% to 60% of global share. Cytiva leads with 22%, supported by strong detector engineering capabilities, validated optical reliability, and extensive adoption across biopharmaceutical R&D, academic laboratories, and molecular diagnostics. Along with LI COR Biosciences and Bio Rad Laboratories, Cytiva benefits from sizable intellectual property portfolios, strong engagement with global research communities, and proven performance in proteomics, western blotting, nucleic acid imaging, and cell-based assay visualization.

Challenger companies including Azure Biosystems, Syngene and Analytik Jena compete through innovation driven platform development, compact modular system design, user centric automation features, and value-oriented pricing that appeals to mid-sized laboratories and rapidly growing Asia Pacific markets. Specialist manufacturers such as Vilber, Cleaver Scientific, Thermo Fisher Scientific imaging divisions, and ProteinSimple focus on specific imaging modalities or cost-efficient platforms, contributing to a diversified competitive structure. Emerging Chinese manufacturers intensify price pressure by offering accessible fluorescence and chemiluminescence systems across India, Southeast Asia, and Latin America.

| Item | Value |

|---|---|

| Quantitative Units | USD 863.7 million |

| Technology | Fluorescence Imaging Systems, Chemiluminescence Imaging Systems, Bioluminescence Imaging Systems, Multimodal (Hybrid) Imagers, Autoradiography & Phosphor Imaging |

| Application | Western Blot and Protein Quantification, DNA/RNA Gel Imaging, In-Gel Fluorescent Staining, Enzyme Kinetics & Reporter Assays, Molecular Interaction & Kinetics Studies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | Cytiva, Azure Biosystems, LI-COR Biosciences, Bio-Rad Laboratories, Thermo Fisher Scientific, Analytik Jena, Vilber, Cleaver Scientific, ProteinSimple, Syngene (Synoptics Ltd.), and others |

| Additional Attributes | Dollar sales vary by technology and application, shaped by regional adoption across Asia Pacific, Europe, and North America. Competition centers on leading manufacturers, distribution networks, advanced specifications, LIMS integration, improved detection sensitivity, higher imaging resolution, and specialized multimodal fluorescence systems enabling precise quantitative analysis |

The global biomolecular imagers market is estimated to be valued at USD 863.7 million in 2025.

The biomolecular imagers market is projected to reach USD 1,722.8 million by 2035.

The biomolecular imagers market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key technology types in the biomolecular imagers market are fluorescence imaging systems, chemiluminescence imaging systems, bioluminescence imaging systems, multimodal imagers, and autoradiography & phosphor imaging platforms.

The western blot and protein quantification segment is expected to command a 38.2% share in the biomolecular imagers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA