The global C5ISR market is projected to grow from USD 11.9 billion in 2025 to USD 38.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 12.4%. During the early adoption phase (2020–2024), market growth was driven by initial deployments in defense and intelligence applications, with limited production and targeted integration. Stakeholders focused on validating performance and establishing operational effectiveness.

By 2025, as the market reaches USD 11.9 billion, the scaling phase begins, characterized by expanding adoption across a broader range of defense platforms and applications, increased production capacity, and gradual standardization of deployment practices. Between 2025 and 2030, the market expands rapidly, growing from USD 11.9 billion to approximately USD 19–24 billion. Adoption spreads across multiple regions and military applications, supported by improved integration and procurement processes. The consolidation phase from 2030 to 2035 sees the market reaching USD 38.3 billion, with adoption stabilizing. By this stage, C5ISR systems are widely implemented, supply chains and deployment processes are well-established, and the market transitions from high-growth expansion to a mature, stable segment, supported by predictable procurement cycles and standardized operational practices.

| Metric | Value |

|---|---|

| C5ISR Market Estimated Value in (2025 E) | USD 11.9 billion |

| C5ISR Market Forecast Value in (2035 F) | USD 38.3 billion |

| Forecast CAGR (2025 to 2035) | 12.4% |

The C5ISR market, growing from USD 11.9 billion in 2025 to USD 38.3 billion by 2035 at a CAGR of 12.4%, exhibits key breakpoints that reflect shifts in adoption and market dynamics. The first significant breakpoint occurs around 2025, when the market reaches USD 11.9 billion. At this stage, adoption moves from early, experimental deployments to broader operational use across defense platforms. Increased production capacity, successful initial implementations, and expanding interest from multiple regions build confidence among stakeholders.

This phase represents the scaling period, characterized by rapid adoption, investment in production and integration, and the gradual establishment of standardized deployment processes across the sector. A second critical breakpoint emerges between 2030 and 2032, as the market approaches USD 27–30 billion. By this stage, C5ISR systems have achieved widespread adoption, and the market begins shifting from rapid expansion to consolidation. Major suppliers strengthen their positions, procurement processes and supply chains stabilize, and system integration becomes more predictable. By 2035, reaching USD 38.3 billion, the market reflects full consolidation, with C5ISR systems established as a mainstream defense solution. Mature production, reliable deployment, and standardized operational practices ensure sustained stability and long-term growth in the market.

The C5ISR market is experiencing sustained expansion, supported by the growing demand for advanced command, control, communications, computers, combat systems, intelligence, surveillance, and reconnaissance capabilities. Governments and defense organizations are prioritizing integrated systems that enable real-time data sharing, threat detection, and mission coordination.

The integration of artificial intelligence, cyber defense, and network-centric technologies is enhancing the operational efficiency of C5ISR platforms, paving the way for improved situational awareness and decision-making. Increased geopolitical tensions, modernization of military infrastructure, and large-scale investments in defense technologies are driving global adoption.

Additionally, the commercial sector is showing growing interest in C5ISR applications for critical infrastructure protection, border security, and maritime surveillance As the emphasis on interoperability, data security, and rapid information dissemination intensifies, the market is expected to benefit from sustained R&D investments and cross-domain integration efforts, creating a strong foundation for future growth.

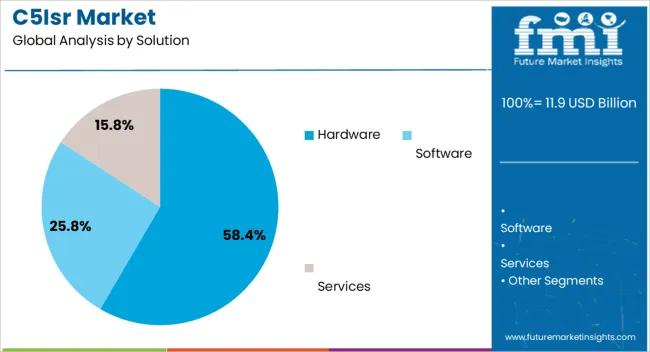

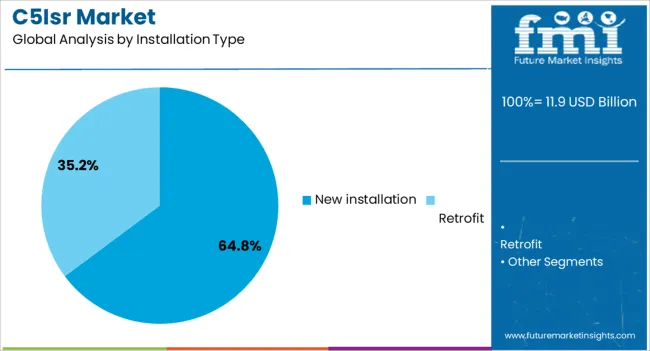

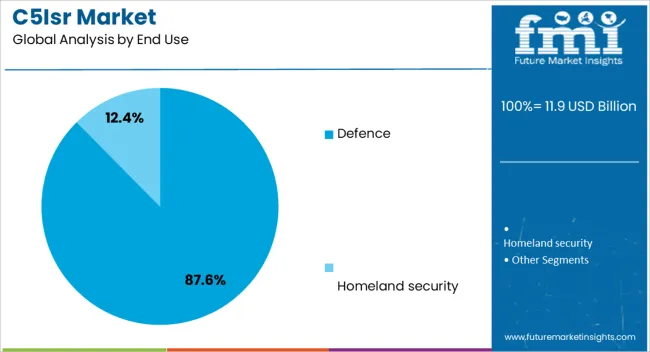

The C5ISR market is segmented by solution, installation type, end use, and geographic regions. By solution, the C5ISR market is divided into Hardware, Software, and Services. In terms of installation type, the C5ISR market is classified into New installation and Retrofit. Based on end use, the C5ISR market is segmented into Defense and Homeland Security. Regionally, the C5ISR industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware solution segment is projected to account for 58.40% of the C5ISR market revenue share in 2025, making it the leading category in this segment. The dominance of hardware solutions has been driven by the essential role of physical infrastructure in enabling secure communication, surveillance, and data acquisition.

High-performance servers, sensors, radars, and communication devices form the backbone of integrated C5ISR operations, ensuring seamless connectivity and reliability in mission-critical environments. The deployment of advanced hardware components is being prioritized to support real-time intelligence processing and multi-domain operations.

Continuous upgrades in radar systems, secure communication terminals, and high-resolution imaging equipment have reinforced the strategic importance of this segment. With modernization programs emphasizing robust and resilient infrastructure, the demand for sophisticated hardware is expected to remain strong, supported by both replacement cycles and expansion of capabilities across defense and allied sectors.

The new installation segment is expected to capture 64.80% of the C5ISR market revenue share in 2025, positioning it as the dominant installation type. This growth has been supported by large-scale defense modernization programs and new infrastructure development across land, air, naval, and space domains.

Governments and allied organizations are prioritizing the installation of next-generation C5ISR systems to replace outdated infrastructure and to enhance interoperability between forces. New installations are enabling the integration of advanced surveillance, communication, and control capabilities into unified platforms, improving operational readiness and responsiveness.

Investment in new facilities, ships, aircraft, and command centers is further boosting demand for initial deployments rather than retrofits The ability to incorporate the latest technological advancements during initial setup is providing operational advantages and reducing long-term maintenance costs, making new installations a preferred approach for high-priority projects in both national defense and strategic security initiatives.

The defence end use segment is anticipated to hold 87.60% of the C5ISR market revenue share in 2025, maintaining its position as the largest end-use category. This dominance is being reinforced by the critical role C5ISR systems play in defense operations, from battlefield awareness and mission coordination to cyber defense and intelligence gathering.

Military forces across the globe are significantly investing in modernizing their C5ISR capabilities to counter evolving threats, including electronic warfare, unmanned systems, and asymmetric tactics. The segment’s growth is further supported by defense budgets prioritizing advanced surveillance, secure communications, and integrated command platforms.

The adoption of C5ISR in joint and coalition operations is ensuring interoperability and faster decision cycles, which are essential for mission success As geopolitical uncertainties persist and the demand for superior situational awareness intensifies, the defence sector will continue to be the primary driver of C5ISR adoption, with sustained investment in both hardware and software integration.

The C5ISR market is expanding as defense forces globally prioritize integrated, real-time situational awareness and operational intelligence for modern warfare. Investments in command, control, communications, computers, combat systems, intelligence, surveillance, and reconnaissance solutions are driven by evolving security threats, advanced technologies, and the need for rapid decision-making. Adoption is fueled by AI, edge computing, autonomous systems, and multi-domain integration. However, cybersecurity risks, interoperability challenges, budgetary constraints, and system complexity pose adoption barriers. Companies delivering secure, interoperable, and modular C5ISR solutions are best positioned to capitalize on modernization programs, strategic alliances, and defense collaborations across regions.

C5ISR systems face multiple challenges that affect adoption and operational performance. Cybersecurity is a major concern because these systems handle highly sensitive data, making them targets for attacks. Ensuring secure communication, data integrity, and system resilience is critical for operational success. Interoperability between different platforms across air, land, sea, and space requires standardization of protocols and integration of both legacy and modern systems. Many defense forces still operate older infrastructure that may not support advanced C5ISR technologies, making modernization complex. Incorporating artificial intelligence, edge computing, and autonomous platforms increases technical difficulty, cost, and project timelines. Maintaining reliability under harsh conditions such as extreme weather, battlefield hazards, or electromagnetic interference adds further complexity. Addressing these issues requires investment in research and development, skilled personnel, rigorous testing, and comprehensive cybersecurity measures.

The C5ISR market is advancing through artificial intelligence, machine learning, and edge computing. AI enhances data analysis, predictive intelligence, and autonomous decision-making, improving situational awareness and response times. Edge computing allows data to be processed closer to the source, reducing latency and bandwidth use, which is critical in real-time operations. Autonomous systems such as drones, unmanned ground vehicles, and robotic platforms are increasingly integrated for reconnaissance, target identification, and risk mitigation. Multi-domain operations that combine land, air, sea, and space assets require seamless data fusion from various sensors and platforms. Other notable trends include cloud-enabled command centers, digital twins for simulation and planning, and smart communication networks that improve interoperability. These innovations help defense forces operate efficiently in high-stakes environments, enhancing operational flexibility, precision, and mission success rates.

Opportunities in the C5ISR market are growing as governments invest in defense modernization and capability upgrades. Existing military infrastructure needs advanced systems to replace outdated equipment and ensure interoperability with modern platforms. Strategic partnerships between defense contractors, technology providers, and government agencies create avenues for co-development, technology transfer, and tailored system integration. Joint and coalition military operations further increase demand for interoperable solutions that work seamlessly across allied forces. Emerging markets in Asia-Pacific, the Middle East, and Africa present significant potential for deployment due to rising defense spending and security priorities. Public-private collaborations can accelerate research and development initiatives and adoption of next-generation technologies such as AI-enabled analytics, autonomous reconnaissance systems, and edge-based data processing. Companies offering modular, scalable, and secure C5ISR solutions are best positioned to capture these opportunities in both domestic and international defense programs.

The C5ISR market faces constraints related to budget limitations and technological complexity. Advanced C5ISR systems require significant investment in development, integration, testing, and deployment, which can strain defense budgets, especially in emerging economies. Rapid technological advancement necessitates continuous upgrades, specialized expertise, and dedicated infrastructure, which may not be available to all organizations. Integration of new technologies with legacy platforms adds complexity, costs, and project timelines. Cybersecurity and system resilience requirements further increase resource demands. Smaller contractors or new entrants may struggle to meet technical, regulatory, and security standards, limiting market competition and innovation. Until cost-effective, modular, and standardized solutions are widely available, adoption may remain concentrated among nations with sufficient budgets and the capability to manage technological complexity effectively.

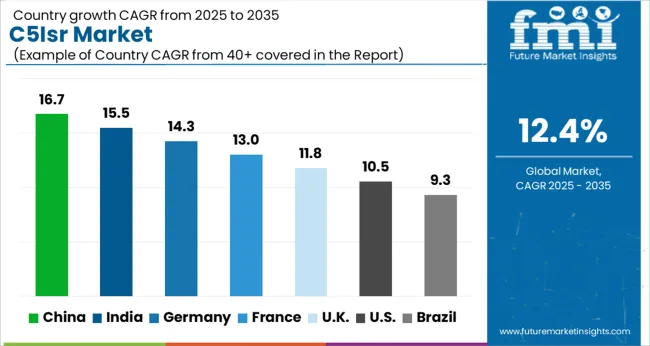

| Country | CAGR |

|---|---|

| China | 16.7% |

| India | 15.5% |

| Germany | 14.3% |

| France | 13.0% |

| UK | 11.8% |

| USA | 10.5% |

| Brazil | 9.3% |

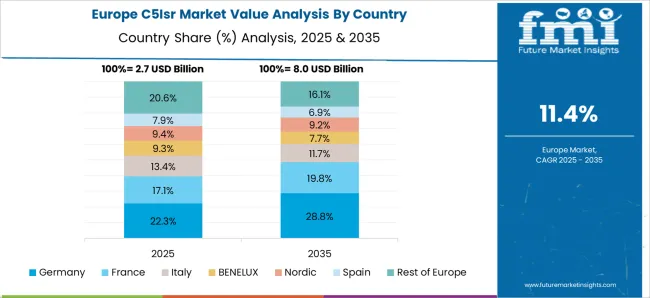

The global C5ISR market is projected to grow at a CAGR of 12.4% through 2035, supported by increasing demand across defense, intelligence, surveillance, and reconnaissance applications. Among BRICS nations, China has been recorded with 16.7% growth, driven by large-scale production and deployment in military and defense communication systems, while India has been observed at 15.5%, supported by rising utilization in intelligence, surveillance, and reconnaissance platforms. In the OECD region, Germany has been measured at 14.3%, where production and adoption for defense, surveillance, and reconnaissance applications have been steadily maintained. The United Kingdom has been noted at 11.8%, reflecting consistent use in military and intelligence systems, while the USA has been recorded at 10.5%, with production and utilization across defense, surveillance, and communication sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The C5ISR market in China is growing at a CAGR of 12.4%, driven by increasing defense modernization, border security initiatives, and advanced surveillance programs. The Chinese government is investing heavily in integrating command, control, communications, and intelligence systems with advanced surveillance and reconnaissance technologies. Defense contractors and technology firms are developing AI powered analytics, real-time data processing, and network centric warfare solutions to enhance situational awareness. Pilot programs for battlefield management, maritime surveillance, and border monitoring demonstrate operational benefits. Collaborations between research institutes, defense organizations, and technology providers are advancing sensor integration, communication networks, and decision support systems. Increased focus on cyber secure, automated, and networked military capabilities is further accelerating adoption across ground, air, and naval forces.

Pressure transmitter market in India is expanding at a CAGR of 3.7%, fueled by growth in power generation, chemical processing, oil and gas, and manufacturing industries. Pressure transmitters are essential for real-time monitoring, process control, and safety management in pipelines, tanks, and industrial equipment. Domestic manufacturers are investing in high precision and reliable transmitters compatible with smart automation systems. Government initiatives promoting industrial modernization, renewable energy projects, and energy efficient infrastructure are accelerating adoption. Pilot installations in refineries, chemical plants, and power stations demonstrate operational benefits including improved process efficiency and safety. Collaboration between technical institutes, research centers, and industrial firms is enhancing calibration accuracy, sensor integration, and durability. As automation and digital monitoring expand in India’s industrial sectors, demand for high performance pressure transmitters continues to grow steadily.

Pressure transmitter market in Germany is recording a CAGR of 4.3%, supported by strong process automation, industrial monitoring, and manufacturing industries. Pressure transmitters are extensively used in chemical plants, refineries, power stations, and industrial pipelines to ensure process control and safety. German manufacturers are investing in high precision, durable, and smart transmitters compatible with Industry 4.0 systems. Pilot projects and industrial trials in automation and energy management demonstrate improved operational efficiency and reduced downtime. Government regulations promoting energy efficiency, environmental safety, and industrial modernization are further encouraging adoption. Collaborations between universities, research institutes, and industrial firms are advancing calibration methods, sensor reliability, and integration with digital control systems. Germany’s advanced industrial sector continues to be a key driver for demand in high performance pressure transmitters.

The United Kingdom is experiencing a CAGR of 3.5% in the pressure transmitter market, driven by demand in chemical processing, power generation, oil and gas, and manufacturing sectors. Pressure transmitters are used for real-time monitoring, process control, and safety management in pipelines, tanks, and industrial equipment. UK manufacturers are focusing on high reliability, precision, and smart automation compatible solutions. Pilot projects in industrial plants, refineries, and energy facilities demonstrate operational improvements and safety benefits. Government programs promoting industrial modernization, automation, and energy efficiency are supporting market growth. Technical collaborations and research initiatives are advancing calibration, sensor integration, and durability. Growing interest in predictive maintenance, smart monitoring, and process optimization continues to support steady adoption of pressure transmitters across the UK industrial sector.

The United States pressure transmitter market is growing at a CAGR of 3.1%, driven by adoption in oil and gas, chemical processing, power generation, and industrial manufacturing sectors. Pressure transmitters are critical for accurate monitoring, process control, and operational safety in pipelines, tanks, and machinery. Domestic manufacturers are focusing on high precision, reliability, and integration with digital and smart automation systems. Pilot projects in industrial plants, refineries, and energy facilities demonstrate benefits in process optimization, safety, and predictive maintenance. Government regulations promoting industrial efficiency, safety standards, and energy conservation are further supporting adoption. Collaboration between universities, technical institutes, and industrial firms is enhancing sensor calibration, integration, and durability. Growing demand for automated monitoring, process optimization, and real-time data collection continues to drive the US market steadily.

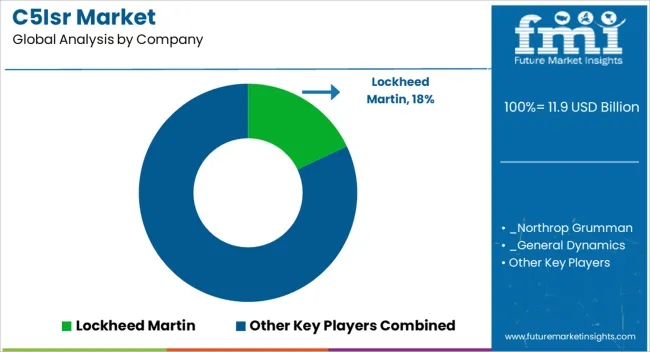

The C5ISR (Command, Control, Communications, Computers, Combat Systems, Intelligence, Surveillance, and Reconnaissance) market is highly competitive, driven by global defense and aerospace leaders. Lockheed Martin leads with integrated solutions combining advanced sensors, communication systems, and command platforms for air, land, and naval applications. Northrop Grumman focuses on next-generation ISR systems, electronic warfare, and autonomous platforms to enhance situational awareness. General Dynamics delivers tactical communication and networked command solutions, targeting both defense and security sectors. Raytheon (RTX) emphasizes radar, sensor fusion, and missile defense integration to provide comprehensive operational capabilities. BAE Systems combines electronics, cybersecurity, and mission systems to support multi-domain operations. L3Harris specializes in communication, surveillance, and electronic warfare technologies for real-time intelligence. Elbit Systems provides advanced ISR and mission support platforms with modular, flexible solutions for defense clients.

Thales delivers integrated C5ISR solutions for aerospace, maritime, and defense operations, emphasizing interoperability and resilience. Competition revolves around technology leadership, system integration, and operational reliability. Companies invest heavily in R&D to enhance sensor performance, communication bandwidth, cybersecurity, and network interoperability. Product brochures and technical materials communicate system capabilities, operational benefits, and deployment scenarios in clear, concise formats. Global leaders highlight end-to-end integration, scalability, and support services, whereas niche or regional players emphasize flexibility, rapid deployment, and specialized solutions tailored to client needs. Marketing materials are crafted to convey technical and operational advantages efficiently. System architecture, real-time intelligence capabilities, and multi-domain integration are highlighted to support decision-making. Success in the C5ISR market depends not only on technology performance but also on effectively demonstrating operational value, making brochures and technical documentation critical tools for maintaining a competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.9 Billion |

| Solution | Hardware, Software, and Services |

| Installation Type | New installation and Retrofit |

| End Use | Defence and Homeland security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, _Northrop Grumman, _General Dynamics, _Raytheon / RTX, _BAE Systems, _L3Harris, _Elbit Systems, and _Thales |

| Additional Attributes | Dollar sales in the C5ISR Market vary by type including command and control systems, communications, computers, intelligence, surveillance, and reconnaissance platforms, application across defense, homeland security, and military operations, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising defense modernization programs, increasing demand for battlefield situational awareness, and advancements in network-centric warfare technologies. |

The global C5ISR market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the C5ISR market is projected to reach USD 38.3 billion by 2035.

The C5ISR market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in C5ISR market are hardware, software and services.

In terms of installation type, new installation segment to command 64.8% share in the C5ISR market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA