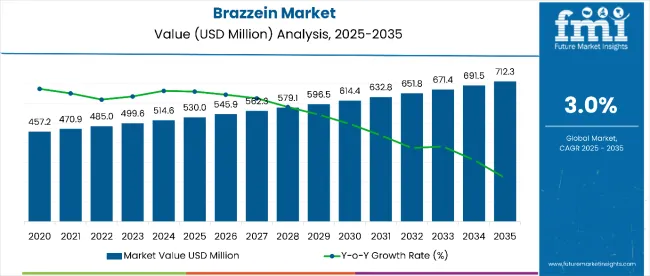

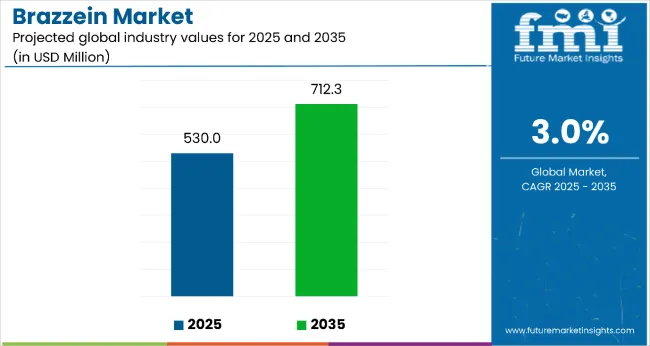

The brazzein market is estimated to be valued at USD 530 million in 2025 and is projected to reach USD 712.3 million by 2035, registering a CAGR of 3.0% over the forecast period. The market is expected to add an absolute dollar opportunity of USD 182.3 million during this period.

This reflects 1.34 times growth at a CAGR of 3.0%. The market’s evolution is likely to be shaped by increasing demand for low-calorie, natural sweeteners in the food and beverage sector, particularly for beverage formulations, bakery products, and dairy alternatives, as consumers increasingly seek healthier, clean-label ingredients.

By 2030, the market is likely to reach approximately USD 610 million, accounting for USD 80 million in incremental value during the first half of the decade. The remaining USD 102.3 million is projected for the second half, indicating a moderately back-loaded growth pattern. Product substitution for traditional sweeteners such as sugar and stevia is gaining traction due to brazzein’sfavorable strength-to-sweetness ratio and low-calorie properties.

Companies such as Senomyx, Magellan Life Sciences, and Sweegen are strengthening their positions through investments in advanced fermentation technologies and scalable production systems. Certification-based procurement models and increased focus on clean-label ingredients are supporting expansion into applications such as modular food formulations and beverage innovations. Market performance will remain anchored in regulatory compliance, taste-masking properties, and durability benchmarks across the product lifecycle.

The brazzein market holds approximately 40% of the low-calorie sweeteners market, driven by its natural sweetness, low-calorie profile, and suitability for beverages, baked goods, and dairy alternatives. It accounts for around 30% of the food and beverage ingredients market, supported by its clean-label properties and compatibility with natural product formulations.

The market contributes nearly 20% to the health and wellness products market, particularly in nutraceuticals and functional foods, where brazzein is used to promote sugar reduction without compromising taste. It holds close to 15% of the natural sweeteners market, where its strength-to-sweetness ratio offers an attractive alternative to stevia and other sweeteners. The share in the sugar reduction market reaches about 25%, reflecting its preference among food manufacturers for sugar-free and low-sugar formulations.

The market is undergoing structural changes driven by the rising demand for healthier sweeteners and low-calorie products. Advanced fermentation technologies and optimized production methods have improved availability, cost-effectiveness, and taste profile of brazzein, making it a viable substitute for sugar and artificial sweeteners.

Manufacturers are introducing brazzein in multiple forms, such as powdered and liquid, for use in beverages, confectionery, dairy, and pharmaceuticals. Strategic collaborations between food and beverage brands and sweetener developers are accelerating adoption in sugar-free and low-calorie product lines. Online retail channels have expanded access and awareness, reshaping traditional distribution patterns and increasing pressure on conventional sugar product suppliers to adapt.

Brazzein’s natural origin, high sweetness potency (up to 2,000 times sweeter than sugar), and low-calorie content make it an attractive alternative to traditional sweeteners like sugar and artificial options.

Growing consumer awareness of health and wellness, combined with the increasing demand for clean-label, sugar-free, and low-calorie products, is propelling the adoption of brazzein, especially in food and beverage sectors. The rise in dietary preferences toward natural ingredients, coupled with concerns over sugar intake and related health risks, is driving significant demand.

As consumer behavior shifts toward healthier diets and demand for sugar substitutes accelerates, brazzein is positioned for strong growth across applications such as beverages, dairy products, bakery, and nutraceuticals. This aligns with global trends toward plant-based, low-sugar, and functional foods. The outlook remains favorable as manufacturers prioritize natural sweeteners in product reformulation and innovation pipelines.

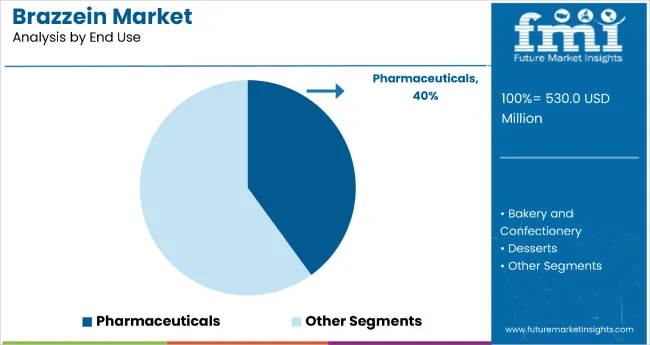

The market segments include end use and region. By end use, the market is classified into food industry (bakery and confectionery, desserts, dairy products, jams and jellies and others such as sauces, spreads, snack bars), beverage (alcoholic beverages and non-alcoholic beverages), and pharmaceuticals (nutraceuticals, HoReCa/foodservice sector). Regionally, the market is classified into North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa (MEA).

The pharmaceuticals segment is projected to hold a substantial share of 40% in 2025. This significant market share is attributed to rising demand for natural sweeteners in sugar-free medications, nutraceuticals, and dietary supplements. Brazzein’s high sweetness potency and low-calorie content make it an effective alternative to traditional sweeteners, particularly for diabetes management, weight loss supplements, and functional food formulations.

Its taste-masking properties are also enabling its use in products such as syrups, chewable tablets, and oral care formulations. As healthcare trends shift toward natural, low-calorie alternatives, brazzein is expected to play a critical role in sugar-free and reduced-calorie pharmaceutical solutions.

From 2025 to 2035, the brazzein market is projected for significant growth as food and beverage manufacturers seek clean-label, low-calorie alternatives to sugar and artificial sweeteners. Brazzein’s natural origin and exceptional sweetness intensity are enabling its integration into advanced formulations that prioritize taste retention, calorie reduction, and consumer transparency.

Structural Benefits and Performance Enhancements Drive Adoption of Brazzein

The rising demand for healthier sweetening solutions is the primary driver for the brazzein market. Brazzein offers an impressive sweetness potency, up to 2,000 times greater than sugar, enabling manufacturers to achieve desired sweetness while reducing caloric content significantly. This capability supports the reformulation of beverages, dairy products, and confectionery without compromising taste or texture.

Laboratory evaluations have confirmed brazzein’s ability to reduce calorie content by up to 50% while maintaining a stable sweetness profile. These attributes position brazzein as a strategic choice for companies aiming to meet global sugar-reduction targets and respond to consumer demand for clean-label products.

Raw Material Sourcing, Regulatory Hurdles, and Limited Scalability Restrict Growth

Despite strong potential, brazzein adoption is constrained by raw material sourcing challenges and regulatory compliance requirements. Pentadiplandrabrazzeana, the natural source of brazzein, faces inconsistent supply availability, creating uncertainty in large-scale production. Lengthy approval timelines for food-grade certification further delay commercialization efforts.

Additionally, current production infrastructure remains insufficient to match rising demand, limiting scalability and global market penetration. These challenges highlight the need for increased investment in biotechnological production methods and faster regulatory clearances to unlock broader adoption.

Biotechnological Innovation and Clean-Label Trends Shape Future Growth

Precision fermentation and protein expression technologies are emerging as key trends influencing brazzein manufacturing. These advanced processes enable consistent yields, enhanced purity, and cost optimization, reducing reliance on natural plant sources. Rising consumer preference for plant-based, clean-label ingredients reinforces the inclusion of brazzein in beverages, confectionery, and functional foods.

At the same time, collaborations between food technology firms and sweetener manufacturers are accelerating commercialization. These developments suggest that scalable production through biotechnology, combined with strong alignment to health-focused consumption, will define the market’s future trajectory.

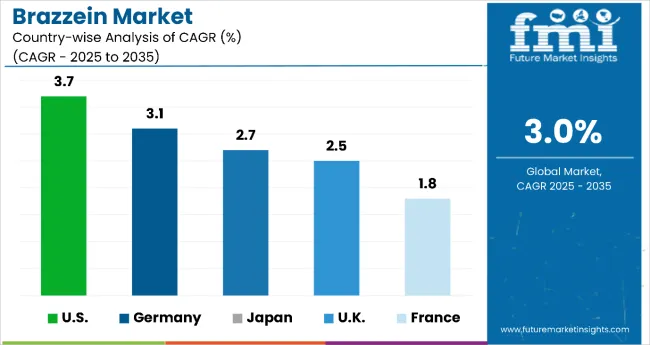

In the brazzein market, the USA is expected to grow at the highest CAGR of 3.7% from 2025 to 2035, driven by strong demand for low-calorie, natural sweeteners in beverages, bakery, and dairy sectors. Germany follows with a CAGR of 3.1%, supported by the rising integration of sugar-free and health-focused products.

The UK is projected to grow at 2.5% CAGR, influenced by increasing consumer preference for clean-label sweeteners. Japan shows moderate growth with 2.7% CAGR, attributed to functional food applications, while France remains slower at 1.8% CAGR, shaped by gradual adoption in premium segments.

The report covers an in depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

The USA brazzein market is projected to grow at a CAGR of 3.7% from 2025 to 2035, maintaining a leadership position in North America. Rising consumer demand for healthier, low-calorie sugar substitutes and increasing awareness of sugar-related health risks are accelerating adoption. Brazzein is gaining prominence across beverages, bakery, and dairy sectors for its high sweetness potency and natural origin. With continued emphasis on clean-label reformulation, brazzein is emerging as a key ingredient in sugar-reduction strategies.

The UK brazzein market is anticipated to register a CAGR of 2.5% from 2025 to 2035. The shift toward health-conscious diets with reduced sugar intake supports the integration of natural sweeteners in everyday consumption. Brazzein is increasingly being formulated into beverages, confectionery, and bakery products to meet consumer expectations for clean-label ingredients. Regulatory policies aimed at lowering sugar levels in packaged foods also encourage market expansion.

Sales of brazzein in Germany are expected to grow at a CAGR of 3.1% from 2025 to 2035, supported by the rising demand for natural sweeteners in sugar-free products. German consumers prioritize organic and clean-label ingredients, prompting significant adoption in beverages and baked goods. A strong regulatory focus on healthier alternatives enhances the position of brazzein within reformulated product lines.

The Frenchbrazzein revenue is projected to grow at a CAGR of 1.8% from 2025 to 2035. The market expansion is driven by demand in confectionery, bakery, and beverages, with increasing consumer interest in sugar-free alternatives. Foodservice outlets are adopting brazzein-based sweeteners to cater to health-conscious diners. While adoption remains gradual, premium positioning in gourmet and specialty segments supports steady growth.

The demand of brazzein in Japan is anticipated to grow at a CAGR of 2.7% from 2025 to 2035, supported by widespread adoption in beverages, dairy substitutes, and functional food products. Health-conscious consumers increasingly prefer low-calorie options to address diabetes and obesity-related concerns. Manufacturers are incorporating brazzein in sugar-free beverages and fortified foods to align with consumer demand for nutritional benefits and natural taste.

The brazzein market is relatively fragmented, with several players offering diverse solutions in the natural sweetener sector. Magellan Life Sciences Ltd. and Natur Research Ingredients, Inc. remain among the top suppliers, while the market continues to attract new entrants focusing on niche applications. Larger companies dominate through innovation, pricing strategies, and partnerships with food and beverage manufacturers. These players prioritize capacity expansion and geographic diversification to capture growing demand for natural sweeteners.

Top players such as Magellan Life Sciences Ltd. and Natur Research Ingredients, Inc. are investing heavily in research and development to enhance product quality and diversify applications. Strategic collaborations with global food and beverage brands are enabling long-term positioning within clean-label and sugar-free product lines.

Companies like Sweegen and Senomyx are concentrating on technological advancements in precision fermentation and protein engineering to improve production efficiency and scalability. Emerging firms are targeting premium segments with natural, plant-derived sweeteners, leveraging clean-label claims to gain competitive differentiation. Competitive intensity is defined by innovation speed, regulatory compliance, and ability to achieve cost-effective scalability.

| Item | Value |

|---|---|

| Quantitative Units | USD 530 Million |

| End Use | Food Industry (Bakery and Confectionery, Desserts, Dairy Products, Jams and Jellies, Others (sauces, spreads, snack bars), Beverage Industry (Alcoholic Beverages, Non-alcoholic Beverages), Pharmaceuticals, (Nutraceuticals, HoReCa /Foodservice, Household/Retail) |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa (MEA) |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Magellan Life Sciences Ltd., Natur Research Ingredients, Inc., Senomyx, Sweegen, Tate & Lyle, Ingredion, Cargill, DSM Nutritional Products, PureCircle, and Merya (Xylos) |

| Additional Attributes | Dollar sales by end-use sector, growing usage in sugar-free beverages and functional foods, stable demand in dairy and bakery products, innovations in b razzein extraction methods improve efficiency, sustainability and natural sweetener appeal |

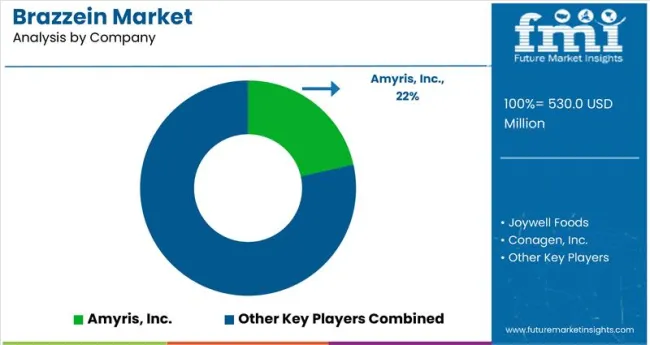

The global brazzein market is estimated to be valued at USD 530.0 million in 2025.

The market size for the brazzein market is projected to reach USD 712.3 million by 2035.

The brazzein market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in brazzein market are food industry, bakery and confectionery, desserts, dairy products, jams and jellies, others, beverage industry, alcoholic beverages, non-alcoholic beverages, pharmaceuticals, nutraceuticals, horeca/foodservice and household/retail.

In terms of , segment to command 0.0% share in the brazzein market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA