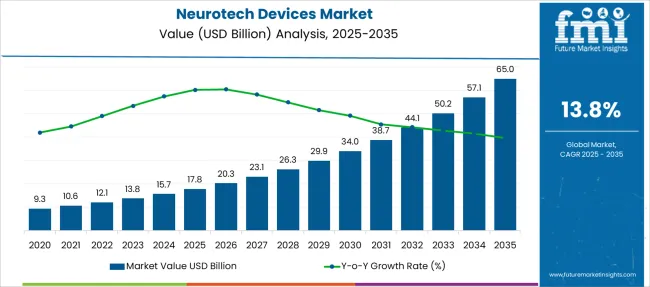

The Neurotech Devices Market is estimated to be valued at USD 17.8 billion in 2025 and is projected to reach USD 65.0 billion by 2035, registering a compound annual growth rate (CAGR) of 13.8% over the forecast period.

| Metric | Value |

|---|---|

| Neurotech Devices Market Estimated Value in (2025 E) | USD 17.8 billion |

| Neurotech Devices Market Forecast Value in (2035 F) | USD 65.0 billion |

| Forecast CAGR (2025 to 2035) | 13.8% |

The neurotech devices market is undergoing significant transformation as advancements in neuroscience, miniaturization of medical electronics, and rising demand for non-invasive therapies converge to drive adoption. Increasing prevalence of neurological disorders, heightened awareness of brain health, and growing acceptance of technology-assisted interventions are fueling current growth.

Hospitals and specialty centers are integrating these devices to improve patient outcomes and reduce long-term care costs. Future expansion is expected to be supported by innovations in wearable neurotech, enhanced connectivity for remote monitoring, and expanding applications beyond traditional neurological diseases into wellness and cognitive enhancement.

Regulatory encouragement and the push toward personalized medicine are creating favorable conditions that are paving the path for wider clinical and consumer adoption..

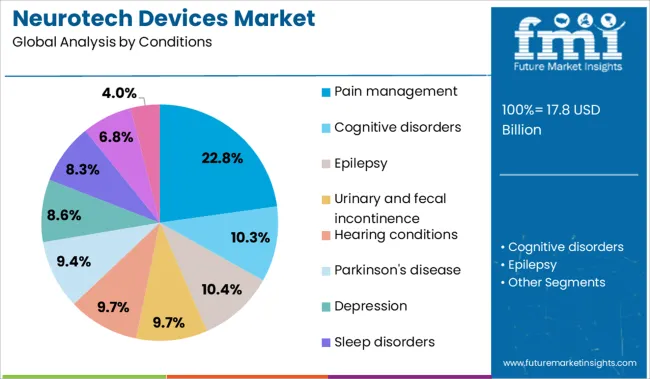

The market is segmented by Conditions, End-use, and region. By Conditions, the market is divided into Pain management, Cognitive disorders, Epilepsy, Urinary and fecal incontinence, Hearing conditions, Parkinson's disease, Depression, Sleep disorders, Essential tremor, and Other conditions.

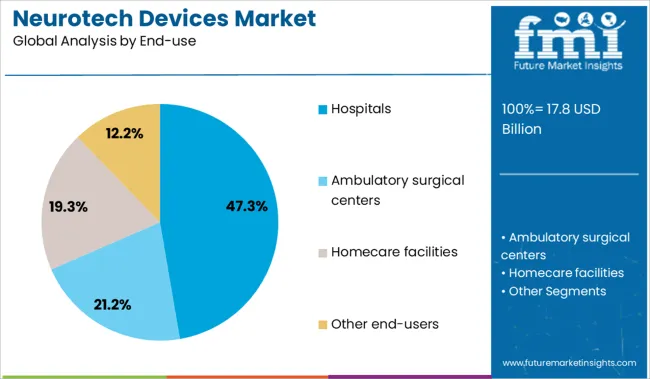

In terms of End-use, the market is classified into Hospitals, Ambulatory surgical centers, home care facilities, and Other end-users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by condition, pain management is anticipated to hold 22.80% of the total market revenue in 2025 establishing itself as a leading application segment. This position is attributed to growing clinical preference for neurostimulation techniques and targeted neuromodulation in managing chronic pain where conventional therapies have limitations.

Widespread adoption has been reinforced by evidence supporting efficacy in reducing opioid dependency and improving quality of life for patients with persistent pain conditions. Enhanced device usability and minimally invasive delivery have contributed to broader acceptance by physicians and patients alike.

Technological advancements enabling precise stimulation and patient-controlled settings have further strengthened this segment’s ability to address a broad spectrum of pain disorders reinforcing its share of the market.

Segmented by end use hospitals are projected to command 47.30% of the market revenue in 2025 maintaining their leadership position. This dominance has been shaped by their established infrastructure clinical expertise and ability to integrate advanced neurotech devices within standard treatment pathways.

Hospitals have been observed to invest heavily in acquiring cutting-edge neurostimulation and monitoring technologies as part of their commitment to comprehensive neurological care. Centralized purchasing capacity training programs and access to multidisciplinary teams have enabled hospitals to effectively deploy and manage these devices ensuring optimal outcomes.

The trust associated with hospital-administered therapies alongside regulatory compliance and ability to scale programs has cemented their leadership as the primary channel for neurotech device utilization.

Demand for neurotech devices is rising across clinical diagnostics, therapeutic neuromodulation, and cognitive performance tracking. Sales of EEG wearables, implantable stimulators, and brain-signal processing units continue to grow in both hospital and consumer-grade segments. AI-powered neuro-assessment tools and non-invasive systems are rapidly transforming neurological healthcare delivery.

Demand for non-invasive neurotech devices increased 21% in 2025 as hospitals and diagnostic labs replaced traditional systems with wearable EEG and fNIRS units. Dry-electrode EEG caps achieved 39% faster prep time in outpatient settings, boosting throughput in neurology departments. Clinics in Canada and the Netherlands deployed cloud-synced EEG headsets to enable real-time cognitive function assessments and seizure pattern monitoring. Multi-sensor wearables offered home-based testing options, reducing the cost per diagnostic case by 27%. Sales of AI-integrated EEG platforms also rose due to their capacity to detect early neurodegenerative markers, especially in Alzheimer's and mild cognitive impairment patients.

Sales of implantable neurotech devices jumped 26% YoY in 2025, supported by rising adoption in managing Parkinson’s, refractory epilepsy, and major depressive disorder. Hospitals across the USA and South Korea integrated deep brain and vagus nerve stimulators into surgical protocols, citing up to 42% symptom reduction. Adaptive neuromodulators featuring closed-loop feedback were deployed to optimize real-time stimulation based on bioelectrical signals. Upgraded IPG (implantable pulse generator) devices extended battery life by 31%, reducing follow-up procedures. Demand for neurotech solutions among neurologists is shifting toward implants as pharmacotherapy response rates plateau in complex neurological cases.

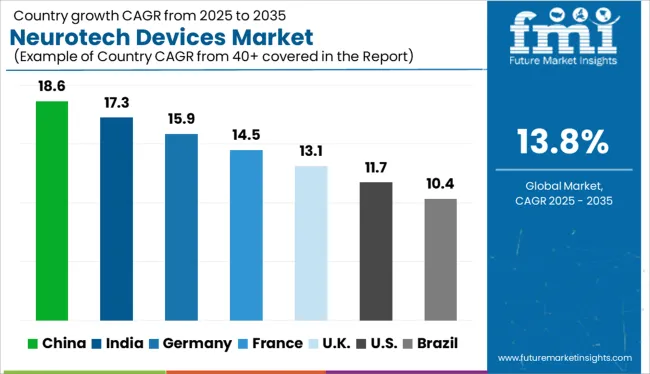

| Country | CAGR |

|---|---|

| China | 18.6% |

| India | 17.3% |

| Germany | 15.9% |

| France | 14.5% |

| UK | 13.1% |

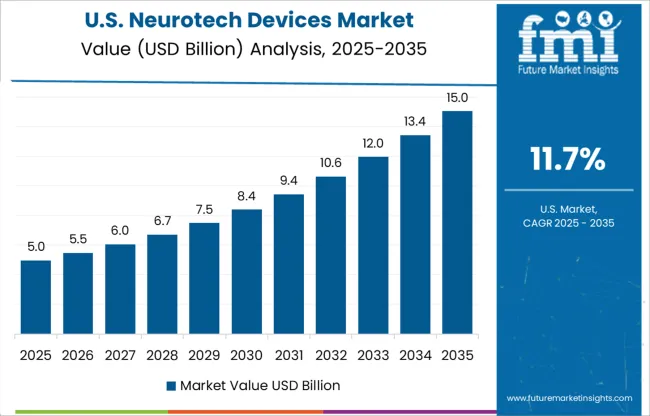

| USA | 11.7% |

| Brazil | 10.4% |

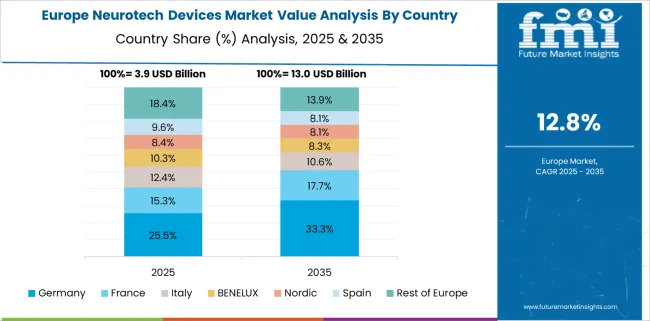

The global neurotech devices market is projected to expand at a CAGR of 13.8% from 2025 to 2035. BRICS nations are emerging as key growth drivers, with China leading at 18.6% due to aggressive government funding and a rapidly expanding medtech ecosystem. India follows at 17.3%, fueled by growing demand for neural diagnostics and digital health integration. Within the OECD, Germany is advancing at 15.9%, supported by strong clinical research networks and rising use of neurostimulation therapies. The UK is progressing at 13.1%, with investments in cognitive health driving commercial uptake. The USA, despite being a hub for neurotech innovation, shows a relatively modest CAGR of 11.7% due to longer regulatory cycles. While ASEAN nations are not individually listed here, rising demand for advanced neurological care is expected to support steady uptake across Southeast Asia, particularly in urban healthcare systems. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Demand for neurotech devices in China is projected to grow at a CAGR of 18.6% through 2035, outperforming global averages. From 2020 to 2024, the market gained traction in rehabilitation centers and neurosurgery clinics due to increased neurological disorder cases and rising healthcare digitization. During 2025–2035, advancements in AI-driven neural interfaces and expanding aging population segments are expected to boost sales of neurotech devices, particularly in cities like Beijing, Shanghai, and Shenzhen. The surge in domestic R&D and government-funded neurotechnology pilots is also reshaping the competitive landscape.

India’s market is forecasted to expand at a CAGR of 17.3% between 2025 and 2035. The 2020–2024 period was marked by moderate adoption, mainly in metro hospitals using EEG and neuro-monitoring systems. The 2025–2035 decade will witness accelerated demand for neurotech devices driven by rising incidences of Parkinson’s disease and epilepsy, and a shift toward digital neurology. Sales of neurotech devices will be further supported by public-private partnerships and the launch of affordable solutions for tier-2 and tier-3 cities.

Germany is anticipated to record a CAGR of 15.9% from 2025 to 2035 in the market. The 2020–2024 phase witnessed significant demand from academic hospitals and neurological research centers, especially for neurostimulation and neuroimaging tools. Over the next decade, the sales of neurotech devices will be driven by integration with robotic-assisted surgery and increased funding for neuroscience innovation. Germany's aging demographic and insurance-covered neurorehabilitation services will reinforce long-term growth.

A CAGR of 13.1% is projected for the United Kingdom’s market between 2025 and 2035. From 2020 to 2024, demand remained steady in NHS-affiliated neurology departments using standard EEG and EMG systems. The outlook for 2025–2035, however, reflects a growing shift toward high-performance, wearable neurotech devices that aid early detection of Alzheimer’s and dementia. Market expansion will be underpinned by rising patient awareness, AI-health startups, and NHS pilot programs.

The US market is set to rise at a CAGR of 11.7% through 2035. While 2020–2024 saw strong adoption across neurology departments and military rehabilitation programs, the upcoming decade will emphasize next-gen neurodevices integrating cloud analytics and AI. Sales of neurotech devices will rise due to surging investments in personalized neurotherapies, FDA fast-tracking for neurostimulation systems, and aging-related cognitive health initiatives.

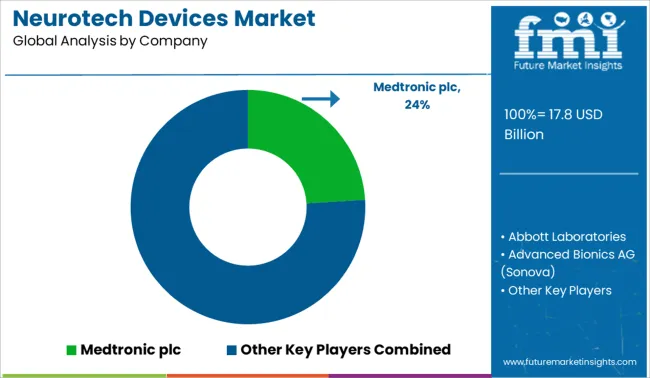

Sales of neurotech devices are witnessing rapid growth in 2025, with innovation in brain-computer interfaces and neuromodulation systems reshaping the competitive landscape. Medtronic leads the market with a 24% share, driven by strong adoption of its spinal and deep brain stimulators. Demand for neurotech devices from Abbott and Boston Scientific remains strong, particularly in chronic pain and Parkinson’s applications. Cochlear Limited and Advanced Bionics are strengthening positions in auditory implants, as global hearing loss cases surge. Startups like Neuralink, NeuroSigma, and BrainCo are disrupting the space with next-generation BCIs and neurofeedback wearables. Control Bionics and Blackrock Microsystems are gaining traction in assistive communication systems. Growth is reinforced by increased funding in neuroengineering and rising clinical validation of neurotech therapies.

In April 2025, Abbott Laboratories launched a next-generation delivery system for its Proclaim™ DRG neurostimulation platform, enhancing precision and ease of electrode placement for treating complex regional pain syndrome in commercial neuromodulation settings.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.8 Billion |

| Conditions | Pain management, Cognitive disorders, Epilepsy, Urinary and fecal incontinence, Hearing conditions, Parkinson's disease, Depression, Sleep disorders, Essential tremor, and Other conditions |

| End-use | Hospitals, Ambulatory surgical centers, Homecare facilities, and Other end-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Medtronic plc, Abbott Laboratories, Advanced Bionics AG (Sonova), Boston Scientific Corporation, BrainCo, Inc, Cochlear Limited, Control Bionics, Inc, LivaNova PLC, Nihon Kohden Corporation, Natus Medical Incorporated, Integra LifeSciences, Blackrock Microsystems, NeuroSigma, Inc., NeuroVigil Inc., and Neuralink Corp. |

| Additional Attributes | Dollar sales by device type and neurological indication, demand dynamics across clinical and home-based care settings, regional trends in brain-computer interface adoption, innovation in non-invasive stimulation technologies and neural signal decoding, environmental impact of electronic waste from implantables, and emerging use cases in cognitive enhancement and neurorehabilitation. |

The global neurotech devices market is estimated to be valued at USD 17.8 billion in 2025.

The market size for the neurotech devices market is projected to reach USD 65.0 billion by 2035.

The neurotech devices market is expected to grow at a 13.8% CAGR between 2025 and 2035.

The key product types in neurotech devices market are pain management, cognitive disorders, epilepsy, urinary and fecal incontinence, hearing conditions, parkinson's disease, depression, sleep disorders, essential tremor and other conditions.

In terms of end-use, hospitals segment to command 47.3% share in the neurotech devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Sleep Aid Devices Market Growth – Industry Insights & Forecast 2022-2032

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA