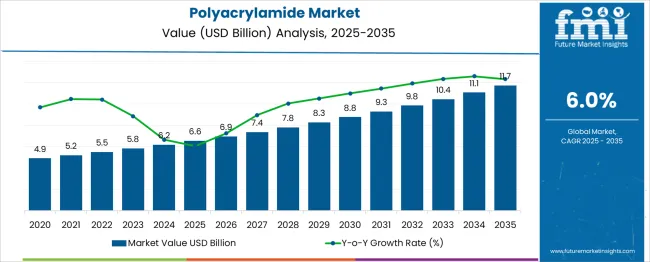

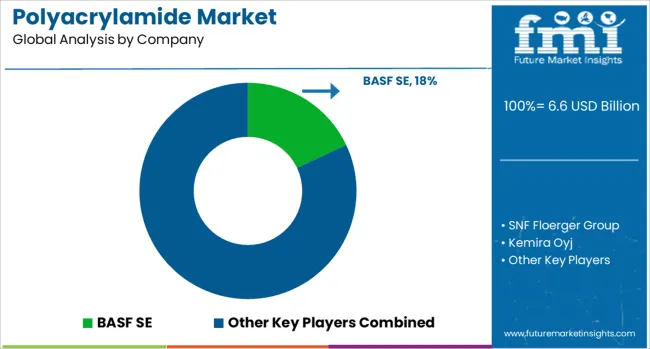

The Polyacrylamide Market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Driven by rising environmental concerns and demand for efficient water treatment solutions, the Polyacrylamide market is expected to expand from USD 6.6 billion in 2025 to USD 11.7 billion by 2035, demonstrating a steady CAGR of 6.0% over the forecast period.

Between 2025 and 2026, the market is forecast to increase from USD 6.6 billion to 6.9 billion, representing a YoY growth of approximately 4.5%. Continued investment in wastewater treatment infrastructure, especially across developing regions, supports consistent growth through 2030, with the market reaching USD 8.3 billion. During this period, annual growth rates remain in the range of 5.5% to 6.2%. From 2030 to 2035, the market continues its upward trend, driven by its expanding use in enhanced oil recovery, paper manufacturing, and mining operations, ultimately reaching USD 11.7 billion. YoY growth during this period averages between 6.0% and 6.5%. The consistent year-on-year performance reflects the essential role of polyacrylamide in enabling industrial efficiency and environmental compliance. Growing emphasis on sustainability and stricter discharge regulations are expected to further accelerate market adoption, especially in Asia-Pacific, which leads global consumption and capacity expansion.

| Metric | Value |

|---|---|

| Polyacrylamide Market Estimated Value in (2025 E) | USD 6.6 billion |

| Polyacrylamide Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The breakpoint in the Polyacrylamide market occurs around the year 2030, when the market value crosses the USD 8.3 billion mark. This point signifies a key transition where the market shifts from moderate growth to a phase of accelerated adoption and higher-value applications. From 2025 to 2030, the market grows steadily, supported by infrastructure development and compliance-driven demand in water treatment. However, post-2030, the growth rate strengthens due to several converging factors. Firstly, enhanced oil recovery (EOR) applications gain traction globally, particularly in the Middle East and North America, as oil producers seek to improve yield amid depleting conventional reserves. Secondly, stringent environmental regulations on industrial effluent discharge compel industries to invest in advanced flocculants like polyacrylamide, increasing volume demand. Technological advancements in polymer formulation and the rising use of bio-based or eco-friendly variants further stimulate market penetration across new end-use sectors. From 2030 to 2035, the market adds USD 3.4 billion, a sharper increase compared to the USD 1.7 billion added between 2025 and 2030. This breakpoint marks a structural shift where the Polyacrylamide market transitions from being compliance-driven to innovation-led, supported by diversified applications and growing awareness of water at both industrial and governmental levels.

The polyacrylamide market is witnessing strong demand across water treatment, oil recovery, and mining applications, driven by global industrialization and regulatory shifts toward sustainable wastewater management. Escalating environmental concerns and stricter discharge norms have compelled industries and municipalities to adopt chemical treatments for solid-liquid separation, where polyacrylamides are playing a critical role.

Advancements in polymer chemistry and process optimization have enabled better flocculation efficiency and tailored performance for specific contaminants. Moreover, regional policies favoring clean water access, particularly in the Asia-Pacific and Middle East regions, are accelerating investment in water treatment infrastructure.

Increasing use of enhanced oil recovery techniques and rising mining activities are also contributing to long-term demand. Innovation in bio-based polyacrylamide alternatives and investments in domestic manufacturing capacities are expected to influence supply chain sustainability and application expansion

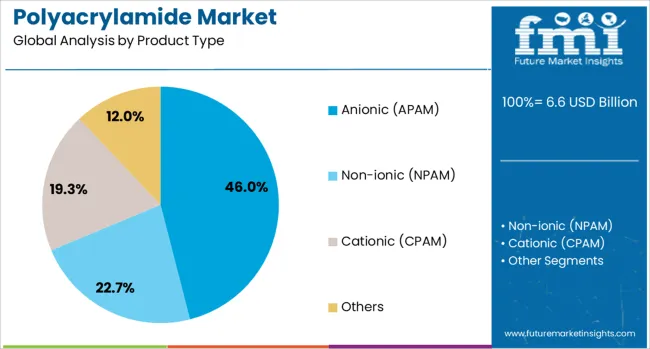

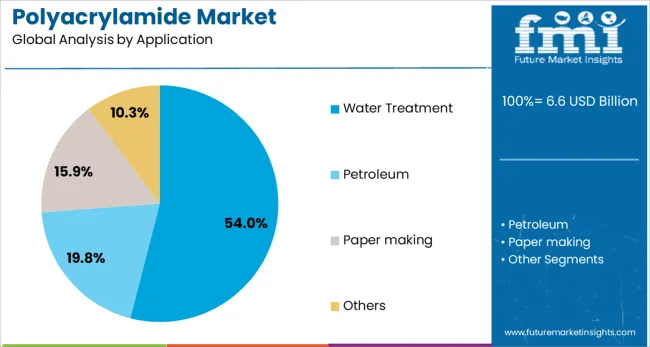

The polyacrylamide market is segmented by product type, application, and geographic regions. The polyacrylamide market is divided by product type into Anionic (APAM), Non-ionic (NPAM), Cationic (CPAM), and Others. The polyacrylamide market is classified into Water Treatment, Petroleum, Papermaking, and Others. Regionally, the polyacrylamide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Anionic polyacrylamide (APAM) is anticipated to hold 46.0% of the total market revenue in 2025, making it the dominant product type in the polyacrylamide market. Its leadership position is being reinforced by high effectiveness in treating wastewater with inorganic particles and suspended solids, particularly in municipal and industrial water systems.

APAM is preferred due to its superior flocculation performance in neutral to alkaline pH conditions, making it suitable for a wide range of treatment plants. Its cost-effectiveness, high molecular weight, and adaptability across sedimentation, sludge thickening, and clarification processes have further enhanced adoption.

Demand has also been strengthened by increasing wastewater volumes generated by textile, pulp and paper, and chemical industries. As water reuse becomes a strategic priority globally, anionic polyacrylamide continues to be a staple solution in large-scale water purification frameworks

Water treatment is expected to account for 54.0% of the overall market share in 2025, establishing it as the leading application segment. This dominance is being driven by rising global water stress, urban population growth, and stricter discharge limits for effluents in both developed and emerging markets.

Polyacrylamide is widely used as a flocculant and coagulant aid in potable water treatment, sludge dewatering, and industrial effluent processing due to its strong bridging capability and effectiveness at low dosage. Government-funded infrastructure upgrades and decentralized treatment projects have further fueled demand for efficient chemical agents like polyacrylamide.

The segment’s momentum is being maintained by rising adoption in desalination pre-treatment, greywater recycling, and zero liquid discharge (ZLD) systems. With environmental sustainability becoming a focal point, water treatment is poised to remain the primary driver for polyacrylamide consumption in the foreseeable future

The polyacrylamide market is expanding steadily due to increasing demand in water treatment, mining, and oil recovery applications. Its ability to improve solid-liquid separation and enhance process efficiency makes it essential in industrial and municipal operations. Regional growth is shaped by infrastructure development, environmental regulations, and industrial expansion. Product innovation focuses on formulation versatility and environmental compatibility. However, concerns over raw material dependency, purity standards, and regulatory scrutiny continue to influence supplier strategies and end-user adoption across diverse application areas.

Polyacrylamide production depends on petrochemical-based monomers that are sensitive to market volatility and supply chain disruptions. These materials require careful handling and strict storage conditions, adding to operational complexity. Suppliers often face margin pressure due to unpredictable costs and availability fluctuations. To address this, manufacturers are exploring alternative sourcing methods and more efficient production technologies. Reliable raw material procurement and long-term supplier partnerships are becoming critical differentiators for companies seeking consistent product quality and delivery across diverse industrial sectors.

The market is seeing greater use of customized polyacrylamide grades tailored to specific process needs. Liquid, powder, and emulsion forms offer flexible dosing and improved handling across sectors such as wastewater treatment, paper processing, and enhanced oil recovery. Innovations in polymer structure, including changes in molecular weight and charge density, allow more precise control over flocculation and viscosity. Suppliers that work closely with clients to test and refine formulations in real-world conditions gain a competitive edge, especially where operational efficiency and environmental compliance intersect.

Environmental and health authorities monitor polyacrylamide use closely due to the potential risks associated with residual monomers. Regulations require strict limits on contaminants, documentation of batch consistency, and transparency in labeling. These requirements can delay product approval and restrict use in sensitive applications like agriculture or drinking water treatment. Producers that fail to meet purity and traceability standards may face restricted market access. Companies investing in clean production lines, validated testing methods, and region-specific compliance frameworks are better positioned to succeed in regulated environments.

Demand is increasing for tailored polyacrylamide solutions designed to meet specific performance requirements. Variations in ionic charge, molecular structure, and form factor allow end-users to fine-tune results in processes like sediment removal, dewatering, and fluid mobility enhancement. Liquid and emulsion formats are enabling easier application and reduced preparation time. This trend favors suppliers that offer technical consultation and lab testing support. As industries seek to optimize operational efficiency and resource use, customized polymers are proving to be high-value differentiators across core markets.

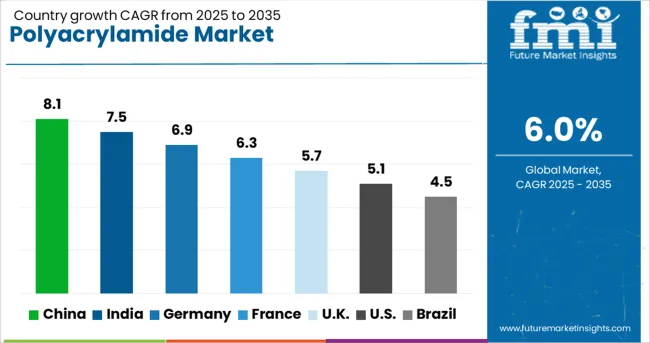

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

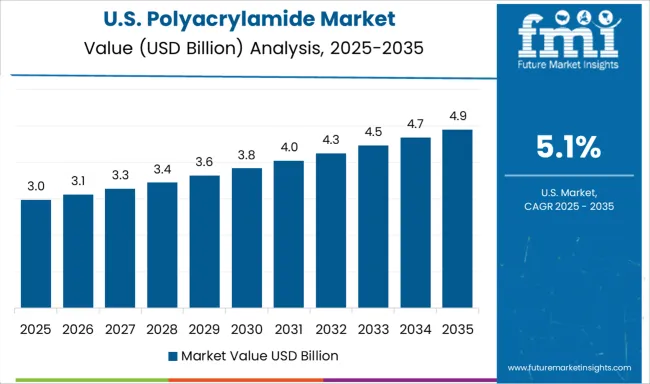

| USA | 5.1% |

| Brazil | 4.5% |

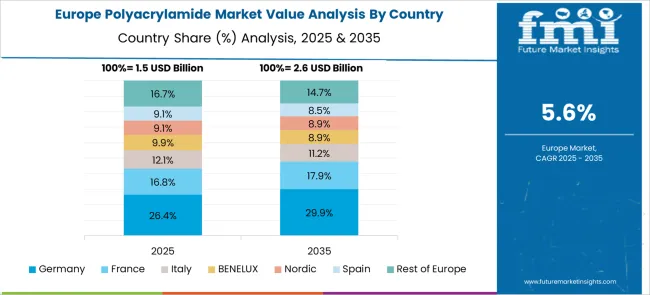

The global polyacrylamide market is projected to grow at a CAGR of 6.0% through 2035, supported by increasing applications in water treatment, mining, and enhanced oil recovery. Among BRICS nations, China leads with an 8.1% growth rate, driven by large-scale industrial water treatment initiatives and strong domestic chemical production. India follows at 7.5%, supported by rising demand in wastewater management and agricultural applications. Within the OECD region, Germany reports 6.9% growth, reflecting innovation in polymer chemistry and strict environmental standards. The United Kingdom shows stable progress at 5.7%, focusing on municipal water treatment and regulatory compliance. The United States, a mature market expanding at 5.1%, emphasizes efficiency, safety, and advanced formulations for industrial applications. These countries demonstrate varying strategies aligned with environmental priorities and sector-specific growth. This report includes insights on 40+ countries; the top five markets are shown here for reference. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has registered a robust CAGR of 8.1% in the polyacrylamide market, fueled by its increasing deployment across wastewater treatment, oil recovery, and mining sectors. With rising water scarcity, polyacrylamide plays a vital role in recycling and reuse systems, particularly in industrial and municipal wastewater streams. Local producers are focusing on high-molecular-weight variants for sludge dewatering and flocculation, tailored to the specific needs of regional treatment plants. The oil and gas sector, particularly in mature basins like Daqing and Xinjiang, has integrated polyacrylamide for enhanced oil recovery (EOR). Mining operations in Inner Mongolia and Sichuan are using polymer-based flocculants to improve solid-liquid separation efficiency. The government’s push for stricter effluent discharge norms has made polyacrylamide a cornerstone in compliance strategies. With growing investments in industrial water recycling and domestic capacity expansion, China continues to lead global consumption in both volume and innovation.

Polyacrylamide market in India is growing at a CAGR of 7.5%, driven by rising demand from the water treatment, agriculture, and chemical processing sectors. Rapid industrialization and urbanization have heightened the need for advanced wastewater treatment technologies in cities and industrial zones. Polyacrylamide is widely applied in sewage treatment plants (STPs) across states like Maharashtra, Tamil Nadu, and Gujarat, where water stress and pollution control regulations are particularly stringent. In the oil sector, polymer flooding techniques using polyacrylamide are being used to enhance crude recovery from onshore fields in Rajasthan and Gujarat. Furthermore, agricultural applications of superabsorbent-grade polyacrylamide have gained traction in arid and semi-arid regions, helping to retain soil moisture and reduce irrigation frequency. Local manufacturers are ramping up capacity to meet region-specific demands, while national infrastructure projects like smart cities and industrial corridors continue to stimulate adoption across sectors.

The United States has experienced a CAGR of 5.1% in the polyacrylamide market, underpinned by its use in oil recovery, municipal treatment systems, and industrial wastewater management. Polyacrylamide plays a key role in shale gas extraction, particularly in Texas, North Dakota, and Pennsylvania, where it reduces friction and separates solids in hydraulic fracturing fluids. Municipal water treatment facilities are adopting high-efficiency flocculants to improve cost-effectiveness and meet EPA discharge standards. Industrial sectors such as food processing and petrochemicals use the polymer to manage high-BOD effluents and improve clarification. Equipment upgrades in pulp mills and chemical plants are boosting demand for specialty grades with enhanced solubility and reduced residual monomer content. Emergency applications in disaster-prone regions, including dredging and water cleanup, have also increased consumption. USA-based manufacturers are investing in dry and liquid formats that align with operational safety and performance goals.

Germany has maintained a CAGR of 6.9% in the polyacrylamide market, driven by applications in environmental engineering, chemical processing, and advanced water management. The country’s emphasis on circular economy practices has increased the use of polyacrylamide in closed-loop industrial systems, particularly in pulp and textile manufacturing. Municipalities and industries alike are deploying high-performance polymers for sludge dewatering and flocculation to meet stringent EU water quality directives. Additionally, Germany’s robust civil engineering sector is utilizing polyacrylamide in tunneling and underground construction projects, including subway expansions and infrastructure renewal. There is also a growing demand for low-toxicity and bio-based formulations to comply with sustainability and environmental regulations. Maintenance dredging activities in rivers and ports, which require soil stabilizers, have further contributed to market growth. Local chemical firms are developing eco-friendly variants to align with Germany’s leadership in green technologies and responsible chemical usage.

The United Kingdom has recorded a CAGR of 5.7% in the polyacrylamide market, with growing use across wastewater management, civil engineering, and specialty chemicals. Polyacrylamide is being incorporated into municipal treatment plants to enhance sludge thickening and improve overall filtration efficiency, aligning with national sustainability goals. Infrastructure projects such as tunnel boring and rail development have spurred demand for soil-stabilizing polymers. The material is also increasingly used in paper and textile sectors to optimize solid-liquid separation and reduce water consumption during processing. The UK's regulatory framework on effluent management has prompted industries to adopt higher-grade, performance-oriented formulations. Collaborations between British manufacturers and European chemical companies are leading to the development of customized variants suited to local water conditions and environmental norms. Modernization of treatment facilities and the country’s push toward reducing freshwater extraction continue to support polymer uptake.

The polyacrylamide market is driven by its widespread use as a flocculant, coagulant, thickener, and binder across water treatment, oil & gas, mining, pulp & paper, and agriculture. The product is offered in various forms including anionic, cationic, non-ionic, and amphoteric grades, each tailored for specific applications such as sludge dewatering, enhanced oil recovery, or mineral separation. The global supply chain includes both multinational corporations and regional producers, each competing on formulation range, product consistency, and bulk delivery capabilities. BASF SE, SNF Floerger Group, and Kemira Oyj are the leading players with a strong international footprint and vertically integrated operations.

SNF dominates with one of the broadest portfolios in high-molecular-weight polyacrylamide for municipal and industrial water treatment systems. BASF and Kemira serve major end-use sectors with both dry and emulsion forms, often backed by technical service and plant-level optimization. Solvay, Ashland Inc, and Solenis LLC are also key players with specialized offerings for the pulp & paper and chemical processing sectors.

China-based companies such as Anhui Jucheng Fine Chemicals, Anhui Tianrun, ZL Petrochemicals, Xitao Polymer, and Yixing Bluwat Chemicals contribute significantly to the global supply, especially for price-sensitive markets. These suppliers offer a mix of standard and custom formulations, often targeting bulk water treatment and agriculture. Other regional players like PetroChina, Mitsubishi Rayon, and Envitech Chemical Specialities Pvt Ltd bring added diversity, offering options for domestic consumption and nearby export markets. As competition intensifies, suppliers with a balance of high-volume manufacturing, reliable logistics, and product versatility remain at the forefront.

As stated in SNF’s official press release (March 24, 2025) and Mitsubishi Chemical’s announcement (March 25, 2025), the license agreement enables SNF to commence commercial production of N‑vinylformamide (NVF) at its Dunkirk facility in June 2025, supporting functional polymers for circular‑economy paper and related applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| Product Type | Anionic (APAM), Non-ionic (NPAM), Cationic (CPAM), and Others |

| Application | Water Treatment, Petroleum, Paper making, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, SNF Floerger Group, Kemira Oyj, Solvay, Anhui Jucheng Fine Chemicals Co. Ltd, PetroChina Company Limited, Anhui Tianrun Chemical Co. Ltd, Beijing Hengju Chemical Group Corporation, Jiangsu Feymer Technology, Mitsubishi Rayon Co. Ltd, Shangdong Polymer Bio-chemicals Co. Ltd., Solenis LLC, Ashland Inc, ZL Petrochemicals Co. Ltd, Yixing Bluwat Chemicals Co. Ltd, King Union Group Corp, Envitech Chemical Specialities Pvt Ltd, Shuiheng Chemical Industry, and Xitao Polymer Co. Ltd. |

The global polyacrylamide market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the polyacrylamide market is projected to reach USD 11.7 billion by 2035.

The polyacrylamide market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in polyacrylamide market are anionic (apam), non-ionic (npam), cationic (cpam) and others.

In terms of application, water treatment segment to command 54.0% share in the polyacrylamide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA