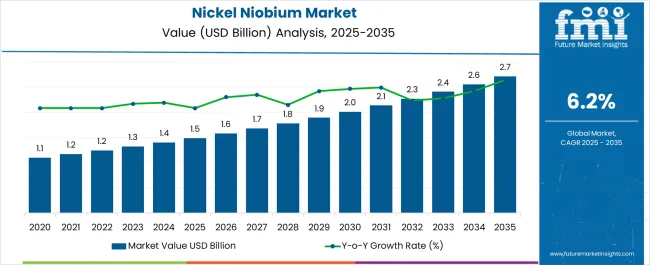

The nickel niobium market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

From 2021 through 2025, the market advances from USD 1.1 billion to USD 1.4 billion, marking the initial phase of expansion with moderate gains, largely supported by rising demand in aerospace alloys, automotive components, and electronics that require enhanced strength and corrosion resistance. This early stage represents a stable linear incline in the growth curve, driven by steady industrial adoption. Between 2026 and 2030, the market progresses from USD 1.5 billion to USD 2.0 billion, contributing nearly 37% of the total projected increase.

The growth curve steepens slightly during this phase as infrastructure projects, renewable energy expansion, and higher penetration of advanced steels accelerate nickel niobium consumption. From 2031 to 2035, the market experiences a more pronounced upswing, rising from USD 2.1 billion to USD 2.7 billion and accounting for nearly 45% of the total gains, creating a convex-shaped curve indicative of back-loaded growth. This acceleration reflects technological innovation in alloy production, increasing use in next-gen batteries, and expansion into specialized industrial applications. Overall, the nickel niobium market demonstrates an S-shaped curve moving towards consolidation, with gradual early gains followed by sharper late-stage growth.

| Metric | Value |

|---|---|

| Nickel Niobium Market Estimated Value in (2025 E) | USD 1.5 billion |

| Nickel Niobium Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The nickel niobium market occupies an important position within the global specialty alloys sector, accounting for nearly 24–26% share of the overall master alloys domain due to its extensive role in enhancing mechanical strength, corrosion resistance, and thermal stability of high-performance metals. Within the stainless steel and superalloy manufacturing segment, nickel niobium contributes around 28–30% share, as its use in turbine blades, jet engines, and power generation components ensures reliable performance under extreme operating conditions. In the automotive lightweighting and specialty components sector, it holds an estimated 15–17% share, driven by increasing use of advanced alloys for improved durability and fuel efficiency.

In the electronics and energy storage materials category, nickel niobium secures roughly 10–12% share, supporting demand for conductive alloys and advanced battery chemistries. Its integration into aerospace and defense applications accounts for another 18–20% share, with rising procurement of materials that meet high fatigue and heat-resistance requirements. Growth is supported by increasing reliance on lightweight yet high-strength materials in multiple industries and by ongoing demand for efficient energy solutions. Producers are focusing on refining processing technologies, ensuring tighter quality control, and developing tailored alloy compositions to cater to diverse industrial needs, positioning nickel niobium as a strategic enabler of advanced materials in the global metals landscape.

The market is experiencing steady expansion, driven by rising demand from high-performance material applications that require enhanced strength, corrosion resistance, and thermal stability. Growing adoption in advanced manufacturing, aerospace engineering, and energy-intensive industries is contributing to sustained growth. The ability of nickel niobium alloys to improve mechanical properties and extend component life has been recognized as a key factor in increasing consumption across multiple sectors.

Technological advancements in alloy processing and powder metallurgy are enabling manufacturers to produce components with higher precision and efficiency. Strategic investments by industry leaders, along with supportive policies promoting domestic production of specialty metals, are further strengthening market prospects.

As global infrastructure projects and defense programs continue to expand, the demand for nickel niobium is expected to rise, particularly in segments that require lightweight, high-strength materials The combination of material innovation, supply chain integration, and end-user diversification is positioning the market for continued growth in the coming years.

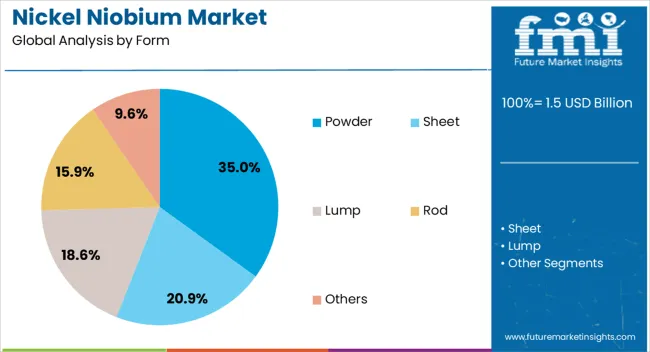

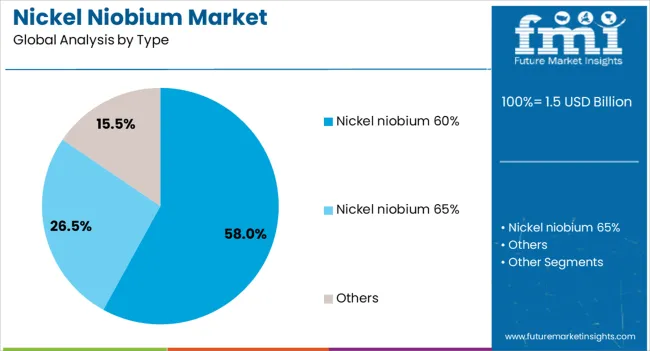

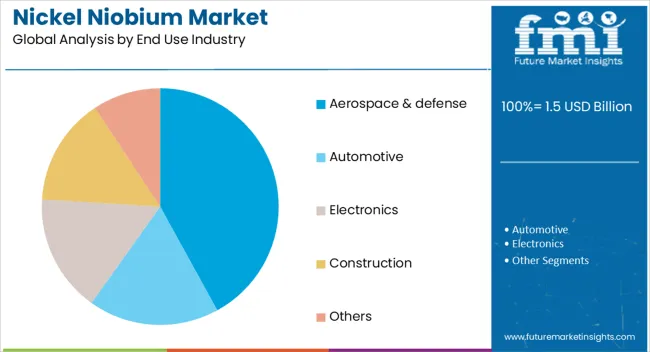

The nickel niobium market is segmented by form, type, end use industry, and geographic regions. By form, nickel niobium market is divided into powder, sheet, lump, rod, and others. In terms of type, nickel niobium market is classified into nickel niobium 60%, nickel niobium 65%, and others. Based on end use industry, nickel niobium market is segmented into aerospace & defense, automotive, electronics, construction, and others. Regionally, the nickel niobium industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder form segment is projected to hold 35% of the market revenue share in 2025, making it the leading form type. Growth in this segment has been supported by the increasing use of powder metallurgy in producing high-precision components for aerospace, automotive, and industrial applications. Powder form offers enhanced versatility, allowing manufacturers to tailor particle size distribution for specific performance requirements.

This adaptability has made it highly suitable for additive manufacturing processes, which are gaining traction in high-performance sectors. The powder form also enables better alloy uniformity, improving mechanical properties and ensuring consistent quality across production batches.

Additionally, advancements in atomization technology and production efficiency have lowered costs, making powder-based materials more accessible to a broader range of industries The ability to integrate with modern manufacturing techniques while maintaining high performance has reinforced the dominance of the powder form in the nickel niobium market.

The nickel niobium 60% type segment is anticipated to account for 58% of the market revenue share in 2025, establishing it as the dominant type. This high concentration composition has been preferred due to its superior ability to enhance the mechanical strength, corrosion resistance, and thermal stability of base alloys. Its high niobium content enables exceptional performance in demanding environments, such as high-temperature applications and corrosive industrial settings.

The segment’s growth has also been supported by its widespread use in superalloys, which are essential in aerospace, defense, and energy generation. The production of nickel niobium 60% type has been streamlined through advanced metallurgical techniques, ensuring consistent quality and optimal alloying properties.

Its compatibility with various manufacturing processes, including casting and powder metallurgy, further expands its application potential The long-term durability and performance benefits associated with this type have solidified its position as a preferred choice for high-value, mission-critical applications.

The aerospace and defense segment is projected to hold 42% of the market revenue share in 2025, making it the leading end-use industry. Growth in this segment has been propelled by the increasing need for lightweight, high-strength materials that can withstand extreme operational environments.

Nickel niobium alloys have been extensively utilized in the production of turbine components, structural parts, and heat-resistant systems, owing to their ability to maintain integrity under high stress and temperature conditions. The sector’s expansion has been further supported by ongoing investments in military modernization programs and the global growth of commercial aviation.

Stringent safety and performance standards in aerospace and defense applications have reinforced the demand for materials with proven reliability and extended service life The ability of nickel niobium to deliver critical performance advantages while enabling weight reduction aligns with the sector’s priorities, ensuring its continued prominence in this high-value market segment.

Nickel niobium demand is rising across aerospace, energy, automotive, and global trade sectors. Its ability to improve alloy performance under extreme conditions ensures its role as a core material in advanced manufacturing.

Nickel niobium has become a key additive in aerospace superalloy manufacturing, where its presence enhances mechanical strength, creep resistance, and durability in extreme conditions. Jet engines, turbine blades, and structural aircraft components increasingly rely on nickel niobium to maintain performance at high temperatures. The rising global demand for fuel-efficient aircraft has increased the adoption of high-performance alloys, further boosting its importance. Aircraft manufacturers are prioritizing alloys that reduce weight while sustaining heat resistance, and nickel niobium’s ability to support both requirements makes it indispensable. This demand has been reinforced by defense procurement programs and commercial aviation fleet expansions, positioning aerospace as a critical driver of nickel niobium demand.

Energy and power generation industries are actively integrating nickel niobium into turbine systems, nuclear applications, and renewable energy infrastructure due to its ability to endure intense thermal and mechanical stress. The alloy is vital in steam turbines and nuclear reactors, where long-term operational reliability is essential. With growing investments in energy infrastructure and the need for efficiency improvements, nickel niobium is increasingly being used in alloys for critical components. Its corrosion resistance and toughness also enhance the lifespan of installations, lowering replacement costs. This role in ensuring energy security and efficiency places nickel niobium at the center of power industry material strategies.

The automotive industry is incorporating nickel niobium into specialized steel and lightweight alloy production to achieve durability, efficiency, and compliance with emission standards. Applications include engine valves, exhaust systems, and advanced drivetrain components where high strength and corrosion resistance are required. Automakers are under pressure to enhance vehicle efficiency while maintaining safety and reliability, and nickel niobium alloys offer solutions that balance these priorities. Their use also extends to electric vehicles, where thermal-resistant alloys support performance in demanding conditions. The integration of nickel niobium into next-generation vehicle platforms reflects its strategic role in strengthening automotive material innovation and industrial competitiveness.

The nickel niobium market is shaped not only by its industrial uses but also by supply chain stability and trade policies. With production concentrated in specific regions, access to niobium resources is critical for alloy manufacturers. Strategic partnerships between mining companies and alloy producers have emerged to ensure steady supply. Trade policies and pricing fluctuations in raw materials can directly affect the competitive landscape, making long-term contracts and diversification essential. Producers are also focusing on enhancing processing efficiency and maintaining consistent quality standards to secure global competitiveness. This supply-driven dimension of the market highlights nickel niobium’s strategic significance across industries.

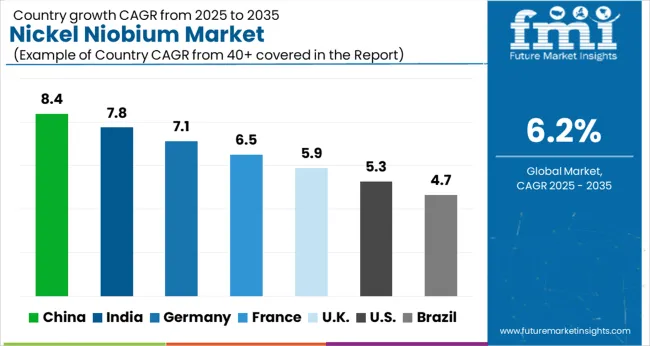

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

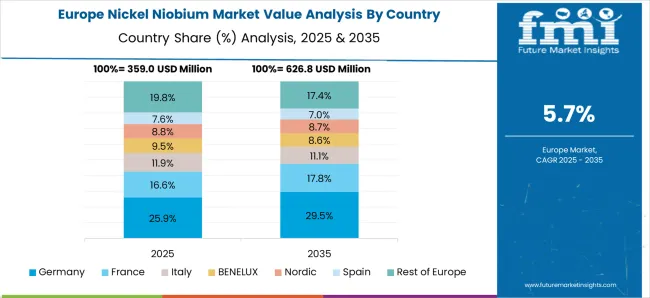

The nickel niobium market is projected to grow at a global CAGR of 6.2% between 2025 and 2035, supported by rising demand for high-strength alloys in aerospace, automotive, and energy industries. China leads with a CAGR of 8.4%, driven by large-scale alloy production, expanding aerospace programs, and strong domestic demand in industrial metals. India follows at 7.8%, influenced by automotive manufacturing growth, infrastructure expansion, and increasing adoption of nickel niobium alloys in specialty steels. France records a CAGR of 6.5%, supported by its aerospace sector, advanced metallurgy, and defense-driven alloy applications. The United Kingdom grows at 5.9%, reflecting adoption in industrial engineering and high-performance materials, while the United States posts 5.3%, shaped by steady demand in aerospace and defense along with targeted use in advanced energy systems. The analysis covers over 40 global markets, with these five countries serving as benchmarks for nickel niobium adoption strategies, alloy innovation, and investment in advanced metallurgical capabilities worldwide.

China posted a CAGR of 7.2% during the 2020–2024 period, which increased to 8.4% during 2025–2035, driven by a surge in demand for nickel niobium alloys in aerospace, automotive, and energy sectors. The earlier growth was fueled by expanding production capabilities in the automotive and aerospace industries. From 2025 onward, the higher CAGR is due to a rapid increase in military aircraft procurement, greater domestic consumption in steel alloys, and significant investments in energy systems. The combination of government-backed industrial growth, major infrastructure projects, and continued R&D into lightweight, high-strength alloys has created strong demand. China is also capitalizing on the growing aerospace sector and its ability to produce large volumes of advanced alloys, which drives the continued market expansion.

India recorded a CAGR of 6.5% during 2020–2024, which climbed to 7.8% during 2025–2035, outpacing the global average of 6.2%. The earlier growth was primarily driven by the rising demand for nickel niobium in specialty steel alloys used in automotive and construction applications. Moving into 2025–2035, the market saw an uptick driven by infrastructure development, government programs targeting advanced material use in construction, and growing awareness of the material's importance in high-performance alloys. India’s automotive and steel sectors have experienced consistent expansion, bolstering the demand for high-strength, corrosion-resistant materials like nickel niobium. The rise in global demand for lightweight, durable alloys has contributed to higher imports, and India is actively expanding its production capabilities.

France posted a CAGR of 5.4% during 2020–2024, which increased to 6.5% for 2025–2035, aligning with global market trends. The earlier growth was driven by the increasing demand for high-performance alloys in the aerospace sector, where nickel niobium is integral to turbine blades and other critical components. This growth accelerated after 2025 due to increased focus on lightweight and heat-resistant materials required in defense and industrial applications. France’s strategic aerospace industry and government-supported defense programs have created substantial demand for these alloys. France’s commitment to high-quality manufacturing and international partnerships in metallurgy has ensured consistent supply and innovation, positioning the country as a leader in high-performance materials within Europe.

The United Kingdom posted a CAGR of 4.9% during 2020–2024, which rose to 5.9% during 2025–2035, slightly underperforming the global average of 6.2%. Early growth was mainly driven by defense applications and the need for advanced alloys in industrial equipment. The rise in CAGR from 4.9% to 5.9% reflects increased usage of nickel niobium in the aerospace sector, including high-performance jet engine components, as well as growing adoption in automotive and marine industries. The UK’s aerospace sector continues to expand, with increasing government and private investments, fueling demand for durable, heat-resistant materials. Furthermore, as manufacturers in the UK integrate new supply chain solutions, it is expected that the growing need for advanced alloys will be met with higher production capabilities, securing a steady market for nickel niobium.

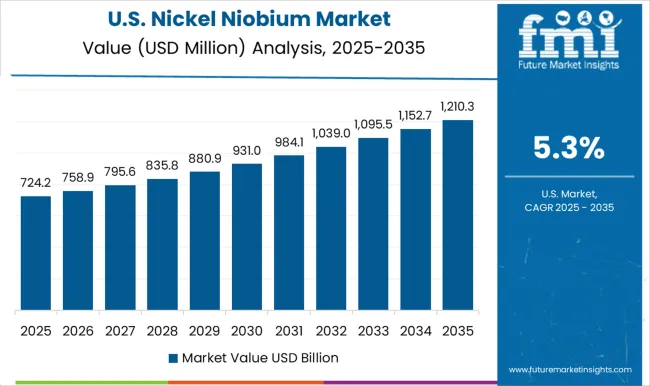

The United States is projected to achieve a CAGR of 5.3% during 2025–2035, up from 4.4% in 2020–2024, underperforming the global CAGR of 6.2%. This increase is attributed to rising demand in aerospace, military, and energy sectors, where high-strength alloys such as nickel niobium are crucial. The earlier CAGR of 4.4% was due to market maturity and a slower adoption of new alloys in industrial applications. However, the shift from 2025 onwards is driven by greater demand for corrosion-resistant, lightweight materials in the aerospace industry, along with growing interest from power generation and renewable energy sectors. The United States continues to leverage its technological leadership in material science, strengthening market demand for nickel niobium, although slower adoption rates relative to other regions like China and India may hold back faster growth.

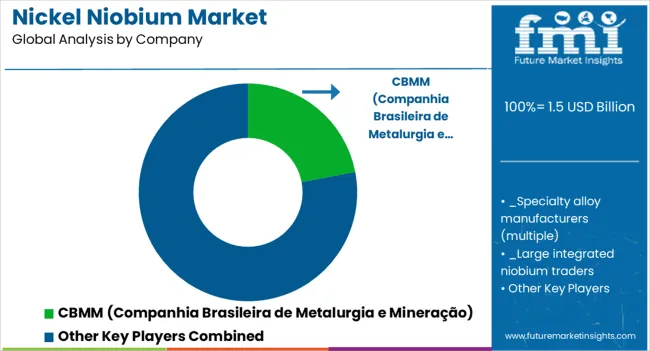

The nickel niobium market is shaped by a mix of global leaders, specialty alloy producers, and regional players that ensure steady supply for aerospace, automotive, energy, and industrial applications. CBMM (Companhia Brasileira de Metalurgia e Mineração) holds a dominant position as the world’s largest niobium producer, securing reliable raw material supply and maintaining extensive partnerships with global alloy manufacturers. Specialty alloy manufacturers are crucial players, offering tailored nickel niobium compositions designed for high-strength and corrosion-resistant applications in superalloys, turbines, and specialty steels. Large integrated niobium traders play a significant role in balancing global distribution, managing long-term contracts, and ensuring steady supply across regions where local production is limited.

Regional producers and fabricators contribute by serving domestic markets with cost-effective alloy blends, providing flexibility for industries requiring smaller volumes or customized formulations. Key strategies across this competitive landscape include vertical integration to secure feedstock access, alloy customization for advanced end-use industries, and partnerships with aerospace and energy companies to expand application scope. Producers are increasingly focused on refining processing technologies, improving quality standards, and building resilient supply chains to manage demand fluctuations. The competitive dynamics are expected to be influenced by continued investment in R&D, global trade agreements, and regional capacity expansions, ensuring nickel niobium maintains its role as a critical enabler of advanced materials worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Form | Powder, Sheet, Lump, Rod, and Others |

| Type | Nickel niobium 60%, Nickel niobium 65%, and Others |

| End Use Industry | Aerospace & defense, Automotive, Electronics, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CBMM (Companhia Brasileira de Metalurgia e Mineração), American Elements, Edgetech Industries LLC, CMOC Group Limited |

| Additional Attributes | Dollar sales, share, demand in aerospace, automotive, and energy sectors, production capacity, raw material supply security, regional market trends, competitive positioning, pricing strategies, and R&D advancements. |

The global nickel niobium market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the nickel niobium market is projected to reach USD 2.7 billion by 2035.

The nickel niobium market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in nickel niobium market are powder, sheet, lump, rod and others.

In terms of type, nickel niobium 60% segment to command 58.0% share in the nickel niobium market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Mining Market Size and Share Forecast Outlook 2025 to 2035

Nickel Superalloy Market Size and Share Forecast Outlook 2025 to 2035

Nickel Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Acetate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Cobalt Aluminium Market Trend Analysis Based on Purity, End Use, and Region 2025 to 2035

Nickel Cobalt Manganese (NCM) Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Nickel Nitrate Hexahydrate Market

Nickel Alloy Market

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Niobium pentoxide Market Size and Share Forecast Outlook 2025 to 2035

Tantalum and Niobium Material Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA