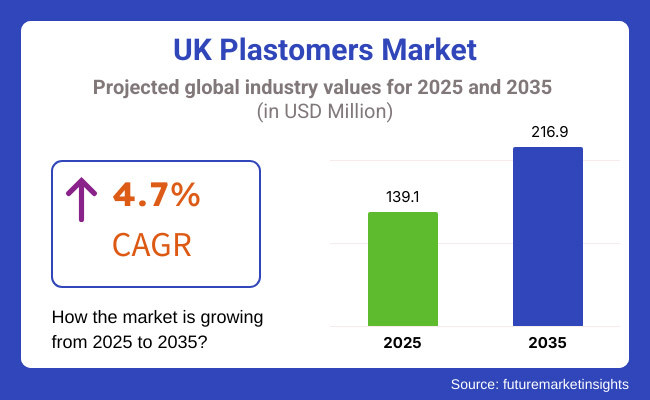

The UK plastomers market is set to witness USD 139.1 million in 2025. Growing at 4.7% CAGR from 2025 to 2035, the industry is expected to reach USD 216.9 million by 2035. The growth is propelled by the ever-increasing need for plastic materials which are both light and strong as well as the development of polymer blending technologies. This growth will be the effect of the increasing need for such materials in various sectors like packaging, automotive, healthcare, and consumer goods, made of soft and strong polymers at high temperatures.

Plastomers are the materials that can be blended, for example, polyolefins, polyamides, and polyvinyl chloride with elastomers, polystyrene, polycarbonate, and polyethylene. Their elasticity, ability to endure impact, and the possibility to seal them by heat make them common in flexible packaging, adhesive films, medical devices, and high-performance automotive components.

The shift toward e-commerce and the increase in delivery services of food have also led to the use of more-than-ever plastomer-based flexible packaging solutions that provide better barrier properties and longer shelf life. For example, major food packaging companies in the UK are more frequently plasticizer-based films for the purpose of making the perishable goods last longer and fresher.

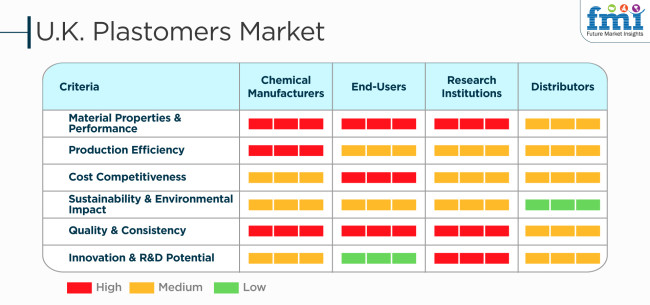

The UK plastomers industry is influenced by a number of key factors that affect chemical manufacturers, end-users, research and development organizations, and distributors. Material performance and properties are of high importance to all industries, with an increased focus on quality and consistency. Efficiency in production is of major concern to producers and research and development organizations, affecting overall industry competitiveness.

Cost competitiveness is of medium level of concern, suggesting a balanced response towards pricing policies. Environmental and sustainability issues are increasingly on the agenda, with research centers leading the efforts to find green solutions. Consistency and quality are still paramount for everyone involved, guaranteeing product performance and reliability.

Challenges come from innovation and R&D potential, particularly for research centers, which experience high pressures to advance material science. The market is transforming with the emphasis on sustainable development, cost-efficient approaches, and technological advancements, reflecting the necessity of strategic investment and cooperation among players in the market to ensure growth and competitiveness.

During the period from 2020 to 2024, the UK plastomers market experienced consistent growth driven by flexible packaging, automotive, and pharmaceutical uses. These products are flexible and resilient. They find applications in manufacturing films, sealing products, and adhesives. Currently, these products are broadly used in food packaging, medical supplies, and household goods. This will continue to foster industry growth. The industry will build itself on sustainability measures, new material trends, and refinement in policymaking between 2025 and 2035.

Tax on the plastic packaging in the UK and net-zero emission targets will shift preferences of manufacturers toward bio-based alternatives, recycled polymer blends, and circular economy alternatives. However, traditional industry practices will become obsolete due to technological advancements in polymer processing, quality control through AI, and smart packaging solutions. Increased demand will come from the EV industry, medical uses, and high-performance flexible films.

Industry Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The UK Plastic Packaging Tax (April 2022) encouraged the use of sustainable products. | Stricter sustainability regulations mandate the use of fully recyclable, compostable, and bio-based products. Government policies push for a circular plastics economy with extended producer responsibility (EPR) frameworks. |

| Growth in food, beverage, and personal care packaging increased the use of products in films, pouches, and heat-sealable coatings. Lightweighting trends favored low-density products. | Smart and interactive packaging innovations integrate embedded sensors, antimicrobial coatings, and recyclability tracking. Products with biodegradable additives replace conventional flexible packaging solutions. |

| Increasing use of products in automotive interior components, gaskets, and sealing applications for lightweighting and durability. | Electric vehicle (EV) expansion drives demand for high-performance elastomeric materials in battery seals, vibration dampening, and thermal insulation. Products with self-healing and conductive properties gain popularity. |

| Initial adoption of recycled and bio-based products in response to consumer demand and corporate sustainability commitments. Focus on reducing plastic waste in flexible packaging. | 100% recyclable and carbon-neutral products become the industry norm. Chemical recycling technologies ensure that high-purity polymers are obtained. Circular economy models integrate plastomer repurposing in multiple industries. |

| Rising demand for biocompatible products in medical tubing, drug delivery systems, and PPE due to the COVID-19 pandemic. | Advancements in medical-grade elastomers for implantable devices, 3D-printed prosthetics, and antimicrobial wound dressings. Nanotechnology-enhanced products improve performance in healthcare applications. |

| Development of metallocene-based products with enhanced flexibility, transparency, and heat stability for industrial and packaging uses. | Expansion of biodegradable, bio-based, and high-performance plastomer formulations. Artificial intelligence-based material design maximizes plastomer composition for energy-efficient processing and superior mechanical properties. |

| Expansion driven by lightweighting in the automotive sector, flexible packaging growth, and medical innovations. Recycling and sustainable materials awareness impacted consumer buying behaviors. | Industry growth through EV industry innovation, intelligent packaging solutions, and new-generation medical application. Government policies promote the shift to high-performance polymer and sustainable solutions. |

The most significant risk in the industry is non-compliance with legal regulations. Plastomers used in food packaging, medical and industrial applications are required to follow strict UK REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), the Food Standards Agency (FSA), and international safety rules first.

Predictability within the supply chain is a further problem. The UK sources both local and foreign suppliers of essential raw materials like ethylene-based products. Disruptions worldwide, trade barriers, and currency fluctuations due to post-Brexit policies can result in increased prices and product unavailability which have an impact on production cost and lead time.

The concerns pertaining to sustainability are also increasing. The government of the UK is fully supportive of this goal, so the plastomers industry is under the great burden of developing recyclable, biodegradable, or bio-based alternatives. Companies that are not proactive in the sustainable innovations' dissemination might bear the consequences with the market demand and image.

Manufacturers have to consider the whole production cost, level of imports, regulatory requirements, and most importantly competitive positioning. Therefore, a well-proportioned practice is a must to keep the profitability up and ensure industry competitiveness.

Cost-plus pricing is generally applicable in this sector to make sure that the cost of the raw material used, production cost, and regulatory compliance are maintained while a consistent profit margin is applied. Nevertheless, in the face of the fluctuation of raw material prices and energy costs, businesses must agreedly revise their pricing strategies to be more competitive.

Competitive pricing is at huge importance for mass-market applications. Dynamic pricing is one effective strategy in reaction to the varying raw material costs and industry demands. Firms can maximize their profits by adjusting price levels as per the core of the economy, trade policies, and seasonal factors. This can help the producer keep the prices and the customers.

The UK industry is primarily dominated by ethylene-octene products, attributed to their excellent elasticity, impact strength, and sealing performance. These characteristics make them indispensable in flexible packaging, automotive parts, and medical applications where clarity and durability are necessary. Some examples include ethylene-octene products made by companies like Dow and ExxonMobil which improve the performance of packing for applications like food packaging, shrink films and agricultural films. They also enhance adhesion and softness in automotive weather seals, wire coatings, and medical tubing.

In the UK the blown film processing sector holds the highest share in the industry, supported by the growing demand for flexible packaging across food, beverages and pharmaceuticals. This process is widely applied for making grocery bags, shrink wraps, protective packaging, and stretch films. Major UK packaging suppliers like Amcor and Berry Global are investing in sustainable blown film solutions to meet the country’s demand for recyclable and biodegradable packaging. Plastomers are largely dominated by ethylene-octene and ethylene-hexene materials, which are increasingly used in next-generation flexible films with their balanced combination of sealability, toughness, and printability.

The packaging sector widely used the product because of the growing need for flexible and eco-friendly packaging solutions. The growing consumer demand for light, strong, and recyclable packaging materials is fueling the use of the product, particularly in food, beverage, and pharmaceutical packaging markets. These products have superior sealability, transparency, and impact resistance, which makes them suitable for flexible packaging films, pouches, and protective coatings.

The food & beverage sector becomes the leading end-use sector of plastomers in the country based on the growth in demand for flexible and green packaging solutions. These products are extensively used in food packing films, pouches, and protective coatings owing to their improved sealability, durability, and resistance to moisture. As the consumer appetite for ready meals, packaged snacks, and frozen foods continues to increase, the demand for high-performance packaging materials that help maintain product freshness and enhance shelf life has grown tremendously.

The UK plastomers market is characterized by stiff competition spurred on by demand emanating from the packaging, automotive, healthcare, consumer goods, and adhesives industries. Products are prized for their properties of flexibility, durability, and impact resistance, which make them critical for applications such as flexible packaging films, stretch wraps, gaskets, seals, and soft-touch materials. The industry is being influenced by trends such as polymer technology innovations, sustainability initiatives, and the rising acceptance of lightweight materials in automotive and industrial uses.

Key players such as ExxonMobil Chemical, Dow, LyondellBasell, and SABIC are already dominating the industry with high-performance polymer blends, advanced resin formulations, and a strong distribution network. These companies are focusing on developing bio-based alternatives, improving recyclability, and meeting environmental regulations to address sustainability apprehensions driven by changing consumer preferences.

On the other hand, regional manufacturers and specialty polymer companies are gaining inroads by providing custom plastomer solutions including low-density and high-clarity grades for niche applications. With the UK government promoting circular economy by tightening laws on plastic wastes, firms investing in recyclable, compostable, and renewable source products will gain a competitive edge.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| ExxonMobil Chemical | 12-15% |

| Dow Chemical Company | 10-13% |

| LyondellBasell Industries N.V. | 8-10% |

| Borealis AG | 5-7% |

| SABIC UK Petrochemicals | 3-5% |

| Other Companies (combined) | 50-57% |

| Company Name | Key Offerings/Activities |

|---|---|

| ExxonMobil Chemical | Produces polyolefin plastomers (POP) and elastomers, such as Vistamaxx™ and Exact™, widely used in packaging, automotive, and hygiene applications. |

| Dow Chemical Company | Develops ethylene-based products (AFFINITY™ and ENGAGE™), focusing on flexible films, adhesives, and stretchable materials with high elasticity and durability. |

| LyondellBasell Industries N.V. | Manufactures polyethylene products for sealants, impact-resistant packaging, and soft-touch automotive parts, prioritizing recyclability and energy efficiency. |

| Borealis AG | Supplies ethylene copolymers for packaging films, medical applications, and automotive interiors, leveraging sustainable polymer production. |

| SABIC UK Petrochemicals | Provides products for adhesives, coatings, and specialty packaging, with a focus on bio-based and circular economy solutions. |

ExxonMobil Chemical

ExxonMobil Chemical is a market leader in the production of polyolefin plastomers (POP) and elastomers, and it provides products like Vistamaxx™ and Exact™. These are applied in making flexible packaging, auto components, pharmaceuticals, and adhesives. The firm specializes in high-performance polymer technology, guaranteeing soft-touch feel, impact strength, and recyclability. ExxonMobil’s strong presence in advanced polymer solutions has solidified its industry leadership in the UK

Dow Chemical Company

Dow Chemical Company is a major supplier of ethylene-based products, including AFFINITY™ and ENGAGE™, which are widely used in packaging, stretch films, and flexible adhesives. The company prioritizes sustainability and polymer optimization, developing low-density, high strength products that enhance film clarity, sealing performance, and durability. Dow’s global supply network and research-driven approach make it a dominant player in the industry.

LyondellBasell Industries N.V.

LyondellBasell manufactures polyethylene products designed for sealants, food packaging, impact-resistant packaging, and automotive interiors. The company focuses on products that can be recylced, and process efficiency, aligning with UK and EU environmental policies. Its advanced polymer blending capabilities allow for customized performance properties, serving to industries seeking lightweight and high-performance materials.

Borealis AG

Borealis supplies ethylene copolymers used in packaging films, medical applications, and automotive components. The company is a leader in sustainable polymer production, investing in bio-based plastics, circular economy initiatives, and advanced compounding technologies. Borealis’ high-performance products are preferred for premium packaging and medical-grade materials.

SABIC UK Petrochemicals

SABIC UK Petrochemicals produces products for adhesives, coatings, and specialty packaging, focusing on bio-based materials and environmentally friendly solutions. The company is investing in circular economy strategies, ensuring its products align with recyclability and sustainable production initiatives. SABIC’s expertise in advanced materials for industrial and consumer applications strengthens its presence in the UK industry.

Other Key Players

The industry is segmented into ethylene butene, ethylene hexene, ethylene octene, ethylene propylene, and others.

The industry is segmented into blown film, cast film, extrusion lamination, extrusion molding, and injection molding.

The industry is segmented into packaging application, adhesive and sealants, wire and cable compounds, polymer modifiers, molded and extruded products, auto component parts, foam products and footwear, heavy duty bags, non-woven coatings, industrial liners, and other applications.

The industry is segmented into automotive, building and construction, compounding, consumer appliances, electrical and electronics, healthcare, food & beverages, agriculture, and other industries.

The industry is set to reach USD 139.1 million in 2025.

The market is projected to reach USD 216.9 million by 2035.

Key manufacturers include LyondellBasell Industries N.V., SABIC, Exxon Mobil Corporation, LG Chem, Westlake Chemical Corporation, Borealis AG, INEOS, Dow Inc., Mitsui Chemicals, and SK geo centric Co., Ltd.

Ethylene octane products are widely used.

Table 01: Market Volume (Tons) and Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 02: Market Value (US$ thousand) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Processing Type

Table 03: Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 04: Market Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 05: Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 06: Market Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 07: Market Value (US$ thousand) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Region

Table 08: England Market Volume (Tons) and Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 09: England Market Value (US$ thousand) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Processing Type

Table 10: England Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 11: England Market Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 12: England Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 13: England Market Value (USD TH) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 14: Scotland Market Volume (Tons) and Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 15: Scotland Market Value (US$ thousand) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Processing Type

Table 16: Scotland Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 17: Scotland Market Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 18: Scotland Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 19: Scotland Market Value (USD TH) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 20: Wales Market Volume (Tons) and Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 21: Wales Market Value (US$ thousand) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Processing Type

Table 22: Wales Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 23: Wales Market Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 24: Wales Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 25: Wales Market Value (USD TH) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 26: Northern Ireland Market Volume (Tons) and Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 27: Northern Ireland Market Value (US$ thousand) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Processing Type

Table 28: Northern Ireland Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 29: Northern Ireland Market Value (USD Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 30: Northern Ireland Market Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Table 31: Northern Ireland Market Value (USD TH) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End-use Industry

Figure 01: Market Volume (Tons), 2018 to 2022

Figure 02: Market Volume (Tons), 2023 to 2033

Figure 03: Market Value (US$ thousand), 2018 to 2022

Figure 04: Market Value (US$ thousand) Forecast and Y-o-Y Growth, 2023 to 2033

Figure 05: Value, Absolute $ Opportunity Analysis

Figure 06: Market Share and BPS Analysis by Product Type to 2023 and 2023

Figure 07: Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 08: Market Attractiveness by Product Type, 2023 to 2033

Figure 09: Market Absolute $ Opportunity by Ethylene Butene Segment

Figure 10: Market Absolute $ Opportunity by Ethylene Hexene Segment

Figure 11: Market Absolute $ Opportunity by Ethylene Octene Segment

Figure 12: Market Absolute $ Opportunity by Ethylene Propylene Segment

Figure 13: Market Absolute $ Opportunity by Others Segment

Figure 14: Market Share and BPS Analysis by Processing Type to 2023 and 2023

Figure 15: Market Y-o-Y Growth Projections by Processing Type, 2023 to 2033

Figure 16: Market Attractiveness by Processing Type, 2023 to 2033

Figure 17: Market Absolute $ Opportunity by Blown Film Segment

Figure 18: Market Absolute $ Opportunity by Cast Film Segment

Figure 19: Market Absolute $ Opportunity by Extrusion Lamination Segment

Figure 20: Market Absolute $ Opportunity by Extrusion Molding Segment

Figure 21: Market Absolute $ Opportunity by Injection Molding Segment

Figure 22: Market Share and BPS Analysis by Application to 2023 and 2023

Figure 23: Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 24: Market Attractiveness by Application, 2023 to 2033

Figure 25: Market Absolute $ Opportunity by Packaging Application Segment

Figure 26: Market Absolute $ Opportunity by Adhesive and Sealants Segment

Figure 27: Market Absolute $ Opportunity by Wire and Cable Compounds Segment

Figure 28: Market Absolute $ Opportunity by Polymer Modifiers Segment

Figure 29: Market Absolute $ Opportunity by Molded and Extruded Products Segment

Figure 30: Market Absolute $ Opportunity by Auto Component Parts Segment

Figure 31: Market Absolute $ Opportunity by Foam Products and Footwear Segment

Figure 32: Market Absolute $ Opportunity by Heavy Duty Bags Segment

Figure 33: Market Absolute $ Opportunity by Non-Woven Coatings Segment

Figure 34: Market Absolute $ Opportunity by Industrial Liners Segment

Figure 35: Market Absolute $ Opportunity by Other Applications Segment

Figure 36: Market Share and BPS Analysis by End-use Industry to 2023 and 2023

Figure 37: Market Y-o-Y Growth Projections by End-use Industry, 2023 to 2033

Figure 38: Market Attractiveness by End-use Industry, 2023 to 2033

Figure 39: Market Absolute $ Opportunity by Automotive Segment

Figure 40: Market Absolute $ Opportunity by Building and Construction Segment

Figure 41: Market Absolute $ Opportunity by Compounding Segment

Figure 42: Market Absolute $ Opportunity by Consumer Appliances Segment

Figure 43: Market Absolute $ Opportunity by Electrical and Electronics Segment

Figure 44: Market Absolute $ Opportunity by Healthcare Segment

Figure 45: Market Absolute $ Opportunity by Food and Beverages Segment

Figure 46: Market Absolute $ Opportunity by Agriculture Segment

Figure 47: Market Absolute $ Opportunity by Other Industries Segment

Figure 48: Market Share and BPS Analysis By Region to 2023 and 2023

Figure 49: Market Y-o-Y Growth Projection By Region, 2023 to 2033

Figure 50: Market Attractiveness Index By Region, 2023 to 2033

Figure 51: Market Absolute $ Opportunity by England Segment

Figure 52: Market Absolute $ Opportunity by Scotland Segment

Figure 53: Market Absolute $ Opportunity by Wales Segment

Figure 54: Market Absolute $ Opportunity by Northern Ireland Segment

Figure 55: England Market Share and BPS Analysis by Product Type to 2023 and 2023

Figure 56: England Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 57: England Market Attractiveness by Product Type, 2023 to 2033

Figure 58: England Market Share and BPS Analysis by Processing Type to 2023 and 2023

Figure 59: England Market Y-o-Y Growth Projections by Processing Type, 2023 to 2033

Figure 60: England Market Attractiveness by Processing Type, 2023 to 2033

Figure 61: England Market Share and BPS Analysis by Application to 2023 and 2023

Figure 62: England Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 63: England Market Attractiveness by Application, 2023 to 2033

Figure 64: England Market Share and BPS Analysis by End-use Industry to 2023 and 2023

Figure 65: England Market Y-o-Y Growth Projections by End-use Industry, 2023 to 2033

Figure 66: England Market Attractiveness by End-use Industry, 2023 to 2033

Figure 67: Scotland Market Share and BPS Analysis by Product Type to 2023 and 2023

Figure 68: Scotland Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 69: Scotland Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Scotland Market Share and BPS Analysis by Processing Type to 2023 and 2023

Figure 71: Scotland Market Y-o-Y Growth Projections by Processing Type, 2023 to 2033

Figure 72: Scotland Market Attractiveness by Processing Type, 2023 to 2033

Figure 73: Scotland Market Share and BPS Analysis by Application to 2023 and 2023

Figure 74: Scotland Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 75: Scotland Market Attractiveness by Application, 2023 to 2033

Figure 76: Scotland Market Share and BPS Analysis by End-use Industry to 2023 and 2023

Figure 77: Scotland Market Y-o-Y Growth Projections by End-use Industry, 2023 to 2033

Figure 78: Scotland Market Attractiveness by End-use Industry, 2023 to 2033

Figure 79: Wales Market Share and BPS Analysis by Product Type to 2023 and 2023

Figure 80: Wales Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 81: Wales Market Attractiveness by Product Type, 2023 to 2033

Figure 82: Wales Market Share and BPS Analysis by Processing Type to 2023 and 2023

Figure 83: Wales Market Y-o-Y Growth Projections by Processing Type, 2023 to 2033

Figure 84: Wales Market Attractiveness by Processing Type, 2023 to 2033

Figure 85: Wales Market Share and BPS Analysis by Application to 2023 and 2023

Figure 86: Wales Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 87: Wales Market Attractiveness by Application, 2023 to 2033

Figure 88: Wales Market Share and BPS Analysis by End-use Industry to 2023 and 2023

Figure 89: Wales Market Y-o-Y Growth Projections by End-use Industry, 2023 to 2033

Figure 90: Wales Market Attractiveness by End-use Industry, 2023 to 2033

Figure 91: Northern Ireland Market Share and BPS Analysis by Product Type to 2023 and 2023

Figure 92: Northern Ireland Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 93: Northern Ireland Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Northern Ireland Market Share and BPS Analysis by Processing Type to 2023 and 2023

Figure 95: Northern Ireland Market Y-o-Y Growth Projections by Processing Type, 2023 to 2033

Figure 96: Northern Ireland Market Attractiveness by Processing Type, 2023 to 2033

Figure 97: Northern Ireland Market Share and BPS Analysis by Application to 2023 and 2023

Figure 98: Northern Ireland Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 99: Northern Ireland Market Attractiveness by Application, 2023 to 2033

Figure 100: Northern Ireland Market Share and BPS Analysis by End-use Industry to 2023 and 2023

Figure 101: Northern Ireland Market Y-o-Y Growth Projections by End-use Industry, 2023 to 2033

Figure 102: Northern Ireland Market Attractiveness by End-use Industry, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Plastomers Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA