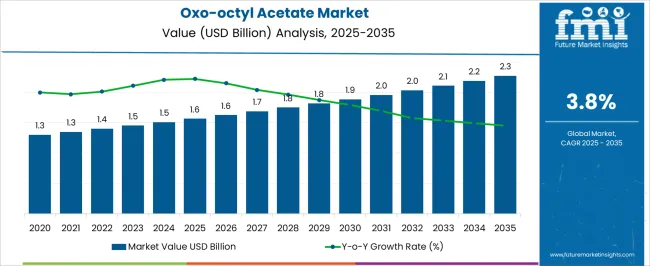

The oxo-octyl acetate market is projected to grow from USD 1.6 billion in 2025 to USD 1.9 billion by 2030, marking the first five-year growth block of the broader forecast toward USD 2.3 billion by 2035, at a CAGR of 3.8%. Yearly progress shows a steady climb from 1.6 billion in 2025 to 1.8 billion by 2028, with incremental growth driven by demand from the personal care, food, and industrial sectors. Growth is driven by increased usage in fragrance formulations, emulsions, and plasticizers, providing stability to the market. The gradual rise reflects steady consumer adoption and application-based demand rather than volatile spikes. From 2029 onward, the market is expected to experience continued steady growth, with values moving toward 1.9 billion in 2030. The growth is expected to be sustained by product adoption in new consumer goods, especially as it is used in products requiring solvent properties and flexibility. Procurement decisions are being influenced by consistency in product quality, supply chain reliability, and compliance with industry standards. The market will see incremental yet reliable growth, driven by industries that rely on the consistent performance of oxo-octyl acetate in various formulations and applications.

| Metric | Value |

|---|---|

| Oxo-octyl Acetate Market Estimated Value in (2025 E) | USD 1.6 billion |

| Oxo-octyl Acetate Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The oxo-octyl acetate segment is estimated to account for about 8% of the organic esters market, roughly 10% of the plasticizers market, close to 5% of the chemical additives market, around 6% of the solvents market, and nearly 3% of the fragrance and flavor chemicals market. In aggregate, this equates to approximately 32% across the listed parent categories. This proportion highlights the significant yet niche role of oxo-octyl acetate as a key chemical used in the production of plasticizers, solvents, and fragrance compounds. Its demand has been driven by its compatibility in formulations requiring a balance of plasticizing performance, solubility, and low volatility.

Oxo-octyl acetate is particularly valuable in applications such as coatings, adhesives, and plastic products, where its properties provide enhanced flexibility, longevity, and smoothness. Industry analysts view oxo-octyl acetate as an indispensable ingredient in the chemical supply chain, particularly in products designed for consumer goods, industrial applications, and the automotive sector.

The demand for oxo-octyl acetate is expected to continue to rise as industries look for cost-effective, high-performance solutions for plastic formulations and additives. Given the market's relatively stable demand, it is predicted that oxo-octyl acetate will maintain a consistent share within these parent markets, with growth supported by advancements in product formulations that emphasize greater efficiency and performance across multiple industries.

The oxo-octyl acetate market is demonstrating steady growth, driven by its increasing use across pharmaceutical, industrial, and specialty chemical applications. The compound’s favorable solvency characteristics, stability under varying conditions, and compatibility with multiple formulations support its adoption in diverse end-use industries. Rising demand for high-purity grades in regulated sectors, such as pharmaceuticals and personal care, is further enhancing market potential.

In the industrial domain, expanding use in coatings, adhesives, and specialty intermediates is contributing to consistent consumption patterns. Advances in production efficiency, coupled with improvements in raw material processing, are ensuring a stable supply chain and cost competitiveness.

Additionally, the growing emphasis on tailored chemical formulations for high-performance applications is encouraging manufacturers to invest in quality control and application-specific product development. As industries seek reliable, versatile, and compliant chemical ingredients, oxo-octyl acetate is expected to maintain its growth trajectory, supported by a balance of regulatory compliance, product innovation, and rising end-use diversification across both mature and emerging markets.

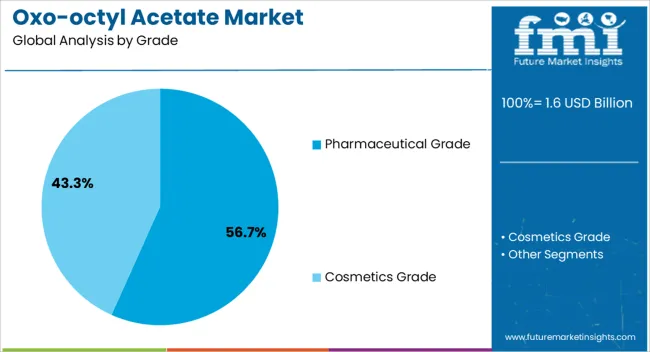

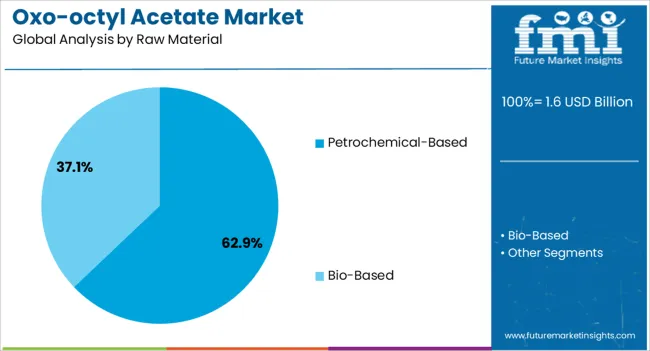

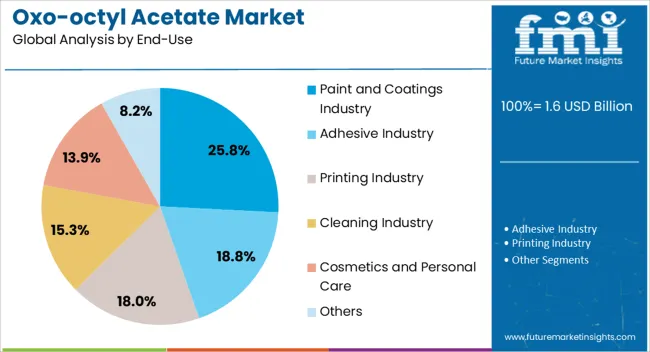

The oxo-octyl acetate market is segmented by grade, raw material, end-use, and geographic regions. By grade, oxo-octyl acetate market is divided into Pharmaceutical Grade and Cosmetics Grade. In terms of raw material, oxo-octyl acetate market is classified into Petrochemical-Based and Bio-Based. Based on end-use, the oxo-octyl acetate market is segmented into the Paint and Coatings Industry, Adhesive Industry, Printing Industry, Cleaning Industry, Cosmetics and Personal Care, and Others. Regionally, the oxo-octyl acetate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceutical grade segment is projected to hold 56.7% of the oxo-octyl acetate market revenue share in 2025, making it the leading grade category. This dominance is attributed to its compliance with stringent purity and safety requirements, which are essential for applications in drug formulation, medical coatings, and other healthcare-related uses. The high level of quality assurance in pharmaceutical-grade production minimizes contaminants, ensuring consistent performance in sensitive applications.

The growth of the pharmaceutical sector is reinforcing demand, driven by expanding healthcare access, rising chronic disease prevalence, and increased R&D activity. The ability of pharmaceutical-grade oxo-octyl acetate to integrate seamlessly into formulations without compromising stability or efficacy is further enhancing its adoption.

Manufacturers are also focusing on meeting global regulatory standards, making this grade suitable for export-oriented markets. With the pharmaceutical industry continuing to prioritize reliable and compliant excipients, the pharmaceutical-grade segment is expected to retain its leadership position in the coming years.

The petrochemical-based raw material segment is expected to account for 62.9% of the oxo-octyl acetate market revenue share in 2025, establishing itself as the dominant raw material source. The ready availability of petrochemical feedstocks, well-established supply chains, and cost-effective large-scale production capabilities supports this leadership. The consistency of petrochemical-based production processes ensures uniform quality, which is essential for both industrial and specialty applications.

Its versatility allows it to serve as the base for multiple grades, including pharmaceutical and industrial variants, broadening its applicability across sectors. The segment benefits from robust refining and petrochemical infrastructure, particularly in regions with integrated chemical manufacturing hubs.

Furthermore, the competitive pricing and reliability associated with petrochemical-based raw materials make them a preferred choice for manufacturers seeking scalability and long-term supply stability. As demand for oxo-octyl acetate grows across different end-use industries, the petrochemical-based segment is expected to maintain its dominance due to its efficiency, availability, and adaptability to varied production requirements.

The paint and coatings industry segment is anticipated to capture 25.8% of the oxo-octyl acetate market revenue share in 2025, making it a leading end-use category. This position is driven by the compound’s excellent solvency, film-forming ability, and compatibility with a wide range of resins and pigments. In coatings, oxo-octyl acetate facilitates improved flow, leveling, and application performance, contributing to superior finish quality.

Its role as a solvent in high-performance formulations supports demand in both industrial and decorative coating segments. The market is also benefiting from infrastructure development, urbanization, and growth in the automotive and construction sectors, which are driving increased consumption of paints and coatings.

Stringent environmental and performance standards are prompting manufacturers to select solvents that deliver both efficiency and regulatory compliance, areas where oxo-octyl acetate performs strongly. With continued innovation in coating technologies and increasing focus on performance-driven formulations, the paint and coatings industry is expected to remain a significant and stable contributor to overall market demand.

The oxo-octyl acetate market is poised for growth as demand from personal care, flavoring, and fragrance industries rises. Demand is driven by the compound’s use in cosmetics, air fresheners, and food products due to its pleasant fruity odor and non-toxicity. Opportunities are opening in the development of eco-friendly formulations and expanding product applications. Trends indicate increasing use in clean-label formulations and growing interest in high-purity grades. Challenges persist with fluctuating raw material prices, stringent regulatory approvals, and competition from alternative flavoring agents.

Demand for oxo-octyl acetate is being reinforced by its widespread use in personal care products such as perfumes, deodorants, and body sprays, where its fruity and pleasant scent enhances consumer appeal. It is increasingly incorporated into air fresheners and household products to create refreshing atmospheres. In food and beverage applications, it serves as a flavoring agent, particularly in fruit and citrus-flavored items. The compound's non-toxic and safe nature makes it attractive for use in products that require direct skin contact. In our opinion, the continued growth of the personal care and fragrance industries will maintain demand for this compound, especially as consumer preferences shift towards more natural ingredients.

Opportunities are expanding in the development of eco-friendly formulations that capitalize on the growing consumer demand for natural, sustainable products. As regulations tighten around synthetic chemicals, the demand for natural flavoring agents like oxo-octyl acetate in clean-label formulations is expected to increase. The compound’s versatility allows it to be used in a wide range of products, from perfumes and cosmetics to cleaning agents and food flavoring. In our view, the strongest market growth will come from product diversification, particularly in green chemistry initiatives, where safer, biodegradable options are prioritized over traditional, petrochemical-based ingredients.

Trends in the oxo-octyl acetate market indicate a growing preference for clean-label products. Consumers are more focused on natural ingredients, leading to an increased demand for non-synthetic compounds like oxo-octyl acetate. This shift aligns with broader market trends in the personal care and food industries, where transparency and non-toxic formulations are key drivers. Manufacturers are increasingly formulating products with fewer chemicals, and oxo-octyl acetate, with its naturally derived properties, has found increasing applications. From an opinionated perspective, companies that prioritize clean-label formulations will capture a more significant share of the market, aligning with consumer demand for safer and more sustainable products.

Challenges in the oxo-octyl acetate market stem from fluctuating raw material costs, which are influenced by the availability of feedstocks and global market dynamics. The compound’s price is closely tied to the cost of raw materials such as octanol, making cost control difficult for manufacturers. Regulatory hurdles surrounding the approval of chemicals in personal care, food, and fragrance products also create challenges, as they require extensive testing and certification processes. In our view, overcoming these barriers requires consistent innovation, cost-efficient sourcing, and effective regulatory navigation to stay competitive in the evolving market.

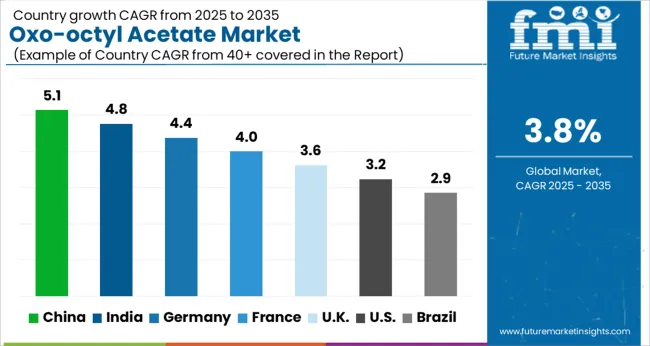

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

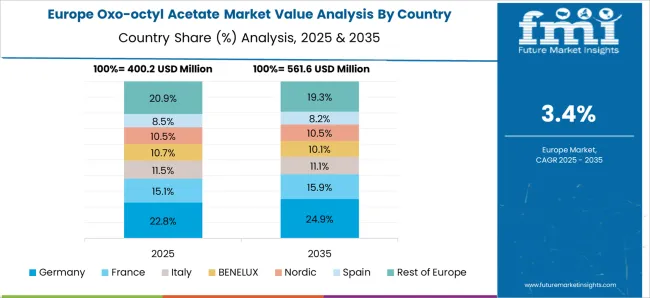

The global oxo-octyl acetate market is projected to grow at 3.8% from 2025 to 2035. China leads at 5.1%, followed by India 4.8% and Germany 4.4%; the United Kingdom 3.6% and United States 3.2% follow. Demand is being driven by applications in plasticizers, adhesives, coatings, and personal care products, where its excellent solvency, compatibility with PVC, and low volatility are highly valued. The increasing use of oxo-octyl acetate in automotive, construction, and consumer goods industries is pushing growth. Asia is set to lead on volume production, while Europe and North America are expected to focus on regulatory compliance and sustainable formulations. Markets will increasingly demand products that comply with environmental regulations and offer improved safety profiles, especially in consumer goods and industrial applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

Freight trucking is propelled by industrial trade, e-commerce expansion, specialized cargo demand, and intermodal integration. These dynamics underscore its critical role as the foundation of global supply chains.

The oxo-octyl acetate market in China is expected to expand at 5.1%. Demand is being propelled by the rapid growth of plasticizer applications in PVC products for construction, automotive, and flooring. Local production of oxo-octyl acetate is increasing, driven by rising domestic consumption in industrial coatings and adhesives sectors. Growing automotive production, coupled with the demand for flexible and durable materials, is boosting the use of this ester. The shift toward environmentally friendly and safer formulations is pushing suppliers to enhance their product lines with more sustainable alternatives. It is expected that China will remain a key driver in the oxo-octyl acetate market, benefiting from its expansive industrial base, low-cost production capabilities, and strong growth in end-use industries.

The oxo-octyl acetate market in India is projected to grow at 4.8%. Demand is being driven by the construction, automotive, and consumer goods industries, where the need for flexible and durable materials continues to rise. The use of oxo-octyl acetate as a plasticizer in PVC products, as well as its application in personal care products, is growing rapidly. Manufacturers in India are increasingly focusing on compliance with global regulatory standards, as consumers and businesses demand safer and more eco-friendly products. The market is also seeing growth in the adhesives sector, with rising demand for this product in the packaging and textile industries. It is expected that India’s expanding industrial base and regulatory shift toward sustainable products will continue to boost market growth.

The oxo-octyl acetate market in Germany is forecast to increase at 4.4%. Growth is being fueled by the demand for high-quality plasticizers in the automotive and construction industries, as well as increasing adoption in personal care formulations. German regulations promoting safer and more sustainable products are leading to the development of eco-friendly alternatives to traditional plasticizers, enhancing the demand for oxo-octyl acetate in these industries. Additionally, the growth of the coatings and adhesives sectors is further driving demand for this versatile compound. Germany’s strong industrial base, along with a focus on regulatory compliance and sustainability, positions it as a leader in the European market for oxo-octyl acetate.

The oxo-octyl acetate market in the UK is expected to expand at 3.6%. The growing need for flexible and durable materials in automotive and construction applications is supporting demand. The demand for oxo-octyl acetate is also rising in personal care products, especially in cosmetics and fragrances, due to its ability to act as a solvent and carrier. The UK’s strong regulatory framework promoting safer chemicals and the demand for eco-friendly solutions are encouraging manufacturers to produce more sustainable products. It is expected that the UK will continue to see steady growth driven by its focus on environmental regulations and innovation in new applications for oxo-octyl acetate.

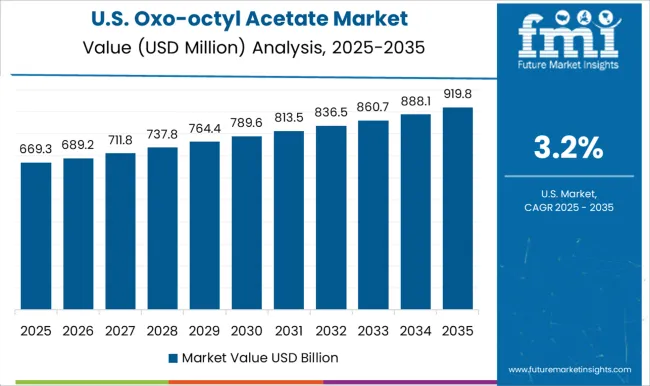

The oxo-octyl acetate market in the United States is projected to grow at 3.2%. The demand for this versatile chemical is being driven by the growth in the automotive and construction sectors, where plasticizers are essential for improving the flexibility and durability of materials. The increasing adoption of sustainable products in the USA market is also pushing manufacturers to explore eco-friendly alternatives, further boosting demand for oxo-octyl acetate.

The rising use of this compound in personal care and cosmetic products is expanding the market’s scope. As regulatory standards continue to tighten, USA manufacturers are focusing on producing safer, non-toxic alternatives to traditional plasticizers.

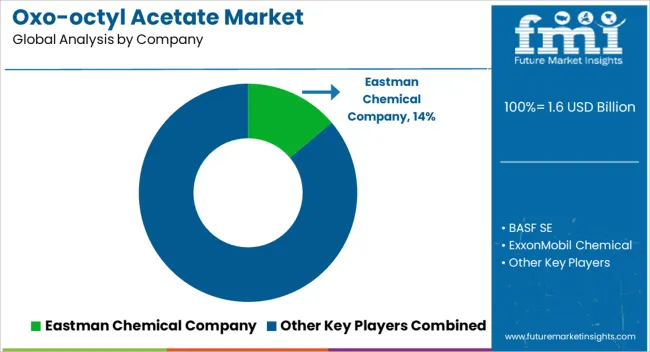

Leading players such as BASF, Eastman Chemical, Lanxess, and Dow Chemicals hold significant market share by leveraging large-scale production capacities, consistent quality, and extensive distribution networks. Competition is shaped by the ability to offer high-purity oxo-octyl acetate suitable for applications in coatings, inks, adhesives, and personal care products. Differentiation is achieved through process efficiency, cost-effective production methods, and regulatory compliance for volatile organic compounds (VOCs) and environmental standards. Regional suppliers focus on serving niche markets with tailored grades for specific applications, adding layers to competitive dynamics. Strategic partnerships with downstream manufacturers, investments in process optimization, and expansion of regional production facilities enhance market positioning. Price volatility of raw materials such as alcohols and acetic acid affects competitiveness, compelling players to adopt flexible supply chain strategies.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Grade | Pharmaceutical Grade and Cosmetics Grade |

| Raw Material | Petrochemical-Based and Bio-Based |

| End-Use | Paint and Coatings Industry, Adhesive Industry, Printing Industry, Cleaning Industry, Cosmetics and Personal Care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eastman Chemical Company, BASF SE, ExxonMobil Chemical, Evonik Industries AG, Dow Chemical Company, Shell Chemicals, LyondellBasell Industries, SABIC, INEOS Group, Mitsui Chemicals, Arkema Group, Mitsubishi Chemical Corporation, Huntsman Corporation, Celanese Corporation, and Solvay S.A. |

| Additional Attributes | Dollar sales by application (cosmetics & personal care, pharmaceuticals, paints & coatings, pesticides), Dollar sales by product type (synthetic, bio-based), Trends in demand for eco-friendly production methods and sustainable alternatives, Role in enhancing product stability and application characteristics, Growth driven by industrial and consumer market adoption, Regional demand across North America, Europe, Asia Pacific. |

The global oxo-octyl acetate market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the oxo-octyl acetate market is projected to reach USD 2.3 billion by 2035.

The oxo-octyl acetate market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in oxo-octyl acetate market are pharmaceutical grade and cosmetics grade.

In terms of raw material, petrochemical-based segment to command 62.9% share in the oxo-octyl acetate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Acetate Salt Market Size and Share Forecast Outlook 2025 to 2035

Acetate Cloth Tape Market Size and Share Forecast Outlook 2025 to 2035

Zinc Acetate Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Acetate Homopolymer Market Size and Share Forecast Outlook 2025 to 2035

Hexyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Neryl Acetate Market

Nickel Acetate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Acetate Market

Calcium Acetate Market Growth – Trends & Forecast 2019-2029

Sucrose Acetate Isobutyrate Market

N-Propyl Acetate Market Growth – Trends & Forecast 2025 to 2035

Potassium Acetate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Acetate Market

Ethyl Cyanoacetate Market Size and Share Forecast Outlook 2025 to 2035

Glycerol Diacetate Market

Glyceryl Triacetate (Triacetin) Market

2-EthylHexyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Calcium Disodium Ethylene Diamine Tetra-acetate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA