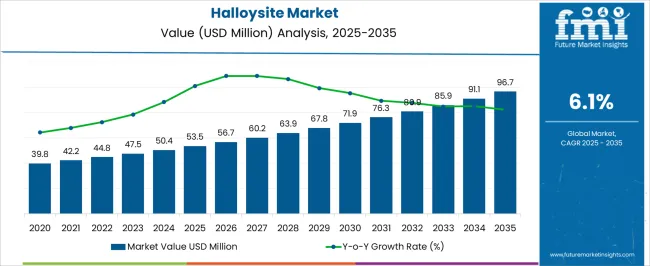

The halloysite market is expected to experience steady growth over the next decade, with a compound annual growth rate (CAGR) of 6.1%, reaching USD 96.7 million by 2035, up from USD 53.5 million in 2025. The primary driver of this market’s growth is the increasing use of halloysite in various industries, including ceramics, cosmetics, and medical applications. As more industries discover the material’s unique properties, such as its high strength, chemical stability, and natural origin, its adoption is expected to rise.

With the increasing demand for high-performance materials, the halloysite market is poised for a steady rise in market share across various sectors. Over the next decade, halloysite is likely to become an integral material in various manufacturing processes, with a particular emphasis on its eco-friendly and versatile properties. From 2025 to 2030, the market is predicted to grow at a steady pace, with industries in ceramics and cosmetics leading adoption. This market expansion reflects a broader trend towards utilizing natural, high-performance materials that offer not unique physical characteristics but also cater to consumer demands for more sustainable and ethical products. As the supply chain for halloysite expands and its applications diversify, its market position will continue to strengthen.

| Metric | Value |

|---|---|

| Halloysite Market Estimated Value in (2025 E) | USD 53.5 million |

| Halloysite Market Forecast Value in (2035 F) | USD 96.7 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The halloysite market is estimated to hold a notable proportion within its parent markets, representing approximately 2-3% of the clay minerals market, around 4-5% of the ceramic materials market, close to 6-7% of the nanomaterials market, about 1-2% of the oil and gas industry market, and roughly 2-3% of the cosmetics and personal care ingredients market. Collectively, the cumulative share across these parent segments is observed in the range of 15-20%, reflecting the niche yet significant role of halloysite in various industries.

The market has been driven by its unique properties, including high surface area, low toxicity, and its applications in ceramics, nanotechnology, and cosmetics. Adoption is influenced by halloysite's ability to enhance the performance of products in these sectors, especially in creating nanocomposites and advanced materials. Market participants have focused on promoting halloysite as a green and sustainable alternative to other materials, capitalizing on its versatility for use in high-performance products. The halloysite market has not only captured a small but growing share in the ceramic and nanomaterial industries but also influenced the oil, gas, and cosmetics markets, underlining its importance as a functional material in specialty applications.

The halloysite market is experiencing significant growth, driven by its unique nanotubular structure, high surface area, and excellent thermal and chemical stability, which enable diverse industrial applications. Increasing demand for halloysite in advanced materials and nanotechnology applications is being observed across multiple regions, with the paints and coatings, ceramics, polymers, and environmental remediation sectors being key contributors. The market’s growth is further supported by rising investments in nanomaterials research and the expanding adoption of halloysite as a cost-effective alternative to traditional nanoclays.

Technological advancements in processing and purification methods have improved the quality of halloysite, allowing for higher performance in specialty applications. Regulatory frameworks encouraging eco-friendly and high-performance materials are also influencing its adoption.

The increasing use of halloysite as a carrier for functional additives, catalysts, and drug delivery systems is broadening its application potential As industries focus on lightweight, high-strength, and multifunctional materials, halloysite is positioned for sustained demand growth, supported by both high-grade production and emerging innovations in nanotechnology and material sciences.

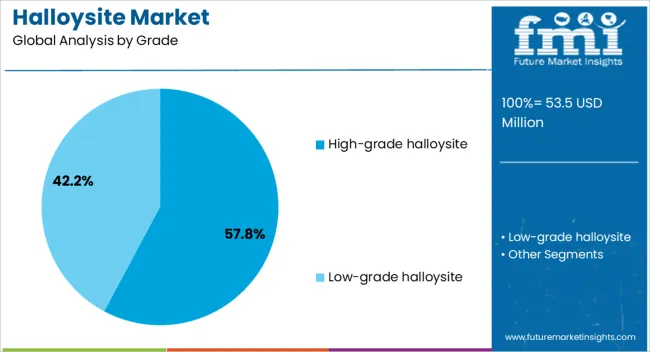

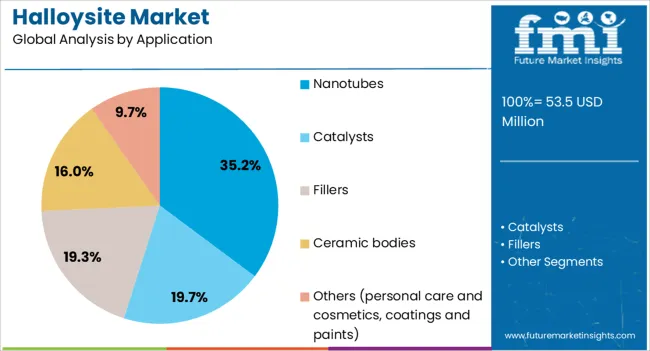

The halloysite market is segmented by grade, application, end-use industry, and geographic regions. By grade, halloysite market is divided into High-grade halloysite and Low-grade halloysite. In terms of application, halloysite market is classified into Nanotubes, Catalysts, Fillers, Ceramic bodies, and Others (personal care and cosmetics, coatings and paints). Based on end-use industry, halloysite market is segmented into Paints & coatings, Cosmetics, Pharmaceuticals, Ceramic, and Others (construction, agriculture). Regionally, the halloysite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high-grade halloysite segment is projected to hold 57.8% of the halloysite market revenue share in 2025, establishing it as the leading grade. Its dominance is being driven by superior purity, uniform particle size, and enhanced nanotubular structure, which make it suitable for high-performance applications in nanotechnology, functional coatings, and advanced composites.

The segment benefits from increasing demand in sectors that require precise material performance, such as pharmaceuticals, electronics, and specialty coatings. High-grade halloysite enables improved dispersion, chemical reactivity, and mechanical properties when incorporated into composite materials, supporting the design of lightweight and high-strength products.

Manufacturers are investing in advanced mining and purification techniques to ensure consistent quality and minimize impurities The segment’s leadership is further reinforced by its ability to provide reliable performance in applications requiring controlled release, encapsulation, or surface modification, making it the preferred choice among industrial end-users seeking quality, consistency, and multifunctional capabilities.

The nanotubes application segment is expected to account for 35.2% of the halloysite market revenue share in 2025, making it the leading application area. Its prominence is being driven by the material’s unique hollow tubular structure, which allows for high surface area, encapsulation of active compounds, and functional modification for advanced applications.

The segment is witnessing strong adoption in industries seeking nanocarriers for catalysts, additives, and controlled-release systems. Halloysite nanotubes provide improved mechanical reinforcement when incorporated into polymers, coatings, and composites, enhancing performance characteristics such as strength, durability, and thermal stability.

The growth of the nanotube application segment is further supported by increasing research and innovation in nanomaterials and functionalized clays, which expand potential use cases across multiple industrial sectors As demand for advanced materials with tunable properties rises, halloysite nanotubes are being recognized as a critical solution for next-generation high-performance applications, reinforcing their leadership within the overall market.

The paints and coatings end-use industry segment is anticipated to hold 36.9% of the halloysite market revenue share in 2025, positioning it as the leading end-use sector. This growth is being supported by the increasing requirement for functional additives that enhance durability, scratch resistance, and environmental protection in coating formulations. High-grade halloysite is being incorporated into paints and coatings to improve viscosity control, pigment dispersion, and mechanical reinforcement, thereby enhancing performance without compromising processability.

Regulatory initiatives promoting eco-friendly and high-performance coatings are further encouraging the adoption of halloysite-based solutions. The segment benefits from halloysite’s ability to act as a carrier for corrosion inhibitors, UV stabilizers, and other functional molecules, providing additional value in industrial and commercial coatings.

Rising investments in construction, automotive, and protective coating applications are driving demand for halloysite-enhanced paints As coatings formulations evolve to meet performance and sustainability standards, halloysite is positioned to maintain its dominant role in the paints and coatings end-use industry, supporting continued market growth over the forecast period.

The halloysite market is set to grow due to increasing demand across industries such as ceramics, cosmetics, and pharmaceuticals. The material's versatility in nanocomposites, coatings, and biodegradable products offers significant opportunities, especially as consumers and industries continue to lean toward sustainable and natural solutions. However, challenges related to production costs and supply chain limitations persist, requiring further advancements in processing techniques. Despite these hurdles, halloysite’s eco-friendly properties position it as a vital material for a variety of emerging applications.

The halloysite market is witnessing an increased demand, driven by the growing use of this versatile material in various industries. Its unique properties, such as high surface area and natural tubular structure, make it ideal for applications in ceramics, cosmetics, pharmaceuticals, and even environmental protection. In particular, the rising trend of using natural and eco-friendly ingredients in products is fostering demand for halloysite in industries like personal care and medicine. Halloysite is also finding a niche in energy storage and nanotechnology, further fueling market growth.

There is a significant opportunity in the development of halloysite-based nanocomposites, which are gaining popularity due to their superior mechanical properties and multifunctional capabilities. The material is increasingly being incorporated into coatings and composites for applications in construction, automotive, and electronics. Its ability to improve material performance, especially in terms of heat resistance, durability, and mechanical strength, makes it a sought-after solution. As industries look for sustainable alternatives to traditional materials, halloysite is being recognized as a key player, opening up new market avenues.

As environmental awareness grows, industries are shifting towards biodegradable and non-toxic materials, and halloysite fits perfectly into this trend. Its natural composition and non-hazardous properties are gaining attention from sectors looking for eco-friendly solutions. Halloysite is increasingly being used in biodegradable packaging materials, reducing environmental footprints. The growing emphasis on "green" products and sustainable manufacturing processes is expected to continue driving demand for halloysite, especially in consumer goods, packaging, and agricultural sectors.

Despite the growing demand for halloysite, its market faces challenges, particularly in large-scale production and pricing. The extraction and processing of halloysite remain complex and costly, making it less accessible for smaller companies or cost-sensitive industries. While the raw material is abundant in certain regions, the infrastructure required for its processing remains underdeveloped. As a result, the market experiences fluctuations in supply, which affects its affordability. Overcoming these production challenges is crucial for the continued growth and accessibility of halloysite in various applications.

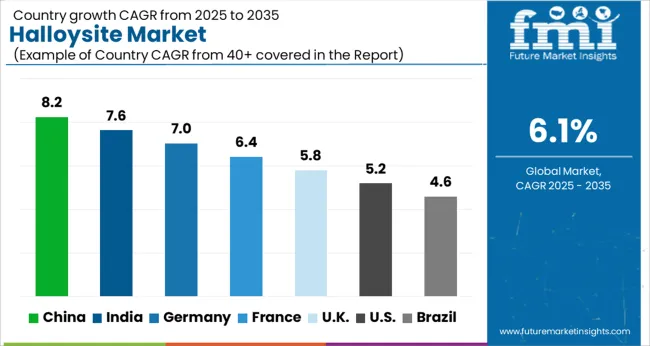

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global halloysite market is projected to grow at a CAGR of 6.1% from 2025 to 2035. China leads with a growth rate of 8.2%, followed by India at 7.6%, and Germany at 7%. The United Kingdom records a growth rate of 5.8%, while the United States shows the slowest growth at 5.2%. The growth is driven by increasing demand for halloysite in industries such as ceramics, plastics, and biomedical applications. As halloysite is increasingly recognized for its unique properties such as high thermal stability, improved material strength, and potential in drug delivery systems, its adoption is expanding across various sectors. Countries like China and India benefit from growing industrial activities, while developed economies focus on high-value applications and sustainable materials. This report includes insights on 40+ countries; the top markets are shown here for reference.

The halloysite market in China is experiencing strong growth, with a CAGR of 8.2%. As the leading producer and consumer of halloysite globally, China’s industrial sector is driving significant demand for halloysite, particularly in ceramics, plastics, and advanced manufacturing. The demand for halloysite in high-performance composites, as well as its application in drug delivery systems, is increasing in China. Moreover, the Chinese government’s focus on technological advancements in materials science and the development of eco-friendly products is fueling the adoption of halloysite in a range of applications. The market is also benefiting from China’s extensive ceramics industry, where halloysite is used as a valuable raw material due to its unique properties.

The halloysite market in India is growing at a robust rate of 7.6%. India’s expanding industrial base, particularly in ceramics, plastics, and healthcare, is driving the demand for halloysite. As Indian manufacturers seek to improve material properties and explore new applications, halloysite is being adopted for its excellent thermal and chemical resistance properties. In addition, the growing demand for environmentally sustainable materials is pushing Indian industries to explore halloysite as a green alternative in manufacturing processes. India’s growing research and development initiatives in nanomaterials and advanced manufacturing are also contributing to the demand for halloysite in various high-tech applications.

The halloysite market in Germany is growing at a rate of 7%. Germany’s strong focus on advanced manufacturing, materials science, and green technologies is contributing to the adoption of halloysite. The country’s well-established ceramic and automotive industries use halloysite as a filler material to enhance product performance, particularly in high-temperature applications. Additionally, halloysite is being explored in biomedical applications, which aligns with Germany’s focus on cutting-edge healthcare technologies. As the country continues to prioritize research into novel materials, the demand for halloysite is expected to rise, particularly for high-value applications such as drug delivery systems and composite materials.

The halloysite market in the United Kingdom is growing at a rate of 5.8%. The UK has a well-established ceramics industry that is increasingly adopting halloysite to improve product quality, particularly in high-performance applications. The demand for halloysite in sustainable materials is also gaining momentum in the UK, where there is a strong push for eco-friendly manufacturing solutions. Moreover, the UK’s focus on advanced materials for healthcare and technology sectors is opening new opportunities for halloysite in applications such as drug delivery and nanomaterial development. With a focus on research and development in these fields, the market for halloysite is expected to grow steadily in the coming years.

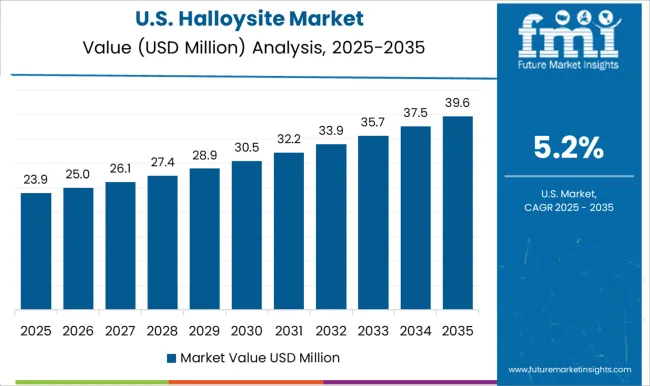

The halloysite market in the United States is growing at a rate of 5.2%. The USA is a significant consumer of halloysite in industries such as ceramics, advanced manufacturing, and healthcare. As demand for high-performance composites and eco-friendly materials rises, halloysite is increasingly being integrated into various applications. The USA is also leading in research and development of halloysite-based nanomaterials for drug delivery systems and other biomedical applications. The growing focus on sustainability and reducing the environmental impact of manufacturing processes is pushing USA industries to explore more sustainable materials like halloysite, contributing to the market's growth.

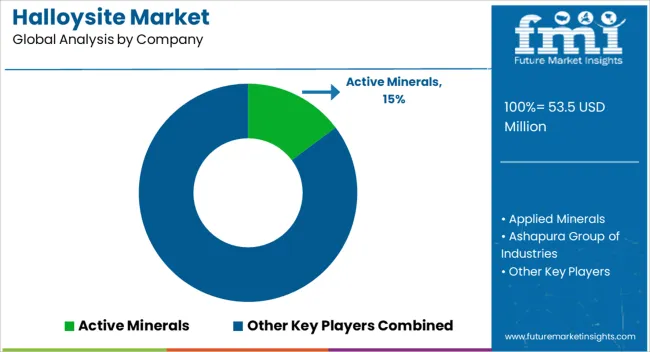

The halloysite market has witnessed considerable growth due to its expanding applications across various industries, including ceramics, healthcare, cosmetics, and agriculture. Companies like Active Minerals and Applied Minerals are key players in this market, providing high-quality halloysite clay, which is highly sought after for its unique properties such as high aspect ratio, nano-structure, and excellent sorption capabilities. Ashapura Group of Industries and BASF have contributed significantly to the market by enhancing the production process and expanding the material's application range. Halloysite's use in ceramics, particularly in the production of porcelain and pottery, is growing, owing to its ability to improve strength, durability, and thermal shock resistance. Additionally, halloysite’s incorporation in cosmetic and healthcare products, including as a carrier for active ingredients, has made it a vital component in these sectors. English Indian Clays and Global Industrial Solutions continue to support the development of halloysite’s potential in various consumer applications. The growing demand for halloysite in industrial and commercial applications has led to more players entering the market, such as Imerys Ceramics and KaMin, both of which are enhancing the availability and quality of halloysite for applications in coatings, paints, and advanced materials. The market has seen a rise in its use as an alternative to traditional kaolin in various industries, providing better thermal stability and improved mechanical properties. I-Minerals and SCR-Sibelco are focusing on the development of more sustainable mining techniques to ensure steady supply chains, while Thiele Kaolin Company and Una Kaolin are exploring halloysite’s potential in the production of functional materials like composites and advanced nanomaterials. As innovation in halloysite processing continues to evolve, it is expected to see expanded uses in agriculture and battery technology, boosting the demand for this versatile material in the coming years.

| Item | Value |

|---|---|

| Quantitative Units | USD 53.5 Million |

| Grade | High-grade halloysite and Low-grade halloysite |

| Application | Nanotubes, Catalysts, Fillers, Ceramic bodies, and Others (personal care and cosmetics, coatings and paints) |

| End-Use Industry | Paints & coatings, Cosmetics, Pharmaceuticals, Ceramic, and Others (construction, agriculture) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Active Minerals, Applied Minerals, Ashapura Group of Industries, BASF, English Indian Clays, Global Industrial Solutions, Halloysite, Imerys Ceramics, I-Minerals, KaMin, KeraSolutions, LB MINERALS, SCR-Sibelco, Thiele Kaolin Company, and Una Kaolin |

| Additional Attributes | Dollar sales by solution type (design software, production management, automation systems) and application (shipbuilding, repair, maintenance) are key metrics. Trends include rising demand for digital transformation in shipbuilding processes, growth in automation and AI integration, and increasing focus on cost reduction and operational efficiency. Regional adoption, technological advancements, and sustainability goals are driving market growth. |

The global halloysite market is estimated to be valued at USD 53.5 million in 2025.

The market size for the halloysite market is projected to reach USD 96.7 million by 2035.

The halloysite market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in halloysite market are high-grade halloysite and low-grade halloysite.

In terms of application, nanotubes segment to command 35.2% share in the halloysite market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA