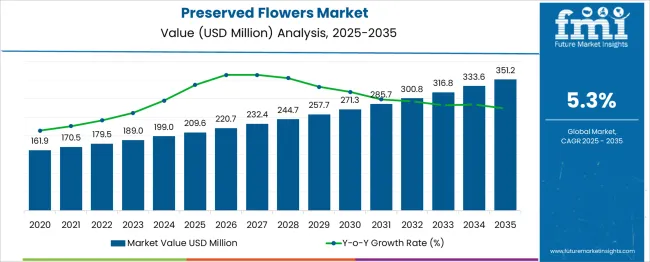

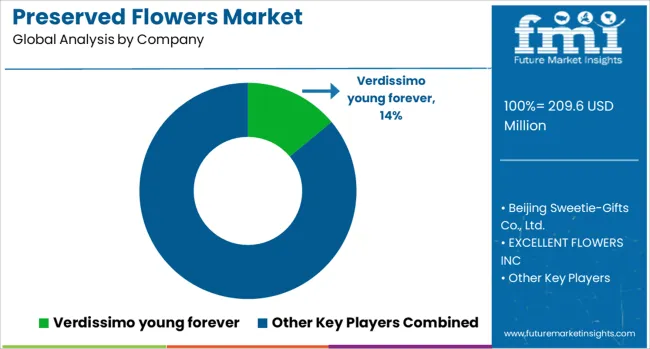

The Preserved Flowers Market is estimated to be valued at USD 209.6 million in 2025 and is projected to reach USD 351.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. From 2025 to 2030, the market is projected to increase steadily from USD 209.6 million to USD 271.3 million, reflecting consistent consumer interest in long-lasting floral arrangements for décor and gifting purposes.

Year-on-year growth analysis shows gradual increments, reaching USD 220.7 million in 2026 and USD 232.4 million in 2027, supported by expanding use in weddings, corporate events, and luxury interior design projects across global markets. By 2028, the market is forecasted to reach USD 244.7 million, advancing to USD 257.7 million in 2029 and USD 271.3 million by 2030. Innovations influence this positive trajectory in preservation techniques that maintain natural aesthetics while extending shelf life.

Online retail platforms and customized bouquet services are expected to drive higher accessibility and premium product adoption. With increasing consumer preference for sustainable alternatives to fresh flowers and the popularity of long-lasting decorative products, preserved flowers are set to hold a strong position in lifestyle and luxury gifting categories over the next decade.

| Metric | Value |

|---|---|

| Preserved Flowers Market Estimated Value in (2025 E) | USD 209.6 million |

| Preserved Flowers Market Forecast Value in (2035 F) | USD 351.2 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The preserved flowers market represents a premium niche within several lifestyle and décor-oriented segments. In the floral products market, its share is around 6–8%, as fresh flowers dominate overall demand, but preserved variants are gaining traction for their longevity and aesthetic appeal. Within the home décor and interior decoration market, the share is modest at 2–3%, given the vast variety of decorative items available.

In the gift and premium products market, preserved flowers contribute approximately 4–5%, as they are increasingly favored for luxury gifting and corporate purposes. For the event decoration and wedding supplies market, the share stands at 5–6%, driven by demand for maintenance-free floral arrangements in weddings, exhibitions, and upscale events. Within the luxury lifestyle and home accessories market, the share remains relatively small at 1–2%, due to competition from other high-end décor options.

Market growth is driven by consumer preference for durable, elegant floral designs that require minimal maintenance while offering a natural aesthetic. Rising adoption in luxury retail, hospitality, and interior design is further boosting demand. With advancements in preservation techniques and customization options, preserved flowers are positioned to capture a larger portion of these parent markets, becoming a hallmark of premium decorative trends globally.

The preserved flowers market is undergoing significant growth as rising consumer interest in long-lasting, aesthetic floral arrangements meets advancements in preservation techniques. Demand has been fueled by increasing awareness of sustainable gifting options, evolving interior decor trends, and premiumization of floral products.

Preserved flowers are gaining prominence as they bridge the gap between fresh flowers and artificial alternatives, offering natural beauty with extended shelf life. The market outlook remains positive, with further opportunities expected to emerge from innovation in preservation processes, expansion of distribution channels, and a growing preference for eco-conscious luxury products.

Shifts in consumer preferences towards experiential and sustainable products are paving the way for greater adoption, while collaborations between floral designers and lifestyle brands are expected to amplify market visibility and acceptance.

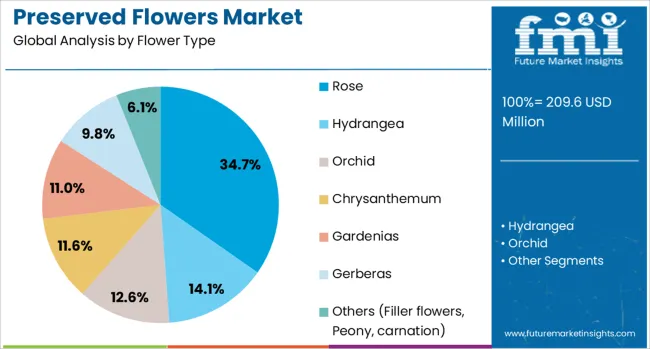

The preserved flowers market is segmented by flower type, preserving techniques, application, price, distribution channel, and geographic regions. The preserved flowers market is divided by flower type into Rose, Hydrangea, Orchid, Chrysanthemum, Gardenias, Gerberas, and Others (Filler flowers, Peony, Carnation).

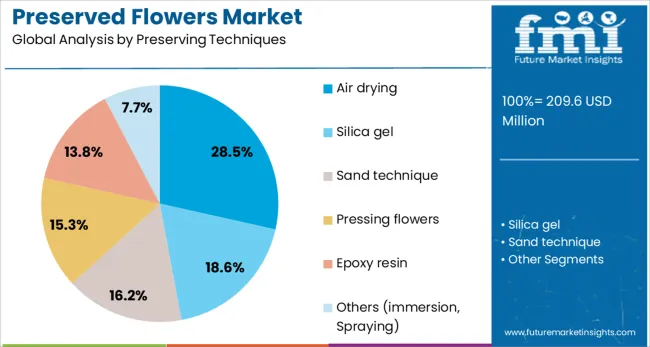

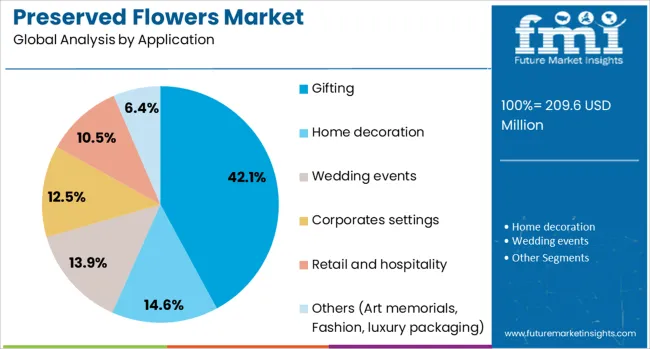

In terms of preserving techniques, the preserved flowers market is classified into Air drying, Silica gel, Sand technique, pressing flowers, Epoxy resin, and Others (immersion, Spraying). Based on the application of the preserved flowers market, it is segmented into Gifting, Home decoration, Wedding events, Corporate settings, Retail and hospitality, and Others (Art memorials, Fashion, luxury packaging).

The preserved flowers market is segmented by price into Medium, Low, and High. The distribution channel of the preserved flowers market is segmented into Offline and Online. Regionally, the preserved flowers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by flower type, the rose segment is expected to hold 34.7% of the total market revenue in 2025, securing its position as the leading segment. This leadership has been reinforced by the rose’s enduring association with love, elegance, and premium gifting, making it the preferred choice for both personal and corporate occasions.

Its universal symbolism and high perceived value have positioned it as a staple in preserved floral arrangements, catering to weddings, anniversaries, and luxury decor. The structural integrity and vivid coloration of roses make them particularly suited for preservation processes, enhancing their appeal and durability.

Furthermore, the ability to offer a wide variety of colors and customizations has strengthened the segment’s relevance among consumers seeking personalized, lasting expressions of sentiment.

In terms of preserving techniques, air drying is projected to account for 28.5% of the market revenue in 2025, establishing itself as the prominent technique segment. This position has been supported by its simplicity, cost effectiveness, and ability to retain the natural appearance of flowers without the use of chemicals.

Air drying is favored for its environmentally friendly nature and compatibility with a range of flower types, which has broadened its application in both mass and premium markets. Its adoption has been further bolstered by increasing consumer demand for natural and minimally processed products, aligning with broader sustainability and wellness trends.

The technique’s accessibility for small-scale producers and artisans has also contributed to its widespread use and market prominence.

Segmenting by application shows that gifting is expected to command 42.1% of the total market revenue in 2025, solidifying its role as the largest application segment. This dominance has been shaped by the strong cultural and emotional significance of flowers as a medium of expression in personal and professional relationships.

The longevity of preserved flowers has made them particularly attractive for gifting purposes, providing recipients with a lasting memory and value beyond that of fresh flowers. Retailers and brands have capitalized on this trend by offering curated collections, customized packaging, and premium arrangements targeted at holidays, milestones, and corporate events.

The combination of aesthetic appeal, practicality, and emotional resonance has firmly entrenched gifting as the primary driver of demand in the preserved flowers market.

The preserved flowers market is experiencing consistent demand growth across retail, event, and hospitality sectors due to its ability to offer long-lasting decorative solutions with aesthetic appeal. In 2024, adoption increased among event planners and home decor brands for year-round use.

By 2025, businesses and luxury gifting providers will prioritize preserved flowers for premium arrangements that eliminate frequent replacement. Companies offering natural-looking, color-stable preserved flowers with customization capabilities are expected to maintain a strong competitive edge.

Long-lasting aesthetics and maintenance-free qualities have positioned preserved flowers as an appealing alternative to fresh arrangements. In 2024, their popularity surged in weddings and large-scale events, where arrangements retained vibrancy without refrigeration or daily care. In 2025, hospitality chains and premium retail brands incorporated preserved flowers for interior design consistency, reducing the operational burden of frequent replacements.

These trends underline that performance in durability and natural appeal determines purchasing priorities. Vendors supplying preserved flowers with authentic texture, vibrant colors, and customizable designs are positioned to dominate in event planning and high-end decor applications.

The rise of premium gifting solutions has created significant opportunities for preserved flower producers. In 2024, luxury retailers introduced preserved floral arrangements packaged in designer boxes to appeal to consumers seeking exclusivity and elegance. By 2025, e-commerce platforms will have expanded these offerings with personalization options such as monogramming and themed packaging.

This evolution suggests that preserved flowers are evolving beyond decor into aspirational products. Suppliers capable of delivering luxury-branded arrangements with high-end presentation and enduring freshness are expected to capture premium market share and differentiate through curated gifting experiences.

In 2024 and 2025, it was observed that the cost of preservation techniques, such as air‐drying or glycerin treatment, imposed a notable barrier. Manufacturers were required to invest in specialized equipment and skilled labour to maintain the petal color and texture. This elevated expense made preserved flower arrangements significantly more costly than fresh or artificial alternatives, particularly impacting price-sensitive segments in regions like Asia-Pacific and Latin America. Because consumer willingness to pay was constrained by competing lower-cost décor options, market penetration remained limited among budget-conscious buyers.

During 2024 and 2025, it was noted that customization gained traction in preserved floral offerings. Retailers introduced bespoke arrangements with themed color palettes, monogrammed tags, and customizable gift boxes, catering to weddings, corporate gifting, and boutique décor use cases. Demand increased for personalized floral art rather than off‑the‑shelf products, with consumer surveys highlighting preference for unique presentation and lasting aesthetic. This trend presents one clear opportunity for suppliers to differentiate through tailor-made arrangements that command premium pricing and foster brand loyalty.

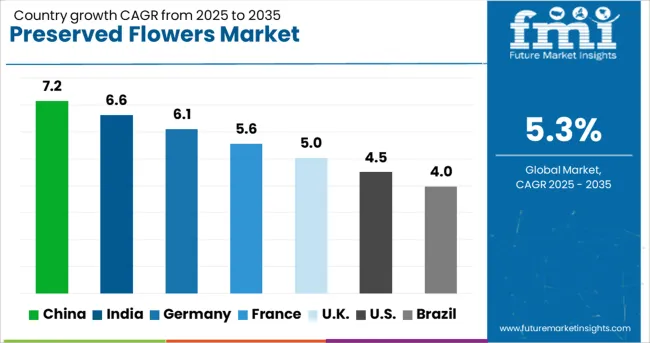

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global preserved flowers market is projected to grow at a CAGR of 5.3% from 2025 to 2035. China leads with 7.2%, followed by India at 6.6% and Germany at 6.1%. France records 5.6%, while the United Kingdom posts 5.0%. Growth is driven by rising demand for long-lasting floral décor, expansion of gifting trends, and adoption of eco-friendly preservation techniques. China and India dominate production due to strong export capabilities and e-commerce growth. Germany focuses on premium preserved arrangements, while France and the UK leverage luxury floral designs for weddings, events, and home aesthetics.

China is forecast to grow at 7.2%, driven by strong production capacity and large-scale exports to global markets. Rose-based preserved flowers dominate the premium gifting category, supported by high demand during festivals and weddings. Manufacturers invest in advanced preservation processes that maintain vibrant colors for extended periods. Online platforms accelerate cross-border sales, boosting accessibility for international buyers seeking cost-effective yet high-quality arrangements.

India is projected to grow at 6.6%, supported by increasing preference for premium floral décor in weddings and gifting occasions. Affordable preserved roses dominate mass-market adoption, while luxury boutiques cater to affluent consumers. Manufacturers focus on eco-friendly preservation chemicals to attract sustainability-conscious buyers. Growth of online gifting portals and customization options further accelerates market penetration in metropolitan cities.

Germany is expected to grow at 6.1%, fueled by strong demand for sustainable floral products in home and event décor. Premium preserved bouquets dominate luxury wedding segments and corporate functions. Manufacturers introduce allergen-free and fragrance-neutral preservation techniques to address health concerns. Subscription-based flower delivery models and growing popularity of personalized floral designs support consistent sales growth in the region.

France is projected to grow at 5.6%, supported by its strong reputation for luxury floral artistry. Vibrant, color-customized arrangements dominate upscale retail offerings and event planning services. Manufacturers integrate innovative packaging solutions to maintain freshness and enhance visual appeal for premium gifting. Partnerships with leading luxury retailers reinforce France’s position as a hub for elegant preserved floral designs.

The UK is forecast to grow at 5.0%, driven by rising demand for sustainable home décor and long-lasting floral arrangements. Neutral-toned preserved flowers dominate minimalist design trends across urban households. Manufacturers develop fragrance-infused preserved blooms to elevate consumer experience. Personalization and custom bouquet options gain traction in online retail platforms, supporting growth in the premium gifting segment.

The preserved flowers market is moderately consolidated, with Verdissimo young forever holding a leading position for its wide range of premium preserved floral arrangements and strong presence across global retail and e-commerce channels. The company specializes in long-lasting roses and decorative solutions for luxury décor and gifting applications, giving it a competitive edge in the high-end segment.

Key players include Beijing Sweetie-Gifts Co., Ltd., EXCELLENT FLOWERS INC, Fleurs depargne, Flor Keeps, Florever Co., Ltd., Immortal Fleur, Native Apothecary, Nord Blooms, Ohchi Nursery Ltd., Rose Amor, Shida Preserved Flowers Ltd., STILLA, The Million Roses, and Verdi UK Ltd. These brands offer preserved roses, orchids, and mixed floral designs tailored for home decoration, weddings, and personalized gifts, often focusing on artisanal quality and elegant packaging.

Market growth is fueled by rising consumer interest in sustainable, low-maintenance alternatives to fresh flowers, coupled with the expansion of premium gifting trends. Companies are investing in advanced preservation techniques to enhance color vibrancy, texture, and lifespan while introducing customization options for events and luxury retail.

The surge in online flower delivery platforms and the demand for year-round availability of exotic blooms further boost adoption. Emerging players are focusing on eco-friendly preservation processes and niche offerings such as seasonal and thematic arrangements to capture untapped segments in this growing market.

| Item | Value |

|---|---|

| Quantitative Units | USD 209.6 Million |

| Flower Type | Rose, Hydrangea, Orchid, Chrysanthemum, Gardenias, Gerberas, and Others (Filler flowers, Peony, carnation) |

| Preserving Techniques | Air drying, Silica gel, Sand technique, Pressing flowers, Epoxy resin, and Others (immersion, Spraying) |

| Application | Gifting, Home decoration, Wedding events, Corporates settings, Retail and hospitality, and Others (Art memorials, Fashion, luxury packaging) |

| Price | Medium, Low, and High |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Verdissimo young forever, Beijing Sweetie-Gifts Co., Ltd., EXCELLENT FLOWERS INC, Fleurs depargne, Flor Keeps, Florever.Co., Ltd, Immortal Fleur., Native Apothecary, Nord blooms, Ohchi Nursery Ltd., Rose amor, Shida Preserved Flowers Ltd, STILLA, The Million Roses, and Verdi UK Ltd |

| Additional Attributes | Dollar sales by flower type (rose, orchid, hydrangea, gardenia, others), Dollar sales by preservation technique (air-drying, silica gel, epoxy, sand pressing), regional demand trends (North America largest share ~36%–38%; Asia-Pacific fastest growth ~7%–7.5% CAGR), competitive landscape of leading preserved-flower brands, consumer preferences for sustainable, long-lasting décor, integration with gifting and home-decoration channels, innovations in eco-friendly preservatives and advanced color retention treatments. |

The global preserved flowers market is estimated to be valued at USD 209.6 million in 2025.

The market size for the preserved flowers market is projected to reach USD 351.2 million by 2035.

The preserved flowers market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in preserved flowers market are rose, hydrangea, orchid, chrysanthemum, gardenias, gerberas and others (filler flowers, peony, carnation).

In terms of preserving techniques, air drying segment to command 28.5% share in the preserved flowers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA