ePrescribing Market Size and Share Forecast Outlook From 2025 to 2035

The ePrescribing market is growing rapidly, driven by healthcare digitalization, rising demand for error-free prescription management, and supportive government initiatives promoting electronic health infrastructure. The technology facilitates improved communication between healthcare providers and pharmacies, reducing medication errors and enhancing patient safety.

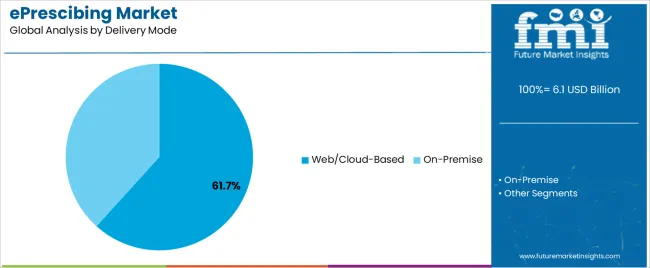

Integration with electronic health records and clinical decision support systems has elevated operational efficiency and care coordination. Cloud-based deployment models are gaining prominence due to their scalability, remote accessibility, and cost-effectiveness.

Increasing focus on data security and interoperability continues to shape industry advancements. With healthcare systems worldwide embracing digital transformation, the ePrescribing market is positioned for sustained expansion in both developed and emerging economies..

Quick Stats for ePrescibing Market

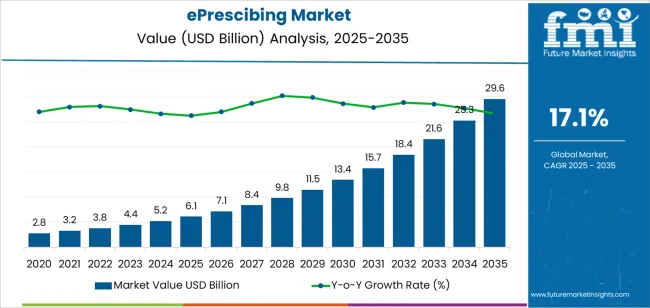

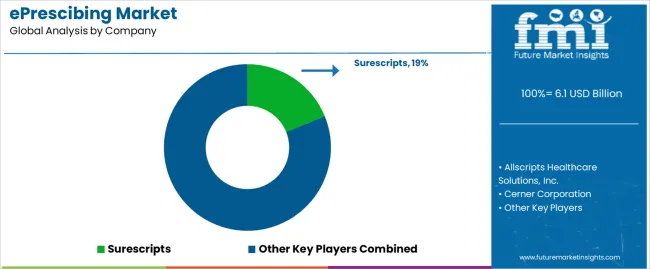

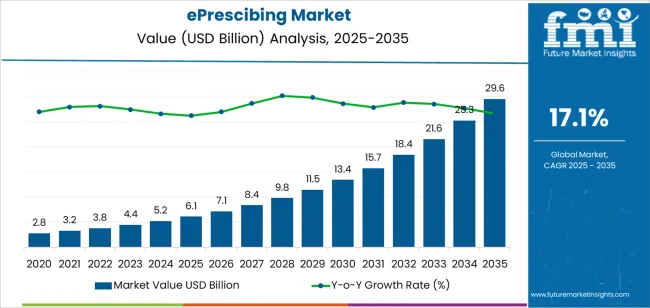

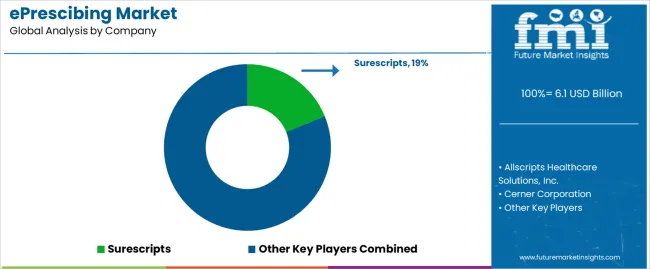

- ePrescibing Market Industry Value (2025): USD 6.1 billion

- ePrescibing Market Forecast Value (2035): USD 29.6 billion

- ePrescibing Market Forecast CAGR: 17.1%

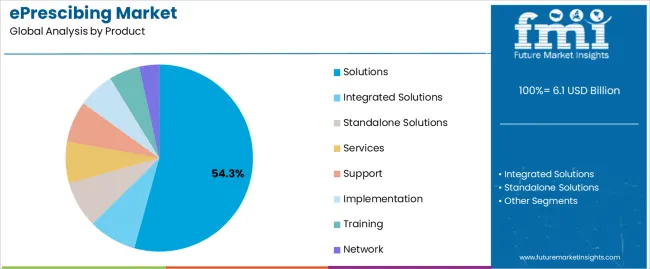

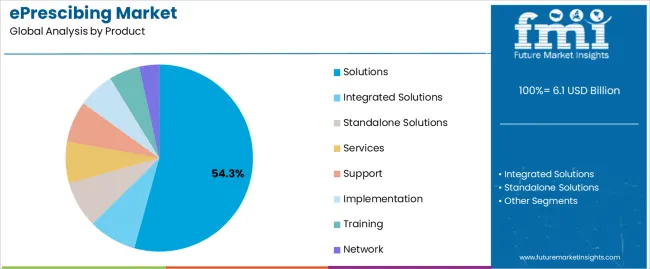

- Leading Segment in ePrescibing Market in 2025: Solutions (54.3%)

- Key Growth Region in ePrescibing Market: North America, Asia-Pacific, Europe

- Top Key Players in ePrescibing Market: Surescripts, Allscripts Healthcare Solutions, Inc., Cerner Corporation, GE Healthcare, RelayHealth Corporation, Athenahealth, Inc., DrFirst, Practice Fusion Inc., Medical Information Technology, Inc., Henry Schein, Inc.

| Metric |

Value |

| ePrescibing Market Estimated Value in (2025 E) |

USD 6.1 billion |

| ePrescibing Market Forecast Value in (2035 F) |

USD 29.6 billion |

| Forecast CAGR (2025 to 2035) |

17.1% |

Segmental Analysis

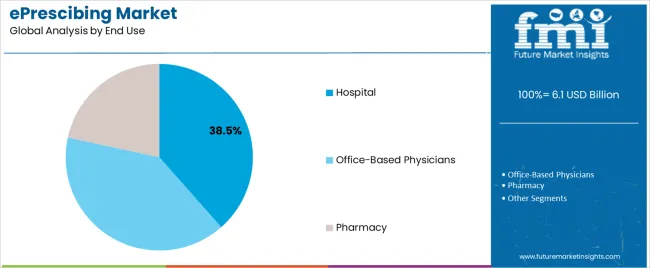

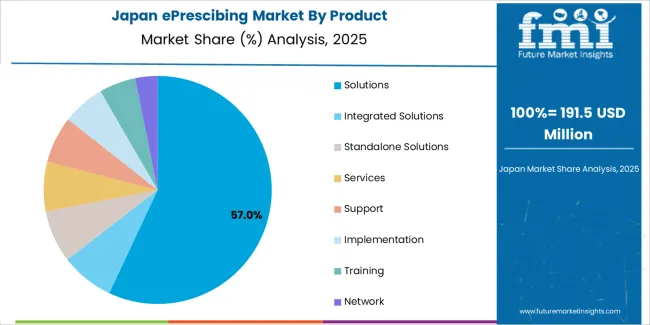

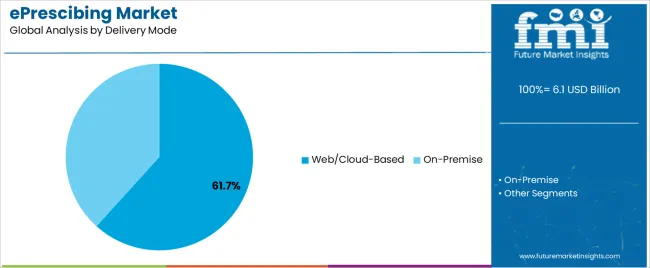

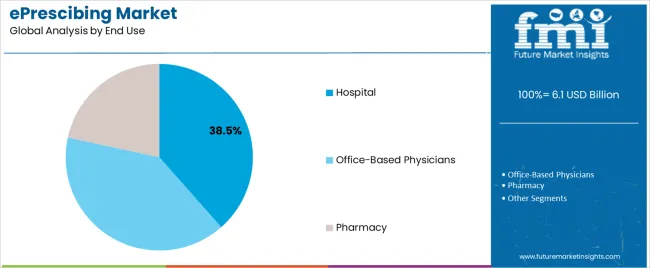

The market is segmented by Product, Delivery Mode, End Use, Usage Methods, Substances, and Specialities and region. By Product, the market is divided into Solutions, Integrated Solutions, Standalone Solutions, Services, Support, Implementation, Training, and Network. In terms of Delivery Mode, the market is classified into Web/Cloud-Based and On-Premise. Based on End Use, the market is segmented into Hospital, Office-Based Physicians, and Pharmacy. By Usage Methods, the market is divided into Handheld and Computer-Based Devices. By Substances, the market is segmented into Controlled Substances and Non-Controlled Substances. By Specialities, the market is segmented into Sports Medicine, Oncology, Neurology, Cardiology, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Solutions Segment

The solutions segment leads the product category with approximately 54.30% share of the ePrescribing market. This dominance is supported by the rising adoption of comprehensive software platforms that facilitate end-to-end prescription management, from drug selection to pharmacy dispensing.

The segment benefits from growing integration with clinical decision support systems, ensuring accuracy and compliance with healthcare standards. Increasing demand for cloud-based and interoperable solutions has further driven market penetration.

Ongoing regulatory support for electronic health system standardization continues to enhance adoption. With healthcare providers prioritizing digital efficiency and patient safety, the solutions segment is expected to retain its lead position in the forecast period..

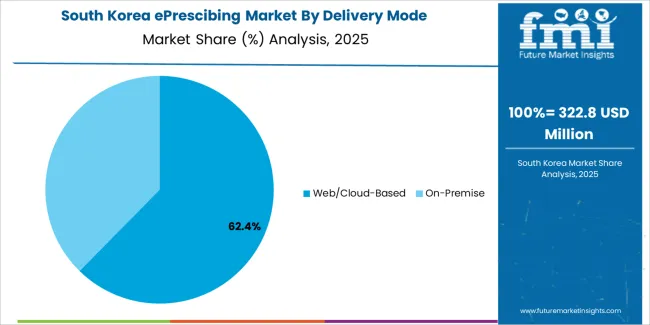

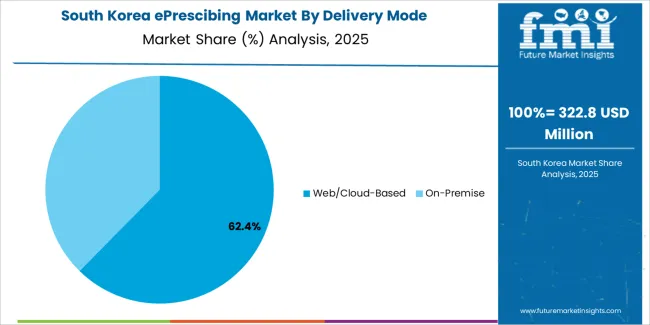

Insights into the Web/Cloud-Based Segment

The web/cloud-based segment dominates the delivery mode category, accounting for approximately 61.70% share. Its leadership is attributed to the scalability, cost efficiency, and accessibility of cloud infrastructure, which enable seamless integration across healthcare networks.

Providers are increasingly adopting cloud-based systems to support remote access, real-time data updates, and enhanced security compliance. The model also simplifies system maintenance and reduces IT overheads for healthcare organizations.

As telemedicine and remote care continue to expand, web/cloud-based ePrescribing solutions are expected to remain the preferred deployment mode. Continuous innovation in cybersecurity and interoperability standards will further strengthen this segment’s growth trajectory..

Insights into the Hospital Segment

The hospital segment accounts for approximately 38.50% share of the ePrescribing market’s end-use category, underscoring its primary role in driving adoption. Hospitals rely on ePrescribing to enhance medication accuracy, improve pharmacy coordination, and ensure regulatory compliance.

Integration with inpatient management systems and electronic health records has optimized prescription workflows, reducing administrative burdens. The segment’s growth is also supported by government mandates promoting digital health infrastructure in hospital networks.

With ongoing expansion of healthcare facilities and increasing emphasis on patient safety, the hospital segment is expected to maintain its leading position within the ePrescribing market..

Emerging Opportunities in the Global ePrescribing Market

- The increasing adoption of electronic health records (EHRs) by healthcare providers.

- Rising need for more accurate and efficient prescribing reduces errors and improving patient safety.

- Growing need to reduce healthcare costs by minimizing waste and improving medication adherence is expected to create lucrative opportunities over the forecast period.

- The demand for mobile healthcare solutions is increasing. Patients are becoming more comfortable with using mobile apps and other digital tools to manage their health, and ePrescribing systems are no exception.

- Growing need for healthcare providers to streamline their workflows makes mobile prescribing solutions the best tool.

- Pharmaceutical companies can also benefit from the ePrescribing market by leveraging data to improve medication adherence and patient outcomes. By analyzing prescribing patterns, pharmaceutical companies can identify opportunities to improve their products or develop new treatments.

Factors Restraining the Growth of the ePrescribing Market

- Interoperability is expected to hamper the market during the forecast period.

- EHRs are often designed by different vendors and have varying levels of compatibility, which can make it difficult to share data across different systems. The difficulty leads to errors and duplication of data, which can ultimately compromise patient safety and the integrity of the healthcare system.

- The lack of standardization leads to medication errors, which can be dangerous for patients and can also result in additional healthcare costs.

- Rising concerns regarding data privacy and security also restrict market growth.

- As more patient data is digitized and shared across different platforms, there is an increased risk of data breaches and cyberattacks.

- Ensuring the security and privacy of patient data is crucial to maintain patient trust and credibility of the healthcare system.

ePrescribing Industry Analysis by Top Investment Segments

The Solutions Segment Dominates the Market by Product Type

| Attributes |

Details |

| Top Product Type |

Solutions |

| CAGR from 2025 to 2035 |

26.9% |

- The complete end-to-end solution by healthcare providers drives the segment’s growth in the market.

- Increasing need for reducing medication errors, increasing patient safety, and improving efficiency in the prescription process drive the segment’s growth.

- Solutions are designed to integrate with electronic health records (EHRs), enabling seamless tracking of patient medication histories and reducing the risk of prescription drug abuse.

- As a result, healthcare providers are increasingly adopting e-prescribing solutions, driving the growth of the solutions segment.

The Web/Cloud-Based Segment Dominates the Market by Delivery Mode

| Attributes |

Details |

| Top Delivery Mode |

Web/Cloud-Based |

| CAGR from 2025 to 2035 |

26.7% |

- Rising need for convenience and accessibility is boosting the market.

- By using web-based e-prescribing, healthcare providers can easily access patient information from anywhere with an internet connection, which allows them to quickly and securely prescribe medications to patients without having to be in the same location as them.

- Web-based e-prescribing systems often come with features such as drug interaction checking and patient history tracking, which can help reduce the risk of medication errors and improve patient outcomes.

- Cloud-based e-prescribing allows for easier integration with other healthcare IT systems, such as electronic health records (EHRs), which can help streamline workflow and improve overall efficiency in healthcare settings.

Analysis of Top Countries, Regulating and Adopting ePrescribing Platforms

| Countries |

CAGR through 2025 to 2035 |

| United States |

27.3% |

| United Kingdom |

27.6% |

| China |

27.4% |

| Japan |

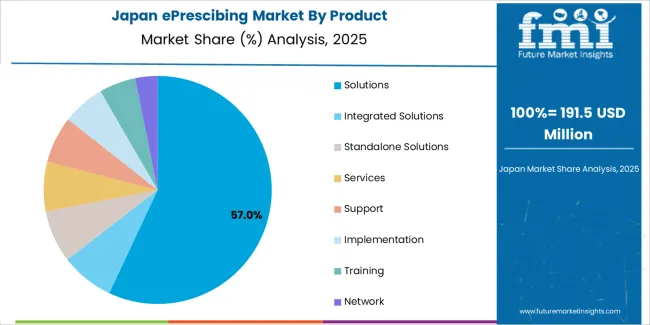

28.6% |

| South Korea |

28.8% |

Surge in Oil and Gas Production in the United States

- The increasing need for accuracy and efficiency in healthcare in the United States.

- Electronic prescribing is much more accurate than traditional paper-based methods, reducing the risk of medication errors and improving patient safety.

- Growing need for convenience for healthcare providers and patients in the United States.

- In line with ePrescribing, healthcare providers can easily send prescriptions to pharmacies, eliminating the need for patients to physically visit their doctors to pick up paper prescriptions.

- ePrescribing not only saves time but also reduces the chances of prescription errors.

- The government has also been promoting the adoption of ePrescribing.

- The Centers for Medicare & Medicaid Services (CMS) have introduced incentive programs to encourage healthcare providers to adopt electronic prescribing.

- The incentive programs aim to improve healthcare quality, reduce costs, and promote the use of technology in healthcare.

Increasing Use of Solid Sulphur in the Chemical Industry in the United Kingdom

- By implementing electronic prescribing systems, healthcare providers can save time and reduce the risk of errors associated with traditional paper-based prescribing methods. Implementation leads to safer and more effective patient care, as well as lower costs and increased productivity for healthcare providers.

- Rising focus on patient safety in the United Kingdom is driving the market demand.

- With electronic prescribing, healthcare providers can reduce the risk of medication errors, such as prescribing the wrong medication or incorrect dosage.

- Electronic prescribing systems can also help to identify potential drug interactions or allergies, which can prevent adverse reactions and improve patient outcomes.

- The adoption of digital technologies in the healthcare industry has made ePrescribing more accessible and user-friendly in the United Kingdom.

- With the use of smartphones, tablets, and other mobile devices, healthcare providers can access patient records and prescribing information quickly and easily, improving the accuracy and efficiency of the prescribing process.

Rising Focus on Agriculture Development in China

- The increasing population of elderly citizens who require medication management.

- With the use of ePrescribing, doctors and pharmacists can easily access patient medication histories, avoid prescription errors, and improve medication adherence.

- The government's push for healthcare reforms in China is also driving the market forward.

- The Chinese government has recently introduced policies to promote the use of electronic medical records and other healthcare technologies, including ePrescribing.

- The government initiatives have led to increased investments in ePrescribing systems by healthcare providers and hospitals.

- Increasing need to reduce healthcare costs and boost efficiency. With electronic prescriptions, doctors can quickly and accurately send prescriptions to pharmacies, reducing the need for paper-based processes.

- ePrescribing reduces the risk of prescription errors, which can lead to adverse drug events and other negative health outcomes.

Increasing Production of Fertilizers in Japan

- Increasing elimination of paper prescriptions and widespread adoption of electronic medical records (EMRs) in Japan is fueling market growth.

- ePrescribing not only saves time but also reduces errors, as illegible handwriting and incorrect dosages can be avoided.

- It helps prevent prescription fraud and abuse, as the system can track prescriptions and monitor patient history.

- With EMRs, doctors can access patient information easily and quickly, enabling them to make informed decisions about prescriptions.

- ePrescribing can be integrated with EMRs, making the process even more seamless.

- The COVID-19 pandemic has accelerated the adoption of ePrescribing in Japan.

- With social distancing measures in place, people are avoiding unnecessary visits to hospitals and clinics.

- ePrescribing allows doctors to prescribe medicines remotely, reducing the need for in-person consultations.

Expansion of the Petrochemical Industry in South Korea

- Increasing need to reduce medication errors in South Korea. The use of paper-based prescriptions can increase the risk of medication errors, such as prescribing the wrong dosage or medication.

- ePrescribing can help to reduce these errors by providing doctors with real-time access to a patient's medication history, allergies, and other relevant information.

- Increased efficiency in healthcare delivery allows doctors to quickly and easily send prescriptions to pharmacies, reducing the time spent on administrative tasks with increased focus on patient care.

- ePrescribing can help to reduce the number of medication-related phone calls between doctors and pharmacies, further streamlining the healthcare delivery process.

- The growing need for better healthcare services is also contributing to the increase in demand for ePrescribing in South Korea.

- Patients are increasingly demanding more convenient and efficient healthcare services, and ePrescribing can help to meet these demands by providing patients with a more streamlined and convenient prescription process.

Key Players and Market Concentration in the ePrescribing Industry

The ePrescribing market is constantly evolving with the emergence of new players in the industry. Companies offer a range of solutions for electronic prescribing, such as software platforms, mobile applications, and cloud-based services.

Additionally, several smaller companies and start-ups are entering the market and providing innovative solutions to meet the growing demand for e-prescribing services. Overall, the competition in the market is intense, and companies are constantly striving to differentiate themselves by offering unique features and capabilities.

Recent Developments

- In 2024, DrFirst, a United States-based company, collaborated with ID.me to streamline the process of identity verification when using iPrescribe, the mobile e-prescribing application developed by DrFirst.

Leading Suppliers in the Global ePrescribing Market

- Surescripts

- Allscripts Healthcare Solutions, Inc.

- Cerner Corporation

- GE Healthcare

- RelayHealth Corporation

- Athenahealth, Inc.

- DrFirst, Practice Fusion Inc.

- Medical Information Technology, Inc.

- Henry Schein, Inc.

Key Shifting Preferences Covered in the ePrescribing Market Report

- Global ePrescribing Market Trends

- Incentive Programs in Key Countries Fostering Adoption of Electronic Prescription

- Top ePrescribing Software Developers

- Innovations in ePrescribing Solution Market

- eRX Software Adoption Trends in Key Regions

Top Segments Studied in the ePrescribing Market

By Product:

- Solutions

- Integrated Solutions

- Standalone Solutions

- Services

- Support

- Implementation

- Training

- Network

By Delivery Mode:

- Web/Cloud-Based

- On-premise

By End Use:

- Hospital

- Office-based Physicians

- Pharmacy

By Usage Methods:

- Handheld

- Computer-Based Devices

By Substances:

- Controlled Substances

- Non-controlled Substances

By Specialities:

- Oncology

- Sports Medicine

- Neurology

- Cardiology

- Others

By Region:

- North America

- Latin America

- East Asia

- South Asia

- Europe

- Oceania

- MEA

Frequently Asked Questions

How big is the eprescibing market in 2025?

The global eprescibing market is estimated to be valued at USD 6.1 billion in 2025.

What will be the size of eprescibing market in 2035?

The market size for the eprescibing market is projected to reach USD 29.6 billion by 2035.

How much will be the eprescibing market growth between 2025 and 2035?

The eprescibing market is expected to grow at a 17.1% CAGR between 2025 and 2035.

What are the key product types in the eprescibing market?

The key product types in eprescibing market are solutions, integrated solutions, standalone solutions, services, support, implementation, training and network.

Which delivery mode segment to contribute significant share in the eprescibing market in 2025?

In terms of delivery mode, web/cloud-based segment to command 61.7% share in the eprescibing market in 2025.