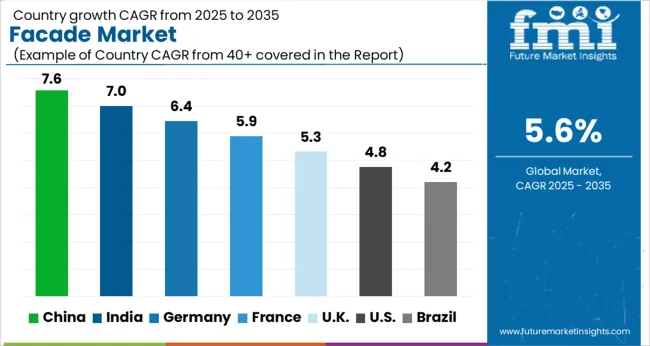

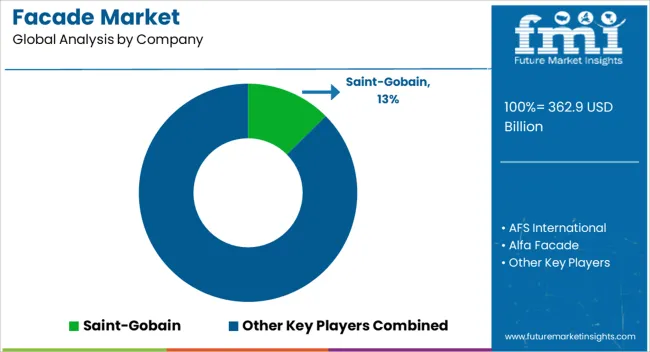

The facade market is estimated to be valued at USD 362.9 billion in 2025 and is projected to reach USD 625.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. Asia-Pacific is expected to maintain the largest contribution, driven by extensive commercial and residential construction, government infrastructure initiatives, and rising investments in high-rise and mixed-use developments. The region’s growth is amplified by the integration of energy-efficient facade systems and advanced building envelope technologies, which are increasingly mandated by regional building codes and energy performance standards. Europe demonstrates steady, moderate growth in the forecast period.

The market expansion in this region is largely shaped by stringent energy efficiency regulations, retrofitting initiatives for existing buildings, and the adoption of high-performance curtain wall systems. Growth in North America is relatively slower compared to Asia-Pacific but remains consistent, propelled by demand for sustainable and resilient building materials and the replacement of aging facade systems in commercial and institutional buildings. The adoption of smart and ventilated facade systems further supports incremental market value. The year-on-year progression highlights that Asia-Pacific captures a disproportionate share of new market additions, reflecting both the scale of construction projects and technological adoption. Europe and North America contribute steadily but more conservatively, resulting in a clear imbalance in regional growth contributions, with Asia-Pacific emerging as the dominant growth engine throughout the forecast period.

| Metric | Value |

|---|---|

| Facade Market Estimated Value in (2025 E) | USD 362.9 billion |

| Facade Market Forecast Value in (2035 F) | USD 625.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The facade market represents a specialized segment within the global building materials and architectural design industry, emphasizing aesthetics, durability, and energy performance. Within the broader construction materials sector, it accounts for about 4.5%, driven by demand in commercial, residential, and institutional buildings. In the curtain wall and exterior cladding segment, its share is approximately 5.2%, reflecting the adoption of glass, aluminum, composite panels, and advanced cladding systems. Across the energy-efficient building solutions market, it contributes around 3.9%, supporting thermal insulation, daylighting, and ventilation optimization. Within the architectural and interior design category, it represents 3.6%, highlighting integration with modern design trends, safety standards, and building codes. Within the overall building envelope and construction ecosystem, the market contributes approximately 3.1%, with a focus on visual appeal, structural performance, and operational efficiency.

Recent developments in the facade market have focused on material innovation, energy efficiency, and design flexibility. Groundbreaking trends include double-skin façades, dynamic shading systems, ventilated curtain walls, and use of high-performance glass and composite materials. Key players are collaborating with architects, contractors, and technology providers to develop modular, prefabricated, and lightweight façade systems for faster installation and reduced costs. Adoption of smart façades with integrated sensors, automated shading, and daylight optimization is gaining momentum. Sustainable materials, low-maintenance finishes, and fire-resistant solutions are being emphasized to meet regulatory standards and enhance lifecycle performance.

The facade market is witnessing consistent growth, driven by rapid urbanization, evolving architectural aesthetics, and increasing demand for energy-efficient building envelopes. Facades have become central to modern building design due to their functional benefits in insulation, ventilation, and light optimization, along with their contribution to structural integrity and visual appeal.

As construction activity surges across commercial, residential, and institutional segments, especially in emerging economies, the integration of advanced facade systems is becoming a key differentiator in project development. Stringent building codes and sustainability mandates are accelerating the adoption of high-performance facades designed to minimize environmental impact and operational energy costs.

The market is expected to benefit from technological advancements in smart materials, modular construction techniques, and automation in facade fabrication, ensuring strong growth across both new construction and retrofit applications.

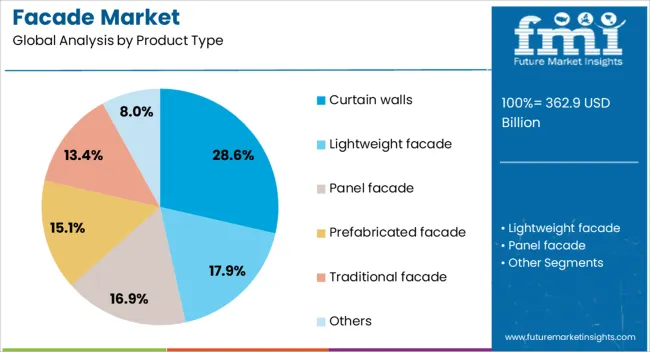

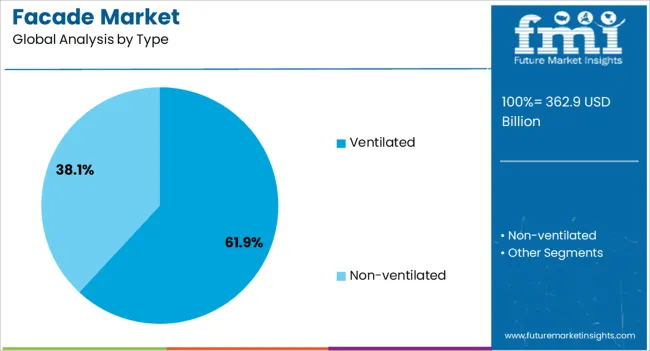

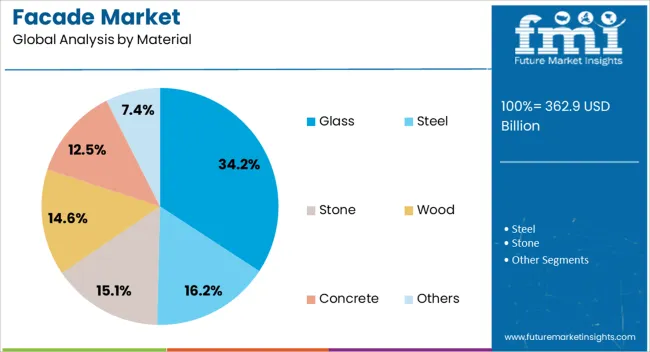

The facade market is segmented by product type, type, material, application, end user, and geographic regions. By product type, facade market is divided into Curtain walls, Lightweight facade, Panel facade, Prefabricated facade, Traditional facade, and Others. In terms of type, facade market is classified into Ventilated and Non-ventilated. Based on material, facade market is segmented into Glass, Steel, Stone, Wood, Concrete, and Others. By application, facade market is segmented into Exterior and Interior. By end user, facade market is segmented into Commercial, Residential, and Industrial. Regionally, the facade industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The curtain walls segment accounts for 29% of the product type category in the facade market, driven by its widespread adoption in commercial and high-rise buildings for achieving seamless aesthetics and lightweight structural performance. Curtain walls are favored for their ability to resist air and water infiltration while allowing natural light penetration, thereby reducing reliance on artificial lighting and improving energy efficiency.

The segment has grown due to rising investment in urban infrastructure and corporate office spaces, where modern architectural trends favor expansive glass surfaces and sleek exteriors. Additionally, the ability to integrate curtain walls with advanced insulation and shading technologies has enhanced their appeal among developers targeting LEED and green building certifications.

Continued focus on high-rise development and innovative glazing solutions is expected to reinforce the segment’s relevance in modern construction

With a commanding 62% share in the type category, the ventilated facade segment leads due to its effectiveness in improving thermal regulation, moisture control, and acoustic insulation. This facade type incorporates a ventilated air gap between cladding and insulation layers, enhancing overall building envelope performance.

Ventilated facades are increasingly preferred for their role in promoting energy efficiency, particularly in regions with variable climates. Architects and developers are adopting this system to achieve modern aesthetic finishes while ensuring functional advantages like reduced heat gain and enhanced indoor air quality.

Growth in this segment is also propelled by the rising renovation and retrofitting activities aimed at upgrading building sustainability standards. The segment is expected to maintain its lead as regulatory pressure mounts for energy-efficient structures and environmental compliance

Glass leads the material category with a 34% share in the facade market, highlighting its dominant role in contemporary architectural design and daylight utilization. The use of glass in facades offers multiple benefits including transparency, lightweight construction, and improved aesthetic value, making it a preferred material for commercial and institutional buildings.

Technological advancements such as double glazing, low-emissivity coatings, and solar control features have expanded the functional value of glass facades by enhancing insulation and reducing energy consumption. The segment's growth is further supported by increasing urban skyscraper developments and demand for high-performance building exteriors.

As building owners and designers continue to prioritize natural lighting and modern aesthetics, glass is expected to remain a central material in facade applications, particularly where both visual impact and environmental performance are critical.

The market has grown significantly as building aesthetics, energy efficiency, and structural performance have become critical considerations in modern construction. Facades serve both protective and decorative functions, influencing thermal insulation, daylight management, and weather resistance. Materials such as glass, aluminum, steel, stone, terracotta, and composite panels are widely used depending on architectural requirements, climate conditions, and sustainability goals. Increasing adoption of high-rise buildings, commercial complexes, and urban redevelopment projects has driven demand. Advanced design software, prefabrication techniques, and smart glazing systems have enhanced both functionality and visual appeal.

The commercial and institutional construction sectors have emerged as key drivers for facade adoption. Office towers, shopping malls, airports, and hospitals increasingly rely on advanced facade systems to optimize natural lighting, reduce energy consumption, and improve thermal comfort. Glass curtain walls, ventilated rainscreens, and aluminum composite panels are commonly deployed to achieve architectural flexibility and long-term durability. Rising investment in smart buildings and green construction has encouraged the adoption of energy-efficient facades with high-performance coatings and double-skin designs. Large-scale infrastructure projects in urban centers, particularly in Asia Pacific and North America, are fueling growth. Demand is also influenced by the need for rapid construction timelines and minimal on-site labor, making prefabricated facade systems increasingly popular.

Technological advancements in facade materials and design have reshaped market dynamics. Lightweight aluminum, laminated and tempered glass, and composite panels with thermal insulation properties are being integrated into contemporary designs. Smart facades equipped with automated shading, ventilation, and energy-harvesting features are gaining traction. Building Information Modeling (BIM) and 3D design tools enable precise planning, reducing material waste and improving installation efficiency. Fire-resistant coatings and anti-reflective glazing enhance safety and user comfort. Material innovations, such as high-performance polymers and nanocoatings, provide weather protection and durability. These technological developments allow architects and engineers to meet evolving regulatory standards while delivering visually striking, functional facades.

Sustainability considerations are significantly shaping the facade market. Energy-efficient facades with improved thermal insulation reduce heating and cooling demands, aligning with global environmental targets. Low-emissivity glass, ventilated facades, and integrated shading systems enhance energy performance while supporting green building certifications such as LEED and BREEAM.

Recyclable and lightweight materials are increasingly preferred to minimize environmental impact. Developers and construction firms are investing in facades that strike a balance between aesthetics, durability, and energy efficiency. Additionally, government regulations in Europe, North America, and Asia have mandated energy-efficient building envelopes, further reinforcing market growth. These trends underscore the pivotal role of sustainable facades in modern construction practices.

Urbanization and redevelopment initiatives are major factors driving regional demand for facade solutions. The Asia Pacific is witnessing high adoption due to the rapid growth of commercial and residential construction, while North America and Europe are emphasizing the retrofitting and modernization of existing structures. Middle East and Gulf countries are investing in energy-efficient and visually striking facades for hospitality and commercial projects.

Prefabrication, modular construction, and local manufacturing capabilities are improving supply chains and project timelines. Urban regulations promoting green building standards are encouraging the use of innovative facade solutions. These factors collectively contribute to the steady expansion of the global facade market, positioning it as a critical component of sustainable and aesthetically appealing modern infrastructure.

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

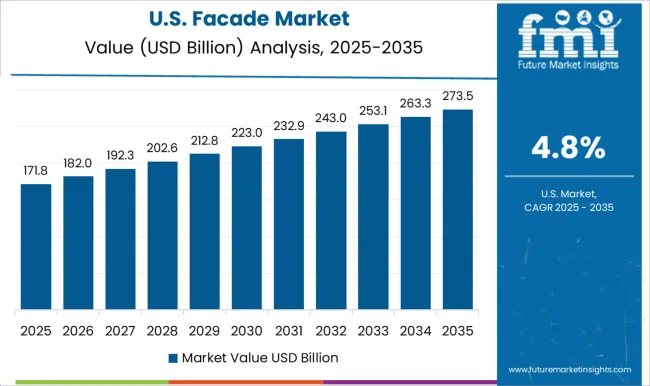

| USA | 4.8% |

| Brazil | 4.2% |

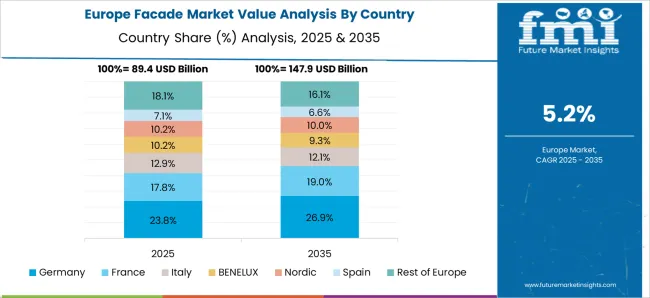

The Facade market is expected to expand at a CAGR of 5.6% from 2025 to 2035, reflecting growing focus on energy-efficient and aesthetically appealing building exteriors. China leads with 7.6%, driven by urban redevelopment projects and high-rise construction demand. India follows at 7.0%, supported by expanding commercial and residential construction activities. Germany records 6.4%, reflecting stringent building standards and integration of advanced facade technologies. The UK stands at 5.3%, influenced by renovations and sustainable building initiatives. The USA registers 4.8%, where architectural innovation and energy efficiency drive market adoption. Increasing emphasis on durable and modern building materials across regions contributes to sustained growth. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is growing at a CAGR of 7.6%, driven by rapid commercial and residential construction, large-scale high-rise projects, and infrastructure modernization. Demand for curtain walls, ventilated facades, and energy-efficient cladding solutions is increasing in urban centers. Local manufacturers focus on aluminum, glass, and composite materials with enhanced thermal and aesthetic properties. Integration of automated installation systems and BIM technology in facade design improves project efficiency. Government incentives for energy-efficient building envelopes further stimulate adoption of modern facade solutions in commercial and industrial sectors.

India is expanding at a CAGR of 7.0%, supported by rapid urban construction, commercial complexes, and IT campuses. Curtain walls, ventilated facades, and composite panel systems are increasingly adopted to improve building aesthetics and energy efficiency. Indian manufacturers are emphasizing cost-effective solutions and modular facade systems suitable for mid-sized and large-scale projects. Demand for green and low-maintenance facades is increasing due to energy efficiency regulations and the growing prominence of smart buildings. Collaborative projects with international material providers enhance technology transfer and quality standards.

Germany is witnessing a CAGR of 6.4%, driven by demand for sustainable, energy-efficient, and aesthetically advanced facades. The market emphasizes high-performance curtain walls, ventilated systems, and smart building facades integrating sensors and shading technologies. German manufacturers prioritize compliance with EU energy regulations and sustainable material sourcing. Research in thermally optimized facades and recyclable components is supporting growth. Commercial complexes, offices, and industrial facilities are major adopters, contributing to the preference for premium, long-lasting solutions.

The United Kingdom is expanding at a CAGR of 5.3%, supported by office complexes, educational institutions, and healthcare facilities. Modern facades are adopted to improve thermal performance, aesthetics, and building value. Energy efficiency compliance and low-maintenance solutions are primary considerations for architects and developers. Modular facade systems, lightweight panels, and smart glass technologies are increasingly integrated into new constructions and retrofits. Collaboration with European material suppliers ensures access to high-quality components, meeting both design and regulatory requirements.

The United States is growing at a CAGR of 4.8%, led by commercial high-rise, institutional, and healthcare construction. Demand focuses on curtain walls, ventilated facades, and energy-efficient cladding that comply with stringent building codes. US developers prioritize sustainability, durability, and integration with smart building technologies. The market also shows rising interest in lightweight composite materials and glass facades for modern aesthetics. Large multinational facade suppliers dominate, providing comprehensive solutions with installation support and maintenance services.

The market is highly competitive, with global and regional players offering innovative architectural cladding, insulation, and curtain wall systems. Leading multinational companies such as Saint-Gobain, Kingspan, Sika, and Rockwool dominate through their extensive product portfolios, advanced material technologies, and global distribution networks. These firms emphasize energy efficiency, fire safety, and sustainable materials, which strengthen their positioning in large-scale commercial and residential projects. Specialized facade providers like Josef Gartner, Seele Group, Enclos, and Lindner Facades focus on customized solutions, combining engineering precision with aesthetic appeal for complex architectural designs. Companies such as AFS International, Alfa Facade, Danpal, Nordic Facade Solutions, Ulma Architectural Solutions, and Gebruder Schneider differentiate through modular designs, lightweight systems, and rapid installation capabilities, targeting both retrofit and new construction markets. Emerging trends, including digital design integration, prefabricated panels, and performance-based facades, drive innovation and create opportunities for mid-sized and regional players to expand their footprint. The market competitiveness is reinforced by collaborations with architects, contractors, and building developers, enabling these companies to deliver functional, sustainable, and visually appealing facade solutions that meet regulatory standards and evolving urban construction demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 362.9 Billion |

| Product Type | Curtain walls, Lightweight facade, Panel facade, Prefabricated facade, Traditional facade, and Others |

| Type | Ventilated and Non-ventilated |

| Material | Glass, Steel, Stone, Wood, Concrete, and Others |

| Application | Exterior and Interior |

| End User | Commercial, Residential, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saint-Gobain, AFS International, Alfa Facade, Danpal, Enclos, Gebruder Schneider, Josef Gartner, Kingspan, Laminam, Lindner Facades, Nordic Facade Solutions, Rockwool, Seele group, Sika, and Ulma Architectural Solutions |

| Additional Attributes | Dollar sales by façade type and application, demand dynamics across commercial, residential, and infrastructure construction sectors, regional trends in energy-efficient and aesthetic building envelope adoption, innovation in materials, thermal performance, and design flexibility, environmental impact of material production and lifecycle energy, and emerging use cases in smart façades, daylight optimization, and sustainable building solutions. |

The global facade market is estimated to be valued at USD 362.9 billion in 2025.

The market size for the facade market is projected to reach USD 625.7 billion by 2035.

The facade market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in facade market are curtain walls, lightweight facade, panel facade, prefabricated facade, traditional facade and others.

In terms of type, ventilated segment to command 61.9% share in the facade market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Facade Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA