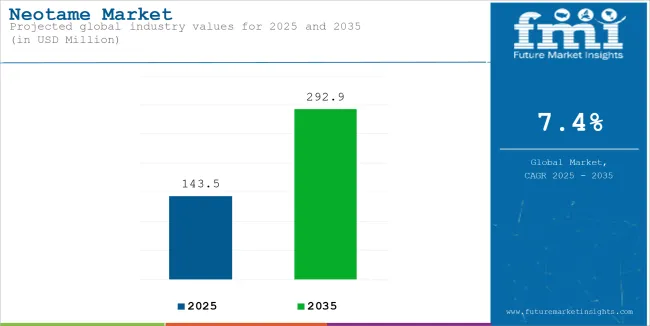

Global sales reached approximately USD 143.5 million at the end of 2025. Forecasts suggest the market will achieve a 7.4% compound annual growth rate (CAGR) and exceed USD 292.9 million in value by 2035.

The rising consumer awareness about low-calorie and mouth-feeling sugar food products is the most important key driver which is elevating the global sales of key manufacturers. Due to increased concern for the consumer’s health, they shifted their preference from the normal sugars thus making a good option to the manufacturers through its high sweetness and low calorie.

So the trend is to include in a large number of different products: sweeteners, confectionery and bakery products, dairy products and beverages. Manufacturers are also using tactical moves to help increase their market weight. Product development is a popular one, which includes evolution of new formulations to suit an application.

For instance, a leading producer just came up with a specifically tailored Neotame called for sugar-free confectionery because of escalating healthy indulgence. One of the other common strategies is the strategy of capacity expansion, as the need increases and the manufacturers try to supply the demand across various industries.

Besides, the partnerships and acquisitions that are being undertaken in the present industry are also important for the sphere globally. The strategies are being used by these players in enhancing its place and fortify its distribution channels and gains access to technology and perceived expertise. Such synergies are helping the manufacturers to expand the range of products, improve existing production lines and tap new regions.

The companies in this industry are also benefited from the potential application of Neotame, and thus grow up. While it was initially developed as a natural high-intensity sweetener for the food and beverages industry especially in places where caloric restriction may interfere with normal bodily functions, it is rapidly making its way into the pharmaceutical and personal care industries. It has particularly application in improving flavor and sweetness effects in many foods and has application in medication, cosmetics, and personal products.

But as it is with any business landscape around the world, the sector all over the globe has its struggles as well. Government regulations and social acceptance of the safety and the sustainability of artificial sweeteners are some of the obstacles to the producer. These issues have to be reported and solved through clear reports, further testing and by coming up with more natural and ecological solutions - that will define the future prosperity of the entire sector.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 143.5 million |

| Projected Global Industry Value (2035F) | USD 292.9 million |

| Value-based CAGR (2025 to 2035) | 7.4% |

In conclusion, the global sphere is set to grow steadily in the coming years by the rising demand for low calorie or no sugar products, the strong promotional plans by manufacturers and the versatile uses of Neotame in different industries.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 7.1% (2024 to 2034) |

| H2 2024 | 7.3% (2024 to 2034) |

| H1 2025 | 7.2% (2025 to 2035) |

| H2 2025 | 7.4% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 7.1% in the first half (H1) of 2024 and then slightly faster at 7.3% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 7.2% in the first half of 2025 and continues to grow at 7.4% in the second half. The industry saw a decline of 38 basis points in the first half (H1 2025) and an increase of 56 basis points in the second half (H2 2025).

Rising consumption of confectionary products elevating the sales

Growing global demand for organic snack food and confectionery items including candy, chocolates, and baked goods has been behind-the-scenes phenomenon for sweeteners market. These products remain in high demand by consumers, and herewith sales of sweeteners used to produce them, such as Neotame, are projected to grow.

Emerging regions will harness this growth into the development of confectionary items with good flavors and textures; hence, increasing demand for more versatile and functional sweetening solutions such as Neotame. The overall increase in sweet consumption is really one of the more important aspects of overall growth in the market because manufacturers come up with various products targeting this increased fad demand.

Neotame rising as a potential sweetener option due to low in calories

Neotame has emerged as a high-intensity sweetener with extremely low calories in comparison with sugar, making it increasingly chosen as the sweetening agent among health-conscious consumers. This convergence continues with the overall trend toward low caloric and sugar-free items, as many people try to keep their intake of the sweet stuff as low as possible.

So, sweetening that imparts the sweetness at far lesser consumption levels glimmers as an attractive alternative to food and beverage manufacturers who are striving to provide this growing need of the consumer. The arena for such low-calorie sweeteners will continue increasing as consumers are now more aware of what they eat.

Pricing Stability and Collaborations in the Supply Chain

Pricing Stability along with Partnerships in the Supply Chain-the Global Supply Chain is for sweeteners, including that for Neotame, which has continued to show relative stable prices partly due to strong partnership links between the manufacturers and distributors. These partnerships ensure that there is supply consistency and reliability while crowned with a certain level of pricing predictability, which is extremely critical for the manufacturers and formulators. Stability in the supply chain is also among the drivers of market growth and sustainability as far as the Neotame industry's concerned, keeping in mind that with stability, more effective planning and decision-making take place among players.

Neotame as a Flavor Enhancer-Within Soft Drinks

Neotame does not just feature as a sweetener; its most remarkable ability is modified, special flavor enhancement. Thus, soft drink manufacturers now find this additive to be a great exciting argument to include in drink formulations for flavor enhancement.

The approach is toward inventing more innovative and new products that tend toward consumer preferences, which has begun is towards increasing complexity in taste and engagement with consumers which will eventually lead to greater industry shares. Continuous increases in economies for innovative and flavour-first approaches to soft drinks will keep growing and the position of Neotame within flavour-enhancing systems for such beverages is expected to grow.

Rising awareness about increasing heath concerns impacting the consumption

The increasing customer awareness and apprehension towards the health hazards that artificial ingredients including synthetic sweeteners such as Neotame presumably not pretending can bring to their health, may have negative effects on the market. This continues trend may make consumers prefer more natural or plant-based substitutes.

The society becomes increasingly particular about transparency in what is consumed, as well as the supposed health benefits it brings. Somewhere along the line between all these concerns, the manufacturers and formulators will have to walk-however-and precariously balance the functional benefits and the shifting consumer sentiment towards artificial additives. Addressing and adapting to all these concerns and changes will be the key to the survival of the sector in the long term.

The 2020 to 2024 financial year has been an active one for the complex global industry where changes in sales reflect the flexibility of the industry towards the changing preferences of the market. The demand projections for the next decade will illustrate the similar pattern for the under-survey period, 2025 to 2035.

New trends in the nutrition, new tendencies for choosing healthy food products, and constant enhancement in sweetener market are some of the future prospects of the consumption. Such changes are being closely observed by industry players, in search of the next big opportunity as well in order to meet the constantly evolving needs of the international populace.

The industry is characterized by a two-tier structure, which includes both organized and unorganized players. Leading companies such as Foodchem International Corporation, Fooding Group, Limited Prinova Group LLC, NutraSweet Co, HuwSweet Co Ltd., SinoSweet Co Ltd., JK Sucralose Inc., H & A Cannada Inc., WuHan HuaSweet Co., Ltd HYET Sweet S.A.S and others some players dominate the organized segment that accounts for 40% of sales in the industry.

Multinational corporations (MNCs) that have target segment revenue greater than 2 million USD belong to these groupings and they maintain their arena presence in this way because they have large volumes of production capacities, high-tech infrastructure and various products.

These well-regulated players have strict distribution networks and can be found in every corner of the world thereby; resulting to huge penetration globally. Their modernized research labs on the other hand enhance innovations enabling them to introduce a range of products with regard to changing trends among health aware consumers who are conscious about their diet.

On the contrary, local participants with target segment revenue below 2 million USD form the unorganized part that contributes up to 60% of total sales within this category. These smaller companies may lack global coverage but are vital for specific areas.

Working in niche community allows them offer particular goods fitted for diverse domestic preferences or specialized dietary needs. In many cases, these entities adjust quickly according to fads in consumer tastes which results into unique and exceptional product mix. This makes sure that there is dynamism as well as competitiveness within industry due to existence of both big and small firms.

This variety brings on board multiple developments along with a wide range of options being made available satisfying different customers across all regions worldwide. This means that the industry has good prospects given its innovative nature coupled with growing trend towards healthier alternatives.

The following table shows the estimated growth rates of the significant three geographies sales. USA, China and India are set to exhibit high consumption, recording CAGRs of 4.3%, 7.9%, and 8.5% respectively, through 2034.

| Countries | CAGR 2024 to 2034 |

|---|---|

| United States | 4.3% |

| China | 7.9% |

| India | 8.5% |

The surging adoption of ketogenic and low-carbohydrate diets among Americans is creating an enormous opportunity for manufacturers. With those diet mechanisms going main stream, consumers are now searching for sweeteners that would give the desired levels of sweetness without that of sugar from traditional carbohydrates.

Neotame is also hardly affecting blood sugar levels, which makes it an attractive source for formulators who wish to offer sweet products to cater to the rising keto and low-carb consumer categories. Of course, these are also products for those using Neotame to create a wide variety of food and beverages- low carb baked goods to keto snacks and drinks.

The soaring demand saw hit the USA shores as it allows indulgent flavors without feeling guilty about excess carbohydrates and is earmarked to be one of the essential ingredients for brands targeting the rapidly growing base of keto and low-carb consumers.

China positions itself as a manufacturing powerhouse. It has enabled the country all because of its capability to manufacture in large quantities. That's why the proximal position of the country plays a key role with regard to Neotame and other sweetening solutions to the global end user industry.

In fact, it has the additional power to when adding high technic in its production and could full control price and dependable supply in turn. It leads manufacturing activity of many multinationals who have been running through a search for sweeteners well balanced in quality and cost.

It has allowed manufacturers in China to trespass the domestic wall and be accessed to markets outside in food, beverage, and pharmaceutical segments. Economies of scale and technological modernization place Chinese manufacturers in a position to develop Neotame formulations that meet high-quality and regulatory standards while still cutting costs for potential international clients.

The overall perception toward food and beverages in the context of the Indian consumption has turned toward the middle-ground. This trend is essential to the need for sweetening agents, which offers equivalent levels of sweetness which cannot be obtained from regular sugars in conjunction with high calorie content.

They are using Neotame to create portion-controlled and reduced calorie products to fit the augmenting interest of moderation and life indulgence found among the Indian population. Meals replacement, low calorie desserts, controlled portion size snacks; Neotame is making it possible for food manufacturers to develop exciting sweet products that the Indian consumer wants and can consume without derailing their diet plans.

Due to the ascendancy of wellness and thoughtful consumption among the people of India, this market that helps the consumers to reduce the Portion size and Intake by moderating sweet taste will increase in the future.

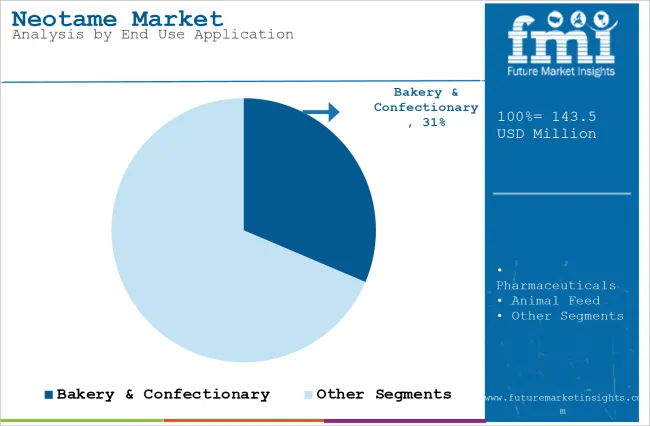

| Segment | Bakery & Confectionary (End Use Application) |

|---|---|

| Value Share (2024) | 31.4% |

Neotame is said to be an intense sweetener typically used in bakery products because of the above mentioned reason. This intense sweetness, which is supposed to be 13000 times sweeter than sucrose, leads bakers to prefer a minimal amount and use of this healthy sweetener.

The right properties that possesses make it stable at high temperatures and with flavor enhancement, to make it most suitable for baked goods, as it could contribute to the overall taste profile without taking over flavor from other ingredients. Neotame also draws people who are health conscious from spending unnecessary superfluous calories on baked goods and seeks alternatives that end up being reduced calorie or sugar-sweetened free.

This speaks affirmatively of the multifunctionality and versatility, featuring this ingredient very prominently within the scope of application in the bakery industry, where it makes it possible to produce appealing and delicious foods for all types of consumers.

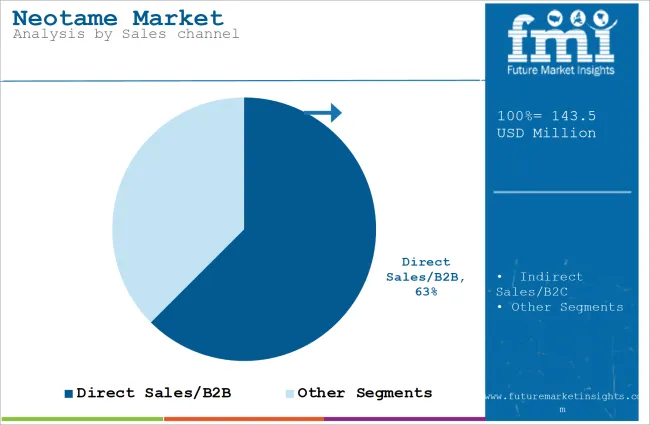

| Segment | Direct Sales/B2B (Sales channel) |

|---|---|

| Value Share (2024) | 62.5% |

The main reason why Neotame has major sales through B2B sales channels is the nature of its applications and structure of the food chain. Neotame, had been utilized mostly in the outside bakery, confectionery, and beverage industries, being very high in sweetener intensity, and therefore was attached to just manufacturers of food rather than going to the consumers directly-sell.

These companies now have a need for supplies of Neotame in bulk and a continuous way. The model used for B2B sales gives an effective distribution of customized formulations with technical assistances, which are much needed in the business of food producers on the optimum use in their recipes and manufacturing methods. An established model makes sure that it goes in the right industrial applications, where the uniqueness of the materials can be taken advantage of in formulating end-products attractive to consumers.

As a way to expand their market, share within the global market, manufacturers are utilizing different strategies. One of the principal opportunities is product development, and to achieve this, companies are releasing new forms of Neotame for particular uses. For instance, a top producer recently introduced an improved version of Neotame designed for implementation in sugar-sweetened confectionery as people pay more attention to their health.

Another strategic management approach is capacity expansion, which has been considered by manufacturers, as different industries experience a growing demand. Some other players are also looking forward to entering into joint ventures and acquisitions to enhance their positions and to capture more distributors. Also, the key players are focusing on the values that certainly characterize the product including high intensity of sweetening, thermal stability, and others, to gain a bigger stake in the global market.

Key applications include Food and Beverage (Bakery Confectionary, Candies and Jellies, Chewing gums, Beverage, Desserts, Dairy Segment, Ice, Creams), Pharmaceuticals, Animal Feed, Cosmetics and Personal Care, Others.

On Direct Sales/B2B, Indirect Sales/B2C, Health & Beauty Store, Pharmacies/Drugstores, Modern Trade Channel and Online Retailing.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The value of the industry is estimated to reach 143.5 million USD by the end of year 2025.

By 2035, the sales value is expected to be worth USD 292.9 million.

The sales increased at a CAGR of around 7.1% over the past half-decade.

Asia is expected to dominate the global consumption.

Some of the key players in manufacturing include Foodchem International Corporation, Fooding Group Limited, Prinova Group LLC, NutraSweet Co, HuwSweet Co Ltd., SinoSweet Co Ltd., JK Sucralose Inc., H & A Cannada Inc., WuHan HuaSweet Co., Ltd HYET Sweet S.A.S and few others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA