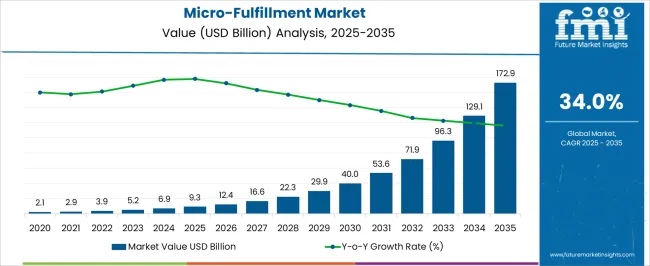

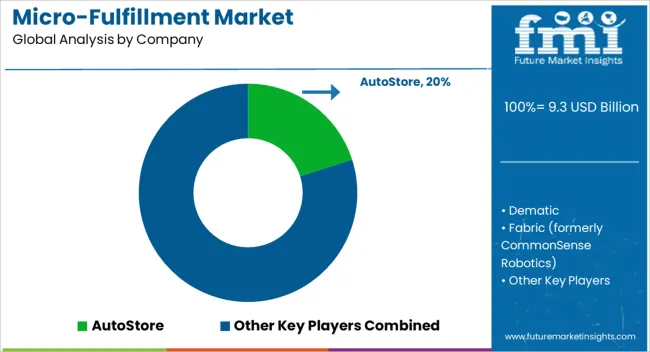

The micro-fulfillment market is estimated to be valued at USD 9.3 billion in 2025 and is projected to reach USD 172.9 billion by 2035, registering a compound annual growth rate (CAGR) of 34.0% over the forecast period. This growth is being driven by the growing demand for faster and more efficient last-mile delivery solutions, especially in urban settings. As e-commerce continues to thrive, companies are turning to localized fulfillment centers to address the growing pressure for quicker delivery times. The shift to micro-fulfillment models, supported by smaller, automated facilities closer to consumers, is transforming logistics strategies and providing competitive advantages for retailers aiming to capture market share in a highly fragmented space.

By 2035, micro-fulfillment is expected to become a dominant strategy in the logistics industry, with a shift away from traditional large-scale warehouses to more agile, high-tech, and compact fulfillment centers. The optimization of storage, sorting, and delivery processes within these centers will continue to be a key area of focus. In turn, this is driving growth in related technologies such as robotics, automation, and real-time data analytics. As businesses increasingly realize the efficiency and cost-saving potential of micro-fulfillment networks, investment is expected to increase, setting the stage for rapid expansion throughout the next decade.

| Metric | Value |

|---|---|

| Micro-Fulfillment Market Estimated Value in (2025 E) | USD 9.3 billion |

| Micro-Fulfillment Market Forecast Value in (2035 F) | USD 172.9 billion |

| Forecast CAGR (2025 to 2035) | 34.0% |

The micro-fulfillment market is estimated to hold a notable proportion within its parent markets, representing approximately 8-10% of the e-commerce logistics market, around 12-14% of the retail automation market, close to 7-8% of the warehouse management systems market, about 5-6% of the last-mile delivery market, and roughly 4-5% of the supply chain automation market.

The cumulative share across these parent segments is observed in the range of 36-43%, reflecting the growing importance of localized, fast, and efficient fulfillment solutions across e-commerce, retail, and logistics operations. The market has been influenced by the increasing demand for rapid order fulfillment and reduced delivery times, where proximity to consumers, space optimization, and integration with automated systems are highly prioritized. Adoption is guided by strategies that emphasize operational cost-efficiency, scalability, and alignment with existing logistics infrastructure. Market participants have focused on optimizing storage capacity, picking efficiency, and technology integration to streamline workflows and enhance delivery speed.

As a result, the micro-fulfillment market has not only captured a significant share within the e-commerce logistics and retail automation domains. It has also impacted warehouse management, last-mile delivery, and supply chain automation markets, highlighting its role in transforming fulfillment strategies to address the evolving demands of customers and operational performance across the supply chain.

The micro-fulfillment market is gaining significant traction as retailers and logistics providers seek faster, more efficient, and cost-effective solutions to meet rising consumer expectations for rapid order fulfillment. Increasing demand for same-day and next-day delivery, driven by the growth of e-commerce and omnichannel retailing, is encouraging the adoption of compact, automated fulfillment systems positioned close to end customers. Micro-fulfillment centers are helping businesses reduce last-mile delivery costs, improve inventory accuracy, and accelerate order processing.

Retailers are increasingly integrating these systems within or adjacent to existing store locations to maximize space utilization and operational efficiency. Advancements in robotics, AI-driven warehouse management software, and real-time analytics are enabling better coordination of inventory, labor, and transportation, resulting in improved service levels and profitability.

As urbanization intensifies and customer service windows shrink, the need for flexible, scalable fulfillment strategies is expected to grow. The market is poised for long-term expansion as retailers continue to prioritize supply chain resilience and faster delivery options in response to changing consumer behaviors and competitive pressures.

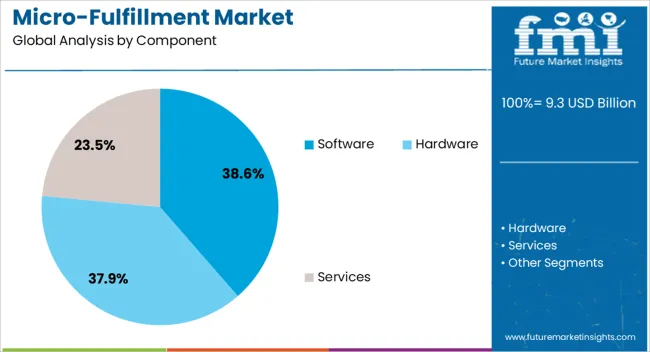

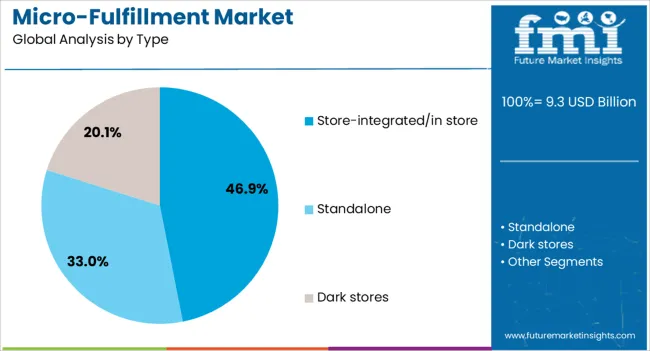

The micro-fulfillment market is segmented by component, type, end-user, and geographic regions. By component, micro-fulfillment market is divided into Software, Hardware, and Services. In terms of type, micro-fulfillment market is classified into Store-integrated/in store, Standalone, and Dark stores.

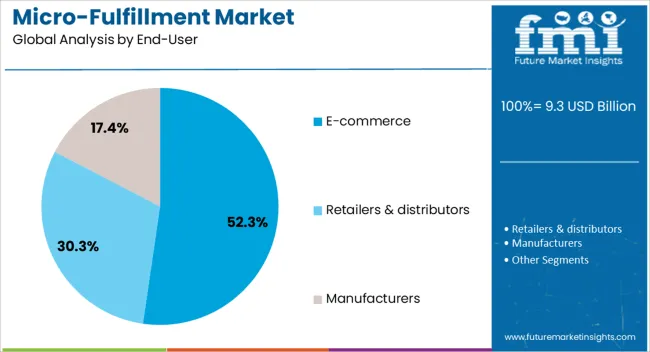

Based on end-user, micro-fulfillment market is segmented into E-commerce, Retailers & distributors, and Manufacturers. Regionally, the micro-fulfillment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is projected to hold 38.6% of the micro-fulfillment market revenue share in 2025, making it a key component driving operational intelligence and system efficiency. This segment's growth is being supported by increasing reliance on advanced software platforms to coordinate order management, inventory control, demand forecasting, and labor optimization. Real-time data processing, AI-driven algorithms, and predictive analytics embedded within these software systems are enabling businesses to optimize workflows and make faster, data-informed decisions.

As micro-fulfillment centers operate in space-constrained urban locations with high throughput demands, software plays a critical role in maximizing resource utilization and minimizing errors. The need for seamless integration between front-end retail platforms and back-end fulfillment operations is reinforcing investment in scalable, cloud-based solutions.

Customizable interfaces, support for automation hardware, and cross-platform compatibility are further enhancing software adoption across retailers and logistics providers. As fulfillment operations become more dynamic and distributed, the importance of robust and adaptable software systems is expected to continue driving this segment's leadership within the market.

The store-integrated or in-store type segment is anticipated to account for 46.9% of the micro-fulfillment market revenue share in 2025, making it the dominant configuration approach. This segment’s leadership is being driven by the strategic shift toward utilizing existing retail spaces as fulfillment hubs to reduce last-mile delivery time and cost. Integrating micro-fulfillment operations within stores allows retailers to combine in-person shopping with online order fulfillment, enhancing service flexibility and improving overall customer satisfaction.

The ability to repurpose underutilized store areas into high-density automated picking zones supports faster turnaround and reduces reliance on large, centralized warehouses. Adoption is further fueled by the increasing need for retailers to maintain hyperlocal inventory visibility and respond quickly to fluctuations in demand.

Store-integrated solutions also enable better alignment with omnichannel strategies, facilitating options such as curbside pickup and same-day delivery. As retailers focus on creating seamless customer experiences and improving operational agility, this type of fulfillment model is expected to remain a preferred and scalable solution across urban and suburban markets.

The e-commerce segment is expected to represent 52.3% of the micro-fulfillment market revenue share in 2025, establishing itself as the largest end-user category. This dominance is being driven by the exponential growth of online shopping and rising customer expectations for rapid delivery and order accuracy. E-commerce players are increasingly adopting micro-fulfillment centers to decentralize inventory and bring it closer to the customer, enabling faster order processing and reducing logistics costs.

The high volume and frequency of e-commerce orders necessitate automated systems capable of handling large SKU assortments and variable order sizes efficiently. Micro-fulfillment systems are helping e-commerce businesses optimize picking speed, reduce fulfillment times, and improve scalability during peak demand periods.

Real-time inventory management and integration with front-end platforms are further enhancing visibility and customer satisfaction. As the competitive landscape intensifies and consumer habits shift toward instant gratification, the e-commerce sector's reliance on localized, automated fulfillment infrastructure is expected to reinforce its leadership in driving micro-fulfillment market growth.

The micro-fulfillment market is being shaped by the demand for faster deliveries and opportunities in real-time inventory management. The growing trend towards automation is seen as a key factor driving operational efficiency. However, high capital investments and finding suitable locations continue to be significant challenges. As e-commerce growth continues, retailers are increasingly turning to micro-fulfillment solutions for enhanced service and scalability, making this market a key focus in the evolving logistics landscape.

The demand for micro-fulfillment centers is being driven by the need for faster and more efficient last-mile deliveries. As e-commerce continues to grow, consumers are demanding quicker order fulfillment, which has led to the adoption of micro-fulfillment solutions. These centers, located closer to the customer, are allowing retailers to cut down delivery times and costs, thus increasing customer satisfaction and competitiveness. The need for quick turnaround in urban areas is being seen as a strong driver for the market’s growth.

Opportunities within the micro-fulfillment market are being created by the increasing integration of real-time inventory management systems. These solutions allow for better demand forecasting, automated replenishment, and more accurate order picking. Retailers are leveraging these capabilities to maintain higher inventory turnover rates and improve stock availability. Additionally, partnerships between logistics providers and fulfillment centers are being formed to optimize resource allocation and delivery processes. Retailers are focusing on scalability, creating potential for further market expansion in diverse sectors.

The trend towards automation in micro-fulfillment centers is being driven by the need to improve operational efficiency and minimize labor costs. Robotics and artificial intelligence are being increasingly utilized for order picking, packaging, and inventory management. Automation is being adopted not only to speed up operations but also to reduce errors and enhance order accuracy. As labor shortages and rising wages continue to impact the logistics sector, automation is being positioned as the solution to future-proof operations in the micro-fulfillment space.

Despite the growing demand, challenges are being posed by the high initial investment required to set up micro-fulfillment centers. The infrastructure and technology needed to create fully automated, high-capacity centers are costly and require significant capital. Smaller retailers are being deterred by the financial burden, which limits market participation.

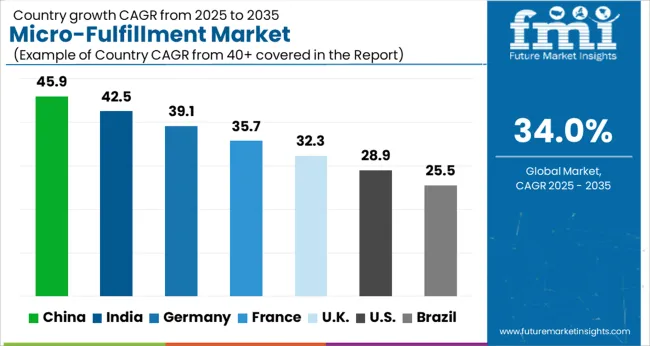

| Country | CAGR |

|---|---|

| China | 45.9% |

| India | 42.5% |

| Germany | 39.1% |

| France | 35.7% |

| UK | 32.3% |

| USA | 28.9% |

| Brazil | 25.5% |

The global micro-fulfillment market is projected to grow at a remarkable CAGR of 49% from 2025 to 2035. China leads with a growth rate of 45.9%, followed by India at 42.5%, and Germany at 39.1%. The United Kingdom records a growth rate of 32.3%, while the United States shows the slowest growth at 28.9%. This expansion is fueled by the rising demand for quicker and more efficient last-mile delivery solutions, especially in urban areas. Emerging markets like China and India are seeing rapid adoption due to the growth of e-commerce and a large, tech-savvy population. Developed markets like the USA and UK focus on optimizing delivery networks and leveraging automation technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The micro-fulfillment market in China is set to grow at a staggering rate of 45.9%, driven by the rapid expansion of e-commerce, growing consumer demand for faster deliveries, and the increasing need for efficient urban distribution solutions. With a large population and expanding urban centers, China is investing heavily in building automated micro-fulfillment centers to cater to both online shopping and traditional retail. Logistics technology innovations, such as robotics, autonomous vehicles, and AI-based solutions, are being integrated into the supply chain to enhance efficiency and reduce delivery times. These factors are crucial for meeting consumer expectations for speed and convenience. The country’s rapid digital adoption and demand for efficient, tech-driven solutions have made it one of the fastest-growing markets for micro-fulfillment.

The micro-fulfillment market in India is expected to grow at a rate of 42.5%, fueled by the country’s expanding e-commerce landscape and the need for faster, more efficient deliveries in dense urban environments. The rise of online shopping, particularly in tier 2 and tier 3 cities, has accelerated the demand for local fulfillment solutions. With a large, young, and tech-savvy population, India is witnessing increasing adoption of automation and robotics in fulfillment centers to streamline processes and improve delivery times. These technologies are helping businesses meet growing consumer expectations for same-day and next-day deliveries. Additionally, government initiatives promoting digitization and smart cities are further encouraging the growth of micro-fulfillment in India.

The micro-fulfillment market in Germany is projected to grow at a rate of 39.1%, driven by the country’s advanced logistics infrastructure, growing e-commerce market, and demand for faster deliveries. Germany is a key player in the European logistics and retail sectors, and the push for same-day and next-day delivery services has led to increased investments in automated fulfillment centers. The country is focusing on enhancing its supply chain efficiency by leveraging cutting-edge technologies like AI, robotics, and real-time data analytics. The rise of urbanization and changing consumer behavior, demanding speedier deliveries, further boost the adoption of micro-fulfillment models in Germany.

The micro-fulfillment market in the UK is projected to grow at a CAGR of 32.3%, driven by the increasing demand for faster delivery times in the growing e-commerce sector. The UK has been investing heavily in creating local fulfillment hubs equipped with automation to provide efficient last-mile delivery solutions in urban areas. With rising consumer expectations for quicker delivery, retailers are turning to micro-fulfillment to reduce costs and enhance service levels. Additionally, government policies supporting the digital transformation of logistics and supply chains are helping the country strengthen its position in the global micro-fulfillment market.

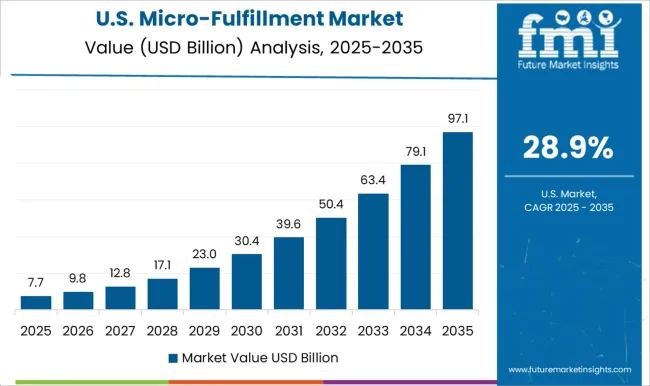

The micro-fulfillment market in the USA is expected to grow at a rate of 28.9%, supported by the nation’s robust e-commerce industry and the demand for improved last-mile delivery solutions. The USA market is seeing widespread adoption of automated micro-fulfillment centers, with both large retailers and smaller e-commerce companies leveraging these solutions to speed up deliveries and reduce operational costs. With a focus on same-day and next-day delivery, the USA continues to innovate in warehouse automation, including the use of robotics, AI, and machine learning. The combination of consumer demand and technological advancements is driving steady growth in the market.

The micro-fulfillment market is undergoing rapid expansion due to the increased demand for quicker delivery times, driven by the surge in e-commerce. Leading players such as AutoStore, Dematic, and Fabric (formerly CommonSense Robotics) are at the forefront, offering innovative automated solutions that optimize the order fulfillment process. By utilizing advanced robotics and artificial intelligence, these companies help businesses enhance operational efficiency, reduce labor costs, and meet the growing demand for faster deliveries. Takeoff Technologies, Alert Innovation, and Swisslog Holding AG are also making significant strides by creating autonomous systems that maximize warehouse space utilization and minimize human intervention. These systems are designed for quick, localized order processing, which is crucial for supporting last-mile delivery operations. Companies often emphasize the scalability and high throughput of their systems, enabling businesses to adapt to increasing order volumes without significant infrastructure overhauls.

As the market becomes increasingly competitive, companies are continuously working to improve their offerings. Innovations such as faster and more accurate picking robots, along with the integration of machine learning, are being incorporated into micro-fulfillment solutions. Exotec SAS and Takeoff Technologies are key examples of companies working to reduce order processing time, enhance accuracy, and streamline workflow. Their systems integrate seamlessly with existing infrastructure, providing retailers with a low-risk, cost-effective way to scale their operations. Additionally, a strong focus on sustainability is emerging, with energy-efficient robotics and processes that help minimize the environmental impact of warehouse operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Component | Software, Hardware, and Services |

| Type | Store-integrated/in store, Standalone, and Dark stores |

| End-User | E-commerce, Retailers & distributors, and Manufacturers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AutoStore, Dematic, Fabric (formerly CommonSense Robotics), Takeoff Technologies, Alert Innovation, Inc., Swisslog Holding AG, and Exotec SAS |

| Additional Attributes | Dollar sales by fulfillment type (automated, manual) and application (grocery, retail, e-commerce) are key metrics. Trends include rising demand for faster, localized delivery solutions, growth in e-commerce, and adoption of automation technologies for inventory and order processing. Regional adoption, technological advancements, and shifting consumer expectations are driving market growth. |

The global micro-fulfillment market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the micro-fulfillment market is projected to reach USD 172.9 billion by 2035.

The micro-fulfillment market is expected to grow at a 34.0% CAGR between 2025 and 2035.

The key product types in micro-fulfillment market are software, warehouse management system, order management, asset management, delivery & transport management, hardware, automated storage and retrieval systems (AS/RS), automated guided vehicles/autonomous mobile robot (AGV/AMR), conveyor systems, sortation systems, services, professional services and managed services.

In terms of type, store-integrated/in store segment to command 46.9% share in the micro-fulfillment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA