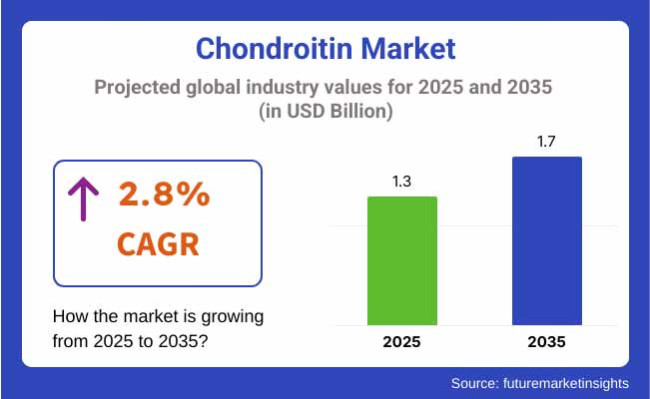

The 2022 market for chondroitin was USD 1.2 billion on a global level. Chondroitin demand has increased and will be USD 1.3 billion in 2025. The global market sale in the forecast period of 2025 to 2035 will be 2.8% CAGR during the forecast period and will be USD 1.7 billion in 2035.

Chondroitin sulfate, previously associated with joint well-being and osteoarthritis treatment, is progressively vital in today's era of increasing population and joint problem. Industry growth is fueled by expanding applications in food, drugs, and cosmetics.

Furthermore, increased consumer demand for preventive healthcare and natural joint maintenance has led to product innovation and segmentation by the companies. Firms such as Synutra Ingredients, TSI Group Ltd., and Bioiberica are even venturing into supply chain innovations, such as converting plant-based and artificial chondroitin as a means to tap vegan and vegetarian order customers.

Manufacturing of chondroitin is becoming cost-saving, as well as more sustainable, with the help of biofermentation technology. Synergistic blend of chondroitin with glucosamine supplements is being used widely since they are prescribed in humongous quantities to cure degenerative joint issues as well as arthritis. North America and Europe still remain profitable, while the Asia Pacific remains an emerging development driver with the increase in health spending and awareness.

Below table illustrates comparative study of six months base year change (2024) and current year (2025) chondroitin CAGR world market. Notably, study gives a very critical perspective into volatility of performance and indicates trends in revenue success, thus making stakeholders better informed about trend in growth over the period during the year. First half year, or H1, is January through June. Second half, H2, July through December.

| Particular | Value CAGR |

|---|---|

| H1 | 2.5% (2024 to 2034) |

| H2 | 2.6% (2024 to 2034) |

| H1 | 2.7% (2025 to 2035) |

| H2 | 2.8% (2025 to 2035) |

Between 2025 to 2035, in the initial half of the time period, the company will expand with a 2.7% CAGR and at the rate of enhanced 2.8% for the second half of the time period. Over the base of 2024, the market for chondroitin increased by 20 BPS in H1 and by 20 BPS in H2, indicating even more accelerating momentum for the trend in the increase in the market up to 2025 and even beyond.

Tier 1, which has a group of competitive firms that are large in revenue, market share, and international coverage. They boast strong supply chains, good associations with pharmaceutical and nutraceutical companies, and spend heavily in R&D and regulatory affairs to back chondroitin manufacture with high quality.

TSI Group Ltd. is a classic example, having world-class production facilities and vast product range in joint health ingredients such as chondroitin. Synutra Ingredients is another powerful firm with a good base in USA and international markets and provides high-purity chondroitin sulfate for pharmaceutical purposes as well as for nutritional supplements.

Tier 2 are companies that enjoy good reputation in the chondroitin market but otherwise small-scale to Tier 1. Such players have games in certain geographies and sell to certain industry segments such as functional foods, food supplements, and regional pharma players. For instance, Shandong Runxin Biotechnology Co., Ltd. has gained good reputation in Asia by virtue of its reliable export and stable quality.

Summit Nutritionals International is a good example, particularly in North America, of employing bovine-derived chondroitin sulfate and emphasizing traceability and transparency of the ingredient. Such firms generally concentrate on differentiation based on source, certifications (Halal, Kosher), and purity of the final product.

Tier 3 are small and emergent firms with minimal marketplace presence but rising reputation in niche markets. Firms such as these leverage unique sourcing (i.e., sea chondroitin), manufacturing flexibility, or direct-to-consumer models for building presence. A case in point can be Bioiberica S.A.U., which might not be gigantic by size but is better recognized for its pioneering work in the field of joint health products such as sea-derived chondroitin. They normally utilize web marketing, local exhibitions, and web retailing websites in order to develop brand recognition and compete within concentrated markets.

Growing Demand for Ethical and Vegan Alternatives

Shift: Consumer awareness in the last several years about the welfare of animals, sustainability, and nutritional morals has also been felt by the health supplement market, including that of chondroitin's, in the sense that traditional chondroitin is found in animal cartilage-bovine, bird, or fish-and is assumed to be of ethical and religious concern to all consumers. In sight of the same, Europe and North America are presently witnessing demand for vegan and plant chondroitin as there are rising vegan and flexitarian eating habits in the respective regions.

Strategic Response: Synutra Ingredients and TSI Group are two of the industry leaders that are spearheading the trend in the form of biotechnology-prepared vegan-approved chondroitin where the final product rivals the animal-sourced competition with regards to quality. In addition to this, consumer brands like MyVegan introduced co-pack joint health supplements with fermented chondroitin and plant collagen boosters.

These are specifically talking about the ethical consumer trend and have been responsible for double-digit growth in vegan supplement sales. For example, Doctor's Best vegan chondroitin portfolio saw 11% eCommerce sales increase in Q3 2024. Brands are also turning to sustainable packaging and non-GMO claims to access sustainability goals.

Preventive Health and Sports Nutrition Gaining Over Traditional Pharma Usage

Shift: Chondroitin was once used as a prescription drug in the treatment of osteoarthritis and joint disease in conjunction with anti-inflammatory drugs. Today's trend, however, is preventive medicine-sports nutrition and wellness. Today's consumers, particularly the 25-45 age group, are more concerned with joint care supplements as forms of prevention from injury, improved mobility, and improved performance than with the cure of disease. This has widened chondroitin's use beyond the pharmaceutical industry into the new fast-developing nutraceutical market.

Strategic Response: NOW Foods and Nature's Bounty: These companies are seriously manufacturing multi-ingredient sports products for preventive health requirements. The product is positioned as a day mobility supplement and located on active life and longevity joints. Swisse, for example, launched gym patrons to joint care sachets with emphasis on easy dosing and on-the-go recovery.

GNC also pioneered marketing sports consumers with chondroitin-fortified protein bars for functional foods. All these activities have driven 9-13% sales spikes in sports supplement segments. Marketing also is changing with companies developing instructional material on prevention of injury again gaining chondroitin's transition from treatment to prevention.

Direct-to-Consumer (D2C) and E-Commerce Sales Dominating

Shift: Online shopping and internet-based consumerism have transformed the consumption of dietary supplements such as chondroitin supplements among consumers. More than 60% of North American and European supplement purchases went online in 2024 because of convenience, availability of information, and expansion of subscription services. This is also being driven by younger generations who are looking for personalized nutrition, automatic replenishment, and online guidance.

Strategic Response: To offset this trend, firms such as Nature's Bounty introduced AI-driven D2C websites that provided customized packs of supplements according to the health objectives of the consumers. The websites included auto-ship option, which increased the customer retention rate by 20%. Doctor's Best introduced monthly subscription options for chondroitin lines, which increased the LTV per consumer by 15%.

Andhra Pradesh and Uttarakhand Startup Festival. In developing economies like India, Himalaya Wellness employed flash selling and mobile-driven promotions to generate Q4 2024 joint health supplement online sales by 22%. The activity reflects the pivotal role D2C sites play in involving consumers, allowing brands to maintain direct price control, capture customer data, and build long-term loyalty.

Regulatory Scrutiny Driving Demand for Traceable, High-Purity Chondroitin

Shift: As the industry progresses, regulatory interest in authenticity of label, quality, and source has increased-particularly in Japan, Europe, and North America. The PMDA, EFSA, and FDA among other regulators are fighting over ingredient quality, traceability, and statements on the label. The consumers themselves are increasingly becoming discerning when it comes to adulterated or misrepresented products, particularly in the market for chondroitin which has had a problem with uneven sourcing as well as questions about efficacy.

Strategic Response: Companies like Solgar have implemented blockchain traceability systems, and customers can scan the QR codes to confirm the entire supply chain for the chondroitin utilized in their product. This provided customers with more trust and repeat purchases by 14%. Puritan's Pride became NSF certified for its chondroitin product line, which allowed it to sell to regulated markets and boosted B2B sales by 11%.

Simultaneously, Swisse leveraged traceability efforts in Asia for consumer education on source transparency through 9% market share expansion in ASEAN leading countries. These activities stay up to date with compliance while establishing credibility and differentiation into the brand.

Emerging Markets Driving Demand Due to Aging Populations

Shift: The Asia-Pacific and Latin America 65+ population is growing at a rapid rate, with an expected 28% growth by 2030. The demographic change is spurring phenomenal demand for dual-care products such as chondroitin. The economies are also plagued by economic inequality and price sensitivity, where 58% of consumers purchase inexpensive, small-pack-size products for $10 or less. Healthcare promotion programs and governmental healthcare programs are also stimulating consumer demand for preventive joint care.

Strategic Response: Players globally are swiftly increasing distribution across these markets. Himalaya launched low-cost chondroitin capsules in packs of 30, reaching 24% rural India sales. Amway made joint care products local with herbal mix + chondroitin and sold them to users of traditional medicine in Latin America.

GNC did the opposite and partnered with regional eCommerce market leaders such as Shopee and MercadoLibre, amplifying online exposure and tapping into new consumer markets. Brands are also spending on education programs, promoting joint health awareness on social networking sites and public health clinics, making chondroitin an every-day preventive product among older consumers.

Emergence of Combination Formulas for Total Joint and Skin Health

Shift: Consumers are looking for multi-purpose supplements that enhance general health and joint health. The most prominent trend is the trend toward combination products, with chondroitin combined with collagen, hyaluronic acid, MSM, glucosamine, turmeric, and vitamins (e.g., C & D) to enhance joint mobility, cartilage repair, and skin elasticity. Convenience needs are behind this, as consumers want one product to solve several problems-i.e., joint health and anti-aging.

Strategic Response: Vital Proteins and NeoCell are at the forefront of developing collagen + chondroitin products as joint and beauty boosters. They are promoting them with lifestyle photography that will appeal to the health-conscious consumer. Nutrafol has also launched a women's joint and skin supplement with chondroitin and saw 20% quarter-to-quarter growth.

Besides this, Swisse and GNC also produced effervescent powders and tablets with multi-ingredient stacks that provide quick assimilation and convenience of use in daily life. These products allow companies to receive more market attention among sportspersons and old age people to cosmetologists and professionals, and they generate real market penetration and brand awareness.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Country | CAGR 2025 to 2035 |

|---|---|

| USA | 3.9% |

| Germany | 4.1% |

| China | 5.3% |

| Japan | 4.8% |

| India | 5.8% |

Ageing population and growing health awareness are driving United States sales of joint health dietary supplements in which chondroitin is paired most often with glucosamine. Nature-sourced and clean-label ingredients are favored by consumers, so correspondingly marine- and plant-source chondroitin is being sought after.

Sustainable sourcing in the form of green extraction from fish cartilage and other side streams adds to consumer confidence as well. Innovative delivery forms-e.g., gummies, liquids, and chewables-are also gaining popularity, particularly with active lifestyle and older adults. FDA dietary supplement compliance assurance also supports market strength because brands can rely on sustainable growth.

Chinese urbanization at a high rate and middle-class growth have raised awareness of joint health, particularly with rising desk jobs and inactive lifestyles. This has led to a boom for the market demand of nutraceuticals, and chondroitin is being consumed on an enormous scale in the form of supplement and fortified food.

The government focus on prevention and integration of conventional and modern medicine has put chondroitin in a better position in functional foods and conventional medicine products. The widespread e-commerce market in the nation also provides mass availability of chondroitin-enriched products so that they reach the masses. The most notable one, however, is that it is now locally produced in growing quantities, and saved resources and independence.

Japan's aging population has created humongous demand for joint health alternatives, and chondroitin has been promoted as a key ingredient for mobility and quality-of-life maintenance. Japanese consumers are well-educated and chose science-supported ingredients with a clean label, prompting manufacturers to invest in naturally derived and high-purity chondroitin.

The wellness and healthiness of functional foods and drinks containing chondroitin, particularly in convenient-to-take forms such as ready-to-drink supplements, also drive market demand. Japan's pharmaceutical and food sectors, which prioritize innovation, have also integrated chondroitin into beauty-from-within items, tapping into its collagen-boosting function for joint and skin uses. Strong food safety regulation and public trust in local brands guarantee a strong and developing market.

| Segment | Value Share (2025) |

|---|---|

| Capsules (By Form) | 58.7% |

With increasing numbers of individuals becoming health-conscious regarding joint health and the therapeutic value of chondroitin in osteoarthritis treatment, capsules have been the most popular method of consumption.

Capsules are favored because they are easy to swallow, accurate in dosage, and convenient, a daily supplement choice. Chondroitin was then mainstreamed by pairing glucosamine and MSM by a number of leading nutraceutical and pharmaceutical companies. Not only has it increased the productivity of the product, but also the popularity among consumers. With a portable nature with the extended shelf life of capsules, the easy factor is given a boost with the majority of consumers having an active lifestyle on the move.

And finally, encapsulation ensures chondroitin's bioavailability and stability as a value addition to enable the complete utilization of the product. The trend of online pharmacies and shopping has also played a role in fueling capsule demand even more, with consumers going out of their way to obtain standardized, high-quality supplements which have been clinically proven to benefit.

| Segment | Value Share (2025) |

|---|---|

| Marine (By Source) | 41.2% |

The sea market segment's chondroitin is developing quickly with growing consumer demand for natural, sustainable, highly bioavailable supplements. It is most commonly found in shark and fish cartilage. Since it will be seen to be cleaner, ethical, and greener compared to avian or bovine origins, flexitarian and pescatarian consumers will love it.

Green culture also influences the trend as companies promote sea chondroitin as traceable and green. Sea chondroitin will also most likely be retailed as of higher quality for absorption, which is a notably desired attribute within sports nutrition and high-end diet supplement markets. Firms are taking advantage of this interest by creating certifications and encouraging ethical purchasing, further solidifying consumer trust and market share.

Top brands are investing in R&D to improve the bioavailability and efficacy of chondroitin supplements. All of them are introducing higher-quality products that incorporate chondroitin with glucosamine, MSM (methylsulfonylmethane), collagen, and hyaluronic acid to bring synergy-based value to joint health and mobility. The transition not only caters to increasing consumer demand for full-solution health but also allows brands to command premium price.

Sustainability is yet another priority area, with companies selling responsibly sourced marine chondroitin from fish and shark cartilage as well as the clean-label and green trends. Key industry participants here are companies like Bioiberica S.A.U., which is offering traceable, high-purity clinically backed chondroitin sulfate. Players are also growing their online presence by offering educational content, personalized nutrition guidance, and direct-to-consumer selling via online channels.

Subscription business models and specialized marketing to geriatric populations, athletes, and health-oriented consumers are becoming increasingly prominent. Strategic partnerships with medical professionals and social media fitness influencers are also helping in credibility and reach generation. Additionally, NSF, GMP, and non-GMO certifications are being pursued aggressively to gain educated consumers.

For instance:

As per source, the industry has been categorized into Marine, Bovine, Avian, and Others (Chicken, Cow, etc.).

This segment is further categorized into Powder and Capsules.

This segment is further categorized into Pharmaceutical Grade and Industrial Grade.

This segment is further categorized into Sports Nutrition, Pharmaceuticals, Dietary Supplements, and Cosmetics and Personal Care.

This segment is further categorized into Direct/B2B, Indirect/B2C, Drug Stores, Pharmacies, and Online Retail.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global market is estimated at a value of USD 1.3 billion in 2025.

Some of the leaders in this industry include Bioiberica S.A.U., Solgar Inc., NOW Foods, Swanson Health Products, Nutramax Laboratories, Schiff Nutrition International, Synutra Pure, Sigma-Aldrich Corporation (Merck KGaA), FlexNow Joint Health, Others.

The North American region is projected to hold a revenue share of 38.7% over the forecast period.

The market is projected to grow at a forecast CAGR of 2.8% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 4: Global Market Volume (Tons) Forecast by Source, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 6: Global Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Grade, 2017 to 2032

Table 8: Global Market Volume (Tons) Forecast by Grade, 2017 to 2032

Table 9: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 10: Global Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 11: Global Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 12: Global Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: North America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 16: North America Market Volume (Tons) Forecast by Source, 2017 to 2032

Table 17: North America Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 18: North America Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 19: North America Market Value (US$ Million) Forecast by Grade, 2017 to 2032

Table 20: North America Market Volume (Tons) Forecast by Grade, 2017 to 2032

Table 21: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 22: North America Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 23: North America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 24: North America Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Latin America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 27: Latin America Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 28: Latin America Market Volume (Tons) Forecast by Source, 2017 to 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 30: Latin America Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 31: Latin America Market Value (US$ Million) Forecast by Grade, 2017 to 2032

Table 32: Latin America Market Volume (Tons) Forecast by Grade, 2017 to 2032

Table 33: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 34: Latin America Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 35: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 36: Latin America Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: Europe Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 39: Europe Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 40: Europe Market Volume (Tons) Forecast by Source, 2017 to 2032

Table 41: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 42: Europe Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 43: Europe Market Value (US$ Million) Forecast by Grade, 2017 to 2032

Table 44: Europe Market Volume (Tons) Forecast by Grade, 2017 to 2032

Table 45: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 46: Europe Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 47: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 48: Europe Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: Asia Pacific Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 52: Asia Pacific Market Volume (Tons) Forecast by Source, 2017 to 2032

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 54: Asia Pacific Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Grade, 2017 to 2032

Table 56: Asia Pacific Market Volume (Tons) Forecast by Grade, 2017 to 2032

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 58: Asia Pacific Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 60: Asia Pacific Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 62: MEA Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 63: MEA Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 64: MEA Market Volume (Tons) Forecast by Source, 2017 to 2032

Table 65: MEA Market Value (US$ Million) Forecast by Form, 2017 to 2032

Table 66: MEA Market Volume (Tons) Forecast by Form, 2017 to 2032

Table 67: MEA Market Value (US$ Million) Forecast by Grade, 2017 to 2032

Table 68: MEA Market Volume (Tons) Forecast by Grade, 2017 to 2032

Table 69: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 70: MEA Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 71: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2017 to 2032

Table 72: MEA Market Volume (Tons) Forecast by Distribution Channel, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Source, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Form, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Grade, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 6: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 8: Global Market Volume (Tons) Analysis by Region, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 12: Global Market Volume (Tons) Analysis by Source, 2017 to 2032

Figure 13: Global Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 14: Global Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 15: Global Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 16: Global Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 17: Global Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 18: Global Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 19: Global Market Value (US$ Million) Analysis by Grade, 2017 to 2032

Figure 20: Global Market Volume (Tons) Analysis by Grade, 2017 to 2032

Figure 21: Global Market Value Share (%) and BPS Analysis by Grade, 2022 to 2032

Figure 22: Global Market Y-o-Y Growth (%) Projections by Grade, 2022 to 2032

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 24: Global Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 25: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 26: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 27: Global Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 28: Global Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 29: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 30: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 31: Global Market Attractiveness by Source, 2022 to 2032

Figure 32: Global Market Attractiveness by Form, 2022 to 2032

Figure 33: Global Market Attractiveness by Grade, 2022 to 2032

Figure 34: Global Market Attractiveness by Application, 2022 to 2032

Figure 35: Global Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 36: Global Market Attractiveness by Region, 2022 to 2032

Figure 37: North America Market Value (US$ Million) by Source, 2022 to 2032

Figure 38: North America Market Value (US$ Million) by Form, 2022 to 2032

Figure 39: North America Market Value (US$ Million) by Grade, 2022 to 2032

Figure 40: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 41: North America Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 42: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 44: North America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 47: North America Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 48: North America Market Volume (Tons) Analysis by Source, 2017 to 2032

Figure 49: North America Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 50: North America Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 51: North America Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 52: North America Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 53: North America Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 54: North America Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 55: North America Market Value (US$ Million) Analysis by Grade, 2017 to 2032

Figure 56: North America Market Volume (Tons) Analysis by Grade, 2017 to 2032

Figure 57: North America Market Value Share (%) and BPS Analysis by Grade, 2022 to 2032

Figure 58: North America Market Y-o-Y Growth (%) Projections by Grade, 2022 to 2032

Figure 59: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 60: North America Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 61: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 62: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 63: North America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 64: North America Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 65: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 66: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 67: North America Market Attractiveness by Source, 2022 to 2032

Figure 68: North America Market Attractiveness by Form, 2022 to 2032

Figure 69: North America Market Attractiveness by Grade, 2022 to 2032

Figure 70: North America Market Attractiveness by Application, 2022 to 2032

Figure 71: North America Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 72: North America Market Attractiveness by Country, 2022 to 2032

Figure 73: Latin America Market Value (US$ Million) by Source, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) by Form, 2022 to 2032

Figure 75: Latin America Market Value (US$ Million) by Grade, 2022 to 2032

Figure 76: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 77: Latin America Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 80: Latin America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 83: Latin America Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 84: Latin America Market Volume (Tons) Analysis by Source, 2017 to 2032

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 87: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 88: Latin America Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 91: Latin America Market Value (US$ Million) Analysis by Grade, 2017 to 2032

Figure 92: Latin America Market Volume (Tons) Analysis by Grade, 2017 to 2032

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Grade, 2022 to 2032

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2022 to 2032

Figure 95: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 96: Latin America Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 99: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 100: Latin America Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 103: Latin America Market Attractiveness by Source, 2022 to 2032

Figure 104: Latin America Market Attractiveness by Form, 2022 to 2032

Figure 105: Latin America Market Attractiveness by Grade, 2022 to 2032

Figure 106: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 107: Latin America Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 108: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 109: Europe Market Value (US$ Million) by Source, 2022 to 2032

Figure 110: Europe Market Value (US$ Million) by Form, 2022 to 2032

Figure 111: Europe Market Value (US$ Million) by Grade, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 113: Europe Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 114: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 116: Europe Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 119: Europe Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 120: Europe Market Volume (Tons) Analysis by Source, 2017 to 2032

Figure 121: Europe Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 123: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 124: Europe Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 125: Europe Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 127: Europe Market Value (US$ Million) Analysis by Grade, 2017 to 2032

Figure 128: Europe Market Volume (Tons) Analysis by Grade, 2017 to 2032

Figure 129: Europe Market Value Share (%) and BPS Analysis by Grade, 2022 to 2032

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Grade, 2022 to 2032

Figure 131: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 132: Europe Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 133: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 135: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 136: Europe Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 137: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 139: Europe Market Attractiveness by Source, 2022 to 2032

Figure 140: Europe Market Attractiveness by Form, 2022 to 2032

Figure 141: Europe Market Attractiveness by Grade, 2022 to 2032

Figure 142: Europe Market Attractiveness by Application, 2022 to 2032

Figure 143: Europe Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 144: Europe Market Attractiveness by Country, 2022 to 2032

Figure 145: Asia Pacific Market Value (US$ Million) by Source, 2022 to 2032

Figure 146: Asia Pacific Market Value (US$ Million) by Form, 2022 to 2032

Figure 147: Asia Pacific Market Value (US$ Million) by Grade, 2022 to 2032

Figure 148: Asia Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 149: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 152: Asia Pacific Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 156: Asia Pacific Market Volume (Tons) Analysis by Source, 2017 to 2032

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 160: Asia Pacific Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Grade, 2017 to 2032

Figure 164: Asia Pacific Market Volume (Tons) Analysis by Grade, 2017 to 2032

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Grade, 2022 to 2032

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Grade, 2022 to 2032

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 168: Asia Pacific Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 172: Asia Pacific Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 175: Asia Pacific Market Attractiveness by Source, 2022 to 2032

Figure 176: Asia Pacific Market Attractiveness by Form, 2022 to 2032

Figure 177: Asia Pacific Market Attractiveness by Grade, 2022 to 2032

Figure 178: Asia Pacific Market Attractiveness by Application, 2022 to 2032

Figure 179: Asia Pacific Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 180: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 181: MEA Market Value (US$ Million) by Source, 2022 to 2032

Figure 182: MEA Market Value (US$ Million) by Form, 2022 to 2032

Figure 183: MEA Market Value (US$ Million) by Grade, 2022 to 2032

Figure 184: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 185: MEA Market Value (US$ Million) by Distribution Channel, 2022 to 2032

Figure 186: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 188: MEA Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 191: MEA Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 192: MEA Market Volume (Tons) Analysis by Source, 2017 to 2032

Figure 193: MEA Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 195: MEA Market Value (US$ Million) Analysis by Form, 2017 to 2032

Figure 196: MEA Market Volume (Tons) Analysis by Form, 2017 to 2032

Figure 197: MEA Market Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 199: MEA Market Value (US$ Million) Analysis by Grade, 2017 to 2032

Figure 200: MEA Market Volume (Tons) Analysis by Grade, 2017 to 2032

Figure 201: MEA Market Value Share (%) and BPS Analysis by Grade, 2022 to 2032

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Grade, 2022 to 2032

Figure 203: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 204: MEA Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 205: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 207: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2017 to 2032

Figure 208: MEA Market Volume (Tons) Analysis by Distribution Channel, 2017 to 2032

Figure 209: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2022 to 2032

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2032

Figure 211: MEA Market Attractiveness by Source, 2022 to 2032

Figure 212: MEA Market Attractiveness by Form, 2022 to 2032

Figure 213: MEA Market Attractiveness by Grade, 2022 to 2032

Figure 214: MEA Market Attractiveness by Application, 2022 to 2032

Figure 215: MEA Market Attractiveness by Distribution Channel, 2022 to 2032

Figure 216: MEA Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA