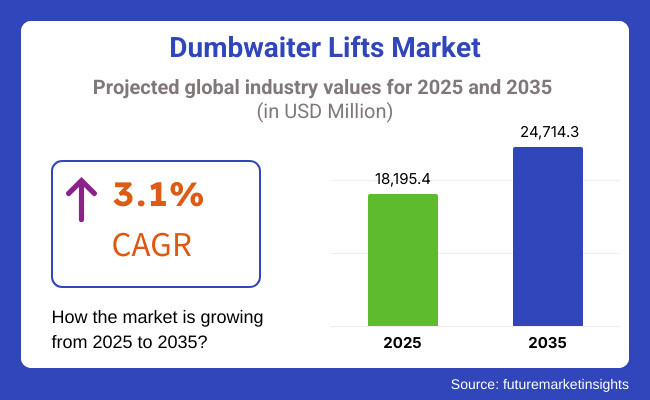

The global dumbwaiter lifts market is set for steady growth between 2025 and 2035, driven by rising adoption in commercial and residential sectors, increasing automation in building infrastructure, and growing demand for efficient material transportation solutions. The market is projected to reach USD 18,195.4 million in 2025 and expand to USD 24,714.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.1% over the forecast period.

Dumbwaiter lifts, commonly used for transporting food, documents, and lightweight goods between Dumbwaiter lifts are typically utilized for the movement of products and supplies between floors simply like a need for transporting meals, files, and lightweight merchandise and are appreciably mounted in resorts, hospitals, eating places, business buildings, and high-end residential structures. Rising focus on operational efficiency in service industries, rising deployment of automated lift solutions, and technological advancements in power efficient lifting mechanisms are contributing to the demand for contemporary dumbwaiter lifts.

Further, advancements in safety features, integration with smart building systems, and rising need for space-saving transport solutions in urban infrastructure are contributing for growth in the market. Recent rising installations of dumbwaiter lifts, especially in the hospitality, healthcare, and corporate sectors, are expected to help the market grow over the forecast period.

Market growth is driven by a high demand for efficient small-scale material transport, an increase in the adoption of automated solutions in commercial buildings, and expansion in infrastructure developments. Moreover, emerging smart elevator technologies, safety features, and touchless operation systems are set to propel future growth for the market.

North America is emerging as a major regional market for dumbwaiter lifts, on the back of high uptake in hotels, healthcare, and office sectors. Growth is taking place in the US and Canada where there is increasing demand for smart building solutions and automated transport systems that is driving the installation rates of dumbwaiter lifts in hotels, restaurants, hospitals, and office buildings.

Moreover, dumbwaiter lift designs are increasingly being improved by manufacturers to ensure safety, efficiency, and adherence to accessibility standards as well as building codes. Increasing automation in the workplace and the expansion of the restaurant and food service sector is further propelling regional market expansion.

The Europe dumbwaiter lift is growing at a moderate pace due to the technological advancements in elevator systems, energy efficiency building programs and growing hospitality and healthcare industries. This has led to the rising adoption of automated service lifts in commercial and public buildings across countries such as Germany, the UK, and France.

Growing adoption of the latest smart building technologies backed by the European Union’s regulations on energy performances of buildings and energy efficiency are influencing investments in advanced dumbwaiter systems, particularly in hotels, high-end residential buildings, and office complexes. Furthermore, increasing urbanization as well as the proliferation of compact infrastructure designs are generating demand for space-saving dumbwaiter solutions.

The Asia Pacific region is one of the fastest-growing, which gradually affecting the expansion of the dumbwaiter lifts market, with rapid urbanization, growth of the commercial sector, and implementation of smart infrastructure projects and investment. The rising demand for space-saving automated transport systems in restaurants, hospitals, and skyscrapers in countries like China, India, and Japan.

The installation rates of dumbwaiter lifts are on the rise in China, particularly in luxury hotels, shopping centers, and residential complexes, driven by the country’s expanding hospitality industry and urban development projects. Increasing demand for small scale automated lifts in India as the disposable income in the country is rising and more people are adopting home automation solutions. Smart lift technologies are widely used by Japan and South Korea, as they are also incorporated in modern dumbwaiter installations with IoT-based controls and voice-activated systems.

Middle East and Africa (MEA) region is also exhibiting a significant demand for dumbwaiters, driven at a major level by the increasing investments in commercial developments, premium hospitality projects, and elite residential buildings. Expansion of countries like UAE, Saudi Arabia, South Africa corporate, hotel, and healthcare sectors will further; propel the growth of automated lift machines.

The rising focus on green building initiatives and energy-efficient transport solutions is also affecting the uptake of smart dumbwaiter lifts in the region. Sparks in market demands are also being driven by the increasing luxury real estate projects, large scale restaurants and high-end office buildings.

Challenges

High Installation and Maintenance Costs

The high cost of implementing dumbwaiter lifts, especially the customized design and the smart automated models is one of the key challenges in making a significant volume in the dumbwaiter lifts market. High-level performance dumbwaiter lift (with IoT integration, energy-efficient motors, and safety sensors) increases the initial costs and extensive regular service over time, increasing overall operational expenditure.

The cost of retrofitting dumbwaiter systems into older buildings can also be technically simple and costly, thereby limiting the integration into existing infrastructure. This obstacle is being overcome by manufacturers through cheap models, leasing models and maintenance packages to make dumbwaiter installations more affordable.

Regulatory Compliance and Safety Standards

Strict safety regulations and building codes are a significant challenge for the dumbwaiter lifts market. Lift installations must adhere to compliance standards laid down by various government agencies and construction regulators including weight capacity, emergency stop mechanisms, and fire safety, usually when an elevator is in unsafe condition, it will be programmed to stop at the next floor.

To follow with these regulations, manufacturers need to undergo testing, obtain product certifications, and secure compliance approvals, which can drive up production costs and time to market. The integration of safety and convenience in high-traffic environments continues to be a major priority for manufacturers and facility managers.

Opportunities

Integration of Smart and IoT-Based Dumbwaiter Systems

With the increasing demand for smart buildings and the automation of facility management, the demand for IoT-based Dumbwaiter Lifts is skyrocketing. Remote monitoring, automated scheduling, voice activation and cloud-based diagnostics make these systems intelligent in optimizing their use and facilitating the monitoring of devices.

AI-driven load optimization, predictive maintenance, and real-time performance analytics, manufacturers are meshing advanced lift control systems with their operations to improve workflow, reduce downtime, and increase security. Demand for next-generation dumbwaiter lifts will benefit from the rise of connected infrastructure and smart workplace automation.

Expanding Hospitality and Healthcare Infrastructure

Growing focus on hotels, resorts, hospitals & other commercial kitchen, the demand for which is anticipated to boost the growth of the automated material transport solutions like dumbwaiter lifts. Hotels and luxury restaurants have increased their adoption of dumbwaiters due to the hospitality industry's focus on driving efficiency in room service, laundry management, and food transport.

Furthermore, the expanding healthcare sector and a need efficient patient-care logistics is rising the demand for dumbwaiter lifts in hospitals, clinics, and assisted living facilities. As medical infrastructure expands, and automation grows in healthcare logistics, touchless, hygienic, and high-capacity dumbwaiter systems should see more widespread adoption.

Between 2020 and 2024, the dumbwaiter lifts market experienced steady growth, fueled by demand for automation in food service, increasing adoption of these lifts in residential and commercial buildings, and rising applications in the healthcare and hospitality sectors. The demand for fast transport of materials in restaurants, hotels, hospitals, and private residences further drove the growth of energy efficient, space-saving, and intelligent dumbwaiter lift.

Improvements like IoT enabled remote monitoring, an automated call system, and durable lightweight stainless-steel structures further added to the performance and reliability of the system. Despite this, quite a few factors including high installation costs, maintenance issues, and low adoption in developing markets acted as challenges for the growth of this market.

Looking ahead to 2025 to 2035, dumbwaiter lifts market will see expansion with the development of predictive maintenance powered by AI, voice-activated controls, and integration with smart building automation systems. Enhancements at this level in hygiene automation, touchless transport solutions, and IoT-based operational monitoring will shape the industry going forward. Moreover, solar-powered dumbwaiters, modular lift systems, and AI-assisted load optimization will have many potential use cases down the line, including for commercial and residential projects.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Adoption in Commercial & Residential Sectors | Growing installations in restaurants, hotels, hospitals, and high-end residential establishments to improve operational efficiency. |

| Integration with Smart Building Technologies | Basic automation with push-button and programmable control panels for seamless operation. |

| Energy Efficiency & Sustainability Trends | Shift toward low-energy consumption motors, regenerative braking systems, and compact design for energy efficiency. |

| Hygiene & Contactless Solutions | Growing use in hospitals and hotels for hygienic, handless movement of food, washing and medical supplies. |

| Industrial & Warehouse Automation Demand | Increasing use in warehouses and manufacturing facilities for lifting or transporting materials vertically. |

| Advancements in Material & Lift Design | Use of lightweight stainless steel and noise-reducing motor systems for smoother operation. |

| Market Growth Drivers | Growth driven by hospitality sector growth, increased need for automation in healthcare and food services, and smart home adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Adoption in Commercial & Residential Sectors | Extend smart homes, automate storage in automatic retail, and use of AIs to move materials in logistics and healthcare facilities. |

| Integration with Smart Building Technologies | AI voice-activated dumbwaiters, IoT-enabled load monitoring, integration with smart home automation platforms. |

| Energy Efficiency & Sustainability Trends | Solar-powered and hybrid energy modes for dumbwaiters, Artificial Intelligence route optimization for multi-level transport. |

| Hygiene & Contactless Solutions | Integration of touchless operation, UV-based disinfection systems, and AI-powered health safety compliance monitoring. |

| Industrial & Warehouse Automation Demand | Expansion of AI-based predictive load management, robotic dumbwaiter integration, and automated guided vehicle (AGV) compatibility for industrial applications. |

| Advancements in Material & Lift Design | 3D-printed customizable dumbwaiters, self-adjusting weight distribution mechanisms, and AI-enhanced load balancing for improved efficiency. |

| Market Growth Drivers | AI-integrated material transport, sustainable energy lifts, and functional dumbwaiters for versatile future smart infrastructure. |

The United States dumbwaiter lifts market is growing at a steady pace, driven by rising demand from commercial establishments, increasing adoption in residential properties, and ongoing advancements in automation. Dumbwaiters are commonly used in restaurants, hotels, hospitals, and retail stores to convey food, laundry, or other goods, between floors.

Market growth key drivers include hospitality and healthcare dumb waiters in hospitals enable the fast, hygiene-conscious transfer of meals and medical supplies between floors; hotels and restaurants enjoy labour-saving food service operations. Furthermore, custom-built dumbwaiters used in luxury homes and high-end residences, as required for convenience in homes, are also boosting the market. Technological trends, such as automated and remote-controlled dumbwaiters are also emerging with the convenience of ones that integrate with smart home and building automation systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.3% |

The United Kingdom dumbwaiter lifts market is experiencing moderate growth phase, owing to increasing demand from the hospitality industry, installations in healthcare infrastructure and adoption of dumbwaiter lifts at modern commercial buildings. One of the major factors driving dumbwaiters market in the UK is the fast-growing fine dining and the luxury hotel industry, which is demanding seamless food service operations in the multi-story structure.

Rising NHS regulations regarding efficient medical logistics are also anticipated for rise in growth of dumbwaiters in hospitals to ensure clean and sanitized movement of medicines, meals and medical instruments. Increased demand for smart dumbwaiters with IoT integration for better operational efficiency as automation of office buildings and co-working spaces has been on the rise.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.0% |

The European Union dumbwaiter lifts market is experiencing stable growth due to stringent building regulations, increasing automation in commercial facilities, and rising installations in healthcare institutions. EU sustainability goals for commercial buildings have driven the adoption of energy-efficient dumbwaiters, with countries like Germany, France and Italy leading the way.

The main end use of dumbwaiters in Europe is in the hospitality sector, especially with luxury hotels and Michelin star service restaurants, which offer their service at several different levels of property and provides them speedy and efficient service. The focus of the healthcare industry on infection control and operational efficiency is also fuelling demand for hospital and elderly care medical-grade dumbwaiters. Geographically progressive dumbwaiter designs, low-noise operating systems, and custom-built units add to the growing market; particularly applicable for heritage buildings and high-end residential properties.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.1% |

The Japan dumbwaiter lifts market is growing steadily, driven by rapid urbanization, increasing smart building adoption, and the rise of compact living solutions. The high-density residential and commercial infrastructure of Japan has also created a demand for space-efficient dumbwaiters in small restaurants, offices and homes.

The aging population and growth of care facilities in the country have also seen dumbwaiters used in hospitals and assisted living centers for the safe transport of medicines and meals. In addition, smart automation in Japan also contributed to the invention of IoT-enabled dumbwaiters with touchless control and voice-activated operation. Designs for compact, foldable, and hidden dumbwaiters are in high demand as the market expands into high-rise apartments and urban commercial properties where such space-saving and convenience-focused solutions

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.9% |

The demand for dumbwaiters across these end-user segments in South Korea on the back of structured living is anticipated to further the growth of South Korea dumbwaiter lifts market. Market growth is primarily attributed to the catering industry, food service industry, and high-end apartment complexes, as businesses and families desire more convenient and labour-saving transport solutions.

As South Korea leads the way in smart city developments, dumbwaiter manufacturers have adapted IoT-enabled monitoring, voice controls and touchless technology to increase usability and efficiency. Moreover, the government’s emphasis on housing solutions for elderly population is raising the demand for residential dumbwaiters that enhance accessibility in multi-level homes. The fast food and replenishment sectors of e-commerce are also motivating adoption for internals in the form of industrial-grade dumbwaiters.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.0% |

Medium load carrying capacity dumbwaiter lifts (up to 200 lbs) dominate the market due to high usage in hotels, hospitals, and commercial establishments. These lifts can move food, laundry, medical supplies, and documents up and down efficiently and save time, significantly increasing the automation of workflow and the efficiency of labour.

In state of the art hotels, medium-capacity dumbwaiters are used to transport food dishes, drinks and cleaning supplies between multiple floors, helping to minimise manual workload and accelerate service delivery. These lifts are utilized in hospitals and medical facilities to transport medication, sterilized equipment and lab samples from one floor to another, ensuring hygienic and rapid delivery without approaches. Medium-Load dumbwaiters are more versatile and more durable than smaller-capacity dumbwaiters (rated for loads of up to 100 lbs), and help you meet the demands of daily operation in busy environments.

High load-carrying capacity dumbwaiter lifts (over 200 lbs.) are increasingly in demand, particularly in malls, large offices and cruise ships, where bulk carrying items are frequently transported. Move heavier payloads, these lifts are critical for transporting overloaded trays, shopping bags, and heavy inventory in business settings.

High-Capacity dumbwaiters for transporting the goods in malls and retail shops between storage rooms and retail shops/food court to enhance operational efficiency. Cruises and ships also go a level up when they fit these lifts into their kitchens, laundry rooms, and service areas to carry their goods around tight spaces. This is further exacerbated by the rising demand for automation in logistics and commercial services, thereby speeding the adoption of heavy-duty dumbwaiter systems for internal transportation process optimizations.

The hospitality sector, in particular hotels is a leading end-user of dumbwaiter lifts, as these systems reduce staff workload, improving service efficiency, and enhancing customer experience. Luxury hotels and upscale resorts will also be investing in high-end dumbwaiters that feature quiet operation, automated doors, and smart controls to enable seamless transportation of food and laundry between kitchens, housekeeping and guest floors.

As the demand for a modern, compact and space-efficient service solution increases, hotels are rallying behind modern dumbwaiter lift designs with customizable compartments, energy-efficient motors, and IoT-based monitoring systems. Furthermore, the expansion of multi-story boutique hotel as well as fine-dining restaurants has contributed to the demand for custom-built dumbwaiters to facilitate speedy and inconspicuous service.

The hospital sector is increasingly adopting dumbwaiter lifts in order to maintain infection control, operational efficiency, and reduce labour costs. Dumbwaiter used to transfer medical equipment, pharmaceuticals, sterilized surgical tools, and patient meals with minimal human interaction, which reduces the risk of cross-contamination.

Dumbwaiters are smaller, more efficient, and cheaper to operate than traditional service elevators and are ideal for medical logistics. Hospital, nursing home, and rehabilitation center numbers per multiple floors further promote investments in automated and smart dumbwaiter lift systems, incorporating touchless controls and antimicrobial coatings to improve the hygiene and safety of such systems.

The global dumbwaiter lifts market is comprised of several key players that are consistently working to provide innovative solutions to meet the evolving needs of consumers. Dumbwaiter lifts are a commonly enjoyed transport option for food, documents, medical supplies, and other light payloads within hotels, restaurants, hospitals, commercial buildings, and residential areas.

Technological advancements in energy-efficient dumbwaiters, the increasing penetration of automation and IoT-integrated systems, and importance of adhering to stringent building safety regulations are some of the factors technologically shaping the market. Manufacturers in the dumbwaiter lift market have been focusing on customised solutions, space-saving designs and larger load-bearing capacities for hospitality, healthcare, industrial, and commercial applications.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Otis Elevator Company | 10-12% |

| Schindler Group | 9-11% |

| Kone Corporation | 8-10% |

| Mitsubishi Electric Corporation | 6-8% |

| Thyssenkrupp Elevator | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| Otis Elevator Company | Specialist manufacturer of automated dumbwaiter lift systems, integrating energy-efficient motors and control panels for ease of integration. |

| Schindler Group | Designs four promising dry cleaning and springs in logistics high-performance dumbwaiter lifts, specializing in smart control technology and compact space design for office buildings. |

| Kone Corporation | Specializes in customized dumbwaiters with modular lift solutions, ensuring low-noise operation and IoT-based monitoring. |

| Mitsubishi Electric Corporation | Offers fast, strong dumbwaiter lifts, with AI-powered lift monitoring and safety upgrades. |

| Thyssenkrupp Elevator | Specializes in touchless automation dumbwaiter lift systems producing non-touch, safe transport solutions for the hospital, hotel, and office. |

Otis Elevator Company

Otis Elevator Company leading manufacturer of dumbwaiter lift systems, their innovative, energy-efficient systems can be tailored for commercial and residential applications. They facilitate digital load monitoring and provide smooth door operations with advanced control panels, ensuring seamless operation.

The IoT-enabled lift is the complete integration of IoT-based lift monitoring, real-time diagnostics and predictive maintenance, which minimizes the downtime while at the same time improves the operational efficiency of the lifts. The company’s state-of-the-art dumbwaiter systems utilize space-efficient designs which enable energy savings. Otis is trusted company for vertical transportation, focusing on technological improvements, leading to the innovations of smart lift solutions that are reliable, safe, and easy to use.

Schindler Group

Schindler Group provides restaurant, hotel and industrial building compact and high-performance dumbwaiter lift systems. Their modular lift designs include touchless operation, automatic load balancing, and AI-powered traffic analysis to improve transport efficiency. Schindler emphasizes sustainability, implementing low-energy motors and regenerative braking devices to minimize power usage and foster environmental sustainability.

Their intelligent dumbwaiter solutions seamlessly move loads from point to point, making the most of space and efficiencies of operation. Focusing on user comfort and digital innovation, Schindler is always progressing its green and AI-integrated lift industries, setting the stage for next-generation vertical transportation landscapes.

Kone Corporation

Kone Corporation manufactures customized dumbwaiter lift solutions that can be deployed across a wide range of applications in the commercial and medical space, and leading supplier of low-noise, vibration-free models. Kone is a hygiene-first lift technology, known to use UV sterilization and antimicrobial surfaces in medical environments. Improves safety and reliability with real-time diagnostics and remote maintenance capabilities.

As the fields of construction and logistics continue to evolve, so Kone's dumbwaiter systems, with a focus on sustainability and innovation ensuring that our products are always tailored to the needs of businesses in all sectors.

Mitsubishi Electric Corporation

Mitsubishi Electric offers high-speed, durable dumbwaiter lifts, ensuring smooth, precision-controlled transport for food service, hotels, and healthcare sectors. The on-board AI diagnostic platforms and adaptive lift speeds enhance operational efficiency and improve load management.

The smart lift technology of Mitsubishi Electric is being added with motion sensors and cloud-based remote operation to allow ease of monitoring and control. Dumbwaiters from this company are built for safety, performance and reliability, promising with minimal maintenance, the systems will work reliably and efficiently. Mitsubishi’s ongoing investment in intelligent automation and predictive maintenance positions them at the forefront of advanced lift solutions for contemporary infrastructure.

Thyssenkrupp Elevator

Thyssenkrupp Elevator is the industry leading provider of fully automated dumbwaiter lift systems, providing safe, hygienic, and efficient transport solutions for hospitals, food service operations, and logistics centers. Equipped with touchless functions for simple operation and automatic doors as well as mini designs, their ground-breaking solution provides the safe and reliable vertical transport of small loads.

Thyssenkrupp is a leading player in the next generation of lift technology, with AI-based dispatch systems available to increase the efficiency of elevators in multi-floor buildings. ThyssenKrupp’s smart dumbwaiter lift systems are particularly well-suited for businesses that demand precision and high-performance in their vertical transport solutions, ensuring that every aspect meeting the needs of the business.

Small (Up to 100 lb), Medium (Up to 200 lb), High (Over 200 lb)

Hotels, Hospitals, High Rising Residences, Malls, Cruises and Ships, Offices, Schools

North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa

The global dumbwaiter lift market is projected to reach USD 18,195.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.1% over the forecast period.

By 2035, the dumbwaiter lift market is expected to reach USD 24,714.3 million.

The medium-capacity segment (up to 200 lb) is expected to dominate due to its extensive use in commercial applications such as hotels, restaurants, hospitals, and retail establishments, where efficient material handling is essential.

Key players in the dumbwaiter lift market include Otis Elevator Company, Mitsubishi Electric Corporation, Schindler Group, Stannah Lifts Holdings Ltd., and Lift Master.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type of Operation, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type of Operation, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Car Door Design, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Car Door Design, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Number of Halts, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Number of Halts, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Load Carrying Capacities, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Load Carrying Capacities, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Type of Operation, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Type of Operation, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Car Door Design, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Car Door Design, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Number of Halts, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Number of Halts, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Load Carrying Capacities, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Load Carrying Capacities, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Type of Operation, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Type of Operation, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Car Door Design, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Car Door Design, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Number of Halts, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Number of Halts, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Load Carrying Capacities, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Load Carrying Capacities, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Type of Operation, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Type of Operation, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Car Door Design, 2018 to 2033

Table 42: Western Europe Market Volume (Units) Forecast by Car Door Design, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Number of Halts, 2018 to 2033

Table 44: Western Europe Market Volume (Units) Forecast by Number of Halts, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Load Carrying Capacities, 2018 to 2033

Table 46: Western Europe Market Volume (Units) Forecast by Load Carrying Capacities, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 48: Western Europe Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Type of Operation, 2018 to 2033

Table 52: Eastern Europe Market Volume (Units) Forecast by Type of Operation, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Car Door Design, 2018 to 2033

Table 54: Eastern Europe Market Volume (Units) Forecast by Car Door Design, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Number of Halts, 2018 to 2033

Table 56: Eastern Europe Market Volume (Units) Forecast by Number of Halts, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Load Carrying Capacities, 2018 to 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by Load Carrying Capacities, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Type of Operation, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Units) Forecast by Type of Operation, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Car Door Design, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Car Door Design, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Number of Halts, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Number of Halts, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Load Carrying Capacities, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Units) Forecast by Load Carrying Capacities, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Type of Operation, 2018 to 2033

Table 76: East Asia Market Volume (Units) Forecast by Type of Operation, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Car Door Design, 2018 to 2033

Table 78: East Asia Market Volume (Units) Forecast by Car Door Design, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Number of Halts, 2018 to 2033

Table 80: East Asia Market Volume (Units) Forecast by Number of Halts, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Load Carrying Capacities, 2018 to 2033

Table 82: East Asia Market Volume (Units) Forecast by Load Carrying Capacities, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 84: East Asia Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Type of Operation, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Units) Forecast by Type of Operation, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Car Door Design, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Units) Forecast by Car Door Design, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Number of Halts, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Units) Forecast by Number of Halts, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Load Carrying Capacities, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Units) Forecast by Load Carrying Capacities, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type of Operation, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Car Door Design, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Number of Halts, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Load Carrying Capacities, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Type of Operation, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Type of Operation, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Type of Operation, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Type of Operation, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Car Door Design, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Car Door Design, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Car Door Design, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Car Door Design, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Number of Halts, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Number of Halts, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Number of Halts, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Number of Halts, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Load Carrying Capacities, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Load Carrying Capacities, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 31: Global Market Attractiveness by Type of Operation, 2023 to 2033

Figure 32: Global Market Attractiveness by Car Door Design, 2023 to 2033

Figure 33: Global Market Attractiveness by Number of Halts, 2023 to 2033

Figure 34: Global Market Attractiveness by Load Carrying Capacities, 2023 to 2033

Figure 35: Global Market Attractiveness by Installation Type, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Type of Operation, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Car Door Design, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Number of Halts, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Load Carrying Capacities, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Type of Operation, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Type of Operation, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Type of Operation, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Type of Operation, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Car Door Design, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Car Door Design, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Car Door Design, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Car Door Design, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Number of Halts, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Number of Halts, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Number of Halts, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Number of Halts, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Load Carrying Capacities, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Load Carrying Capacities, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 67: North America Market Attractiveness by Type of Operation, 2023 to 2033

Figure 68: North America Market Attractiveness by Car Door Design, 2023 to 2033

Figure 69: North America Market Attractiveness by Number of Halts, 2023 to 2033

Figure 70: North America Market Attractiveness by Load Carrying Capacities, 2023 to 2033

Figure 71: North America Market Attractiveness by Installation Type, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Type of Operation, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Car Door Design, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Number of Halts, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Load Carrying Capacities, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Type of Operation, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Type of Operation, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Type of Operation, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Type of Operation, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Car Door Design, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Car Door Design, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Car Door Design, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Car Door Design, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Number of Halts, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Number of Halts, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Number of Halts, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Number of Halts, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Load Carrying Capacities, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Load Carrying Capacities, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Type of Operation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Car Door Design, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Number of Halts, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Load Carrying Capacities, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Installation Type, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Type of Operation, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Car Door Design, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Number of Halts, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Load Carrying Capacities, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Type of Operation, 2018 to 2033

Figure 120: Western Europe Market Volume (Units) Analysis by Type of Operation, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Type of Operation, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Type of Operation, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Car Door Design, 2018 to 2033

Figure 124: Western Europe Market Volume (Units) Analysis by Car Door Design, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Car Door Design, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Car Door Design, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Number of Halts, 2018 to 2033

Figure 128: Western Europe Market Volume (Units) Analysis by Number of Halts, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Number of Halts, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Number of Halts, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 132: Western Europe Market Volume (Units) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Load Carrying Capacities, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Load Carrying Capacities, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 136: Western Europe Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Type of Operation, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Car Door Design, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Number of Halts, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Load Carrying Capacities, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Installation Type, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Type of Operation, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Car Door Design, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Number of Halts, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Load Carrying Capacities, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Type of Operation, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Units) Analysis by Type of Operation, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Type of Operation, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Type of Operation, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Car Door Design, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Units) Analysis by Car Door Design, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Car Door Design, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Car Door Design, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Number of Halts, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Units) Analysis by Number of Halts, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Number of Halts, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Number of Halts, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Units) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Load Carrying Capacities, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Load Carrying Capacities, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Type of Operation, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Car Door Design, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Number of Halts, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Load Carrying Capacities, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Installation Type, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Type of Operation, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Car Door Design, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Number of Halts, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Load Carrying Capacities, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Type of Operation, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by Type of Operation, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type of Operation, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type of Operation, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Car Door Design, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Car Door Design, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Car Door Design, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Car Door Design, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Number of Halts, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Number of Halts, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Number of Halts, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Number of Halts, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Load Carrying Capacities, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Load Carrying Capacities, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Type of Operation, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Car Door Design, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Number of Halts, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Load Carrying Capacities, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Installation Type, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Type of Operation, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Car Door Design, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Number of Halts, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Load Carrying Capacities, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Type of Operation, 2018 to 2033

Figure 228: East Asia Market Volume (Units) Analysis by Type of Operation, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Type of Operation, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Type of Operation, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Car Door Design, 2018 to 2033

Figure 232: East Asia Market Volume (Units) Analysis by Car Door Design, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Car Door Design, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Car Door Design, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Number of Halts, 2018 to 2033

Figure 236: East Asia Market Volume (Units) Analysis by Number of Halts, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Number of Halts, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Number of Halts, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 240: East Asia Market Volume (Units) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Load Carrying Capacities, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Load Carrying Capacities, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 244: East Asia Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Type of Operation, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Car Door Design, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Number of Halts, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Load Carrying Capacities, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Installation Type, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Type of Operation, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Car Door Design, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Number of Halts, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Load Carrying Capacities, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Type of Operation, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Units) Analysis by Type of Operation, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Type of Operation, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type of Operation, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Car Door Design, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Car Door Design, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Car Door Design, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Car Door Design, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Number of Halts, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Number of Halts, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Number of Halts, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Number of Halts, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Units) Analysis by Load Carrying Capacities, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Load Carrying Capacities, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Load Carrying Capacities, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Type of Operation, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Car Door Design, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Number of Halts, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Load Carrying Capacities, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Installation Type, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hook Lifts and Skip Loaders Market Size and Share Forecast Outlook 2025 to 2035

Stair Lifts and Climbing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Lifts Market Size and Share Forecast Outlook 2025 to 2035

Construction Lifts Market

Vertical Mast Lifts Market Analysis & Forecast by Product Type, Working Height, Capacity, End-user Industry, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA