The Demolition Hammers Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. During the early adoption phase (2020–2024), the market expanded from USD 2.3 billion to USD 2.8 billion as construction and demolition companies began adopting advanced, high-efficiency demolition hammers.

Early adoption was driven by the need for faster, safer, and more precise demolition solutions, as well as increasing infrastructure and urban redevelopment projects. However, limited awareness of advanced tools, higher initial costs, and slower replacement cycles constrained rapid market penetration.

From 2025 to 2030, the market enters a scaling phase, with revenues increasing from USD 2.9 billion to approximately USD 3.8 billion. Wider adoption was facilitated by improvements in hammer durability, ergonomics, and energy efficiency, making them more cost-effective for commercial operators. Rising demand in emerging economies and government investments in construction and infrastructure projects further fueled market growth.

Between 2030 and 2035, the market transitions into consolidation, reaching USD 4.9 billion by 2035. Key manufacturers strengthen positions through strategic partnerships, product standardization, and supply chain optimization. Incremental innovations focus on performance, safety, and operational efficiency, stabilizing growth. The market matures into a competitive, technologically advanced, and efficient segment, moving from early adoption to scaling and finally to consolidation.

| Metric | Value |

|---|---|

| Demolition Hammers Market Estimated Value in (2025 E) | USD 2.9 billion |

| Demolition Hammers Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The demolition hammers market is gaining momentum as infrastructure development, renovation activity, and urban reconstruction projects continue to expand globally. Rising investments in commercial real estate, smart city development, and transportation infrastructure have increased the demand for durable and efficient demolition tools.

Additionally, manufacturers are focusing on ergonomic design, vibration control, and cordless power advancements to address user fatigue and enhance precision. Growing emphasis on safety standards and productivity at job sites has driven the adoption of advanced hammer models equipped with overload protection, speed control, and energy-efficient motors.

Emerging markets are contributing significantly to growth as residential redevelopment and urban density challenges fuel construction-related demolition needs. Going forward, regulatory compliance, electrification, and integration with smart tools and digital diagnostics are expected to reshape the competitive landscape and innovation strategies.

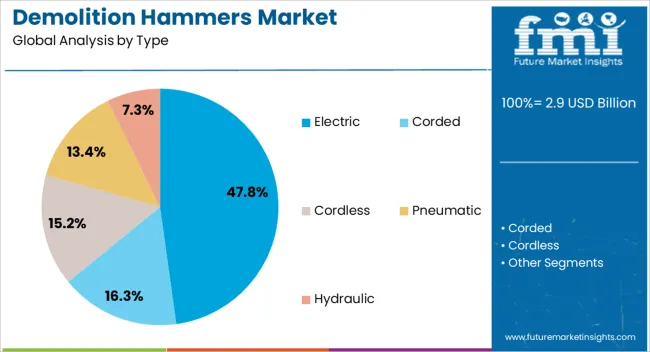

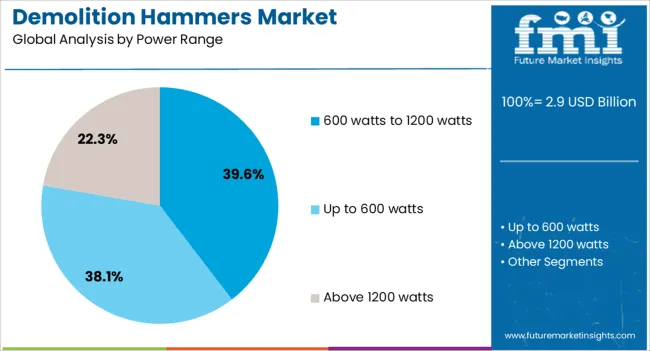

The demolition hammers market is segmented by type, power range, end use, distribution channel, and geographic regions. By type, the demolition hammers market is divided into Electric, Corded, Cordless, Pneumatic, and Hydraulic. In terms of power range, the demolition hammers market is classified into 600 watts to 1200 watts, up to 600 watts, and above 1200 watts.

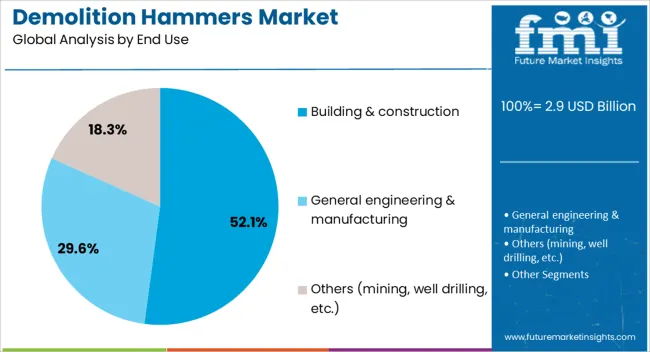

Based on end use, the demolition hammers market is segmented into Building & construction, General engineering & manufacturing, and Others (mining, well drilling, etc.). By distribution channel of the demolition hammers market is segmented into Offline and Online. Regionally, the demolition hammers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Electric demolition hammers are projected to account for 47.80% of the total revenue in 2025, making them the leading product type in the market. Their dominance is being supported by ease of operation, widespread job site compatibility, and lower maintenance requirements compared to pneumatic or hydraulic variants.

With enhanced portability and plug-and-play functionality, electric models are increasingly preferred for both indoor and outdoor applications. Improvements in motor efficiency, dust control, and ergonomic design have addressed historical limitations, expanding usage in urban and confined work environments.

As the global construction workforce adopts more compact, user-friendly tools, electric hammers continue to be viewed as the most practical and scalable solution across small and medium-scale demolition tasks.

Demolition hammers with a power range between 600 watts and 1200 watts are expected to contribute 39.60% of the overall market revenue in 2025, establishing this range as the leading power category. This performance band offers the optimal balance between operational control and impact energy, making it suitable for medium-duty tasks such as tile removal, wall breaking, and light concrete demolition.

The segment's growth has been supported by rising demand from residential and small commercial construction sites where agility, reduced noise, and tool manageability are prioritized. Equipment within this range is also favored for renovation work, as it ensures precise demolition without over-penetration or collateral damage.

Enhanced heat dissipation, variable speed functions, and broader availability across brands have further solidified this segment’s lead in power tool selection.

Building and construction is expected to remain the dominant end-use sector in the demolition hammers market, contributing 52.10% of total revenue in 2025. This leadership is being driven by the continued expansion of urban infrastructure, commercial real estate development, and structural modification projects.

Increasing global investment in residential complexes, transport hubs, and public works has created steady demand for efficient demolition equipment that can meet varying scale and material challenges. Additionally, the segment benefits from higher frequency of site retrofitting, code compliance renovations, and structure dismantling in aging urban zones.

With project managers focusing on turnaround time and workforce safety, demolition hammers remain critical tools in the construction workflow. The ongoing trend of replacing labor-intensive methods with mechanized tools further supports the segment’s sustained dominance.

The demolition hammers market is growing as construction, renovation, and infrastructure projects expand globally. These powerful tools are essential for breaking concrete, asphalt, and masonry efficiently, improving productivity and reducing manual labor. Rising demand in urban development, road repairs, and industrial demolition drives market adoption. Manufacturers are offering ergonomic, durable, and high-performance models, catering to contractors and rental service providers. Advanced designs, vibration control, and enhanced motor efficiency are enabling safer, faster, and more reliable demolition operations across various applications.

Ongoing construction, urban redevelopment, and infrastructure maintenance projects require efficient tools for concrete and masonry demolition. Contractors increasingly prefer demolition hammers over traditional manual methods to reduce labor intensity and accelerate project timelines. Residential, commercial, and industrial sectors all contribute to demand growth, with a focus on equipment that can handle continuous operation without overheating. The availability of versatile tools that work across different materials and applications encourages adoption, ensuring demolition hammers remain indispensable in modern construction and renovation workflows.

Modern demolition hammers are designed with enhanced vibration control, anti-slip grips, and optimized weight distribution to reduce operator fatigue and risk of injury. Safety standards are driving the integration of protective features such as insulated handles, noise reduction, and improved balance. Ergonomic designs not only enhance comfort during prolonged use but also increase precision and efficiency. Contractors and rental companies prioritize equipment that safeguards operators while maintaining performance, which drives demand for newer models with advanced user-friendly features in both professional and DIY segments.

Construction professionals seek demolition hammers that withstand heavy-duty, continuous usage in demanding environments. High-quality motors, reinforced housings, and replaceable components enhance tool longevity and reduce downtime. Products requiring minimal maintenance are preferred, as they lower operational costs and increase job site efficiency. Vendors offering durable, reliable tools build brand loyalty among contractors and rental service providers. As project timelines tighten and equipment utilization increases, the durability and maintainability of demolition hammers become critical factors influencing purchase decisions.

The expansion of equipment rental services contributes significantly to market growth. Contractors and small-scale construction companies often prefer renting demolition hammers rather than purchasing them due to high costs and intermittent usage. Rental businesses focus on maintaining a diverse fleet of high-performance, well-maintained tools, ensuring availability for various project sizes. This trend allows wider access to advanced demolition hammers for multiple users, promoting adoption while encouraging manufacturers to offer robust, low-maintenance models suitable for repeated rental cycles.

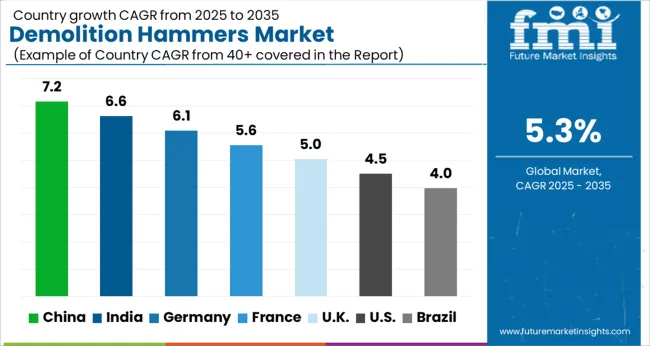

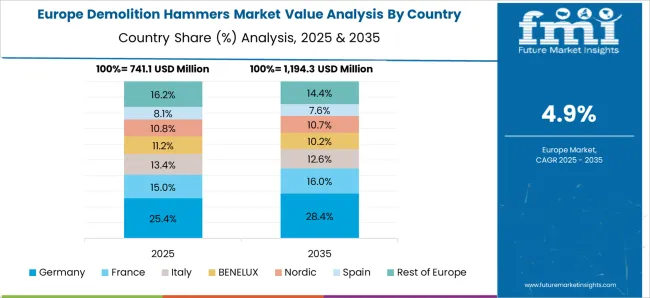

The global demolition hammers market is projected to grow at a CAGR of 5.3%, supported by increasing construction, renovation, and infrastructure activities worldwide. China leads with a growth rate of 7.2%, driven by large-scale construction projects and industrial demand. India follows at 6.6%, fueled by urban development and expanding infrastructure initiatives.

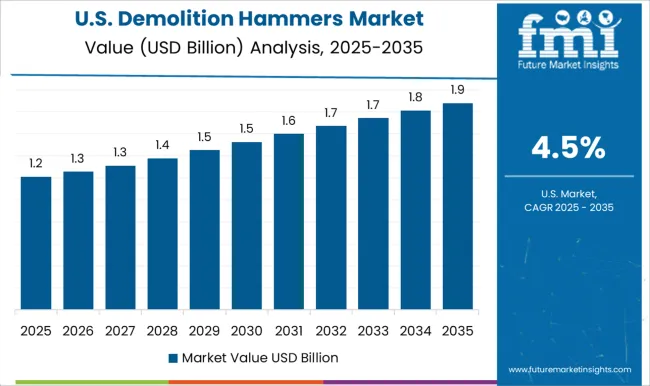

Germany shows steady growth at 6.1%, leveraging advanced construction technologies and industrial applications. The UK and USA record moderate growth rates of 5.0% and 4.5%, respectively, reflecting consistent demand in residential and commercial construction sectors. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the demolition hammers market with a 7.2% growth rate, driven by rapid urbanization and large-scale infrastructure projects. Construction and renovation activities create strong demand for durable and high-performance demolition tools. Manufacturers focus on advanced electric and pneumatic hammer designs for efficiency and operator safety. Adoption is fueled by government investments in urban development and industrial facilities.

Technological innovations enhance vibration control, energy efficiency, and operational lifespan. Contractors prefer reliable and cost-effective tools for high-volume demolition tasks. Export opportunities to neighboring Asian countries further boost market growth. Industrial and commercial construction sectors remain the largest end-users. Competitive pricing and strong distribution networks increase market penetration.

Demolition hammers market grows at 6.6%, supported by expanding infrastructure projects and residential construction. Rising demand for efficient and durable tools encourages manufacturers to innovate with lightweight and high-performance models. Government investments in roadways, metro projects, and commercial facilities increase adoption.

Industrial and contractor segments dominate the market due to frequent heavy-duty usage. Improved operator ergonomics and vibration reduction technologies enhance productivity. Distribution channels, including online platforms and dealers, expand market reach. Export opportunities for Indian-made tools to neighboring countries support growth. Urban renovation and infrastructure upgrades further contribute to demand. Competitive pricing helps manufacturers capture market share from international players.

Germany shows a 6.1% growth rate, driven by construction, renovation, and industrial projects emphasizing precision and durability. Manufacturers focus on advanced electric and pneumatic hammer models to meet high safety and efficiency standards. Environmental regulations encourage energy-efficient and low-noise tools.

Industrial and commercial construction sectors represent significant demand segments. Technological innovations improve vibration reduction, operational lifespan, and ease of use. High adoption in urban renovation projects supports steady market growth. Export of German-made tools enhances the global market presence. Contractors prefer reliable, high-quality tools for long-term durability. Competitive pricing with advanced features attracts professional users.

The UK market grows at 5.0%, driven by residential renovation and urban infrastructure projects. Manufacturers focus on portable, durable, and energy-efficient demolition hammers. Technological innovations enhance vibration control, operator safety, and longevity. Construction and commercial sectors remain key end-users. Government initiatives supporting urban redevelopment and industrial projects boost adoption. Contractors and industrial users prefer tools with high performance and reliability. Distribution through dealers and online platforms expands market penetration. Export of UK-made hammers contributes marginally to overall growth. Cost-effective solutions with advanced features attract a broad user base.

The USA market grows at 4.5%, driven by commercial construction, industrial projects, and renovation activities. Manufacturers focus on high-performance, reliable demolition hammers for heavy-duty tasks. Technological advancements improve energy efficiency, vibration reduction, and operator safety. Contractors and industrial sectors dominate market demand.

Distribution networks, including retailers and e-commerce, enhance market reach. Urban redevelopment and infrastructure projects fuel adoption in metropolitan areas. Competitive pricing and advanced features attract professional users. Export opportunities for USA-made tools are limited but contribute modestly. Government initiatives and safety regulations support continued market growth.

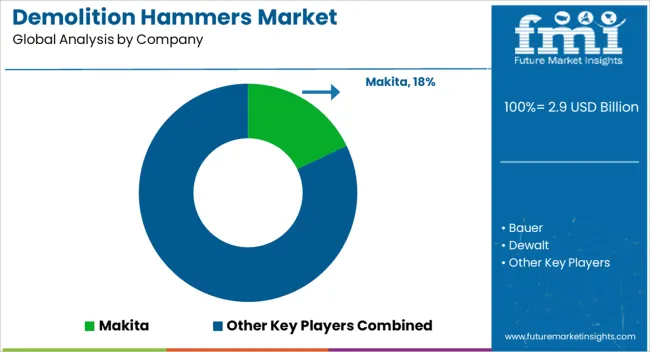

Established multinationals such as Bosch, Stanley Black & Decker, Makita, Hilti, and Hitachi (Koki Holdings) hold the premium tier. Their strategy emphasizes product reliability, ergonomic innovation, vibration-reduction technology, and distribution control through professional channels. They compete by embedding demolition hammers within comprehensive tool ecosystems, where cross-compatibility with batteries, accessories, and service networks creates lock-in for contractors and industrial buyers. Pricing power is protected by strong after-sales guarantees and compliance with international safety standards.

Mid-tier competitors such as Einhell, Ferm International, and Bauer focus on functional differentiation at accessible price points. Their positioning relies on blending acceptable durability with simplified design, offering contractors and mid-sized construction firms affordable alternatives without sacrificing core performance. These firms highlight modular serviceability and retail availability through large DIY outlets, widening their footprint in semi-professional markets.

Emerging suppliers, including TR Industrial and Vevor, are driving disruption at the lower end by competing almost exclusively on cost efficiency and direct-to-consumer digital channels. Their appeal is strongest in price-sensitive regions and among small contractors with limited capital budgets. While warranties are thinner and product ranges are narrower, aggressive online pricing and bundled accessory kits allow them to capture volume quickly.

Competitive intensity is reinforced by the ongoing shift from corded to cordless demolition tools, where battery ecosystem dominance is becoming the new battleground. Companies with mature battery platforms, such as Dewalt, Milwaukee, and Makita, are leveraging this capability to secure long-term share in both professional and DIY segments. The inflection point for the market rests on which players can translate ergonomics, digital integration, and energy efficiency into tangible productivity gains, making demolition hammers not just commodities but integrated elements of professional tool systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.9 Billion |

| Type | Electric, Corded, Cordless, Pneumatic, and Hydraulic |

| Power Range | 600 watts to 1200 watts, Up to 600 watts, and Above 1200 watts |

| End Use | Building & construction, General engineering & manufacturing, and Others (mining, well drilling, etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Makita, Bauer, Dewalt, Einhell, Ferm International, Hilti, Hitachi, Koki Holdings, Milwaukee, Robert Bosch Tool Corporation, Stanley Black & Decker, TR Industrial, and Vevor |

| Additional Attributes | Dollar sales by type including electric, pneumatic, and hydraulic hammers, application across construction, mining, and renovation projects, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing construction activities, demand for efficient demolition tools, and advancements in power tool technology. |

The global demolition hammers market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the demolition hammers market is projected to reach USD 4.9 billion by 2035.

The demolition hammers market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in demolition hammers market are electric, corded, cordless, pneumatic and hydraulic.

In terms of power range, 600 watts to 1200 watts segment to command 39.6% share in the demolition hammers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demolition Equipment Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Demolition Machine And Breaker Market

Counterblow Hammers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA