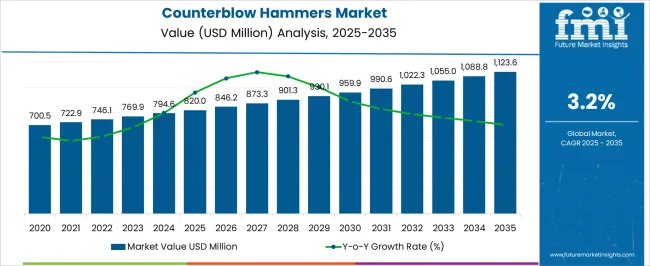

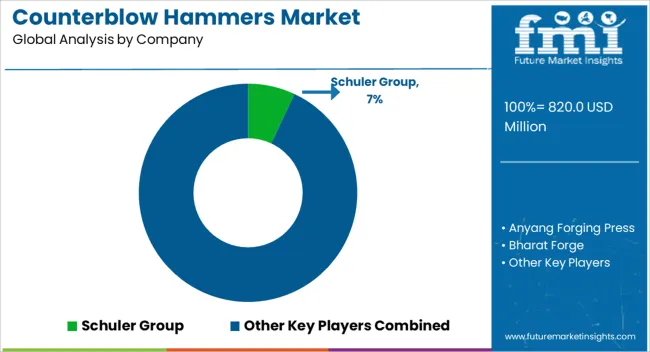

The global counterblow hammers market is projected to grow from USD 820.0 million in 2025 to reach USD 1,123.5 million by 2035, reflecting an absolute increase of USD 303.5 million over the forecast period. This translates into a cumulative growth of approximately 37.0% over the decade. The market is expected to expand at a compound annual growth rate (CAGR) of 3.2% between 2025 and 2035. The overall market size is projected to grow by nearly 1.37X during the same period, supported by the rising integration of advanced forging technologies across aerospace and automotive manufacturing segments.

The market is growing as industries demand advanced forging solutions capable of handling high-strength materials with greater efficiency and precision. Counterblow hammers, which deliver equal and opposite forces through two rams, reduce foundation loads, vibrations, and energy consumption compared to conventional forging equipment. This makes them ideal for aerospace, automotive, defense, and energy sectors where lightweight alloys and complex geometries are increasingly required. The push toward lightweight vehicles, renewable energy components, and high-performance parts is driving adoption. Additionally, technological advancements in automation, digital controls, and material handling systems are enhancing productivity, reliability, and cost-effectiveness, fueling market expansion.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 820.0 million |

| Forecast Value in (2035F) | USD 1,123.5 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

Between 2020 and 2025, the counterblow hammers market expanded from USD 715.7 million to USD 820.0 million, reflecting a cumulative value increase of USD 104.3 million and a five-year CAGR of 2.7%. Growth during this period was supported by steady recovery in aerospace manufacturing following pandemic-related disruptions and increased investment in automotive lightweighting initiatives. The period saw significant adoption of automation features and improved safety systems in hammer designs.

Between 2025 and 2030, the counterblow hammers market is projected to expand from USD 820.0 million to USD 959.9 million, resulting in a value increase of USD 139.9 million during this period. This phase of growth will be shaped by rising demand for precision forging in aerospace applications, with manufacturers increasingly adopting counterblow hammer technology for complex component manufacturing. The growing emphasis on lightweight materials in automotive and aerospace industries is expected to drive adoption of specialized forging equipment capable of handling aluminum and titanium alloys.

From 2030 to 2035, the market is forecast to grow from USD 959.9 million to USD 1,123.5 million, adding another USD 163.6 million in value. This period is expected to be characterized by technological advancements in hammer control systems and energy efficiency improvements. The integration of digital monitoring and predictive maintenance capabilities will become standard features, while manufacturers focus on developing hammers optimized for high-strength materials processing in aerospace and defense applications.

Market expansion is being supported by increasing demand for precision forged components in high-performance applications, particularly in aerospace and automotive sectors. The superior force distribution and reduced vibration characteristics of counterblow hammers make them ideal for producing complex geometries with tight tolerances. Growing adoption of lightweight materials such as aluminum and titanium alloys in aerospace applications is driving demand for specialized forging equipment capable of handling these challenging materials.

The shift toward sustainable manufacturing practices is also contributing to market growth, as counterblow hammers offer improved energy efficiency compared to conventional forging methods. Their ability to produce near-net-shape components reduces material waste and subsequent machining requirements, aligning with industry sustainability goals.

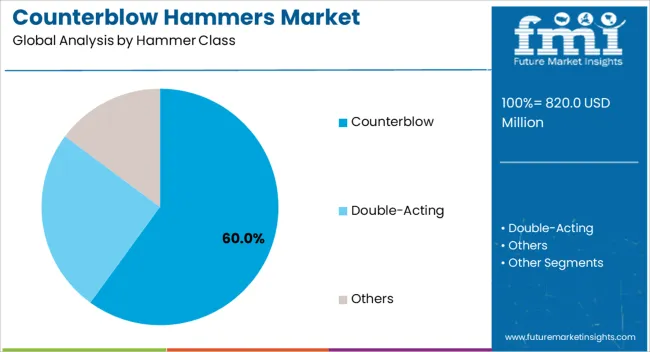

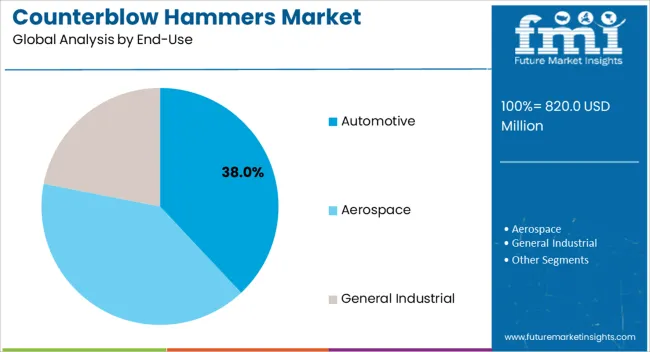

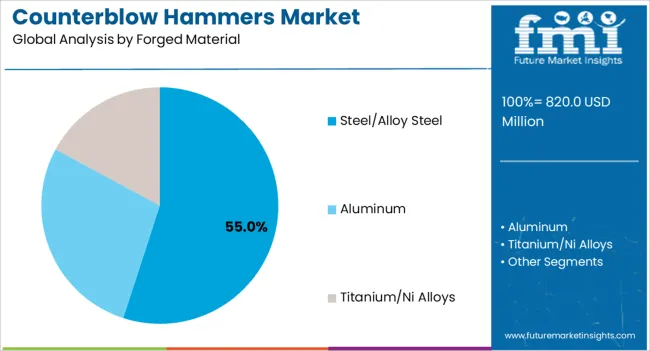

The market is segmented by hammer class, forged material, end-use, energy/capacity, and region. By hammer class, the market is divided into counterblow, double-acting, and others. Based on forged material, the market is classified into steel/alloy steel, aluminum, and titanium/nickel alloys. In terms of end-use, the market is categorized into aerospace, automotive, and general industrial sectors. By energy capacity, the market is segmented into below 100 kN, 100-400 kN, and above 400 kN. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Counterblow hammers are projected to account for 60% of the market in 2025, reflecting their unmatched efficiency in precision forging. Their dual-ram design provides superior force distribution, reduces vibration, and minimizes die wear, making them ideal for complex, high-strength parts. This capability ensures improved dimensional accuracy and material flow, enabling manufacturers to produce intricate geometries with reduced draft angles and tighter tolerances. The demand from high-value industries such as aerospace, defense, and advanced automotive ensures counterblow hammers remain the preferred choice for applications where both productivity and component quality are paramount.

The automotive sector represents 38% of the counterblow hammers market in 2025, driven by rising demand for forged components such as crankshafts, connecting rods, gears, and suspension parts. Counterblow hammers enable the precision forging of lightweight aluminum and high-strength steel alloys, supporting industry goals for fuel efficiency, emissions reduction, and vehicle safety. Their ability to deliver consistent dimensional accuracy, lower scrap rates, and high-volume throughput makes them essential for large-scale automotive production. With growing adoption of electric vehicles requiring specialized drivetrain and structural components, the automotive industry continues to be a dominant end-user, ensuring sustained investment in advanced hammer technologies.

Steel and alloy steel materials are projected to hold 55% of the market share in 2025, sustaining their leadership despite rising interest in lightweight alternatives. Their dominance stems from cost efficiency, high availability, and well-established processing techniques that allow consistent performance in safety-critical applications. Industries such as automotive, construction, and machinery continue to depend on steel forging for parts that demand durability, impact resistance, and reliability. The widespread use of high-strength steel in automotive safety components, combined with ongoing industrial infrastructure growth, ensures that steel and alloy steels will remain at the core of forging materials selection.

The market is experiencing technological evolution driven by digitalization and automation trends. Integration of sensors and monitoring systems enables real-time process control and predictive maintenance capabilities. Energy efficiency improvements are becoming increasingly important as manufacturers seek to reduce operational costs and environmental impact.

Modern counterblow hammers are incorporating advanced control systems with digital interfaces that allow precise programming of forging parameters. These systems enable consistent reproduction of forging conditions and facilitate quality control through automated monitoring of force, temperature, and timing parameters. The integration of Industry 4.0 concepts is enabling data-driven optimization of forging processes and predictive maintenance scheduling.

Manufacturers are developing more energy-efficient hammer designs that reduce power consumption while maintaining forging quality. Advanced hydraulic systems and optimized mechanical designs contribute to lower energy usage per forged part. Environmental regulations are driving adoption of cleaner technologies and improved noise reduction features in hammer designs.

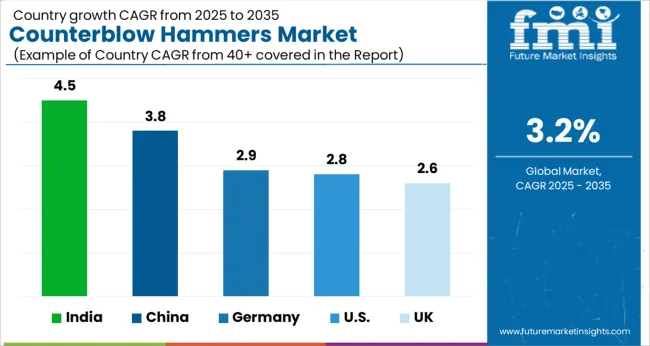

| Country | CAGR |

|---|---|

| India | 4.5% |

| China | 3.8% |

| Germany | 2.9% |

| USA | 2.8% |

| UK | 2.6% |

Demand for counterblow hammers in India is projected to achieve the highest growth rate at 4.5% CAGR, driven by the rapid expansion of aerospace and automotive manufacturing capabilities. The government’s focus on indigenous defense production, supported by programs such as “Make in India,” is encouraging large-scale investment in advanced forging technologies. Aerospace parks and collaborations with international players are further strengthening the ecosystem for precision component manufacturing.

Alongside aerospace, India’s automotive sector is witnessing accelerated growth, with demand shifting toward lighter yet stronger components for both domestic use and exports. Counterblow hammers are particularly relevant in this context, offering precision, force control, and the ability to forge complex geometries. The combined expansion of defense, aerospace, and automotive industries ensures India remains one of the most promising markets for forging equipment over the coming decade.

Revenue from counterblow hammers in China is expected to grow at 3.8% CAGR, underpinned by its strong role as a global manufacturing powerhouse. The government’s industrial upgrading initiatives, including “Made in China 2025,” are promoting adoption of advanced forging technologies that enhance productivity, energy efficiency, and product quality. Demand is particularly strong across automotive, aerospace, and heavy machinery sectors, where precision forging is critical to meeting both domestic needs and export competitiveness.

The automotive industry remains a cornerstone, driving large-scale adoption of high-strength forged components. At the same time, China’s aerospace ambitions, including commercial aviation and emerging space programs, are opening new opportunities for counterblow hammer installations. With its vast industrial base, strong domestic demand, and push for technological advancement, China will continue to play a pivotal role in shaping the global forging market landscape.

Sales of counterblow hammers in Germany are projected to grow at 2.9% CAGR, benefiting from its long-standing leadership in engineering excellence and premium equipment manufacturing. The country’s aerospace and automotive industries maintain strong demand for forging solutions capable of producing highly complex and safety-critical parts. German manufacturers lead in innovation, introducing forging equipment with advanced digital monitoring, automation, and sustainability features.

These technological advantages reinforce Germany’s role as both a consumer and an exporter of high-precision forging equipment and forged components. The aerospace sector continues to rely on counterblow hammers for turbine blades and structural parts, while the automotive industry increasingly demands lightweight forged components for electrification and safety-critical applications. Germany’s emphasis on quality, innovation, and global export markets ensures steady growth and reinforces its reputation as a hub of advanced forging technology.

Demand for counterblow hammers in USA is expected to achieve 2.8% CAGR, driven primarily by aerospace and defense industries. With some of the world’s largest commercial aircraft manufacturers and defense contractors, the USA requires forging technologies capable of meeting strict quality and safety standards. Counterblow hammers play a critical role in producing engine components, landing gear, and structural parts that must perform under extreme conditions.

Rising defense spending, coupled with modernization initiatives, continues to support adoption of advanced forging equipment. Beyond aerospace and defense, reshoring efforts are boosting domestic production, creating opportunities for new equipment installations. The USA remains a key market for precision forging technologies, combining high-value demand with strong technological advancement.

Revenue form counterblow hammers in UK is projected to grow at 2.6% CAGR, supported by its strength in aerospace and specialized manufacturing. The country is recognized for leadership in high-value aerospace applications, where precision forging equipment is essential for producing advanced engine components, turbine blades, and critical structural parts. Both commercial and defense aviation segments rely on forging technologies that ensure safety, dimensional accuracy, and performance reliability.

The UK’s emphasis on advanced manufacturing, innovation, and collaboration between research institutions and industry is promoting adoption of sophisticated forging systems. While overall market size is smaller compared to other regions, the UK stands out for its specialization in high-margin, technologically advanced applications, which will sustain steady growth in forging equipment demand.

The counterblow hammers market features established manufacturers with strong technological expertise and regional dominance. Companies are prioritizing innovation in forging technology, energy efficiency improvements, and digital integration to deliver high-performance, reliable, and cost-effective forging solutions. The competitive landscape includes both global equipment manufacturers and regional specialists catering to niche market segments, with strategic investments in modernization and customer-focused engineering.

Anyang Forging Press, based in China, is a leading supplier of heavy forging equipment with a strong export footprint in Asia and beyond. Bharat Forge, India, integrates counterblow hammer technology into its broader forging solutions, focusing on efficiency and industrial scalability. Bêché (Lasco), Germany, specializes in high-performance hammer systems with strong customization capabilities. ERIE Press Systems, USA, delivers advanced forging equipment with emphasis on durability and process integration.

Hasenclever, Germany, provides precision hammer solutions with a focus on technological innovation. Lasco Umformtechnik, Germany, is recognized for energy-efficient and automated forging systems. MECOLPRESS, Italy, delivers advanced forging machines with flexibility for diverse applications. SMS group and Schuler Group, Germany, dominate globally with integrated digital forging solutions. Weber Pressen, Germany, focuses on tailored, durable hammer technologies.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 820.0 million |

| Hammer Class | Counterblow, Double-Acting, Others |

| Forged Material | Steel/Alloy Steel, Aluminum, Titanium/Ni Alloys |

| End-Use | Aerospace, Automotive, General Industrial |

| Energy/Capacity | ≤100 kN, 100-400 kN, >400 kN |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Anyang Forging Press, Bharat Forge, Bêché (Lasco), ERIE Press Systems, Hasenclever, Lasco Umformtechnik, MECOLPRESS, SMS group, Schuler Group, Weber Pressen |

| Additional Attributes | Dollar sales by hammer class and capacity, regional demand shifts, OEM competition, buyer tilt toward automation, digital integration, energy-saving innovations, and sustainable forging practices with closed-loop, low-carbon operations. |

The global counterblow hammers market is estimated to be valued at USD 820.0 million in 2025.

The market size for the counterblow hammers market is projected to reach USD 1,123.6 million by 2035.

The counterblow hammers market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in counterblow hammers market are counterblow, double-acting and others.

In terms of forged material, steel/alloy steel segment to command 55.0% share in the counterblow hammers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demolition Hammers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA