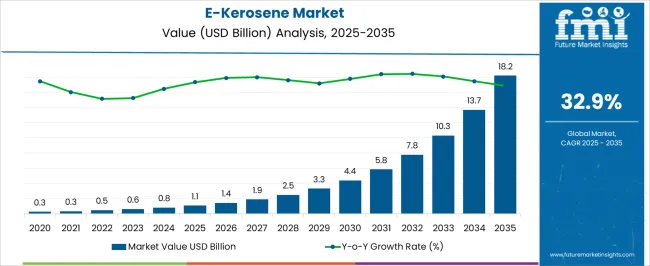

The e-kerosene market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 18.2 billion by 2035, registering a compound annual growth rate (CAGR) of 32.9% over the forecast period. The market demonstrates a cost-sensitive and technology-intensive value chain that shapes overall market dynamics. Production costs dominate the cost structure due to high capital expenditure on electrolysis units, carbon capture systems, and hydrogen synthesis infrastructure. Feedstock costs, particularly renewable electricity and captured CO2, constitute a significant portion of operational expenses, and fluctuations in energy pricing directly affect the final product cost.

Technological efficiency improvements in electrolysis and synthetic fuel synthesis are therefore critical for margin optimization and scalability. The value chain begins with renewable energy generation and CO2 sourcing, followed by hydrogen production through water electrolysis, and subsequent catalytic conversion into e-kerosene. Each stage involves specialized technology providers, with process integration efficiency impacting overall cost competitiveness.

Distribution and storage of e-kerosene add secondary costs, including logistics, compliance with aviation fuel standards, and blending requirements with conventional jet fuels. End-use adoption in aviation, shipping, and industrial applications influences economies of scale, which in turn gradually reduces unit costs over the forecast period. With projected exponential growth from USD 1.1 billion in 2025 to USD 18.2 billion in 2035, strategic focus on process optimization, energy sourcing, and supply chain integration will define profitability, making the cost structure and value-chain efficiency central to the market’s long-term viability.

| Metric | Value |

|---|---|

| E-Kerosene Market Estimated Value in (2025 E) | USD 1.1 billion |

| E-Kerosene Market Forecast Value in (2035 F) | USD 18.2 billion |

| Forecast CAGR (2025 to 2035) | 32.9% |

The e-kerosene market represents an emerging segment within the sustainable aviation fuels and alternative energy industry, emphasizing low-carbon, synthetic fuel solutions for aviation and transport. Within the overall aviation fuel market, it accounts for about 2.9%, reflecting early adoption in experimental and commercial flight testing. In the renewable and synthetic fuels segment, it holds nearly 3.4%, highlighting production from biomass, carbon capture, and hydrogen-based processes.

Across the civil and commercial aviation sector, the segment captures 2.6%, supporting airlines seeking to reduce greenhouse gas emissions. Within the energy transition and decarbonization category, it represents 3.1%, emphasizing integration with existing jet fuel infrastructure. In the chemical synthesis and hydrogen utilization sector, it secures 2.7%, underscoring technological advancements in Fischer-Tropsch and electrochemical conversion processes. Recent developments in this market have focused on process efficiency, scale-up, and regulatory alignment. Innovations include catalytic and electrochemical pathways to convert captured CO2 and green hydrogen into kerosene with minimal carbon footprint.

Key players are collaborating with airlines, fuel producers, and research institutions to establish pilot projects and demonstration flights. Integration with carbon capture facilities and renewable hydrogen production is increasing to ensure feedstock sustainability. Additionally, blending e-kerosene with conventional jet fuel is being tested to meet aviation certification standards while lowering emissions.

The E-Kerosene market is witnessing steady growth, driven by the global aviation sector’s transition toward sustainable fuels and the increasing adoption of renewable energy-based production methods. Policy mandates, carbon reduction targets, and airline commitments to net-zero goals have accelerated investment in synthetic kerosene production.

Advancements in renewable energy infrastructure, particularly solar and wind, are enabling on-site fuel synthesis, reducing transportation costs, and improving supply chain efficiency. Fischer-Tropsch synthesis technology, widely recognized for producing high-quality synthetic fuels, has gained traction due to its compatibility with existing aircraft engines and fueling infrastructure.

Furthermore, partnerships between energy companies, airlines, and technology providers are expanding pilot projects into commercial-scale production. The market outlook remains positive as regulatory incentives, international carbon trading schemes, and growing corporate sustainability initiatives create a favorable environment for scale-up. Future growth will be supported by technological improvements, cost reductions, and expansion of application areas, with aviation expected to remain the dominant end-use sector.

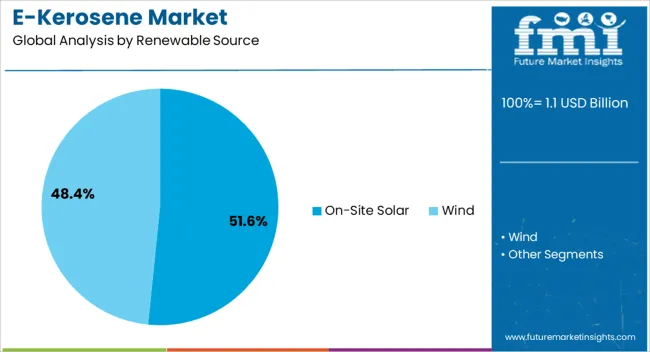

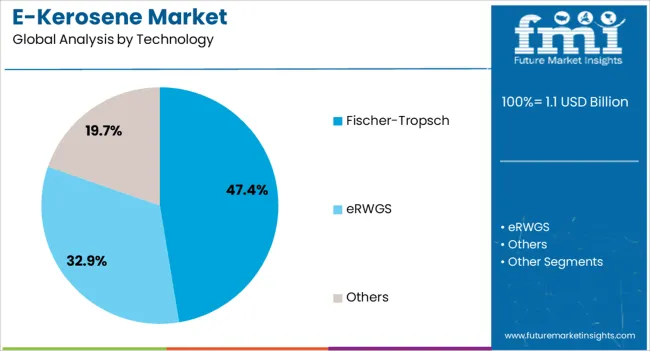

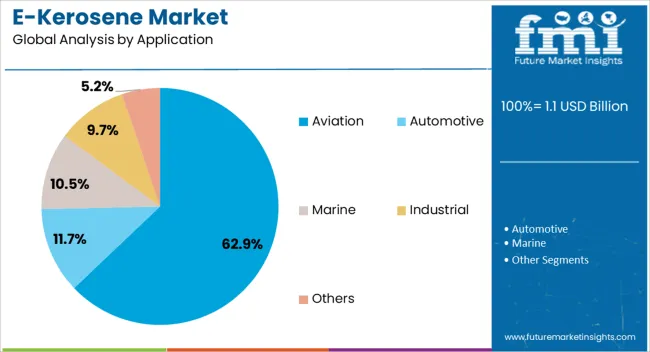

The e-kerosene market is segmented by renewable source, technology, application, and geographic regions. By renewable source, e-kerosene market is divided into On-Site Solar and Wind. In terms of technology, e-kerosene market is classified into Fischer-Tropsch, eRWGS, and Others. Based on application, e-kerosene market is segmented into Aviation, Automotive, Marine, Industrial, and Others. Regionally, the e-kerosene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The On-Site Solar segment is projected to account for 51.6% of the E-Kerosene market revenue in 2025, holding the leading share among renewable sources. This segment’s growth is driven by the ability of solar-based systems to generate clean electricity directly at production sites, minimizing transmission losses and operational costs.

The scalability of solar installations allows producers to align energy generation with fuel production demands, enhancing efficiency. In regions with high solar irradiance, on-site solar has proven to be a cost-effective and sustainable option for synthetic kerosene production.

The segment has also benefited from supportive renewable energy policies and declining photovoltaic technology costs. As producers seek to decarbonize fuel synthesis while maintaining competitive pricing, on-site solar is expected to remain the preferred renewable source for E-Kerosene manufacturing.

The Fischer-Tropsch segment is anticipated to capture 47.4% of the E-Kerosene market revenue in 2025, establishing itself as the dominant technology. Its leadership is attributed to the ability to convert renewable hydrogen and captured CO₂ into high-quality liquid fuels that meet existing aviation fuel standards.

The process has a proven track record in synthetic fuel production and is compatible with commercial-scale deployment. Energy companies have invested in optimizing Fischer-Tropsch reactors to improve yields and reduce energy consumption, further enhancing cost competitiveness.

The technology’s compatibility with a variety of renewable energy sources has broadened its adoption potential across diverse geographies. Given its scalability and certification readiness, Fischer-Tropsch technology is expected to remain the core production pathway for E-Kerosene.

The Aviation segment is projected to hold 62.9% of the E-Kerosene market revenue in 2025, making it the leading application area. This dominance stems from the aviation industry’s urgent need to transition away from fossil-based jet fuels to meet international decarbonization commitments.

E-Kerosene offers a drop-in fuel solution, requiring no modifications to existing aircraft engines or fueling infrastructure, which has accelerated airline interest. Regulatory frameworks such as SAF (Sustainable Aviation Fuel) mandates and voluntary carbon reduction programs have further stimulated adoption.

Airlines and airports are increasingly entering long-term offtake agreements with E-Kerosene producers to secure supply and stabilize costs. As global air travel demand recovers and sustainability targets tighten, the aviation sector is expected to remain the primary growth driver for E-Kerosene consumption.

The market has been emerging as a sustainable alternative to conventional fossil-based jet fuel, driven by growing environmental concerns and the aviation sector’s decarbonization goals. E-kerosene, produced from renewable feedstocks such as biomass, green hydrogen, and captured CO2, is used primarily in aviation and industrial applications requiring high-energy-density fuels. Its adoption reduces greenhouse gas emissions and mitigates reliance on crude oil.

Government incentives, global climate commitments, and increasing investment in synthetic fuel production technologies have supported market expansion. Challenges include high production costs, limited large-scale production capacity, and supply chain complexities.

The aviation industry has been a major driver for the market, as airlines seek to reduce carbon emissions from commercial flights. E-kerosene provides an alternative to traditional jet fuel with similar energy content and performance characteristics but significantly lower life-cycle greenhouse gas emissions. Airlines are increasingly entering purchase agreements and pilot programs with synthetic fuel producers to secure a reliable supply. Integration into airport fueling infrastructure and compatibility with existing engines allow immediate utilization without extensive retrofitting. Regulatory pressure, carbon taxation, and public demand for sustainable travel options have incentivized adoption. By incorporating e-kerosene into fuel blends, airlines can meet emission reduction targets and contribute to net-zero aviation initiatives, establishing a long-term market opportunity for renewable aviation fuels.

Advances in production technologies have expanded the feasibility and efficiency of e-kerosene manufacturing. Fischer-Tropsch synthesis, powered by renewable hydrogen and captured CO2, allows conversion of carbon-neutral feedstocks into high-quality synthetic fuels. Electrochemical and catalytic processes are being optimized to improve energy efficiency, yield, and scalability. Research into alternative feedstocks, including municipal waste, algae, and lignocellulosic biomass, has broadened supply options and reduced dependence on agricultural inputs. Continuous-flow reactors and modular production units facilitate decentralized production, supporting regional fuel availability. Enhanced monitoring, process control, and automation have also increased consistency and purity of e-kerosene. These technological advancements are making synthetic kerosene more commercially viable while supporting environmental objectives and enabling integration into existing fuel supply chains.

Beyond aviation, e-kerosene is being explored in industrial and specialty applications requiring high energy density and clean combustion. Industrial heating, power generation, and remote energy solutions benefit from its stable energy output and lower emissions profile. Specialty sectors, including aerospace testing, maritime applications, and laboratory usage, are evaluating e-kerosene for performance and regulatory compliance. The use of e-kerosene in blended formulations with conventional kerosene allows gradual transition in existing systems, reducing infrastructure modifications. Growing awareness of environmental performance and sustainability certifications is driving adoption in industries with carbon reporting requirements. The diversity of applications enhances market potential and encourages investment in production facilities capable of serving multiple sectors.

Despite its potential, the market faces challenges related to high production costs, limited feedstock availability, and scaling barriers. Large-scale commercial production requires substantial investment in renewable hydrogen, carbon capture, and synthetic fuel infrastructure. Fluctuations in energy prices and regulatory incentives affect economic feasibility, while transportation and storage protocols must meet safety and stability requirements. Certification processes for aviation and industrial applications are stringent, delaying market entry. The integration with existing fuel distribution networks requires coordination among multiple stakeholders, including airlines, fuel suppliers, and regulatory agencies. Overcoming these challenges through technological innovation, public-private partnerships, and strategic policy frameworks will be essential for long-term market growth and adoption of e-kerosene as a sustainable energy solution.

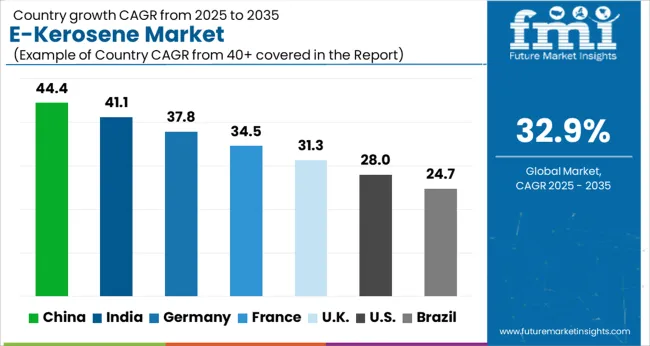

| Country | CAGR |

|---|---|

| China | 44.4% |

| India | 41.1% |

| Germany | 37.8% |

| France | 34.5% |

| UK | 31.3% |

| USA | 28.0% |

| Brazil | 24.7% |

China leads the market with a forecast growth rate of 44.4%, driven by rapid adoption in aviation, industrial heating, and sustainable energy applications. India follows at 41.1%, supported by expanding renewable fuel initiatives and increasing integration in the aviation sector. Germany records 37.8%, fueled by advancements in synthetic fuel technologies and stringent environmental regulations. The United Kingdom reaches 31.3%, where investment in alternative fuels and carbon reduction strategies supports market expansion. The United States maintains 28.0%, with growing use in aviation and industrial processes enhancing steady development. Collectively, these countries demonstrate a dynamic landscape of production, deployment, and technological innovation shaping the global trajectory of the E-kerosene market. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 44.4%, fueled by growing adoption in aviation, transportation, and industrial sectors. Increasing environmental regulations and government incentives are accelerating the shift from conventional fossil fuels to cleaner alternatives such as e-kerosene. The aviation industry is investing heavily in sustainable fuels to reduce carbon emissions and comply with global environmental standards. Industrial applications are leveraging e-kerosene for energy-efficient operations, while renewable energy integration supports production scaling. China’s commitment to decarbonization and sustainable aviation initiatives is expected to drive consistent market growth.

India is expected to grow at a CAGR of 41.1%, driven by rising demand in the aviation and industrial sectors. Government policies promoting sustainable energy and carbon reduction are boosting the market. Indian airlines are increasingly investing in cleaner fuel options to comply with emission regulations and improve environmental performance. The industrial sector is adopting e-kerosene for energy-efficient operations, particularly in chemical and processing industries. Expansion of renewable energy infrastructure is enhancing domestic production capacity. Rising awareness of climate change impacts and the need for greener energy solutions is further stimulating market adoption.

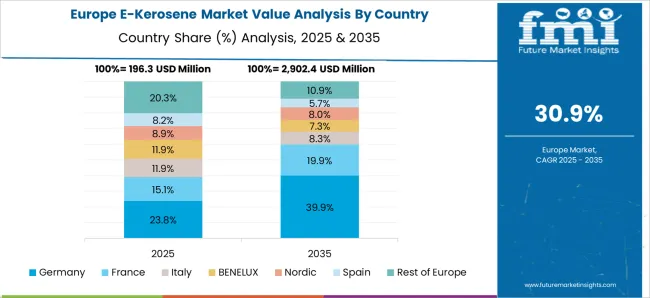

Germany is anticipated to grow at a CAGR of 37.8%, supported by increasing adoption in sustainable aviation and industrial applications. Focus on decarbonization and carbon-neutral fuel solutions is driving investments from private and public sectors. E-kerosene is being leveraged to reduce carbon emissions in aviation while supporting energy efficiency in industrial operations. Regulatory frameworks promoting low-carbon fuels and the European Union’s green energy targets are creating favorable conditions. German manufacturers are investing in advanced production technologies to meet quality and environmental standards, while collaborations with renewable energy providers are expanding production capacity.

The market in the United Kingdom is projected to grow at a CAGR of 31.3%, driven by the aviation and energy-intensive industrial sectors. Adoption is supported by government incentives for sustainable fuel and initiatives to meet carbon reduction targets. Airlines are prioritizing e-kerosene as a low-emission alternative to conventional jet fuel, while industrial players integrate it for cleaner energy solutions. Expansion of domestic production capabilities and investment in advanced fuel technologies are further boosting growth. Environmental awareness among stakeholders and commitment to sustainable operations are key factors contributing to the increasing penetration of e-kerosene.

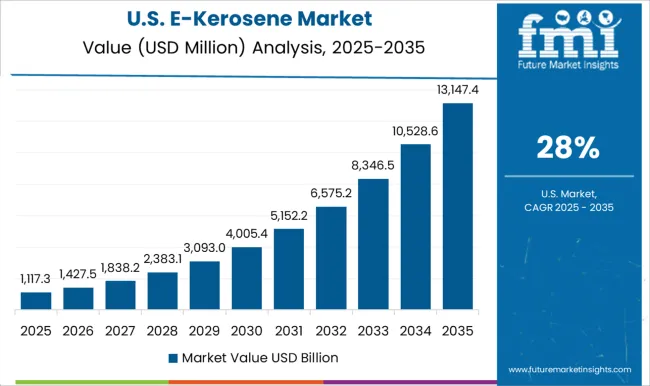

The United States market is expected to expand at a CAGR of 28.0%, driven by growing adoption in aviation, energy, and industrial sectors. Airlines are increasingly using e-kerosene to reduce carbon emissions, comply with regulations, and achieve sustainability goals. Industrial facilities are incorporating e-kerosene to enhance energy efficiency and transition to low-carbon fuel alternatives. Investment in renewable energy infrastructure and advanced fuel technologies is supporting domestic production capacity. Rising awareness of environmental impacts, combined with government policies promoting clean energy, is encouraging broader adoption across aviation and industrial segments.

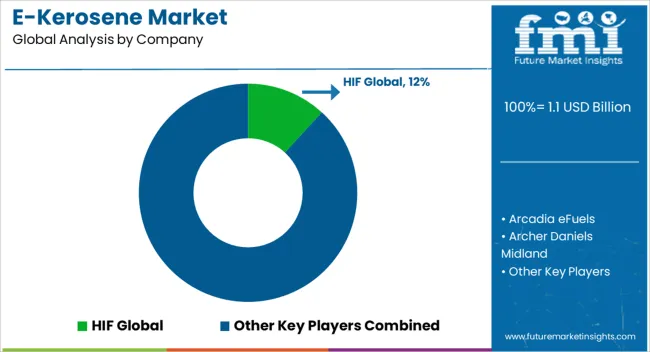

The market is gaining momentum as global aviation and transportation sectors move toward decarbonization and sustainable fuel alternatives. HIF Global and Arcadia eFuels lead the industry in developing large-scale e-kerosene production facilities, focusing on carbon-neutral fuels synthesized from renewable electricity and captured carbon dioxide. Archer Daniels Midland and ExxonMobil are leveraging their extensive feedstock supply chains and technological expertise to produce synthetic kerosene at an industrial scale, while also integrating carbon capture and storage solutions. Companies such as Ballard Power Systems, Ceres Power Holding, FuelCell Energy, and Electrochaea contribute to the market by advancing the hydrogen and electrochemical pathways essential for green kerosene production.

Climeworks and LanzaJet specialize in direct air capture technologies, enabling sustainable carbon sourcing for e-fuels. Sunfire, Liquid Wind, Norsk E-Fuel, Synhelion, eFuel Pacific, and Porsche are actively investing in pilot projects and commercial-scale production, emphasizing efficiency, scalability, and lifecycle carbon reduction.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Renewable Source | On-Site Solar and Wind |

| Technology | Fischer-Tropsch, eRWGS, and Others |

| Application | Aviation, Automotive, Marine, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HIF Global, Arcadia eFuels, Archer Daniels Midland, Ballard Power Systems, Ceres Power Holding, Clean Fuels Alliance America, Climeworks, eFuel Pacific, Electrochaea, ExxonMobil, FuelCell Energy, INERATEC, LanzaJet, Liquid Wind, Norsk E-Fuel, Porsche, Sunfire, and Synhelion |

| Additional Attributes | Dollar sales by fuel type and application, demand dynamics across aviation, industrial, and power sectors, regional trends in sustainable fuel adoption, innovation in production efficiency, energy density, and blending, environmental impact of reduced carbon emissions and lifecycle energy use, and emerging use cases in commercial aviation, shipping, and renewable energy integration. |

The global e-kerosene market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the e-kerosene market is projected to reach USD 18.2 billion by 2035.

The e-kerosene market is expected to grow at a 32.9% CAGR between 2025 and 2035.

The key product types in e-kerosene market are on-site solar and wind.

In terms of technology, fischer-tropsch segment to command 47.4% share in the e-kerosene market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA