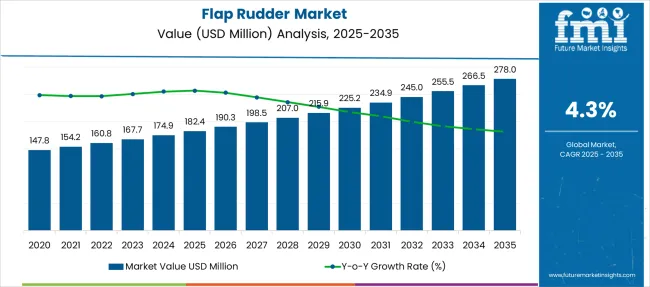

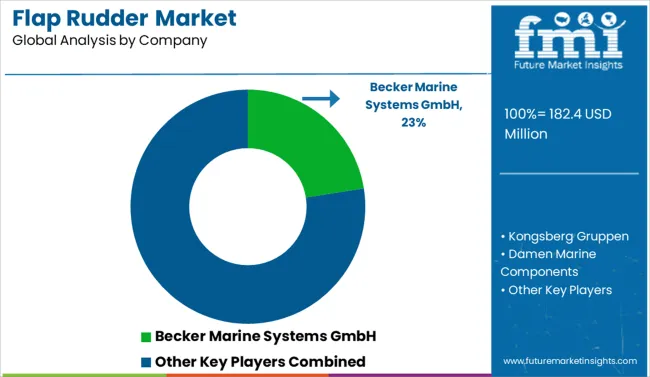

The Flap Rudder Market is estimated to be valued at USD 182.4 million in 2025 and is projected to reach USD 278.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Flap Rudder Market Estimated Value in (2025 E) | USD 182.4 million |

| Flap Rudder Market Forecast Value in (2035 F) | USD 278.0 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The flap rudder market is witnessing steady growth as the shipping industry increasingly focuses on fuel efficiency, maneuverability, and compliance with stricter emission regulations. Rising demand for larger vessels with enhanced hydrodynamic performance has supported the adoption of advanced rudder technologies that reduce drag and improve steering precision.

Operators are prioritizing solutions that deliver operational savings and sustainability benefits over the vessel’s lifecycle. Future growth is expected to be driven by expansion in global trade, modernization of aging fleets, and heightened attention to port safety and environmental impact.

Continuous innovations in materials and flap mechanisms along with increasing shipbuilding activity in emerging economies are paving the way for further market penetration and technological advancement.

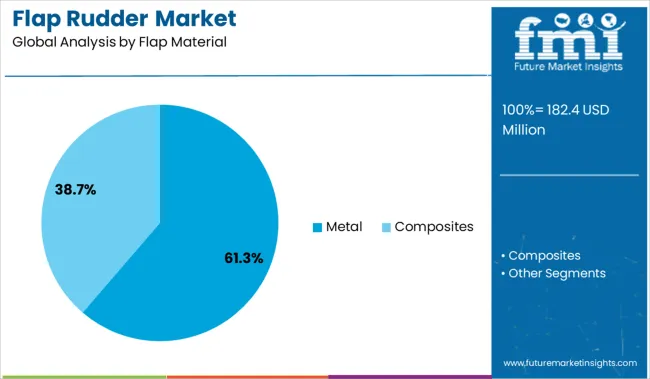

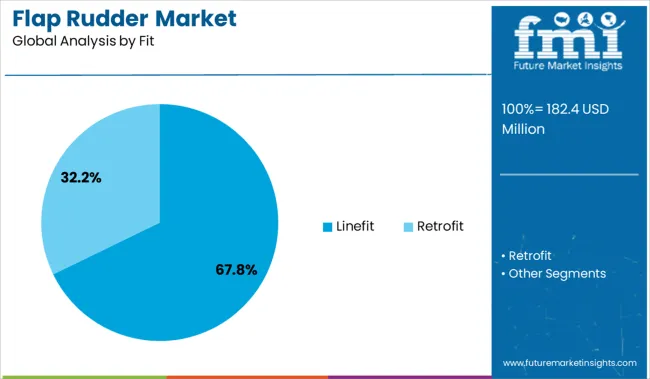

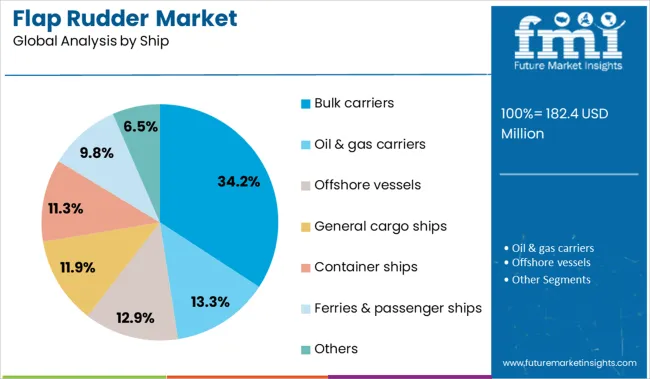

The market is segmented by Flap Material, Fit, and Ship and region. By Flap Material, the market is divided into Metal and Composites. In terms of Fit, the market is classified into Linefit and Retrofit. Based on Ship, the market is segmented into Bulk carriers, Oil & gas carriers, Offshore vessels, General cargo ships, Container ships, Ferries & passenger ships, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by flap material, the metal segment is expected to hold 61.3% of the total market revenue in 2025, establishing itself as the leading material choice. This leadership is attributed to the superior strength, durability, and corrosion resistance offered by metal flaps, making them suitable for demanding marine environments.

The structural integrity of metal allows for precise manufacturing tolerances, ensuring optimal hydrodynamic performance and reliability even under high loads. Operators favor metal flaps for their proven lifespan and lower maintenance frequency compared to alternative materials.

Additionally, advancements in metal alloys have further enhanced fatigue resistance and reduced weight, contributing to continued preference for metal in both commercial and specialized vessels.

Segmented by fit, the linefit segment is projected to account for 67.8% of the flap rudder market revenue in 2025, maintaining its position as the dominant configuration. This prominence is driven by the widespread adoption of flap rudders during the shipbuilding phase, enabling seamless integration with hull design and optimized hydrodynamic performance from delivery.

Shipyards and owners have increasingly specified linefit solutions to achieve immediate operational efficiency and regulatory compliance without the need for costly retrofits. The ability to tailor the rudder to vessel specifications and the assurance of warranty and certification at delivery have reinforced demand for linefit installations.

Enhanced shipyard capabilities and standardized production processes have also made linefit the preferred choice for newbuild projects across vessel types.

When segmented by ship type, bulk carriers are forecast to capture 34.2% of the flap rudder market revenue in 2025, securing their position as the leading vessel category. This dominance is supported by the high volume of bulk carrier construction and their operational requirement for efficient maneuvering in congested ports and narrow waterways.

The significant size and load characteristics of bulk carriers necessitate rudder solutions that provide improved course stability and reduced turning radius, both of which are achieved through flap designs. Operators of bulk carriers have prioritized investments in flap rudders to minimize fuel consumption and enhance operational safety, contributing to their continued leadership.

The segment has also benefited from global commodity trade growth and the replacement of older fleets with modern, efficient vessels equipped with advanced rudder systems.

Flap rudder systems are being redefined by evolving trends in digital steering integration, lightweight composite materials, and CFD-optimized designs. Naval architects are prioritizing high-lift rudders to accommodate growing vessel sizes and tighter maneuvering in restricted waters. Demand is shifting toward modular, retrofit-friendly systems compatible with IoT-based monitoring and real-time diagnostics.

Manufacturers are focusing on asymmetric designs that reduce drag while improving directional control. These innovations are aligning flap rudders with next-generation propulsion systems and performance benchmarks in both commercial and defense fleets.

A growing number of commercial fleets are being retrofitted with flap rudder systems to improve hydrodynamic efficiency and maneuvering control. Older feeder ships operating in the Mediterranean and Panamax-class bulkers have adopted flap rudders to reduce turning time and improve energy transfer to the propeller.\ Becker’s Twisted Rudder Retrofit and Kongsberg’s sensor-integrated rudder controls are being deployed in mid-life upgrades. These systems provide smoother steering, enhanced propulsion coordination, and real-time performance analytics.

Shipyards in Japan and South Korea are offering retrofit packages to operators aiming to meet port entry guidelines and environmental standards. The integration of digital monitoring with physical control hardware is helping vessel owners extend asset life while aligning with operational benchmarks. This opportunity is accelerating partnerships between OEMs, control system developers, and drydock service providers.

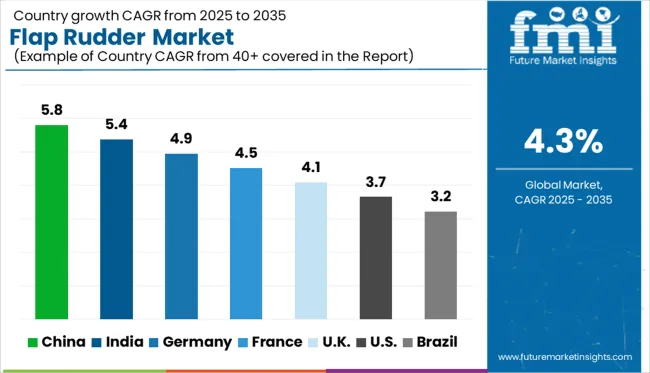

| Countries | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The global flap rudder market is projected to advance at a CAGR of 4.3% from 2025 to 2035, driven by the pursuit of enhanced hydrodynamic control, reduced fuel consumption, and better maneuverability across commercial and defense marine fleets. China leads with 5.8%, propelled by naval modernization and merchant shipbuilding expansions.

India follows at 5.4%, supported by fabrication upgrades in coastal yards and dual-use vessel output. Germany, a major OECD economy, records 4.9%, benefiting from precision-engineered rudder assemblies in high-speed vessels. France posts 4.5%, with a tilt toward integrated steering systems for luxury and coastal vessels. The United Kingdom reports 4.1%, shaped by retrofitting initiatives and offshore logistics demand. The report includes analysis of over 40 countries, with five profiled below for reference.

Adoption of flap rudders in China is projected to increase steadily, with growth estimated at a CAGR of 5.8% between 2025 and 2035. Expansion is being encouraged by demand from naval programs and high-capacity cargo vessels built in large-volume shipyards. Local manufacturers are focusing on hydrodynamic flap designs capable of reducing turning radii and enhancing fuel efficiency.

Government procurement schemes are supporting localized production of modular rudder systems. Design preference is shifting toward cast assemblies with vibration control features. Innovation is also being pushed through automation alignment and component standardization.

Sales of the flap rudders in India are forecast to expand at a CAGR of 5.4% through 2035. Increased production of patrol boats, inland cargo ships, and harbor utility vessels is contributing to system-level upgrades. Indigenous design capabilities are being promoted through national maritime manufacturing initiatives.

Flap rudders are being fitted in regional shipyards transitioning from fixed to articulated steering systems. Compact assemblies with better low-speed control are in higher demand. Supply chains are being strengthened by domestic sourcing of castings, hydraulic units, and flap blade assemblies.

The United Kingdom is projected to achieve a CAGR of 4.1% in flap rudder demand from 2025 to 2035. Fleet renewal programs and vessel retrofits are creating a steady pipeline for rudder upgrades. Operators are adopting flap systems designed for quieter motion and precision handling.

Domestic yards are sourcing hybrid flap systems suited for survey vessels, support craft, and coastal haulers. Government agencies and maritime engineering firms are collaborating to develop vibration-dampening control units. Installation services and component packages are now bundled under turnkey upgrade solutions.

Demand for flap rudders across Germany is expected to rise consistently, backed by a CAGR of 4.9% through 2035. Engineering excellence in high-speed commercial vessels has led to a preference for dual-axis rudder systems. Precision-fabricated steel flaps and integrated sensors are now standard in major shipyards.

Demand is seen from fleet operators looking to meet EU compliance on manoeuvrability and emission reduction. Retrofit initiatives in container ships and tankers are being aligned with propulsion upgrades. Control software and predictive diagnostics are becoming critical components.

France is projected to post steady growth in flap rudder adoption, with a CAGR of 4.5% forecast through 2035. Vessel operators are upgrading to improve turning response and to meet safety norms in ferry and cargo applications. Compact flap systems are being installed in smaller vessels operating in dense port traffic. Marine OEMs are developing stainless-steel variants optimized for coastal navigation. Advanced sealing and anti-corrosion treatments are becoming standard in system design. Certification authorities are influencing product lifecycle and installation protocols across public and commercial fleets.

The flap rudder industry is led by Becker Marine Systems GmbH, holding a significant market share through its patented twisted and flap rudder designs that enhance maneuverability and fuel efficiency in large vessels. Kongsberg Gruppen and Damen Marine Components follow with robust portfolios catering to commercial and naval fleets. Kamome Propeller and Nakashima Propeller Co., Ltd. focus on integrated propulsion solutions combining rudders and propellers for improved hydrodynamic performance.

De Waal BV and Kemp Propulsion Systems target inland and coastal shipping with customized steering systems. Chinese firms like Wuxi Delin and China Empire Offshore are expanding aggressively across bulk and offshore vessels. Competitive focus has shifted toward energy-saving appendages, noise reduction, and compatibility with LNG and electric propulsion platforms.

In May 2024, Becker Marine Systems launched its new Steering Gear and Daggerboard range, including enhanced Flap Rudder options. These systems optimize hydrodynamic performance, thanks to features like twisted leading edges and compact hydraulic steering, unveiled at SMM 2024 in Hamburg

| Item | Value |

|---|---|

| Quantitative Units | USD 182.4 Million |

| Flap Material | Metal and Composites |

| Fit | Linefit and Retrofit |

| Ship | Bulk carriers, Oil & gas carriers, Offshore vessels, General cargo ships, Container ships, Ferries & passenger ships, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Becker Marine Systems GmbH, Kongsberg Gruppen, Damen Marine Components, Kamome Propeller, Nakashima Propeller Co., Ltd., YMV Kreyn ve Makina Sistemleri A., De Waal BV, Kemp Propulsion Systems, Wuxi Delin Marine Equipment Co., Ltd., and Jiangsu China Empire Offshore Engineering Equipment Manufacture Co., Ltd. |

| Additional Attributes | Dollar sales are segmented by vessel type such as tugs, offshore, and cargo with flap rudders gaining share due to improved maneuverability and fuel efficiency. Demand is increasing for automated control systems and corrosion-resistant materials. OEMs and shipyard partners support turnkey solutions. Adoption is strong in Asia-Pacific and Europe, driven by eco regulations. |

The global flap rudder market is estimated to be valued at USD 182.4 million in 2025.

The market size for the flap rudder market is projected to reach USD 278.0 million by 2035.

The flap rudder market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in flap rudder market are metal and composites.

In terms of fit, linefit segment to command 67.8% share in the flap rudder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual Flap Dispensing Closure Market Size & Trends 2025 to 2035

Dental Flap Surgery Market Size and Share Forecast Outlook 2025 to 2035

Hinged Dual Flap Caps Market Size and Share Forecast Outlook 2025 to 2035

Ship Rudders Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA