The Neonicotinoid Pesticide Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. The growth momentum analysis highlights the gradual yet consistent increase in market value, with certain periods showing faster growth due to factors like changing agricultural practices and increasing demand for pest control solutions.

Starting from USD 4.3 billion in 2025, the market grows steadily during the early years, reaching USD 5.6 billion by 2029. This early growth is driven by the ongoing demand for neonicotinoid-based pesticides in crop protection, particularly for staple crops like corn, wheat, and cotton. Between 2029 and 2031, the market experiences a noticeable acceleration, reaching USD 5.9 billion, as agricultural productivity and pest management solutions are further optimized through the use of neonicotinoid pesticides. The market momentum strengthens during this period as the need for more effective pest control solutions in agriculture intensifies. From 2031 to 2035, the growth momentum picks up significantly, reaching USD 9.7 billion by 2035. This period sees increased adoption of neonicotinoid pesticides in emerging agricultural markets and continued demand from developed economies. Factors such as evolving pest resistance and the need for higher crop yields will continue to propel growth, reinforcing the long-term market momentum.

| Metric | Value |

|---|---|

| Neonicotinoid Pesticide Market Estimated Value in (2025 E) | USD 5.6 billion |

| Neonicotinoid Pesticide Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The neonicotinoid pesticide market is experiencing notable expansion due to the rising need for effective pest control in high-value crops and the increasing demand for yield enhancement across global agriculture. These pesticides are favored for their systemic properties, long residual activity, and selective toxicity to pests over beneficial organisms.

Regulatory allowances in several key agricultural economies have continued to support their controlled use, particularly where pest resistance to older chemistries is prevalent. Advancements in application methods and integration with precision farming practices have also improved their efficiency and reduced environmental impact.

As farmers focus on crop protection strategies that are cost-effective and capable of safeguarding production in changing climatic conditions, the demand for neonicotinoid-based solutions is expected to remain resilient. The market outlook appears steady with continued development in formulation technologies and sustained adoption in major crop-producing regions.

The neonicotinoid pesticide market is segmented by type, crop type, application method, and geographic regions. By type, the neonicotinoid pesticide market is divided into Imidacloprid, Thiamethoxam, Clothianidin, Dinotefuran, Acetamiprid, and Others. In terms of crop type, the neonicotinoid pesticide market is classified into Cereals, Oilseed, Fruits, Vegetables, Pulses, and Others. Based on application method, the neonicotinoid pesticide market is segmented into Seed treatment, Foliar spray, Soil treatment, and Others. Regionally, the neonicotinoid pesticide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The imidacloprid segment is projected to account for 38.60% of total market revenue by 2025, establishing itself as the leading type within the market. This position is supported by its broad-spectrum insecticidal activity, strong systemic properties, and widespread registration across global agricultural markets.

It has shown high efficacy in controlling sap-feeding insects such as aphids, whiteflies, and leafhoppers, which affect a wide range of crops. The compound’s versatility in application methods, including seed treatments, foliar sprays, and soil drenches, has reinforced its preference among growers.

Additionally, imidacloprid is valued for its compatibility with integrated pest management programs, helping reduce crop losses while aligning with regulatory frameworks that emphasize responsible pesticide use.

The cereals segment is expected to hold 27.90% of the total market revenue by 2025 within the crop type category, marking it as a major contributor. This is driven by the global demand for staple food grains such as wheat, rice, and corn, which are highly vulnerable to insect infestations during both cultivation and storage.

The economic and food security implications of pest-induced yield loss have made neonicotinoid usage vital in cereal production. Consistent efforts by producers to protect crops at early growth stages and ensure optimal output are reinforcing the need for effective pest management.

As a result, cereals remain a key driver of market demand, particularly in regions with large-scale grain cultivation.

The seed treatment segment is anticipated to represent 41.30% of total market revenue by 2025 under the application method category, making it the dominant approach. This growth is attributed to its precision, cost efficiency, and reduced environmental footprint compared to foliar and soil applications.

By delivering protection directly at the seed level, this method ensures early-stage pest resistance, enhances plant vigor, and minimizes the need for multiple pesticide applications throughout the crop cycle. Seed treatment also supports sustainable farming practices by lowering pesticide runoff and minimizing exposure to non-target organisms.

These benefits have made it a preferred method across various crop types, solidifying its leadership in the application landscape.

The neonicotinoid pesticide market is growing due to the increasing demand for effective pest control solutions in agriculture. Neonicotinoids, a class of neurotoxic insecticides, are widely used to protect crops from a range of pests, including insects that damage food production. Their systemic nature, allowing for long-lasting effects, makes them a preferred choice in crop protection. Despite concerns about their environmental impact, including potential links to pollinator decline, the market continues to expand due to the increasing global demand for food and the need for effective crop protection solutions in both developed and developing countries.

The neonicotinoid pesticide market is primarily driven by the growing need for effective crop protection and improved agricultural yields. As the global population continues to rise, the demand for increased agricultural productivity is becoming more pressing. Neonicotinoids provide a potent solution for controlling a wide range of pests that threaten crop yields, including insects that damage essential crops such as grains, fruits, and vegetables. Their effectiveness in offering long-lasting protection helps farmers minimize losses and improve crop quality, which contributes to the rising adoption of neonicotinoids in both conventional and organic farming practices. As farmers seek ways to enhance productivity and meet growing food demand, the use of neonicotinoid pesticides remains prevalent.

Despite their widespread use, the neonicotinoid pesticide market faces challenges related to environmental concerns and regulatory restrictions. The most significant concern is the potential harmful effects on pollinators, particularly bees, which have been linked to neonicotinoid exposure. These concerns have led to increased scrutiny from environmental organizations and regulators worldwide. Several countries have already imposed restrictions or bans on the use of certain neonicotinoids, particularly in the European Union, to mitigate their impact on pollinator populations. As research continues to explore the long-term effects of neonicotinoid use, the market is facing increasing regulatory hurdles that may limit growth. The development of safer, more sustainable alternatives to neonicotinoids presents both challenges and opportunities for the market.

The neonicotinoid pesticide market presents significant opportunities driven by the development of safer, more sustainable alternatives. As public concern about the environmental impact of chemical pesticides grows, there is a strong push towards creating less toxic, eco-friendly pest control solutions. Researchers are focusing on developing new formulations of pesticides with reduced environmental impact and lower toxicity to non-target organisms, including pollinators. Biopesticides and natural pest control methods are gaining popularity as they offer safer alternatives while still protecting crops effectively.The advancements in precision agriculture, including targeted pesticide application and integrated pest management (IPM) strategies, are creating opportunities to reduce the reliance on traditional chemical pesticides, driving growth in more sustainable crop protection methods.

A key trend in the neonicotinoid pesticide market is the growing emphasis on integrated pest management (IPM) practices. IPM combines biological, cultural, and chemical methods to control pest populations while minimizing the environmental impact. As farmers and agricultural companies seek to comply with stricter regulations and reduce their environmental footprint, the adoption of IPM is increasing. This trend is driving the development of more targeted pesticide application systems, where neonicotinoids and other chemicals are used only when necessary, reducing overall pesticide use. Moreover, there is a rising demand for eco-friendly and non-toxic pest control solutions, further encouraging the research and development of alternatives that align with evolving regulations and market demands for sustainability. These trends are shaping the future of the neonicotinoid pesticide market, with a growing focus on reducing chemical use in agriculture.

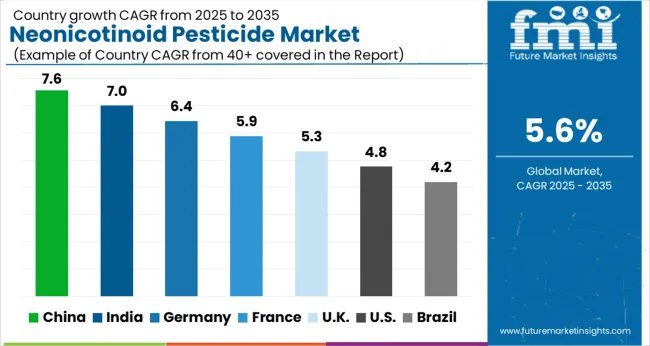

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

Global neonicotinoid pesticide market demand is projected to rise at a 5.6% CAGR from 2025 to 2035. China leads at 7.6%, followed by India at 7.0%, and France at 5.9%, while the United Kingdom records 5.3% and the United States posts 4.8%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing agricultural production, government policies, and demand for pest control solutions in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established usage and regulatory challenges. The analysis covers over 40 countries, with the leading markets shown below.

Demand for neonicotinoid pesticide in China is expanding at a robust CAGR of 7.6%, driven by the massive agricultural sector and the rising demand for high-yield crops. With a focus on improving food security and enhancing crop productivity, China is increasingly adopting pesticides, including neonicotinoids, to combat pests and diseases. The government’s policies aimed at boosting agricultural efficiency, alongside the expansion of modern farming practices, are contributing to the growth of the market. Additionally, China’s investments in research and development to improve pesticide formulations and efficiency further accelerate the adoption of neonicotinoids.

The neonicotinoid pesticide market in India is growing at a CAGR of 7.0%, driven by the expanding agricultural base and the need for effective pest control solutions. As India strives to increase crop production to meet the demands of a growing population, the use of pesticides, including neonicotinoids, has risen significantly. The country’s government policies to support agricultural development and improve crop yield through better pest management are key factors driving market growth. The increasing shift towards commercial agriculture, especially in cash crops like cotton and rice, is contributing to the demand for these pesticides.

The United Kingdom’s neonicotinoid pesticide market is growing at a CAGR of 5.3%, with increasing demand from the agricultural sector. The UK’s focus on maintaining high crop yields in the face of rising pest and insect challenges is driving the market for effective pest control solutions. However, the UK faces regulatory scrutiny regarding pesticide use, particularly with neonicotinoids, which are under tight control due to environmental and bee population concerns. Despite these challenges, the demand for neonicotinoids continues in certain sectors, such as field crops and horticulture, where pest damage poses a serious risk to crop health.

Demand for neonicotinoid pesticide in France is expanding at a CAGR of 5.9%, with demand driven by the country’s strong agricultural and horticultural sectors. Neonicotinoids are increasingly being used in France to protect crops, particularly in the face of rising pest infestations. The European Union’s regulations on pesticide usage, particularly for insecticides, are shaping the market, and France is adhering to these policies while also investing in sustainable and efficient pest control solutions. The country’s focus on organic farming and eco-friendly alternatives, while still relying on chemical pesticides for certain crops, contributes to the continued demand for neonicotinoids.

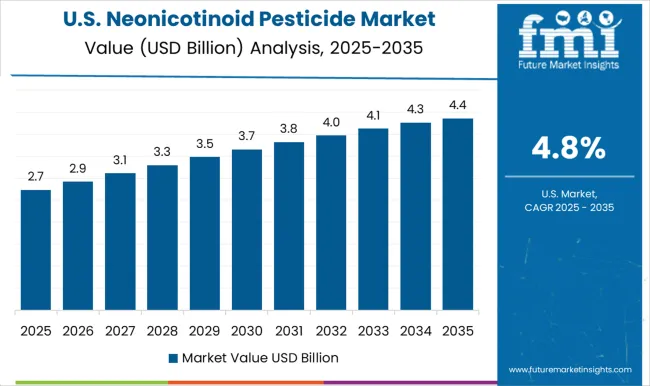

The USA neonicotinoid pesticide market is growing at a CAGR of 4.8%, with steady demand driven by large-scale agricultural operations. The use of neonicotinoid pesticides in the USA is widespread across various crops, including corn, soybeans, and cotton, where pest damage can significantly impact yields. Government policies related to pest control and crop protection are helping drive the market, although regulatory concerns over the environmental impact of neonicotinoids have led to stricter controls. The USA continues to lead in the development of more advanced pesticide formulations, ensuring the continued use of neonicotinoids in managing pest-related risks.

The neonicotinoid pesticide market is driven by major players offering highly effective and broad-spectrum insecticides used to protect crops from a variety of pests. Adama is a leading player, providing neonicotinoid-based solutions known for their efficacy in pest control across various agricultural applications. American Vanguard Corporation offers a wide range of pest control products, including neonicotinoid insecticides, focused on improving crop protection and yields in both conventional and organic farming. Arysta Lifescience Corporation specializes in developing neonicotinoid pesticides that are used to protect crops from harmful insects, offering solutions that improve agricultural productivity. BASF is a global leader in agricultural chemicals, providing neonicotinoid insecticides that enhance crop yield while ensuring minimal environmental impact.

FMC Corporation delivers a broad portfolio of neonicotinoid pesticides, targeting crop protection needs across various crops and regions with high effectiveness and ease of application. Mitsui Chemicals America offers innovative neonicotinoid solutions that focus on pest control while promoting agricultural sustainability. Nissan Chemical Corporation provides neonicotinoid-based products with a focus on improving pest resistance and increasing crop yields. Nufarm is a significant player, offering a wide range of pest control products, including neonicotinoid insecticides, focusing on performance and cost-effectiveness in agriculture. Sumitomo Chemical offers advanced neonicotinoid-based solutions for pest management, ensuring high efficacy and crop protection. Syngenta is a global leader, providing cutting-edge neonicotinoid pesticides aimed at boosting crop production while managing pest resistance and minimizing environmental impact.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.6 Billion |

| Type | Imidacloprid, Thiamethoxam, Clothianidin, Dinotefuran, Acetamiprid, and Others |

| Crop Type | Cereals, Oilseed, Fruits, Vegetables, Pulses, and Others |

| Application Method | Seed treatment, Foliar spray, Soil treatment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adama, American Vanguard Corporation, Arysta Lifescience Corporation, Basf, Fmc Corporation, Mitsui Chemicals America, Nissan Chemical Corporation, Nufarm, Sumitomo Chemical, and Syngenta |

| Additional Attributes | Dollar sales by product type (insecticides, seed treatments, foliar sprays) and end-use segments (crop protection, commercial agriculture, pest management). Demand dynamics are driven by the increasing need for effective pest control solutions, rising demand for food production, and the growing preference for high-efficiency pesticides. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in pesticide formulations and the rising need for effective pest management solutions driving market expansion. |

The global neonicotinoid pesticide market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the neonicotinoid pesticide market is projected to reach USD 9.7 billion by 2035.

The neonicotinoid pesticide market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in neonicotinoid pesticide market are imidacloprid, thiamethoxam, clothianidin, dinotefuran, acetamiprid and others.

In terms of crop type, cereals segment to command 27.9% share in the neonicotinoid pesticide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pesticide Detection Market Analysis - Size, Share, and Forecast 2025 to 2035

Pesticides Packaging Market Growth & Industry Forecast 2025 to 2035

Biorational Pesticide Market Size and Share Forecast Outlook 2025 to 2035

Rodent Control Pesticides Market Size and Share Forecast Outlook 2025 to 2035

Home and Garden Pesticides Market Analysis by Type, Application, and Region from 2025 to 2035

Organophosphate Pesticides Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA