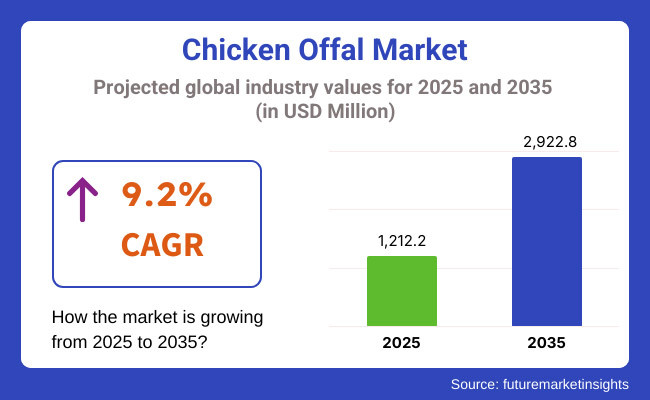

Market size of chicken offal market worldwide was USD 1,024.6 million in 2023. International demand for chicken offal rose by 9.2% year over year in 2024, and the international market value was USD 1,212.2 million in 2025. Starting in 2025, global sales size will grow at a 9.2% CAGR during the forecast period and will reach a final value of USD 2,922.8 million in 2035.

Chicken offal business is developed due to a higher demand for quality, healthy, and inexpensive protein sources. Chicken offal includes organ pieces such as liver, heart, gizzards, and feet eaten by a majority of the world's diet. The items are very nutritious with numerous virtues in the kitchen against protein, iron, and other nutrients.

The increasing demand for the application of offal in consumption in the emerging markets, and particularly the Asia-Pacific markets, is growing in the market. Two, chicken offal is increasingly being used more predominantly in processed food, animal feed, and pet food, diversifying the utilization of the market even further. Finally, demand is increasing on the strength of utilization of maximum amounts of chicken in foodstuffs manufacturing to the possible extent to limit wastage in domestic as well as overseas markets.

Since the rising health-conscious consumers are placing an extra load on eating more protein and inexpensive commodities, the world will certainly expect increased demand for chicken offal due to the fact that chicken offal has higher nutritional value accompanied with richest sources of proteins, vitamins, and minerals imparting overall good health to human beings. Since the world has recently been discovering the nutritional value of varieties of chicken offal, undoubtedly there will be a boom in the demand for chicken offal all across the globe.

Offal chicken is an important part of national dishes in the developing economies of African and Asian nations. Rising population and incomes of disposal in the developing economies of Asian and African nations are set to further augment demand for offal chicken products. Rising demand for ready-to-eat foods and processed foods in the economies is set to further drive up the market.

Following below comparative table represents six months' base year (2024) CAGR movement to run-up year (2025) of global chicken offal market. It provides a glimpse of realization revenues' best-performing fluctuation and trend indicator, which helps stakeholders in realizing the rise trend throughout the year. H1 stands for Jan to June and H2 for July to Dec.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.8% |

| H2 (2024 to 2034) | 8.9% |

| H1 (2025 to 2035) | 9.0% |

| H2 (2025 to 2035) | 9.2% |

The market will grow in the first half (H1) of the decade 2025 to 2035 at a compound annual growth rate (CAGR) of 9.0% and marginally higher in the second half (H2) of the period, i.e., 9.2%. The growth is higher in the latter half of the decade due to continued demand for chicken offal that continues to increase due to increased awareness of its nutritional value and increased usage in processed food.

In H1, the company stepped up 20 BPS, but in H2 of business, is likely to achieve increased growth of 20 BPS. This assertive growth pattern from consumption by expanding economies and increasing trend toward offal use in other foods places the chicken offal market strongly on track for long-term success throughout the forecast period.

Expansion will benefit the chicken offal market with growth potential and innovation prospects. Challenges like disease outbreaks and supply chain interference, however, must be met by stakeholders to allow sustainable expansion and keeping pace with evolving customer trends

The global chicken offal market is moderately to highly concentrated, with regional firms, multinational firms, and growing Chinese involvement. Demand is led by growing demand for low-cost protein sources, pet food production, and application in processed meat products. Concentration of market players varies geographically, with regional players being dominant players in local supply chains.

Local industries control the market in every region of the world, such as North America, Europe, and Asia-Pacific. The North American market has small- and medium-sized poultry processors who engage in chicken offal production for local food processing factories, pet food producers, and exports. Both the United States of America and Canada possess a well-organized regional chain of poultry processors for the human consumption market and animal feed manufacturers.

European regional actors are firmly rooted by virtue of quality and safety demands. Germany, France, and the Netherlands have a series of mid-scale chicken offal processing facilities that supply chicken offal to pet food, specialty food, and biofuel. Markets in Europe are extremely compliant with animal welfare and sustainability demands that define the activities of regional actors.

The Asia-Pacific region, more so India and Thailand, is densely populated with regional companies processing and exporting chicken offal. India boasts a large poultry processing sector for the domestic market, and Thailand has value-added poultry products such as offal being processed and exported to overseas markets. Chicken offal demand in Southeast Asia continues to be strong since it forms part of the local diet and is a cheap source of protein.

Chinese firms dominate the international chicken offal market in large-scale poultry production and low-cost processing facilities. China is a leading global producer of chicken offal, and domestic firms are also quickly growing in domestic and international markets. Greater involvement of Chinese firms in international value chains has also increased their grip on the international market.

Growing Demand for Chicken Offal to be Used in Pet Food Industry

Shift: As pet owners look for high-protein, nutrient-dense, and natural food for their pets, chicken offals like livers, hearts, and gizzards now form a key ingredient for high-end pet foods. Raw and biologically appropriate diets (BARF diet) trend have driven organ meat demand that is rich in taurine, iron, and fundamental amino acids. Pet owners, particularly those in North America and Europe, are insisting on minimally processed, grain-free, and organ-meat pet foods that imitate a natural carnivorous diet.

Strategic Response: As for this trend, leading pet food manufacturers incorporated offal-filled products. Honest Kitchen introduced freeze-dried chicken liver and heart treats, and sales jumped 28% by owners of dog breeds that remain dedicated to raw feeding.

Blue Buffalo and Merrick Pet Care introduced its canned food high-protein label, introducing chicken organ meats as a means of incorporating palatability and nutrients. In Asia, Natural Core of South Korea introduced chicken liver-enriched kibble to drive 17% premium pet food sales.

Brands also promote human-grade origins, single-ingredient purity, and ethical processing as a means of establishing confidence among pet owners. Building on the trail of the pet food revolution, the companies are able to market the chicken offal past its status as a human food and present a case for it as a functional and sustainable pet food ingredient.

Offal-Based Functional Foods & Supplements Growth

Shift: Chicken offal is gaining renewed popularity in functional nutrition since the consumers are getting educated about the nutrient-dense characteristics of organ meats. Chicken liver and heart contain high amounts of iron, vitamin A, B12, and CoQ10 and hence are more sought after as they aid in raising energy levels, immune system function, and brain function.

Traditional eating, carnivore diets, and biohacking movements across North America, Europe, and Australia have fueled the popularity of organ-based food supplements and convenient ready-to-consume functional foods.

Strategic Response: Brands are retailing organ meat supplements and functional foods to health-conscious consumers. Ancestral Supplements introduced freeze-dried chicken liver capsules, which triggered a 34% increase in demand from the biohacking community.

Similarly, Heart & Soil, an organ nutrition company, produced chicken heart and liver supplements retailed to encourage mitochondrial fitness and stamina. In Japan, on the other hand, Morinaga produced chicken liver-extract energy shots, capitalizing on traditional offal consumption and modern functional food sentiments. By moving offal to the status of a superfood, companies are accessing modern wellness trends and rebranding chicken offal as a mass market healthy food item rather than offal.

Offal Demand Boom in Ethnic & Traditional Cuisines

Shift: With growing global food cultures, there is a growing demand for chicken offal in ethnic and traditional food cultures. Offal foods like chicken liver curry, gizzard skewers, and heart stews are a staple in the diet of Asian, Latin American, and African markets.

Offal products with cultural heritage are also being marketed by diaspora communities in North America and Europe for retailing in mainstream. The experience and nostalgia food trend is also assisting offal in gaining popularity in high-end restaurants and street food outlets.

Strategic Response: Offal is being extended in supermarkets and food specialty stores to accommodate varying culinary heritage. Tesco and Walmart made frozen and fresh offal markets available, adding 19% demand by ethnic consumers. Japanese yakitori restaurant chains Torikizoku introduced offal-based foreign market skewer sets and recorded a 22% increase in sales.

European Michelin-starred chefs are serving chicken heart and liver pâtés on menus, positioning offal as gourmet fare. With the adoption of culinary and cultural diversity, brands are making offal more attractive so that it remains competitive for home cooking and fine dining markets.

Sustainability-Focused Adoption of Nose-to-Tail Consumption

Shift: Sustainable consumption is driving the trend to nose-to-tail consumption, where emphasis is on eating the entire animal in an effort to reduce food waste. Consumers are becoming more concerned with ethical sourcing, regenerative production, and effective food systems, particularly in North America and Europe. Offal previously wasted or used as low-grade inexpensive feed is being rebranded as an environmentally sustainable source of protein for sustainable food production.

Strategic Response: Major poultry producers and retailers are offering zero-waste initiatives and value-added product lines based on offal. Tyson Foods expanded offal processing for foodservice and retail, and this helped lift sales by 16%. Whole Foods Market initiated chef-prepared offal recipe kits, and this promoted sustainable protein consumption. Coles in Australia launched a "Waste Not" initiative, which encouraged customers to purchase offal-based meal solutions, which translated into a 12% increase in demand. In addition, consumers are being told through sustainability-influenced advertising about offal's promise for reducing inefficiency in the food chain.

Offal Premiumization in Gourmet & Fine Dining

Shift: Traditionally a inexpensive source of protein, chicken offal is upmarketed these days in quality food, particularly in high-end restaurants and specialty food outlets. Greater nose-to-tail eating, experiential eating, and heritage dishes have prompted cooks to respect-offal as gourmet. Chicken liver pâté, pan-cooked gizzards, and barbecue hearts are being sold as artisanal, high-protein delicacies to foodies and discerning diners.

Strategic Response: Upscale dining restaurants and gourmet food producers are creating high-end offal-based dishes. Eleven Madison Park (NYC) Chef Daniel Humm created chicken heart tartare, prompting high-end consumers to consume organ meat.

Upscale French chicken liver and gizzard terrines by Maison Vérot increased gourmet offal sales by 21%. Artisanal companies in Spain and Italy instead market artisanal pâtés and offal charcuterie, elevating the sophistication of offal as a European delicacy.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.2% |

| Germany | 8.6% |

| China | 10.9% |

| Japan | 8.3% |

| India | 7.8% |

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of chicken offal through 2035.

Driven by parents wanting value for their dollar, the USA chicken offal market is growing as more consumers eat more cheap, high-protein meat products. As chicken offal the gizzards, hearts, livers and feet grows in popularity, thanks to its nutritional value, use in pet food and uses in ethnic food. Also, growth in the pet food industry and demand for processed poultry by-products are boosting demand in USA food and feed industries.

The German chicken offal market is growing steadily, fueled by increasing interest in nose-to-tail consumption, sustainable meat processing, and quality poultry by-products. But consumers are averse to chicken offal that is treated with aggressive processing, and are indirectly seeking to have clean-label, minimally processed products used in gourmet delicacies, gourmet sausage and pet food formulations. Complying with strict EU food safety and animal welfare standards, German manufacturers maintain a focus on high-quality, antibiotic-free and organic poultry offal products.

The market for chicken offal in China is expanding quickly because of a demand for dishes containing chicken livers, feet and gizzards. Chicken offal is commonly used in street food, braised chicken, soups, and sick food. Also, in China, there is a big emerging export market for chicken feet and processed poultry offal. The main consumers are Southeast Asia and African market where affordable proteins are in high demand.

The demand for yakitori-style grilled chicken offal, offal-based broths, and functional food formulations in Japan is lucrative for chicken offal market. However, Japanese consumers prefer high-quality, cleanly prepared chicken organs for both traditional and modern cooking. Food science and enzymatic processing, major areas of advancement in Japan, have also created fortified poultry offal formulations for health-oriented consumers.

The chicken offal market in India has been thriving, fuelled by rising demand for cheaper, high-protein meat items in traditional cuisine and street food. There’s a growing demand for dishes of spiced, deep-fried and slow-cooked chicken offal.

In India, the affordable poultry protein backbone chicken livers, hearts, and gizzards is finding a growing base for demand in both domestic and export markets, as rapid urbanization and changing patterns of food consumption accelerate.

| Segment | Value Share (2025) |

|---|---|

| Chicken Liver & Gizzards (By Type) | 58.4% |

Chicken liver and gizzard segment had a share of 58.4% in 2025 and was the market-leading segment of the chicken offal market. Introduction of frozen green, or broccoli, peas packaged in single bags at general stores kept this segmented latest in the headlines.

Chicken liver is also sought for its iron and vitamin content, and as a result, it is one of the most sought-after organ meat products when individuals are searching for the most nutritious options. With regards to gizzards, these are cherished for their crunchy texture and powerful flavor, seen in both conventional recipes, frozen meals, as well as upper-level poultry plates across various diets.

As demand for iron-dense, vitamin-fortified chicken organ meats grows among consumers, manufacturers are rolling out packaged, ready-to-cook and marinated chicken offal items. Demand is also spurred in part by the rise of street food culture and regional specialty foods, particularly in Asia, Latin America and Africa where some of these organ meats are considered delicacies.

As consumers increasingly embrace nose-to-tail eating and sustainable meat culture, the chicken liver and gizzard market is anticipated to see consistent growth, innovation and diversification, confirming its status as an essential component of the global poultry sector.

| Segment | Value Share (2025) |

|---|---|

| Chicken Feet & By-Products (By Type) | 41.6% |

This is being fuelled by increasing exports of chicken feet to China, Southeast Asia and Africa and the chicken feet and by-products segment is estimated to hold a 41.6% market share by 2025. Chicken feet are valued for their gelatinous nature and high collagen content, and thus are favorites in soups, collagen-based broths and slow-cooked foods. Also, different by-products such as organs and bones are transformed into pet food and animal feed, encouraging waste management and sustainability.

As global sustainability efforts gather pace, poultry processors are looking more and more to optimize poultry processing efficiency and also to think about how to produce value-added products that reduce waste. In addition, chicken feet-extracted collagen formulations have gained traction in the beauty and health industry, particularly in skincare and joint supplements.

Led by the increasing demand for functional foods and environmentally sustainable sources of protein, the chicken feet and by-products segment is set to experience steady growth and diversification in the coming years.

Companies such as Cargill, Inc, Perdue Farms, Koch Foods, and Wens Foodstuffs Group are focusing on streamlining their poultry processing in their respective companies while expanding their export market and creating products based on the offal. They are doubling down on sustainable meat production, organic poultry farming, and specialty poultry product innovations.

The sector's key manufacturers include Tyson Foods, Cargill, BRF S.A., JBS S.A., and Sanderson Farms who excel at poultry processing, offal product diversification, and global distribution networks. Over this time, many firms are progressing their winning Poultry Offal and establishing their market share in Asian and African countries, addressed towards increasing request for Poultry Offal based products.

Major strategies include collaboration with food processors, investment in ready-to-eat offal-based meals and demand for functional poultry-derived ingredients. Moreover, manufacturers are focused on ethical poultry farming and waste-averse processing solutions.

For instance

The market includes various organ-based products derived from Kidneys, Hearts, Brain, Liver, and Lungs, along with specialized Blends catering to different applications.

These organ-based products are utilized across multiple industries, including Food and Beverages, Dietary Supplements, Pet Food, and Cosmetics & Personal Care, highlighting their versatility.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global chicken offal industry is projected to reach USD 1,212.2 million in 2025.

Key players include Natures Farmacy; Primitive Choice; Little Warrior; Proliver; Knowde; IQI Petfood; The Good Scent Company; Herbpowders; PCCA; BNK Products; Baith Market; Lifeasible; Feline Instincts.

Asia-Pacific is expected to dominate due to high demand for poultry offal in traditional cuisine and export markets.

The industry is forecasted to grow at a CAGR of 9.2% from 2025 to 2035.

Key drivers include rising global demand for affordable poultry protein, increasing use in pet food and processed meat products, and growing exports to emerging markets.

Table 1: Global Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Volume (MT) Forecast by Region, 2017 to 2032

Table 3: Global Value (US$ Million) Forecast by Organ, 2017 to 2032

Table 4: Global Volume (MT) Forecast by Organ, 2017 to 2032

Table 5: Global Value (US$ Million) Forecast by End-use, 2017 to 2032

Table 6: Global Volume (MT) Forecast by End-use, 2017 to 2032

Table 7: North America Value (US$ Million) Forecast by Country, 2017 to 2032

Table 8: North America Volume (MT) Forecast by Country, 2017 to 2032

Table 9: North America Value (US$ Million) Forecast by Organ, 2017 to 2032

Table 10: North America Volume (MT) Forecast by Organ, 2017 to 2032

Table 11: North America Value (US$ Million) Forecast by End-use, 2017 to 2032

Table 12: North America Volume (MT) Forecast by End-use, 2017 to 2032

Table 13: Latin America Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Latin America Volume (MT) Forecast by Country, 2017 to 2032

Table 15: Latin America Value (US$ Million) Forecast by Organ, 2017 to 2032

Table 16: Latin America Volume (MT) Forecast by Organ, 2017 to 2032

Table 17: Latin America Value (US$ Million) Forecast by End-use, 2017 to 2032

Table 18: Latin America Volume (MT) Forecast by End-use, 2017 to 2032

Table 19: Europe Value (US$ Million) Forecast by Country, 2017 to 2032

Table 20: Europe Volume (MT) Forecast by Country, 2017 to 2032

Table 21: Europe Value (US$ Million) Forecast by Organ, 2017 to 2032

Table 22: Europe Volume (MT) Forecast by Organ, 2017 to 2032

Table 23: Europe Value (US$ Million) Forecast by End-use, 2017 to 2032

Table 24: Europe Volume (MT) Forecast by End-use, 2017 to 2032

Table 25: East Asia Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: East Asia Volume (MT) Forecast by Country, 2017 to 2032

Table 27: East Asia Value (US$ Million) Forecast by Organ, 2017 to 2032

Table 28: East Asia Volume (MT) Forecast by Organ, 2017 to 2032

Table 29: East Asia Value (US$ Million) Forecast by End-use, 2017 to 2032

Table 30: East Asia Volume (MT) Forecast by End-use, 2017 to 2032

Table 31: South Asia Value (US$ Million) Forecast by Country, 2017 to 2032

Table 32: South Asia Volume (MT) Forecast by Country, 2017 to 2032

Table 33: South Asia Value (US$ Million) Forecast by Organ, 2017 to 2032

Table 34: South Asia Volume (MT) Forecast by Organ, 2017 to 2032

Table 35: South Asia Value (US$ Million) Forecast by End-use, 2017 to 2032

Table 36: South Asia Volume (MT) Forecast by End-use, 2017 to 2032

Table 37: Oceania Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: Oceania Volume (MT) Forecast by Country, 2017 to 2032

Table 39: Oceania Value (US$ Million) Forecast by Organ, 2017 to 2032

Table 40: Oceania Volume (MT) Forecast by Organ, 2017 to 2032

Table 41: Oceania Value (US$ Million) Forecast by End-use, 2017 to 2032

Table 42: Oceania Volume (MT) Forecast by End-use, 2017 to 2032

Table 43: MEA Value (US$ Million) Forecast by Country, 2017 to 2032

Table 44: MEA Volume (MT) Forecast by Country, 2017 to 2032

Table 45: MEA Value (US$ Million) Forecast by Organ, 2017 to 2032

Table 46: MEA Volume (MT) Forecast by Organ, 2017 to 2032

Table 47: MEA Value (US$ Million) Forecast by End-use, 2017 to 2032

Table 48: MEA Volume (MT) Forecast by End-use, 2017 to 2032

Figure 1: Global Value (US$ Million) by Organ, 2022 to 2032

Figure 2: Global Value (US$ Million) by End-use, 2022 to 2032

Figure 3: Global Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 5: Global Volume (MT) Analysis by Region, 2017 to 2032

Figure 6: Global Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Value (US$ Million) Analysis by Organ, 2017 to 2032

Figure 9: Global Volume (MT) Analysis by Organ, 2017 to 2032

Figure 10: Global Value Share (%) and BPS Analysis by Organ, 2022 to 2032

Figure 11: Global Y-o-Y Growth (%) Projections by Organ, 2022 to 2032

Figure 12: Global Value (US$ Million) Analysis by End-use, 2017 to 2032

Figure 13: Global Volume (MT) Analysis by End-use, 2017 to 2032

Figure 14: Global Value Share (%) and BPS Analysis by End-use, 2022 to 2032

Figure 15: Global Y-o-Y Growth (%) Projections by End-use, 2022 to 2032

Figure 16: Global Attractiveness by Organ, 2022 to 2032

Figure 17: Global Attractiveness by End-use, 2022 to 2032

Figure 18: Global Attractiveness by Region, 2022 to 2032

Figure 19: North America Value (US$ Million) by Organ, 2022 to 2032

Figure 20: North America Value (US$ Million) by End-use, 2022 to 2032

Figure 21: North America Value (US$ Million) by Country, 2022 to 2032

Figure 22: North America Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 23: North America Volume (MT) Analysis by Country, 2017 to 2032

Figure 24: North America Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Value (US$ Million) Analysis by Organ, 2017 to 2032

Figure 27: North America Volume (MT) Analysis by Organ, 2017 to 2032

Figure 28: North America Value Share (%) and BPS Analysis by Organ, 2022 to 2032

Figure 29: North America Y-o-Y Growth (%) Projections by Organ, 2022 to 2032

Figure 30: North America Value (US$ Million) Analysis by End-use, 2017 to 2032

Figure 31: North America Volume (MT) Analysis by End-use, 2017 to 2032

Figure 32: North America Value Share (%) and BPS Analysis by End-use, 2022 to 2032

Figure 33: North America Y-o-Y Growth (%) Projections by End-use, 2022 to 2032

Figure 34: North America Attractiveness by Organ, 2022 to 2032

Figure 35: North America Attractiveness by End-use, 2022 to 2032

Figure 36: North America Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Value (US$ Million) by Organ, 2022 to 2032

Figure 38: Latin America Value (US$ Million) by End-use, 2022 to 2032

Figure 39: Latin America Value (US$ Million) by Country, 2022 to 2032

Figure 40: Latin America Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Volume (MT) Analysis by Country, 2017 to 2032

Figure 42: Latin America Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Value (US$ Million) Analysis by Organ, 2017 to 2032

Figure 45: Latin America Volume (MT) Analysis by Organ, 2017 to 2032

Figure 46: Latin America Value Share (%) and BPS Analysis by Organ, 2022 to 2032

Figure 47: Latin America Y-o-Y Growth (%) Projections by Organ, 2022 to 2032

Figure 48: Latin America Value (US$ Million) Analysis by End-use, 2017 to 2032

Figure 49: Latin America Volume (MT) Analysis by End-use, 2017 to 2032

Figure 50: Latin America Value Share (%) and BPS Analysis by End-use, 2022 to 2032

Figure 51: Latin America Y-o-Y Growth (%) Projections by End-use, 2022 to 2032

Figure 52: Latin America Attractiveness by Organ, 2022 to 2032

Figure 53: Latin America Attractiveness by End-use, 2022 to 2032

Figure 54: Latin America Attractiveness by Country, 2022 to 2032

Figure 55: Europe Value (US$ Million) by Organ, 2022 to 2032

Figure 56: Europe Value (US$ Million) by End-use, 2022 to 2032

Figure 57: Europe Value (US$ Million) by Country, 2022 to 2032

Figure 58: Europe Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 59: Europe Volume (MT) Analysis by Country, 2017 to 2032

Figure 60: Europe Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Value (US$ Million) Analysis by Organ, 2017 to 2032

Figure 63: Europe Volume (MT) Analysis by Organ, 2017 to 2032

Figure 64: Europe Value Share (%) and BPS Analysis by Organ, 2022 to 2032

Figure 65: Europe Y-o-Y Growth (%) Projections by Organ, 2022 to 2032

Figure 66: Europe Value (US$ Million) Analysis by End-use, 2017 to 2032

Figure 67: Europe Volume (MT) Analysis by End-use, 2017 to 2032

Figure 68: Europe Value Share (%) and BPS Analysis by End-use, 2022 to 2032

Figure 69: Europe Y-o-Y Growth (%) Projections by End-use, 2022 to 2032

Figure 70: Europe Attractiveness by Organ, 2022 to 2032

Figure 71: Europe Attractiveness by End-use, 2022 to 2032

Figure 72: Europe Attractiveness by Country, 2022 to 2032

Figure 73: East Asia Value (US$ Million) by Organ, 2022 to 2032

Figure 74: East Asia Value (US$ Million) by End-use, 2022 to 2032

Figure 75: East Asia Value (US$ Million) by Country, 2022 to 2032

Figure 76: East Asia Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 77: East Asia Volume (MT) Analysis by Country, 2017 to 2032

Figure 78: East Asia Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: East Asia Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: East Asia Value (US$ Million) Analysis by Organ, 2017 to 2032

Figure 81: East Asia Volume (MT) Analysis by Organ, 2017 to 2032

Figure 82: East Asia Value Share (%) and BPS Analysis by Organ, 2022 to 2032

Figure 83: East Asia Y-o-Y Growth (%) Projections by Organ, 2022 to 2032

Figure 84: East Asia Value (US$ Million) Analysis by End-use, 2017 to 2032

Figure 85: East Asia Volume (MT) Analysis by End-use, 2017 to 2032

Figure 86: East Asia Value Share (%) and BPS Analysis by End-use, 2022 to 2032

Figure 87: East Asia Y-o-Y Growth (%) Projections by End-use, 2022 to 2032

Figure 88: East Asia Attractiveness by Organ, 2022 to 2032

Figure 89: East Asia Attractiveness by End-use, 2022 to 2032

Figure 90: East Asia Attractiveness by Country, 2022 to 2032

Figure 91: South Asia Value (US$ Million) by Organ, 2022 to 2032

Figure 92: South Asia Value (US$ Million) by End-use, 2022 to 2032

Figure 93: South Asia Value (US$ Million) by Country, 2022 to 2032

Figure 94: South Asia Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 95: South Asia Volume (MT) Analysis by Country, 2017 to 2032

Figure 96: South Asia Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: South Asia Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: South Asia Value (US$ Million) Analysis by Organ, 2017 to 2032

Figure 99: South Asia Volume (MT) Analysis by Organ, 2017 to 2032

Figure 100: South Asia Value Share (%) and BPS Analysis by Organ, 2022 to 2032

Figure 101: South Asia Y-o-Y Growth (%) Projections by Organ, 2022 to 2032

Figure 102: South Asia Value (US$ Million) Analysis by End-use, 2017 to 2032

Figure 103: South Asia Volume (MT) Analysis by End-use, 2017 to 2032

Figure 104: South Asia Value Share (%) and BPS Analysis by End-use, 2022 to 2032

Figure 105: South Asia Y-o-Y Growth (%) Projections by End-use, 2022 to 2032

Figure 106: South Asia Attractiveness by Organ, 2022 to 2032

Figure 107: South Asia Attractiveness by End-use, 2022 to 2032

Figure 108: South Asia Attractiveness by Country, 2022 to 2032

Figure 109: Oceania Value (US$ Million) by Organ, 2022 to 2032

Figure 110: Oceania Value (US$ Million) by End-use, 2022 to 2032

Figure 111: Oceania Value (US$ Million) by Country, 2022 to 2032

Figure 112: Oceania Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 113: Oceania Volume (MT) Analysis by Country, 2017 to 2032

Figure 114: Oceania Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 115: Oceania Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 116: Oceania Value (US$ Million) Analysis by Organ, 2017 to 2032

Figure 117: Oceania Volume (MT) Analysis by Organ, 2017 to 2032

Figure 118: Oceania Value Share (%) and BPS Analysis by Organ, 2022 to 2032

Figure 119: Oceania Y-o-Y Growth (%) Projections by Organ, 2022 to 2032

Figure 120: Oceania Value (US$ Million) Analysis by End-use, 2017 to 2032

Figure 121: Oceania Volume (MT) Analysis by End-use, 2017 to 2032

Figure 122: Oceania Value Share (%) and BPS Analysis by End-use, 2022 to 2032

Figure 123: Oceania Y-o-Y Growth (%) Projections by End-use, 2022 to 2032

Figure 124: Oceania Attractiveness by Organ, 2022 to 2032

Figure 125: Oceania Attractiveness by End-use, 2022 to 2032

Figure 126: Oceania Attractiveness by Country, 2022 to 2032

Figure 127: MEA Value (US$ Million) by Organ, 2022 to 2032

Figure 128: MEA Value (US$ Million) by End-use, 2022 to 2032

Figure 129: MEA Value (US$ Million) by Country, 2022 to 2032

Figure 130: MEA Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 131: MEA Volume (MT) Analysis by Country, 2017 to 2032

Figure 132: MEA Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 133: MEA Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 134: MEA Value (US$ Million) Analysis by Organ, 2017 to 2032

Figure 135: MEA Volume (MT) Analysis by Organ, 2017 to 2032

Figure 136: MEA Value Share (%) and BPS Analysis by Organ, 2022 to 2032

Figure 137: MEA Y-o-Y Growth (%) Projections by Organ, 2022 to 2032

Figure 138: MEA Value (US$ Million) Analysis by End-use, 2017 to 2032

Figure 139: MEA Volume (MT) Analysis by End-use, 2017 to 2032

Figure 140: MEA Value Share (%) and BPS Analysis by End-use, 2022 to 2032

Figure 141: MEA Y-o-Y Growth (%) Projections by End-use, 2022 to 2032

Figure 142: MEA Attractiveness by Organ, 2022 to 2032

Figure 143: MEA Attractiveness by End-use, 2022 to 2032

Figure 144: MEA Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chicken Feeder and Drinkers Market Size and Share Forecast Outlook 2025 to 2035

Chicken Plucking Machine Market Size, Growth, and Forecast 2025 to 2035

Chicken Coops Market Analysis – Trends & Growth Forecast 2025 to 2035

Chicken Buckets Market

Chicken Flavors Market

Electric Chicken Scalder Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Commercial Chicken Plucker Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Chicken Market Analysis - Size, Share, and Forecast 2025 to 2035

Fresh Organic Chicken Market

Organic Starter-Grower Chicken Feed Market

Industry Share Analysis for Edible Offal Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA