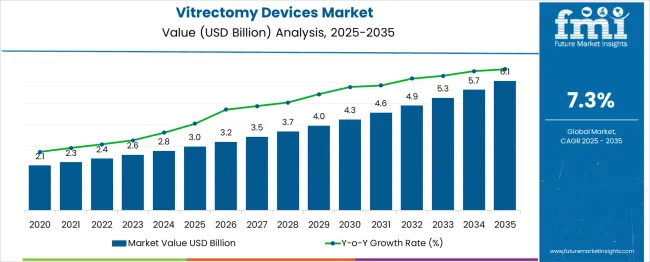

The Vitrectomy Devices Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

The vitrectomy devices market is demonstrating sustained growth as technological advancements, rising prevalence of retinal disorders, and improved surgical outcomes converge to enhance adoption. Increasing demand for minimally invasive vitreoretinal surgeries and growing awareness among patients about early diagnosis have contributed to market momentum.

Continuous innovations in device ergonomics, energy efficiency, and integration with imaging systems are enabling surgeons to perform complex procedures with greater precision and safety. The market outlook remains positive, driven by expanding access to ophthalmic care, rising geriatric population, and improved reimbursement scenarios in several regions.

Strategic collaborations between device manufacturers and ophthalmology centers are paving the path for broader accessibility and the development of next-generation systems, ensuring that growth opportunities continue to emerge.

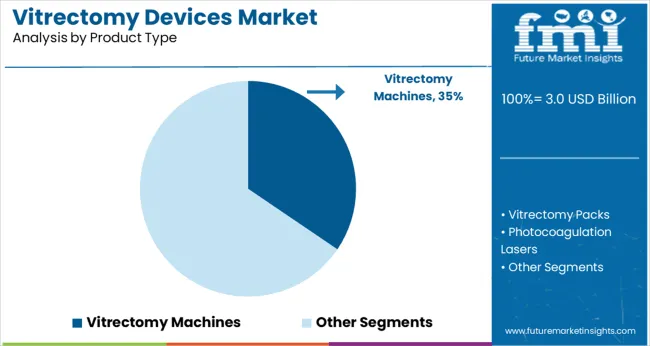

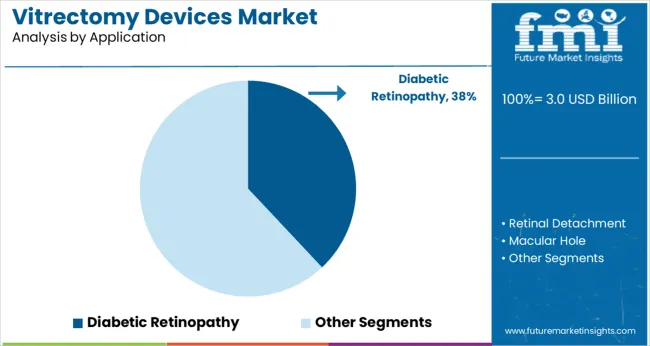

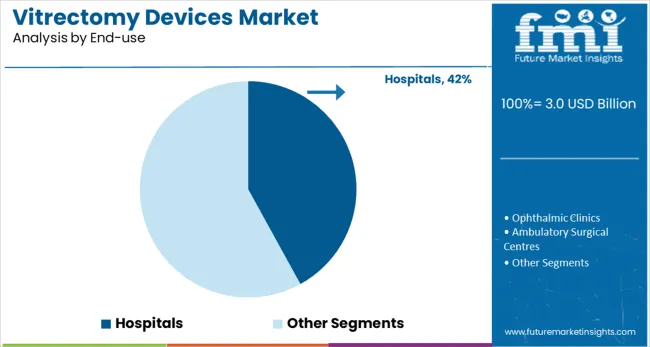

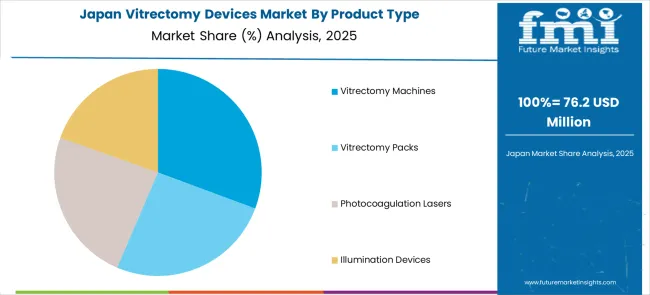

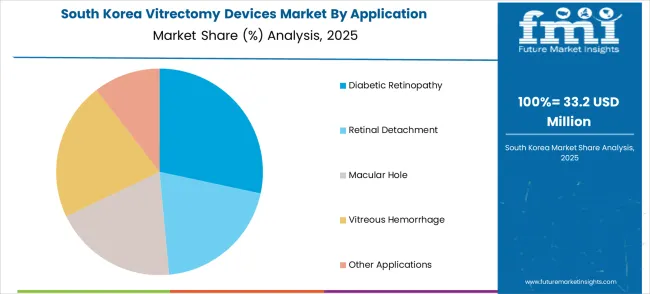

The market is segmented by Product Type, Application, and End-use and region. By Product Type, the market is divided into Vitrectomy Machines, Vitrectomy Packs, Photocoagulation Lasers, and Illumination Devices. In terms of Application, the market is classified into Diabetic Retinopathy, Retinal Detachment, Macular Hole, Vitreous Hemorrhage, and Other Applications. Based on End-use, the market is segmented into Hospitals, Ophthalmic Clinics, and Ambulatory Surgical Centres. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Application, and End-use and region. By Product Type, the market is divided into Vitrectomy Machines, Vitrectomy Packs, Photocoagulation Lasers, and Illumination Devices. In terms of Application, the market is classified into Diabetic Retinopathy, Retinal Detachment, Macular Hole, Vitreous Hemorrhage, and Other Applications. Based on End-use, the market is segmented into Hospitals, Ophthalmic Clinics, and Ambulatory Surgical Centres. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type the vitrectomy machines segment is expected to account for 34.5% of the total market revenue in 2025 positioning itself as the leading product category. This dominance has been reinforced by their central role in enabling efficient and safe removal of vitreous humor during retinal surgeries.

Enhanced machine precision faster cut rates and improved fluidics have allowed surgeons to perform delicate procedures with minimal trauma and reduced recovery times. Compact designs and integration with advanced illumination and visualization systems have further improved usability in operating rooms.

These machines have also benefited from manufacturers’ focus on improving portability and user interface features making them indispensable in both routine and complex surgical settings. Their ability to deliver consistent performance under varying surgical demands has solidified their leadership in the product category.

In terms of application the diabetic retinopathy segment is projected to hold 38.0% of the market revenue share in 2025 securing its place as the top application area. This prominence has been driven by the increasing global incidence of diabetes which has led to a rising number of patients developing vision threatening complications requiring surgical intervention.

Advancements in diagnostic capabilities have enabled earlier detection of diabetic retinopathy contributing to higher surgical volumes. Vitrectomy devices have proven highly effective in addressing retinal hemorrhages and tractional detachments associated with this condition. The segment’s growth has also been supported by greater awareness programs encouraging diabetic patients to seek regular ophthalmic evaluations.

The ability of vitrectomy procedures to significantly improve or preserve vision in affected individuals has reinforced diabetic retinopathy as the leading application for these devices.

When analyzed by end-use the hospitals segment is forecast to capture 42.0% of the market revenue in 2025 maintaining its leadership position. This has been underpinned by hospitals’ ability to offer comprehensive ophthalmic services equipped with advanced surgical facilities and specialized personnel.

High patient inflow for complex retinal procedures and the availability of multidisciplinary care in hospital settings have supported the segment’s dominance. Investments by hospitals in state-of-the-art surgical suites and their focus on training surgeons in cutting-edge techniques have further enhanced adoption of vitrectomy devices in this segment.

Moreover hospitals often serve as referral centers for severe or complicated cases reinforcing their critical role in the care pathway. The combination of infrastructure expertise and trust among patients has ensured that hospitals continue to be the preferred end-use environment for vitrectomy procedures.

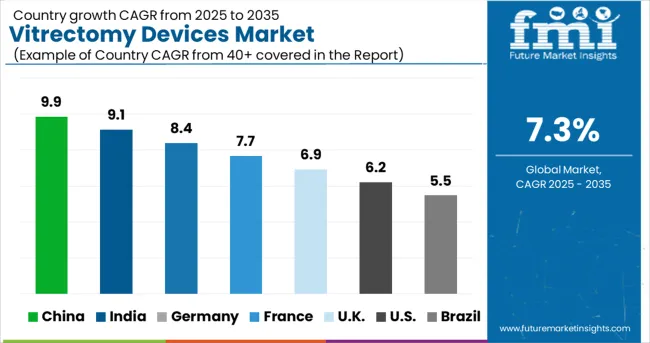

As per the Vitrectomy Devices industry research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Vitrectomy Devices industry increased at around 6.5% CAGR, wherein, countries such as the USA, United Kingdom, China, South Korea, and Japan held a significant share in the global market. Owing to this, the Vitrectomy Devices market is projected to grow at a CAGR of 7.3% over the coming 10 years.

Vitrectomy aids in the removal of blood from the vitreous humour and the prevention of traction retinal detachment. This, in turn, helps to smooth the process of many other ophthalmic surgeries and prevents further retinal detachment during the procedure. Furthermore, vitrectomy aids in the restoration of vision loss caused by vitreous humour bleeding.

The increased frequency of retinal illness, as well as the causes for it, are expected to drive the market throughout the forecast period. Diabetes has a negative impact on eye health, causing eyesight loss through damaging the retina's blood vessels. Diabetic retinopathy affected 2.1 million Americans in 2020, according to the National Eye Institute. By 2035, this number is projected to rise to 11.3 million, thus propelling the market forward.

Hospital admissions for Rhegmatogenous Retinal Detachment (RRD) in the United Kingdom have been increasing since 2000. A substantial number of patients are admitted for RRD, according to HES Hospital Admitted Patient Care Activity statistics, increasing demand for pars plana vitrectomy surgeries.

As a result, market participants are demonstrating innovations in the retina domain at conferences in order to broaden its reach and adoption in order to fulfill rising demand. In July 2020, Alcon debuted their new HYPERVIT Dual Blade Vitrectomy Probe at the American Society of Retina Specialists’ annual meeting. During microincision vitrectomy surgery, this cutting-edge probe is designed to increase stability and balance.

Aside from the numerous benefits affiliated with vitrectomy surgical procedures and devices, the risks associated with the procedure are expected to pose a barrier to its widespread adoption. The risks of vitrectomy include eye infection, bleeding in the vitreous gel, retinal detachment, and high intraocular pressure. Furthermore, after a few years of vitrectomy, patients may develop cataracts or other eye problems.

The market in Asia Pacific is expected to register the highest CAGR of nearly 8% during the forecast period due to increased demand for Vitrectomy Devices in developing countries, especially Japan and China. This can be attributed to the increasing geriatric population in the region.

During the forecast period, the market in Asia Pacific will grow at the fastest rate of the presence of a large patient pool seeking ophthalmic care and the adoption of vitrectomy devices. Furthermore, the government's increasing emphasis on providing improved healthcare centers and proper patient care is further contributing to market growth.

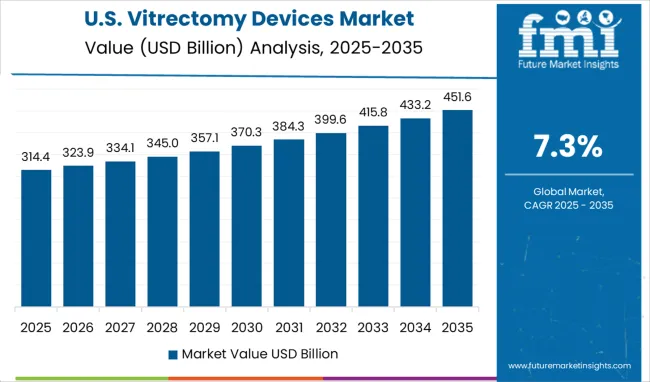

In 2024, the United States held the largest market share, accounting for over 35% of total revenue. The rising prevalence of ocular ailments including diabetic retinopathy, retinal detachment, and the macular hole is likely to boost market expansion in the region.

Several companies in the country are seeking FDA approval in the United States for their products, allowing them to remain competitive in the market. Medical Instrument Development Facilities, Inc., for example, gained FDA 510 (k) clearance in July 2020 for the Bi-Blade Vitrectomy Cutter. Thus, the growing prevalence of such diseases caused a rise in the revenue share in the USA.

The market in the United Kingdom is projected to reach a valuation of USD 6.1 million by 2035. With a CAGR of 8%, the market is expected to gross an absolute dollar opportunity of USD 3 million from 2025 to 2035.

In Japan, the market is projected to reach a valuation of USD 122 million by 2035. Growing at a CAGR of 7.8%, the market is expected to garner an absolute dollar opportunity of USD 65 million.

The market in South Korea is projected to garner an absolute dollar opportunity of USD 18.5 million, growing at a CAGR of 5.3% from 2025 to 2035. By 2035, the market is likely to reach a valuation of USD 45 million.

In 2024, the vitrectomy machines segment dominated the market, accounting for 36.8% of the total revenue. The development of new generation machines with advanced features such as improved fluidics, high cut rates, small gauge size, and intraocular pressure control has contributed to the segment's growth. For example, Alcon's Constellation Vision System has fluidics that works for small-gauge surgery, overcoming previous machines' limitations.

During the forecast period, the vitrectomy packs segment is projected to expand at the fastest rate. This can be attributed to the increased use of these packs in a variety of indications, including vitreous removal from the retina, epiretinal membrane removal, collective procedures for retinal surgery, and posterior vitreous detachment.

Furthermore, the vitrectomy pack's additional benefits, such as portability, optical magnification, and fast response, are expected to propel the growth of vitrectomy devices. According to the CDC, diabetic retinopathy affects one-third of African-Americans and Mexican Americans over the age of 40. Furthermore, 4.2 million people have diabetic retinopathy, and 655,000 have vision-threatening diabetic retinopathy. As a result, the increasing incidence of diabetic retinopathy is expected to drive segment growth over the forecast period.

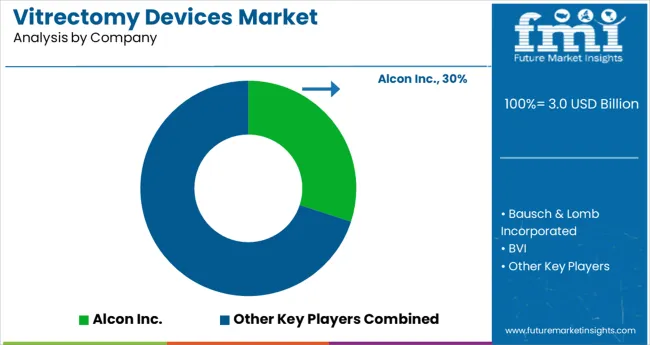

The key players operating in the vitrectomy devices market include Alcon Inc., Bausch & Lomb Incorporated, BVI, NIDEK CO., LTD., Johnson & Johnson Vision Care, Inc., Blink Medical, Topcon Corporation, Carl Zeiss Meditec AG, and Hoya Surgical Optics

Some of the recent developments of key Vitrectomy Devices providers are as follows:

Similarly, recent developments related to companies offering Vitrectomy Devices have been tracked by the team at Future Market Insights, which are available in the full report.

The global vitrectomy devices market is estimated to be valued at USD 3.0 billion in 2025.

It is projected to reach USD 6.1 billion by 2035.

The market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types are vitrectomy machines, vitrectomy packs, photocoagulation lasers and illumination devices.

diabetic retinopathy segment is expected to dominate with a 38.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA