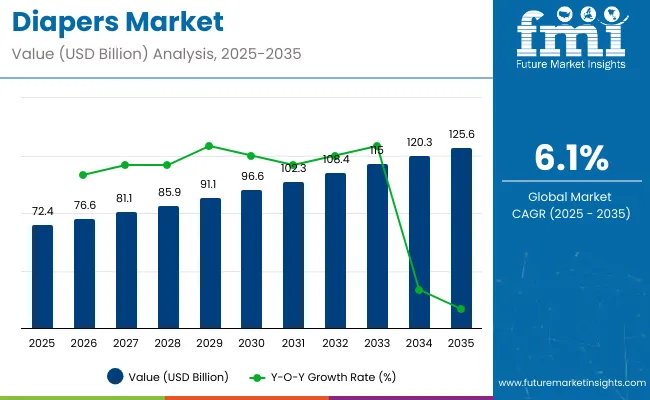

The global diapers market is set to experience substantial growth over the next few years, with its value USD 72.4 billion in 2025 and is poised to register USD 125.6 billion by 2035. This growth represents a CAGR of 6.1% during the forecast period. The increasing demand is attributed to various factors, primarily the rising birth rates in emerging economies and the growing aging population, which is driving the need for both baby and adult diapers.

With more awareness around hygiene and sanitary practices, the demand for high-quality, reliable diaper products is expected to rise across different demographic segments. Furthermore, as consumers increasingly prioritize convenience and eco-consciousness, the market will also see a significant shift towards sustainable and technologically advanced solutions.

One of the primary driving factors of this market’s expansion is the increase in birth rates in developing countries. These regions are expected to witness a surge in demand for baby diapers, as access to healthcare and hygiene products improves. At the same time, the aging population, especially in developed countries, is contributing to the rising demand for adult incontinence products. With an expanding elderly population and the growing prevalence of conditions like incontinence, the need for products tailored to adult care is becoming a significant market driver. This demographic shift, combined with heightened awareness of hygiene and comfort, makes diapers a necessity not only for infants but also for older adults.

In addition to demographic trends, innovations in diaper technology are also playing a critical role in market growth. The development of advanced, biodegradable materials, smarter diapers with features like wetness indicators, and ultra-thin absorbent cores are making diapers more efficient and appealing to consumers.

Eco-friendly solutions are gaining momentum as sustainability becomes a priority for both consumers and manufacturers. The rise of e-commerce and direct-to-consumer sales channels is further enhancing accessibility, convenience, and availability, especially in remote or underserved regions. These driving factors collectively contribute to the robust growth trajectory of the global diapers market from 2025 to 2035.

Per capita spending on diapers is rising globally, driven by increasing birth rates in some regions, higher disposable incomes, and growing awareness of infant hygiene and convenience. The demand for premium, eco-friendly, and specialty diapers such as biodegradable and organic options is also contributing to higher consumer spending. Urbanization and working parents’ lifestyle changes further accelerate market growth.

Developed Countries:

In countries like the United States, Canada, Germany, the United Kingdom, and Australia, per capita spending on diapers is relatively high. Consumers in these regions often opt for premium and branded products that emphasize comfort, skin sensitivity, and environmental sustainability. Brands such as Pampers, Huggies, and Honest Company dominate the market. Availability through supermarkets, pharmacies, and e-commerce channels supports steady consumer expenditure.

Emerging Markets

In nations including India, Brazil, Indonesia, South Africa, and Mexico, per capita spending on diapers is growing steadily but remains lower compared to developed markets. Rising urban middle-class populations, improved healthcare awareness, and increasing working mothers drive the demand. Local and regional brands like MamyPoko, Johnson & Johnson, and Libero are gaining prominence, alongside international players expanding their footprint through retail and digital channels.

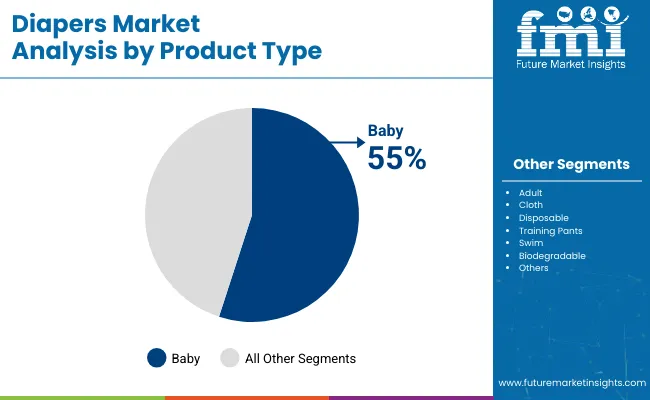

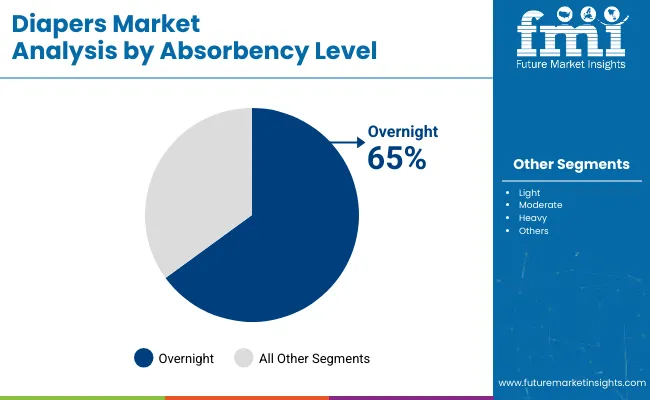

The global diapers market is segmented by product type into baby, adult, cloth, disposable, and others (biodegradable diapers, training pants, and eco-friendly). By absorbency level, the market is categorized into light, moderate, heavy, overnight, and others (wetness indicators, or those made from organic or biodegradable materials). In terms of sales channels, the market includes supermarkets/hypermarkets, specialty stores, online, departmental stores, and others (pharmacies, drugstores, and direct-to-consumer brands). Geographically, the market spans across regions such as North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The baby diapers segment dominates the global diapers market, holding a substantial share of 55% of the total market value as of 2025. This dominance is primarily driven by several factors, most notably the rising birth rates, especially in developing regions, and the increasing awareness around infant health and hygiene. As a result, there is a consistent demand for high-quality baby diapers, which are essential for maintaining the well-being of infants. The segment includes various types of diapers, such as disposable, eco-friendly, and advanced diapers with added features like wetness indicators and ultra-thin absorbent cores.

The baby diapers segment benefits from a strong consumer base, with parents increasingly seeking convenience, comfort, and reliability. These demands have led to continuous innovation within the sector, with brands focusing on improving the absorbency, breathability, and eco-friendliness of their products. For instance, leading brands like Procter & Gamble (Pampers), Kimberly-Clark (Huggies), and Unicharm (MamyPoko) have invested in research and development to create more sustainable and technologically advanced diaper solutions.

The adult diaper segment is growing rapidly due to the increasing elderly population and rising incontinence cases, with a focus on innovations like breathable materials, improved absorbency, and discreet designs to enhance comfort and mobility for adult users. Cloth diapers, while having a smaller market share, are gaining traction among eco-conscious consumers for their reusability and sustainability, offering an alternative to disposables. Disposable diapers remain the dominant choice globally due to their convenience and absorbency, particularly in emerging markets.

Meanwhile, the "others" segment, which includes biodegradable, organic, and training pants, is seeing growth driven by consumer demand for sustainable and environmentally-friendly products. Manufacturers are responding with advanced biodegradable technologies and eco-friendly materials.

The overnight absorbency segment is the fastest-growing within the absorbency level category, with an estimated CAGR of 9% from 2025 to 2035. This growth is driven by increasing consumer demand for diapers that provide extended protection, especially for nighttime use.

Parents and caregivers seek products that ensure a full night’s sleep for infants, toddlers, and elderly users, leading to a rise in overnight diapers, which offer enhanced absorbency and long-lasting comfort. As consumer awareness around convenience and quality grows, the overnight absorbency segment is expected to continue its rapid expansion.

The light absorbency segment is designed for users requiring minimal protection, such as light incontinence or daytime use, and is experiencing steady demand due to its affordability and comfort. Moderate absorbency diapers cater to more typical usage needs, offering a balance between comfort and absorbency, making them popular among both babies and adults.

The heavy absorbency segment, catering to those requiring maximum protection, is commonly used for managing more severe incontinence or for longer durations, such as overnight or extended use. The other category includes specialized products, such as diapers with additional features like wetness indicators or those made from organic materials, which are gaining popularity as consumers prioritize sustainability and convenience.

The online sales channel is the fastest-growing segment in the diapers market, projected to experience a CAGR of 11% from 2025 to 2035. The rapid expansion of e-commerce is a key driver of this growth, fueled by the increasing penetration of the internet, enhanced delivery logistics, and the convenience of shopping from home.

Online platforms provide consumers with a broader selection of products, detailed product descriptions, and user reviews, enabling informed purchasing decisions. Additionally, competitive pricing and regular discounts offered by e-commerce giants like Amazon, Walmart, and direct-to-consumer brands make it easier for parents to stock up on diapers without having to leave their homes.

The shift towards online shopping is particularly pronounced in markets where accessibility to physical stores is limited, such as rural or remote regions, thus expanding the reach of diaper brands. Online sales channels are rapidly growing, especially in rural or remote regions, due to the convenience of home delivery and a wider product range. However, supermarkets and hypermarkets remain dominant for bulk purchasing, offering competitive prices and a variety of brands.

Specialty stores cater to eco-conscious consumers seeking premium, biodegradable, or hypoallergenic diapers, and are expected to see rising demand as sustainability becomes a priority. Departmental stores provide a convenient one-stop shopping experience, but their growth is limited by the rise of e-commerce. The "others" category, including pharmacies and direct-to-consumer brands, is also growing, driven by targeted marketing, personalized service, and customer loyalty programs, offering a more tailored shopping experience.

Challenges

the disposal of conventional diapers remains a significant environmental challenge, as they contribute to plastic waste and tip accumulation. Disposable diapers take hundreds of times to putrefy, leading to growing enterprises among consumers and controllers about their environmental impact. As a result, governments in colourful regions are introducing programs to reduce plastic waste, encouraging the relinquishment of sustainable preferences.

Also, the product of biodegradable diapers, while an eco-friendly result, frequently comes with advanced manufacturing costs, making them more precious than traditional options.

This price difference can limit availability, particularly in price-sensitive requests where affordability plays a pivotal part in copping opinions. Also, force chain dislocations and shifting raw material costs farther add to the pricing pressure, making it challenging for manufacturers to balance sustainability with cost- effectiveness

Opportunities

The adding demand for biodegradable and factory-grounded diapers presents a major growth occasion for manufacturers. Consumers are getting more conscious of environmental sustainability, driving brands to invest in druthers similar to bamboo-grounded and compostable diaper options. Companies that introduce refillable diapering systems and applicable cloth diapers with enhanced absorbency are gaining traction in the request.

Also, technological advancements are revolutionizing diaper assiduity, with the preface of smart diapers featuring stuffiness detectors, pH pointers, and real-time health monitoring.

These inventions feed to the requirements of parents looking for convenience and better child care, as well as healthcare providers managing adult incontinence issues. E-commerce platforms and subscription- grounded models are farther enhancing the availability of decoration, sustainable, and technologically advanced diapers, furnishing manufacturers with new profit aqueducts and request expansion openings.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 98.40 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 65.70 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 88.90 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 76.50 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 82.30 |

The USA leads in per capita spending on diapers due to high birth rates, ultra-expensive product preference, and adding relinquishment of eco-friendly options. The presence of global brands like Pampers and Huggies, alongside private- marker inventions, strengthens request expansion. Subscription models and online retail contribute to consumer convenience.

China’s diaper request is fleetly expanding as middle-class consumers prioritize quality and safety. Urbanization and advanced disposable inflows drive demand for decoration and organic diapers. Domestic brands contend with transnational players, while e-commerce platforms like Alibaba and JD.com grease broad request access.

Japan has a high per capita diaper expenditure, attributed to a growing population that generates demand for adult incontinence products. Advanced accessories, superior absorbency, and hypoallergenic features are crucial product preferences. Original brands dominate the request, emphasizing invention and comfort.

Germany’s diaper request benefits from strong demand for biodegradable and chemical-free options. The focus on sustainability drives inventions in factory-grounded and compostable diapers. Supermarkets, apothecaries, and e-commerce channels corroboration steady deals growth, with ultra expensive brands holding a significant request share.

The UK market shows a rising preference for eco-friendly and reusable diaper options. Parents seek hypoallergenic and dermatologically tested products. The presence of both multinational brands and local sustainable alternatives boosts consumer choices, while online sales and subscription services gain traction.

Diaper market is expanding gradually due to increasing birth rates in emerging economies, increased demand for green products, and greater usage of adult incontinence products. Emerging industry trends are discovered by surveying 250 care givers, care givers, and industry experts.

Disposable diapers are most in demand by consumers, and 72% of the mothers use them due to greater absorbency and ease of use. 26% of the interviewed respondents prefer cloth and reusable diapers and state environmental protection and cost savings as the main reasons. Of the consumers using reusable diapers, 63% state that they require better absorbency and greater leak protection.

There is increased demand for organic and premium baby diapers, and 41% of parents would pay more for organic cotton and plant-based product diapers. Fragrance-free, chemical-free, and hypoallergenic are popular, and 52% of caregivers report that diaper purchasing is driven by skin sensitivity.

Adult incontinence products are also picking up steam, with 38% of the physicians polled citing expansion in demand for adult diapers due to aging populations and increased awareness of incontinence care. Convenience, high absorbency, and door-control are among the leading purchase drivers among adult consumers.

E-commerce and subscription are transforming the market with 58% of diapers purchased online through doorstep delivery, bulk discounting, and convenience. Subscription formats are also catching up, with 29% of parents subscribing to automated diaper delivery, which offers handy supply and affordability.

Sustainability is also gaining prominence, with 35% of parents interested in compostable and biodegradable diapers. Businesses with a focus on environmentally friendly production processes, reduced plastic use, and increased recyclability are gaining trust, with 22% of parents interested in sustainability while they make their diaper choices.

With shifting consumer values, technological advancement in diaper design, and increasing sustainability concerns, companies need to perform well on comfort, dryness, and sustainability to be sustainable in the new diapers market

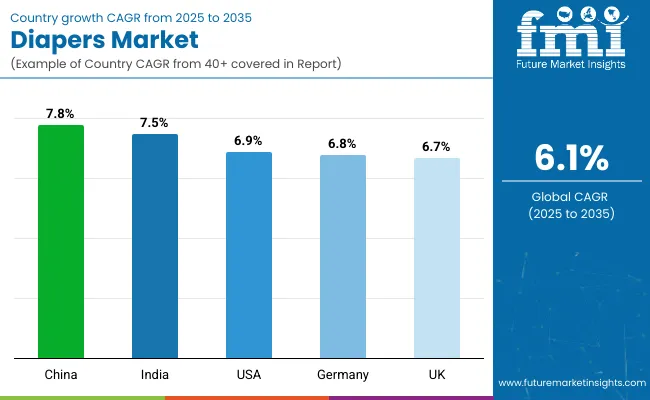

The USA diapers request is witnessing steady growth, driven by adding demand for eco-friendly and biodegradable diapers, rising birth rates, and advancements in super-absorbent and skin-friendly accoutrements. Major players include Pampers, Huggies, and The Honest Company.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.9% |

The UK diaper request is expanding due to rising demand for sustainable and applicable cloth diapers, adding disposable income among parents, and the presence of strong retail and e-commerce networks. Leading brands include Bambino Mio, Pampers, and Kit & Kin.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.7% |

Germany’s diapers request is growing, with a strong preference for high- performance, dermatologically tested, and sustainable diapering results. Crucial players include DM Baby love, HiPP, and Pingo.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.8% |

India’s diapers request is witnessing rapid-fire growth, fuelled by rising urbanization, adding disposable inflows, and growing mindfulness of child hygiene. Major brands include MamyPoko, Huggies, and Himalaya Baby Care.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

China’s diapers request is expanding significantly, driven by adding disposable inflows, rising demand for decoration diapering results, and the rapid-fire relinquishment of smart diaper technology. crucial players include Moony, Merries, and Chiaus.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

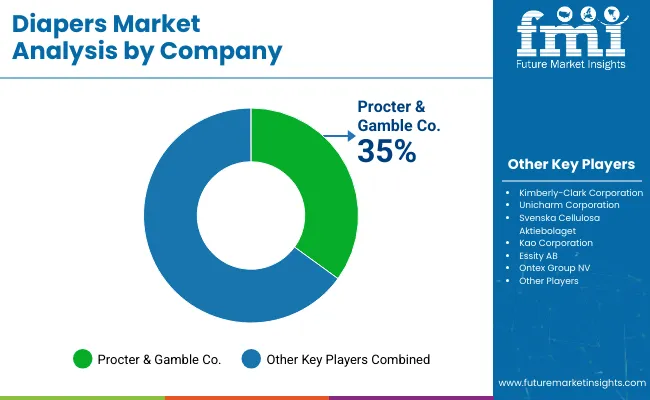

The global baby diaper market is highly competitive, featuring a blend of established multinational corporations and emerging regional players. Leading companies such as Procter & Gamble (Pampers), Kimberly-Clark (Huggies), and Unicharm (MamyPoko) dominate the market with their extensive product lines and strong brand recognition.

These giants continue to innovate, focusing on features like enhanced absorbency, eco-friendly materials, and smart diaper technologies to meet evolving consumer demands.

Procter & Gamble (Pampers) (35-40%)

Pampers continues to lead the global request through invention in immersion technology and factory- grounded diapers. The company strengthens its sustainability commitment, reducing plastic operation in packaging and promoting recyclable diaper enterprise.

AI- powerede-commerce strategies farther boost its digital deals.Essity enhances its sustainable product range, fastening oneco-friendly, chlorine-free diapers. The company expands its private- marker collaborations with major retailers, adding availability and affordability.

Unicharm (MamyPoko, Moony) (15-19%)

Unicharm strengthens its dominance in Asia, leveraging super-soft and breathable diaper innovations. The company promotes biodegradable diaper lines in response to sustainability concerns. Strong retail and e-commerce penetration in India and China fuels growth.

Essity (Libero, Drypers) (8-12%)

Essity enhances its sustainable product range, focusing on eco-friendly, chlorine-free diapers. The company expands its private-label collaborations with major retailers, increasing accessibility and affordability.

Other Key Players (10-15% Combined)

Several regional brands and niche players contribute to market expansion with sustainable, organic, and budget-friendly diaper alternatives. Notable brands include:

| Attribute Category | Details |

|---|---|

| Industry Size (2025) | USD 72.4 billion |

| Projected Market Size (2035) | USD 125.6 billion |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/Volume in million diaper units |

| Segments by Product Type | Baby, Adult, Cloth, Disposable, Training Pants, Swim, Biodegradable |

| Segments by Absorbency Level | Light, Moderate, Heavy, Overnight |

| Segments by Sales Channel | Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online, Specialty Stores, Others |

| Segments by End User | Infants, Toddlers, Preschoolers, Adults (Elderly & Special Needs) |

| Key Regions | North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA) |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | Procter & Gamble Co., Kimberly-Clark Corporation, Unicharm Corporation, Svenska Cellulosa Aktiebolaget, Kao Corporation, Essity AB, Ontex Group NV, Nobel Hygiene Pvt. Ltd, Domtar Corporation, First Quality Enterprises Inc. |

| Additional Attributes | Growth driven by premium disposable tech, eco-friendly fibers, e-commerce penetration, and adult incontinence product innovation |

| Customization and Pricing | Customization and pricing details available on request |

Baby, Adult, Cloth, Disposable , Training Pants, Swim , and Biodegradable.

Light, Moderate, Heavy, and Overnight.

Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online, Specialty Stores, and Others.

Infants, Toddlers, Preschoolers, and Adults (Elderly & Special Needs).

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Diapers industry is projected to witness a CAGR of 6.1%% between 2025 and 2035.

The Diapers industry stood at USD 69.4 billion in 2024.

The Diapers industry is anticipated to reach USD 125.6 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 6.3% in the assessment period.

The key players operating in the Diapers industry include Procter & Gamble, Kimberly-Clark, Unicharm Corporation, Essity AB, Hengan International, and Kao Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Style, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Style, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Fragrance, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Fragrance, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Consumer Operation, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Consumer Operation, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Style, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Style, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Fragrance, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Fragrance, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Consumer Operation, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Consumer Operation, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Style, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Style, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Fragrance, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Fragrance, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Consumer Operation, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Consumer Operation, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 42: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Style, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast by Style, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Fragrance, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast by Fragrance, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Consumer Operation, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast by Consumer Operation, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 54: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Style, 2018 to 2033

Table 56: Asia Pacific Market Volume (Units) Forecast by Style, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Fragrance, 2018 to 2033

Table 58: Asia Pacific Market Volume (Units) Forecast by Fragrance, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Consumer Operation, 2018 to 2033

Table 60: Asia Pacific Market Volume (Units) Forecast by Consumer Operation, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 66: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Style, 2018 to 2033

Table 68: MEA Market Volume (Units) Forecast by Style, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Fragrance, 2018 to 2033

Table 70: MEA Market Volume (Units) Forecast by Fragrance, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Consumer Operation, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast by Consumer Operation, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Style, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Fragrance, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Consumer Operation, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Style, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Style, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Style, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Style, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Fragrance, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Fragrance, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Fragrance, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Fragrance, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Consumer Operation, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Consumer Operation, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Consumer Operation, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Consumer Operation, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 33: Global Market Attractiveness by Style, 2023 to 2033

Figure 34: Global Market Attractiveness by Fragrance, 2023 to 2033

Figure 35: Global Market Attractiveness by Consumer Operation, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Style, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Fragrance, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Consumer Operation, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Style, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Style, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Style, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Style, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Fragrance, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Fragrance, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Fragrance, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Fragrance, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Consumer Operation, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Consumer Operation, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Consumer Operation, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Consumer Operation, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 69: North America Market Attractiveness by Style, 2023 to 2033

Figure 70: North America Market Attractiveness by Fragrance, 2023 to 2033

Figure 71: North America Market Attractiveness by Consumer Operation, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Style, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Fragrance, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Consumer Operation, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Style, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Style, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Style, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Style, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Fragrance, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Fragrance, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Fragrance, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Fragrance, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Consumer Operation, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Consumer Operation, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Consumer Operation, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Consumer Operation, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Style, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Fragrance, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Consumer Operation, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Style, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Fragrance, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Consumer Operation, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 124: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Style, 2018 to 2033

Figure 128: Europe Market Volume (Units) Analysis by Style, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Style, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Style, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Fragrance, 2018 to 2033

Figure 132: Europe Market Volume (Units) Analysis by Fragrance, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Fragrance, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Fragrance, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Consumer Operation, 2018 to 2033

Figure 136: Europe Market Volume (Units) Analysis by Consumer Operation, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Consumer Operation, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Consumer Operation, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 141: Europe Market Attractiveness by Style, 2023 to 2033

Figure 142: Europe Market Attractiveness by Fragrance, 2023 to 2033

Figure 143: Europe Market Attractiveness by Consumer Operation, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Style, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Fragrance, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Consumer Operation, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 160: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Style, 2018 to 2033

Figure 164: Asia Pacific Market Volume (Units) Analysis by Style, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Style, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Style, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Fragrance, 2018 to 2033

Figure 168: Asia Pacific Market Volume (Units) Analysis by Fragrance, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Fragrance, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Fragrance, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Consumer Operation, 2018 to 2033

Figure 172: Asia Pacific Market Volume (Units) Analysis by Consumer Operation, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Consumer Operation, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Consumer Operation, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Style, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Fragrance, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Consumer Operation, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Style, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Fragrance, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Consumer Operation, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 196: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Style, 2018 to 2033

Figure 200: MEA Market Volume (Units) Analysis by Style, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Style, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Style, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Fragrance, 2018 to 2033

Figure 204: MEA Market Volume (Units) Analysis by Fragrance, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Fragrance, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Fragrance, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Consumer Operation, 2018 to 2033

Figure 208: MEA Market Volume (Units) Analysis by Consumer Operation, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Consumer Operation, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Consumer Operation, 2023 to 2033

Figure 211: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 212: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 213: MEA Market Attractiveness by Style, 2023 to 2033

Figure 214: MEA Market Attractiveness by Fragrance, 2023 to 2033

Figure 215: MEA Market Attractiveness by Consumer Operation, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adult Diapers Market Size and Share Forecast Outlook 2025 to 2035

Smart Diapers Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA