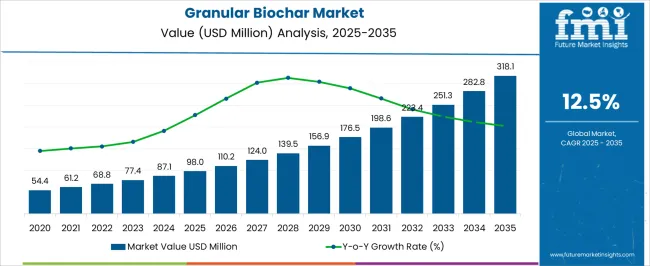

The granular biochar market is projected to grow from USD 98.0 million in 2025 to USD 318.1 million in 2035, reflecting a CAGR of 12.5%. This represents an absolute dollar opportunity of USD 220.1 million over the decade. The market is expected to expand steadily, reaching USD 110.2 million in 2026, USD 139.5 million in 2029, USD 176.5 million in 2031, and USD 282.8 million in 2034.

The strong growth trajectory highlights rising adoption of biochar in agriculture, soil management, and industrial applications, offering manufacturers and investors significant opportunities to capture incremental revenue and strengthen their market presence over the forecast period. From an absolute dollar perspective, annual incremental growth starts at approximately USD 12–13 million in the early years and accelerates to around USD 35 million in the later stages, culminating in USD 220.1 million by 2035. Intermediate benchmarks, such as USD 87.1 million in 2025, USD 156.9 million in 2030, and USD 251.3 million in 2033, illustrate predictable growth phases and major inflection points. This allows stakeholders to plan production, distribution, and capacity expansion efficiently. Capturing both yearly increments and the cumulative USD 220.1 million opportunity ensures maximum revenue potential in the granular biochar market over the decade.

| Metric | Value |

|---|---|

| Granular Biochar Market Estimated Value in (2025 E) | USD 98.0 million |

| Granular Biochar Market Forecast Value in (2035 F) | USD 318.1 million |

| Forecast CAGR (2025 to 2035) | 12.5% |

Continuing with the granular biochar market, a breakpoint analysis highlights key phases of accelerated growth. Between 2025 and 2027, the market rises from USD 98.0 million to USD 110.2 million, marking the early adoption phase where initial utilization and moderate demand drive incremental gains. Another critical breakpoint occurs around 2029–2031, as the market grows from USD 139.5 million to USD 176.5 million, reflecting a period of faster expansion and higher absolute dollar growth. These stages are essential for manufacturers and investors to optimize production, align supply chains, and capture revenue during periods of increasing market adoption and commercial traction.

The final major breakpoint is observed between 2033 and 2035, when the market surges from USD 282.8 million to USD 318.1 million, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 156.9 million to USD 223.4 million, acting as bridging periods that maintain momentum. Identifying these breakpoints enables stakeholders to strategically plan investments, scale operations efficiently, and maximize revenue potential. Focusing on these pivotal stages ensures capturing both incremental and cumulative opportunities in the granular biochar market.

The granular biochar market is experiencing steady growth driven by its growing adoption as an eco-friendly solution in agriculture and environmental management. Increasing awareness of sustainable farming practices and soil health enhancement has contributed significantly to market expansion.

The future outlook is promising as demand rises for carbon sequestration techniques and soil restoration initiatives worldwide. Investment in research and development to improve biochar production efficiency and the emphasis on reducing greenhouse gas emissions are further fueling growth.

Additionally, the increasing use of biochar in improving water retention and nutrient cycling in degraded soils is expected to open new opportunities. As regulatory policies favor sustainable inputs and carbon credit frameworks evolve, granular biochar is anticipated to maintain strong growth momentum in both developed and emerging markets.

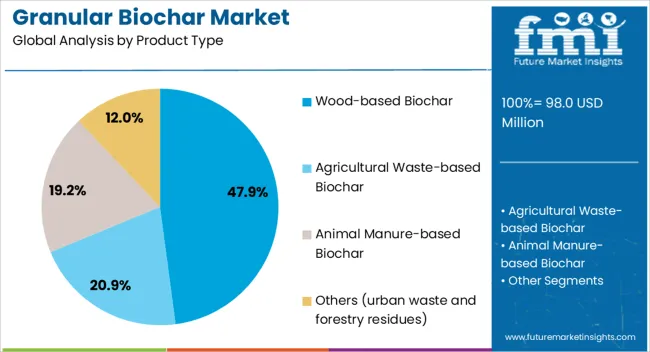

The granular biochar market is segmented by product type, application, distribution channel, and geographic regions. By product type, granular biochar market is divided into Wood-based Biochar, Agricultural Waste-based Biochar, Animal Manure-based Biochar, and Others (urban waste and forestry residues).

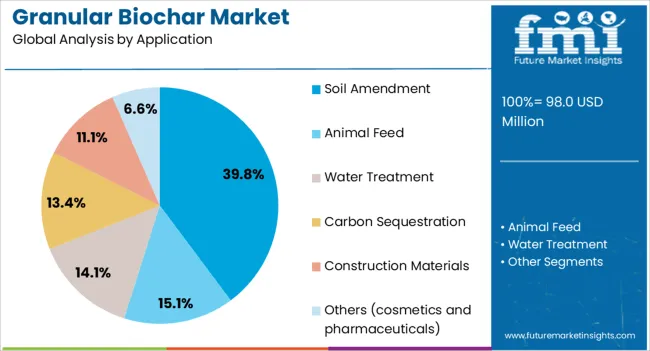

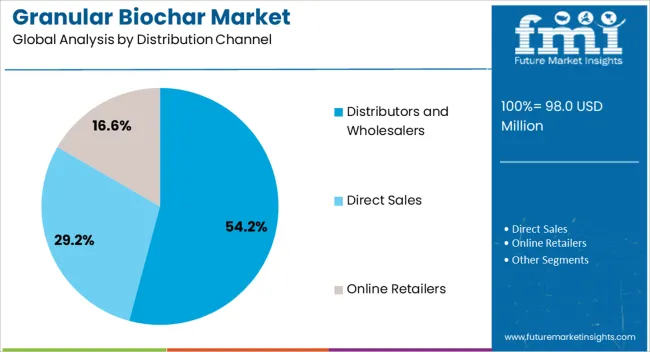

In terms of application, granular biochar market is classified into Soil Amendment, Animal Feed, Water Treatment, Carbon Sequestration, Construction Materials, and Others (cosmetics and pharmaceuticals). Based on distribution channel, granular biochar market is segmented into Distributors and Wholesalers, Direct Sales, and Online Retailers. Regionally, the granular biochar industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wood-based biochar product type is projected to hold 47.9% of the Granular Biochar market revenue share in 2025, making it the leading segment in this category. This prominence is attributed to the abundant availability of wood biomass as a raw material and the high carbon content and stability of wood-derived biochar.

The growth of this segment has been encouraged by its effectiveness in enhancing soil structure, increasing nutrient retention, and improving crop yields. The versatility of wood-based biochar in diverse agricultural and environmental applications has further strengthened its position.

Moreover, sustainable sourcing practices and increasing consumer preference for organic and natural soil amendments have supported its expanding adoption.

The soil amendment application segment is expected to account for 39.8% of the overall Granular Biochar market revenue share in 2025, establishing it as the dominant application. This segment’s leadership has been driven by the growing focus on improving soil fertility, moisture retention, and carbon sequestration in agriculture.

The segment’s growth is supported by increasing demand for sustainable agricultural inputs that reduce dependency on chemical fertilizers. The benefits of granular biochar in enhancing soil microbial activity and mitigating soil degradation have encouraged farmers and land managers to adopt biochar-based soil amendments widely.

Environmental concerns and government incentives for sustainable farming practices are also significant factors driving this segment.

The distributors and wholesalers segment is anticipated to hold 54.2% of the Granular Biochar market revenue share in 2025, marking it as the leading distribution channel. This dominance is due to the established supply chain networks that distributors and wholesalers maintain, enabling efficient product reach across regional and international markets.

The segment’s growth has been supported by their role in providing access to diverse customer bases, including agricultural cooperatives, landscapers, and industrial users. The ability to maintain optimal inventory levels and provide timely deliveries has strengthened their market position.

Additionally, distributors and wholesalers have been instrumental in educating end users about product benefits, which has accelerated market penetration for granular biochar products.

The granular biochar market is growing as farmers and agribusinesses seek solutions to improve soil fertility and crop yield. Granular biochar enhances water retention, reduces nutrient leaching, and strengthens soil structure, leading to healthier plant growth. It is increasingly used in row crops, vegetables, and orchards due to its ability to retain nutrients and provide a stable growing medium.

Companies producing biochar with uniform particle size, high porosity, and tailored nutrient content gain an edge in the market. Integration with organic fertilizers and microbial additives further improves crop performance. Increasing programs promoting improved agricultural practices and field productivity support demand. Granular biochar is recognized as an effective solution for enhancing soil quality and boosting agricultural output.

Growth is limited by the variation in biomass used for production and the costs involved in processing. Granular biochar is made from sources such as crop residues, wood chips, and organic waste, which differ in nutrient content and moisture. Pyrolysis or other processing methods require energy and careful control to produce consistent particle size, porosity, and carbon content. High capital investment for processing equipment, combined with operational expenses, increases the overall cost. Variations in quality can affect crop performance, making farmers hesitant to adopt it at scale. Until production methods are simplified and feedstock quality standardized, adoption may be limited to farms with high-value crops or areas that prioritize soil improvement programs.

New approaches in processing and handling granular biochar are affecting market dynamics. Techniques such as pelletization and coating with nutrients or microbial additives help enhance its effect on soil and plant health. Tools and equipment for precise field application allow targeted distribution, minimizing waste and maximizing nutrient efficiency. Adjusting particle size and granule stability improves water retention and soil aeration. These methods increase the effectiveness of biochar in various soil types and growing conditions. Farmers adopting these improved application methods report higher crop yields and stronger soil resilience. Companies offering biochar tailored to specific crop needs or soil conditions can attract a wider user base and strengthen market presence.

Opportunities are being driven by the need to improve soil quality and crop output. Granular biochar supports nutrient retention, reduces water loss, and strengthens soil structure, helping crops grow better under varied field conditions. Regions with degraded or nutrient-poor soils show higher adoption potential. Farmers and cooperatives are using biochar to improve productivity in horticulture, staple crops, and specialty farming. Producers offering locally sourced, high-quality, and crop-specific biochar can gain a competitive edge. Collaborations with agricultural service providers, field trials, and demonstration plots create awareness and encourage adoption. As the focus on improving soil efficiency and crop yield grows, the market for granular biochar is expected to expand.

Growth is restrained by competitive pressures, limited understanding of proper usage, and differing regulatory standards. Multiple suppliers compete on quality, feedstock source, particle size, and price, affecting market margins. Farmers may not be aware of optimal application rates, blending methods, or crop-specific benefits, limiting adoption. Regulations for soil amendments, nutrient content, and organic labeling vary between regions, creating compliance challenges for producers. Maintaining consistent product quality at scale is difficult for smaller manufacturers. Until educational programs, standardized quality metrics, and uniform regulations are implemented, adoption will likely remain concentrated among large-scale farms, high-value crops, and regions with supportive agricultural programs.

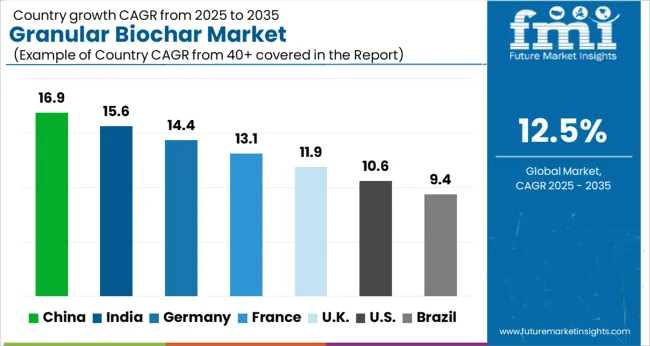

| Country | CAGR |

|---|---|

| China | 16.9% |

| India | 15.6% |

| Germany | 14.4% |

| France | 13.1% |

| UK | 11.9% |

| USA | 10.6% |

| Brazil | 9.4% |

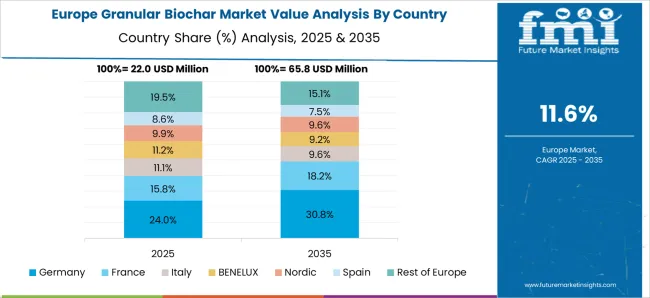

The global granular biochar market was projected to grow at a 12.5% CAGR through 2035, driven by demand in soil amendment, agricultural productivity, and environmental management applications. Among BRICS nations, China recorded 16.9% growth as large-scale production and processing facilities were commissioned and compliance with material and safety standards was enforced, while India, at 15.6% growth, saw expansion of manufacturing units to meet rising regional agricultural demand.

In the OECD region, Germany, at 14.4% maintained substantial output under strict industrial and environmental regulations, while the United Kingdom, at 11.9% relied on moderate-scale operations for soil improvement and agricultural applications. The USA, expanding at 10.6%, remained a mature market with steady demand across commercial agriculture and environmental management segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The granular biochar market in China is growing at a CAGR of 16.9% due to increasing adoption in agriculture, soil improvement, and carbon sequestration applications. Farmers, agricultural organizations, and environmental agencies are using biochar to enhance soil fertility, retain nutrients, improve water retention, and reduce greenhouse gas emissions. Growth is supported by rising awareness of sustainable agricultural practices, government incentives, and demand for higher crop yields. Suppliers provide high-quality granular biochar suitable for various soil types and crop applications. Distribution through agricultural suppliers, cooperatives, and e-commerce platforms ensures wide market accessibility. Adoption is further driven by the need to improve soil health, crop productivity, and environmental outcomes. China remains a leading market due to its large agricultural sector, government support, and growing interest in sustainable farming practices.

India is witnessing growth at a CAGR of 15.6% in the granular biochar market due to rising adoption in agriculture, horticulture, and soil management applications. Farmers, agricultural research institutes, and cooperatives use granular biochar to enhance soil fertility, improve nutrient retention, and increase crop productivity. Growth is supported by increasing awareness of soil health management, government initiatives promoting sustainable agriculture, and rising demand for higher yields. Suppliers provide biochar products suitable for diverse soil types and crop requirements.

Distribution through agricultural suppliers, cooperatives, and e-commerce platforms ensures accessibility across regions. Adoption is further driven by the need for sustainable farming, improved crop performance, and environmental benefits. India continues to see strong growth due to its large agricultural sector, rising focus on soil health, and adoption of modern agricultural practices.

Germany is growing at a CAGR of 14.4% in the granular biochar market due to increasing demand in agriculture, horticulture, and environmental management. Farmers, research institutions, and agricultural service providers adopt biochar to enhance soil quality, retain nutrients, improve water efficiency, and support sustainable practices. Growth is supported by government programs promoting environmentally friendly agriculture, increasing awareness of soil health, and demand for higher crop yields. Suppliers provide granular biochar products with high purity and performance suitable for various soil types. Distribution through agricultural suppliers, cooperatives, and environmental organizations ensures market reach. The focus on sustainable farming, soil fertility enhancement, and carbon reduction initiatives further drives adoption. Germany remains a key European market due to strong emphasis on environmental sustainability and high-quality agricultural practices.

The United Kingdom market is expanding at a CAGR of 11.9% due to rising adoption in agriculture, horticulture, and soil management applications. Farmers, cooperatives, and environmental agencies are using granular biochar to enhance soil fertility, improve nutrient retention, and increase crop productivity. Suppliers provide high quality biochar suitable for a variety of crops and soil types.

Growth is supported by government programs promoting sustainable farming practices, rising awareness of soil health, and demand for higher yields. Distribution through agricultural suppliers, cooperatives, and e-commerce platforms ensures accessibility across the country. Adoption is further driven by the need for improved soil performance, sustainable agricultural practices, and environmental benefits. The United Kingdom continues to see steady growth due to focus on sustainable farming and soil quality improvement.

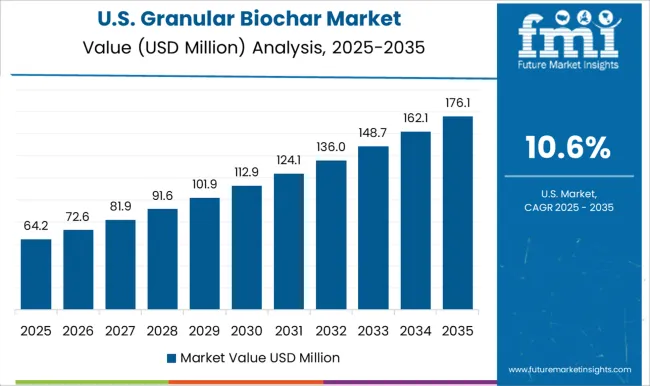

The United States market is growing at a CAGR of 10.6% due to increasing adoption of granular biochar in agriculture, horticulture, and soil remediation applications. Farmers, research institutions, and environmental organizations use biochar to improve soil fertility, enhance water retention, and boost crop productivity. Suppliers provide high quality granular biochar suitable for different soil types and agricultural requirements. Growth is supported by government initiatives promoting sustainable farming, increasing awareness of soil health, and demand for efficient farming practices.

Distribution through agricultural suppliers, cooperatives, and e-commerce platforms ensures market accessibility. The need for environmental benefits, improved crop performance, and sustainable agricultural practices further drive adoption. The United States remains a key market due to its large agricultural sector, investment in modern farming practices, and focus on soil health management.

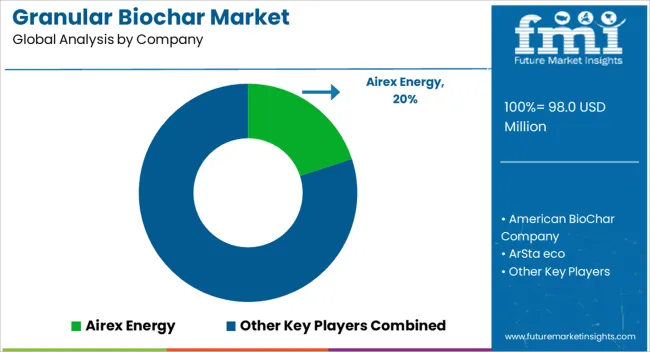

The granular biochar market is supported by key players such as Airex Energy, American BioChar Company, ArSta eco, Biochar, Carbonis, CharGrow, Circular Carbon GmbH, Oregon Biochar Solutions, Phoenix Energy, PYREG, and Vedic Orgo LLP. These companies focus on producing high-quality biochar from agricultural residues, forestry waste, and other biomass sources. Granular biochar is primarily used in soil amendment, water filtration, and carbon sequestration, with suppliers emphasizing particle uniformity, porosity, and nutrient retention capabilities. Market competition revolves around feedstock selection, production technology, and product customization. Companies like American BioChar and PYREG leverage pyrolysis technology for efficient carbonization, while Circular Carbon GmbH and CharGrow focus on engineered biochar products with enhanced adsorption and water retention properties.

Airex Energy and Oregon Biochar Solutions emphasize sustainable sourcing and regional distribution to meet agricultural and industrial demands. Trends in the market include the integration of granular biochar with fertilizers, composts, and soil conditioners to boost crop yields, reduce nutrient leaching, and improve soil structure. Suppliers provide detailed technical specifications, application guidelines, and environmental impact reports to help end-users optimize performance. Expansion into emerging agricultural regions and partnerships with agritech firms are common strategies to increase market reach and product adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 98.0 Million |

| Product Type | Wood-based Biochar, Agricultural Waste-based Biochar, Animal Manure-based Biochar, and Others (urban waste and forestry residues) |

| Application | Soil Amendment, Animal Feed, Water Treatment, Carbon Sequestration, Construction Materials, and Others (cosmetics and pharmaceuticals) |

| Distribution Channel | Distributors and Wholesalers, Direct Sales, and Online Retailers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airex Energy, American BioChar Company, ArSta eco, Biochar, Carbonis, CharGrow, Circular Carbon GmbH, Oregon Biochar Solutions, Phoenix Energy, PYREG, and Vedic Orgo LLP. |

| Additional Attributes | Dollar sales vary by feedstock, including wood, agricultural residues, and manure; by application, such as soil amendment, water treatment, livestock bedding, and carbon sequestration; by end-use industry, spanning agriculture, horticulture, environmental management, and energy; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sustainable agriculture, carbon reduction initiatives, and soil fertility enhancement. |

The global granular biochar market is estimated to be valued at USD 98.0 million in 2025.

The market size for the granular biochar market is projected to reach USD 318.1 million by 2035.

The granular biochar market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in granular biochar market are wood-based biochar, agricultural waste-based biochar, animal manure-based biochar and others (urban waste and forestry residues).

In terms of application, soil amendment segment to command 39.8% share in the granular biochar market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Large Granular Lymphocytic Leukemia (LGLL) Therapeutics Market - Growth, Demand & Outlook 2025 to 2035

Biochar Fertilizer Market Outlook – Growth, Demand & Forecast 2025 to 2035

Asia Pacific Biochar Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA