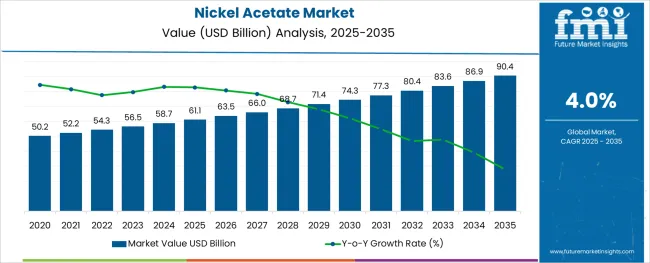

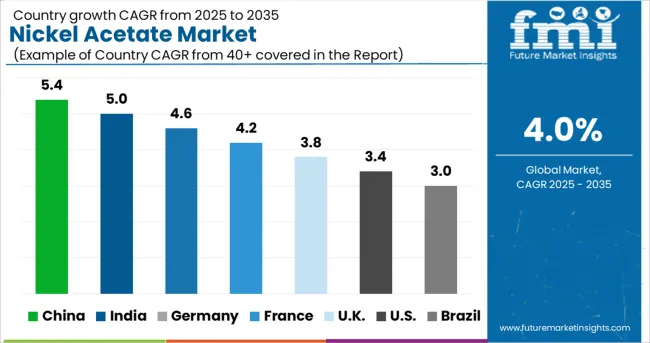

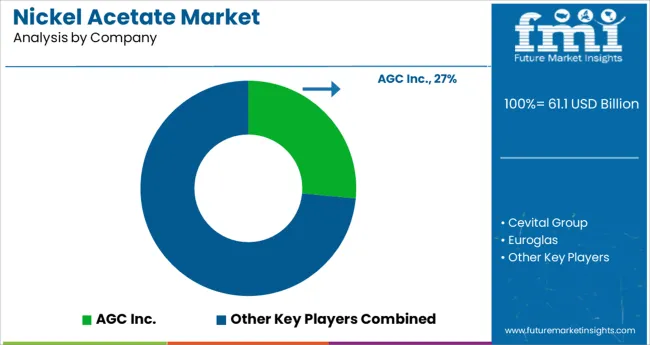

The Nickel Acetate Market is estimated to be valued at USD 61.1 billion in 2025 and is projected to reach USD 90.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

The nickel acetate market is expanding steadily due to its vital role in electroplating and related industrial applications. Its importance in producing corrosion-resistant coatings and enhancing surface durability has driven demand. Increasing industrialization and the growth of electronics manufacturing have further boosted the need for high-quality nickel acetate products.

Technological improvements in production methods have enhanced purity levels and product consistency. Environmental regulations have encouraged the adoption of efficient electroplating processes, increasing reliance on nickel acetate formulations.

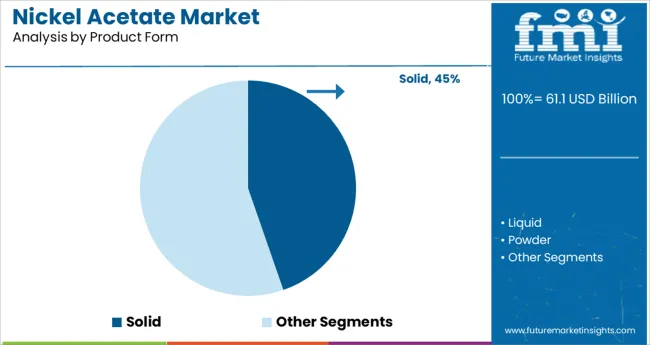

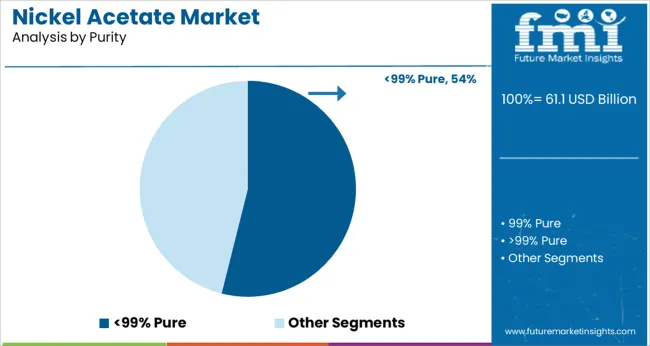

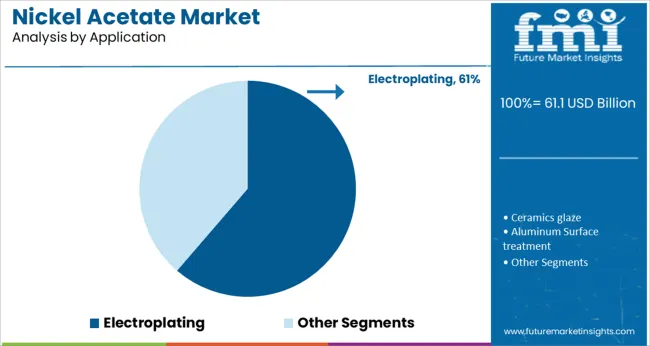

The market’s growth is expected to be sustained by the expansion of automotive, electronics, and metal finishing sectors. Segmental growth is expected to be led by the solid product form, purity levels below 99%, and electroplating applications due to their broad industrial use.

The market is segmented by Product Form, Purity, and Application and region. By Product Form, the market is divided into Solid, Liquid, and Powder. In terms of Purity, the market is classified into <99% Pure, 99% Pure, and >99% Pure. Based on Application, the market is segmented into Electroplating, Ceramics glaze, Aluminum Surface treatment, and Coinage.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solid product form segment is projected to hold 44.7% of the nickel acetate market revenue in 2025. Solid nickel acetate is favored for its ease of storage, transport, and handling. It is commonly used in electroplating baths where controlled dissolution is required for uniform coating deposition.

The solid form allows manufacturers to prepare customized solutions according to specific process requirements. Its stability under varying environmental conditions enhances supply chain reliability.

As industries continue to seek efficient and manageable raw materials for surface treatment, solid nickel acetate remains preferred.

The <99% purity segment is expected to contribute 53.9% of the market revenue in 2025. Nickel acetate with purity below 99% offers a balance between performance and cost-effectiveness. It meets the quality requirements for many electroplating and coating applications without incurring excessive production expenses.

This purity range is suitable for large-scale industrial use where ultra-high purity is not essential but consistency is important.

Growing demand from sectors such as automotive and electronics, which require reliable surface treatments, supports this segment’s growth.

The electroplating application segment is projected to account for 61.3% of the nickel acetate market revenue in 2025, solidifying its dominance. Electroplating processes rely on nickel acetate to deposit nickel layers that improve corrosion resistance, wear resistance, and aesthetic appearance.

The growth of automotive, electronics, and metal fabrication industries has driven this segment. Electroplating enables manufacturers to extend product lifespans and meet stringent quality standards.

As industries expand and focus on sustainable and efficient coating methods, electroplating remains the primary application driving nickel acetate demand.

Nickel acetate is utilised in a variety of applications, including as a catalyst in aluminate sealing materials and in coinage so sales of nickel acetate are predicted to skyrocket. Nickel acetate forms a corrosion-resistant layer on metal surfaces, preventing them from rusting and oxidising which helps the sales of nickel acetate by increasing its applications.

Additionally, technological advancements and the increasing demand for nickel acetate in aluminium surface treatment are important factors boosting the nickel acetate market. However, due to its dangerous effects on human health.

Irritation and dermatitis are some of the factors through which sales of nickel acetate will decline, hence restraining the global demand for nickel acetate in the near future. Several of the leading producers fulfilling the demand for nickel acetate have been identified as being active in activities such as mass production and the establishment of new manufacturing facilities in developing countries contributing to the nickel acetate market share.

When it comes to geography, the Asia-Pacific region is likely to lead the worldwide sales of nickel acetate and is expected to maintain its dominance during the forecast years. China is predicted to dominate the nickel acetate market in the Asia-Pacific region, both in terms of production and consumption.

North America is likely to obtain a sizable revenue share in the approaching period. Europe is expected to be followed by North America in the worldwide demand for nickel acetate, with both regions expected to exhibit growth in sales of nickel acetate during the estimated period.

Latin America's nickel acetate market is expected to stagnate in the future years. Although the Middle East and Africa account for a relatively modest proportion of the market, sales of nickel acetate are likely to expand significantly in the near future.

The report consists of key players, contributing to the nickel acetate market share. It also consists of organic and inorganic growth strategies adopted by market players to improve their market positions. This exclusive report analyzes the competitive landscape and nickel acetate market share acquired by players to strengthen their market position.

Eastmen Chemicals, Noah Technologies Corporation, Fairsky industrial co. Ltd., Hangzhou Yuhao Chemical Technology Co. Ltd., Zhangjiagang Huayi Chemical Co. Ltd., Palm international Inc., Accela ChemBio Inc., Axiom Chemicals Pvt. Ltd., Vesino industrial co. Ltd., Univertical, Forbes pharmaceuticals, Hunter Chemical LLC, ProChem Inc, Jilin Jien Nickel Industry Co. Ltd., TIB Chemicals AG, Seidler Chemical Co, Inc., Foshan Qiruide Additives co. Ltd., Alconix Corporation and others are some of the leading participants in the nickel acetate market.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 4% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in billion, volume in kilotons, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors and trends, Pricing Analysis |

| Segments covered | Product form, purity, application, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | AGC Inc.; Cevital Group; Euroglas; Guardian Industries; Saint-Gobain; Sisecam Group; Vitro |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. |

The global nickel acetate market is estimated to be valued at USD 61.1 billion in 2025.

It is projected to reach USD 90.4 billion by 2035.

The market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types are solid, liquid and powder.

<99% pure segment is expected to dominate with a 53.9% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Mining Market Size and Share Forecast Outlook 2025 to 2035

Nickel Superalloy Market Size and Share Forecast Outlook 2025 to 2035

Nickel Niobium Market Size and Share Forecast Outlook 2025 to 2035

Nickel Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Cobalt Aluminium Market Trend Analysis Based on Purity, End Use, and Region 2025 to 2035

Nickel Cobalt Manganese (NCM) Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Nickel Nitrate Hexahydrate Market

Nickel Alloy Market

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Cloth Tape Market Size and Share Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Acetate Homopolymer Market Size and Share Forecast Outlook 2025 to 2035

Hexyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Neryl Acetate Market

Sodium Acetate Market

Calcium Acetate Market Growth – Trends & Forecast 2019-2029

Sucrose Acetate Isobutyrate Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA