Different industries are harnessing this scenario and are pouring in investments towards projects which will drive the N-Propyl acetate market in the upcoming 10 years thus, steering towards a strong demand transition for the product. Easily evaporating, having excellent solubility properties, and being of low toxicity make n-propyl acetate a versatile solvent used in paints and coatings, adhesives, and printing inks.

The increasing focus toward high-performance and sustainable chemical solutions and bio-based solvent production innovations are collectively augmenting the market growth. Industrial manufacturing is also blooming as well as the more capital is allocated to green chemistry, while regulatory demand is set on green soluble solutions, allowing the industry to mature gradually.

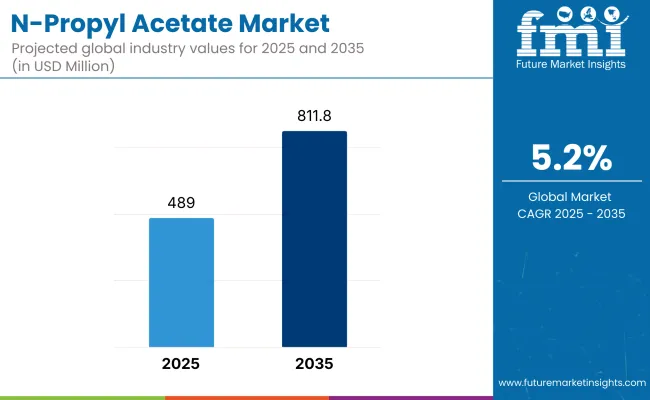

In 2025, the N-Propyl acetate market was valued at approximately USD 489.02 million. By 2035, it is projected to reach USD 811.87 million, reflecting a compound annual growth rate (CAGR) of 5.2%. The growth of this market is attributed to increasing adoption of N-propyl acetate in coatings and adhesives, rising consumer preference for low-VOC formulations, and expanding investments in next-generation solvent technologies.

The integration of AI-driven chemical process optimization, enhanced purity levels, and cost-effective production techniques is further supporting market expansion. Additionally, the development of bio-based and high-performance solvent alternatives is playing a crucial role in market penetration and industry adoption.

N-propyl acetate market in North America would be supported by the strong demand for low-emission solvents, rising investment in sustainable coatings, and immense improvements in the efficiency of chemical processes. USA and Canada are at the forefront of developing and commercializing next generic solvents, such as bio based and ultra-pure N-propyl acetate for industrial and consumer applications.

Rising demand for compliant high-performance coatings, increasing focus on reducing air pollution from industrial solvents, and growing adoption of non-toxic printing inks support this market growth. Increasing industrial production in a sustainable way, against a backdrop of stringent EPA regulations, also presses the envelope for product innovation and adoption.

Increasing demand for sustainable and low-VOC (volatile organic compounds) chemical formulations in industrial processes contributes to Europe’s market and demand for green solvent-based chemical formulations along with government policies are projected to benefit the market in this region further with advancements in high-purity ester-based-solvents. N-propyl acetate is extensive in applications such as the development of eco-friendly coatings and printing solutions in countries like Germany, France, and the UK.

Additionally, the increasing focus on reducing emissions of industrial solvents, their growing use in food packaging inks and adhesives, and research in biodegradable solvent alternatives are driving market adoption. Furthermore, growing uses in automobile coatings, specialty chemical formulations, and high-performance adhesives are opening up new avenues for manufacturers and suppliers.

The Asia-Pacific region is expected to register the highest growth in the N-Propyl acetate market during the forecast period, owing to the growing demand for industrial solvents, increasing use of sophisticated coatings and adhesives, and rising investments in sustainable chemical production. China, India, and Japan are researching and developing cost-effective, high-purity N-propyl acetate for use in paints, coatings, and electronics. The growing demand for sustainable, eco-conscious printing inks, highly developed automotive and construction sectors, and developing regulatory landscape complemented by government campaigns encouraging the practice of green industrial processes are fuelling the expansion of the regional market.

Moreover, growing awareness regarding sustainable alternatives to solvent along with developments in chemical distillation and purification processes are also driving the growth of this market. Domestic presence of chemical manufacturers and partnerships with global specialty chemical companies also boost market growth.

To support a wider range of gradual developments in solvent refinement, bio-based products, and energy-efficient compound making, the N-Propyl acetate market will remain to steadily develop for the duration of the following decade. To enhance functionality, market relevance, and longevity of applications, companies are concentrating on developing innovative low-emission solvent compositions, improved compatibility with next-generation coatings, and sustainable next-generation adhesives.

Other factors that are setting the direction for the future of the industry include growing consumer demand for eco-friendly chemicals, digitalization of industrial chemical supply chains and changing regulatory standards. Combining cross-sector expertise in AI-assisted Process Optimization, Next-gen Distillation Technologies and Sustainable Sourcing of Feedstock is enabling production efficiency and high quality N-propyl acetate solutions across geographies.

Challenge

Volatility in Raw Material Prices and Supply Chain Disruptions

N-Propyl acetate price changes of raw materials including propanol and acetic acid are also influencing N-Propyl acetate Market. These fluctuations are driven by supply chain disruptions and geopolitics and changes in the price of crude oil, both of which result in changes in production costs. Transportation bottlenecks and regional production constraints can also affect availability, leading to fluctuations in supply.

As a result, companies must learn how to take advantage of this by diversifying their sourcing strategies, optimizing logistics, and putting money into alternative feedstock’s to better cope with volatile raw materials markets.

Stringent Environmental and Regulatory Compliance

Since N-Propyl Acetate is flammable and generates VOC emissions, various regulatory agencies, such as the EPA, REACH, and OSHA, set guidelines for producing, storing, and handling it. Environmental standards are continually tightening, and compliance increases operational costs as companies must invest in technologies to reduce emissions or implement less harmful processes of production.

To meet regulatory requirements and increase market acceptance, businesses should implement green chemistry principles, create low VOC formulations, and utilize bio-based manufacturing practices.

Opportunity

Growing Demand in Coatings, Inks, and Adhesives Industries

Rising use of N-Propyl acetate in paints, coatings medical inks and adhesives is contributing to the growth of global N-Propyl acetate market. It is an excellent candidate to replace synthetics in high-performance industrial formulations due to its rapid evaporation rate, low toxicity and excellent solvent properties.

And the growing demand for green and high-solids coatings especially in the automotive, packaging, and furniture industries creates a significant opportunity. In these industries, customized solvent solutions, sustainable coatings, and VOC-compliant formulations provide companies with a competitive edge.

Advancements in Bio-Based and Sustainable Solvent Alternatives

In addition, as sustainability becomes a growing concern, the market is seeing a transitioning toward the use of bio-based solvents, as well as an improved environmental performance of production processes. Research in biodegradable n-propyl acetate, renewable chemicals synthesis, and green solvents is opening up new business opportunities.

In addition, the demand for circular economy models and solvent recovery systems is driving manufacturers to create cost-effective and energy-efficient solutions. This new trend will benefit companies that invest in green solvent R&D, carbon-neutral production, and sustainable supply chain practices.

Get an overview of key trends impacting the growth of N-Propyl acetate market 2020 to 2024: Before we move on to the key trends of N-Propyl acetate market affecting on the growth of this industry, let us take a look at the factors restraining the growth of N-Propyl acetate market. Yet, market growth was limited by supply chain challenges, price fluctuations, and strict environmental regulations. However, production efficiencies, sustainable sourcing strategies, and optimized formulations were adopted by companies in response to VOC regulations.

From 2025 to 2035, the market will see transformative developments in bio-based solvent production, AI-based supply chain optimization, and smart chemical monitoring. Bio-based acetates, carbon-neutral manufacturing, and AI-integrated quality control Systems will set new benchmarks for the domain.

Moreover, high-purity N-Propyl Acetate production for specialty applications such as electronics, pharmaceuticals, and green coatings will open up new avenues. The next stage of the N-Propyl acetatemarket will be dominated by those companies focused on innovation, sustainability, and digital integration.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with VOC reduction and hazardous chemical regulations |

| Technological Advancements | Growth in solvent recovery systems and formulation optimization |

| Industry Adoption | Increased use in coatings, inks, and adhesives |

| Supply Chain and Sourcing | Dependence on petrochemical-derived raw materials |

| Market Competition | Dominance of traditional chemical manufacturers |

| Market Growth Drivers | Demand for high-performance solvents in coatings and adhesives |

| Sustainability and Energy Efficiency | Initial focus on reducing solvent waste and VOC emissions |

| Integration of Smart Monitoring | Limited real-time tracking of solvent purity and emissions |

| Advancements in Solvent Innovation | Development of low-VOC, high-performance solvent blends |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance monitoring, stricter global sustainability mandates, and bio-based solvent standardization |

| Technological Advancements | Expansion of bio-based acetates, AI-optimized production, and smart chemical process monitoring |

| Industry Adoption | Widespread adoption in green coatings, pharmaceuticals, and high-purity industrial applications |

| Supply Chain and Sourcing | Shift toward renewable feedstock’s, sustainable chemical synthesis, and closed-loop solvent recovery |

| Market Competition | Rise of green chemistry startups, AI-powered formulation firms, and sustainable solvent innovators |

| Market Growth Drivers | Growth in bio-solvent adoption, carbon-neutral manufacturing, and circular economy-driven chemical solutions |

| Sustainability and Energy Efficiency | Large-scale implementation of biodegradable solvent production, renewable feedstock utilization, and energy-efficient synthesis |

| Integration of Smart Monitoring | AI-powered quality control, blockchain-enabled chemical traceability, and predictive maintenance for solvent systems |

| Advancements in Solvent Innovation | Introduction of self-recycling solvents, biodegradable acetate formulations, and AI-assisted solvent applications |

North America is leading in the N-Propyl acetate market owing to growing demand from the coatings, adhesives, and printing ink industries in the region. The increasing use of eco-friendly solvents and low VOC formulations, among other factors, will continue to contribute to the growth of the market. The demand for industrial solvent production industries is increasing, which boosts the growth of the market. Also, the use of eco-friendly extraction methods, organic substitutes, and increasing chemical stability is facilitating the product efficiency.

As the demands of environmental regulations evolved, expanding high-performance, fast-evaporating, and non-toxic N-propyl acetate formulation designs by companies have become evident. Demand from USA market is also being driven rapidly due to growing use of N-propyl acetate in industrial cleaning, automotive coatings, and pharmaceutical applications.

| Country | CAGR (2025 to 2035) |

|---|---|

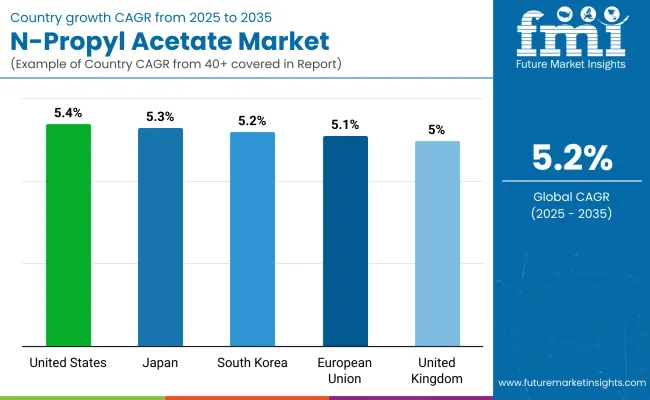

| USA | 5.4% |

The United Kingdom is the key market for N-propyl acetate, attributed to growing adoption of sustainable solvents across industrial applications, stringent regulations on VOC emissions and surging application in specialty coatings and printing inks. The focus on green chemistry, as well as regulatory compliance is also fueling market growth.

The market will be bolstered by government initiatives promoting low-emission solvents, combined with the development of high-purity and biodegradable N-propyl acetate formulations. In addition, emerging waterborne coatings, low-odor adhesives and high-efficiency printing inks are expected to gain increasing attention. Businesses are allocating funds toward process optimization, solvent recovery systems and energy-efficient manufacturing to enhance sustainable production.

Growing demand in flexible packaging, automotive refinishing and high-performance adhesives are contributing to the growth of N-propyl acetate market in UK. Moreover, the ongoing shift towards bio-based solvents is driving demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

Countries including Germany, France, and Italy are priority markets for N-Propyl acetate in Europe, on the back of burgeoning industrial production, widening usage of sustainable solvents, and surging demand for high-performance coatings and adhesives. Growing influence on reducing environmental impact from European Union and investments on next generation solvent technology ensures a steady growth for the overall market.

Moreover, increasing application in automotive coating, electronics, and food packaging of high-purity low-toxicity N-propyl acetate is enhancing product applications. They further propel the market growth due to the increasing demand for solvent-based flexographic and gravure printing inks and stringent VOC regulations in Europe. The increasing adoption within the EU is also supported by the expansion of sustainable manufacturing initiatives and the growth of partnerships between chemical manufacturers and industrial end-users. Additionally, the growing interest in bio-based solvents is active in terms of innovation in this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.1% |

The expanding N-Propyl acetate market in Japan is attributed to the country’s dominating position in high-precision chemical production, which results in a growing demand for low-toxicity solvents, and growing applications in electronics and automotive coatings. This is attributed to the increasing emphasis on ultra-pure solvents in high-tech sectors alongside the developments of a new generation of ultra-pure solvents for the global market. The country’s focus on solvent refinement and advances in low-odor, high-performance formulations are sparking innovation.

Furthermore, stringent government regulations on chemical emissions, along with growing investments in specialty solvent applications, are prompting players to offer advanced solutions. Additionally, the growing use of high efficiency N-propyl acetate in water-based coatings for automotive and semiconductor processing and in pharmaceutical intermediates is also driving growth of the market in the industrial vertical of Japan. Japan is also influential in shaping the future of sustainable solvent production due to its investment in chemical recycling and closed-loop solvent recovery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

There is a growing market for N-propyl acetate in South Korea, primarily due to the rising demand for high-performance coatings, the increasing use of sustainable solvent solutions, and significant government support for VOC reduction initiatives. Market expansion is aided by strict environmental rules governing solvent emissions, as well as growing investment in green chemistry solutions. Moreover, improved competitiveness as a result of the country’s focus on enhancing solvent efficiency, decreasing toxicity, and using advanced formulation techniques is also providing a boost.

Increasing usage of N-propyl acetate in electronic coatings, industrial cleaning, and automotive refinishing is further contributing to market adoption. Even during these tumultuous and unpredictable times, companies are diversifying their production capabilities materials, chemicals, composites and more while also investing in production methods and systems that promote efficiency, such as high-purity solvent production, smart chemical processing and AI quality control. The growing environmentally friendly solvent innovations as well as the regulatory-driving market shifts in South Korea are likely to continue driving the demand of N-propyl acetate.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

Industrial/Technical Grade N-Propyl Acetate (99%) owing to its greater purity levels, reduced impurities, and adherence to the strictest regulations. This sort is necessary in flavoring agents, pharmaceutical formulations, and food handling where pureness and safety in using are essential.

Pharmaceutical and food-grade N-Propyl Acetate is anticipated to witness the highest growth among these segments due to the increasing prevalence of clean-label ingredients, natural flavoring agents, and zero-solvent-based dosage forms. In addition, technological advancements such as distillation processes, solvent recovery systems, and formulations consistent with food-grade solvent legislation further support the demand for pharmaceutical and food-grade N-Propyl Acetate.

Solvent applications in the N-Propyl acetate market are prominent segment as the N-Propyl acetate compound acts as an integral ingredient for coatings, adhesives and in chemical synthesis. So much so that its low surface tension, exceptional solvency, and compatibility with different resins and polymers has made it a mainstay of industrial paint formulations, lacquer coatings and automotive refinishing.

There has been increased research in green chemistry-based N-Propyl Acetate formulations driven by the demand for eco-friendly, biodegradable, and high-performance solvents. Moreover, advancements in solvent recovery methods, energy-saving distillation techniques, and regulatory compliance efforts contribute to the increasing use of N-Propyl Acetate as a solvent.

Recent trends in N-Propyl Acetate demand also include flavoring agent applications, particularly in food and beverage industry that use it to enhance fruit flavors, confectionery aromas, and beverage formulations. Acts as mild, fruity aroma and flavor compound, popularly used in flavored syrups, bakery products, and beverage concentrates.

The detailed study of N-Propyl Acetate is based on the facts and figures of the product which warns the investors and market players for a possible downturn in such specifications within the forecast period. Moreover, microencapsulation, controlled-release flavoring, and solvent-free extraction technologies are being developed, which further enhances the function of N-Propyl Acetate in food processing applications.

N-Propyl Acetate is a commonly used solvent in the paint and coatings industry, where it is used as a solvent in formulations for fast-drying high-volume high-gloss and durable coatings. High solvency property, smooth application, and drying property are the key characteristics that make it extensively used in automotive coatings, wood finishes, and industrial protective coatings.

The commercial necessity has caused an ove of economically optimized N-Propyl Acetate-based solvent systems supporting low-VOC coatings, waterborne formulations & performance-enhanced industrial finishes. The coatings industry is being driven by advances in nanocoatings, anti-corrosive paint additives, and hybrid solvents.

N-Propyl Acetate is widely used as the most difficult solvent in the pharmaceutical industries used in drug formulation, for solvent based extractions and controlled release medications. Rising adoption of N-Propyl Acetate across processes of Active Pharmaceutical Ingredient (API) processing, tablet coating and bioavailability enhancement techniques can be substantiated by increasing demand for high-purity, non-toxic solvents across pharmaceutical manufacturing.

Moreover, the regulatory bodies are enforcing GMP (Good Manufacturing Practices) compliance, solvent-free drug formulations and green-friendly pharmaceutical excipients, this boosts the demand for safer and more efficient solvent alternatives. The pharmaceutical-grade N-Propyl acetate market continues to be impacted by innovations in pharmaceutical solvent recovery, varying green synthesis methods, and the formulations of biologic drugs.

A rise in applications in the paints & coatings, printing inks, and chemical industries is the major factor responsible for the growth of the N-Propyl acetate market, owing to its high solvency, fast evaporation, and low toxicity. To ensure product quality and safety, companies are working on sustainable manufacturing processes, developing bio-based alternatives and achieving regulatory compliance. Prominent trends are the emergence of high-purity grades, eco-sustainable manufacturing methods, and higher use in medical and cosmetic sectors.

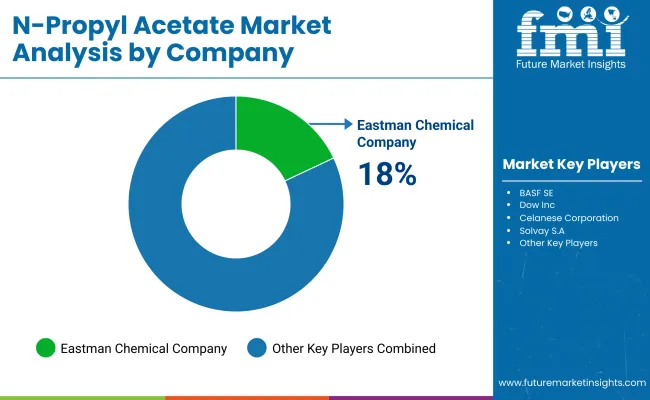

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eastman Chemical Company | 18-22% |

| BASF SE | 14-18% |

| Dow Inc. | 11-15% |

| Celanese Corporation | 8-12% |

| Solvay S.A. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Eastman Chemical Company | Leading supplier of high-purity N-Propyl Acetate for coatings, adhesives, and specialty chemicals. |

| BASF SE | Specializes in eco-friendly solvents with low VOC emissions for industrial applications. |

| Dow Inc. | Develops sustainable N-Propyl Acetate solutions with advanced manufacturing processes. |

| Celanese Corporation | Offers solvent-grade and pharmaceutical-grade N-Propyl Acetate with strict quality control. |

| Solvay S.A. | Focuses on innovative solvent formulations with enhanced performance characteristics. |

Key Company Insights

Eastman Chemical Company (18-22%)

Eastman Chemical dominates the N-Propyl acetate market, offering high-purity solvent solutions for industry sectors including paints, coatings, and adhesives. Along these lines, the company invests in sustainable production processes and leading distillation technologies to maintain the quality of its products. With its vast doughnut distribution channel, Eastman cements its market leadership.

BASF SE (14-18%)

BASF SE offers a product range of environmentally friendly solvents, including low-VOC N- Propyl Acetate for industrial and specialty applications. EMBAPO provides bio-based alternatives to traditional solvents with an emphasis on regulatory compliance and sustainability. Innovation has long been a pillar of BASF's winning strategy.

Dow Inc. (11-15%)

Dow Inc. leading producer of advanced solvent portfolio such as specialty N-Propyl Acetate which is used in coatings, inks, and adhesives. It uses sustainable manufacturing practices to use less resources for environmental sustainability. Due to the combination of its expertise in chemical formulations, and global supply chain capabilities, Dow has a stronger position in the polymer market.

Celanese Corporation (8-12%)

Celanese Corporation provides high purity, low impurity grade solvents including N-Propyl Acetate with a wide range of solvent grades and pharmaceutical grades. As a company they are dedicated to high levels of quality control and rapid production. The specialty chemicals expertise of Celanese is supportive of the competitive positioning.

Solvay S.A. (6-10%)

With a range of specialty solvents, Solvay offers high performance solvent formulations such as N-Propyl Acetate for industrial coatings and chemical processing. The company focuses on research-based product development and tailor-made solvent solutions. Technological innovation drives Solvay’s strategic compass.

Other Key Players (30-40% Combined)

The N-Propyl acetate market is fairly competitive with a wide range of global and regional players holding market shares, focusing on sustainability, enhancing performance, and meeting regulatory framework. Key players include:

The overall market size for N-Propyl acetate market was USD 489.02 million in 2025.

The N-Propyl acetate market expected to reach USD 811.87 million in 2035.

The demand for the N-Propyl acetate market will be driven by increasing applications in the paints and coatings industry, rising demand in printing inks and adhesives, growing use as a solvent in pharmaceuticals and cosmetics, expanding industrial manufacturing, and advancements in eco-friendly and low-VOC formulations.

The top 5 countries which drives the development of N-Propyl acetate market are USA, UK, Europe Union, Japan and South Korea.

Solvent and flavoring agent applications propel market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2024 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2024 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2024 to 2034

Table 4: Global Market Volume (Tons) Forecast by Grade, 2024 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2024 to 2034

Table 6: Global Market Volume (Tons) Forecast by Application, 2024 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End-Use Industry, 2024 to 2034

Table 8: Global Market Volume (Tons) Forecast by End-Use Industry, 2024 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2024 to 2034

Table 10: North America Market Volume (Tons) Forecast by Country, 2024 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Grade, 2024 to 2034

Table 12: North America Market Volume (Tons) Forecast by Grade, 2024 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2024 to 2034

Table 14: North America Market Volume (Tons) Forecast by Application, 2024 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End-Use Industry, 2024 to 2034

Table 16: North America Market Volume (Tons) Forecast by End-Use Industry, 2024 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2024 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2024 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Grade, 2024 to 2034

Table 20: Latin America Market Volume (Tons) Forecast by Grade, 2024 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2024 to 2034

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2024 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2024 to 2034

Table 24: Latin America Market Volume (Tons) Forecast by End-Use Industry, 2024 to 2034

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2024 to 2034

Table 26: Europe Market Volume (Tons) Forecast by Country, 2024 to 2034

Table 27: Europe Market Value (US$ Million) Forecast by Grade, 2024 to 2034

Table 28: Europe Market Volume (Tons) Forecast by Grade, 2024 to 2034

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2024 to 2034

Table 30: Europe Market Volume (Tons) Forecast by Application, 2024 to 2034

Table 31: Europe Market Value (US$ Million) Forecast by End-Use Industry, 2024 to 2034

Table 32: Europe Market Volume (Tons) Forecast by End-Use Industry, 2024 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2024 to 2034

Table 34: East Asia Market Volume (Tons) Forecast by Country, 2024 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by Grade, 2024 to 2034

Table 36: East Asia Market Volume (Tons) Forecast by Grade, 2024 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Application, 2024 to 2034

Table 38: East Asia Market Volume (Tons) Forecast by Application, 2024 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2024 to 2034

Table 40: East Asia Market Volume (Tons) Forecast by End-Use Industry, 2024 to 2034

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2024 to 2034

Table 42: South Asia Market Volume (Tons) Forecast by Country, 2024 to 2034

Table 43: South Asia Market Value (US$ Million) Forecast by Grade, 2024 to 2034

Table 44: South Asia Market Volume (Tons) Forecast by Grade, 2024 to 2034

Table 45: South Asia Market Value (US$ Million) Forecast by Application, 2024 to 2034

Table 46: South Asia Market Volume (Tons) Forecast by Application, 2024 to 2034

Table 47: South Asia Market Value (US$ Million) Forecast by End-Use Industry, 2024 to 2034

Table 48: South Asia Market Volume (Tons) Forecast by End-Use Industry, 2024 to 2034

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2024 to 2034

Table 50: Oceania Market Volume (Tons) Forecast by Country, 2024 to 2034

Table 51: Oceania Market Value (US$ Million) Forecast by Grade, 2024 to 2034

Table 52: Oceania Market Volume (Tons) Forecast by Grade, 2024 to 2034

Table 53: Oceania Market Value (US$ Million) Forecast by Application, 2024 to 2034

Table 54: Oceania Market Volume (Tons) Forecast by Application, 2024 to 2034

Table 55: Oceania Market Value (US$ Million) Forecast by End-Use Industry, 2024 to 2034

Table 56: Oceania Market Volume (Tons) Forecast by End-Use Industry, 2024 to 2034

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2024 to 2034

Table 58: MEA Market Volume (Tons) Forecast by Country, 2024 to 2034

Table 59: MEA Market Value (US$ Million) Forecast by Grade, 2024 to 2034

Table 60: MEA Market Volume (Tons) Forecast by Grade, 2024 to 2034

Table 61: MEA Market Value (US$ Million) Forecast by Application, 2024 to 2034

Table 62: MEA Market Volume (Tons) Forecast by Application, 2024 to 2034

Table 63: MEA Market Value (US$ Million) Forecast by End-Use Industry, 2024 to 2034

Table 64: MEA Market Volume (Tons) Forecast by End-Use Industry, 2024 to 2034

Figure 1: Global Market Value (US$ Million) by Grade, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End-Use Industry, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2024 to 2034

Figure 6: Global Market Volume (Tons) Analysis by Region, 2024 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Grade, 2024 to 2034

Figure 10: Global Market Volume (Tons) Analysis by Grade, 2024 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Grade, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Grade, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2024 to 2034

Figure 14: Global Market Volume (Tons) Analysis by Application, 2024 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End-Use Industry, 2024 to 2034

Figure 18: Global Market Volume (Tons) Analysis by End-Use Industry, 2024 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2024 to 2034

Figure 21: Global Market Attractiveness by Grade, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by End-Use Industry, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Grade, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End-Use Industry, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2024 to 2034

Figure 30: North America Market Volume (Tons) Analysis by Country, 2024 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Grade, 2024 to 2034

Figure 34: North America Market Volume (Tons) Analysis by Grade, 2024 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Grade, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Grade, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2024 to 2034

Figure 38: North America Market Volume (Tons) Analysis by Application, 2024 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End-Use Industry, 2024 to 2034

Figure 42: North America Market Volume (Tons) Analysis by End-Use Industry, 2024 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2024 to 2034

Figure 45: North America Market Attractiveness by Grade, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by End-Use Industry, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Grade, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End-Use Industry, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2024 to 2034

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2024 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Grade, 2024 to 2034

Figure 58: Latin America Market Volume (Tons) Analysis by Grade, 2024 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Grade, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2024 to 2034

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2024 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2024 to 2034

Figure 66: Latin America Market Volume (Tons) Analysis by End-Use Industry, 2024 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Grade, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End-Use Industry, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Europe Market Value (US$ Million) by Grade, 2024 to 2034

Figure 74: Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Europe Market Value (US$ Million) by End-Use Industry, 2024 to 2034

Figure 76: Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2024 to 2034

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2024 to 2034

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Europe Market Value (US$ Million) Analysis by Grade, 2024 to 2034

Figure 82: Europe Market Volume (Tons) Analysis by Grade, 2024 to 2034

Figure 83: Europe Market Value Share (%) and BPS Analysis by Grade, 2024 to 2034

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Grade, 2024 to 2034

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2024 to 2034

Figure 86: Europe Market Volume (Tons) Analysis by Application, 2024 to 2034

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Europe Market Value (US$ Million) Analysis by End-Use Industry, 2024 to 2034

Figure 90: Europe Market Volume (Tons) Analysis by End-Use Industry, 2024 to 2034

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2024 to 2034

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2024 to 2034

Figure 93: Europe Market Attractiveness by Grade, 2024 to 2034

Figure 94: Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Europe Market Attractiveness by End-Use Industry, 2024 to 2034

Figure 96: Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) by Grade, 2024 to 2034

Figure 98: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: East Asia Market Value (US$ Million) by End-Use Industry, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2024 to 2034

Figure 102: East Asia Market Volume (Tons) Analysis by Country, 2024 to 2034

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: East Asia Market Value (US$ Million) Analysis by Grade, 2024 to 2034

Figure 106: East Asia Market Volume (Tons) Analysis by Grade, 2024 to 2034

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Grade, 2024 to 2034

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Grade, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) Analysis by Application, 2024 to 2034

Figure 110: East Asia Market Volume (Tons) Analysis by Application, 2024 to 2034

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2024 to 2034

Figure 114: East Asia Market Volume (Tons) Analysis by End-Use Industry, 2024 to 2034

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2024 to 2034

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2024 to 2034

Figure 117: East Asia Market Attractiveness by Grade, 2024 to 2034

Figure 118: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 119: East Asia Market Attractiveness by End-Use Industry, 2024 to 2034

Figure 120: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia Market Value (US$ Million) by Grade, 2024 to 2034

Figure 122: South Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia Market Value (US$ Million) by End-Use Industry, 2024 to 2034

Figure 124: South Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2024 to 2034

Figure 126: South Asia Market Volume (Tons) Analysis by Country, 2024 to 2034

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia Market Value (US$ Million) Analysis by Grade, 2024 to 2034

Figure 130: South Asia Market Volume (Tons) Analysis by Grade, 2024 to 2034

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Grade, 2024 to 2034

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Grade, 2024 to 2034

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2024 to 2034

Figure 134: South Asia Market Volume (Tons) Analysis by Application, 2024 to 2034

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia Market Value (US$ Million) Analysis by End-Use Industry, 2024 to 2034

Figure 138: South Asia Market Volume (Tons) Analysis by End-Use Industry, 2024 to 2034

Figure 139: South Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2024 to 2034

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2024 to 2034

Figure 141: South Asia Market Attractiveness by Grade, 2024 to 2034

Figure 142: South Asia Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia Market Attractiveness by End-Use Industry, 2024 to 2034

Figure 144: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 145: Oceania Market Value (US$ Million) by Grade, 2024 to 2034

Figure 146: Oceania Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: Oceania Market Value (US$ Million) by End-Use Industry, 2024 to 2034

Figure 148: Oceania Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2024 to 2034

Figure 150: Oceania Market Volume (Tons) Analysis by Country, 2024 to 2034

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: Oceania Market Value (US$ Million) Analysis by Grade, 2024 to 2034

Figure 154: Oceania Market Volume (Tons) Analysis by Grade, 2024 to 2034

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Grade, 2024 to 2034

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Grade, 2024 to 2034

Figure 157: Oceania Market Value (US$ Million) Analysis by Application, 2024 to 2034

Figure 158: Oceania Market Volume (Tons) Analysis by Application, 2024 to 2034

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: Oceania Market Value (US$ Million) Analysis by End-Use Industry, 2024 to 2034

Figure 162: Oceania Market Volume (Tons) Analysis by End-Use Industry, 2024 to 2034

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End-Use Industry, 2024 to 2034

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End-Use Industry, 2024 to 2034

Figure 165: Oceania Market Attractiveness by Grade, 2024 to 2034

Figure 166: Oceania Market Attractiveness by Application, 2024 to 2034

Figure 167: Oceania Market Attractiveness by End-Use Industry, 2024 to 2034

Figure 168: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 169: MEA Market Value (US$ Million) by Grade, 2024 to 2034

Figure 170: MEA Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: MEA Market Value (US$ Million) by End-Use Industry, 2024 to 2034

Figure 172: MEA Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2024 to 2034

Figure 174: MEA Market Volume (Tons) Analysis by Country, 2024 to 2034

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: MEA Market Value (US$ Million) Analysis by Grade, 2024 to 2034

Figure 178: MEA Market Volume (Tons) Analysis by Grade, 2024 to 2034

Figure 179: MEA Market Value Share (%) and BPS Analysis by Grade, 2024 to 2034

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Grade, 2024 to 2034

Figure 181: MEA Market Value (US$ Million) Analysis by Application, 2024 to 2034

Figure 182: MEA Market Volume (Tons) Analysis by Application, 2024 to 2034

Figure 183: MEA Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: MEA Market Value (US$ Million) Analysis by End-Use Industry, 2024 to 2034

Figure 186: MEA Market Volume (Tons) Analysis by End-Use Industry, 2024 to 2034

Figure 187: MEA Market Value Share (%) and BPS Analysis by End-Use Industry, 2024 to 2034

Figure 188: MEA Market Y-o-Y Growth (%) Projections by End-Use Industry, 2024 to 2034

Figure 189: MEA Market Attractiveness by Grade, 2024 to 2034

Figure 190: MEA Market Attractiveness by Application, 2024 to 2034

Figure 191: MEA Market Attractiveness by End-Use Industry, 2024 to 2034

Figure 192: MEA Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Cloth Tape Market Size and Share Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Acetate Homopolymer Market Size and Share Forecast Outlook 2025 to 2035

Hexyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Neryl Acetate Market

Nickel Acetate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Acetate Market

Calcium Acetate Market Growth – Trends & Forecast 2019-2029

Sucrose Acetate Isobutyrate Market

Oxo-octyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Acetate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Acetate Market

Ethyl Cyanoacetate Market Size and Share Forecast Outlook 2025 to 2035

Glycerol Diacetate Market

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Glyceryl Triacetate (Triacetin) Market

2-EthylHexyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Demand for Cellulose Diacetate Film in Middle East & Africa Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA