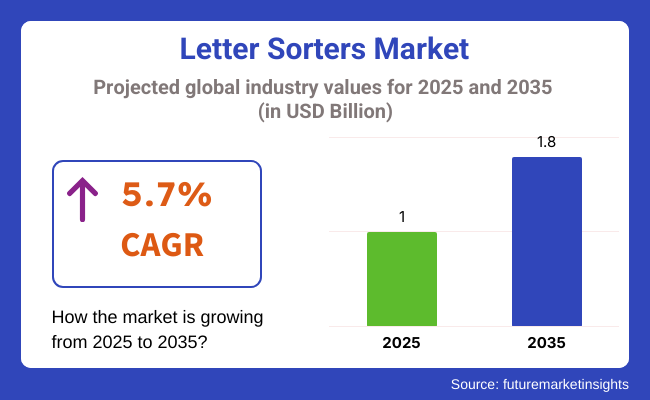

The value of the letter sorters market was USD 1 billion in 2025 and is expected to increase at a 5.7% CAGR between the years 2025 and 2035. The value of the global industry is expected to be USD 1.8 billion in 2035. The increased automation in postal and logistics services as a result of increased numbers of small parcels and mail handling in e-commerce and government segments is one of the major key drivers of the growth.

As postal operations evolve to serve modern logistical networks, letter-sorting machines are being retrofitted with high-speed scanning, optical character recognition, and address verification technology. These features enhance throughput, eliminate manual errors, and automate labor-intensive processes. National postal operators and private carriers are both investing in automated systems to counter operational delays and handle peak volumes more efficiently.

Growth is also rising from emerging industries, where government digitalization initiatives are modernizing existing infrastructure. Asian-Pacific and Eastern European countries are employing letter sorters to handle more official letters and citizen services, validating the legitimacy of hybrid models of communication that integrate physical and electronic mail delivery.

Industry players increasingly focus on the modular design of sorters, which facilitates connection to existing conveyor lines and automation-based picking systems. Such versatility appeals to medium-sized operators seeking long-term savings in operating costs. In addition, the demand for sustainability influences buying, with a preference for systems with low power usage and minimal maintenance.

The next decade will witness next generation sorting equipment demand fueled by digital convergence, parcel diversification expansion, and aging infrastructure replacement. Suppliers with the ability to offer multi-function machines with flexible software and predictive maintenance features will be best positioned to lead the marketplace revolution and address the evolving needs of postal and logistics networks worldwide.

Letter sorter implementation in multiple end-use applications highlights distinctions within the buying dynamic. For product categories aimed at consumer channels, small but accurate configurations connecting to postal tracking and notice services-based online platforms remain top priorities. These machines enable greater degrees of customer involvement applications, connection to the Internet of Things, and minimal maintenance needs, and serve as key buying decision drivers.

In industrial surveillance, letter sorters are used to automate document handling in administrative logistics. These environments require very high capacity and accuracy, so high imaging and sort speed are critical. Meanwhile, the healthcare and disinfection industries are concerned with regulatory compliance and require assured processing of sensitive mail like patient records or lab results.

Environmental monitoring commonly utilizes document sorting in regulatory filing or compliance communication. These end-users value strength, high productivity, and minimal operating costs. Across all segments, the need for flexible, smart-enabled, and compliance-ready sorters is shaping public and private procurement strategies further to meet the requirement for innovation in sorter design and software interfaces.

The greatest threat to the industry is the declining volume of traditional mail due to the rapid digitization of communication. As more government and corporate mail becomes electronic, the return on investment for high-capacity letter sorting machines may not be so attractive, particularly where there is universal internet penetration and mobile access.

In addition, the high capital costs associated with letter sorter purchase, installation, and maintenance pose financial risks to small and medium-sized businesses. Budget constraints and long-term cost-justification concerns can limit industry penetration, especially in emerging regions that are only beginning to automate their postal infrastructures.

Lastly, technological obsolescence is a long-term concern. As software and integration requirements evolve quickly, deployed sorter systems may struggle to keep up with newer logistics platforms or regulatory updates. Without timely upgrades and modularity, old systems may contribute to inefficiencies, data breaches, or bottlenecks in services, further pressuring vendors to future-proof their products.

From 2020 to 2024, the industry witnessed steady growth due to growing demand for effective mail processing solutions across industries. The growth in e-commerce and global trade caused a sharp rise in cross-border mail and package shipments, which required innovative sorting systems to process higher volumes. Technological developments during this period have been aimed at heightening automation, speed, and accuracy in sorting processes, and this has contributed to higher operational efficiency for postal and logistics players.

Going forward, up to 2025 to 2035, the sector is expected to continue expanding due to several underlying trends. The use of artificial intelligence (AI) and machine learning for sorting systems will be anticipated to improve predictive powers and automate sorting processes.

Further, there is going to be increased focus on sustainability, and manufacturers will implement environmentally friendly sorting systems to avoid the impacts. Tailoring the sorting systems according to the specialized demands of industry and implementing modularity for expanding scope will promote industry growth and provide customized solutions for various purposes.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing demand for effective processing solutions for mails | Integration of AI, machine learning, and sustainability initiatives |

| Accent on automation, speed, and precision in sorting processes | Establishment of AI-driven systems, sustainable solutions, and modularity designs |

| Preference for efficient and dependable sorting systems | Need for customizable, scalable, and sustainable sorting solutions |

| Online retail platforms growth | Breadth expansion of omnichannel strategies marrying online and offline experiences |

| Front-runner adoption of sustainable packaging and materials | General application of biodegradable and responsibly produced materials |

| Compliance with prevailing postal and logistic regulations | Increased emphasis on green regulations and industry-specific regulations |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

| UK | 4.3% |

| France | 4% |

| Germany | 4.4% |

| Italy | 3.8% |

| South Korea | 5.7% |

| Japan | 4.6% |

| China | 6.9% |

| Australia-NZ | 4.5% |

The USA industry will grow at a 4.9% CAGR during the study period. Demand for letter sorters is being boosted by ongoing digitalization in logistics and postal services in the USA As traditional mail volumes fall, increased parcel traffic and combined delivery operations are driving demand for efficient sorting plants. Letter sorters are now being designed to handle multi-format sorting, thus ensuring their long-term relevance to postal automation strategy.

Government and private logistics organizations are putting money into smart infrastructure investments like high-speed optical character recognition (OCR) technology and artificial intelligence-driven sorting software. Facilities are redesigned for greater throughput, precision, and cost savings for labor.

With e-commerce fueling package volumes, the role of letter sorters has evolved to facilitate semi-automated processing for mailroom and distribution center applications. Although the industry is mature, developments in mechatronics and integration with tracking technology will bring steady, although modest, growth.

The UK industry is expected to rise at a 4.3% CAGR during the research period. The UK industry is transforming with the modernization of the national postal infrastructure and the private courier business. Although the shift to electronic communication has reduced the volume of traditional letters, investment in automation still maintains quality service and enhances operating efficiency.

Letter sorters are still required for business mail, legal mail, and hybrid parcels on urban and rural networks. Advances in small and modular letter sorter designs are making installation possible in decentralized operations such as university campuses, government offices, and law firms.

Barcode scanners and machine learning-based address recognition are improving sorting speed and efficiency. Although the public sector remains a significant end-user, corporate mailroom demand is providing stability to the industry. Future growth will depend on technology innovation, energy-efficient designs, and service flexibility as delivery expectations evolve.

The Frenchindustry will grow at 4% CAGR during the study period. The French demand is based upon the need for high-efficiency processing of important mail such as government mail, business mail, and financial messages. Though digitization, regulatory and institutional segments are reducing letter volumes, they still employ physical mail for certain transactions, driving consistent, if modest, demand.

French logistics networks are emphasizing automation as part of broader supply chain modernization efforts. This includes the use of programmable logic controllers, OCR systems, and modular conveyor systems in letter-sorting processes. Government postal entities continue to upgrade older infrastructure with more energy-efficient and space-saving models, while private sector demand centers around high-volume mail processing facilities. The evolution towards multi-purpose sorters and smart facility management is making operational agility more practical.

The German industry is also predicted to expand by 4.4% CAGR during the forecast period. Germany's structured logistics network and accuracy-based operation requirements necessitate sustained investment in letter-sorting systems. Although electronic communication has stifled volumes in the regular mail, methodical mailing in legal, insurance and governmental sectors retains a stable level of demand.

German companies also favor long-term cost savings in automating and maintaining letter sorters' usefulness in high-volume mailrooms. Technology innovation is key to industry evolution. Suppliers are adding advanced imaging, fault detection, and adaptive sorting algorithms to boost performance and reliability. Small, energy-conserving machines optimally suited for flexible deployment in regional gateways are finding favor. The German industry is also adopting modular upgrades to lengthen equipment life cycles and maximize parcel sorting workflow compatibility.

The Italian industry is forecast to expand at 3.8% CAGR during the study period. Italian industry growth is relatively restrained, in line with broader trends in digital take-up and cost pressures on postal operations. Letter sorters continue to play an important role in large-volume government and legal mail, as well as financial industries, with paper-based document handling for regulatory purposes.

Investment is primarily aimed at low-cost and reliable sorter models with minimal maintenance needs. There is a growing demand for small desktop units for in-house mailrooms and institutions that process structured mail sorting. Adoption of automation is slower than in northern Europe, but local demand exists for low-footprint and semi-automatic sorting equipment. Long-term growth will depend on the upgrading of public sector logistics infrastructure and growing interest from private firms in workflow automation.

South Korea's industry will grow at a 5.7% CAGR during the research period. South Korea's sophisticated infrastructure combined with technology uptake acceleration makes it a desirable smart letter sorting systems industry. Digital communications remain dominant in all but a few industries, but underlying demand from legal, educational, and logistics sectors continues to keep physical document transfers in play.

Accuracy performance and throughput speed are the reasons why emphasis is being placed on driving high-speed, AI-enabled letter sorters. Local manufacturers are focusing on scalable, software-driven solutions that support predictive maintenance and system analysis. Integration with mobile tracking programs and centralized control systems is increasingly common, particularly in high-tech urban regions. Letter sorters are also being adapted for hybrid use in mixed-format mail and lightweight parcel sorting.

The Japanese industry will grow at 4.6% CAGR during the period of study. The demand in Japan is consistent on the basis of the institutional and cultural importance of hard documents in business, government, and education. Despite the penetration of digital technology, traditional forms have gained acceptance in formal communication, certificates, and contracts.

This ongoing reliance is the basis for the steady demand for efficient and reliable sorting mechanisms. Quality, automation, and space efficiency are the focus of the industry. Japanese manufacturers are producing compact yet highly powerful machines with noise-reduction features, advanced diagnostics, and easy-to-use interfaces. Integration into robotic arms and IoT capabilities for real-time tracking are also on the increase.

The industry in China will develop at 6.9% CAGR during the period under study. China's vast geographic coverage and rapidly emerging e-commerce environment are playing a significant role in propelling demand for automation in mail and document sorting. Although personal letters have seen declining usage, business and legal mail, government documents, and hybrid packages continue to require sorted solutions.

Synchronized mass construction of intelligent logistics hubs between provinces is creating new demand for smart and high-capacity letter sorters. Chinese technology companies are investing in artificial intelligence, machine vision, and machine learning algorithms to enhance address reading speed and accuracy. In addition, letter sorters are being incorporated into end-to-end warehouse management systems to enhance end-to-end logistics performance.

The Australia-New Zealand industry will expand at 4.5% CAGR during the period of study. While total mail volumes have fallen in the region, essential government communications, legal notices, and formal business correspondence create a floor of demand for letter-sorting equipment. The focus is on optimizing postal efficiency and reducing labor costs through scalable automation.

Postal and courier network modernization efforts are resulting in the replacement of outdated equipment. Small- and mid-sized firms are also using desktop letter sorters more to sort incoming and outgoing mail effectively. Energy efficiency, low maintenance, and ease of integration with legacy systems are shaping product demand. As e-commerce logistics infrastructure continues to evolve, hybrid models that handle both letters and lightweight parcels are becoming increasingly popular.

The industry for letter sorting equipment is mainly electronic based, which will cover 82% of its share in 2025, while the18% will go to manual letter sorters.

The reason behind the significant prevalence of automated letter sorters is attributed to the increasing demand for an efficient and productive mail sorting process. They have been widely introduced into such industries and thus into sectors such as postal services, logistics, and large enterprises that are involved in heavy mail movements. They can process thousands of letters and parcels in minutes instead of hours as manual sorters.

The great reduction in human error makes the overall process quicker. Providing advanced automated letter sorting solutions that are highly scalable and customizable to suit the needs of different organizations. Some of those are Siemens, Pitney Bowes, and Bell and Howell. The efficiency provided by these systems and the accuracy of getting things done cost-effectively makes them the choice of preference for large-scale operations.

Though small in industry size, manual letter sorters still earn their place in small trades or for activities where the volume of mail does not convince one to invest in such technology. Such systems are comparatively cheaper options available to small businesses and offices that would not have a large amount of mail movement. Mailroom Solutions and Kern provide solutions such as manual sorting solutions that cater to companies or specific use cases where advanced technology is not required, are reliable, and are easy to maintain.

Automated letter sorters will yet continue to hold the major industry share, but manual systems will stay relevant for the smallest operations and some low-volume specific applications.By ApplicationThe industryin 2025 will be held at 40% by government postal services. express & parcel services will take up the next 35%.

Government postal services are the biggest industry segment because they handle about a billion pieces of mail per day, including letters, parcels, and official correspondence. Because of this large volume, efficient sorting systems are needed to be able to handle this flow of mail across a number of locations. These facilities usually employ automated letter sorters for their operations, ensuring quick delivery of letters throughout vast geographical areas.

Organizations such as Pitney Bowes and Neopost have been very helpful to government postal agencies in tailoring and developing large-scale sorting solutions worldwide, thus drastically improving their operational efficiency and cost reduction. As governments now focus on digital transformation and modernization, the need for advanced sorting technologies in postal services rises.Express andparcel services, the second significant industry segment, will see substantial growth in the years to come with a 35% industry share.

As a result, companies like FedEx, UPS, and DHL have adopted high-volume automated letter sorting systems to collect express and parcel deliveries and e-commerce logistics, making delivery really easy. Unlike other systems that require an easy and accurate sorting machine, these systems tend to be fast due to their varying sizes and types of parcels.

This is where automated sorting systems from Siemens and Beumer Group come into play, providing high-speed sorting along with the best shipment tracking. The growing e-commerce demand coupled with fast deliveries is projected to set up a real boom in this segment.

The industryis projected to grow due to the rising demand for high-speed automation in postal services and logistics operations. Other well-known players include BÖWE SYSTEC GmbH, Fluence Automation, ID Mail Systems, Dematic, and Honeywell International Inc., who are already investing in high-tech sorting systems for improved operational efficiency, reduced manual labor, and higher throughput.

However, BÖWE SYSTEC GmbH has been the technological leader in providing modular and scalable letter sorting systems with OCR and real-time analytics. Fluence Automation, specializing in compact-sorting solutions specific to mail, enjoys an extensive industry share in mid-size postal facilities and government agencies. ID Mail Systems tailors small-parcel and letter-sorting systems specifically for their address verification and barcode scanning accuracy.

Dematic, using the richness of its intralogistics expertise, has configured letter sorting into its broader automated solutions for e-commerce fulfillment facilities and retail lockdowns. Honeywell International Inc. offers spectacularly developed vision and control systems in its sorting trunk, which deliver high-level accuracy and automation in a mixed mail environment. The industry is also attracting interest in AI software upgrades that can be retrofitted onto old machines to help meet new delivery speeds and address accuracy standards.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| BÖWE SYSTEC GmbH | 18-22% |

| Fluence Automation | 14-18% |

| ID Mail Systems | 12-16% |

| Dematic | 10-14% |

| Honeywell International Inc. | 8-12% |

| Other Players | 24-28% |

| Company Name | Offerings & Activities |

|---|---|

| BÖWE SYSTEC GmbH | Offers modular letter sorters with advanced OCR, automation control systems, and high-speed sorting. |

| Fluence Automation | Focuses on compact, mid-volume letter sorters with address recognition and mail tracking capabilities. |

| ID Mail Systems | Develops intelligent, space-saving sorters with real-time address verification and barcode precision. |

| Dematic | Integrates letter sortation into full-scale automation for postal and e-commerce operations. |

| Honeywell International Inc. | Provides smart vision systems and automated mail-handling hardware for scalable letter sorting. |

Key Company Insights

BÖWE SYSTEC GmbH (18-22%)

A global leader in mailroom automation, known for fast, modular sorting systems with deep analytics and software integration.

Fluence Automation (14-18%)

It specializes in mail-centric solutions for mid-sized operations and offers user-friendly systems with high OCR accuracy.

ID Mail Systems (12-16%)

Delivers compact and customizable sorting units, favored for mixed mail operations in government and private sectors.

Dematic (10-14%)

Leverages intralogistics experience to support smart sortation systems in hybrid postal and retail environments.

Honeywell International Inc. (8-12%)

Integrates AI-powered imaging and automated material handling for accurate and efficient letter sortation.

The industry is segmented into manual and automated.

The industry is divided into government postal, courier, and express & parcel.

The industry covers North America, Latin America, Europe, Asia Pacific, and Middle East and Africa.

The industry is anticipated to be valued at USD 1 billion in 2025.

The industry is projected to reach USD 1.8 billion by 2035.

China is projected to grow at a 6.9% CAGR.

Demand is notably driven by a shift toward electronic-based sorting solutions that offer real-time tracking, faster throughput, and reduced human error.

Prominent companies operating in the space include Bastian Solutions, BÖWE SYSTEC GmbH, Dematic, EuroSort Systems BV, Falcon Autotech Private Limited, Fluence Automation, GBI Intralogistics, Honeywell International Inc., ID Mail Systems, and NEC Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 107: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cross-Belt Sorters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA