The world's stair lifts and climbing devices market is expected to grow steadily from 2025 through 2035, fueled by the aging population and individuals with disabilities. Stair lifts and climbing devices now provide increased access and independence-even in residential and healthcare environments.

Meanwhile, technological advances like battery-powered, remote-controlled stair lifts are providing further impetus to market expansion. The growing concern for home adaptability and access solutions also plays a role in its development. The market is projected to surpass USD 8196.10 Million by 2035, growing at a CAGR of 11.5% during the forecast period.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2759.68 Million |

| Projected Market Size in 2035 | USD 8196.10 Million |

| CAGR (2025 to 2035) | 11.5% |

Given the growing aging population and the high incidence of mobility impairments, North America is the dominant market for indoor Stair Lifts. With advanced healthcare infrastructure, USA leads the market and people's increasing awareness of home, the benefits that come from it Government measures and insurance coverage for mobility devices are also important factors in its growth.

Technological advancements such as artificial intelligence integrated lifts or lightweight portable climbing devices are even more driving demand in this region.

Europe has made great gains recently. This is because the increase in elderly populations and a variety of access laws have swept into countries like Germany or UK, which have been able to almost monopolize advanced products such as stair lifts and climbing aids with generous government grants and newly popular home construction.

In other words, the continuing existence of large manufacturers not only provides most of the jobs in this industry but also becomes an impetus for further expansion as innovative design work on lighter, more convenient products of these types takes place here.

Countries like Japan and China are presently the focus of fear in the region. However, as those countries age there has to be growth somewhere and surprisingly it looks like East Asia will go with its population. Rapid urbanization combines with increasing disposable income and growing understanding about how to increase mobility to lift people out of poverty when they are trapped within it, contribute to market expansion here.

High Installation and Maintenance Costs

Both stair lifts and lifting devices also require professional installation and routine maintenance, which makes them a major investment for buyers. This could reduce their adoption, especially among restrained budget buyers.

Regulatory and Safety Compliance

Across different regions, strict regulations and safety standards constitute challenges for manufacturers. Complying with different standards adds to production costs and lengthens the time required for product development.

Aging Population and Rising Mobility Challenges

The growing elderly population and increasing cases of mobility impairments present a highly promising market for stair lift and climbing device manufacturers. Demand will start to rise as more people seek solutions that allow them live independently.

Technological Advancements and Smart Features

Such innovations like AI-powered assistance (such as the one offered by Panasonic), a remote-controlled stair lift all add to the potential consumer base for the market. They also provide improved user experience and safety features to attract more buyers.

Driven by technological advancements in the home modification industry and a growing lift market, dates from 2020 to 2024 saw steady gains. Meanwhile, government-promoted services and support for mobility-related issues were a further boost for these changes.

Between 2025 and 2035, the market will see a consumer push all over again. This time, it is caused by an aging population, more diversified customization options and home automation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with basic safety regulations |

| Market Demand | Growing awareness of home mobility aids |

| Industry Adoption | Used primarily in residential settings |

| Supply Chain and Sourcing | Reliance on traditional manufacturing |

| Market Competition | Dominated by established accessibility brands |

| Market Growth Drivers | Increasing aging population and accessibility needs |

| Sustainability and Energy Efficiency | Limited focus on energy-efficient solutions |

| Integration of Digital Innovations | Basic remote-control operations |

| Advancements in Product Design | Standardized models with fixed installations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global standards and sustainability requirements |

| Market Demand | Increased adoption across residential and commercial sectors |

| Industry Adoption | Wider adoption in public infrastructure and workplaces |

| Supply Chain and Sourcing | Integration of smart technologies and automation |

| Market Competition | Entry of tech-driven startups and IoT -enabled solutions |

| Market Growth Drivers | Smart home integration, lightweight designs, and AI-powered assistance |

| Sustainability and Energy Efficiency | Expansion of battery-powered, energy-efficient stair lifts |

| Integration of Digital Innovations | Advanced IoT connectivity, voice control, and predictive maintenance |

| Advancements in Product Design | Foldable, modular, and customizable climbing solutions |

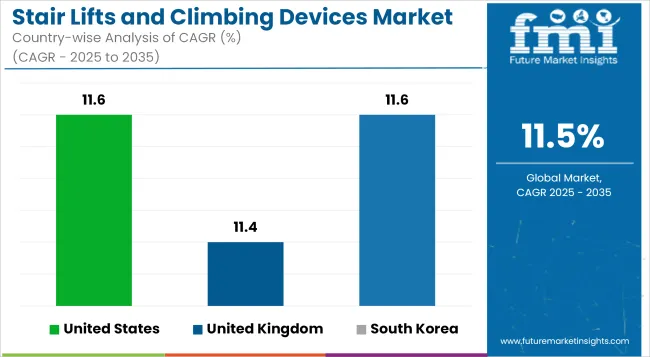

The USA is experiencing strong demand for mobility aids among the elderly and handicapped, which is driving up the need for stair lifts and climbing equipment’s. Residential and commercial space alike are getting in on the act, which in turn is also boosting market expansion. Further advances (notably in smart technology and automation) enhance overall product effectiveness as well as making it easier to use.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 11.6% |

With aging populations replacing convenience and reliability, the United Kingdom's stair lifts and climbing devices service markets are disillusioning into golden opportunity. Government endeavours to improve public buildings and house layouts by the elderly have boosted demand there. At the same time, major healthcare & mobility equipment manufacturers settled their market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 11.4% |

The European Union market for lifts and climbing devices is attracting even better prospects, at the same time as the general public goes up to its elbows about mobility frailties. Countries like Germany and France lead in product innovation, partly helped by robust healthcare infrastructures and helpful regulations to aid progressions. E-commerce and direct-to-consumer sales channels also play a critical role in how markets develop.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.5% |

South Korea's stair lifts and climbing devices market is developing rapidly due to a large, aging population and heavy urbanization. The country's emphasis on high-quality, sophisticated mobility devices has made them popular. The advent of smart home integrations and accessibility solutions also play a vital role in overall market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.6% |

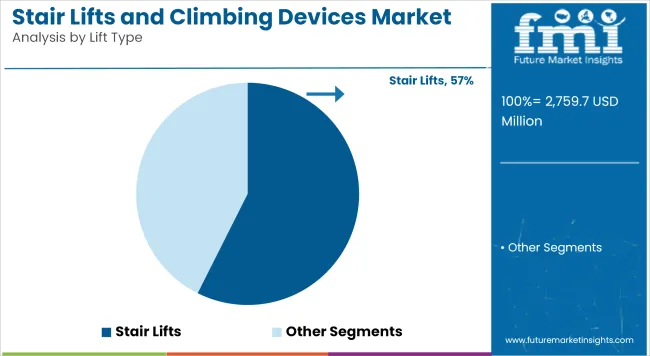

| Lift Type | Market Share (2025) |

|---|---|

| Stair Lifts | 57.4% |

An increasing stock of the global elderly population combined with a growing number of people suffering from mobility impairments and assignments in assistive technologies for mobility means definite long-term business opportunities for Stair Lifts and Climbing Devices. The market is divided into stair lifts, stair climbing wheelchairs, and other types of equipment.

Third, with 57.4% market share probably projected to be under the stair lifts segment by 2025, it becomes the foremost category. Stair lifts enable people to use stairs again safely and easily whatever their age or condition. In homes, electric stair lifts are being installed more and more to help older residents keep their independence as they get lazy with age.

Technology innovations like foldable stair lifts, remote control equipped machinery devices and AI-integrated handrails for assisting the disabled in particular, business opportunities are booming.

We now have battery-operated chairlifts that feature safety advantages like motion sensors, seat belts and so forth at present coming into the market to promote user comfort and security. As globalization progresses and an aging population seeks to find its place, the demand for stair lifts is expected again surge up either in family or health settings.

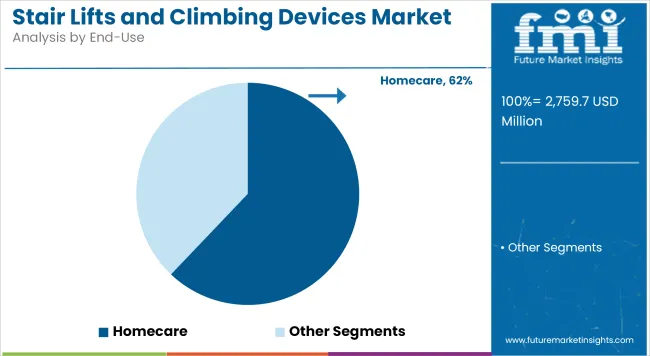

| End-Use | Market Share (2025) |

|---|---|

| Homecare | 62.1% |

The homecare component will be the single largest end-use industry for stair lifts and climbing devices, representing 62.1% of total market share. Emphasis on and the growing trend of aging in place, home facility alterations to make them universally accessible, choosing home-based care over institutional settings have brought about greater receptiveness to stair lifts their use is spreading from institutional locations to domestic contexts.

As the number of people seeking personalized and inexpensive transport solutions increases, the market for home-installed stair lifts and stair climbing wheelchairs will likewise grow. These devices not only offer improved safety and greater ease of use for people with mobility impairments; they also offer them increased independence.

Governments and financial assistance programs which help to pay for home modifications for the elderly or disabled have also played a major part in promoting market expansion.

The development of remote healthcare and telemedicine has further propelled the integration of smart mobility solutions into homes. Manufacturers responding to varied consumer needs with stair lifts which fold away for easy storage, conform perfectly to the narrowest spaces and take up just enough room ergonomically designed comfort models that further expand this field.

An increasing need for mobility solutions among older people and those with disabilities has led to significant increases in both the sale of stair lifts and also climbing devices. A combination of better assistive technology, enhanced safety features, and customization is firing some growth in this market Key players in the market have begun to focus on ergonomic design, product innovation efforts. They now also bring an intelligent approach to all these areas in order to delight more different end users.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Stannah Stairlifts | 14-18% |

| Handicare Group | 12-16% |

| Bruno Independent Living Aids | 10-14% |

| Acorn Stairlifts | 8-12% |

| Thyssenkrupp AG | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Stannah Stairlifts | In March 2024, launched a modular stair lift system. In January 2025, expanded operations in Asia-Pacific markets. |

| Handicare Group | In April 2024, introduced a foldable stair lift for compact spaces. In February 2025, developed a smart stair lift with AI-driven safety features. |

| Bruno Independent Living Aids | In May 2024, expanded its range of outdoor stair lifts. In March 2025, integrated voice-control capabilities into select models. |

| Acorn Stairlifts | In June 2024, launched a budget-friendly stair lift series. In February 2025, enhanced product durability and safety mechanisms. |

| Thyssenkrupp AG | In August 2024, introduced a stair lift with multi-angle adaptability. In March 2025, expanded its presence in European markets. |

Key Company Insights

StannahStairlifts (14-18%)

Stannah leads in high-quality, durable stair lifts with strong global distribution and a focus on modular and ergonomic solutions.

Handicare Group (12-16%)

Handicare specializes in innovative mobility solutions, offering foldable and AI-powered stair lifts for enhanced user experience.

Bruno Independent Living Aids (10-14%)

Bruno is a major player in the stair lift market, known for premium outdoor stair lifts and smart home integrations.

Acorn Stairlifts (8-12%)

Acorn provides cost-effective and durable stair lifts, making mobility solutions accessible to a broader audience.

Thyssenkrupp AG (6-10%)

Thyssenkrupp focuses on technologically advanced stair lifts with multi-angle adaptability and expansion into European markets.

Other Key Players (35-45% Combined)

The overall market size for Stair Lifts and Climbing Devices market was USD 2759.68 Million in 2025.

The Stair Lifts and Climbing Devices market is expected to reach USD 8196.10 Million in 2035.

The demand for stair lifts and climbing devices will be driven by an aging population, increasing mobility impairments, rising home healthcare adoption, advancements in assistive technology, and growing healthcare infrastructure investments.

The top 5 countries which drives the development of Stair Lifts and Climbing Devices market are USA, European Union, Japan, South Korea and UK.

Stair Lifts Segment demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million), By Type, 2018 to 2022

Table 2: Global Market Value (US$ Million), By Type, 2023 to 2033

Table 3: Global Market Value (US$ Million), By End to Use, 2018 to 2022

Table 4: Global Market Value (US$ Million), By End to Use, 2023 to 2033

Table 5: Global Market, By Region, 2018 to 2022

Table 6: Global Market, By Region, 2023 to 2033

Table 7: North America Market Value (US$ Million), By Type, 2018 to 2022

Table 8: North America Market Value (US$ Million), By Type, 2023 to 2033

Table 9: North America Market Value (US$ Million), By End to Use, 2018 to 2022

Table 10: North America Market Value (US$ Million), By End to Use, 2023 to 2033

Table 11: North America Market, By Country, 2018 to 2022

Table 12: North America Market, By Country, 2023 to 2033

Table 13: Latin America Market Value (US$ Million), By Type, 2018 to 2022

Table 14: Latin America Market Value (US$ Million), By Type, 2023 to 2033

Table 15: Latin America Market Value (US$ Million), By End to Use, 2018 to 2022

Table 16: Latin America Market Value (US$ Million), By End to Use, 2023 to 2033

Table 17: Latin America Market, By Country, 2018 to 2022

Table 18: Latin America Market, By Country, 2023 to 2033

Table 19: Europe Market Value (US$ Million), By Type, 2018 to 2022

Table 20: Europe Market Value (US$ Million), By Type, 2023 to 2033

Table 21: Europe Market Value (US$ Million), By End to Use, 2018 to 2022

Table 22: Europe Market Value (US$ Million), By End to Use, 2023 to 2033

Table 23: Europe Market, By Country, 2018 to 2022

Table 24: Europe Market, By Country, 2023 to 2033

Table 25: Asia Pacific Market Value (US$ Million), By Type, 2018 to 2022

Table 26: Asia Pacific Market Value (US$ Million), By Type, 2023 to 2033

Table 27: Asia Pacific Market Value (US$ Million), By End to Use, 2018 to 2022

Table 28: Asia Pacific Market Value (US$ Million), By End to Use, 2023 to 2033

Table 29: Asia Pacific Market, By Country, 2018 to 2022

Table 30: Asia Pacific Market, By Country, 2023 to 2033

Table 31: MEA Market Value (US$ Million), By Type, 2018 to 2022

Table 32: MEA Market Value (US$ Million), By Type, 2023 to 2033

Table 33: MEA Market Value (US$ Million), By End to Use, 2018 to 2022

Table 34: MEA Market Value (US$ Million), By End to Use, 2023 to 2033

Table 35: MEA Market, By Country, 2018 to 2022

Table 36: MEA Market, By Country, 2023 to 2033

Table 37: Global Market Incremental $ Opportunity, By Type, 2018 to 2022

Table 38: Global Market Incremental $ Opportunity, By End to Use, 2023 to 2033

Table 39: Global Market Incremental $ Opportunity, By Region, 2023 to 2033

Table 40: North America Market Incremental $ Opportunity, By Type, 2018 to 2022

Table 41: North America Market Incremental $ Opportunity, By End to Use, 2023 to 2033

Table 42: North America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 43: Latin America Market Incremental $ Opportunity, By Type, 2018 to 2022

Table 44: Latin America Market Incremental $ Opportunity, By End to Use, 2023 to 2033

Table 45: Latin America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 46: Europe Market Incremental $ Opportunity, By Type, 2018 to 2022

Table 47: Europe Market Incremental $ Opportunity, By End to Use, 2023 to 2033

Table 48: Europe Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 49: Asia Pacific Market Incremental $ Opportunity, By Type, 2018 to 2022

Table 50: Asia Pacific Market Incremental $ Opportunity, By End to Use, 2023 to 2033

Table 51: Asia Pacific Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 52: MEA Market Incremental $ Opportunity, By Type, 2018 to 2022

Table 53: MEA Market Incremental $ Opportunity, By End to Use, 2023 to 2033

Table 54: MEA Market Incremental $ Opportunity, By Country, 2023 to 2033

Figure 1: Global Market Value (US$ million) and Year-on-Year Growth, 2018 to 2033

Figure 2: Global Market Absolute $ Historical Gain (2018 to 2022) and Opportunity (2023 to 2033), US$ million

Figure 3: Global Market Share, By Type, 2023 to 2033

Figure 4: Global Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 5: Global Market Attractiveness Index, By Type – 2023 to 2033

Figure 6: Global Market Share, By End-Use, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 8: Global Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 9: Global Market Share, By Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth Projections, By Region – 2023 to 2033

Figure 11: Global Market Attractiveness Index, By Region – 2023 to 2033

Figure 12: North America Market Value (US$ million) and Year-on-Year Growth, 2018 to 2033

Figure 13: North America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ million

Figure 14: North America Market Share, By Type, 2023 to 2033

Figure 15: North America Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 16: North America Market Attractiveness Index, By Type – 2023 to 2033

Figure 17: North America Market Share, By End-Use, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 19: North America Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 20: North America Market Share, By Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 22: North America Market Attractiveness Index, By Country – 2023 to 2033

Figure 23: Latin America Market Value (US$ million) and Year-on-Year Growth, 2018 to 2033

Figure 24: Latin America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ million

Figure 25: Latin America Market Share, By Type, 2023 to 2033

Figure 26: Latin America Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 27: Latin America Market Attractiveness Index, By Type – 2023 to 2033

Figure 28: Latin America Market Share, By End-Use, 2023 to 2033

Figure 29: Latin America Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 30: Latin America Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 31: Latin America Market Share, By Country, 2023 to 2033

Figure 32: Latin America Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 33: Latin America Market Attractiveness Index, By Country – 2023 to 2033

Figure 34: Europe Market Value (US$ million) and Year-on-Year Growth, 2018 to 2033

Figure 35: Europe Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ million

Figure 36: Europe Market Share, By Type, 2023 to 2033

Figure 37: Europe Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 38: Europe Market Attractiveness Index, By Type – 2023 to 2033

Figure 39: Europe Market Share, By End-Use, 2023 to 2033

Figure 40: Europe Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 41: Europe Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 42: Europe Market Share, By Country, 2023 to 2033

Figure 43: Europe Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 44: Europe Market Attractiveness Index, By Country – 2023 to 2033

Figure 45: MEA Market Value (US$ million) and Year-on-Year Growth, 2018 to 2033

Figure 46: MEA Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ million

Figure 47: MEA Market Share, By Type, 2023 to 2033

Figure 48: MEA Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 49: MEA Market Attractiveness Index, By Type – 2023 to 2033

Figure 50: MEA Market Share, By End-Use, 2023 to 2033

Figure 51: MEA Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 52: MEA Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 53: MEA Market Share, By Country, 2023 to 2033

Figure 54: MEA Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 55: MEA Market Attractiveness Index, By Country – 2023 to 2033

Figure 56: Asia Pacific Market Value (US$ million) and Year-on-Year Growth, 2018 to 2033

Figure 57: Asia Pacific Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ million

Figure 58: Asia Pacific Market Share, By Type, 2023 to 2033

Figure 59: Asia Pacific Market Y-o-Y Growth Projections, By Type – 2023 to 2033

Figure 60: Asia Pacific Market Attractiveness Index, By Type – 2023 to 2033

Figure 61: Asia Pacific Market Share, By End-Use, 2023 to 2033

Figure 62: Asia Pacific Market Y-o-Y Growth Projections, By End-Use – 2023 to 2033

Figure 63: Asia Pacific Market Attractiveness Index, By End-Use – 2023 to 2033

Figure 64: Asia Pacific Market Share, By Country, 2023 to 2033

Figure 65: Asia Pacific Market Y-o-Y Growth Projections, By Country – 2023 to 2033

Figure 66: Asia Pacific Market Attractiveness Index, By Country – 2023 to 2033

Figure 67: USA Market Value (US$ million) and Forecast, 2023 to 2033

Figure 68: USA Market Share, By Type, 2022

Figure 69: USA Market Share, By End-Use, 2022

Figure 70: Canada Market Value (US$ million) and Forecast, 2023 to 2033

Figure 71: Canada Market Share, By Type, 2022

Figure 72: Canada Market Share, By End-Use, 2022

Figure 73: Brazil Market Value (US$ million) and Forecast, 2023 to 2033

Figure 74: Brazil Market Share, By Type, 2022

Figure 75: Brazil Market Share, By End-Use, 2022

Figure 76: Mexico Market Value (US$ million) and Forecast, 2023 to 2033

Figure 77: Mexico Market Share, By Type, 2022

Figure 78: Mexico Market Share, By End-Use, 2022

Figure 79: Germany Market Value (US$ million) and Forecast, 2023 to 2033

Figure 80: Germany Market Share, By Type, 2022

Figure 81: Germany Market Share, By End-Use, 2022

Figure 82: U.K. Market Value (US$ million) and Forecast, 2023 to 2033

Figure 83: U.K. Market Share, By Type, 2022

Figure 84: U.K. Market Share, By End-Use, 2022

Figure 85: France Market Value (US$ million) and Forecast, 2023 to 2033

Figure 86: France Market Share, By Type, 2022

Figure 87: France Market Share, By End-Use, 2022

Figure 88: Italy Market Value (US$ million) and Forecast, 2023 to 2033

Figure 89: Italy Market Share, By Type, 2022

Figure 90: Italy Market Share, By End-Use, 2022

Figure 91: BENELUX Market Value (US$ million) and Forecast, 2023 to 2033

Figure 92: BENELUX Market Share, By Type, 2022

Figure 93: BENELUX Market Share, By End-Use, 2022

Figure 94: Nordic Countries Market Value (US$ million) and Forecast, 2023 to 2033

Figure 95: Nordic Countries Market Share, By Type, 2022

Figure 96: Nordic Countries Market Share, By End-Use, 2022

Figure 97: China Market Value (US$ million) and Forecast, 2023 to 2033

Figure 98: China Market Share, By Type, 2022

Figure 99: China Market Share, By End-Use, 2022

Figure 100: Japan Market Value (US$ million) and Forecast, 2023 to 2033

Figure 101: Japan Market Share, By Type, 2022

Figure 102: Japan Market Share, By End-Use, 2022

Figure 103: South Korea Market Value (US$ million) and Forecast, 2023 to 2033

Figure 104: South Korea Market Share, By Type, 2022

Figure 105: South Korea Market Share, By End-Use, 2022

Figure 106: GCC Countries Market Value (US$ million) and Forecast, 2023 to 2033

Figure 107: GCC Countries Market Share, By Type, 2022

Figure 108: GCC Countries Market Share, By End-Use, 2022

Figure 109: South Africa Market Value (US$ million) and Forecast, 2023 to 2033

Figure 110: South Africa Market Share, By Type, 2022

Figure 111: South Africa Market Share, By End-Use, 2022

Figure 112: Turkey Market Value (US$ million) and Forecast, 2023 to 2033

Figure 113: Turkey Market Share, By Type, 2022

Figure 114: Turkey Market Share, By End-Use, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stair Lift Motors Market Growth - Trends & Forecast 2025 to 2035

Hook Lifts and Skip Loaders Market Size and Share Forecast Outlook 2025 to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Lifts Market Size and Share Forecast Outlook 2025 to 2035

Dumbwaiter Lifts Market Growth - Trends & Forecast 2025 to 2035

Construction Lifts Market

Vertical Mast Lifts Market Analysis & Forecast by Product Type, Working Height, Capacity, End-user Industry, and Region Through 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA