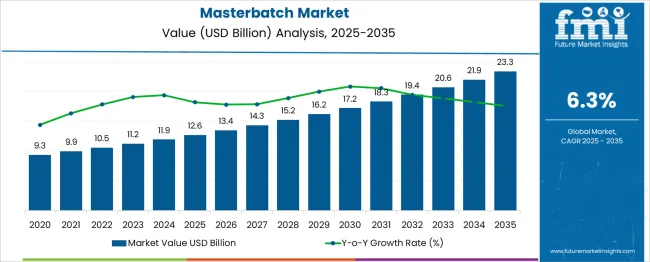

The Masterbatch Market is estimated to be valued at USD 12.6 billion in 2025 and is projected to reach USD 23.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

The steady increase in market value indicates stable demand growth with limited risk of market share erosion for established players. Between 2025 and 2030, the market value rises from USD 12.6 billion to USD 17.2 billion, representing an increase of USD 4.6 billion.

Annual increments average around USD 0.8 billion during this period, supported by growing applications in the packaging, automotive, and construction industries. Existing suppliers with well-established customer relationships and strong technical capabilities are likely to maintain or modestly increase their market share due to the specialized nature of masterbatch formulations.

From 2030 to 2035, the market further expands by USD 6.1 billion, reaching USD 23.3 billion. Annual growth accelerates slightly to USD 1.2 billion in later years, driven by rising demand for sustainable and customized color solutions, as well as innovations in additive technologies. Entry barriers remain significant due to technical expertise and quality standards, limiting potential share loss to new competitors.

The data suggests that market share erosion will be minimal over the forecast period. Established companies are positioned to consolidate their presence by leveraging innovation and strong customer partnerships, allowing for controlled and steady market share gains within a growing industry.

| Metric | Value |

|---|---|

| Masterbatch Market Estimated Value in (2025 E) | USD 12.6 billion |

| Masterbatch Market Forecast Value in (2035 F) | USD 23.3 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The masterbatch market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 3.0% of the global plastics additives market, driven by demand for colorants, fillers, and performance modifiers in plastic manufacturing. Within the polymer processing and plastics compounding sector, a share of approximately 3.6% is assessed due to widespread use in packaging, automotive, and consumer goods.

In the packaging materials industry, around 2.8% is observed reflecting demand for color and functional masterbatches that improve product appeal and durability. Within the automotive components manufacturing market, about 2.9% is evaluated as masterbatches contribute to lightweight and aesthetic solutions. In the construction materials segment, a contribution of roughly 2.5% is calculated driven by use in pipes, profiles, and insulation products.

Market expansion has been influenced by growing focus on customization, environmental compliance, and enhanced material properties. Innovations have been directed toward bio-based and recycled content masterbatches, low migration additives for food packaging, and functional masterbatches offering UV protection and anti microbial properties. Interest has been increasing in masterbatches designed for 3D printing and high performance engineering plastics.

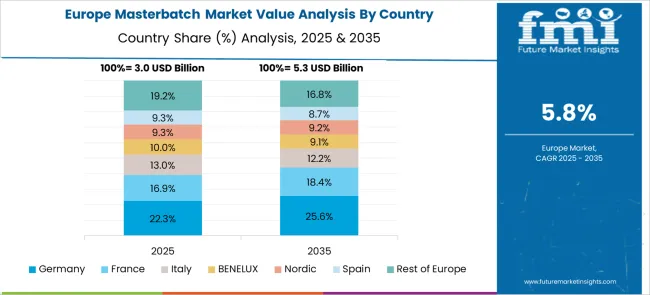

The Asia Pacific region has been observed to exhibit the fastest growth due to expanding plastic processing industries, while Europe and North America maintain steady demand driven by regulatory standards and product quality requirements. Strategic initiatives have included collaborations between additive producers and polymer manufacturers to develop tailor made masterbatch solutions and support sustainable plastic applications.

The masterbatch market is witnessing robust expansion, supported by rising plastic consumption across the packaging, automotive, and consumer goods industries. Black masterbatch continues to experience high demand due to its cost-effectiveness in imparting opacity, UV resistance, and superior aesthetic value in various plastic applications.

Environmental regulations and increased recyclability requirements have prompted manufacturers to explore advanced pigment formulations and sustainable carriers, further boosting demand. The packaging sector, in particular, is driving volume consumption, aided by rapid growth in e-commerce, FMCG demand, and flexible packaging innovation.

Global manufacturing shifts toward lightweight materials and enhanced polymer properties are shaping future opportunities in the market, especially for high-performance and specialty masterbatches.

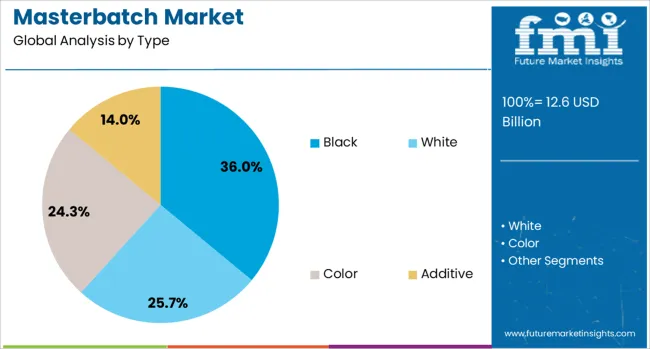

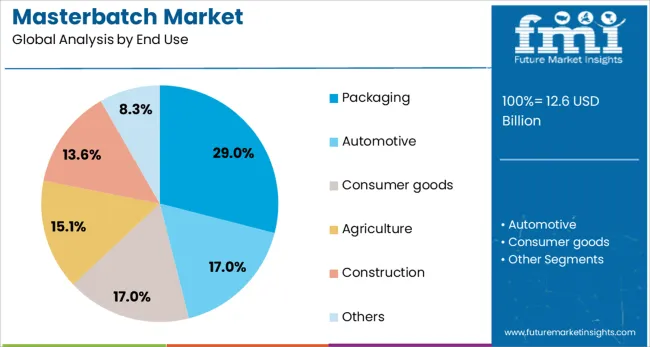

The masterbatch market is segmented by type, end use, and geographic regions. By type of the masterbatch market is divided into Black, White, Color, and Additive. The end use of the masterbatch market is classified into Packaging, Automotive, Consumer goods, Agriculture, Construction, and Others. Regionally, the masterbatch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Black masterbatch is anticipated to dominate the masterbatch market with a 36.0% share in 2025. This leadership is attributed to its wide-ranging utility in imparting color, opacity, and UV protection across diverse plastic applications.

Demand has been strengthened by its compatibility with recycled resins and its ability to mask defects or inconsistencies in recycled polymer streams. The automotive and electrical sectors have also relied heavily on black masterbatch for under-the-hood components and cable insulation, where heat stability and color retention are crucial.

Additionally, high pigment loading capacity and lower processing costs have driven widespread adoption in high-volume production environments.

Packaging is expected to hold a 29.0% revenue share in 2025, making it the leading end-use segment within the masterbatch market. Growth is being propelled by surging demand for colored and functional plastics in consumer packaging, industrial films, and rigid containers.

The sector has benefitted from the increasing need for enhanced shelf appeal, brand differentiation, and barrier properties in packaged goods. Moreover, sustainability pressures have encouraged packaging companies to incorporate recyclable materials colored using non-toxic, biodegradable masterbatches.

The rapid growth of food delivery, personal care, and retail logistics has further amplified demand for functional masterbatch additives, positioning packaging as a central driver in the market’s expansion.

Demand for masterbatches, used as colorants, additives, and fillers in polymer processing, has been stimulated by the need for enhanced material properties and aesthetic appeal. Technological advancements in formulation and customization have broadened product versatility. Sustainability considerations, including the incorporation of bio-based and recycled polymers, have gained traction. The increasing shift toward lightweight and durable plastic components in various industries has further propelled market expansion.

Continuous innovation in masterbatch formulations has been observed to improve the functionality and compatibility of these additives with diverse polymer matrices. Advanced dispersing techniques have enabled uniform color distribution and improved additive efficiency, contributing to superior end-product quality. The integration of functional additives such as UV stabilizers, flame retardants, and anti-microbial agents has expanded the application scope of masterbatches. Sustainable masterbatches incorporating biodegradable and recycled materials have been developed to meet regulatory demands and consumer preferences for environmentally friendly products. These technological improvements have allowed manufacturers to tailor solutions for specific processing conditions and performance requirements, increasing adoption across industries.

The demand for masterbatches has been significantly driven by their use in the packaging industry, where color customization and functional additives enhance product appeal and shelf life. Automotive manufacturers have utilized masterbatches to achieve lightweight, durable plastic components with improved UV resistance and aesthetic finishes. In construction, masterbatches contribute to weather resistance and color stability in piping and fittings. Consumer goods have seen increased incorporation of masterbatches for vibrant colors and enhanced mechanical properties in household products and electronics. The rising adoption of plastic components in these sectors has created a consistent demand for specialized masterbatch solutions tailored to industry-specific needs.

Regional markets exhibit varied growth patterns, with Asia-Pacific leading due to rapid industrialization and rising plastics consumption in countries such as China and India. Europe and North America maintain steady demand supported by stringent quality standards and the focus on sustainable products. Manufacturers have localized production facilities to cater to regional preferences and regulatory requirements. Emerging markets in Latin America and the Middle East are witnessing gradual uptake supported by infrastructure development and increasing consumer awareness. Strategic partnerships, mergers, and acquisitions have been pursued to strengthen market presence and expand product portfolios, ensuring responsiveness to evolving customer demands across geographies.

The masterbatch market faces challenges stemming from fluctuating raw material prices, supply chain disruptions, and complex regulatory landscapes. Dependence on petrochemical-derived polymers exposes manufacturers to price volatility and availability risks. Compliance with environmental regulations regarding chemical composition and emissions has necessitated reformulation efforts and investment in sustainable alternatives. The introduction of biodegradable plastics has required adaptation in masterbatch compatibility and performance. Additionally, stringent quality control and certification requirements increase production costs and time-to-market. Overcoming these challenges demands strategic sourcing, innovation in green materials, and collaboration with regulatory bodies to ensure product safety and market acceptance.

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

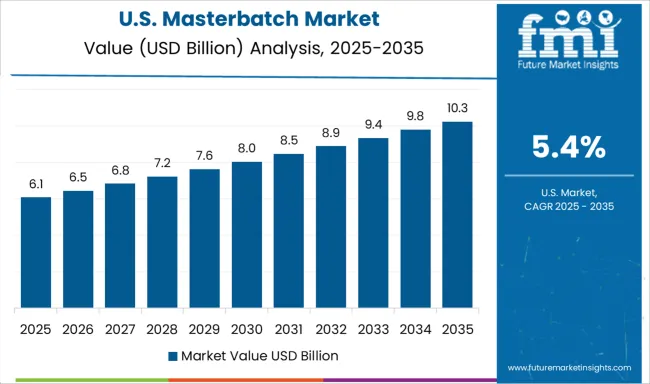

| USA | 5.4% |

| Brazil | 4.7% |

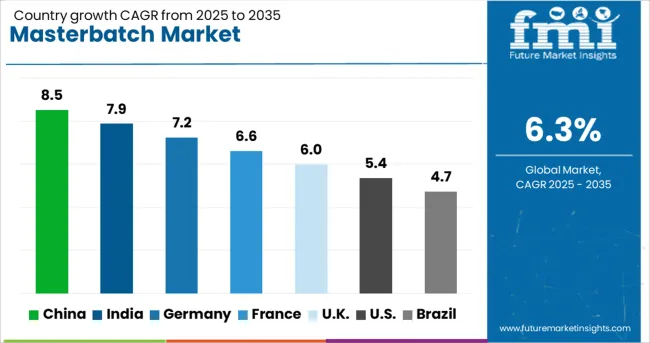

The masterbatch market is expected to grow at a global CAGR of 6.3% between 2025 and 2035, driven by increasing demand for color and additive concentrates in packaging, automotive, and consumer goods industries. China leads with an 8.5% CAGR, supported by large-scale plastic processing and manufacturing growth. India follows at 7.9%, fueled by expanding packaging sectors and automotive production. Germany, at 7.2%, benefits from advanced polymer technologies and high-quality masterbatch formulations. The UK, projected at 6.0%, sees steady growth from packaging and construction applications. The USA, at 5.4%, reflects stable demand across diverse manufacturing segments. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.5% from 2025 to 2035, driven by expanding plastic processing industries and increasing use in packaging, automotive, and consumer goods sectors. Major producers such as Rongsheng Petrochemical and Jiangsu Sanfangxiang are investing in color and additive masterbatches with enhanced UV resistance and anti-microbial properties. Growth in flexible packaging and automotive lightweighting applications has increased demand for specialized formulations. Collaborations with global raw material suppliers have improved product quality and diversification. Industrial upgrades in Tier 1 and Tier 2 cities have further supported market expansion.

India is expected to register a CAGR of 7.9% from 2025 to 2035, supported by rising plastic consumption and growing demand from packaging and construction sectors. Companies like Clariant India and Aarti Industries are focusing on cost-effective color masterbatches and functional additives. Increasing adoption of masterbatches in flexible films and pipes has contributed to volume growth. Expansion of local compounding facilities has improved supply chain efficiency. Government initiatives promoting plastic recycling are encouraging masterbatch manufacturers to develop recycled-content compatible products.

Germany is forecasted to achieve a CAGR of 7.2% from 2025 to 2035, with strong demand from automotive, packaging, and electrical industries. Producers such as BASF and Clariant Germany are developing high-performance masterbatches with improved thermal stability and color fastness. Increasing use of masterbatches in electric vehicle components and sustainable packaging is supporting market growth. The country’s well-established recycling systems have led to greater adoption of recycled-content masterbatches. Export demand for specialty masterbatch products remains robust across Europe.

The United Kingdom is expected to expand at a CAGR of 6.0% from 2025 to 2035, driven by growth in packaging and construction sectors. Companies such as Ampacet UK and PolyOne Corporation are investing in biodegradable and additive masterbatches to meet evolving regulatory requirements. The rising demand for sustainable packaging solutions is encouraging the development of eco-friendly masterbatches compatible with recycled plastics. Infrastructure development projects also provide opportunities for masterbatch use in durable pipes and fittings.

The United States is forecasted to grow at a CAGR of 5.4% from 2025 to 2035, supported by demand in packaging, automotive, and consumer goods industries. Key players like Ampacet Corporation and PolyOne Corporation are focusing on high-performance color and additive masterbatches with improved durability and UV protection. Increasing use of masterbatches in sustainable packaging and medical device applications has boosted market growth. Regulatory focus on recycled content and safety standards continues to shape product innovation.

The masterbatch market is led by global chemical and compound producers supplying concentrated pigment and additive formulations for the plastics industry. Ampacet Corporation and Avient Corporation are key players offering a broad range of color, additive, and functional masterbatches tailored to packaging, automotive, consumer goods, and healthcare sectors.

Cabot Corporation specializes in carbon black masterbatches and conductive compounds, serving high-performance applications. LyondellBasell provides integrated polymer and masterbatch solutions, leveraging scale and technology to deliver cost-efficient color and additive concentrates. Penn Color Inc. and RTP Company focus on custom color and engineering compounds with enhanced performance features for specialty plastics.

Alok Masterbatches Pvt. Ltd. and Colloids Ltd. cater primarily to the Indian market, offering competitive pricing and a wide product portfolio. Plastiblends, Polyblends, and Hubron International supply masterbatches for packaging, agricultural films, and injection molding applications. Plastika Kritis S.A. and Tosaf Compounds Ltd. provide specialty and sustainable masterbatches targeting European and global markets.

Americhem emphasizes innovation in additive technologies and sustainable product lines. Key strategies include expanding product portfolios to include biodegradable and performance-enhancing additives, investing in regional manufacturing facilities to reduce lead times, and forming partnerships with polymer producers and converters. Entry into the masterbatch market is limited by capital-intensive production equipment, technical expertise in formulation, and established customer relationships within the plastics processing industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.6 Billion |

| Type | Black, White, Color, and Additive |

| End Use | Packaging, Automotive, Consumer goods, Agriculture, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alok Masterbatches Pvt. Ltd., Ampacet Corporation, Avient Corporation, Cabot Corporation, Colloids Ltd., Hubron International, LyondellBasell, Penn Color Inc., Plastiblends, Plastika Kritis S.A., Polyblends, RTP Company, Tosaf Compounds Ltd., and Americhem |

| Additional Attributes | Dollar sales by type, polymer, and application, demand dynamics across color, white, black, additive, and filler masterbatches; polypropylene (PP), polyethylene (PE), and polyethylene terephthalate (PET) carrier polymers; and packaging, automotive, construction, and consumer goods sectors; regional trends in Asia-Pacific, North America, and Europe; innovation in sustainable and functional masterbatches; environmental impact of production and disposal; and emerging use cases in biodegradable plastics, electric vehicle components, and smart packaging solutions. |

The global masterbatch market is estimated to be valued at USD 12.6 billion in 2025.

The market size for the masterbatch market is projected to reach USD 23.3 billion by 2035.

The masterbatch market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in masterbatch market are black, white, color and additive.

In terms of end use, packaging segment to command 29.0% share in the masterbatch market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA