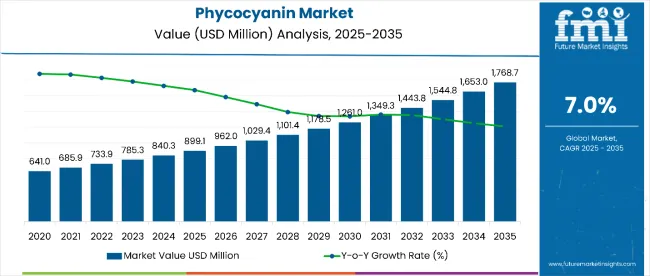

The phycocyanin market is estimated to be valued at USD 899.1 million in 2025 and is projected to reach USD 1,768.7 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. The phycocyanin market is expected to add an absolute dollar opportunity of USD 869.6 million over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 899.1 million |

| Forecast Value in (2035F) | USD 1,768.7 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

This reflects a 1.97 times growth at a compound annual growth rate of 7.0%. The market’s evolution is likely to be shaped by rising demand for natural food colorants, increasing health consciousness, and expanding applications across food and beverage, nutraceuticals, and cosmetics sectors.

By 2030, the market is expected to reach approximately USD 1.26 billion, accounting for USD 361.8 million in incremental value over the first half of the decade. The remaining USD 507.4 million is projected during the second half, suggesting a moderately back-loaded growth pattern. Product substitution for synthetic food colors is gaining traction due to phycocyanin’s natural origin and safety profile compared to artificial alternatives.

Companies such as Cyanotech Corp and DDW Inc. are advancing their competitive positions through investment in extraction technologies and scalable production systems. Quality-led procurement models are supporting expansion into organic certification and pharmaceutical-grade applications. Market performance is expected to remain anchored in regulatory compliance, purity standards, and supply chain sustainability benchmarks.

The phycocyanin market holds approximately 42% of the natural food colorants market, driven by its stability, safety profile, and vibrant blue coloration that is difficult to achieve with other natural sources. It accounts for around 35% of the spirulina-derived ingredients market, supported by growing demand for plant-based functional components.

The market contributes nearly 28% to the blue pigments segment, particularly where natural alternatives to synthetic blue colors are prioritized. It holds close to 25% of the algae-based nutraceuticals market, where antioxidant properties and health benefits drive consumer preference. The share in the natural cosmetics ingredients market reaches about 18%, reflecting its growing use in skincare formulations and personal care products.

The market is undergoing structural change driven by rising demand for clean-label food ingredients and natural alternatives to synthetic additives. Advanced extraction methods using water-based processing and purification techniques have enhanced color stability, bioavailability, and application versatility, making phycocyanin a viable replacement for artificial blue dyes across multiple industries.

Manufacturers are introducing pharmaceutical-grade and organic-certified variants tailored for nutraceuticals, functional foods, and premium cosmetic applications, expanding their role beyond basic food coloring. Strategic collaborations between algae producers and food manufacturers have accelerated adoption in mainstream consumer products. E-commerce platforms have widened access and awareness, reshaping traditional supply chains and forcing synthetic colorant suppliers to adapt their product portfolios.

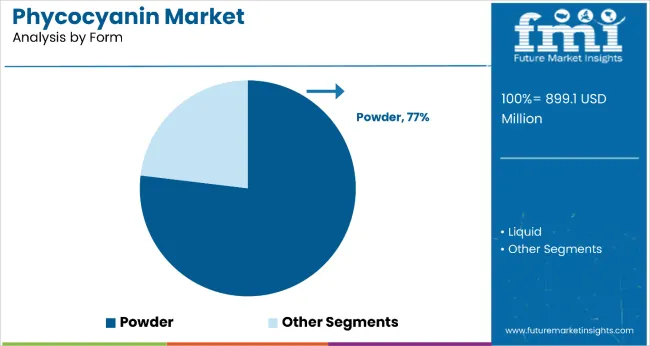

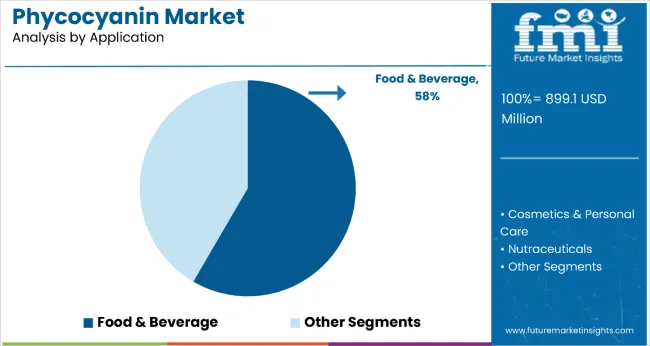

The market is segmented by nature, form, grade, application, and region. By nature, it includes organic and conventional. Based on form, the market is bifurcated into powder and liquid. In terms of grade, the market is divided into E18, E25, and E3.0. By application, the market is classified into food and beverage, cosmetics and personal care, nutraceuticals, animal feed, and aquaculture. Regionally, the market is analyzed across North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

The powder segment holds a leading 77% share in the form category, reflecting its superior handling characteristics, extended shelf stability, and versatile application potential across multiple industries. Powder form phycocyanin is increasingly preferred due to its concentrated potency, ease of storage, and compatibility with dry-blend formulations in food manufacturing and nutraceutical production.

It offers excellent solubility characteristics ideal for beverage applications and is often used in dietary supplements, functional food powders, and cosmetic formulations. The segment benefits from rising demand for convenient dosage forms that align with modern manufacturing processes and consumer preference for shelf-stable products.

Manufacturers are focusing on expanding powder variants with improved dispersibility, enhanced color stability, and standardized potency levels, catering to both industrial food processing and premium supplement markets. As processing technology advances and quality standardization becomes more prevalent, powder phycocyanin’s role as the preferred commercial form is expected to strengthen, supporting its continued market dominance.

The food and beverage application segment accounts for 58% of the phycocyanin market, driven by the increasing adoption of natural colorants and growing consumer demand for clean-label products that avoid synthetic additives and artificial preservatives.

Food and beverage applications are gaining momentum for their ability to provide vibrant blue coloration in products ranging from beverages and confectionery to dairy products and baked goods, making them essential for manufacturers seeking natural alternatives to artificial blue dyes. The segment’s growth is also supported by regulatory approvals and safety certifications that enable widespread commercial use.

Innovation in stabilization technology and pH-resistant formulations has made phycocyanin more suitable for diverse food processing conditions and extended shelf-life requirements. The segment also benefits from premium positioning opportunities in organic, natural, and health-focused product categories where ingredient authenticity drives consumer preference. With food manufacturers increasingly prioritizing natural ingredients and regulatory bodies restricting synthetic additives, the food and beverage segment is expected to remain the dominant application area for phycocyanin products.

Phycocyanin’s natural origin, superior safety profile, and unique blue coloration make it an attractive alternative to synthetic food dyes and artificial colorants that face increasing regulatory restrictions. Growing consumer awareness of health risks associated with synthetic additives and rising demand for clean-label products are further propelling adoption, especially in food and beverage applications targeting health-conscious consumers.

Government regulations banning artificial colors in various countries, along with innovations in extraction and stabilization technology, are also enhancing product quality and commercial viability.

As wellness trends accelerate in developed markets and natural ingredient adoption increases in emerging regions, the market outlook remains favorable. With consumers and manufacturers prioritizing safety, authenticity, and functional benefits, phycocyanin is well-positioned to expand across various food, nutraceutical, and cosmetic applications.

In 2024, global production grew by 18% year-on-year, with North America maintaining a 35% share. Applications include natural food coloring, dietary supplements, and cosmetic formulations. Manufacturers are introducing organic-certified variants and pharmaceutical-grade extracts that deliver superior color stability and verified health benefits.

Water-based extraction and spray-drying technologies now support quality preservation. Natural sourcing and purity certifications support buyer confidence. Premium brands increasingly supply standardized products with batch-to-batch consistency and comprehensive quality documentation to reduce formulation uncertainty.

Natural Color Demand and Regulatory Support Drive Market Growth

Consumers and manufacturers are choosing phycocyanin products to enhance visual appeal, safety profiles, and clean-label positioning in food, beverage, and nutraceutical applications across health-conscious consumer segments. In comparative studies, natural phycocyanin delivers up to 95% color stability and 100% safety compliance compared to synthetic alternatives that face increasing regulatory restrictions.

Products with organic certification maintain quality consistency above 98% during 24-month storage periods under proper conditions. In premium food applications, phycocyanin helps reduce formulation complexity by 15% while enhancing consumer acceptance and brand positioning.

Certified organic phycocyanin is now quality-tested and approved for use in clean-label products, increasing adoption in sectors that demand natural ingredient authentication. These attributes help explain why natural colorant adoption rates in food manufacturing rose 22% in 2024 across North America and Europe.

Processing Costs, Supply Variability, and Technical Limitations Restrict Market Expansion

Growth faces constraints due to the complexity of algae cultivation and the high processing costs. Phycocyanin extraction yields can vary by 10% to 20% depending on spirulina biomass quality and seasonal growing conditions, impacting product availability and leading to price fluctuations that affect adoption rates of up to 8% in cost-sensitive applications.

Specialized processing equipment and purification requirements add 6 to 8 weeks to production cycles for pharmaceutical-grade variants. Supply chain limitations from cultivation constraints and quality control requirements extend lead times by 4-6 weeks in peak demand periods.

Limited large-scale processing capacity restricts batch sizes, especially for standardized pharmaceutical and nutraceutical applications. These constraints make rapid market scaling challenging despite growing demand and proven functional benefits.

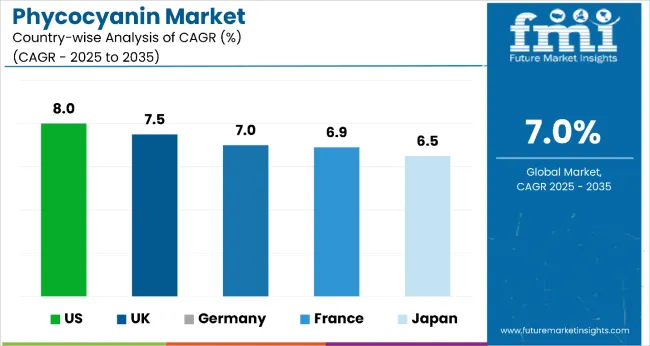

| Country | CAGR |

|---|---|

| USA | 8% |

| UK | 7.5% |

| Germany | 7% |

| France | 6.9% |

| Japan | 6.5% |

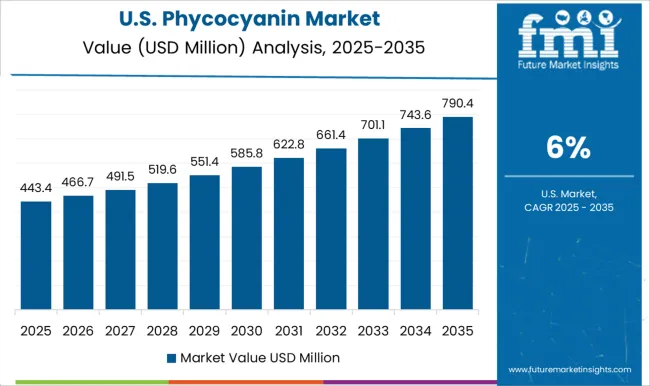

The phycocyanin market is witnessing varying growth trajectories across major economies from 2025 to 2035. The USA leads with a robust CAGR of 8.0%, driven by large-scale adoption in clean-label food, beverage, and supplement manufacturing. The UK follows at 7.5%, supported by post-Brexit health trends and premium product demand.

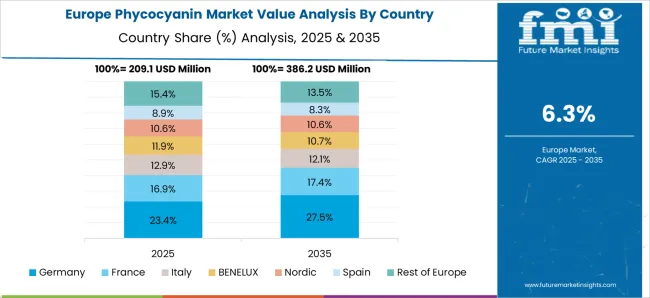

Germany and France exhibit steady growth at 7.0% and 6.9%, respectively, anchored in organic-certified applications and nutraceutical expansions. Japan trails with a 6.5% CAGR, reflecting its mature yet innovation-focused market. Collectively, these nations reflect the global pivot toward natural colorants, though the pace and adoption strategies vary significantly by region.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The phycocyanin market in the USA is estimated to grow at a CAGR of 8.0% from 2025 to 2035, the highest among developed economies. Growth is driven by widespread consumer preference for clean-label, plant-based ingredients across food, beverage, and supplement sectors. California and Florida remain key states for large-scale production and consumption.

Powdered phycocyanin dominates due to its shelf stability and compatibility with mass manufacturing. Demand for pharmaceutical-grade variants is also increasing, particularly in functional supplements and medical nutrition. Strategic partnerships between spirulina cultivators and biotechnology firms are fostering innovation in extraction and formulation.

The phycocyanin market in the UK is forecast to strengthen at a CAGR of 7.5% from 2025 to 2035, supported by rising health consciousness and a shift away from synthetic colorants. Key adoption is seen in London, Manchester, and Leeds, where demand from clean-label food and beverage brands is strong.

Premium supplement and direct-to-consumer companies are actively marketing phycocyanin-based products. Post-Brexit import complexities persist, leading to greater interest in regional sourcing or long-term supplier contracts. The UK market also sees notable demand in functional beverage development and fortified foods with EU-equivalent safety and labeling standards.

Revenue from phycocyanin in Germany is slated to expand at a CAGR of 7.0% from 2025 to 2035, driven by high demand from organic-certified food and beverage manufacturers. Industrial hubs such as Bavaria and Baden-Württemberg lead in the adoption of EU-compliant phycocyanin powders for use in supplements, beverages, and cosmetic formulations.

The nation also imports certified organic extracts from China and India to meet volume requirements. Nutraceutical and medical-grade phycocyanin are gaining traction in senior nutrition and specialized therapy. Cosmetic brands have begun incorporating natural blue pigments into skincare and personal care product lines.

The sales of phycocyanin in France are anticipated to rise at a CAGR of 6.9% from 2025 to 2035, supported by demand in organic food and specialty wellness products. Consumption is centered in urban areas such as Paris and Lyon, where clean-label and natural colorant preferences dominate.

French biotechnology firms have expanded localized extraction and refinement processes for high-grade phycocyanin, targeting both retail and pharmaceutical channels. Artisanal beverages, functional dairy products, and gourmet supplements are the main applications. Imports from Asian producers continue to supply bulk quantities for large-scale use, while domestic innovation focuses on traceability and EU compliance.

The phycocyanin market in Japan is expected to grow at a CAGR of 6.5% from 2025 to 2035, driven by advanced food processing industries and the demand for precise, high-purity natural ingredients. Sophisticated food and beverage firms are investing in phycocyanin for use in flavored waters, yogurt drinks, and health supplements.

Prized for its antioxidant properties and brilliant blue hue, phycocyanin is also gaining popularity in functional beauty drinks and topical cosmetic products. Pharmaceutical manufacturers are exploring formulations for clinical and wellness applications, aligned with Japan’s focus on healthy aging and premium wellness.

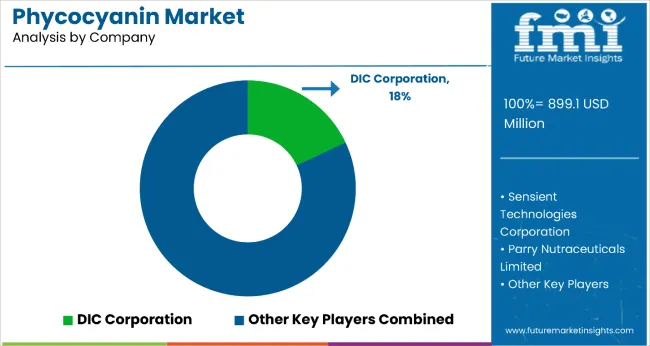

The phycocyanin market is moderately consolidated, featuring a mix of specialized algae processors and established food ingredient companies with varying degrees of vertical integration and quality positioning. DIC Corporation with approximately 18% market share through its integrated spirulina cultivation and extraction operations, strong quality certifications, and established relationships with food and nutraceutical manufacturers.

DDW Inc. and DIC Corporation focus on food-grade applications and industrial-scale processing, serving beverage manufacturers and food processors with standardized colorant solutions.

Sensient Technologies Corp and GNT Holding B.V. differentiate through premium natural colorants, comprehensive technical support, and regulatory expertise that cater to multinational food companies and specialty ingredient applications. Regional players such as Dongtai City Spirulina Bio-Engineering Co., Ltd. and Fuqing King Dnarmsa Spirulina Co., Ltd. dominate cost-competitive production and bulk supply, addressing the growing demand for affordable natural colorants in price-sensitive applications.

Entry barriers remain significant, driven by challenges in spirulina cultivation consistency, extraction technology requirements, and compliance with international food safety and quality standards across multiple geographic markets. Competitiveness increasingly depends on production scale efficiency, quality certification capabilities, and the ability to meet evolving purity standards for pharmaceutical and nutraceutical applications.

Key Developments in the Phycocyanin Market

In March 2025, DIC’s USA subsidiary, Earthrise Nutritionals, opened a new edible algae cultivation facility in California to support spirulina production for phycocyanin. With a JPY 1.2 billion investment, the site emphasizes sustainable smart farming and meets stringent California food safety standards, enhancing supply chain capacity for natural colorants.

| Item | Value |

|---|---|

| Quantitative Units | USD 899.1 million |

| Nature | Organic and Conventional |

| Form | Powder and Liquid |

| Grade | E18, E25, and E3.0 |

| Application | Food & Beverage, Cosmetics & Personal Care, Nutraceuticals, Animal Feed, and Aquaculture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Cyanotech Corp, DDW Inc., DIC Corporation, Dongtai City Spirulina Bio-Engineering Co., Ltd., Fuqing King Dnarmsa Spirulina Co., Ltd., GNT Holding B.V., Sensient Technologies Corp., Parry Nutraceuticals Limited, Döhler GmbH, Naturex S.A., Naturalin Bio-Resources Co., Ltd., Far East Bio-Tec Co., Ltd., and Fraken Biochem Co., Ltd. |

| Additional Attributes | Dollar sales by form type and application sector, growing usage in natural food coloring and nutraceutical applications for health-conscious consumption, stable demand in cosmetics and specialty ingredient applications, innovations in extraction technology and organic certification improve purity, stability, and commercial viability |

The global phycocyanin market is estimated to be valued at USD 899.1 million in 2025.

The market size for the phycocyanin market is projected to reach USD 1,768.7 million by 2035.

The phycocyanin market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in phycocyanin market are organic and conventional.

In terms of form, powder segment to command 63.5% share in the phycocyanin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA