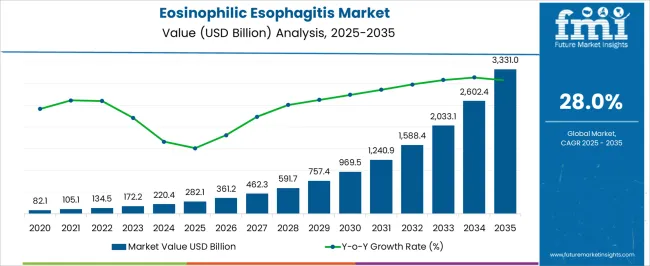

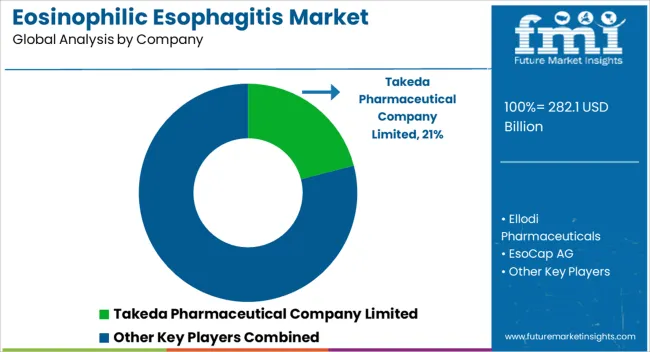

The Eosinophilic Esophagitis Market is estimated to be valued at USD 282.1 billion in 2025 and is projected to reach USD 3331.0 billion by 2035, registering a compound annual growth rate (CAGR) of 28.0% over the forecast period.

| Metric | Value |

|---|---|

| Eosinophilic Esophagitis Market Estimated Value in (2025 E) | USD 282.1 billion |

| Eosinophilic Esophagitis Market Forecast Value in (2035 F) | USD 3331.0 billion |

| Forecast CAGR (2025 to 2035) | 28.0% |

The Eosinophilic Esophagitis market is experiencing steady expansion, driven by rising disease awareness, improved diagnostic techniques, and increased clinical focus on managing chronic inflammatory conditions of the esophagus. The current landscape is shaped by ongoing research into biologics and targeted therapies, alongside a growing emphasis on early intervention and symptom control. Industry news and clinical updates have emphasized that corticosteroids and dietary management remain primary treatment options, but pipeline developments signal a shift toward personalized medicine approaches.

Press releases from pharmaceutical firms have also highlighted regulatory approvals and orphan drug designations, which are encouraging market entry and innovation. Additionally, patient advocacy and healthcare provider education programs are accelerating diagnosis rates, contributing to earlier treatment initiation.

In the near future, increased investment in gastrointestinal research, expanded access to specialty care, and improved reimbursement frameworks are expected to strengthen the treatment ecosystem These developments are positioning the market for continued growth and diversification of therapeutic strategies.

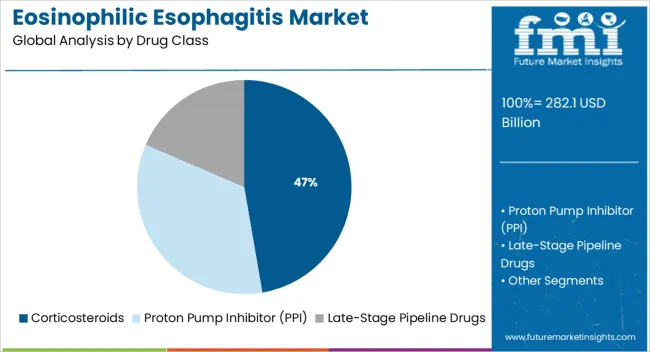

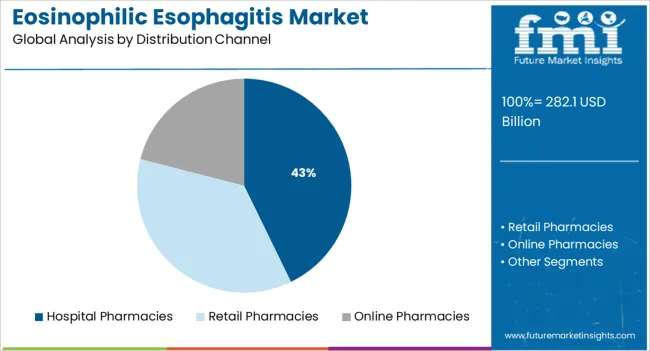

The market is segmented by Drug Class and Distribution Channel and region. By Drug Class, the market is divided into Corticosteroids, Proton Pump Inhibitor (PPI), and Late-Stage Pipeline Drugs. In terms of Distribution Channel, the market is classified into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The corticosteroids drug class is expected to account for 47.3% of the Eosinophilic Esophagitis market revenue share in 2025, establishing it as the dominant therapeutic category. This leading position is being supported by their established efficacy in reducing esophageal inflammation and alleviating symptoms in both pediatric and adult patients. Clinical guidelines and hospital treatment protocols have long recommended corticosteroids as first-line therapy, which has reinforced their widespread use.

The segment’s growth has also been driven by the availability of both systemic and topical corticosteroid formulations, providing flexible treatment options based on disease severity. Pharmaceutical communications and medical journals have reported that corticosteroids remain cost-effective and accessible, especially in hospital settings.

Their rapid onset of action and favorable risk-benefit profile have further contributed to consistent prescribing patterns among clinicians These advantages, combined with extensive clinical data and regulatory support, are expected to maintain corticosteroids as the preferred drug class within the treatment landscape.

The hospital pharmacies distribution channel is projected to hold 42.8% of the Eosinophilic Esophagitis market revenue share in 2025, making it the most prominent channel for medication dispensing. This position is being sustained by the high volume of corticosteroid prescriptions initiated and managed in inpatient and specialty care environments. Hospitals often serve as the first point of diagnosis and treatment initiation, particularly for moderate to severe cases requiring endoscopic evaluation or biopsies.

Medical news sources and institutional reports have highlighted the role of hospital pharmacies in ensuring access to on-label therapies and off-label corticosteroid preparations that are compounded for topical esophageal use. Additionally, hospital-based treatment allows for more structured patient monitoring and adverse event management, which has increased physician reliance on institutional pharmacies.

Their close integration with gastroenterology and allergy-immunology departments further supports efficient care delivery These operational and clinical advantages are expected to reinforce hospital pharmacies as the leading distribution channel in 2025.

The global demand for eosinophilic esophagitis is projected to increase at a CAGR of 28% during the forecast period between 2025 and 2035, reaching a total of USD 2,032.8 Billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 23%.

In the past decade, advances in EoE diagnosis have included endoscopic functional lumen imaging probes (FLIP), transnasal endoscopy (TNE), and noninvasive test methods such as mucosal impedance probes, EoE cytosponge, and esophageal string tests. There has not been clinical evidence to support biomarkers for EoE. EoE continues to evolve with the development of new diagnostic algorithms, treatment modalities, and noninvasive diagnostic methods. In order to manage EoE patients effectively, multimodal and multidisciplinary approaches are still required.?

Increasing public-private subsidies are expected for target investigation activities, the demand for minimally invasive surgery will increase, the number of children participating in sports will increase, and as technology advances throughout the world, new product inventions and developments will increase the profits for market players. As the internet diffusion rate increases, arthroscopic surgeries are increasingly implemented, and the elderly and obese population are growing throughout the world, the market is expected to expand at a higher rate in future years.

Extensive Uptake during the Pandemic Crisis for Developing Drugs provided a Major Boost in past years

Increasing awareness of EoE and conditions are expected to grow the market in the near future. In order to spread awareness of eosinophil-associated complaints, numerous awareness plans have been developed and implemented, which are predicted to drive market growth over the forecast period. As a non-profit organization, the American Enterprise for Eosinophilic Disorders (APFED) educates, hovers consciousness, supports, and advocates for patients and families dealing with eosinophil-associated conditions.?

Increasing funding for Research and Development programs and the development of new treatments for EoE is expected to further drive the market's growth in the future. As new technologies and drug delivery methods are developed in the coming years, it is expected that the market will continue to grow in the future. EGD requires invasive procedures for monitoring and diagnosis, so offices are seeking minimally invasive tests and noninvasive biomarkers.

Numerous New Initiatives Offer Lucrative Opportunities to Treat Eosinophilic Esophagitis

Market players are also taking strategic initiatives to develop products for eosinophilic esophagitis and market them effectively. As well, several new drugs are being developed for the treatment of inflammatory conditions of the esophagus. For example, Jorveza (budesonide), a medicine for treating eosinophilic oesophagitis, a condition affecting the esophagus, was recommended for marketing authorization by the European Medicines Agency (EMA).

Similarly, in December 2025, a professor of medicine at the University of Toronto who heads the Center for Esophageal Diseases and Swallowing, Prof. Evan Dellon, MD, MPH, will be leading an effort to get an allergy medicine, dupilumab, approved to treat high-grade eosinophilic esophagitis in adults and adolescents.

Economic Costs of Eosinophilic Esophagitis Impede Growth?

Market growth is expected to be hindered by regulatory approval challenges over the forecast period. Regulation authorities require a lot of effort and time to approve the drug, as regulatory authorities such as the USA Food and Drug Administration (FDA) companies that develop, manufacture, market, and distribute drugs face substantial and burdensome requirements.

Eosinophilic esophagitis is not widely understood and improper treatment can further harm the market if it is not treated timely. As a result of the high cost of treatment and the lack of information provided to patients, the eosinophilic esophagitis market in various regions has been constrained.

Healthcare Sector Expansion Boosts Eosinophilic Esophagitis Adoption

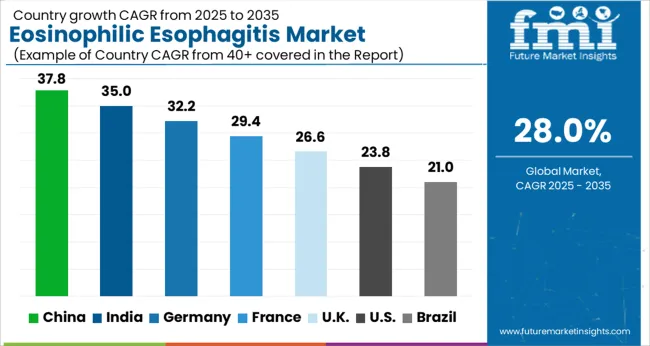

With an established healthcare infrastructure, high patient awareness, and growing EoE research prospects, North America held the biggest market share of 33% in 2025. There is an increase in demand for advanced treatments in North America, a rise in health care expenditures, and a high level of diagnosis in the region which contributes to the growth of this market. Because there is no FDA-approved drug for EoE and the burden of EoE has been increasing over the past few years, there is intense competition between market players to get a first-mover advantage.

According to the USA Government, about 160,000 people in the country suffer from eosinophilic esophagitis, which is treated with off-label drugs that have not been approved by the FDA, and dietary modifications. Healthcare costs associated with EoE in the United States alone are approximately USD 1.6 billion annually.

APFED (American Partnership for Eosinophilic Disorders) and Rare Diseases Clinical Research Network (CEGIR) are two organizations that provide research grants and funding, particularly in developed economies. For instance, The American Academy of Allergy, Asthma & Immunology (AAAAI) and the American Academy of Pediatrics and Pediatric Feeding Disorders (APFED) have awarded USD 140,000 for a two-year study to investigate to what extent the immune system interacts with foods that cause food allergy reactions. Moreover, the research will play a significant role in the identification of future drug targets as well as disease pathogenesis.

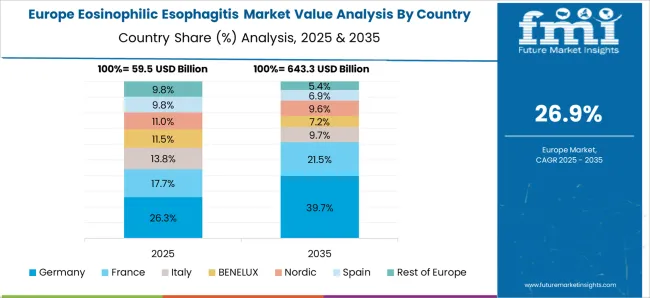

New Drugs and Medical Infrastructure are propelling Eosinophilic Esophagitis Treatment Demand in Europe?

As the forecast period continues to unfold, the Europe region is projected to exhibit the fastest growth rate due to the increasing disposable incomes, the large population of patients who suffer from EoE Oesophagitis, and an increased focus on healthcare during the forecast period.

Research and development prospects are expected to be positively affected by countries such as the UK that offer attractive investment opportunities for clinical research. For instance, EsoCap supports the first Europe EoE Day in May 2025 of the European Society of Eosinophilic Oesophagitis. EoE diagnosis and treatment pathways are the focus of the campaign, which is the first of its kind in Europe. Increasing public awareness will increase screening and better diagnosis rates, which are critical for effectively treating EoE since early intervention is key.

Patients with GERD Disease are expected to Increase PPI Production at a Significant Rate

In the field of gastroesophageal reflux disease (GERD), proton pump inhibitors are the gold standard medication. Various factors are driving the growth of this market, including an increase in GERD cases, the acceptance of new drug delivery systems, as well as the growth in proton pump inhibitor sales. A rise in the prevalence of gastrointestinal disorders, including barrettes esophagus, duodenal ulcers, and non-erosive reflux disease (NERD), is likely to fuel the market growth for proton pump inhibitors in the coming years.

In the last few years, proton pump inhibitors have become more widely prescribed in ambulatory settings in the US. The marketing of brands is also a major expense for many firms. The American Board of Internal Medicine has also acknowledged the widespread use of PPIs; therefore, a campaign was launched to promote their appropriate use. Furthermore, the market will also be affected by product launches in a generic category. For instance, Hanmi Pharmaceutical aims to address the gastritis treatment market with Esomezol DR SR Cap. 10 mg (esomeprazole magnesium trihydrate), or Esomezol DR 10 mg, which was released recently. Watchers of the industry pay attention to which medicine or component will prevail in the fierce competition over gastritis treatments.

Demand for Eosinophilic Esophagitis in Hospital Pharmacies to Gain Traction

EoE treatments for GERD are becoming increasingly popular in hospitals, which is leading to a 42.1% market share in 2025. It is expected that the segment will continue to dominate during the forecast period due to rising healthcare expenditures globally, growing patient awareness levels, and advanced hospital infrastructure in developed countries.

A tenfold increase in EoE-related hospitalizations from 2010 to 2020 has been observed in US hospital admission rates, along with an associated increase in mean costs. The high risk of side effects and risks associated with medicines may further increase the market sales of medicines in hospital pharmacies.

Some of the start-ups in the eosinophilic esophagitis market? include?

Manufacturers can increase production and meet consumer demand with strategic partnerships, boosting revenue and market share. End users will benefit from natural drugs for the treatment of EoE by leveraging new products and technologies. Strategic partnerships can help companies expand their production capabilities.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 282.1 billion |

| Market Value in 2035 | USD 3331.0 billion |

| Growth Rate | CAGR of 28% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Drug Class, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa (MEA) |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, The UK France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Ellodi Pharmaceuticals; EsoCap AG; GlaxoSmithKline plc.; Teva Pharmaceutical Industries Ltd.; Cipla Limited; Sun Pharmaceutical Industries Limited; AstraZeneca Plc; Sanofi S.A.; Arena Pharmaceuticals, Inc.; Takeda Pharmaceutical Company Limited; Revolo Biotherapeutics; Allakos Inc. |

| Customization | Available Upon Request |

The global eosinophilic esophagitis market is estimated to be valued at USD 282.1 billion in 2025.

The market size for the eosinophilic esophagitis market is projected to reach USD 3,331.0 billion by 2035.

The eosinophilic esophagitis market is expected to grow at a 28.0% CAGR between 2025 and 2035.

The key product types in eosinophilic esophagitis market are corticosteroids, _budesonide, _fluticasone, proton pump inhibitor (ppi), _omeprazole, _esomeprazole, _others, late-stage pipeline drugs, _dupixent, _apt-1011, _lirentelimab (ak002), _cendakimab, _etrasimod, _tak-721 and _omilancor (bt-11).

In terms of distribution channel, hospital pharmacies segment to command 42.8% share in the eosinophilic esophagitis market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eosinophilic Granulomatosis with Polyangiitis (EGPA) Treatment Market – Trends & Therapeutic Advances 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA