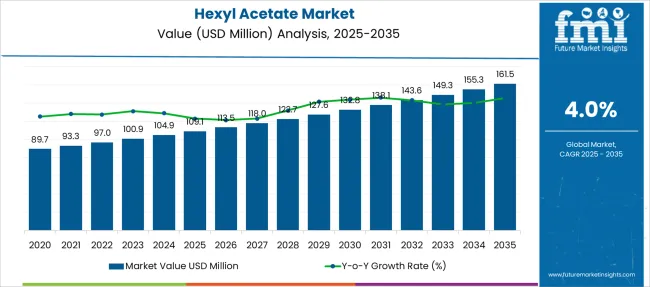

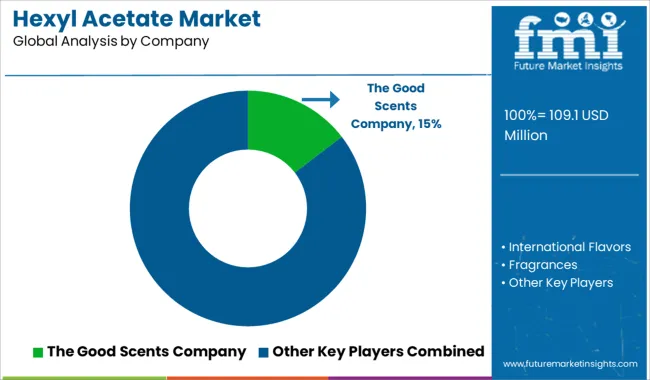

The Hexyl Acetate Market is estimated to be valued at USD 109.1 million in 2025 and is projected to reach USD 161.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Hexyl Acetate Market Estimated Value in (2025 E) | USD 109.1 million |

| Hexyl Acetate Market Forecast Value in (2035 F) | USD 161.5 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The hexyl acetate market is gaining traction due to its widespread use as a fragrant and flavor-enhancing compound in multiple end-use industries. Demand is being propelled by its application in flavoring, perfumery, cosmetics, and specialty solvents, with increased consumption observed in food and beverage formulations and personal care products.

Market expansion is also supported by the growing preference for naturally derived and environmentally safe compounds in product development. The synthesis process plays a crucial role in cost-efficiency and scalability, influencing manufacturers’ choice of production methods.

Favorable regulatory frameworks promoting low-toxicity ingredients and expanding demand from emerging economies further strengthen the market outlook. Going forward, rising consumer inclination toward clean-label and aromatic-rich products is expected to drive continued growth and investment in advanced manufacturing technologies for hexyl acetate.

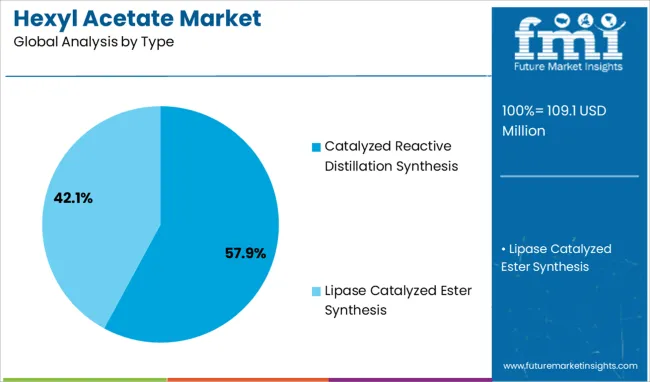

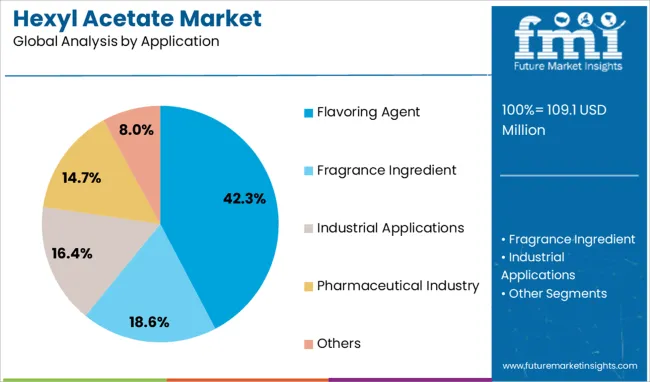

The hexyl acetate market is segmented by type, application, and geographic regions. The hexyl acetate market is divided by type into Catalyzed Reactive Distillation Synthesis and Lipase Catalyzed Ester Synthesis. The hexyl acetate market is classified into Flavoring Agent, Fragrance Ingredient, Industrial Applications, Pharmaceutical Industry, and Others. Regionally, the hexyl acetate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The catalyzed reactive distillation synthesis segment dominates the type category with a commanding 57.9% market share, highlighting its efficiency and economic advantage in producing high-purity hexyl acetate. This method integrates chemical reaction and separation into a single unit, reducing energy consumption and production costs while improving overall yield.

Its adoption is rising across industrial facilities aiming for sustainable production and streamlined operations. The process offers better conversion rates and is particularly effective in handling equilibrium-limited reactions, making it ideal for esterification applications like hexyl acetate synthesis.

Increased investment in continuous manufacturing systems and advancements in catalytic technologies further support this segment's growth. As environmental regulations tighten and demand for eco-efficient production rises, catalyzed reactive distillation is expected to remain the preferred synthesis method for industrial-scale hexyl acetate manufacturing.

The flavoring agent segment leads the application category with a 42.3% share, reflecting hexyl acetate’s extensive use in imparting fruity, apple-like aromas in food and beverage formulations. It is highly valued for its sensory attributes and is commonly used in candies, baked goods, and beverages, contributing to its wide commercial adoption.

The segment’s growth is supported by increasing consumer preference for naturally aromatic and flavor-rich products, along with rising demand from the packaged food industry. Food manufacturers are incorporating hexyl acetate to enhance taste profiles while meeting clean-label expectations.

Additionally, its Generally Recognized As Safe (GRAS) status by regulatory bodies ensures continued usage in consumables. The outlook for this segment remains strong as innovation in flavor engineering and demand for multi-sensory experiences in food products continue to drive the need for high-performance flavoring compounds like hexyl acetate.

The hexyl acetate market is growing due to strong demand in fragrances, personal care, food flavoring, and household applications, supported by versatility and safety compliance. Strategic partnerships, product innovation, and clean-label positioning further enhance market competitiveness.

The hexyl acetate market is driven by its extensive use in perfumes, body sprays, and personal care products due to its pleasant fruity aroma. Its ability to blend seamlessly with floral and fruity notes makes it a preferred ingredient in fine fragrances and toiletries. Growing consumer inclination toward premium and long-lasting perfumes has amplified demand. Cosmetic brands are incorporating hexyl acetate in deodorants and skincare products to enhance sensory appeal. This rise in application within personal grooming products, combined with expanding retail channels, underlines the compound's importance in meeting evolving preferences for sophisticated and refreshing fragrance profiles across both mass and luxury segments.

Hexyl acetate plays a significant role in the food and beverage sector as a flavoring agent, contributing sweet and fruity notes to candies, baked goods, and beverages. Its compatibility with natural and synthetic flavors allows flexibility for manufacturers in creating appealing taste profiles. Rising demand for processed foods, flavored drinks, and confectionery in developing regions has further strengthened its position. The growing popularity of fruit-inspired flavors in alcoholic and non-alcoholic beverages has also contributed to market expansion. Compliance with safety standards from regulatory bodies ensures its continued acceptance, making it a vital additive in the global flavor industry.

Beyond fragrances and flavors, hexyl acetate finds applications in cleaning solutions, polishes, and coatings due to its solvent properties. Its effectiveness in enhancing surface finishes and imparting mild fragrance makes it valuable in household cleaning formulations. Industrially, it is used in paints, coatings, and adhesives where evaporation rates and solvency characteristics are critical for performance. Rising demand for specialty cleaning products in both residential and commercial sectors, alongside increased construction activities, has boosted consumption. This multi-functional capability provides manufacturers with diverse revenue streams, enabling hexyl acetate to remain competitive against substitute compounds across multiple end-use industries globally.

The competitive landscape of the hexyl acetate market is characterized by a focus on product consistency, cost efficiency, and regulatory compliance. Leading players are investing in advanced manufacturing processes to ensure high-purity grades for sensitive applications like cosmetics and food flavoring. Strategic collaborations with fragrance houses and flavor developers are enhancing innovation pipelines for tailored solutions. Companies are also leveraging e-commerce and distribution partnerships to strengthen regional presence. Emphasis on clean-label positioning and natural sourcing alternatives is shaping marketing strategies. These initiatives, combined with rigorous adherence to safety regulations, position industry participants to capture emerging opportunities across diverse consumer markets.

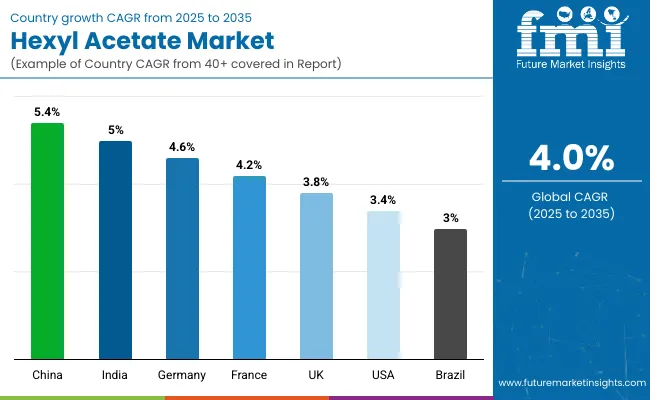

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

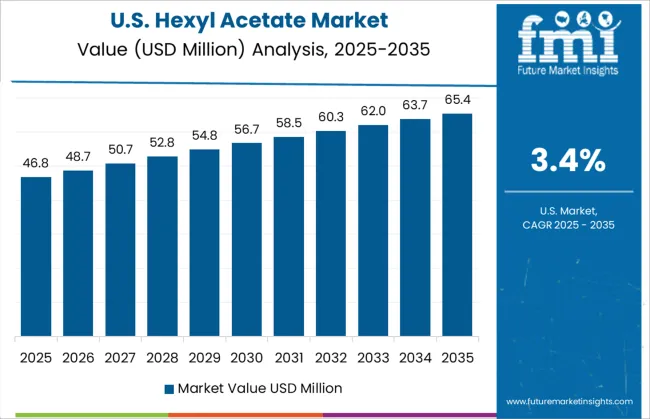

| USA | 3.4% |

| Brazil | 3.0% |

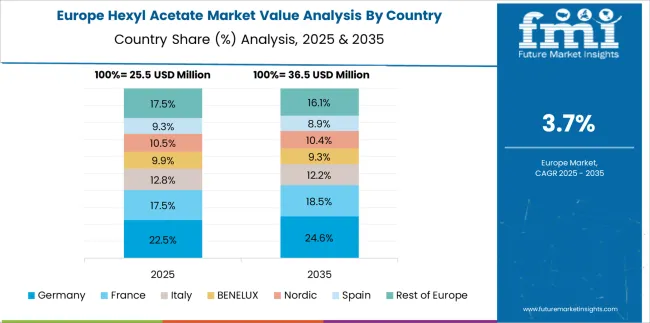

The hexyl acetate industry, projected to grow at a global CAGR of 4.0% from 2025 to 2035, is demonstrating stronger growth in emerging markets. China leads with a 5.4% CAGR driven by its large-scale fragrance and personal care manufacturing base. India follows at 5.0%, supported by expansion in processed food and beverage production coupled with rising cosmetic demand. Germany posts a 4.6% growth rate, emphasizing its advanced chemical sector and high-quality flavor formulation standards, while France secures a 4.2% CAGR anchored by its luxury perfume industry, which remains a major consumer of hexyl acetate.

The United Kingdom and the United States exhibit slower but steady growth at 3.8% and 3.4%, respectively, largely influenced by mature market dynamics and regulatory frameworks. These regions prioritize clean-label and bio-based ingredient development, aligning with consumer demand for safe formulations. Growth in the USA is particularly supported by increased application in household cleaning products and industrial coatings, whereas the UK is witnessing innovation in natural-scented personal care goods. Collectively, these regional variations indicate a mix of maturity and emerging opportunities across different geographies. The report provides detailed insights across more than 40 countries, highlighting the top five markets as benchmarks for future investment and expansion.

The CAGR for the hexyl acetate market in the United States increased from nearly 2.4% during 2020–2024 to 3.4% in the 2025–2035 period. This growth is attributed to the rising use of hexyl acetate in fragrances, cleaning agents, and food flavoring applications. The USA market is benefiting from growing demand for premium perfumes and personal care products emphasizing fruity and floral notes, where hexyl acetate serves as a critical blending compound. Regulatory focus on safe chemical use and consumer inclination toward cleaner, effective ingredients has led to an increase in research-based formulations. Expansion in household and industrial cleaning solutions incorporating solvent-based components also strengthened market prospects.

The CAGR in the United Kingdom climbed from approximately 2.5% in 2020–2024 to 3.8% during 2025–2035, supported by innovation in natural fragrance solutions and increasing consumer interest in premium body sprays and skincare products. Rising demand for flavor ingredients in beverage formulations has also contributed to this market expansion. Premium perfume manufacturers are introducing novel blends using fruity and floral notes to cater to evolving consumer expectations. Furthermore, the adoption of solvent-based cleaners in commercial spaces is driving incremental demand. Regulatory compliance with EU norms continues to shape procurement, influencing companies to prioritize high-purity formulations to sustain growth momentum in this competitive market.

The French hexyl acetate market rose from around 3.2% CAGR in 2020–2024 to nearly 4.2% between 2025 and 2035. France continues to dominate luxury fragrance manufacturing, and this segment remains the strongest demand contributor for hexyl acetate as brands explore fruit-forward compositions to elevate premium positioning. Regulatory-driven emphasis on natural-sourced and allergen-free solutions has boosted innovation across personal care and cosmetics. Beverage and confectionery manufacturers are integrating this compound into fruity flavor profiles to enhance sensory appeal. Strategic tie-ups between French perfumers and raw material suppliers aim to ensure consistent ingredient quality, strengthening the domestic supply chain while enabling exports to premium markets worldwide.

China’s CAGR for the hexyl acetate market surged from about 4.6% during 2020–2024 to 5.4% in the 2025–2035 phase, fueled by large-scale fragrance manufacturing and expanding personal care production hubs. Local brands are increasingly targeting young consumers with affordable yet long-lasting perfumes, incorporating fruity notes that rely heavily on hexyl acetate. Growth in processed food and beverage manufacturing has further strengthened flavor applications. Industrial use in coatings and cleaning products also adds stability to demand. Strategic collaborations between domestic players and global suppliers have been instrumental in ensuring ingredient consistency and compliance with international quality benchmarks, boosting competitiveness in regional and export markets.

India witnessed a rise in CAGR from nearly 4.3% during 2020–2024 to about 5.0% in the 2025–2035 period. This expansion is linked to increasing adoption of hexyl acetate in regional flavor systems for beverages, sweets, and processed food categories, as well as its growing use in perfumery and personal care goods. Rapid urban retail penetration and the proliferation of mid-range cosmetic brands are major contributors. Household cleaning solutions, particularly those emphasizing aromatic features, have adopted this ingredient as a solvent-fragrance enhancer. Investments in local fragrance manufacturing and flavor extraction facilities are creating sustained opportunities, alongside the rising inclination toward sensory-driven consumer goods across Tier 2 and Tier 3 cities.

In the hexyl acetate market, leading companies are adopting targeted strategies to meet growing demand across fragrances, flavors, and industrial segments. The Good Scents Company and International Flavors & Fragrances are at the forefront, offering premium-grade aroma chemicals tailored for high-end personal care, luxury perfumes, and body sprays. These firms emphasize consistent quality and regulatory compliance to maintain trust among global clients.

Bontoux and Apiscent Labs are prioritizing the development of natural-sourced hexyl acetate to address the increasing consumer preference for clean-label and plant-derived formulations. Advanced Biotech and Nimble Technologies are focusing on innovative flavor blends for the food and beverage sector, where fruity and sweet profiles dominate confectionery and beverage applications. On the industrial side, Beijing Lys Chemicals and RX Marine International have strengthened their portfolio to include solvent-grade esters for coatings, polishes, and specialty cleaning agents. Zhejiang NetSun plays a pivotal role as a distribution leader in Asia-Pacific, ensuring seamless market connectivity and access to emerging regional buyers.

Lanxess AG and Merck KGaA dominate the specialty chemical space by leveraging advanced R&D to produce high-purity variants for cosmetic and industrial uses. Strategic moves such as capacity expansions, sustainability-focused sourcing, and partnerships with global distributors define the competitive landscape.

These companies are also investing in digital sales channels and supply chain optimization to enhance market penetration across developed and high-growth economies. This multi-faceted approach positions them strongly in an evolving global market driven by performance, safety, and consumer trends.

In May 2025, Lanxess AG announced it will showcase its high‑purity aroma chemicals, covering floral, spicy, citrus, woody, and earthy notes, at SIMPPAR 2025, the perfumery raw materials trade show in Paris.

| Item | Value |

|---|---|

| Quantitative Units | USD 109.1 Million |

| Type | Catalyzed Reactive Distillation Synthesis and Lipase Catalyzed Ester Synthesis |

| Application | Flavoring Agent, Fragrance Ingredient, Industrial Applications, Pharmaceutical Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Good Scents Company, International Flavors, Fragrances, Bontoux, Beijing Lys Chemicals, Apiscent Labs, Advanced Biotech, Nimble Technologies, RX Marine International, Zhejiang NetSun, Lanxess AG, and Merck KGaA |

| Additional Attributes | Dollar sales, share, regional demand trends, pricing analysis, regulatory compliance updates, competitive landscape, raw material cost patterns, emerging end-use sectors, distribution strategies, and growth forecasts across key regions. |

The global hexyl acetate market is estimated to be valued at USD 109.1 million in 2025.

The market size for the hexyl acetate market is projected to reach USD 161.5 million by 2035.

The hexyl acetate market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in hexyl acetate market are catalyzed reactive distillation synthesis and lipase catalyzed ester synthesis.

In terms of application, flavoring agent segment to command 42.3% share in the hexyl acetate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

2-EthylHexyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Hexylene Glycol Market Trends 2025 to 2035

2-Hexyldecanol Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Palmitate Market Size and Share Forecast Outlook 2025 to 2035

Cyclohexylbenzene Market Growth - Trends & Forecast 2025 to 2035

1,4-Dicyclohexylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Cloth Tape Market Size and Share Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Acetate Homopolymer Market Size and Share Forecast Outlook 2025 to 2035

Neryl Acetate Market

Nickel Acetate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Acetate Market

Calcium Acetate Market Growth – Trends & Forecast 2019-2029

Sucrose Acetate Isobutyrate Market

N-Propyl Acetate Market Growth – Trends & Forecast 2025 to 2035

Oxo-octyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Potassium Acetate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA