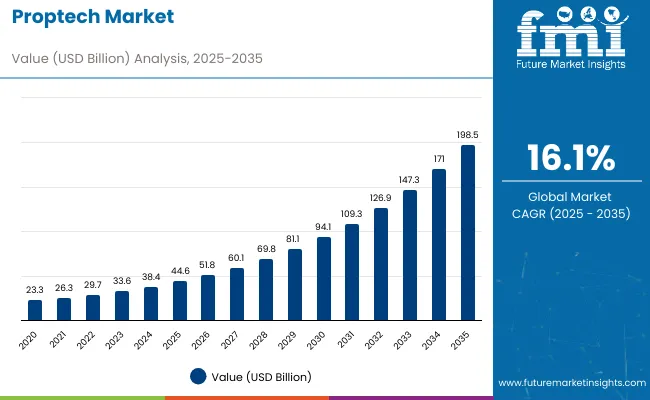

The proptech market is estimated to be valued at USD 44.6 billion in 2025 and is projected to reach USD 198.5 billion by 2035, registering a compound annual growth rate (CAGR) of 16.1% over the forecast period. The market is expected to add an absolute dollar opportunity of USD 153.9 billion during this period.

Quick Stats Proptech Market

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 44.6 billion |

| Projected Value (2035F) | USD 198.5 billion |

| CAGR (2025 to 2035) | 16.1% |

This reflects a 4.5 times growth at a compound annual growth rate of 16.1%. The market evolution is expected to be shaped by the rising demand for digital transformation in real estate, technological advancements in AI and IoT, growing smart building requirements, and increasing infrastructure development in emerging markets, particularly where sustainability and operational efficiency are prioritized.

By 2030, the market is likely to reach approximately USD 94.1 billion, accounting for USD 49.5 billion in incremental value over the first half of the decade. The remaining USD 104.4 billion is expected to be realized during the second half, suggesting an accelerated growth pattern. Product innovation in AI-driven property management, blockchain transactions, and smart building technologies is gaining significant traction.

Companies such as Airbnb, WeCompany (WeWork), and Compass are advancing their competitive positions through investment in platform development, strategic partnerships, and global market expansion. Rising urbanization, digitalization trends, and improved operational efficiency requirements are supporting expansion into residential management, commercial real estate, and short-term rental platforms. Market performance will remain anchored in digital adoption rates, regulatory compliance, and user experience benchmarks.

The market holds a significant share across its parent markets. Within the global real estate technology market, it accounts for approximately 65.2% due to its comprehensive digital solutions portfolio. In the property management software segment, it commands a 42.8% share, supported by increasing automation requirements and operational efficiency demands. It contributes nearly 38.7% to the smart building technology market and 28.9% to the digital transaction platforms segment. In real estate analytics and data services, proptech solutions hold around 31.4% share, driven by data-driven decision-making requirements. Across the facility management technology market, its share is close to 26.8%, owing to its position as a key enabler of intelligent building operations.

The market is being driven by rising demand for digital real estate solutions, AI-powered property management, and smart building integration. Advanced technologies using artificial intelligence, blockchain, IoT connectivity, and big data analytics have enhanced operational efficiency, transaction transparency, and predictive maintenance capabilities, making modern proptech solutions essential alternatives to traditional real estate operations. Manufacturers are introducing specialized platforms, including residential management systems and commercial property applications tailored for different property types, expanding their role beyond basic property listing to comprehensive ecosystem management. Strategic collaborations between proptech companies and traditional real estate firms have accelerated innovation in digital transformation applications and market penetration.

Proptech’s innovative solutions are transforming the real estate and property management sectors by providing digital efficiency, cost optimization, and enhanced user experience. Its functional capabilities make it indispensable for property listing platforms, smart building management, virtual tours, and data-driven decision-making, where accuracy, speed, and transparency are critical. By integrating technologies like AI, IoT, and cloud-based platforms, proptech enables real-time monitoring, predictive maintenance, and seamless transactions, driving adoption across residential, commercial, and industrial real estate markets worldwide.

Rising focus on sustainability, operational cost reduction, and data-driven decision making is further propelling adoption, particularly in commercial real estate, residential property management, and short-term rental platforms. Rising property values, regulatory compliance requirements, and technological advancements in AI and blockchain are also enhancing system capabilities and market penetration.

As smart city initiatives and digital infrastructure accelerate across property management and real estate applications, the market outlook remains highly favorable. With property managers and real estate professionals prioritizing operational efficiency, customer experience, and competitive differentiation, proptech solutions are well-positioned to expand across various residential, commercial, and industrial property applications.

The market is segmented by property type, end user, solution, and region. By property type, the market includes residential property, commercial property, and industrial property. By solution, the market is segmented into PropTech Platforms and PropTech Services. By end user, the market is categorized into real estate agents/brokers, property developers/builders, property managers, commercial/industrial real estate companies, housing associations, and others. Regionally, the market spans across North America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Latin America, and the Middle East & Africa.

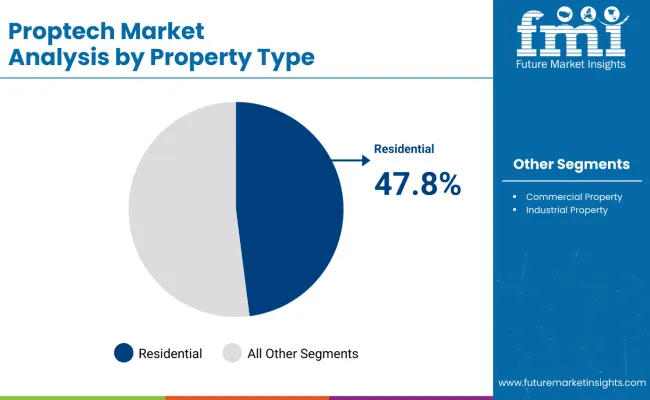

The residential property segment holds a dominant position with 47.8% of the market share in the property type category, owing to its vast application base and growing demand for digital property management solutions across residential real estate. Residential properties represent the largest consumer base for proptech solutions, including property search platforms, virtual tours, smart home technologies, and digital transaction processing.

They enable property managers, landlords, and residents to achieve optimal operational efficiency while maintaining excellent user experience and property value optimization in both urban and suburban markets. As demand for convenient, technology-enabled residential services grows, the residential property segment continues to maintain preference in proptech adoption.

Manufacturers are investing in advanced residential-focused platforms, improved user interfaces, and enhanced property management capabilities to maintain market leadership, broaden service offerings, and improve tenant satisfaction. The segment is positioned to remain dominant as global residential markets prioritize digital transformation and smart living solutions.

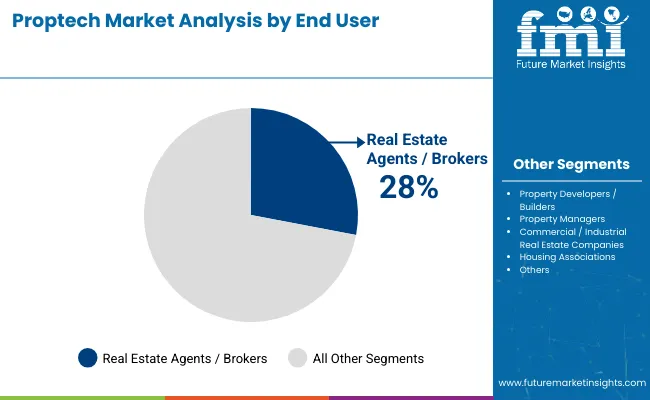

The real estate agents and brokers segment holds the largest position with 28% of the market share in the end-user category, owing to their critical role as intermediaries in property transactions and their early adoption of digital platforms to enhance client services and operational efficiency. Real estate professionals are widely leveraging proptech solutions across residential, commercial, and mixed-use property segments due to their need for comprehensive listing management, customer relationship tools, and transaction processing capabilities.

They enable property professionals and their clients to achieve optimal transaction efficiency while maintaining excellent customer experience and market competitiveness in both traditional and digital real estate environments. As demand for streamlined, technology-enabled real estate services grows, the agents and brokers segment continues to maintain preference in proptech platform adoption.

Technology providers are investing in advanced CRM systems, improved mobile applications, and enhanced virtual tour capabilities to maintain market leadership, broaden service offerings, and improve client satisfaction metrics. The segment is positioned to remain dominant as global real estate markets prioritize digital transformation and customer-centric solutions.

In 2024, global proptech adoption grew by 18% year-on-year, with Asia-Pacific taking a 45% share. Applications include property management platforms, digital transaction systems, and smart building technologies. Manufacturers are introducing AI-powered solutions and blockchain integration that deliver superior efficiency profiles and transaction transparency. Digital platforms now support IoT connectivity and smart building positioning. Sustainability regulations and operational efficiency initiatives support property managers confidence. Technology providers increasingly supply ready-to-deploy platform systems with integrated analytics capabilities to reduce implementation complexity.

Digital Transformation Accelerates Proptech Market Demand

Property managers and real estate professionals are choosing proptech solutions to achieve superior operational efficiency, enhance customer experience, and meet growing demands for digital, connected property services. In field applications, proptech platforms deliver up to 40% improvement in operational efficiency compared to traditional property management methods. Platforms equipped with AI and automation maintain optimal property performance throughout varying market conditions and seasonal demand cycles. In commercial buildings, integrated proptech systems help reduce operational costs while maintaining service standards by up to 35%. Digital applications are now being deployed for residential and industrial segments, increasing adoption in sectors demanding precise property management.

Implementation Costs, Regulatory Complexity and Technology Integration Challenges Limit Growth

Market expansion is constrained by higher implementation costs, regulatory compliance requirements, and complex technology integration needs. Comprehensive proptech platform implementations can cost 50-70% more than traditional property management systems, depending on features and integration requirements, impacting adoption in cost-sensitive markets. Regulatory compliance across different jurisdictions requires extensive validation processes, adding 3-6 weeks to deployment timelines. Specialized integration and data migration requirements extend implementation costs by 30-45% compared to standalone systems. Limited availability of trained professionals for proptech platform management restricts scalable deployment, especially in emerging markets. These constraints make proptech adoption challenging in traditional markets despite growing performance advantages and competitive pressures.

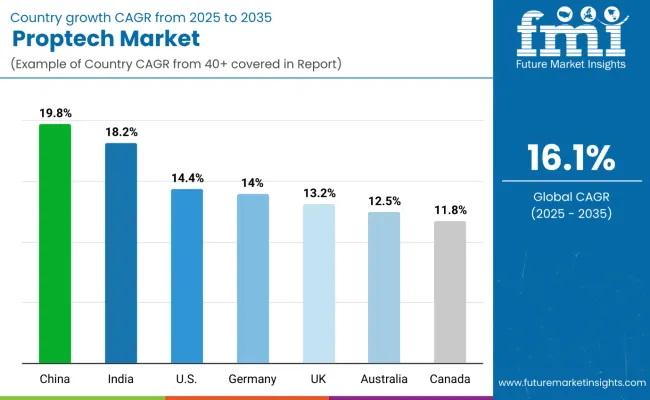

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| India | 18.2% |

| USA | 14.4% |

| Germany | 14.0% |

| UK | 13.2% |

| Australia | 12.5% |

| Canada | 11.8% |

The proptech market shows varied growth trajectories across the top six countries. China leads with the highest projected CAGR of 19.8% from 2025 to 2035, driven by rapid urbanization, massive real estate development, and government support for digital infrastructure. India follows with a CAGR of 18.2%, supported by growing internet penetration and expanding urban property markets. The USA demonstrates solid growth at 14.4%, supported by mature technology adoption and innovation leadership. Germany shows strong growth at 14.0%, driven by sustainability regulations and smart building adoption. The UK, with a CAGR of 13.2%, experiences steady expansion supported by digital transformation initiatives. In contrast, Australia, at 12.5% and Canada, at 11.8% reflect regional differences in technology adoption and real estate market dynamics.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from proptech solutions in China is projected to grow at a CAGR of 19.8% from 2025 to 2035, driven by massive urbanization, government digital infrastructure initiatives, and increasing real estate digitalization across major cities, including Beijing, Shanghai, and Shenzhen. The China PropTech Market is expected to grow from USD 3.52 billion in 2024 to USD 25.8 billion by 2035, with residential being the largest revenue generating property type while commercial and industrial segments show fastest growth.

Key Statistics

Sales of proptech solutions in India are expected to grow at a CAGR of 18.2% from 2025 to 2035, due to urban infrastructure development and residential property digitalization in Mumbai, Delhi, and Bangalore regions. Market adoption is shifting from basic property listing solutions toward comprehensive property management platforms and smart building integration. Local technology capabilities and international platform partnerships are leading commercial deployment strategies. Rising internet penetration and growing middle-class property ownership are primary demand drivers.

Key Statistics

The proptech market in the USA is anticipated to expand at a CAGR of 14.4% from 2025 to 2035, reflecting mature market dynamics with a focus on innovation and efficiency upgrades. Growth is centered on platform optimization and smart building integration in California, New York, and Texas regions. Advanced AI adoption and blockchain integration are being deployed for commercial real estate, residential management, and digital transaction platforms. Technology innovation and venture capital investment support practical platform development across diverse property types.

Key Statistics

The demand for proptech solutions in Germany is expected to grow at a CAGR of 14.0% from 2025 to 2035,driven by strong regulatory support, rising investment in green buildings, and rapid adoption of AI-enabled property management platforms. Advanced digital infrastructure, robust sustainability regulations, and comprehensive building efficiency standards in Berlin, Munich, and Hamburg markets drive demand. Evidence-based building codes and specialized property management systems are increasingly adopting smart building technologies for optimal operational performance.

Key Statistics

Sales for proptech in the UK is expected to grow at a CAGR of 13.2% from 2025 to 2035, driven by digital transformation initiatives and regulatory modernization in the London, Manchester, and Edinburgh regions. Integrated proptech systems and data analytics are expanding technology adoption, while property managers incorporate efficiency-focused protocols into comprehensive facility management programs. Brexit-related market adjustments and emphasis on operational efficiency are influencing market dynamics. Increasing venture capital inflows and demand for AI-driven real estate platforms further accelerate adoption.

Key Statistics

The demand for proptech solutions in Australia is projected to expand at a CAGR of 12.5% from 2025 to 2035, driven by urbanization and growing demand for digital property services. Growth is concentrated in urban markets, including Sydney, Melbourne, and Brisbane, where residential and commercial property management requirements are expanding. Smart building technologies and digital transaction platforms are gradually building comprehensive property management capabilities. Increasing government initiatives promoting sustainable infrastructure and energy-efficient buildings further support market expansion.

Key Statistics

The proptech market in Canada is projected to expand at a CAGR of 11.8% from 2025 to 2035, supported by steady demand for digital property management and smart building technologies. Growth is driven by urbanization and technology adoption in the Toronto, Vancouver, and Montreal regions. Canadian proptech adoption focuses on energy efficiency, regulatory compliance, and integrated property management solutions that meet quality expectations for comprehensive building operations. Rising venture capital investments and partnerships with global technology providers are further accelerating market expansion. Increasing emphasis on sustainability and green building certifications is shaping adoption patterns.

Key Statistics

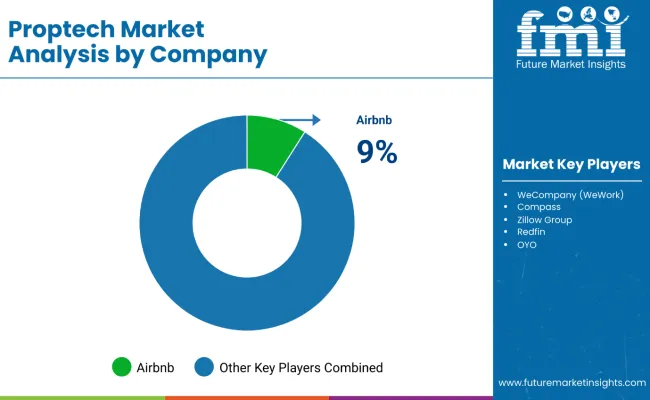

The market is moderately concentrated, featuring a mix of global technology platforms, specialized real estate technology companies, and traditional real estate firms with varying degrees of digital expertise, platform capabilities, and market reach proficiency. Airbnb leads the market with an estimated 9.0% share, primarily driven by its dominance in short-term rental platforms and global marketplace presence.

WeCompany (WeWork), Compass, and Zillow Group maintain significant market presence through their specialization in coworking spaces, real estate brokerage technology, and comprehensive property platforms, respectively. Redfin, OYO, and CBRE differentiate through innovative brokerage models, hospitality technology, and commercial real estate digital services that cater to various residential, commercial, and hospitality applications.

Regional specialists and emerging platforms focus on specific market segments, niche applications, and local market development, addressing growing demand from property managers, real estate professionals, and technology-forward property owners.

Entry barriers remain moderate, driven by challenges in technology development, regulatory compliance, and network effects across multiple property categories. Competitiveness increasingly depends on platform innovation, user experience, and market penetration capabilities for diverse real estate environments.

| Items | Value |

|---|---|

| Quantitative Units | USD 44.6 Billion |

| Property Type | Residential Property, Commercial Property, and Industrial Property |

| End User | Real Estate Agents/Brokers, Property Developers/Builders, Property Managers, Commercial/Industrial Real Estate Companies, Housing Associations, and Others |

| Solutions | PropTech Platforms and PropTech Services |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India and 40+ Countries |

| Key Companies Profiled | Airbnb, WeCompany (WeWork), Compass, Zillow Group, Redfin, OYO, CBRE, CoStar Group, Houzz, and Beike / Lianjia |

| Additional Attributes | Dollar sales by application and user type, regional adoption trends, competitive landscape, consumer preferences for integrated versus specialized solutions, integration with sustainable building practices, innovations in AI and blockchain technology, and quality standardization for diverse property applications |

The global proptech market is estimated to be valued at USD 44.6 billion in 2025.

The proptech market size is projected to reach USD 198.5 billion by 2035.

The proptech market is expected to grow at a CAGR of 16.1% between 2025 and 2035.

The residential property segment is projected to lead in the proptech market with 47.8% market share in 2025.

In terms of end-user, the real estate agents and brokers segment is expected to command 28% share in the proptech market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Proptech Agent Tool Market Trends - Growth & Forecast 2025 to 2035

AI-Powered PropTech CRM – Future of Real Estate Management

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA