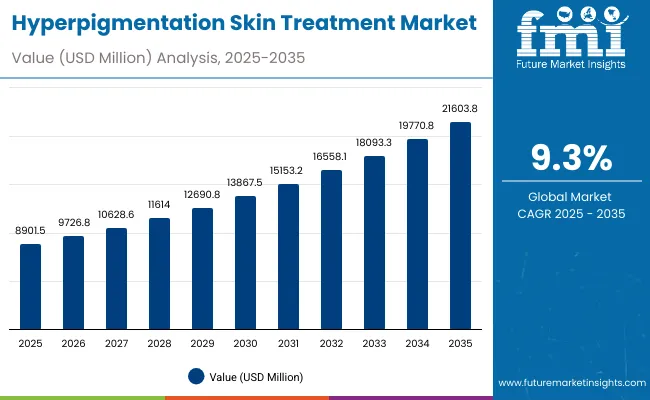

The Hyperpigmentation Skin Treatment Market is expected to record a valuation of USD 8,901.5 million in 2025 and USD 21,603.8 million in 2035, with an increase of USD 12,702.3 million, which equals a growth of ~143% over the decade. The overall expansion represents a CAGR of 9.3% and more than a 2X increase in market size.

Hyperpigmentation Skin Treatment Market Key Takeaways

| Metric | Value |

|---|---|

| Hyperpigmentation Skin Treatment Market Estimated Value in (2025E) | USD 8,901.5 million |

| Hyperpigmentation Skin Treatment Market Forecast Value in (2035F) | USD 21,603.8 million |

| Forecast CAGR (2025 to 2035) | 9.3% |

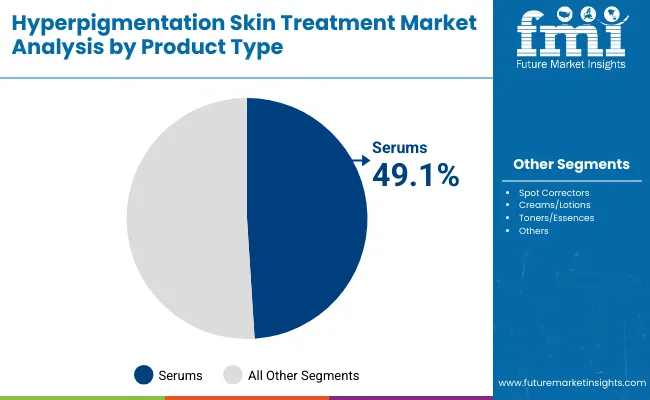

During the first five-year period from 2025 to 2030, the market increases from USD 8,901.5 million to USD 13,867.5 million, adding USD 4,966 million, which accounts for ~39% of the total decade growth. This phase records steady adoption of topical formulations like serums, creams, and spot correctors, with serums dominating at 49.1% share in 2025.

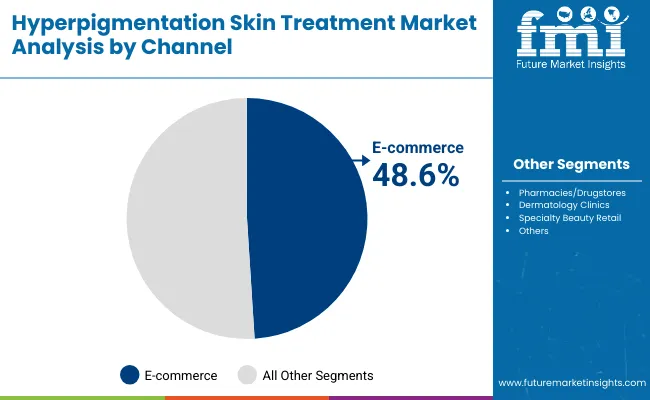

The second half from 2030 to 2035 contributes USD 7,736.3 million, equal to ~61% of total growth, as the market jumps from USD 13,867.5 million to USD 21,603.8 million. This acceleration is powered by advanced formulations targeting melasma, hormonal spots, and post-acne PIH, combined with rising demand for clinically validated and dermatologist-tested solutions. E-commerce emerges as the leading channel with 48.6% share in 2025, expanding further through digital-first skincare adoption and cross-border online sales.

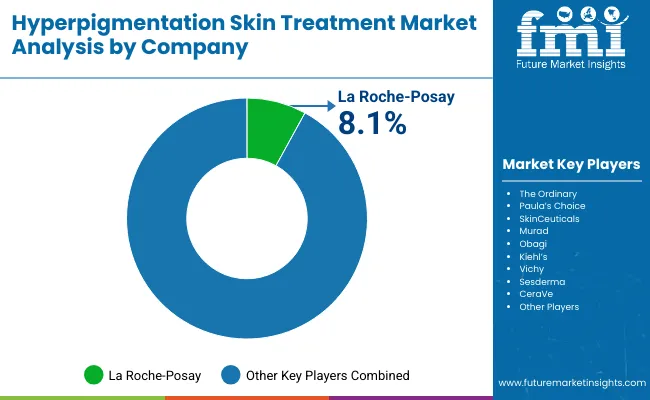

From 2020 to 2024, the Hyperpigmentation Skin Treatment Market grew steadily as consumer preference shifted toward dermatologist-recommended actives such as vitamin C, niacinamide, and tranexamic acid. During this period, the competitive landscape was dominated by multinational skincare companies controlling nearly 70-75% of global revenue, with leaders such as La Roche-Posay, The Ordinary, and Paula’s Choice focusing on efficacy-driven, fragrance-free, and sensitive-skin-safe formulations. Competitive differentiation relied on clinical validation, ingredient transparency, and dermatologist endorsements, while natural and clean-label offerings emerged as auxiliary drivers of growth. Service-based dermatology clinic treatments contributed modestly, representing less than 10% of the market value.

Demand for Hyperpigmentation Treatment is projected to expand to USD 8,901.5 million in 2025, with the revenue mix shifting as e-commerce and digital-first skincare platforms grow beyond 48% share. Traditional retail-led players face rising competition from digital-native brands leveraging influencer-driven marketing, AI-powered skin diagnostics, and subscription-based skincare models. Established leaders are pivoting toward hybrid omnichannel strategies, integrating direct-to-consumer sales and personalization platforms to retain relevance. Emerging entrants specializing in clean-label, vegan, and clinically validated actives are gaining share. The competitive advantage is moving away from mass hardware-driven distribution to ecosystem strength, personalization, clinical proof, and digital scalability.

The surge in acne cases and cosmetic procedures such as chemical peels and laser resurfacing has significantly increased the incidence of post-inflammatory hyperpigmentation among younger consumers. This demographic shift has expanded demand for preventive and corrective products like serums and spot correctors, with clinically validated actives such as niacinamide and alpha-arbutin gaining traction. Younger age groups are adopting these treatments early, driving consistent long-term demand for multi-step hyperpigmentation care routines.

Consumers are increasingly seeking hybrid skincare solutions that address both pigmentation and visible aging signs. Active ingredients such as vitamin C, peptides, and tranexamic acid are being formulated together in serums and creams to reduce melasma, sunspots, and fine lines simultaneously. This multifunctional trend allows brands to market premium-positioned products with higher margins while catering to the convenience-driven lifestyles of consumers who prefer fewer, more effective products in their daily routines.

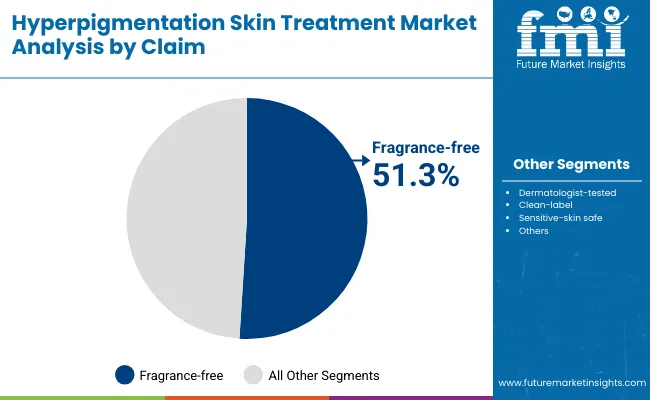

The Hyperpigmentation Skin Treatment Market is segmented by active ingredient, product type, claim, channel, and use case. Active ingredients include vitamin C, alpha-arbutin, niacinamide, azelaic acid, kojic acid, and tranexamic acid, which target different pigmentation pathways. Product types span serums, spot correctors, creams/lotions, and toners/essences, with serums leading adoption due to higher potency and faster results.

Claims include fragrance-free, dermatologist-tested, clean-label, and sensitive-skin safe, reflecting demand for safer formulations. Distribution channels cover e-commerce, pharmacies/drugstores, dermatology clinics, and specialty beauty retail. Key use cases include post-acne PIH, melasma, sun/age spots, and overall tone evening. Regionally, growth is strongest in Asia-Pacific, followed by North America and Europe.

| Claim | Value Share% 2025 |

|---|---|

| Fragrance-free | 51.3% |

| Others | 48.7% |

The fragrance-free segment is projected to contribute the largest share of the Hyperpigmentation Skin Treatment Market revenue in 2025, reflecting its dominance as the preferred claim among consumers with sensitive and reactive skin. Rising awareness of fragrance allergens, alongside dermatologists’ recommendations for fragrance-free products, has significantly boosted adoption. This segment benefits from growing demand for gentle formulations that minimize irritation, especially in treatments for melasma and post-acne PIH. Brands are innovating with clean-label, fragrance-free serums and creams, ensuring efficacy while maintaining tolerance, positioning this claim as the anchor of hyperpigmentation care.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 49.1% |

| Others | 50.9% |

The serum segment is forecasted to lead the Hyperpigmentation Skin Treatment Market in 2025, holding a significant share due to its high concentration of actives and rapid absorption capabilities. Serums are particularly favored for delivering potent ingredients like vitamin C, alpha-arbutin, and tranexamic acid directly to the skin, accelerating results for post-acne PIH, melasma, and sunspots. Their lightweight texture and suitability for layering make them essential in multi-step skincare routines. With growing clinical validation and consumer trust in targeted efficacy, serums are expected to sustain their leadership as the preferred format in hyperpigmentation care.

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 48.6% |

| Others | 51.4% |

The e-commerce segment is projected to account for the largest share of the Hyperpigmentation Skin Treatment Market revenue in 2025, solidifying its role as the fastest-growing distribution channel. Online platforms provide unmatched convenience, price comparison, and access to a wide assortment of serums, spot correctors, and creams targeting pigmentation concerns. The channel is strengthened by digital-first brand strategies, influencer-driven marketing, and subscription-based models offering recurring purchases. With Asia-Pacific driving rapid online adoption and global consumers prioritizing convenience, e-commerce is expected to remain the most influential sales channel shaping future hyperpigmentation product distribution.

Rising Incidence of Pigmentation Disorders The growing prevalence of pigmentation disorders such as melasma, post-inflammatory hyperpigmentation (PIH), and age spots is a major driver of market expansion. Rising acne incidence among younger populations, combined with increasing sun exposure and hormonal imbalances, has fueled demand for effective topical solutions. Consumers are turning to clinically validated actives like vitamin C, niacinamide, and tranexamic acid for visible correction. This expanding disease burden is broadening the consumer base and encouraging both pharmaceutical and cosmetic brands to diversify their pigmentation-focused portfolios.

Shift Toward Dermatologist-Recommended and Premium Formulas

An increasing number of consumers are choosing dermatologist-tested and premium hyperpigmentation treatments, especially in urban and affluent markets. Clinical evidence supporting ingredients such as alpha-arbutin and kojic acid has strengthened consumer trust. Dermatologists frequently recommend branded formulations that combine multiple actives for better efficacy. This professional endorsement, coupled with consumer willingness to pay more for proven results, is driving the premiumization of serums, creams, and spot correctors. Brands are leveraging medical validation and clinical trials to differentiate themselves and capture higher-margin opportunities.

Irritation Risks and Regulatory Barriers

A key restraint in the Hyperpigmentation Skin Treatment Market is the risk of skin irritation and sensitivity associated with potent actives like hydroquinone, high-strength vitamin C, and kojic acid. Many markets enforce strict regulations on concentration levels and labeling standards, slowing product launches and creating compliance costs. Negative consumer experiences with irritation or adverse reactions can also erode trust and deter long-term usage. This has prompted brands to reformulate with gentler alternatives, but regulatory scrutiny continues to limit speed-to-market for high-efficacy treatments.

Growth of Multifunctional and Preventive Formulations A clear trend in the Hyperpigmentation Skin Treatment Market is the rise of multifunctional products that combine brightening with anti-aging, hydration, and barrier-repair benefits. Consumers increasingly seek serums and creams with vitamin C, peptides, and hyaluronic acid blends to address both dark spots and early aging signs in one step. Preventive skincare is also on the rise, with younger consumers adopting tone-evening products earlier to avoid pigmentation concerns. This trend supports premium product launches, cross-category innovation, and greater adoption across wider age demographics.

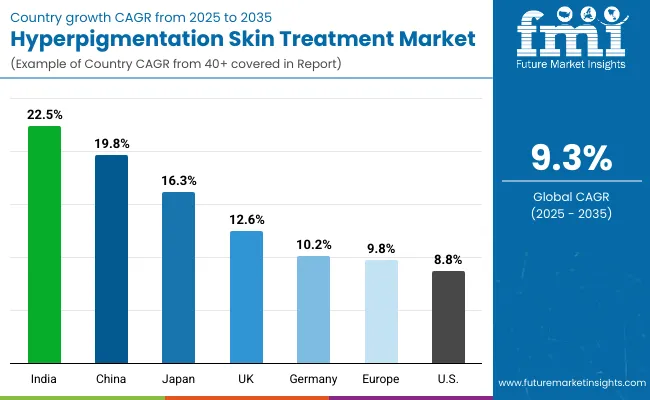

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| USA | 8.8% |

| India | 22.5% |

| UK | 12.6% |

| Germany | 10.2% |

| Japan | 16.3% |

The global Hyperpigmentation Skin Treatment Market shows pronounced regional disparities in adoption speed, driven by differences in consumer demographics, dermatological awareness, and retail access. Asia-Pacific is the fastest-growing region, led by China at 19.8% CAGR and India at 22.5%. Growth here is powered by rising disposable incomes, strong digital retail ecosystems, and consumer demand for brightening solutions targeting melasma, post-acne PIH, and sun-induced spots. China benefits from e-commerce-led penetration and K-beauty/J-beauty innovations, while India’s growth reflects expanding middle-class adoption and increasing dermatologist recommendations.

Europe maintains steady demand, with Germany (10.2%) and the UK (12.6%) emphasizing dermatologist-tested, fragrance-free, and clean-label products due to stricter regulations. Japan (16.3%) shows strong momentum from multifunctional brightening and anti-aging formulations. North America, led by the USA (8.8%), demonstrates moderate growth, shaped by premium skincare adoption, consumer preference for clinically validated brands, and higher trust in dermatologist-recommended products.

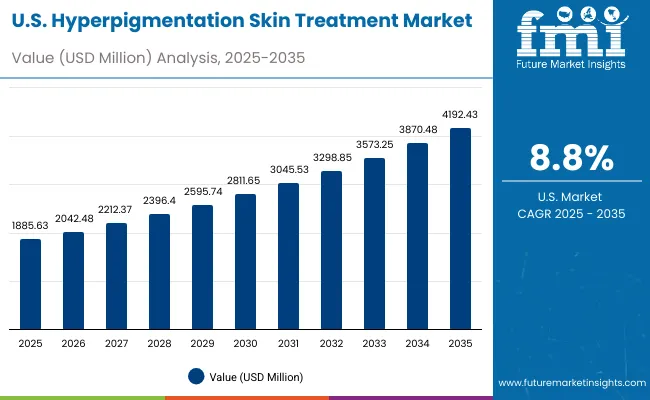

| Year | USA Hyperpigmentation Skin Treatment Market (USD Million) |

|---|---|

| 2025 | 1,885.63 |

| 2026 | 2,042.48 |

| 2027 | 2,212.37 |

| 2028 | 2,396.40 |

| 2029 | 2,595.74 |

| 2030 | 2,811.65 |

| 2031 | 3,045.53 |

| 2032 | 3,298.85 |

| 2033 | 3,573.25 |

| 2034 | 3,870.48 |

| 2035 | 4,192.43 |

The Hyperpigmentation Skin Treatment Market in the United States is projected to grow at a CAGR of 8.8%, driven by rising awareness of skin health, a surge in dermatologist-prescribed pigmentation therapies, and increasing consumer preference for premium, clinically validated formulations. Demand is especially strong for vitamin C and niacinamide-based serums targeting post-acne pigmentation, as well as spot correctors positioned for melasma and sunspot reduction. E-commerce continues to expand access, while pharmacies and dermatology clinics play a pivotal role in building consumer trust through professional recommendations.

The Hyperpigmentation Skin Treatment Market in the United Kingdom is expected to grow at a CAGR of 12.6%, driven by rising demand for clinically validated skincare and a strong retail ecosystem. Consumers are increasingly opting for dermatologist-tested and fragrance-free formulations to address melasma, age spots, and post-acne pigmentation. Pharmacies and dermatology clinics play a central role in prescription-led adoption, while online retail platforms and specialty beauty stores are expanding reach among younger, digital-savvy buyers. The clean-label and sensitive-skin-safe trend is particularly strong in the UK, where regulatory scrutiny pushes brands toward safer, high-quality formulations.

India is witnessing rapid growth in the Hyperpigmentation Skin Treatment Market, which is forecast to expand at a CAGR of 22.5% through 2035. The rise of pigmentation concerns such as melasma, acne-related PIH, and uneven skin tone has fueled strong demand across both urban and tier-2 cities. Increasing affordability of international and domestic skincare brands, combined with heightened dermatological awareness, is expanding the consumer base. E-commerce platforms are boosting accessibility, while dermatology clinics and pharmacies are reinforcing trust with prescription-grade formulations. Younger consumers are also adopting preventive brightening routines, further strengthening long-term growth.

The Hyperpigmentation Skin Treatment Market in China is expected to grow at a CAGR of 19.8%, the highest among leading economies. Growth is fueled by widespread adoption of brightening serums, spot correctors, and creams formulated with vitamin C, alpha-arbutin, and tranexamic acid. Local beauty brands are intensifying competition with affordable, clinically inspired products that appeal to younger consumers seeking fast results. Cross-border e-commerce platforms and livestreaming sales are further expanding accessibility, while dermatologist-backed K-beauty and J-beauty imports are driving premium adoption. Rising urban pollution and UV exposure are also heightening demand for daily pigmentation-prevention routines.

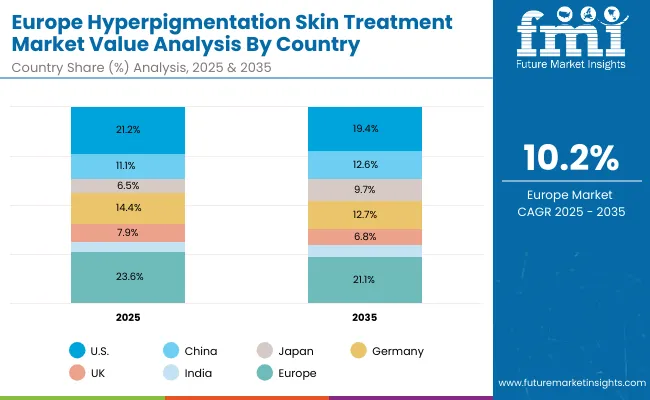

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.2% |

| China | 11.1% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.9% |

| India | 4.9% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 19.4% |

| China | 12.6% |

| Japan | 9.7% |

| Germany | 12.7% |

| UK | 6.8% |

| India | 5.5% |

The Hyperpigmentation Skin Treatment Market in Germany is projected to grow at a CAGR of 10.2%, supported by strong consumer preference for dermatologist-tested and fragrance-free formulations. Pharmacies and drugstores remain the dominant sales channels, while dermocosmetic clinics are expanding adoption of prescription-grade products like azelaic acid and tranexamic acid creams. German consumers show high demand for clean-label and sensitive-skin-safe solutions, driving innovation in multifunctional serums combining pigmentation correction with anti-aging benefits. EU cosmetic regulations further ensure product safety and efficacy, reinforcing consumer trust.

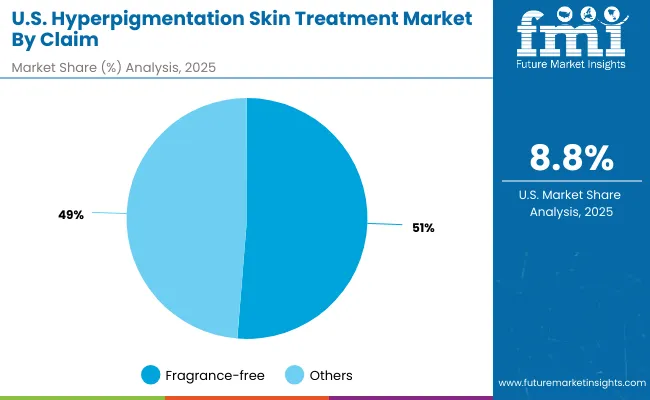

| USA by Claim | Value Share% 2025 |

|---|---|

| Fragrance-free | 51.3% |

| Others | 48.7% |

The Hyperpigmentation Skin Treatment Market in the USA is projected to expand steadily at a CAGR of 8.8%, supported by rising consumer preference for dermatologist-recommended and fragrance-free formulations. Fragrance-free products hold a majority share at 51.3% in 2025, reflecting heightened sensitivity awareness and stricter dermatological advice. Demand is driven by treatments for post-acne hyperpigmentation, melasma, and sunspots, with vitamin C and niacinamide serums leading adoption. Pharmacies and dermatology clinics remain trusted channels, while e-commerce is accelerating access and convenience. The clean-label trend is also shaping innovation pipelines across leading USA skincare brands.

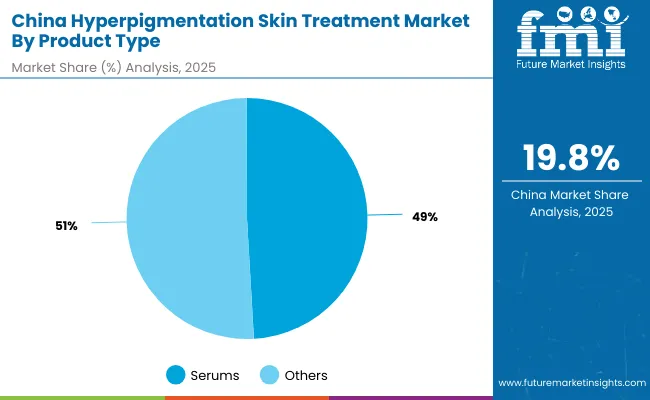

| China by Product Type | Value Share% 2025 |

|---|---|

| Serums | 49.1% |

| Others | 50.9% |

The Hyperpigmentation Skin Treatment Market in China is valued at USD 8,901.5 million in 2025, with serums emerging as the leading format at 49.1%. The popularity of serums stems from their high concentration of active ingredients like vitamin C, niacinamide, and tranexamic acid, which target pigmentation more effectively than traditional creams. Domestic and international brands are leveraging China’s robust e-commerce infrastructure and influencer-driven marketing to expand serum penetration. Affordable local serums are capturing mass-market segments, while premium brands dominate cross-border platforms. As younger consumers adopt pigmentation care preventively, serums are positioned to drive long-term growth in China.

The Hyperpigmentation Skin Treatment Market is moderately fragmented, with global leaders, premium dermocosmetic brands, and niche-focused innovators competing for market share. Leading players such as La Roche-Posay, SkinCeuticals, and Obagi dominate the premium clinical skincare segment with dermatologist-recommended, scientifically validated formulations. Their strategies emphasize multi-active serums, fragrance-free lines, and dermatologist endorsements to maintain consumer trust. Mid-tier brands like The Ordinary, Paula’s Choice, and Murad are driving adoption through affordable yet effective solutions, strong digital-first marketing, and ingredient transparency, making them particularly appealing to younger demographics.

Specialist players such as Sesderma, Vichy, and Kiehl’s leverage clean-label positioning, sensitive-skin-safe claims, and pharmacy-driven retail strategies to strengthen their foothold across Europe and Asia. Competitive differentiation is increasingly shaped by clinical validation, digital-first consumer engagement, and multifunctional innovations (combining brightening with anti-aging and hydration). E-commerce penetration, coupled with subscription models, is also redefining market competition by creating recurring revenue streams.

Key Developments in Hyperpigmentation Skin Treatment Market

| Item | Value |

|---|---|

| Quantitative Units | USD 8,901.5 Million |

| Active Ingredient | Vitamin C/ascorbic acid, Alpha-arbutin, Niacinamide, Azelaic acid, Kojic acid, Tranexamic acid |

| Product Type | Serums, Spot correctors, Creams/lotions, Toners/essences |

| Claim | Fragrance-free, Dermatologist-tested, Clean-label, Sensitive-skin safe |

| Channel | E-commerce, Pharmacies/drugstores, Dermatology clinics, Specialty beauty retail |

| Use Case | Post-acne PIH, Melasma & hormonal spots, Sun/age spots, Overall tone evening |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Ordinary, Paula’s Choice, La Roche-Posay, SkinCeuticals, Murad, Obagi, Kiehl’s, Vichy, Sesderma, CeraVe |

| Additional Attributes | Dollar sales by product type and claim, adoption trends in fragrance-free and clinically validated formulations, rising demand for serums and spot correctors, sector-specific growth in e-commerce and dermatology clinics, premiumization through multi-active formulations, and regional trends driven by Asia-Pacific and Europe. |

The global Hyperpigmentation Skin Treatment Market is estimated to be valued at USD 8,901.5 million in 2025.

The market size for the Hyperpigmentation Skin Treatment Market is projected to reach USD 21,603.8 million by 2035.

The Hyperpigmentation Skin Treatment Market is expected to grow at a 9.3% CAGR between 2025 and 2035.

The key product types in the Hyperpigmentation Skin Treatment Market are serums, spot correctors, creams/lotions, and toners/essences.

In terms of product type, serums are projected to command 49.1% share in the Hyperpigmentation Skin Treatment Market in 2025, driven by their efficacy in targeted pigmentation correction and higher consumer adoption across both dermatology clinics and retail channels.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hyperpigmentation Lighteners Market Size and Share Forecast Outlook 2025 to 2035

Hyperpigmentation Treatment Market - Trends & Future Outlook 2025 to 2035

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Skin Antiseptic Market - Demand, Growth & Forecast 2025 to 2035

Skin Bioactive Market Analysis - Trends, Growth & Forecast 2025 to 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA