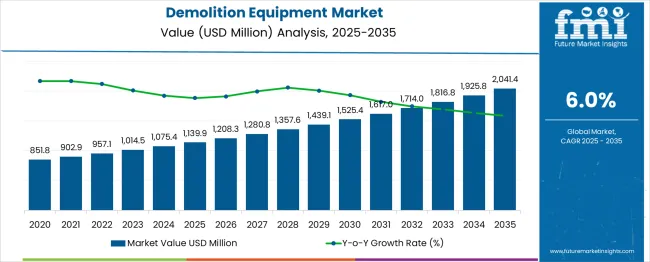

The Demolition Equipment Market is estimated to be valued at USD 1139.9 million in 2025 and is projected to reach USD 2041.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The demolition equipment market is expanding, propelled by increasing construction and infrastructure development activities worldwide. The need for efficient and safe demolition processes has driven demand for advanced equipment capable of handling diverse project requirements. Emphasis on urban redevelopment, renovation, and environmental regulations has encouraged the adoption of machinery that can reduce debris and enhance recycling efforts.

Technological advancements have improved the efficiency, safety, and versatility of demolition tools. Growing construction activities, particularly in urban centers and emerging markets, continue to support market expansion.

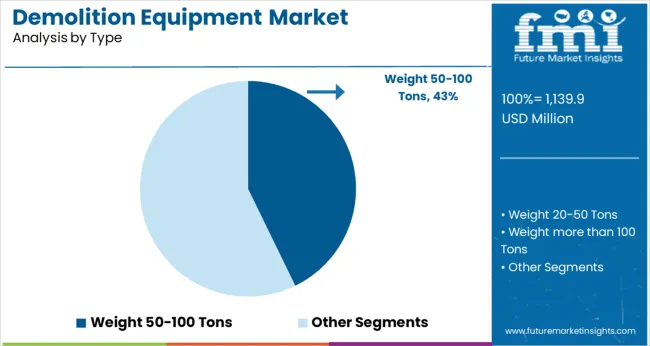

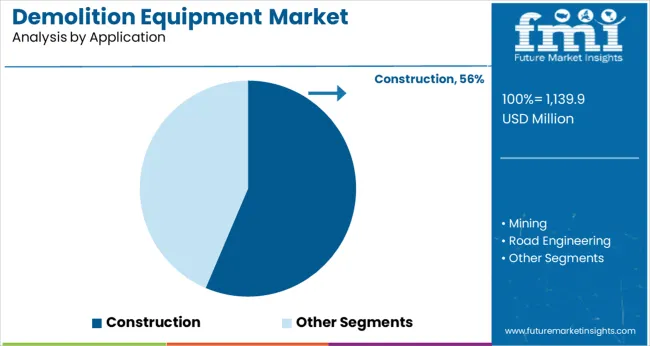

Future growth will likely be shaped by the integration of automation and telematics in demolition equipment, as well as by the demand for sustainable demolition solutions. Segmental growth is expected to be driven by the weight category of 50-100 tons, the construction application segment, reflecting their broad utility and demand in large-scale projects.

The market is segmented by Type and Application and region. By Type, the market is divided into Weight 50-100 Tons, Weight 20-50 Tons, and Weight more than 100 Tons. In terms of Application, the market is classified into Construction, Mining, and Road Engineering.

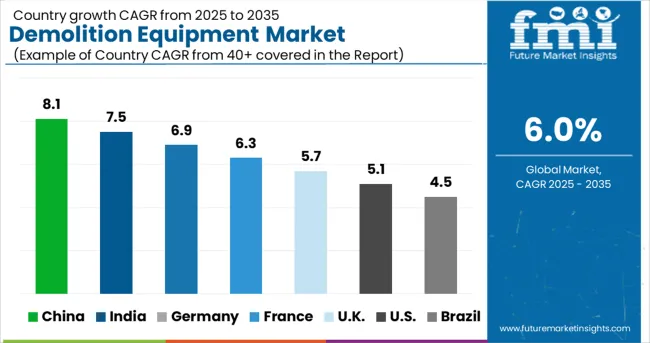

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 50-100 tons weight category is projected to contribute 42.8% of the demolition equipment market revenue in 2025, making it the leading type segment. Equipment in this weight range offers a balance of power and maneuverability, suitable for a wide range of demolition tasks from medium-sized buildings to industrial structures.

Operators prefer this category because it can handle substantial material loads while maintaining operational flexibility. The segment benefits from advancements in hydraulic systems and durability enhancements that improve performance and reduce maintenance needs.

As urban demolition projects grow in scale and complexity, equipment in this weight range is expected to remain popular for its versatility.

The construction segment is expected to hold 56.4% of the demolition equipment market revenue in 2025, dominating the application landscape. This segment’s growth has been driven by expanding infrastructure projects, urban redevelopment, and the replacement of aging structures.

Demolition equipment is essential in site preparation, enabling safe and efficient clearing of existing buildings to make way for new construction. Regulatory pressures to manage waste and recycle materials have increased the demand for advanced demolition tools in construction.

The segment benefits from increased government spending on public works and private sector investments in commercial and residential developments. As construction activities continue to rise globally, this application segment is projected to sustain its leadership position.

Over the next few years, growth in the construction industry, combined with significant measures to demolish very old and worthless multistory buildings, is likely to fuel demand for demolition equipment.

Furthermore, an increase in the number of smart city and smart building projects is expected to boost the sales of demolition equipment which is likely to boost the overall demolition equipment market. The government is deconstructing those structures with demolition equipment, which is likely to increase demand for demolition equipment in the next decades.

Regardless of the benefits of demolition equipment, it is connected with a significant cost. As a result, the primary necessity for purchasing demolition equipment is funded, which may cause headwinds in the sales of demolition equipment market's growth over the projection period.

The expanding investments in the construction sector are promoting the sales of demolition equipment, as well as fast urbanization in developing nations, are propelling the demand for demolition equipment and adding growth to the demolition equipment market.

Asia Pacific region is expected to hold a considerable value share in the global demolition equipment market owing to increasing smart building projects coupled with rising urbanization.

Europe is expected to be the second-largest market for demolition equipment due to rising awareness of lightweight and high shock-absorbing building structures, which in turn shape the demand for demolition equipment in the coming years.

North America is projected to grow with an addressable growth rate in the demolition equipment market due to increasing safety concerns towards multistory buildings.

Therefore, the government is making new buildings for various applications such as residential, educational, among others. As a result, the sales of demolition equipment in the Middle East and Africa are also expected to gain relatively moderate traction in the demolition equipment market.

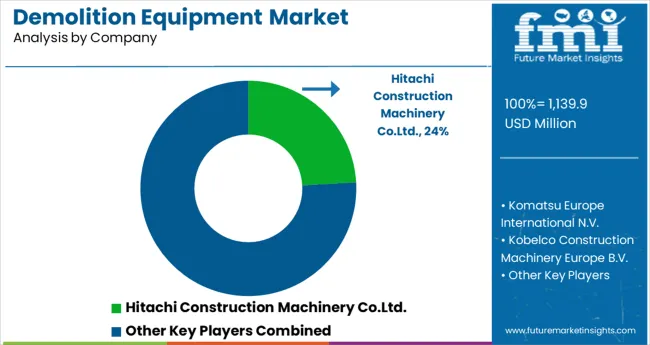

Some of the key players in the demolition equipment market identified across the value chain Hitachi Construction Machinery Co., Ltd. Komatsu Europe International N.V., Kobelco Construction Machinery Europe B.V., Hughes & Salvidge Limited, AB Volvo Atlas Copco (India) Ltd., Caterpillar McClung-Logan Equipment Company, Inc. Brokk UK Ltd, BAUER Equipment India Pvt. Ltd, (BEI) Soosan USA, Inc., Company Wrench Hyundai Construction Equipment India Pvt. Ltd.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 6% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in billion, volume in kilotons and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Product type, Equipment weight, end use, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Hitachi Construction Machinery Co., Ltd. Komatsu Europe International N.V.; Kobelco Construction Machinery Europe B.V.; Hughes & Salvidge Limited; AB Volvo Atlas Copco (India) Ltd.; Caterpillar McClung-Logan Equipment Company, Inc.; Brokk UK Ltd; BAUER Equipment India Pvt. Ltd; (BEI) Soosan USA, Inc.; Company Wrench Hyundai Construction Equipment India Pvt. Ltd. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global demolition equipment market is estimated to be valued at USD 1,139.9 million in 2025.

It is projected to reach USD 2,041.4 million by 2035.

The market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types are weight 50-100 tons, weight 20-50 tons and weight more than 100 tons.

construction segment is expected to dominate with a 56.4% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demolition Hammers Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Demolition Machine And Breaker Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA