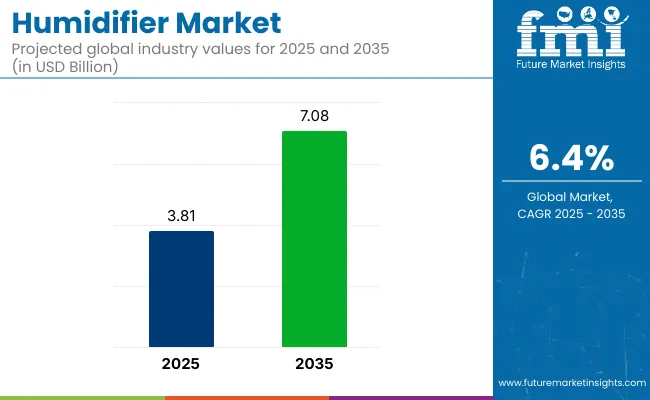

The global humidifier market is worth USD 3.81 billion in 2025 and is set to witness USD 7.08 billion by 2035, which shows a CAGR of 6.4% over the forecast period. The market is expanding steadily due to growing awareness about indoor air quality, respiratory health, and the need to combat dry environments in residential, commercial, and healthcare settings.

Humidifiers are increasingly used to maintain optimal humidity levels, helping alleviate symptoms of asthma, sinus congestion, dry skin, and allergies. Rising demand for energy-efficient and low-maintenance air management systems is also contributing to the adoption of both portable and whole-house humidifiers across urban and semi-urban households.

Technological advancements and smart home integration are fueling product innovation and consumer appeal. Manufacturers are offering ultrasonic, evaporative, and hybrid humidifiers with features such as humidity sensors, app connectivity, antimicrobial filters, and auto shut-off functions. The growing popularity of IoT-enabled home appliances is encouraging companies to develop Wi-Fi compatible and voice-controlled humidifiers that enhance convenience and indoor comfort.

Commercial and institutional facilities such as hospitals, laboratories, and data centers are adopting advanced humidification systems to meet health, safety, and equipment preservation standards. Additionally, the wellness industry is embracing humidifiers for aromatherapy and skin care applications, further diversifying use cases.

Furthermore, government guidelines promoting better indoor air management and increasing construction of residential and commercial buildings with HVAC integration are supporting the humidifier market globally. Regulatory bodies in North America, Europe, and parts of Asia are introducing energy-efficiency norms and health advisories that favor humidification in enclosed spaces.

In emerging economies, rising disposable incomes, urbanization, and awareness campaigns about air-related illnesses are propelling market penetration. As indoor health and smart living become central to consumer lifestyles, the global humidifier market is expected to witness sustained growth driven by innovation, affordability, and expanding applications across climate-sensitive regions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.81 billion |

| Industry Value (2035F) | USD 7.08 billion |

| CAGR (2025 to 2035) | 6.4% |

The below table presents the expected CAGR for the global humidifier market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2035, the business is predicted to surge at a CAGR of 4.9%, followed by a slightly higher growth rate of 4.8% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.9% |

| H2(2024 to 2034) | 5.2% |

| H1(2025 to 2035) | 6.4% |

| H2(2025 to 2035) | 6.8% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 6.8% in the first half and remain relatively moderate at 6.4% in the second half. In the first half H1 the market witnessed a decrease of 30 BPS while in the second half H2, the market witnessed an increase of 40 BPS.

The market is segmented based on humidifier type, installation type, sales channel, end user, and region. By humidifier type, the market includes warm mist humidifiers, cool mist humidifiers, ultrasonic humidifiers, and others (hybrid humidifiers, steam vaporizers, evaporative humidifiers, and impeller humidifiers).

In terms of installation type, it is categorized into fixed humidifiers and portable humidifiers. By sales channel, the market is divided into online/e-commerce and retail stores. Based on end user, the market is divided into residential humidifiers, commercial humidifiers, and industrial humidifiers. Regionally, the market is segmented into North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

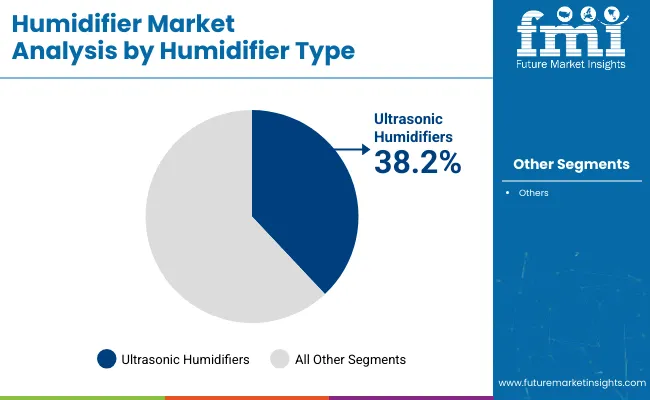

Ultrasonic humidifiers are projected to dominate the humidifier market by installation type, capturing a 38.2% share in 2025. Their leadership is attributed to quiet operation, energy efficiency, and safety advantages, particularly for residential and nursery applications. These humidifiers use ultrasonic vibrations to produce a fine mist, making them ideal for long-duration use without heat emission.

Consumers also favor them for their sleek design, low maintenance, and compatibility with essential oil diffusers. Companies like Honeywell, Levoit, and Crane are offering smart-enabled ultrasonic models that support app-based control, air quality monitoring, and customizable humidity settings. The segment is further driven by increased health awareness and the surge in respiratory issues due to indoor pollution and dry environments.

The cool mist humidifiers segment is expected to hold 27.4% of the market share in 2025. These units are commonly used in warmer climates and pediatric care, as they maintain ambient temperatures without introducing heat. Cool mist humidifiers are preferred for treating colds, congestion, and dry sinuses.

While warm mist models offer microbial control, concerns about heating elements and child safety limit their use. The market continues to shift toward misting technologies that combine energy efficiency with smart features, positioning ultrasonic and cool mist humidifiers as the preferred installation types across households and healthcare settings.

| Humidifier Type Segment | Market Share (2025) |

|---|---|

| Ultrasonic Humidifiers | 38.2% |

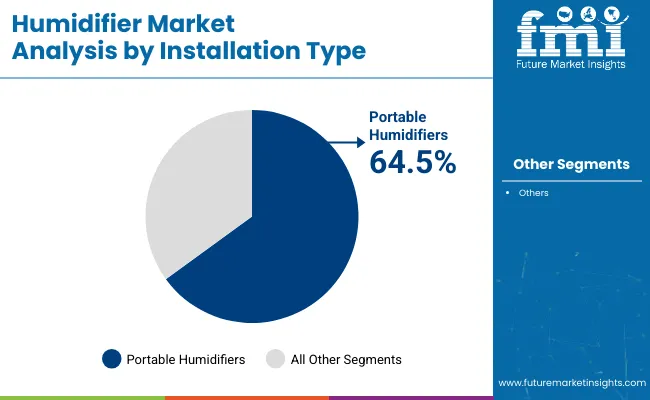

Portable humidifiers are expected to dominate the humidifier market, holding a substantial 64.5% market share in 2025. Their popularity stems from affordability, ease of installation, and the flexibility to humidify individual rooms or compact spaces. These units are widely used in bedrooms, offices, baby nurseries, and during travel.

With rising health consciousness and increasing urbanization, consumers are turning to portable models for improved sleep, sinus relief, and skin hydration. Key manufacturers such as Dyson, Pure Enrichment, and others are investing in mini and travel-size versions that offer USB compatibility, aromatherapy features, and automatic shut-off for safety.

Fixed humidifiers are usually integrated into HVAC systems or installed as central units in large residential or commercial buildings. Fixed systems offer long-term humidity control and are favored in environments requiring consistent air moisture, such as museums, hospitals, and luxury homes. However, their higher cost and professional installation requirements limit adoption in cost-sensitive markets. Despite this, both portable and fixed humidifiers are witnessing growing adoption due to global trends in air quality awareness and the need for respiratory comfort in increasingly dry indoor environments.

| Installation Type Segment | Market Share (2025) |

|---|---|

| Portable Humidifiers | 64.5% |

The online/e-commerce segment is expected to register the highest CAGR of 9.2% from 2025 to 2035 in the humidifier market. Increasing internet penetration, smartphone adoption, and digital-savvy consumers have led to a shift in purchasing behavior from brick-and-mortar outlets to digital platforms.

Consumers prefer the convenience of browsing multiple brands, reading reviews, comparing features, and receiving home delivery with easy return options. Platforms such as Amazon, Flipkart, JD.com, and Shopee have become the go-to channels for purchasing small home appliances like humidifiers. Online-exclusive discounts, flash sales, and bundled deals attract first-time buyers and repeat customers alike. Moreover, influencer-driven marketing and targeted ads are driving visibility and trust for lesser-known and emerging humidifier brands.

The rise of direct-to-consumer models, subscription-based filter replacements, and social commerce integrations is further transforming the humidifier shopping experience online. With more consumers shifting to digital ecosystems for home and wellness solutions especially in urban areas, online channels are set to outpace traditional retail growth. As global e-commerce infrastructure matures, this segment will remain the key distribution pathway for both premium and budget humidifiers.

| Sales Channel Segment | CAGR (2025 to 2035) |

|---|---|

| Online Retail | 9.2% |

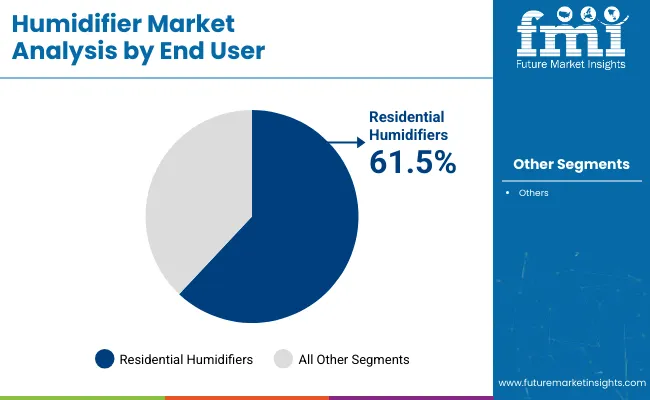

The residential humidifiers segment is projected to lead the end user category, accounting for 61.5% of the total market share in 2025. This dominance is largely driven by growing consumer awareness of the health benefits of maintaining optimal indoor humidity levels such as relief from dry skin, respiratory comfort, and prevention of static electricity. Residential demand is further amplified by seasonal dryness, increased use of indoor heating and air conditioning, and higher urban air pollution levels, particularly in colder or drier regions.

Homeowners and renters alike are increasingly investing in humidifiers to enhance indoor wellness, especially as hybrid and work-from-home lifestyles extend. Residential users prioritize models that are compact, low-noise, easy to maintain, and budget-friendly. Companies like Honeywell, Vicks, Dyson, and Levoit are introducing models with air purification, essential oil diffusion, and smartphone connectivity to cater to wellness-conscious consumers.

Retailers, both online and offline, have recognized this trend by curating product selections suited to living rooms, bedrooms, and nurseries. As households continue to prioritize air quality and comfort, residential humidifiers will remain the largest and most stable contributor to the global humidifier market.

| End User Segment | Market Share (2025) |

|---|---|

| Residential Humidifiers | 61.5% |

Health awareness and indoor air quality concerns will drive the market

One of the major factors fueling the humidifier market is the increasing public awareness about the importance of maintaining the optimum indoor air quality for ensuring good health. With more individuals now understanding how horrible dry air could be for some asthmatic fitness situations such as allergic reactions and dehydration, humidifiers have come to be a must-have.

Moisture can be brought to interior parts using humidifier which help with problems like dry skin, nasal congestion, and difficulty breathing. In places that experience cold winters or severe pollution, this has become especially prevalent, and today, humidification devices are considered indispensable household appliances necessary for shaping a healthy and comfortable living environment.

Technological innovations moving the humidifier industry forward.

In addition to Internet of Things compatibility, smart humidifiers can integrate seasonal condensation effects with smartphone apps and integrated air filtration functions, enticing the tech-savvy consumer.

Humidifiers have gained popularity due to improvements in energy efficiency, noise and ease of use. The shift drives market growth by satisfying the growing need for smart home devices and augmenting performance.

The Increasing Pollution Levels will fuel the market

Rising levels of pollution in many countries, especially in major urban centers, are driving the humidifier market. Cold air is known to cause respiratory disorders and other health problems, so humidifiers form an essential component in any course of action to improve indoor air quality.

This demand also explains the growth of this market, with consumers becoming more aware of the negative consequences of polluted air, leading to demand for humidifiers that add moisture to the air and relieve the symptoms of dry, polluted air.

The high initial cost and maintenance will the hamper the growth of Humidifier market

The high initial cost and continuous maintenance of humidifiers serve as a major deterrent despite the growing demand. Smart feature-rich, high-efficiency advanced humidifiers might be expensive, which may put off consumers on a budget.

Furthermore, routine upkeep like filter replacement and cleaning can raise total costs and cause annoyance for users. These elements may discourage prospective purchasers, particularly in emerging nations where disposable income may be less, which would otherwise impede market expansion.

The global humidifier industry recorded a CAGR of 5.2% during the historical period between 2020 and 2024. The growth was positive as it reached a value of USD 3.57 billion in 2024 from USD 2.79 billion in 2020. From 2020 to 2024, global humidifier sales increased steadily, driven by increased knowledge of the health advantages of maintaining appropriate indoor humidity levels and a boom in home appliance adoption as a result of the COVID-19 pandemic.

Technological developments, such as smart features and increased energy efficiency also contributed to this expansion. The market grew significantly in nations with severe air quality challenges, such as China and India, while demand remained stable in developed markets such as the United States and Europe.

The anticipated demand estimate for humidifiers from 2025 to 2035 indicates that the market is likely to expand at an accelerated rate worldwide. The market is projected to expand as a result of factors such poor weather, a rise in respiratory diseases, and ongoing developments in humidifier technology.

The demand for devices would expand due to the growth of smart homes and their integration of IoT in household equipment. Furthermore, increasing disposable incomes in developing nations and increasing consumer attention to indoor air quality will play a major role in the humidifier market's steady expansion over the coming ten years.

Tier one companies, such as Honeywell International Inc. and Dyson Ltd. dominate the humidifier market. Honeywell applies its deep know-how in climate control and air quality management to offer a range of durable and premium quality humidifiers for residential and commercial use.

They are leveraging new technologies and strong distribution networks as their strategy. A pioneer in its field, Dyson emphasizes progressive design and seamless technology intergration to attract a tech-savvy clientele. Their high-end branding, combined with stellar brand awareness at a national level, drives them to market dominance.

Tier 2: De'Longhi S.p.A, Condair, and BONECO AG: These companies have a substantial market share but operate in more specialized niches; De’Longhi offers adaptable and attractive humidifiers, with a focus on user-friendly functionality and design. Condair - the clear specialist in the industrial and commercial provision of humidity, deploys its experience to provide customised solutions across a range of sectors.

BONECO AG have a great reputation for high-end products that are designed with Swiss engineering and an innovative filtering system. These firms have decided to specialize in product reliability,performance, and niche markets, in order to maintain their competitive edge.

Companies in Tier 3: Carel Industries SpA, Neptronic, Smart Fog Inc., DriSteem, Aprilaire and LevoitCarel Industries and Neptronic focus on innovative solutions for industrial and commercial use, especially energy efficiency and smart control systems. Smart Fog Inc. and DriSteem, both players catering to specialised markets, offer advanced fogging systems and steam-based humidification solutions, respectively.

They also focus on the residential market, concentrating on whole-home system and air quality improvement. Levoit is an iconic consumer brand specializing in cost-effective, user-friendly and aesthetically-pleasing humidifiers. Market share with a niche marketing and product differentiation approac.

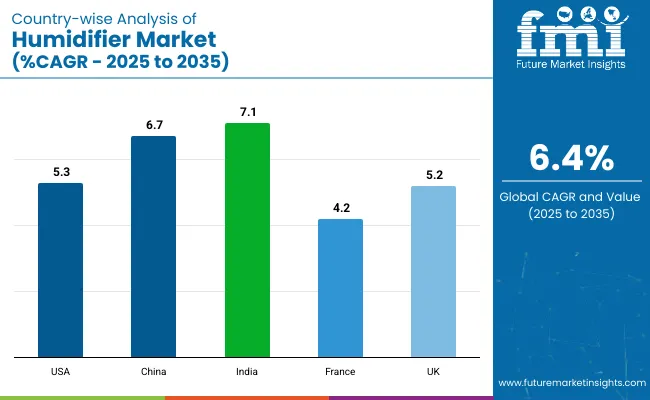

The section below covers the industry analysis for the humidifier market for different countries. The market demand analysis on key countries in several countries of the world, including USA, France, UK, China and India is provided.

The United States are anticipated to remain at the forefront in North America, with a value share of 61.2% in 2025. In East Asia, China is projected to witness a CAGR of 6.7% by 2035.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

| China | 6.7% |

| India | 7.1% |

| France | 4.2% |

| UK | 5.2% |

The USA humidifier market is poised to exhibit a CAGR of 5.3% between 2025 and 2035. The poor air quality is boosting the demand for the product. Air quality is a dynamic that has benefited the humidifier market in the United States as climate change worsens air pollution. Changes in the climate, like warmer days and longer periods without rain, can increase levels of ozone and particulate matter in the air that make dry air conditions and respiratory illness worse.

Demand for humidifiers is increasing as a result to reduce these effects. As people increasingly try to find ways to fix different aspects of their homes due to declining air quality, the demand for humidifiers is expected to increase and ultimately drive the market. This is due to customers becoming more conscious of the premium air quality of their internal environment and the importance of humidity control.

South Asia & Pacific, spearheaded by the India currently holds around 7.1% market share of the humidifier market. India's air pollution drives up the demand for humidifiers. Over the last few years, India has been declared the third most polluted country in the world with data up to October 2023, according to the IQAir 2024 World Air Quality Report far exceeding the WHO recommended guideline of 5 µg /m³. India's average PM2. 5 values are 53.3 µg/m³.

With concerns over air quality on the rise in India, the serious health effects of prolonged exposure to contaminated air, such as allergies, breathing problems, and cardiac disease, are becoming increasingly clear. The growing awareness among consumers about health and well-being, along with increasing desire/need to use advanced, effective and intelligent humidifiers, is projected to boost the demand for humidifier technology. Rising disposable incomes and the proliferation of e-commerce platforms that offer access to a range of air quality products will drive this demand.

East Asia, led by the China currently holds around 58.8% market share of the humidifier market. China is anticipated to grow at a CAGR of 6.7% during the forecast period. China has been investing heavily in smart city initiatives and advanced air quality management systems in an effort to mitigate serious pollution issues.

Improvement in these capabilities is driving the consumer demand for smart humidifier with the ability to be integrated with home automation systems, providing automated humidity control, and real-time air quality data. As the tech-savvy Chinese prioritize indoor air quality, the broader market for sophisticated humidifiers with high-tech features is experiencing rapid growth.

Some focus on technological innovation weekly, while others, on product variety or targeted marketing in the humidifier Space. Advanced features: Highlight advanced features, such as air purification and smart connectivity features, to appeal to tech-savvy customers and stay relevant in the market.

Others, such as Honeywell, prioritize durability and performance in a range of climate conditions, and serve both residential and commercial markets. Vicks, for instance, uses its healthcare legacy to give the brand cachet to products with therapeutic benefits. Moreover, manufacturers provide sustainable designs, noise-free working, and custom features to fulfil the specific requirements of different consumer segments.

Recent Industry Developments in Humidifier Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.81 billion |

| Projected Market Size (2035) | USD 7.08 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Humidifier Type | Warm Mist Humidifiers, Cool Mist Humidifiers, Ultrasonic Humidifiers, Others |

| By Installation Type | Fixed Humidifiers, Portable Humidifiers |

| By Sales Channel | Fixed Humidifiers, Portable Humidifiers |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Honeywell International Inc., Dyson Ltd., De'Longhi S.p.A, Condair, BONECO AG, Carel Industries SpA, Neptronic, Smart Fog Inc., DriSteem, Aprilaire, Levoit |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

In terms of humidifier type, the is divided into Warm Mist Humidifiers, Cool Mist Humidifiers, Ultrasonic Humidifiers and Others.

In terms of installation type, the is segregated into Fixed Humidifiers and Portable Humidifiers.

The sales channel is classified by industries as Online/E-commerce and Retail Stores.

The end user is classified by industries as Residential Humidifiers, Commercial Humidifiers and Industrial Humidifiers.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Installation Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Installation Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Market Attractiveness by Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Installation Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Market Attractiveness by Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Installation Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Installation Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Europe Market Attractiveness by Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Installation Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Installation Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Installation Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Installation Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Installation Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Installation Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Installation Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: MEA Market Attractiveness by Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Installation Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 179: MEA Market Attractiveness by End User, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

The global humidifier market is expected to reach USD 7.08 billion by 2035, up from USD 3.81 billion in 2025, expanding at a CAGR of 6.4% during the forecast period.

Ultrasonic humidifiers lead the market by installation type with a 38.2% share in 2025, favored for their silent operation, energy efficiency, and rising demand in homes and nurseries.

Portable humidifiers are set to dominate the market with a 64.5% share in 2025, driven by their affordability, ease of use, and suitability for bedrooms, offices, and small spaces.

India is projected to grow at the fastest pace with a CAGR of 7.1% from 2025 to 2035, driven by severe air pollution levels, increasing health awareness, and higher adoption of smart indoor air solutions.

Key drivers include rising awareness of respiratory health, integration with smart home systems, growing prevalence of dry indoor environments, and increasing demand for energy-efficient and IoT-enabled air quality products.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.