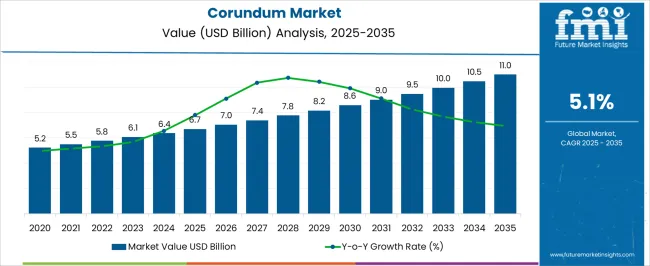

The Corundum Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Corundum Market Estimated Value in (2025 E) | USD 6.7 billion |

| Corundum Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The corundum market is witnessing steady growth, supported by its critical applications in industrial and technological processes where high hardness, thermal stability, and chemical resistance are required. Increasing adoption of advanced materials for abrasives, cutting tools, electronics, and optical components is driving demand for high-purity corundum varieties. The market is further influenced by growth in sectors such as automotive, aerospace, construction, and electronics, which require durable materials capable of withstanding extreme conditions.

Innovations in processing technologies are enhancing the quality, uniformity, and performance of corundum products, enabling their integration into precision applications. Rising industrialization in emerging economies and growing investments in manufacturing infrastructure are contributing to increasing demand for corundum-based materials.

As manufacturers focus on improving product efficiency, reducing wear and maintenance costs, and supporting environmentally compliant production processes, the market is expected to experience sustained expansion Continuous development in synthetic corundum production and the increasing preference for high-purity grades for technical applications are also expected to reinforce long-term growth opportunities across global markets.

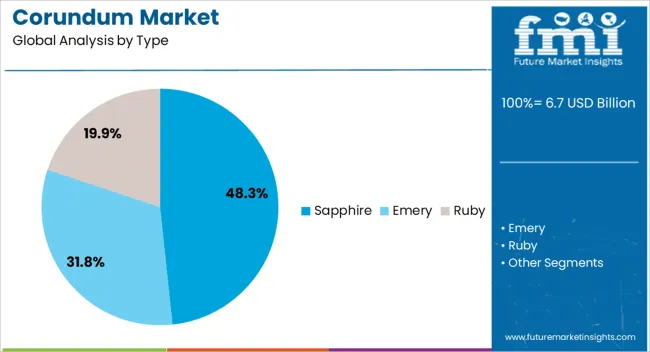

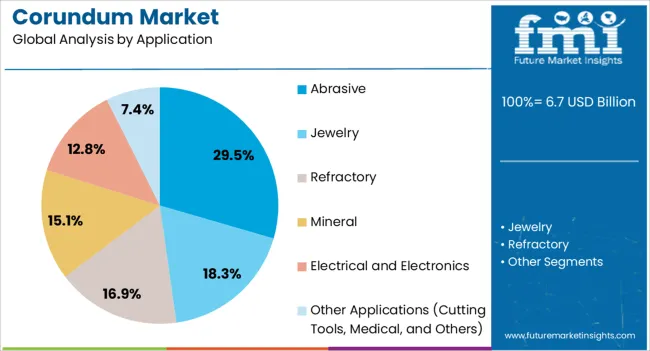

The corundum market is segmented by type, application, and geographic regions. By type, corundum market is divided into Sapphire, Emery, and Ruby. In terms of application, corundum market is classified into Abrasive, Jewelry, Refractory, Mineral, Electrical and Electronics, and Other Applications (Cutting Tools, Medical, and Others). Regionally, the corundum industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sapphire type segment is projected to hold 48.3% of the corundum market revenue share in 2025, making it the leading product type. This dominance is being driven by its exceptional hardness, chemical stability, and optical clarity, which make it suitable for a wide range of high-performance industrial applications. The synthetic sapphire production process has enabled cost-effective scaling while maintaining consistent quality, supporting its growing adoption in electronics, optics, and precision engineering applications.

Its mechanical and thermal properties enhance wear resistance, extend product life, and reduce operational maintenance requirements, which is particularly critical in abrasive and high-precision applications. The segment’s performance in both conventional and advanced manufacturing processes has positioned it as the preferred material for industries seeking durability and efficiency.

Rising investments in sectors such as semiconductors, automotive, and electronics are also encouraging the integration of sapphire-based corundum, reinforcing its market leadership Additionally, the ability to produce customized grades tailored to specific technical requirements has strengthened its position as the dominant type segment globally.

The abrasive application segment is expected to account for 29.5% of the corundum market revenue share in 2025, establishing itself as the leading application. This leadership is being reinforced by the increasing need for high-performance grinding, cutting, polishing, and finishing solutions across industries. Corundum’s exceptional hardness and durability allow it to deliver superior abrasion resistance, reduce tool wear, and enhance productivity in manufacturing and processing operations.

Demand growth is being driven by expanding industrialization in emerging markets, where high-quality abrasives are critical for maintaining production efficiency and ensuring product quality. The adoption of automated and precision machinery has further emphasized the importance of reliable abrasive materials that can sustain high loads and rotational speeds.

Corundum abrasives are also being preferred for eco-friendly production methods as they enable longer tool life and lower material waste Continuous improvements in synthetic corundum production and quality control are enhancing consistency and performance, further supporting the segment’s market share and reinforcing its leading position in the global corundum market.

Based on its chemical composition, corundum is nothing but aluminum oxide. When it is synthesized through various processes, For industrial applications, artificial corundum is manufactured synthetically with a small addition of colouring agents, which is later left for cooling and solidification.

This entire process of manufacturing artificial corundum is known as the Verneuil Process.

Corundum is a highly stable and hard mineral; second hardest mineral available in the world after diamond. Corundum can be made available in a variety of colours. The most commonly preferred types of corundum are Padparadscha (Pink and orange variety of Sapphire), Emery (Black), Star Ruby, Ruby (Pink or red), Blue Sapphire, Star Sapphire, and Green Sapphire.

While corundum is commonly used in a large variety of applications, its sales in the jewellery industry as precious stones account for a significant share in the global corundum market.

Corundum minerals are used in the manufacturing of various gemstones, and are emerging as among the gemstones that are highest in demand, after diamonds. This is among the biggest driving forces for the global market for corundum.

As mentioned earlier, the demand for corundum is not only high across the popular segments such as Blue Sapphires and Red Rubies, but rare gemstones such as padparadscha are also witnessing significantly high demand across the jewellery industry, mainly for their uncommon and unique colour.

This creates a great potential for leading stakeholders in the corundum market across the jewellery and precious stones industries.

Furthermore, non-gemstones manufactured using corundum are commonly used in various industrial applications, contributing to the growth of the global corundum market. For instance, Black Emery finds applications as an abrasive, which is mainly attributed to its natural hardness.

Brown corundum is also witnessing high demand as a deburring agent in various applications such as grinding, sand blasting, and plunge cutting, owing to its ability to smoothen and soften ragged edges.

Though it is not as hard as brown corundum, white corundum is used in abrasion applications, such as polishing glass, where high speed is required without producing more heat during friction. It is also used as a sharpening agent for cutting tools, in vitrified grinding wheels, as well as in the manufacturing of precision milling equipment that are used in similar applications.

Consequently, though the corundum market is mainly driven by its demand in the jewellery industry, its growing significance in industrial abrasion applications will also contribute to the growth of the market in the coming years.

While the global market for corundum continues to witness positive growth due to its burgeoning demand as precious stones, the constant fluctuations in the prices of jewellery-grade corundum create roadblocks for market players in the industry. This is mainly attributed to the fluctuating demand and the dynamics of consumer markets.

Sapphires made from corundum, especially the ones in a colour other than red or blue, are highly volatile as consumer demand is unpredictable and highly dynamic. Thereby, this triggers constant fluctuations in the prices of fancy sapphire, and restricts market players from introducing stability in the prices of corundum.

In addition to this, another factor that impacts the prices of corundum is the political instability in some African countries such as the Republic of Madagascar. Such geopolitical factors often lead to unpredictable restrictions on the export of precious stones that are manufactured using corundum.

This ultimately contributes to the disruptions in the demand supply chain, which has a direct impact on the prices of corundum in the international markets. In the coming years, this may emerge as a hindrance for the growth of the corundum market.

Global market for corundum is geographically segmented into seven regions - North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa. Attributing to the surging demand for artificial corundum due to its lack of natural occurrence in the United States along with many European countries such as the United Kingdom, Germany, and Turkey, North America and Europe are expected to remain the largest regional market for cordum, in the coming years.

China is one of the largest producers of artificial corundum, and this is expected to boost the significance of Asia Pacific in the global market for corundum. Apart from China, other Asia countries such as Thailand, India, Japan, and Korea are also expected to account for a significant share in the market owing to the expanding presence of leading manufacturers in these countries.

Leading stakeholders in the global corundum market are entering Asia countries including Cambodia, Afghanistan, Sri Lanka, Vietnam, and Myanmar to capitalize on the natural corundum mines in these countries.

African countries such as the Republic of Madagascar, are also gaining attention from market leaders with the natural occurrence of corundum in this region. This is expected to amplify growth potential for stakeholders in the corundum market in the Middle East & African region, in the coming years.

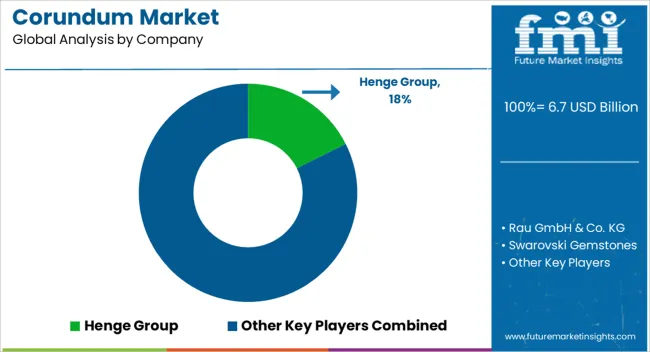

The global market is moderately consolidated as the top 5 stakeholders have established a stronghold with the global footprint of their businesses.

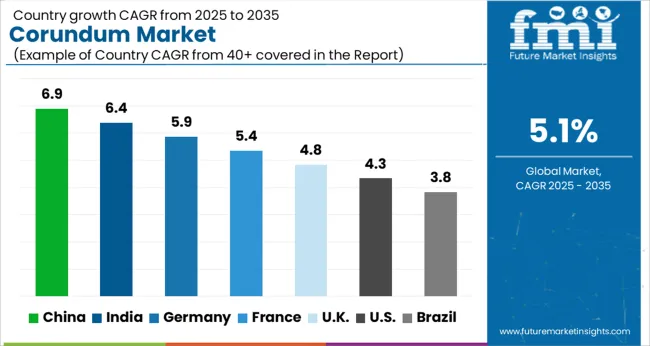

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The Corundum Market is expected to register a CAGR of 5.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.9%, followed by India at 6.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global Corundum Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.9%. The USA Corundum Market is estimated to be valued at USD 2.5 billion in 2025 and is anticipated to reach a valuation of USD 3.9 billion by 2035. Sales are projected to rise at a CAGR of 4.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 367.5 million and USD 230.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.7 Billion |

| Type | Sapphire, Emery, and Ruby |

| Application | Abrasive, Jewelry, Refractory, Mineral, Electrical and Electronics, and Other Applications (Cutting Tools, Medical, and Others) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Henge Group, Rau GmbH & Co. KG, Swarovski Gemstones, Mineralmühle Leun, K.A. Refractories Co. Ltd., Zibo Jinjiyuan Abrasives Co.,Ltd, Alteo Alumina, and Riken corundum Co. Ltd. |

The global corundum market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the corundum market is projected to reach USD 11.0 billion by 2035.

The corundum market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in corundum market are sapphire, emery and ruby.

In terms of application, abrasive segment to command 29.5% share in the corundum market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA