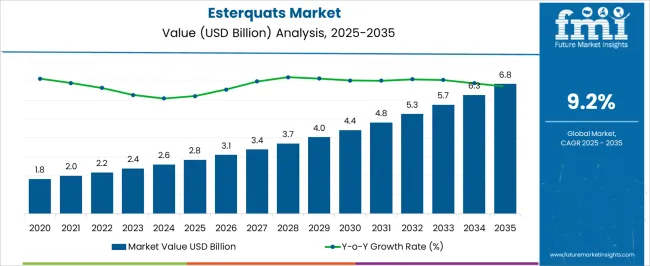

The esterquats market, valued at USD 2.8 billion in 2025 and projected to reach USD 6.8 billion by 2035 at a CAGR of 9.2%, presents a strong absolute dollar opportunity over the forecast period. Between 2025 and 2030, the market grows from USD 2.8 billion to USD 4.0 billion, creating an opportunity of USD 1.2 billion in just five years. This phase is driven by expanding use in household cleaning and fabric care, where esterquats serve as key conditioning agents. The consistent year-on-year increase, ranging from USD 0.3 to 0.4 billion annually, reflects strong baseline demand growth.

From 2030 to 2035, the market expands further from USD 4.0 billion to USD 6.8 billion, unlocking an additional USD 2.8 billion in opportunity within five years. This is the most lucrative phase, as annual increments accelerate to nearly USD 0.5 to 0.6 billion per year, reflecting broader adoption across end-use sectors. The total absolute dollar opportunity from 2025 to 2035 stands at USD 4.0 billion, more than doubling the market size. This trajectory highlights both the near-term incremental gains and the long-term scale of expansion, ensuring esterquats remain a high-value revenue stream within the chemical ingredients market.

| Metric | Value |

|---|---|

| Esterquats Market Estimated Value in (2025 E) | USD 2.8 billion |

| Esterquats Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The esterquats market, valued at USD 2.8 billion in 2025 and projected to reach USD 6.8 billion by 2035 at a CAGR of 9.2%, is closely tied to several parent markets, each contributing significantly to growth. The surfactants market accounts for nearly 30%, as esterquats are widely used as cationic surfactants in detergents and cleaning products. The fabric care market represents around 20%, driven by esterquats’ strong role in softening and conditioning agents. The personal care and cosmetics market contributes about 15%, with growing applications in hair conditioners and skin care. The household cleaning products market accounts for 12%, reflecting the presence of esterquats in multipurpose cleaners and related formulations.

The industrial cleaning chemicals market is expected to grow by roughly 8%, driven by increased usage in institutional and commercial cleaning products. Additionally, the chemical ingredients market accounts for 7%, as esterquats serve as specialty additives. The agrochemicals formulation market holds nearly 5%, where esterquats are used as dispersants and enhancers. The remaining 3% comes from niche applications across allied chemical industries. This distribution shows how esterquats are integrated across multiple parent markets, with surfactants and fabric care leading, while personal care and industrial usage steadily expand the demand base through the forecast period.

The esterquats market is experiencing consistent growth, driven by increasing demand for environmentally friendly and biodegradable conditioning agents. These compounds are widely recognized for their superior softening and antistatic properties, making them valuable in both personal care and fabric care applications. The shift toward sustainable and non-toxic formulations is influencing manufacturers to adopt esterquats over conventional quaternary ammonium compounds, especially in regions with strict environmental regulations.

Rising consumer awareness regarding eco-labels and green certifications is also boosting demand. Advancements in formulation technologies are improving the compatibility of esterquats with diverse product bases, enabling their incorporation into a broader range of applications.

Growth is further supported by the expansion of the personal care sector, particularly in emerging markets where premium hair care and skin care products are seeing rapid adoption. The balance between high performance, safety, and environmental compliance positions Esterquats as a preferred choice for manufacturers, ensuring continued growth potential in the coming years as sustainable product trends intensify globally.

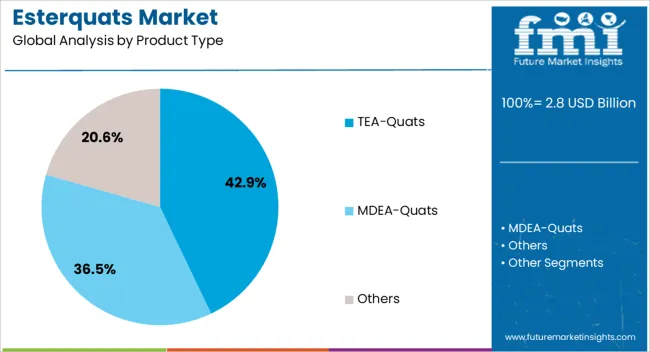

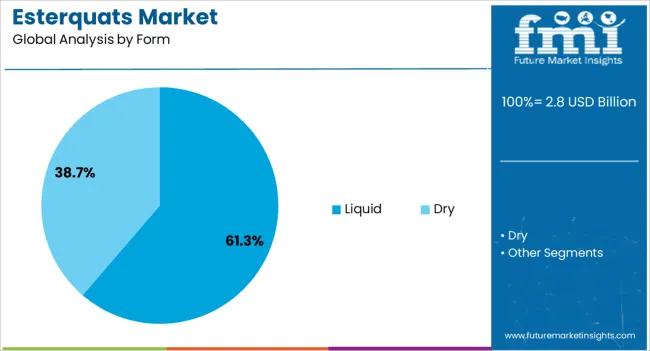

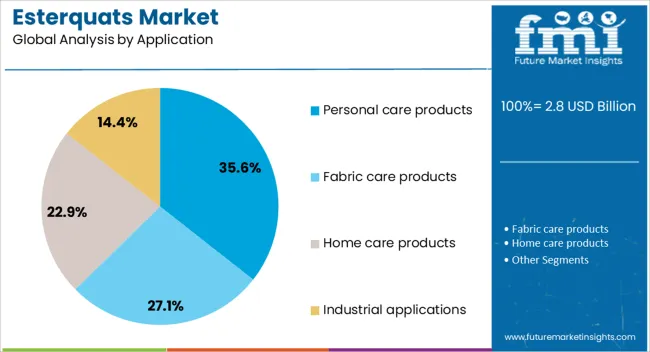

The esterquats market is segmented by product type, form, application, and geographic regions. By product type, esterquats market is divided into TEA-Quats, MDEA-Quats, and Others. In terms of form, esterquats market is classified into Liquid and Dry. Based on application, esterquats market is segmented into Personal care products, Fabric care products, Home care products, and Industrial applications. Regionally, the esterquats industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The TEA-quats segment is projected to hold 42.9% of the esterquats market revenue share in 2025, making it the leading product type. This leadership is supported by its proven effectiveness as a conditioning agent with excellent biodegradability and mildness on skin and hair. Its chemical structure provides superior cationic activity, enhancing softening performance in both personal care and fabric care formulations.

The segment benefits from its versatility, as TEA-quats are easily incorporated into both rinse-off and leave-on products without compromising stability. Rising consumer demand for eco-friendly alternatives in hair conditioners, body lotions, and premium fabric softeners is accelerating adoption. The regulatory compliance and positive environmental profile of TEA-quats also contribute to their preference over older-generation conditioning agents.

Continuous improvements in production methods are ensuring higher purity levels and consistent quality, further strengthening its position in global markets With sustainability becoming a decisive purchasing factor, TEA-quats are expected to maintain their dominance through their balance of performance, safety, and environmental responsibility.

The liquid form segment is anticipated to account for 61.3% of the esterquats market revenue share in 2025, positioning it as the leading form type. This dominance is being driven by the ease of handling, faster solubility, and high formulation flexibility offered by liquid esterquats. Manufacturers favor liquid forms for their ability to blend seamlessly into a wide variety of product bases, reducing processing time and improving production efficiency.

The segment is benefiting from growing demand in applications requiring rapid dispersion, such as liquid fabric softeners, hair conditioners, and skin care creams. Additionally, the liquid format reduces energy consumption during production, aligning with sustainability goals.

Expanding industrial and consumer applications, coupled with increasing investments in advanced manufacturing and storage systems, are reinforcing the segment’s market position As demand grows for cost-effective, high-performance, and environmentally sustainable ingredients, the liquid form is expected to retain its leadership in the esterquats market.

The personal care products application segment is expected to capture 35.6% of the esterquats market revenue share in 2025, making it the largest application segment. This dominance is being fueled by the rapid growth of the global personal care industry, particularly in premium hair care and skin care categories. Esterquats are highly valued in personal care formulations for their superior conditioning, emulsifying, and sensory-enhancing properties, which improve product performance and consumer satisfaction.

The segment benefits from increasing consumer preference for eco-friendly, biodegradable ingredients in shampoos, conditioners, lotions, and creams. Innovation in formulations, including the development of multifunctional products, is further driving the adoption of these products. The shift toward sulfate-free and naturally derived products is creating opportunities for esterquats as they align with clean beauty trends.

Rising disposable incomes, urbanization, and heightened awareness of personal grooming in emerging economies are also contributing to demand growth. With environmental compliance and performance efficiency as key selection criteria, esterquats are expected to maintain a strong foothold in the personal care sector.

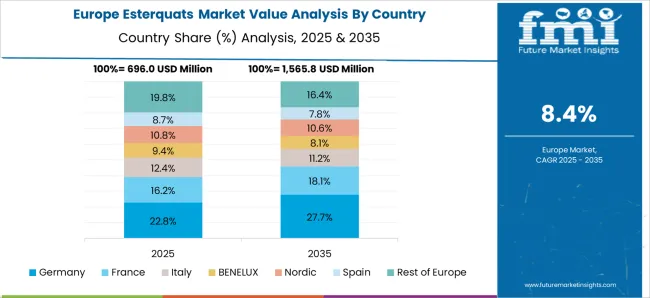

The esterquats market is expanding as demand grows for fabric softeners, personal care products, and biodegradable surfactants. North America and Europe lead adoption due to advanced laundry care markets and strong environmental regulations favoring eco-friendly alternatives. Asia-Pacific shows rapid growth driven by urbanization, rising disposable incomes, and expanding home and personal care consumption. Producers differentiate through softness performance, biodegradability, and cost efficiency. Regional differences in regulations, consumer preferences, and raw material availability significantly shape market expansion and competitive positioning globally.

Adoption of esterquats is strongly driven by their widespread use in fabric softeners and laundry care formulations. North America and Europe emphasize premium products with strong softening performance and environmentally friendly profiles. Asia-Pacific markets prioritize cost-effective formulations for high-volume consumption, particularly in rapidly urbanizing regions with rising detergent demand. Differences in consumer washing habits, product performance expectations, and disposable incomes influence esterquat selection and formulation strategies. Leading producers offer highly biodegradable, efficient esterquats for concentrated fabric softeners, while regional players provide cost-sensitive, volume-oriented options. Demand contrasts between premium and mass-market laundry care shape adoption, product positioning, and competitiveness in the global esterquats market.

Environmental concerns and regulatory frameworks significantly affect esterquat adoption. North America and Europe enforce strict biodegradability and toxicity standards, making esterquats attractive replacements for traditional quats in detergents and fabric softeners. Asia-Pacific markets show mixed regulatory enforcement but increasing interest in biodegradable surfactants, particularly in countries with growing environmental awareness. Differences in regulatory stringency, certification processes, and consumer perception of eco-friendly products affect adoption rates and market acceptance. Leading suppliers invest in high-purity, biodegradable esterquats aligned with EU REACH and EPA standards, while regional manufacturers focus on practical compliance. Regulatory and environmental contrasts shape adoption, credibility, and competitive differentiation globally.

The production of esterquats depends heavily on the availability and cost of fatty acids, amines, and other raw materials. North America and Europe benefit from established chemical supply chains and consistent raw material availability. Asia-Pacific, however, faces price fluctuations linked to palm oil and fatty acid markets, affecting production stability and cost structures. Differences in feedstock sourcing, pricing, and sustainability certification influence competitiveness and supply reliability. Leading suppliers secure integrated sourcing and long-term contracts for stable production, while regional players rely on variable, cost-sensitive supply chains. Raw material contrasts significantly shape production economics, product pricing, and competitiveness globally.

Esterquats are gaining traction beyond laundry care, particularly in personal care and specialty chemical applications. North America and Europe prioritize esterquats in hair conditioners, skincare formulations, and eco-friendly emulsifiers due to their mildness and biodegradability. Asia-Pacific markets are adopting esterquats for haircare and niche personal care, striking a balance between cost and performance. Differences in consumer grooming habits, spending levels, and formulation trends affect adoption. Leading suppliers develop multi-functional esterquats tailored for conditioning and emulsification, while regional players focus on cost-effective solutions for everyday use. Diversification into personal care and specialty segments strengthens market growth, adoption flexibility, and competitiveness globally.

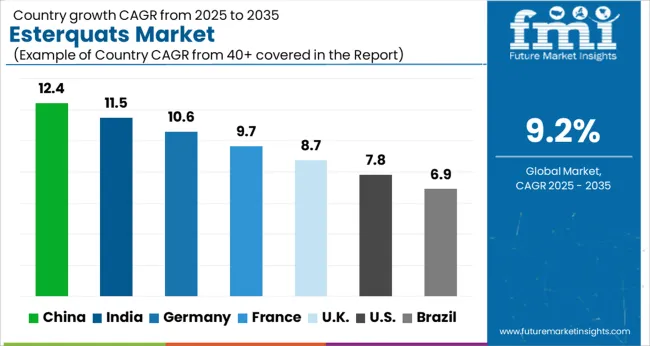

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The global esterquats market is forecast to expand at a 9.2% CAGR through 2035, supported by rising demand for fabric softeners, personal care, and cleaning formulations. Among BRICS nations, China led with 12.4% growth as large-scale production facilities and widespread utilization across textile and household care sectors accelerated market expansion, while India at 11.5% growth boosted capacity and adoption in detergents and industrial cleaning. In the OECD region, Germany at 10.6% strengthened manufacturing and compliance under stringent EU chemical safety regulations, while the United Kingdom at 8.7% advanced integration into sustainable cleaning and fabric care solutions. The USA, growing at 7.8%, focused on consistent utilization in home care, industrial applications, and eco-friendly product lines while adhering to federal environmental standards. This report covers 40+ countries, with the top five markets highlighted here.

The esterquats market in China is forecasted to grow at a CAGR of 12.4%, supported by demand from textile softening, personal care, and household cleaning applications. Adoption is being encouraged by growing consumer preference for effective and long lasting fabric conditioners. Local manufacturers are being urged to supply cost efficient products while maintaining international quality standards. Distribution through both offline retail channels and e commerce platforms is being expanded to ensure wide product reach. Partnerships with detergent and personal care product manufacturers are being strengthened. Growing disposable income, rapid urban lifestyles, and a preference for premium cleaning solutions are considered key factors driving the esterquats market in China.

In India, the esterquats market is expected to expand at a CAGR of 11.5%, driven by adoption in textile care, household detergents, and cosmetics. The need for effective and sustainable conditioning agents is being emphasized in both urban and semi urban markets. Local producers are being encouraged to focus on affordability while matching performance with global brands. Distribution through traditional retail stores, modern trade outlets, and online marketplaces is being reinforced. Awareness campaigns highlighting the benefits of fabric softeners and personal care products are being promoted. Rising middle class consumption, household hygiene preferences, and textile industry expansion are recognized as strong contributors to the esterquats market in India.

Germany is experiencing steady growth in the esterquats market with a CAGR of 10.6%, driven by strong demand in textile care, household cleaning, and industrial applications. The preference for high quality conditioning agents is being reflected in consumer purchasing decisions. Manufacturers are being urged to introduce innovative, efficient, and skin friendly esterquats to meet strict European standards. Distribution through supermarkets, pharmacies, and online retail channels is being optimized. Research in bio based and advanced formulations is being prioritized to align with changing customer needs. Increased focus on quality, textile performance, and regulatory compliance is driving the esterquats market in Germany.

The esterquats market in the United Kingdom is projected to grow at a CAGR of 8.7%, encouraged by demand for effective household care and textile applications. Products offering better softness, fragrance retention, and long lasting conditioning are being widely adopted. Local and international suppliers are being urged to provide reliable and performance oriented esterquats. Distribution through large retail chains, e commerce channels, and detergent manufacturers is being maintained. Consumer inclination toward fabric comfort and household hygiene is being reinforced by marketing campaigns. The expansion of premium household care products and consistent textile use are considered key drivers of the esterquats market in the United Kingdom.

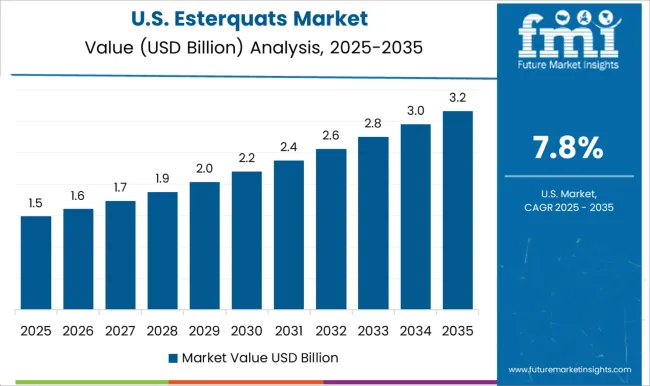

The esterquats market in the United States is forecasted to expand at a CAGR of 7.8%, influenced by high demand in textile softening, household cleaning, and personal care sectors. Emphasis is being placed on efficient, high quality, and skin safe esterquats that align with consumer expectations. Manufacturers are being encouraged to provide advanced formulations with superior conditioning properties. Distribution networks through supermarkets, pharmacies, and online platforms are being expanded to ensure easy accessibility. Research into new applications in industrial cleaning and cosmetics is being pursued. Increasing demand for high performance products, brand driven purchases, and fabric care awareness are key factors supporting the esterquats market in the United States.

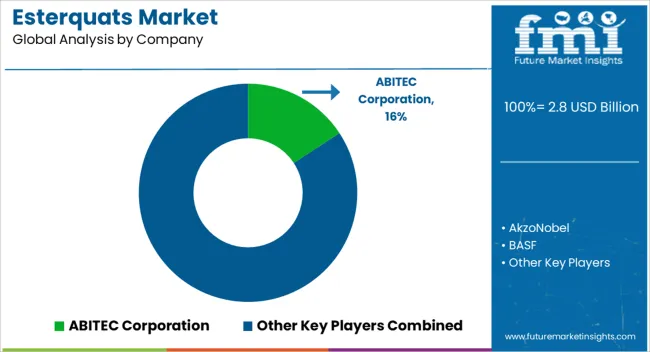

The esterquats market is supported by several leading suppliers that focus on producing high-performance conditioning agents widely used in fabric softeners, personal care products, and various industrial applications. Prominent companies active in this market include ABITEC Corporation, AkzoNobel, BASF, Clariant, Chemelco, Dongnam Chemical Industries, Evonik Industries, Hangzhou Fandachem, Italmatch Chemicals, Kao Corporation, Stepan Company, Solvay, and The Lubrizol Corporation. These players have established strong market positions by offering diverse esterquat formulations that cater to evolving customer needs in sustainability, biodegradability, and performance efficiency. The growth of the market has been driven by rising consumer demand for eco-friendly and biodegradable ingredients in detergents, fabric care, and cosmetics. Companies such as BASF, Evonik Industries, and Clariant focus on innovating bio-based esterquats that align with global sustainability trends. Meanwhile, Kao Corporation and Stepan Company emphasize applications in personal care formulations, ensuring gentleness and effectiveness in hair conditioners and skincare products.

Chemical distributors like Chemelco and Hangzhou Fandachem play a crucial role in ensuring regional availability, while manufacturers such as Italmatch Chemicals and Solvay extend the product’s reach into specialized industrial applications. Global competition in this sector is defined by innovation, regulatory compliance, and sustainability commitments. Increasing emphasis on reducing environmental impact has encouraged suppliers to develop esterquats that are not only highly efficient but also safe for aquatic ecosystems. Companies are investing in R&D to improve formulation stability, enhance performance in low-temperature washing, and expand applications into emerging markets. As a result, leading suppliers are shaping the esterquats market by meeting the dual demand for high performance and ecological responsibility, ensuring steady adoption across household, personal care, and industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Product Type | TEA-Quats, MDEA-Quats, and Others |

| Form | Liquid and Dry |

| Application | Personal care products, Fabric care products, Home care products, and Industrial applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABITEC Corporation, AkzoNobel, BASF, Clariant, Chemelco, Dongnam Chemical Industries, Evonik Industries, Hangzhou Fandachem, Italmatch Chemicals, Kao Corporation, Stepan Company, Solvay, and The Lubrizol Corporation |

| Additional Attributes | Dollar sales vary by product type, including diesterquats, triesterquats, and others; by form, spanning liquid and solid; by application, such as fabric softeners, hair conditioners, and personal care products; by end-use industry, covering household care, textile, and cosmetics; by region, led by Europe, North America, and Asia-Pacific. Growth is driven by rising demand for biodegradable surfactants, eco-friendly formulations, and expanding personal care consumption. |

The global esterquats market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the esterquats market is projected to reach USD 6.8 billion by 2035.

The esterquats market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in esterquats market are tea-quats, mdea-quats and others.

In terms of form, liquid segment to command 61.3% share in the esterquats market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

MDEA Esterquats Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA