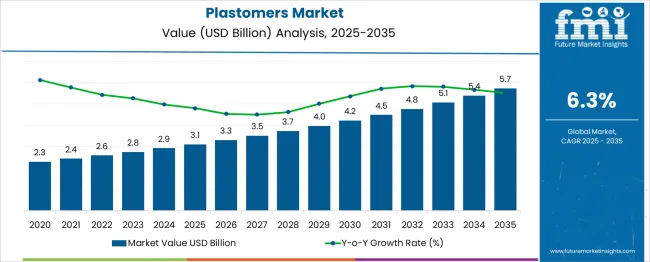

The Plastomers Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. This early-phase growth is driven by increasing demand for flexible, durable, and high-performance materials in applications such as packaging, automotive, and consumer goods. The market will benefit from advancements in plastics processing technologies and the growing trend of replacing conventional plastics with advanced, sustainable, and cost-effective plastomers. The second half (2030–2035) will contribute USD 1.8 billion, representing 61.5% of the total growth, driven by continued adoption in automotive, medical, and industrial applications, particularly with the increasing emphasis on sustainable and recyclable plastic materials.

Annual increments during the first phase average USD 0.2 billion per year, while the later years will see stronger growth driven by innovation in material properties and the shift toward high-performance polymers. Manufacturers focusing on bio-based and multi-functional plastomers will capture the largest share of this USD 2.6 billion growth opportunity.

| Metric | Value |

|---|---|

| Plastomers Market Estimated Value in (2025 E) | USD 3.1 billion |

| Plastomers Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The plastomers market is witnessing consistent growth, driven by the rising preference for flexible, durable, and cost-efficient polymers in automotive, packaging, consumer goods, and medical sectors. These materials are being increasingly adopted as alternatives to conventional thermoplastics and elastomers, offering a balance of elasticity, softness, and heat resistance. The market is being shaped by advancements in catalyst technologies and polymerization processes that allow tailored properties for end-use requirements.

With evolving regulations around lightweighting and recyclability, plastomers are being positioned as sustainable solutions in high-volume manufacturing industries. Investment in advanced compounding facilities and joint ventures among polymer manufacturers and converters has enabled the rapid commercialization of new plastomer grades.

Moreover, integration into multilayer packaging, sealing, and film formulations has driven significant demand across both food and industrial applications. Over the coming years, the market is expected to benefit from continued innovation in metallocene catalysis and strategic supply chain shifts aimed at improving polymer performance, processing efficiency, and regulatory compliance across global production hubs.

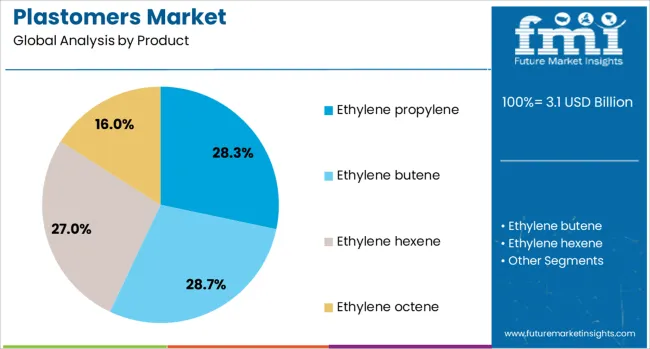

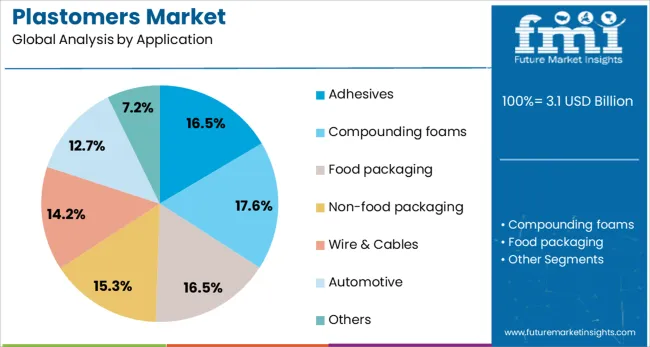

The plastomers market is segmented by product, application, and geographic regions. By product, the plastomers market is divided into ethylene-propylene, ethylene-butene, ethylene-hexene, and ethylene-octene. In terms of application, the plastomers market is classified into Adhesives, Compounding foams, Food packaging, Non-food packaging, Wire & Cables, Automotive, and Others. Regionally, the plastomers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ethylene propylene segment is projected to account for 28.3% of the total revenue share in the plastomers market in 2025, making it the leading product type. This growth has been driven by its favorable balance of flexibility, impact resistance, and chemical stability, which makes it ideal for use in automotive parts, wire and cable coatings, and flexible packaging films.

Ethylene propylene-based plastomers have been increasingly utilized in applications requiring weather resistance, low-temperature performance, and soft-touch finishes. The segment's dominance is supported by improvements in polymer design and catalyst technology that enable better control of molecular structure, resulting in enhanced processability and mechanical properties.

Its compatibility with a wide range of base resins and fillers has further strengthened its utility in compound formulations for both rigid and flexible applications. Additionally, its role in developing recyclable packaging structures has reinforced demand among converters seeking high-performance yet sustainable alternatives, positioning ethylene propylene as a strategic material choice across multiple industrial verticals.

The adhesives segment is expected to hold 16.5% of the overall plastomers market revenue in 2025, reflecting its growing application in bonding and sealing technologies across packaging, construction, and hygiene product manufacturing. The increasing demand for hot melt adhesives with enhanced flexibility, thermal stability, and low odor emissions has driven the integration of plastomers as key performance enhancers.

Plastomer-based adhesives are being adopted due to their ability to provide strong adhesion on low-energy surfaces and their compatibility with various substrates, including polyolefins, paper, and metal foils. The segment has gained momentum from growing use in pressure-sensitive adhesives and laminating systems, particularly in flexible packaging and nonwoven hygiene products.

Additionally, advances in metallocene polymerization have enabled consistent quality and performance, meeting the stringent application requirements of fast-processing adhesive technologies. As industries prioritize both operational efficiency and environmental sustainability, the demand for plastomer-modified adhesive systems is expected to continue rising, thereby solidifying this segment’s contribution to overall market expansion.

The plastomers market is driven by increasing demand for flexible, durable materials in packaging, automotive, and construction sectors. Opportunities are growing in packaging and automotive applications, particularly for flexible packaging and automotive components. Emerging trends towards high-performance and bio-based plastomers are reshaping the market. However, challenges such as high production costs and raw material availability may limit growth. By 2025, addressing these challenges will be essential for maintaining a competitive edge and ensuring continued market expansion.

The plastomers market is expanding due to their versatility and increasing demand across a variety of industries, including packaging, automotive, and construction. Plastomers offer properties like high flexibility, chemical resistance, and durability, which make them suitable for applications in flexible packaging, adhesives, and protective coatings. As industries seek more reliable, cost-effective materials, the demand for plastomers is expected to rise significantly by 2025, particularly in the packaging sector, where performance and recyclability are key drivers.

Opportunities in the plastomers market are emerging in the expanding packaging and automotive sectors. Plastomers are increasingly used in flexible packaging due to their excellent sealing and barrier properties, driving demand in food and beverage packaging. In the automotive industry, plastomers are utilized for their durability and flexibility in interior and exterior components. By 2025, the growing focus on lightweight materials and sustainable solutions in these industries will create further opportunities for plastomer adoption, supporting long-term market growth.

Emerging trends in the plastomers market point to the increasing demand for high-performance and bio-based plastomers. As industries push for more efficient materials, plastomers are evolving to provide better resistance to environmental stress and enhanced performance in extreme conditions. Additionally, bio-based plastomers, derived from renewable resources, are gaining traction due to their environmental benefits. By 2025, the market is expected to see a shift towards these advanced, eco-friendly plastomers, further driving industry growth and meeting regulatory requirements.

Despite growth, challenges related to high production costs and raw material availability persist in the plastomers market. The complexity of manufacturing plastomers, combined with the cost of specialized raw materials, can make them more expensive than alternative materials, hindering widespread adoption. Additionally, fluctuations in the supply of key raw materials could disrupt production. By 2025, overcoming these challenges through improved production processes and cost-effective sourcing will be crucial for sustaining market growth, particularly in price-sensitive sectors.

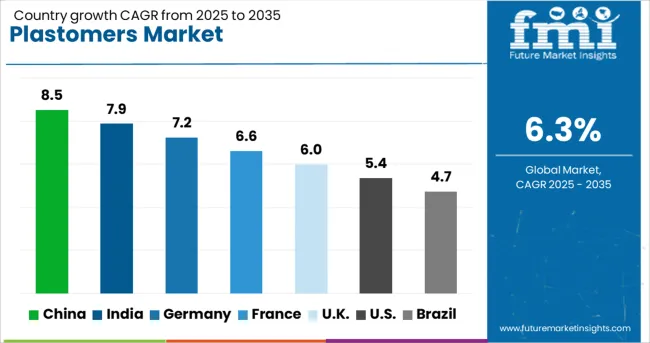

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

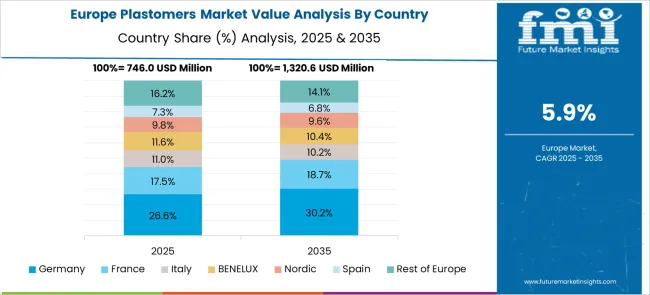

The global plastomers market is projected to grow at a 6.3% CAGR from 2025 to 2035. China leads with a growth rate of 8.5%, followed by India at 7.9%, and Germany at 7.2%. The United Kingdom records a growth rate of 6.0%, while the United States shows the slowest growth at 5.4%. These varying growth rates are influenced by factors such as increasing demand for packaging materials, rising industrial production, and the expansion of automotive and consumer goods sectors. Emerging markets like China and India are witnessing higher growth due to rapid industrialization, increasing manufacturing output, and growing demand for high-performance polymers, while more mature markets like the USA and the UK experience steady growth driven by established industries and technological advancements in polymer processing. This report includes insights on 40+ countries; the top markets are shown here for reference.

The plastomers market in China is growing at an impressive rate, with a projected CAGR of 8.5%. As China’s manufacturing sector continues to expand, the demand for plastomers, which are used in a variety of applications such as packaging, automotive, and consumer goods, is increasing. The country’s increasing focus on high-performance polymers and advanced plastic solutions, coupled with the growing demand for packaging materials in e-commerce and food industries, is driving market growth. Additionally, China’s emphasis on sustainable materials and eco-friendly solutions is supporting the adoption of plastomers in various applications.

The plastomers market in India is projected to grow at a CAGR of 7.9%. India’s growing manufacturing sector, coupled with increased demand for high-performance materials in packaging, automotive, and construction, is driving the need for plastomers. The country’s expanding e-commerce sector, along with rising disposable incomes and urbanization, further boosts demand for packaging solutions. Additionally, India’s growing focus on sustainability and the adoption of advanced polymers in various industries support the demand for plastomers, particularly in packaging applications. With the increasing demand for lightweight and durable materials, the market for plastomers is expected to continue expanding.

The plastomers market in Germany is projected to grow at a CAGR of 7.2%. Germany’s well-established automotive and industrial sectors, combined with its focus on technological innovation, are key drivers of demand for plastomers. The demand for lightweight and high-performance polymers in automotive applications is contributing significantly to market growth. Additionally, Germany’s emphasis on sustainability and eco-friendly solutions, particularly in the packaging industry, supports the adoption of plastomers. The country’s strong manufacturing base and its leadership in the European Union ensure continued growth in the plastomers market, particularly in automotive and packaging sectors.

The plastomers market in the United Kingdom is projected to grow at a CAGR of 6.0%. The UK’s well-established manufacturing sector, particularly in packaging, automotive, and consumer goods, is driving steady demand for plastomers. The growing focus on lightweight and high-performance materials in the automotive and packaging industries is fueling the market’s growth. Additionally, the UK’s commitment to sustainability and environmental regulations is encouraging the adoption of eco-friendly plastomer solutions. Despite slower growth compared to emerging economies, the market remains robust due to increasing demand for high-quality, durable, and versatile materials in various industries.

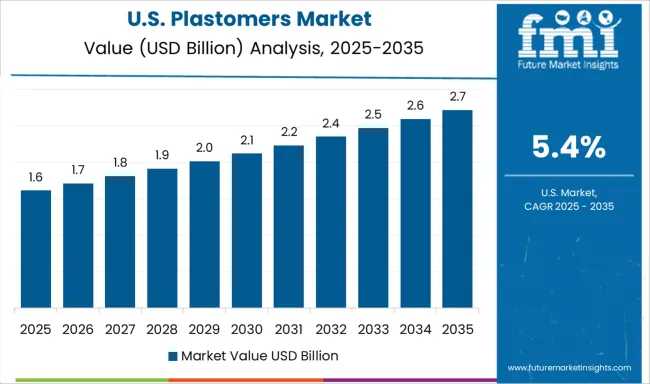

The plastomers market in the United States is expected to grow at a CAGR of 5.4%. The USA remains a major player in the global plastomers market, driven by its strong automotive, packaging, and consumer goods sectors. The growing demand for lightweight, durable, and high-performance materials in automotive and packaging applications is a key factor contributing to market growth. Additionally, the increasing focus on sustainable packaging solutions and the rising adoption of advanced polymers in various industries further accelerate the market’s expansion. However, growth in the USA is slower compared to emerging markets due to market maturity and the saturation of traditional manufacturing solutions.

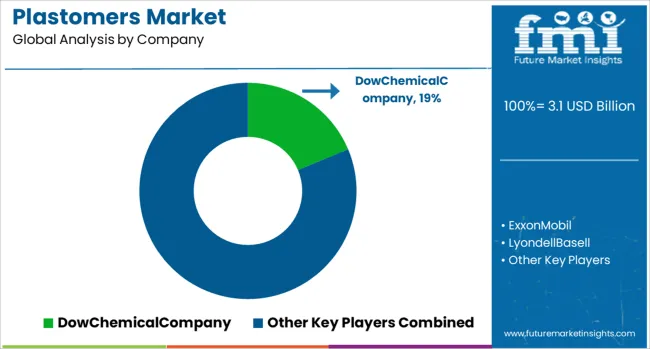

The global plastomers market is characterized by the presence of dominant chemical manufacturers, specialized regional players, and emerging innovators targeting high-performance applications. Dow Chemical Company leads the market with a comprehensive portfolio of plastomers that combine flexibility, clarity, and durability, addressing needs in packaging, automotive, and medical sectors. Dow’s scale, global production footprint, and extensive R&D capabilities allow it to rapidly respond to evolving market requirements while offering materials optimized for processability and performance consistency. The company’s historical strategy has emphasized product innovation, global expansion, and strategic partnerships with converters and OEMs to secure long-term industrial adoption.

ExxonMobil, LyondellBasell, and SABIC maintain strong competitive positions by delivering plastomers with enhanced impact resistance, optical clarity, and chemical stability, which are critical in high-demand applications such as flexible packaging, films, and automotive components. Their strategies have historically focused on process efficiency, product diversification, and penetration into emerging regions where industrial growth is accelerating. These players leverage robust global distribution networks and technical support services to reinforce client relationships and ensure market share retention.

Emerging and specialized players, including Borealis, Chevron Phillips Chemical Company, and Westlake Chemical Corporation, are targeting niche applications such as biomedical devices, high-barrier packaging, and automotive interiors. These companies differentiate through tailored material solutions, enhanced processing capabilities, and bio-based or partially recyclable plastomer formulations. Forecast strategies indicate a shift toward bio-based plastomers, hybrid polymer blends, and circular economy initiatives to meet rising regulatory and environmental compliance pressures. Opportunities lie in lightweight packaging, durable automotive components, and sustainable product offerings, where market demand for recyclability and energy-efficient production is growing. Strategic alliances, co-development agreements, and aftermarket technical advisory services are increasingly employed to strengthen customer loyalty and accelerate adoption of next-generation plastomer solutions globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Product | Ethylene propylene, Ethylene butene, Ethylene hexene, and Ethylene octene |

| Application | Adhesives, Compounding foams, Food packaging, Non-food packaging, Wire & Cables, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DowChemicalCompany, ExxonMobil, LyondellBasell, SaudiBasicIndustriesCorporation(SABIC), RoyalDutchShell, Borealis, ChevronPhillipsChemicalCompany, and WestlakeChemicalCorporation |

| Additional Attributes | Dollar sales by polymer type and application, demand dynamics across packaging, automotive, and consumer goods sectors, regional trends in plastomer adoption, innovation in high-performance and biodegradable formulations, impact of regulatory standards on environmental safety, and emerging use cases in flexible packaging and medical device manufacturing. |

The global plastomers market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the plastomers market is projected to reach USD 5.7 billion by 2035.

The plastomers market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in plastomers market are ethylene propylene, ethylene butene, ethylene hexene and ethylene octene.

In terms of application, adhesives segment to command 16.5% share in the plastomers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Plastomers Market Growth – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA