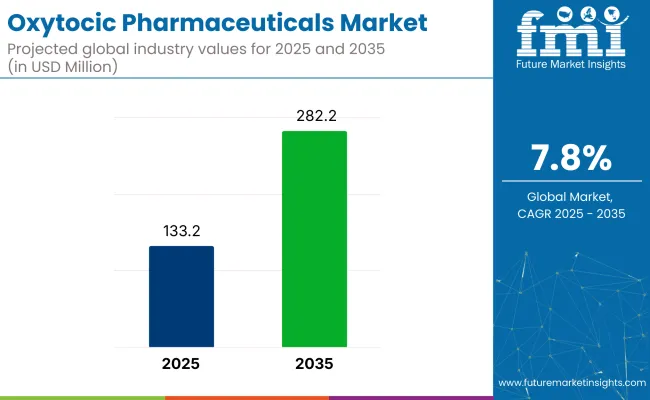

The oxytocic pharmaceuticals market is expected to grow significantly, nearly doubling in size from USD 133.2 million in 2025 to USD 282.2 million by 2035 at a CAGR of 7.8% during the forecast period. This growth is primarily driven by the increasing number of childbirths requiring medical intervention and global efforts to reduce maternal mortality. There is a notable rise in institutional births, particularly in regions such as South Asia and Sub-Saharan Africa, which is increasing the demand for uterotonic drugs essential for maternal care protocols.

Injectable oxytocics, like oxytocin, remain the standard treatment for preventing postpartum hemorrhage (PPH), the leading cause of maternal deaths globally. The use of these agents is supported by World Health Organization (WHO) guidelines, which recommend active management of the third stage of labor. Furthermore, the increasing prevalence of high-risk pregnancies and cesarean deliveries further amplifies the need for safe and effective uterotonics.

The market is also undergoing innovation, particularly in drug formulation and delivery. In November 2024, Insud Pharma secured a USD 2.7 million grant from the Bill & Melinda Gates Foundation to fund Phase II clinical trials for a thermostable sublingual oxytocin tablet. This development aims to eliminate cold chain dependency, a significant barrier in low-resource settings, offering a more accessible solution for maternal care.

North America and Europe continue to be key markets due to their advanced healthcare infrastructure, while regions like Asia Pacific and Latin America experience the fastest growth, driven by public health reforms and expanding access to maternal healthcare services.

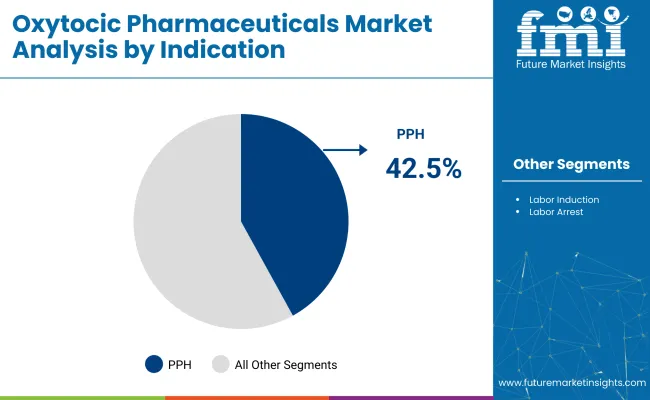

Synthetic oxytocin will lead the industry in 2025 due to quick action and clinical reliability, holding 89.3% share. Postpartum hemorrhage management will dominate applications with 42.5% share, driven by global maternal health priorities, rising cesarean rates, WHO recommendations, and expanded access through public health programs and product innovations.

Synthetic oxytocin is expected to dominate the industry in 2025, accounting for 89.3% of the total revenue.

Postpartum hemorrhage (PPH) management is expected to capture 42.5% of the industry in 2025, making it the leading application segment.

Intravenous infusion/injection will continue to lead the route of administration segment, accounting for 60% of the industry in 2025.

Hospitals will remain the largest end-user segment, accounting for 75% of industry demand in 2025.

Heightened Childbirth Complications Drive Advanced Uterotonic Demand

Globally, the incidence of high-risk pregnancies is rising, with more deliveries taking place in hospitals due to public health reforms. Oxytocin and carbetocin are increasingly used in institutional births. WHO trials in Kenya and Nigeria have proven heat-stable carbetocin’s efficacy in low-resource settings. Ferring Pharmaceuticals launched pre-filled oxytocin injectables. With rising labor induction rates in the USA and India, demand for safer uterotonics is reinforced by WHO guidelines, and cesarean delivery rates surpass 30% globally.

Cold Chain Limitations and Adverse Effects Challenge Market Expansion

Oxytocin requires storage between 2-8°C, posing challenges in rural clinics without cold chain infrastructure. Traditional formulations degrade quickly under heat, reducing therapeutic efficacy. Regulatory bodies remain cautious about approving analogs due to risks like uterine rupture from incorrect dosing. WHO issued warnings on overuse during community births in 2023. Poor access in Tier 3 towns is caused by logistical gaps, while high costs and training barriers limit the rollout of newer variants. Misoprostol’s adverse reactions further slow industry expansion.

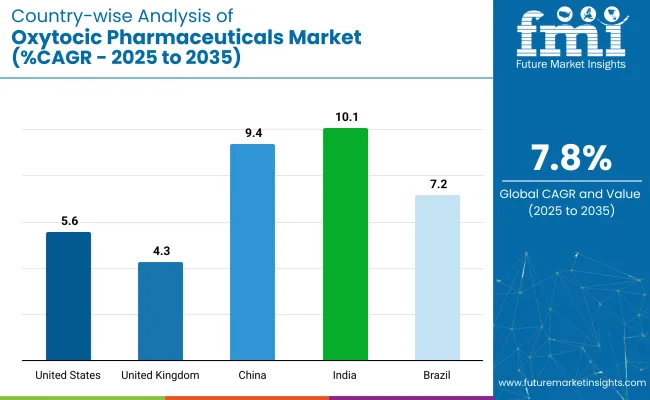

The industry is expanding across key countries, driven by rising institutional births, government healthcare initiatives, and adoption of heat stable formulations. India leads with the highest growth, followed by China and Brazil. Public sector engagement, local manufacturing, and digital healthcare integration are fueling global industry momentum.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

| United Kingdom | 4.3% |

| China | 9.4% |

| India | 10.1% |

| Brazil | 7.2% |

The United States industry is set to grow at a CAGR of 5.6% from 2025 to 2035.

The United Kingdom industry is expected to grow at a CAGR of 4.3% between 2025 and 2035.

The industry in China is projected to grow at a CAGR of 9.4% from 2025 to 2035.

The industry in India is forecast to grow at a CAGR of 10.1% from 2025 to 2035, the highest among major markets.

The Brazil industry is expected to grow at a CAGR of 7.2% from 2025 to 2035.

The global industry is characterized by dominant players, key players, and emerging players. Dominant players such as Pfizer Inc., Ferring Pharmaceuticals, and Novartis AG lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across maternal healthcare sectors.

Key players including Hikma Pharmaceuticals, Sun Pharmaceutical, Teva Pharmaceuticals, Cipla Ltd., and Mylan N.V. offer specialized oxytocic formulations, catering to regional markets and specific therapeutic needs. Emerging players like Fresenius Kabi and Baxter International focus on innovative delivery systems and cost-effective solutions, expanding their presence in the global industry.

Recent Oxytocic Pharmaceuticals Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 133.2 million |

| Projected Industry Size (2035) | USD 282.2 million |

| CAGR (2025 to 2035) | 7.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Product Types Analyzed (Segment 1) | Natural Oxytocin, Synthetic Oxytocin |

| Indications Analyzed (Segment 2) | Abortion Induced Incomplete, Inevitable Abortion, Postpartum Hemorrhage , Labor Induction, Labor Arrest |

| Routes of Administration Analyzed (Segment 3) | Intravenous Infusion/Injection, Intramuscular Injection |

| End Users Analyzed (Segment 4) | Hospitals, Maternity Clinics |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Key Players influencing the Industry | Pfizer Inc., Ferring Pharmaceuticals, Novartis AG, Hikma Pharmaceuticals, Sun Pharmaceutical, Teva Pharmaceuticals, Cipla Ltd., Mylan N.V., Fresenius Kabi , Baxter International, Others |

| Additional Attributes | Dollar sales by product type (natural vs. synthetic), Demand trends in labor induction and PPH treatment, Hospital vs. maternity clinic adoption, Regional gaps in oxytocic availability, Intravenous vs. intramuscular efficacy landscape, Role of oxytocics in maternal care programs |

The industry is segmented into natural oxytocin and synthetic oxytocin.

The industry is segmented into abortion induced incomplete, inevitable abortion, postpartum hemorrhage, labor induction, and labor arrest.

The industry is segmented into intravenous infusion or injection and intramuscular injection.

The industry is segmented into hospitals and maternity clinics.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa.

It is expected to be valued at USD 133.2 million.

It is projected to grow at a CAGR of 7.8% from 2025 to 2035.

Synthetic oxytocin accounts for 89.3% of the industry in 2025.

Postpartum hemorrhage (PPH) management, with 42.5% of industry value in 2025.

The leading player in the industry is Pfizer Inc. with a 15% industry share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Preservative Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Machinery Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Grade Sodium Bicarbonate Market Insights - Size, Share & Industry Growth 2025 to 2035

Biopharmaceuticals Packaging Market Growth – Forecast 2025 to 2035

RFID in Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of High Barrier Packaging Films for Pharmaceuticals

Urinary Antibacterial & Antiseptic Pharmaceuticals Market Analysis – Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA