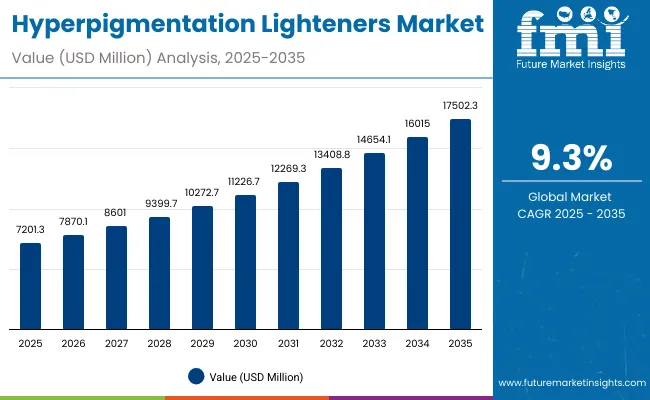

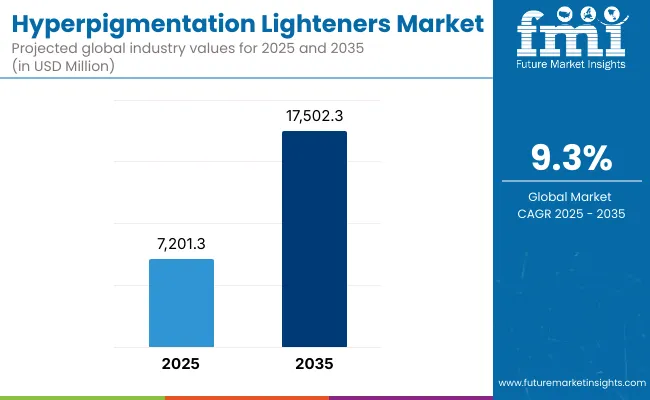

The Global Hyperpigmentation Lighteners Market is expected to record a valuation of USD 7,201.3 million in 2025 and USD 17,502.3 million in 2035, with an increase of USD 10,301.0 million, which equals a growth of over 143% during the decade. This overall expansion reflects a CAGR of 9.3%, representing nearly a 2.4X increase in total market size.

Global Hyperpigmentation Lighteners Market Key Takeaways

| Metric | Value |

|---|---|

| Global Hyperpigmentation Lighteners Market Estimated Value in (2025E) | USD 7,201.3 million |

| Global Hyperpigmentation Lighteners Market Forecast Value in (2035F) | USD 17,502.3 million |

| Forecast CAGR (2025 to 2035) | 9.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 7,201.3 million to USD 11,226.7 million, adding over USD 4,025.4 million, which accounts for nearly 39% of total decade growth. This phase reflects growing consumer adoption in post-acne PIH and sun/age spot correction, particularly in developed markets such as the USA and Europe, where dermatologist-tested and fragrance-free claims drive trust.

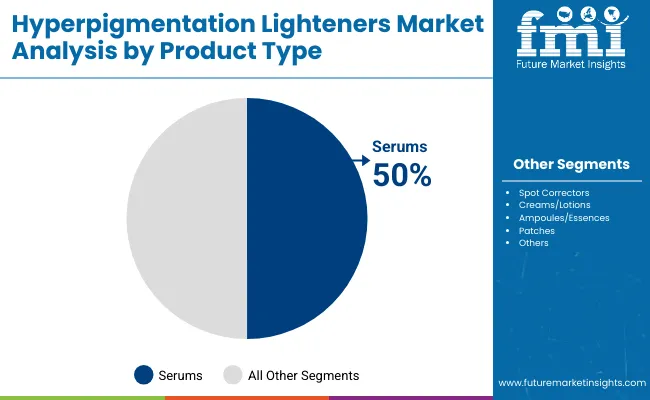

Serums dominate this period as they cater to almost half of consumer demand, offering concentrated actives and easy integration into existing routines. The second half from 2030 to 2035 contributes USD 6,275.6 million, equal to 61% of total growth, as the market surges from USD 11,226.7 million to USD 17,502.3 million.

This accelerated adoption is powered by the rising demand for clean-label formulations, niacinamide and tranexamic acid actives, and widespread use of patches and ampoules/essences in East Asia. Emerging economies such as China and India drive double-digit CAGR growth, fueled by increasing middle-class spending and rising incidence of melasma and hormonal pigmentation.

Advanced delivery systems, AI-powered skin diagnostics, and personalized e-commerce retail experiences push consumer penetration, while hydroquinone-free products gain regulatory approval and trust worldwide.

From 2020 to 2024, the Global Hyperpigmentation Lighteners Market witnessed steady growth from a lower base to 7,201.3 million by 2025, driven by hydroquinone-free and Vitamin C-based innovations. During this period, leading brands such as La Roche-Posay and SkinCeuticals dominated the premium dermatology-driven space, holding a strong consumer trust advantage in developed markets.

Competitive differentiation relied heavily on dermatologist endorsements, clinical evidence, and premium active formulations, while hydroquinone-based products began facing stricter regulatory checks. Entry-level competition from brands such as The Ordinary and Paula’s Choice disrupted pricing models by offering effective low-cost solutions, pushing legacy players to innovate faster.

Demand for hyperpigmentation lighteners is expected to expand to USD 7,870.1 million in 2026, with a revenue mix shifting toward clean-label, fragrance-free, and dermatologist-tested categories. Traditional cream and lotion formats face pressure from serums and ampoules/essences, as consumers seek higher potency and faster results. Brands are moving toward personalized skincare platforms, AI-powered digital consultations, and e-commerce subscription models to retain market share.

Emerging entrants in Asia are leveraging herbal actives and licorice extract formulations to target culturally specific pigmentation needs, adding strong regional differentiation. The competitive advantage is gradually shifting from product efficacy alone toward ecosystem-based skincare services, omnichannel retail presence, and digital community engagement strategies.

Advances in dermatology research and consumer awareness are improving treatment outcomes for sun-induced damage, melasma, and post-acne PIH, which are among the most common pigmentation issues. Serums have gained popularity due to their higher concentration of actives such as Vitamin C, niacinamide, and alpha-arbutin, which deliver visible brightening results.

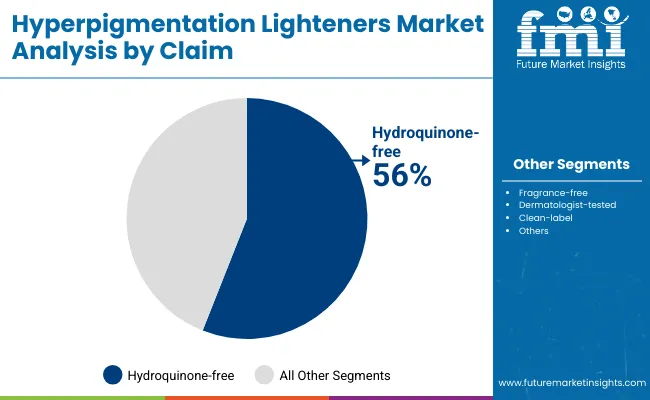

The rise of hydroquinone-free claims is particularly significant, as regulatory frameworks increasingly restrict hydroquinone usage in many geographies. This shift has accelerated R&D investment in alternative actives like tranexamic acid and kojic acid, which are gaining acceptance across both medical and cosmetic formulations.

The market is further fueled by dermatologist endorsements, e-commerce-led product discovery, and consumer demand for clean-label solutions. Asia-Pacific consumers are driving the adoption of ampoules, patches, and essences, while Western consumers prefer serums and spot correctors integrated with skincare routines.

By 2035, the market will be shaped by AI-driven personalization, smart diagnostics, and eco-friendly packaging, making the category increasingly competitive yet innovative.

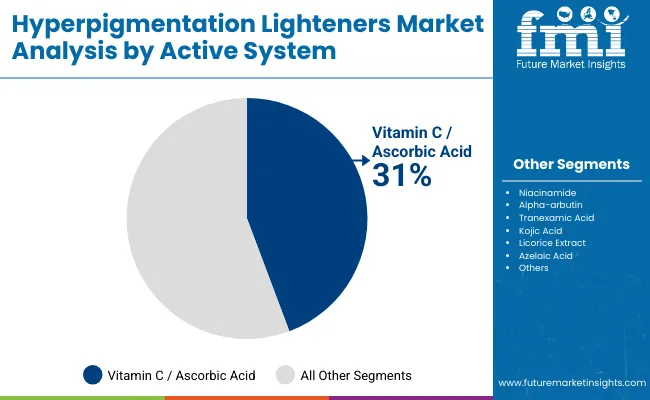

The Global Hyperpigmentation Lighteners Market is segmented by active system, product type, claim, channel, use case, and geography. Actives include Vitamin C/ascorbic acid, niacinamide, alpha-arbutin, tranexamic acid, kojic acid, licorice extract, and azelaic acid, with Vitamin C holding the largest share in 2025.

Product types range across serums, spot correctors, creams/lotions, ampoules/essences, and patches, with serums dominating. Claims include hydroquinone-free, fragrance-free, dermatologist-tested, and clean-label, reflecting strong consumer preference for safe and effective products. Distribution channels are diversified between e-commerce, pharmacies, specialty beauty retail, and dermatology clinics, where e-commerce leads growth.

Use cases span sun/age spots, post-acne PIH, melasma and hormonal spots, and overall tone evening. Regionally, growth is concentrated in North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa, with China and India leading the fastest CAGR trajectory.

| Product type | Value Share % 2025 |

|---|---|

| Serums | 50% |

| Others | 50.0% |

The serum segment is projected to contribute 50% of the Global Hyperpigmentation Lighteners Market revenue in 2025, maintaining its lead as the dominant product type. This leadership stems from the consumer preference for high-concentration formulations that deliver potent brightening actives directly to the skin. Serums are lightweight, penetrate quickly, and allow layering within complex skincare routines, which has driven adoption across both premium and mass-market consumers.

The segment’s growth is also supported by the innovation of multi-active blends, combining Vitamin C, niacinamide, and tranexamic acid to address multiple pigmentation concerns simultaneously. In addition, e-commerce platforms and dermatology clinics strongly promote serums as the first line of treatment for pigmentation, further reinforcing their market dominance. As clean-label and hydroquinone-free formulations expand, serums are expected to retain their role as the backbone of hyperpigmentation lightening solutions through 2035.

| Claim | Value Share % 2025 |

|---|---|

| Hydroquinone-free | 56% |

| Others | 44.0% |

The hydroquinone-free segment is forecasted to hold 56% of the Global Hyperpigmentation Lighteners Market share in 2025, led by rising regulatory restrictions and growing consumer demand for safer, long-term alternatives. Hydroquinone, once considered the gold standard, has faced tightening controls in the USA, EU, and Asia, pushing brands and consumers toward alternative actives such as alpha-arbutin, tranexamic acid, and kojic acid.

This segment’s growth is bolstered by the perception of safety, fewer side effects, and broader skin compatibility, making these formulations more accessible across diverse consumer groups. Hydroquinone-free claims are also central to brand marketing strategies, especially in premium and dermatologist-tested categories, where transparency and trust are critical.

With the clean beauty movement influencing product innovation, the hydroquinone-free segment is expected to continue expanding its share as a core growth driver of the hyperpigmentation lighteners market.

| Active System | Value Share % 2025 |

|---|---|

| Vitamin C/ascorbic acid | 31% |

| Others | 69.0% |

The Vitamin C/ascorbic acid segment is projected to account for 31% of the Global Hyperpigmentation Lighteners Market revenue in 2025, establishing it as the leading active system. Known for its antioxidant and melanin-inhibiting properties, Vitamin C is highly effective in brightening skin tone, reducing sun-induced spots, and protecting against environmental stressors.

Its dual role as both a corrective and preventive ingredient has solidified its widespread adoption. Advancements in stabilization technology, including encapsulated Vitamin C and derivative forms such as sodium ascorbyl phosphate, have further enhanced its efficacy and shelf life. Its broad compatibility with other actives like niacinamide and ferulic acid has increased its inclusion in serums, spot correctors, and creams across global markets. Given its strong brand recognition, clinical backing, and consumer trust, Vitamin C is expected to maintain its leadership in the active system category through the forecast period.

Rising Shift Toward Hydroquinone-Free Formulations

Since 2020, regulatory tightening around hydroquinone use in skincare (e.g., FDA restrictions and EU cosmetic safety frameworks) has forced a global pivot toward safer alternatives. This has created sustained demand for actives such as alpha-arbutin, kojic acid, licorice extract, and tranexamic acid. In 2025, hydroquinone-free products already account for 56% of market revenue, and this share is expected to rise further as consumers increasingly equate hydroquinone-free claims with safety, efficacy, and dermatologist backing.

The driver is amplified by e-commerce channels where “free-from” claims influence buying decisions. Brands like La Roche-Posay and The Ordinary have accelerated this movement with innovative clean-label serums, reshaping the industry. This positions hydroquinone-free not as a niche but as the new standard, fueling global adoption.

East Asia and South Asia as Engines of Future Growth

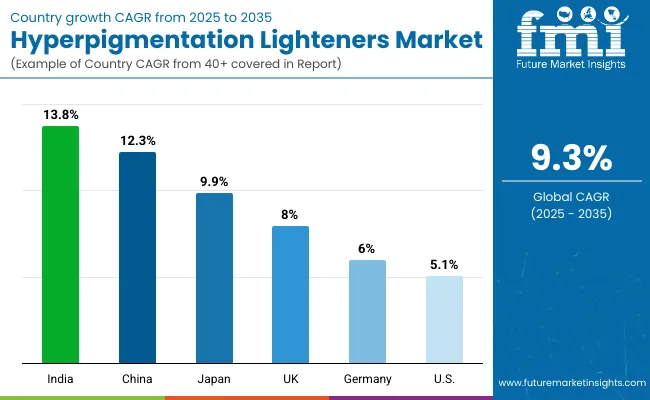

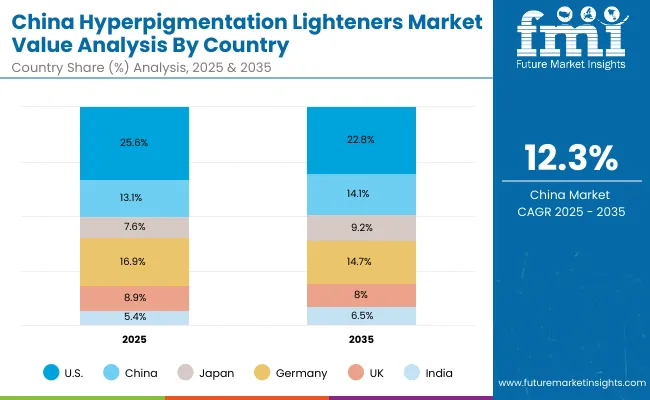

China (12.3% CAGR) and India (13.8% CAGR) are among the fastest-growing hyperpigmentation lightener markets globally. Rising incidences of melasma and sun-induced pigmentation, coupled with a growing middle class and high digital penetration, drive massive demand. Unlike Western markets where serums dominate, Asia-Pacific consumers adopt a multi-layered approach, favoring ampoules, essences, and patches, which broadens product category innovation.

Indian consumers are also shifting from traditional remedies to clinically proven dermatology-backed actives, offering strong potential for new entrants. The rising dominance of Asia is a structural driver, as the global market share balance shifts: the USA declines from 25.6% in 2025 to 22.8% in 2035, while China and India collectively expand their weight. This regional transformation drives the next decade of growth.

Stability Issues with Active Ingredients like Vitamin C

While Vitamin C holds the largest active share (31% in 2025), its instability in formulations creates a significant restraint. Pure ascorbic acid oxidizes easily when exposed to light, air, or heat, reducing efficacy and consumer trust. Brands often attempt stabilization through derivatives (e.g., sodium ascorbyl phosphate, magnesium ascorbyl phosphate) or encapsulation, but these add cost and complicate formulations.

As consumers demand transparency, any visible product oxidation (such as yellowing of Vitamin C serums) leads to brand credibility loss and product returns, creating a challenge for sustained leadership of this active.

Unequal Consumer Access Due to High Prices in Premium Segments

Premium hyperpigmentation products from brands like Obagi, SkinCeuticals, and Murad dominate dermatologist-backed solutions, often priced at USD 80-150 per serum. This creates affordability gaps, particularly in emerging markets where pigmentation prevalence is high but purchasing power is limited.

While mass-market disruptors like The Ordinary offer lower-cost alternatives, many consumers in Latin America, Africa, and South Asia still face limited access due to import tariffs, fragmented retail channels, and lack of local distribution. This disparity slows overall adoption and risks confining clinical-grade innovation to affluent consumers only, restraining the market from reaching its full growth potential.

AI-Powered Skin Diagnostics Driving Personalized Hyperpigmentation Treatments

A key trend is the integration of AI-driven skin analysis tools across e-commerce and dermatology clinics. Platforms now use smartphone imaging or in-clinic AI scanners to map pigmentation severity and recommend personalized regimens. This trend aligns with rising digital-first adoption in East Asia and the USA, where consumers are willing to pay for tailored solutions.

Companies are bundling serums, spot correctors, and patches into personalized subscription kits, creating recurring revenue streams. As trust builds in AI-backed accuracy, consumers view these solutions as clinically validated, reinforcing brand loyalty and product upselling opportunities.

Clean-Label Positioning Merging with Multifunctional Skincare

The clean beauty trend has merged with multifunctionality, pushing hyperpigmentation products to not only lighten spots but also offer anti-aging, hydration, and barrier-strengthening benefits. Serums now often combine Vitamin C with hyaluronic acid, peptides, or niacinamide, making them more versatile and reducing the need for multiple products.

Clean-label demands-fragrance-free, dermatologist-tested, and hydroquinone-free-are no longer “add-ons” but baseline expectations. This drives R&D investment into plant-derived actives like licorice extract and biotech-driven molecules that align with eco-friendly and safety-conscious narratives. By 2035, this multifunctional clean-label trend will reshape consumer purchase decisions and further increase serum dominance in the category.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.3% |

| USA | 5.1% |

| India | 13.8% |

| UK | 8.0% |

| Germany | 6.0% |

| Japan | 9.9% |

The country-level growth outlook for the Global Hyperpigmentation Lighteners Market highlights a clear contrast between emerging and mature economies. India is expected to register the highest CAGR of 13.8%, followed closely by China at 12.3%, making South Asia and East Asia the most dynamic markets. This growth is fueled by increasing urbanization, higher disposable incomes, and rising cases of melasma and post-acne pigmentation, particularly among younger consumers.

Both India and China are experiencing a cultural shift from traditional home remedies toward dermatologist-endorsed, active-based formulations, with serums, ampoules, and patches gaining traction. In Japan, the CAGR of 9.9% reflects its strong beauty culture, high consumer awareness, and preference for essences and multi-step skincare, which provide fertile ground for advanced actives like tranexamic acid and niacinamide.

On the other hand, mature markets such as the USA, UK, and Germany show more moderate growth, with CAGRs of 5.1%, 8.0%, and 6.0%, respectively. These regions already have high consumer penetration and strong dominance of premium brands, which limits acceleration. Growth here is primarily driven by product innovation-including hydroquinone-free, clean-label claims, and multifunctional formulations that combine anti-aging with pigmentation benefits.

While the USA retains a large market share due to strong dermatology channels and clinical skincare brands, its slower CAGR reflects saturation compared to Asia’s expanding middle class. The overall shift indicates that by 2035, Asia-Pacific will play a pivotal role in global market leadership, while Europe and North America focus on innovation-driven stability.

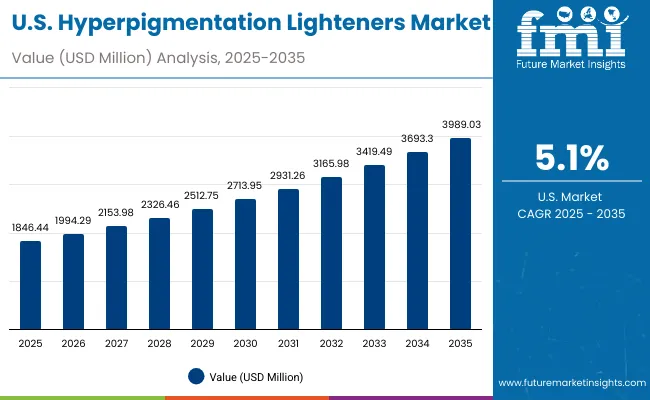

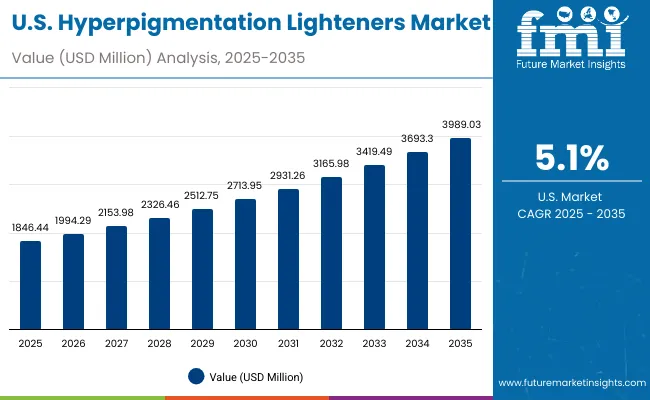

| Year | USA Hyperpigmentation Lighteners Market (USD Million) |

|---|---|

| 2025 | 1846.44 |

| 2026 | 1994.29 |

| 2027 | 2153.98 |

| 2028 | 2326.46 |

| 2029 | 2512.75 |

| 2030 | 2713.95 |

| 2031 | 2931.26 |

| 2032 | 3165.98 |

| 2033 | 3419.49 |

| 2034 | 3693.30 |

| 2035 | 3989.03 |

The Global Hyperpigmentation Lighteners Market in the United States is projected to grow at a CAGR of 5.1%, reflecting steady adoption of dermatologist-endorsed and premium formulations. Growth is led by strong consumer demand for serums, which accounted for nearly half of the USA market in 2025.

Hydroquinone-free solutions are expanding rapidly due to tightening regulations and a shift toward safer actives such as niacinamide and tranexamic acid. Dermatology clinics remain critical channels, supported by growing consumer trust in prescription-backed pigmentation solutions. Digital retail platforms and clinical e-commerce portals are also expanding product visibility.

The Global Hyperpigmentation Lighteners Market in the United Kingdom is expected to grow at a CAGR of 8.0%, supported by demand for clean-label and dermatologist-tested formulations. Consumers are increasingly adopting multi-step routines with spot correctors and serums positioned as central solutions.

The UK has also seen rapid adoption of fragrance-free pigmentation products due to rising consumer sensitivities. Premium European brands such as La Roche-Posay and Vichy maintain a strong presence in retail and pharmacies, while online dermatology platforms enhance accessibility. The market is shaped by regulatory trust and a strong preference for clinical-grade active ingredients.

India is witnessing rapid growth in the Global Hyperpigmentation Lighteners Market, forecast to expand at a CAGR of 13.8% through 2035, the highest globally. Rising cases of melasma and post-acne pigmentation among young adults drive demand.

Serums and creams are expanding beyond metro cities, reaching tier-2 and tier-3 regions due to e-commerce penetration and cost-effective launches. Local consumers are shifting from herbal lightening remedies to clinically proven actives such as niacinamide, alpha-arbutin, and licorice extract. Dermatology clinics and digital-first beauty platforms are boosting awareness, while affordability challenges are met by mass-market entrants.

The Global Hyperpigmentation Lighteners Market in China is expected to grow at a CAGR of 12.3%, driven by premium skincare adoption and widespread consumer focus on tone-evening solutions. Hydroquinone-free products already account for 54% of the market in 2025, supported by strong consumer trust in clean and safe formulations.

Ampoules, essences, and patches are favored due to the popularity of multi-step routines and K-beauty/J-beauty influences. Domestic brands are offering competitively priced solutions with botanicals like licorice extract, fueling mass adoption. Cross-border e-commerce and dermatologist-endorsed imports are also contributing to premium segment expansion.

| Country | 2025 Share (%) |

|---|---|

| USA | 25.6% |

| China | 13.1% |

| Japan | 7.6% |

| Germany | 16.9% |

| UK | 8.9% |

| India | 5.4% |

| Country | 2035 Share (%) |

|---|---|

| USA | 22.8% |

| China | 14.1% |

| Japan | 9.2% |

| Germany | 14.7% |

| UK | 8.0% |

| India | 6.5% |

| USA By product type | Value Share % 2025 |

|---|---|

| Serums | 49% |

| Others | 51.0% |

The Hyperpigmentation Lighteners Market in the United States is projected at USD 1,846.44 million in 2025. Serums contribute 49%, while creams, spot correctors, and other formats hold 51%, indicating a strong consumer preference toward lightweight, concentrated formulations.

The dominance of serums stems from their ease of use, higher potency, and dermatologist endorsements, making them the entry point for consumers seeking pigmentation solutions. Clinical brands emphasize Vitamin C and niacinamide-based serums, often marketed through dermatology clinics and e-commerce platforms.

Growth in the USA is supported by regulatory-driven demand for hydroquinone-free solutions, with safer alternatives such as tranexamic acid and alpha-arbutin gaining traction. Premium consumer expectations for fragrance-free, dermatologist-tested, and multifunctional claims amplify the market for clean-label serums. Digital platforms offering AI-powered skin analysis tools and subscription-based routines are also shaping consumer engagement, helping brands expand across younger demographics seeking preventive skincare.

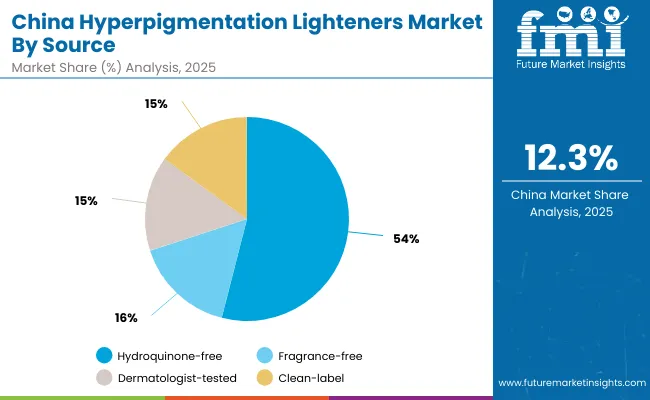

| China By claim | Value Share % 2025 |

|---|---|

| Hydroquinone-free | 54% |

| Others | 46.0% |

The Hyperpigmentation Lighteners Market in China is projected to be one of the fastest-growing globally, expanding at a CAGR of 12.3% through 2035. In 2025, hydroquinone-free formulations contribute 54%, reflecting consumer trust in safer actives and the regulatory push away from hydroquinone.

Chinese consumers prefer ampoules, essences, and patches, influenced by K-beauty and J-beauty routines that emphasize layering multiple products for holistic results. This positions the market for broad innovation beyond traditional creams and serums.

The dominance of hydroquinone-free claims is further amplified by domestic brands offering competitively priced products with botanicals like licorice extract, alongside premium imports from La Roche-Posay and SkinCeuticals.

Rapid adoption of e-commerce and cross-border beauty platforms drives access to both global and local labels, enabling fast category expansion. With melasma, sunspots, and hormonal pigmentation as rising skin concerns, China’s market outlook remains highly attractive, particularly in urban centers where digital-first beauty shopping is mainstream.

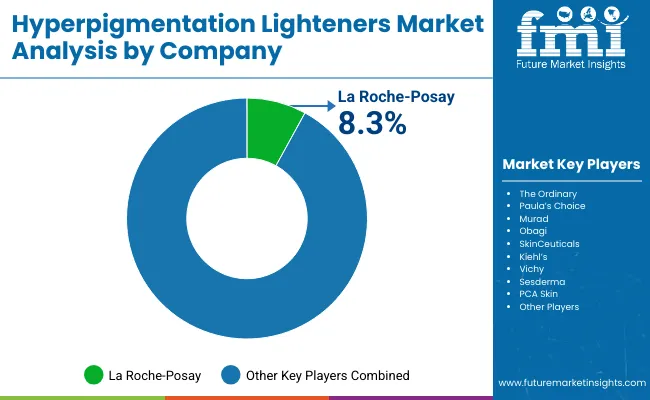

| Company | Global Value Share 2025 |

|---|---|

| La Roche- Posay | 8.3% |

| Others | 91.7% |

The Global Hyperpigmentation Lighteners Market is moderately fragmented, with multinational cosmetic and dermatology-backed brands competing alongside emerging digital-first disruptors. La Roche-Posay, with an 8.3% global value share in 2025, leads through its dermatologist-recommended product lines emphasizing Vitamin C and hydroquinone-free actives. Other established players such as SkinCeuticals, Obagi, and Murad focus on clinical-grade formulations distributed via dermatology clinics and specialty retail, strengthening their credibility through scientific validation.

Mass-market disruptors like The Ordinary and Paula’s Choice have captured younger audiences with low-cost, high-concentration serums, reshaping pricing strategies and increasing consumer accessibility. European legacy brands like Vichy and Kiehl’s continue to leverage strong pharmacy and retail channels, while Sesderma and PCA Skin specialize in dermatologist-tested, clinic-led solutions.

Competitive differentiation is moving beyond product efficacy alone to emphasize clean-label claims, e-commerce personalization, and integration with AI-based diagnostics. Emerging Asian brands leveraging botanical actives and affordable pricing are further intensifying competition, particularly in high-growth markets such as China and India.

Key Developments in Global Hyperpigmentation Lighteners Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Active System | Vitamin C/ascorbic acid, Niacinamide, Alpha- arbutin, Tranexamic acid, Kojic acid, Licorice extract, Azelaic acid |

| Product Type | Serums, Spot correctors, Creams/lotions, Ampoules/essences, Patches |

| Claim | Hydroquinone-free, Fragrance-free, Dermatologist-tested, Clean-label |

| Channel | E-commerce, Pharmacies/drugstores, Specialty beauty retail, Dermatology clinics |

| Use Case | Sun/age spots, Post-acne PIH, Melasma & hormonal spots, Overall tone evening |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | La Roche- Posay, The Ordinary, Paula’s Choice, Murad, Obagi, SkinCeuticals, Kiehl’s, Vichy, Sesderma, PCA Skin |

| Additional Attributes | Dollar sales by product type and claim, adoption trends in serums and hydroquinone-free solutions, rising demand for dermatologist-tested and fragrance-free products, category-specific growth in sun/age spots and post-acne PIH, segmentation by channels including e-commerce and clinics, integration of AI diagnostics and personalized skincare, regional demand shifts led by China, India, and Japan, and innovations in actives such as tranexamic acid and stabilized Vitamin C derivatives. |

The Global Hyperpigmentation Lighteners Market is estimated to be valued at USD 7,201.3 million in 2025.

The market size for the Global Hyperpigmentation Lighteners Market is projected to reach USD 17,502.3 million by 2035.

The Global Hyperpigmentation Lighteners Market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in the Global Hyperpigmentation Lighteners Market are serums, spot correctors, creams/lotions, ampoules/essences, and patches.

In terms of claims, the hydroquinone-free segment is expected to command a 56% share in the Global Hyperpigmentation Lighteners Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hyperpigmentation Skin Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hyperpigmentation Treatment Market - Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA